|

After years of wrangling over labeling rules for biotech foods and feeds, regulators in some parts of the world are now turning their attention to the labeling of biotech seeds. This is, in part, due to the gradual recognition that compliance with food and feed labeling laws starts with seed purity. Accordingly, labeling rules for biotech seed are being devised through backward induction from existing food and feed labeling rules. For regulatory systems with strict standards, this is a tightrope exercise.

Consider the European Union (EU). After seeing its food and feed biotech labeling and traceability law take effect in April 2004, European regulators have sought to finalize their regulatory framework by establishing labeling standards for biotech planting seeds. Yet, the choice of standards has remained contentious (Smith, 2004). A principal point of discord is the purity thresholds for technical unavoidable or adventitious presence, or AP, of biotech material in conventional seeds. Thresholds for AP in conventional seeds are to be set at levels that would allow the resultant crops and their derivatives to meet the existing AP thresholds for foods and feeds, which are equal to 0.9%. Under these conditions, some interest groups have called for minimum tolerances set at the level of detectability allowed by testing technology, typically 0.1%. Other groups have advocated maximum tolerances that would minimize disruptions in the agrifood supply chain, typically 0.5%. The EU Commission has sought a "middle ground"—discussing AP standards between 0.3% and 0.5%—with little success.

At first glance, the differences in these AP standards seem minute. Yet they have caused strong disagreements, even inside the EU Commission. This is, in part, because little is known about the economic and structural implications of different AP standards. What is known, however, is that excessive compliance and displacement costs from structural change could bring substantial losses in social welfare. This would compromise the relevance of the seed-labeling regulation altogether (Kalaitzandonakes, 2004). In this paper, we seek to inform public policy by examining compliance costs for alternative AP standards in biotech seed labeling and evaluate their structural impacts. We use seed corn production as a case study.

Managing Purity in Seed Production

To the seed industry, purity has always been a chief concern. Seed purity is essential for reaching the full genetic potential of proprietary varieties and hybrids developed through lengthy breeding programs. Accordingly, seed firms invest heavily to ensure purity through strict practices and quality control systems. Established best management practices and quality control systems are intended to minimize the accidental presence of genetic material or whole seeds from other varieties, crops, or weeds in every commercial seed shipment. Despite strict standards, however, virtually every seed shipment contains small amounts of adventitious material, as seed production occurs in open environments where other seeds and crops are also produced and processed. Such realities are recognized in various national and international standards of seed purity (e.g., AOSCA, 2004; OECD, 2003).

The advent of biotechnology has produced another source of admixture that must be managed by seed firms. Biotech and conventional seeds typically coexist. They are produced in the same production areas and processed in the same seed processing and conditioning plants. Both conventional and biotech seeds are produced alongside conventional and biotech crops destined for the commodity grain market. Under these conditions, adventitious presence of biotech material in conventional seeds is possible and likely.

Adventitious presence occurs through unintended mechanical admixtures during operations such as sowing, harvesting, and processing—and through outcrossing with pollen from nearby fields of same crop type. Adventitious presence due to mechanical admixture can be monitored closely and minimized, but it cannot be eliminated, due to multiple potential points of commingling, large volumes handled, and occasional breakdowns (e.g., a piece of equipment that is not amenable to timely dismantling or cleaning). On the other hand, natural factors—such as cross pollination due to insects or pollen flow—are harder to control. Accordingly, AP is more difficult to control in cross-pollinating seeds (e.g., canola and corn) than in self-pollinating ones (e.g., soybeans and cotton).

Currently, seed firms strive to separate biotech and conventional seeds in order to ensure their genetic purity and performance. But they manage seed purity for both conventional and biotech seeds through the same best management practices and quality control systems used to manage other seed impurities. The seed industry has never sought to meet strict AP standards, like those under consideration in the EU.1

Strategies for Reducing Adventitious Presence

The seed industry could re-engineer its current breeding, processing and conditioning operations, in order to reduce AP levels of biotech material in conventional seed. Not all re-engineering strategies are equally effective or costly. Some strategies substitute for one another, whereas others can be used jointly to increase effectiveness. Hence, depending on the AP regulatory thresholds, seed firms could consider a mix of strategies to minimize compliance costs and risks. Potential re-engineering strategies relevant to our case study of seed corn production are as follows.

Breeding: As purity can only diminish in seed production and distribution, extremely high purity levels must be achieved at the initial breeding stage. Breeding is highly controlled and AP is unlikely. Best management practices can be tightened, but the primary strategy for ensuring purity in breeding is exhaustive testing. Seed firms could test all inbred lines for various biotechnology events, but costs could increase rapidly due to the numerous lines and traits under development.

Production: Seed corn production involves multiplication of both parent lines and commercial hybrid seed. Different strategies may be adopted to limit admixtures, the presence of volunteers, or pollen intrusion in seed corn production fields. Controlling pollen intrusion is most challenging. Limited traveling distance and viability of corn pollen suggest that increased isolation distances between fields can reduce (though not eliminate) potential outcrossing with foreign pollen. Higher isolation distances can be secured only at higher per-acre contract costs and, sometimes, at lower per-acre seed yields if land quality declines.

Block planting consists of grouping seed production fields that use the same male pollinator to limit the intrusion of foreign pollen in the block. Block planting reduces potential outcrossing but could encounter higher contracting costs for securing adjacent fields. Growing conditions could also decline as hybrid seed production is moved away from premium to less-productive fields.

Changes in cultural practices may also reduce the probability of AP. For instance, increasing the number of rows of the male parent in a field's outer border can reduce outcrossing. In this way, foreign pollen is diluted by the pollen mass of the male parent. Increasing the number of male border rows is costly, however, because less hybrid seed is produced per unit of land, and extra costs for the male seeds are incurred.

Careful time-isolation may also prove effective. Under time-isolation, seed parent lines are planted later than other nearby corn in order to prevent cross pollination during flowering and shedding periods. Seed firms may time-isolate only part of their production to limit frost risks from delayed harvest and avoid decreases in expected yields resulting from suboptimal growing season lengths.

Seed firms might also shift the production of conventional parent lines or hybrids to areas where commercial cultivation of biotech seeds or crops does not take place. Such movements can minimize AP but at the costs of suboptimal growing environments and longer transport distances.

Processing and Conditioning: Various re-engineering strategies can also be implemented at the processing level, although processing is already highly controlled. For instance, fields suspected of possible foreign pollen intrusion can be "flagged" and harvested separately. Aggressive flagging of fields can decrease the extent of AP but at increasing processing costs. As identical hybrids produced in different fields are less and less commingled, they lead to a larger number of lower volume stock keeping units (SKUs), inefficient use of dryers, storage bins, and other plant assets, and ultimately, added processing costs.

Plant equipment is cleaned after each individual SKU is processed, but extra care needed under very low AP thresholds would prolong processing operations, increase plant inefficiencies, and add costs. Separate testing of all SKUs produced in any single plant for various biotechnology events ensures that adventitious presence can be detected at some statistical confidence level. SKUs that do not meet AP thresholds can be discarded but only after production and processing costs have been incurred.

The Economics of AP Thresholds

In order to analyze the compliance costs of re-engineering seed production to meet various AP standards, we developed a detailed process and economic simulation model. The model was built on the PRESIP platform used to model identity-preserved and traceable systems in the agrifood supply chain (e.g., Kalaitzandonakes et al., 2001). Throughput and economic data from existing seed firms were used to operationalize the model.

Modeling Methodology & Data: Pioneer, Monsanto, and Syngenta provided operational and cost data for seed corn production from representative plants located in the US Corn Belt. These plants produce both conventional and biotech seed corn in areas producing large amounts of conventional and biotech grain corn. Separate baselines were developed for all simulated plants by calibrating the parameters of the model against the data provided by the collaborating seed firms. Baselines were considered complete only when plant managers confirmed that detailed throughput statistics and costs derived from the model closely matched actual experience. Monte Carlo simulation was then used to identify an optimal mix of cost minimizing re-engineering strategies for alternative AP thresholds. Baseline (normal operation) costs were compared against costs implied under the new set of operations designed to meet the selected AP purity thresholds.

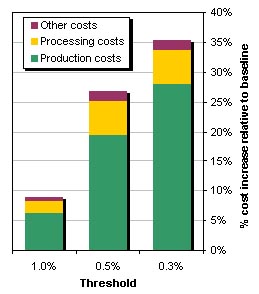

Figure 1 illustrates the compliance costs associated with AP thresholds of 1%, 0.5% and 0.3%—expressed here as percent increases over normal operation costs. Cost categories correspond to the basic activities in the production of commercial corn seeds. Production compliance costs result from changes in the field operations, such as incremental land, material inputs, labor, and field management. Processing compliance costs result from changes in the drying and conditioning of seeds. "Other" compliance costs are incurred for testing and extra storage and transportation.2

Empirical estimates indicate that compliance costs, on average, would increase by 9.06% for the 1% threshold, 26.82% for the 0.5% threshold, and 35.29% for the 0.3% threshold. Incremental production costs account for the largest share of compliance costs, which reflects the costly control of pollen flow at the field level and the dominance of production costs (80% of the total cost) in seed production. Incremental processing costs are a relatively important share of the estimated compliance costs.

In general, stricter regulatory standards and purity thresholds increase compliance costs at an increasing rate, yielding potentially large cost increases from even small changes in the regulatory standards.

Potential Structural Impacts

Compliance costs may be unevenly distributed across regions and firms. In this case, AP thresholds could have significant distributional and structural impacts.

Impacts on Industry Structure: Clearly, not all seed firms have the same exposure or capabilities to respond to various AP thresholds. In the US corn industry, for instance, about 300 firms compete to supply the market (Table 1). The top five firms that are national or multinational in their operations share 64% of the market. These firms are integrated, developing their own proprietary hybrids and owning substantial processing and distribution assets. The next 10 largest firms are mostly regional in focus with some proprietary germplasm base that is complemented through genetics from foundation seed firms. They typically own processing and distribution assets located in the regions they operate. Finally, some 250 smaller regional and local seed firms focus mostly on distribution. They depend heavily on foundation seed firms for genetics and often outsource the manufacturing of their seed brands. This structure of variable firm attributes and capabilities is typical of most international seed corn markets and leaves open the possibility for structural impacts from uneven AP compliance costs.

We conducted a survey of national and international seed corn firms in order to assess possible structural impacts of AP compliance costs. A web-based survey was sent to firms that are members of the American Seed Trade Association or of the International Seed Federation with a cover letter from the leadership of the associations encouraging participation. A total of 62 firms completed the survey—a 24% response rate.

Survey responses indicated that compliance costs anticipated by various seed firms for selected AP thresholds were variable but similar in structure to the above simulation results. Regression analysis of the survey data revealed that expected compliance costs were unevenly distributed among seed firms of different size. Interestingly, medium size firms (i.e., firms producing between 250,000 and 1,000,000 bags per year) might face a competitive disadvantage against larger and smaller firms, as they expected to incur 11.25% higher compliance costs across all selected thresholds. Small firms might be less exposed to AP regulatory standards due to greater ownership and control of their land base and a limited number of hybrids and volume to manage. Similarly, larger firms might be less exposed to AP standards, because they can employ a broader set of cost-minimizing strategies. For instance, larger seed firms can manage AP for a whole portfolio of parent lines and hybrids by shifting production across multiple national and international locations where they own processing facilities. Medium size firms may lack such flexibility due to limited assets and locations. Additionally, the high costs of quality assurance programs necessary to manage AP thresholds can be spread over larger volumes and numbers of hybrids. As sales increase, such costs can be substantially lowered. Thus, structural impacts from AP regulatory standards could accelerate the disappearance of medium size seed firms in a renewed cycle of industry consolidation (Kalaitzandonakes, 2001).

Impact on International Trade: The international market for planting seeds is an active one. US imports and exports of seed corn alone have averaged almost $300 million per year in the last three years (Table 2). In the case of the EU, seed corn imports and exports were almost twice that over the same period. How much these trade flows could be affected by various AP standards is not clear.

Some trade flows could be weakened, especially those from export countries with commercial production of biotech seeds and crops (e.g., Argentina, Canada, and the United States) to importing countries with limited approvals of biotechnology traits (e.g., the European Union). Inspection of trade flows over the last decade suggests that such changes might already be underway. The permanence of such changes is difficult to foresee because of the substantial fixed investments in both germplasm and processing infrastructure around the world.

Even less clear are the cost implications of such potential changes. Seed trade controls seed costs by increasing competition at local seed markets and providing for cost minimization strategies (e.g., shifting seed production from one country to another in response to shifting exchange rates). Furthermore, seed trade prevents price swings in local markets through imports and exports that smooth out local supply shortages or oversupplies caused by weather variation.

Concluding Comments

The economic and structural implications of regulatory standards in biotech labeling laws and associated compliance costs have attracted little attention. Labeling standards typically arise through a political process. Our results highlight the need for comprehensive economic analysis. As AP thresholds become stricter compliance costs quickly escalate, especially at low threshold levels. Even minute changes in such standards translate into large cost increases. Furthermore, uneven distribution of such costs across firms and regions suggest potentially large impacts on industry structure and international seed trade. The social costs of these changes could significantly offset any gains in welfare sought through regulation.

Notes

1 A number of seed firms produce both biotech and conventional seeds and cater to a few small European markets that have already imposed strict AP standards for biotech material in seed (i.e., Austria and Italy). They manage such standards by "skimming" their seed production—that is, by testing all conventional seed lots and then selecting the ones that meet those standards for exports to the selected markets. Of course, such practices cannot be generalized when AP standards apply broadly.

2 Estimated testing costs provide a lower bound to such expenditures, as a single generic PCR test was assumed to be administered for each SKU. If multiple tests are necessary to test for AP of specific biotech events, testing costs could quickly escalate.

For More Information

Association of Seed Certifying Agencies. (2001). Genetic and Crops Standards of the AOSCA.

Kalaitzandonakes, N. (2004). Another look at biotech regulation. Regulation, 27(1), 44-50.

Kalaitzandonakes, N. (2001). Strategies and structure in the emerging global seed industry. Biofutur, 215, 38-42.

Kalaitzandonakes, N., Maltsbarger, R., & Barnes, J. (2001). The costs of identity preservation in the global food system. Canadian Journal of Agricultural Economics, 49, 605-615.

OECD. (2003). OECD scheme for the varietal certification of crucifer seed and other oil or fibre species seed moving in international trade. OECD Seed Schemes.

Smith, J. (2004, May 3). EU to tackle last piece of GMO legal jigsaw. Reuters.

|

|

Table 1

Seed corn trade for selected regions (avg. 1999-2002).

| EU |

6,046 |

60,194 |

| NAFTA |

9,672 |

64,456 |

| Argentina |

33,418 |

3,842 |

| Chile |

74,998 |

2,052 |

| Other |

1,562 |

33,791 |

| Total |

125,695 |

164,336 |

| EU |

244,062 |

284,432 |

| NAFTA |

57,387 |

6,220 |

| Argentina |

1,453 |

105 |

| Chile |

12,782 |

701 |

| Hungary |

32,795 |

7,402 |

| Other |

10,784 |

33,946 |

| Total |

359,263 |

332,805 |

|

|

Table 2

Structure of US seed corn industry (avg. 1999-2002).

| Top 5 |

64% |

National/Multinational

Own genetics, production, processing, distribution |

| Next 10 |

16% |

Mostly regional

Both own & purchased genetics; own production & distribution |

| Rest 250 |

20% |

Mostly local

Mostly purchased genetics; some owned production; focus on distribution |

|

|