|

The potential impact of China's future meat trade on world markets, and in turn on US exports, has experienced considerable debate. Several articles have appeared in Choices over the past five years (Hayes, 1999; Hertel, Nin, Rae, & Ehui, 2000) as well as in China (Guoda & Zhang, 2001; Qiao, 2001; Lu & Yang, 2002). Some analysts believe that China will become an important net importer of livestock products (Beghin & Fabiosa, 2001; Organisation for Economic Cooperation and Development, 2000), while others argue that she will become a major net exporter (Delgado, Rosegrant, Steinfeld, Ehui, & Courbois, 1999). A third set of estimates stresses the wide range of possible outcomes depending on macro- and microeconomic uncertainty (Nin, Hertel, Foster, & Rae, in press).

A clearer understanding of China's imports and exports of livestock products is needed to address successfully the future of China's trade. In this article, we will show the difficulties in assessing China's meat trade, including the definition of national boundaries, the valuation of trade flows, and the role of smuggling and unreported imports into China. Although many studies assert that China is currently a net importer of poultry and pork products, consideration of these difficulties yields a very different picture.

Which China?

Any discussion of China's trade in livestock products must determine: Which China? The Food and Agriculture Organization of the United Nations Statistical Database (FAOSTAT, http://apps.fao.org/default-c.htm) has options for Greater China, Macau, Hong Kong, and China+ (which refers to China plus Taiwan). Hong Kong and Macau are part of China, but have separate customs territories with unique economic characteristics. They are largely trading hubs with zero tariffs, which thrive on buying and selling products as well as financial intermediation. Including them in the trade data for China makes the mainland economy look more open than it really is.

Taiwan is more complicated, because mainland China considers it a province, while the Taiwanese operate as an independent country. This political dispute is presumably why the FAO has not separated Taiwan from China in their data (even though separate customs data are available). Yet Taiwan is a more highly developed economy, with per capita income roughly 13 times that of mainland China. In recent years, Taiwan's growth rate has also been much lower than mainland China's. Separating the two when examining trade patterns and making future projections makes sense. We focus on mainland China, with data obtained from China's Ministry of Agriculture through the Chinese language version of FAOSTAT.

Which Units: Tons or Dollars?

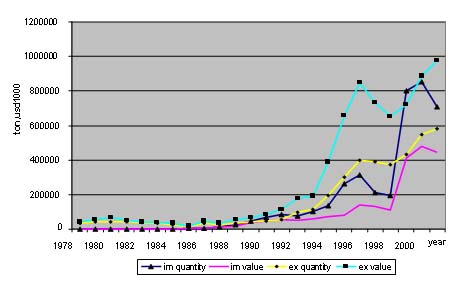

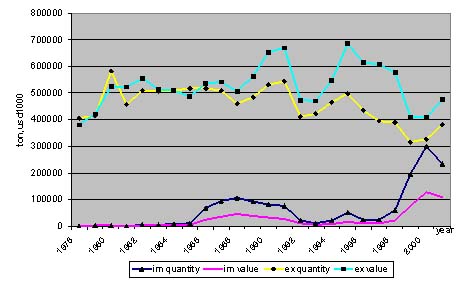

The next key point in assessing China's meat trade is whether trade should be measured in physical volume (metric tons) or in value (e.g., $US millions). Units of measurement can make a big difference. Based on volume, China is a net importer of poultry meat (Figure 1). The net import status is widely reported in the agricultural trade literature. Based on value of trade, however, China is a substantial net exporter of poultry meat. The value of exports is more than double import values. Why is this? China tends to import low price products such as chicken feet and wings, while exporting higher priced products such as deboned chicken breast.

So, is China currently a net importer or exporter of poultry meat? This point is fundamental to forecasting future trends. Value data are more relevant. After all, the US trade deficit is not reported in terms of tons. It makes little sense to combine diverse products without weighting them by their economic value. Adding tons of chicken breast together with chicken feet makes no more sense than adding tons of coal and microchips. The conclusion is that China is currently a substantial net exporter of poultry meat products, with a trade surplus of $US 530.8 million.

Which Products?

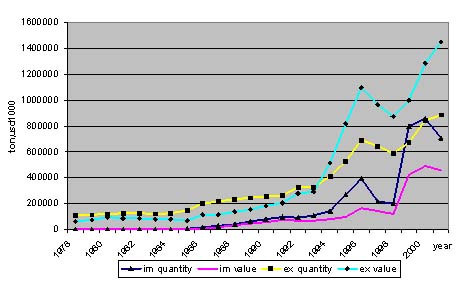

In addition to fresh, chilled and frozen poultry meat, trade in live animals, viscera, and canned poultry products is substantial. Although few of China's imports fall into this category, the country exported nearly $400 million of canned poultry meat in 2001, a 100% increase over 1999. When all poultry products are combined (Figure 2), China is a substantial net exporter. China's trade surplus for all poultry products in 2001 amounted to nearly $1 billion. This dampens some of the enthusiasm for China's poultry market, based only on tons of meat traded.

Figure 2 suggests that imports and exports have been increasing strongly. This "intra-industry" trade characterizes an industry with considerable product differentiation. Producing the product for which imports are rising can be beneficial. However, by-products (e.g., chicken feet) do little to bolster the total demand for poultry production.

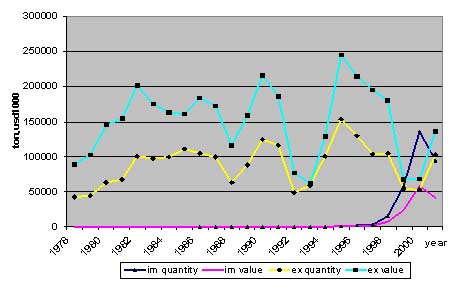

Poultry meat has garnered the attention of agricultural trade experts, but pig meat remains the largest consumption item in China. Figure 3 reports the volume and value of China's trade of pig meat. When trade is measured in tons, China was a net importer of pig meat in 1999 and 2000. Like poultry, however, China imports lower price items and exports higher price items, yielding a net export status in value terms.

Over time, exports of pig meat have fallen while imports have risen, especially since 1999. This same pattern is evident from Figure 4, which includes other pork products (live animals, skins, viscera, sausages, canned meat, etc.). Thus exporting pork to China may be more promising, even though the volume of poultry imports into China remains about four times as large as for pork.

Which Trade? The Role of Illegal Trade

Any discussion of recent rends in China's meat trade must consider smuggling and underinvoicing of imports. Substantial smuggling in meat products (Yu & Ma, 2000) occurred prior to 1999, when the costs were low due to lax enforcement. The benefits were high, as tariff rates were roughly 45% (and higher in earlier years). In 1999, government crackdowns greatly increased the costs of smuggling. Meanwhile in November 1998, as part of its preparation for entry into the World Trade Organization (WTO), China sharply reduced tariffs on meat products to 20%. Both of these changes made smuggling into China less profitable, and led to sharp increases in reported imports from 1998 to 1999. Further indirect evidence of the significance of the crackdown on smuggling is provided by the fact that these changes coincided with a doubling of the price of chicken feet in China. This was the most popular item among smugglers (Wang, 2002).

Distinguishing between true import increases and reduced smuggling is difficult. One approach to measure underreporting of imports is to compare China's bilateral import data with the export data of its trading partners. This method should pick up any systematic discrepancies in reported imports and exports. Mark Gehlhar (2002), of the USDA Economic Research Service, has formalized this approach, although differences in data classifications hamper comparisons with the FAOSTAT data. Gehlhar's estimates for nonruminant meat imports into China show only a 1.1% increase from 1998-1999, after correcting for underreporting of China's imports. Thus, much of the previously "missing" imports were reported in the exporting country. They simply evaded the Chinese import authorities in order to avoid paying import duties. These findings suggest that the sharp increase in meat trade from 1998-99 is misleading and likely misinterpreted by some observers as the start of an import boom.

Which Trade Partners?

Who is trading with China? The United States dominates this market, supplying 93% of the poultry products and 75% of the pig products (China Customs, 2002; calculated by imports and exports data of poultry products in volume from January to September 2002). About 70% of the US poultry exports to China consist of chicken wings and chicken feet (i.e., byproducts) to meet the preferences of Chinese consumers. China's major export partners for poultry are Japan, Hong Kong, Saudi Arabia, and Russia, among others. Most exports to Hong Kong are live animals, whereas other countries mostly received processed poultry products. Russia also takes two thirds of China's pork exports — mostly frozen products. As with poultry, most of the Hong Kong imports from mainland China are live hogs.

Conclusion

Each measurement issue addressed above has likely led to excessive optimism about China's import potential for meat products. First, using the Greater China, or China+ data from the FAOSTAT website, which includes Taiwan and perhaps Hong Kong and Macao, will erroneously suggest a net importer position.

Second, most projections of China's future trade are based on tons of product. Currently China is a net importer in tons, but a net exporter in dollars because it imports low-value by-products, such as chicken feet, and exports higher value processed meat products.

Third, most discussions of meat trade focus on fresh, chilled, and frozen meat, ignoring trade in live animals and processed products. When the latter products are factored in, China's trade surplus in poultry products increases to more than $1 billion. Finally, the huge jump in China's reported meat imports from 1998 to 1999 disappears when previous underreporting of imports is considered.

For More Information

Beghin, J., and Fabiosa, J. (2001). China's accession to the WTO: Effects on US pork and poultry. Iowa Ag Review, Summer 2001

China Customs. (2002). The imports and exports reports by monthly.1-9.

Delgado, C., Rosegrant, M., Steinfeld, H., Ehui, S., and Courbois, C. (1999). Livestock to 2020: The next food revolution (Food, Agriculture, and the Environment Discussion Paper No. 28). Washington, DC: International Food Policy Research Institute.

FAOSTAT. (2003). Chinese language version. Available on the World Wide Web: http://apps.fao.org/default-c.htm.

Gehlhar, M. (1996). Reconciling bilateral trade data for use in GTAP (GTAP Technical Paper No. 10). West Lafayette, IN: Purdue University Center for Global Trade Analysis. Available on the World Wide Web: http://www.gtap.agecon.purdue.edu/resources/tech_papers.asp.

Guoda, K., and Zhang, L. (2001). Analysis of comparative advantages of China livestock products exports. China Rural Economy, 7.

Hayes, D. (1999). China's role in world livestock and feed-grain markets. Choices, 1999(1).

Hertel, T.W., Nin, A., Rae, A., and Ehui, S. (2000). China: Future customer or competitor in livestock markets? Choices, 2000(3).

Lu, K., and Yang, W. (2002). How to expand the exports of Chinese pork? China Rural Economy, 1.

Nin, A., Hertel, T.W., Foster, K., and Rae, A. (in press). Productivity growth, catching-up and uncertainty in China's meat trade. Agricultural Economics.

Organisation for Economic Cooperation and Development. (2000). OECD agricultural outlook: 2000-2005. Paris: OECD.

Qiao, J. (2001). Analysis of the international competitiveness of China's meat products. China Rural Economy, 7.

Wang, F. (2002, July 5). The trade of chicken feet runs into deadlock. Southern Weekend.

|

|