Foreign workers have been an important part of U.S. labor-intensive segments of agriculture throughout U.S. history. Typically, these are specialty crops such as tree crops, vegetables, and nursery and greenhouse crops. Each requires large amounts of labor relative to other resources used in production. Tree crop and vegetable production not only has very large labor requirements, but the requirements are often concentrated into a very short time span of a relatively few weeks, particularly at harvest time. Nursery and greenhouse production has large, but nearly year-round labor requirements. While there has been considerable mechanization in agriculture, a number of fruits and vegetables, particularly for the fresh market, continue to be hand-harvested. Most greenhouse and nursery production utilizes manual labor.

Economic Issues

Wage Rates

Legal immigrants. While some economists suggest that increased immigration has reduced wage rates for native-born, unskilled workers (Borjas, 2003), most have found negative wage effects of increased immigration extremely difficult to demonstrate once all appropriate adjustments are made. For example, the 1980 Mariel Boatlift from Cuba to Miami increased the Miami labor force by 7%, but had no significant effect on wages of comparable Miami workers (Card, 1990). A second example is the sudden, unanticipated 14% increase in the Israeli labor force by Russian émigrés over 1989-1996, resulting in no significant wage effects in the Israeli economy (Gandal, Hanson, & Slaughter, 2004). These two cases encompass both extremes of the skill distribution of immigrants: the Mariel Boatlift was a relatively low-skilled population, while the Russian emigrants to Israel were a relatively skilled group. Card (2005) summarizes studies based on U.S. data: ". . . although immigration has a strong effect on relative supplies of different skill groups, local labor market outcomes of low skilled natives are not much affected by these relative supply shocks" (p. F321).

The most important economic consideration in absorption of large numbers of immigrants without significant wage effects is that the host country operates as an open economy with minimal restrictions on trade in goods, production resources, and capital. The economic adjustments mitigating the wage effects are technological change, changes in the output mix of the economy, and the employment of additional factors of production complementary to the additional labor (Gandal, Hanson, & Slaughter, 2004; Freeman, 2006).

Unauthorized workers. Not only are most hired workers in agriculture foreign-born, but over half are unauthorized for work in the United States. Although there may be no significant wage effects from immigration, there are likely to be significant wage differences between authorized and unauthorized workers. The average earnings reported in Table 1 suggest sizeable differences in reported hourly earnings by authorized and unauthorized workers. Observed differences were 8 and 9% for the periods 1989-1998 and 1999-2001, respectively. Following 2001, however, real hourly earnings for unauthorized workers fell 13% below authorized worker earnings for the 2002-2004 period.

There are a number of reasons why the earnings of groups of workers could differ. For example, they may have different levels of experience, they may be of different age groups or gender, or they may be doing different types of work, etc. A standard way to address the question and isolate the effect of legal status, is to utilize the observed earnings of different types of workers to predict their earnings in each legal status while holding all other worker and job characteristics constant. Estimates based on the 1989-2004 NAWS data for various combinations of worker and employment characteristics are summarized in box 1. Estimates suggest a wage penalty of 11% after 2001 for a typical illegal worker in agriculture. The wage penalty is much higher for skilled workers, but most agricultural workers are unskilled, not skilled.

The estimated wage penalties summarized in box 1 are qualitatively similar to earlier research by Taylor (1992) and Isé and Perloff (1995). The estimates are also in line with an estimated wage penalty of 14% to 24% for the broader labor force based on legalization under the General Legalization Program of the 1986 Immigration Reform and Control Act (IRCA) (Kossoudji & Cobb-Clark, 2002).

The ultimate question is what will happen to wage rates in agriculture under alternative immigration policy scenarios? Suppose for the moment that there are no changes in technology with the change in immigration policy so that the structure of labor demand by agriculture remains unchanged. With full legalization of unauthorized workers and access to guest workers, market-determined wage rates would be expected to remain at the level they currently are for legal workers; the only difference would be the absence of a wage penalty for the formerly illegal workers.1 The direct wage cost would clearly be higher for employers under this scenario. However, a significant part of the eliminated wage penalty must be interpreted as a risk premium to the employer to compensate for potential losses through: 1) uncertainty about the potential removal of labor at a critical production time resulting from an immigration regulatory change, 2) the potential discovery and removal of illegal workers under existing regulations, or 3) facing penalties from having employed illegal workers. The remainder of the wage penalty is best attributed to the lower opportunity cost of illegal workers resulting from their more limited alternatives in an illegal employment status. The removal of this latter component of the penalty through legalization would result in a higher cost to employers if all workers were legal. However, the opportunity cost component has surely diminished over time as illegal workers have become more widely dispersed throughout the economy (Passell, 2006).

The alternative scenario of full removal of illegal workers, closing the border, and no significant guest worker program could result in increased wage rates in agriculture under the assumption of immobile capital and no changes in production technology or product mix in agriculture or other industries. It is argued below, however, that immobile capital and fixed technology and product mix are unlikely scenarios, and that once these assumptions are relaxed, the wage effects would be greatly reduced or eliminated.

A related issue is the extent to which illegal workers utilize more public services than their tax contributions. Moretti and Perloff (2000) found that participation in welfare programs2 by unauthorized farm worker families was 8% in contrast to 27%, 30%, and 42% for citizen, amnesty, and green card farm worker families, respectively. Participation in social insurance programs3 by unauthorized farm worker families was 2% in contrast to 21%, 38%, and 41% for citizen, amnesty, and green card farm worker families, respectively. Their analysis based on the NAWS does not permit a comparison of the tax contributions with service usage. However, since most pertinent tax payments are via payroll deductions or sales tax collections, the general belief is that tax contributions vary little by legal status. Examining the experience for overall U.S. immigration, a National Research Council publication reports that "… the average long-term fiscal impacts of immigration are generally found to be positive under most scenarios…" (Smith & Edmonston, 1997, p. 354). Their analysis included not only welfare and social insurance programs, but all public services, including public education. Important qualifications of their summary statement are the variations by attributes of the immigrants (a negative (positive) impact for immigrants with less (more) than a high school education), and a negative impact on state and local governments in areas of high immigration, but a strong positive impact at the federal level.

Work Duration

Labor availability is a continuing concern by agricultural employers. Labor-intensive specialty crops often have a narrow window when certain activities must be accomplished, requiring relatively large amounts of labor at those times, but relatively little labor during the rest of the year. Typically, crops requiring manual labor for harvest are the most time-critical and labor-intensive. The fact that the grower's income from the crop is contingent upon a timely harvest of the crop, the availability of labor at this point is obviously a major concern to the grower. One element of this concern is that currently undocumented workers in agriculture would leave agriculture for alternative employment once they achieve a legal immigration status. Similar concerns at the time of the passage of IRCA resulted in the Replenishment Agricultural Worker program (RAW) of IRCA. The RAW program provided authorization for foreign workers to legally work in agriculture if there were an agricultural labor shortage as determined by the Departments of Agriculture and Labor. Since a shortage was never declared by the Departments, the RAW program was never actually implemented.

Access to foreign workers has been one way that agriculture has attempted to secure a timely labor force. The vast Bracero Program (P.L. 78) was operational from 1942-1964 largely in the western states authorizing the migration of labor from Mexico to U.S. agriculture. The H-2A program (and its precursors) for agriculture was initially between the British West Indies and the United States, but more recently has focused on workers from Mexico. Although there were only 7,011 persons with H-2A visas admitted in fiscal year 2005, there were 22,141 in fiscal year 2004; the largest number over the past decade was in fiscal year 2000 with 33,292 persons with H-2A visas admitted (U.S. DHS, 2006, Table 26). The H-2A program clearly accounts for a very small portion of the agricultural labor force. The program is typically found to be too cumbersome and expensive by growers: "H[-]2A is bureaucratic, unresponsive, expensive, and prone to litigation" (U.S. Congress, 2006).

AgJOBS (Agricultural Job Opportunities, Benefits, and Security Act of 2007, H.R.371, S.340) is a proposed guest worker program for agriculture that has the support of both labor advocates and grower organizations. A similar AgJOBS bill was attached to the U.S. Senate immigration proposal, S. 2611 in the 109th Congress. The distinguishing characteristic of AgJOBS, the Bracero Program, and the H-2A program is that each of them ties the worker for varying periods of time specifically to agricultural employment. The former Bracero Program and the H-2A program were, and are, strictly for agricultural work with no path to permanent residency in the United States. The proposed AgJOBS offers adjustment to a legal status for existing unauthorized agricultural workers meeting past agricultural work requirements in the United States, and with a possible path to permanent residency. Nevertheless, the initial years have a required period of work in agriculture. Future foreign workers would be permitted through a streamlined H-2A program, but again restricted to agriculture.

The restrictions on legalized workers to work proscribed amounts of time in agriculture stem from concerns by the industry about the availability of labor at critical times. In the context of existing unauthorized workers, the concern is that once authorized for work in the United States, they will leave agriculture for employment in other industries. Research to this point in time does not support this concern.

Existing research indicates that if illegal agricultural workers were to be legalized, their expected length of job would increase (Hashida & Perloff, 1996; Tran & Perloff, 2002; Iwai, Napasintuwong, & Emerson, 2005; Iwai, Emerson, & Walters, 2006b). Iwai, Emerson, and Walters (2006b), for example, find that the likelihood of remaining in agriculture upon being legalized ranges from a one percentage point reduction to an increase of 7.3 percentage points. Of 32 combinations of worker characteristics considered, only five resulted in a decrease in the likelihood of remaining in agriculture; among these five, only two were realistically relevant combinations. One noteworthy result is that the likelihood of remaining in agriculture generally increased modestly following 2001; correspondingly, the increases in the likelihood of remaining in agriculture attributed to a hypothetical legalization were generally smaller after 2001. A somewhat different methodology used by Iwai, Napasintuwong, and Emerson (2005) suggests an increase in job duration of an unauthorized worker of 4.4% upon becoming authorized under a program such as the Seasonal Agricultural Worker (SAW) program under IRCA, or by 3.9% by becoming a permanent resident. The effects are not large, amounting to slightly fewer than three more work days. However, they are positive when the concern has been that once legal status is obtained, there would be less attachment to agriculture.

Hashida and Perloff (1996) and Tran and Perloff (2002), using data from the 1989-91 NAWS, found qualitatively similar results. A somewhat different approach was taken by Emerson and Napasintuwong (2002), who examined information on the number of years workers reported having worked in agriculture in the United States. Their results suggested that the expected number of years of work were larger for authorized than for unauthorized workers.

Technology and Labor

U.S. agriculture has a long history of technological innovations, with considerable evidence suggesting that new technologies developed in the United States save labor given a history of relatively abundant land (Hayami & Ruttan, 1970). An early example of agricultural producers responding to changes in the labor market by changing production techniques is the adoption of the mechanical tomato harvester in California. A major source of labor for California agriculture was the Bracero Program until its termination in 1964. Schmitz and Seckler (1970) summarize the adoption:

The first 25 harvesters were used in California in 1961. By 1964, 75 were in use; a year later, 250. The number increased to 1,000 in 1967 (Lynch, 1968), when approximately 80 percent of the California acreage was harvested by machines. (p. 570)

The agricultural labor market experience starting in the 1970s through the present time has been the reverse of the termination of the Bracero Program: workers have increasingly flowed across the border seeking employment opportunities. Napasintuwong and Emerson (2004), using data for Florida, found that while technology had been labor-saving prior to IRCA, it became labor-neutral following IRCA as foreign-born workers became the dominant labor source for agriculture. In other words, technologies employed in agriculture no longer had the effect of continually reducing the quantity of labor relative to other inputs for given input price ratios.

Shifts in technology can also alter the extent to which inputs are substitutable for each other. Napasintuwong and Emerson (2004) found that labor was a substitute for capital throughout most of the time period, but from the mid-1980s through the early 1990s, there was some indication that labor and capital were complements when viewed as changes due to a change in the price of capital. The implication is that if more stringent immigration legislation were to stimulate the ready availability of new mechanized technology, and at a lower cost, it would not necessarily follow that the employment of hired labor would decrease. Another interesting finding is that capital and labor are more easily substitutable when returns to labor change than when capital prices change. This implies that it is easier to substitute capital for labor (such as adopting mechanized technology) when labor becomes more expensive than it is to substitute labor for capital when capital becomes more expensive. In the context of the mechanical tomato harvester noted earlier, once the harvester was adopted in the late 1960s, a larger reduction in the relative price of labor would be required to shift back to hand harvesting than the initial reduction in the relative price of capital required to adopt the harvester.

The substitutability of labor and capital has implications for various forms of immigration policies. For example, a policy sealing the border, deporting all unauthorized workers, and authorizing no guest workers could result in temporarily higher wage rates for agriculture in the immediate term. The Napasintuwong and Emerson (2004) substitutability estimates suggest that such a policy would stimulate the adoption of additional available labor-saving technology, with increased substitution of capital for labor. With a hypothetical 10% increase in the wage rate, their estimates suggest an 18% increase in the capital-to-labor ratio. By contrast, a less restrictive policy toward foreign workers would reduce the incentives for adopting new mechanical technology, and reduce the extent of substitution of capital for labor.

Crop Mix

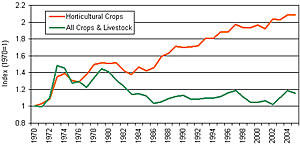

In addition to changes in technology, producers also adjust to the relative availability of labor through changes in the mix of crops produced. Deflated cash receipts from horticultural crops (vegetables, fruits and nuts, and greenhouse and nursery crops) in the United States more than doubled from 1970 to 2005 (Figure 1). By comparison, deflated cash receipts for all U.S. crops and livestock increased by less than 16% over the same time period. This shift in production is to be expected in part from increased demand for many horticultural products as consumer income rises. However, the real price for horticultural products fell by 20% between 1970 and 1999.4 Moreover, since horticultural products are internationally traded goods, domestic demand can be, and is, met by a combination of domestic and international supply.

Cash receipts from U.S. horticultural crops represented 21% of all U.S. agricultural cash receipts in 2005; the comparable figure for 1970 was less than 12% (U.S. Department of Agriculture, 2006). However, since horticultural crops are the labor-intensive component of agriculture, they represent a much larger portion of expenditures on labor. Labor expenditures by horticultural farms were 51% of all farm labor expenditures in 2002 (U.S. Department of Agriculture, 2004).

Clearly, the agricultural product mix shifted over this 35-year period toward more labor-intensive commodities. Napasintuwong and Emerson (2004) have found that agricultural technology has become more perishable crop-producing since IRCA, and has become increasingly biased against other types of agricultural products such as the grains and livestock. A restrictive immigration policy of border closure, deportation of unauthorized workers, and authorizing no foreign workers could slow the technology bias toward producing more perishable crops.

Capital Mobility

Coincident with the labor intensive characteristic of specialty crop agriculture is that specialty crop farms tend to be quite large with substantial capital investment. Although fruit and tree nut, vegetable and melon, and greenhouse and nursery farms represent only 9% of all U.S. farms, they represented 26% of U.S. farms with the value of land and buildings exceeding $10,000,000 in 2002 (USDA, 2004). In the long term there may not be increases in wage rates due to either closing the border or a shift to legal migration. However, the short term effect of a threat to close the border could be an increased risk of labor availability. Furthermore, one mechanism through which market forces result in minimal wage effects is the movement of capital to either other industries or countries where the expected return on capital is higher. One example of this type of capital movement is the shift of some leather leaf fern production from Florida to Costa Rica, Ecuador and Guatemala, ostensibly in reaction to labor market considerations. The result is increased international trade in lieu of labor mobility.

Summary

Opinions vary widely about the future course of immigration policy in the United States as evidenced by the stark contrast between the House of Representatives bill "Border Protection, Antiterrorism, and Illegal Immigration Control Act of 2005" referred to the Senate in January 2006 (H.R.4437 109th Congress, 2nd sess.), and the Senate bill "Comprehensive Immigration Reform Act of 2006" passed in May 2006 (S.2611 109th Congress, 2nd sess.). H.R. 4437 would close the border, deport all illegal aliens, and offer no provision for guest workers in agriculture or any other industry. S. 2611 would increase border enforcement, authorize a guest worker program, provide a path to permanent residency for guest workers, and incorporate AgJOBS as a subtitle of the act. The House and the Senate were unable to transcend their differences prior to the November elections, choosing not to meet in a Conference Committee. The end result prior to the November elections was the passage by the House and the Senate of a House of Representatives sponsored bill, the Secure Fence Act of 2006 (H.R. 6061), directing the Department of Homeland Security to erect fencing on hundreds of miles of the U.S. - Mexico border. The bill was signed by the President amid verbiage that this was one small component of comprehensive immigration reform. Subsequently, limited funds for fencing were authorized in the Department of Homeland Security's appropriations bill for fiscal year 2007.

Given the strong differences of opinion on immigration reform, does economics offer any useful guidelines? While economics typically cannot determine which policy approach is best (that is a political choice), it can provide useful information on the economic effects of alternative approaches. The effects discussed earlier are summarized in Table 2. Considerations particularly relevant for agriculture are offered below.

Closing the Border

Closing the border is frequently discussed as one option in immigration reform. The Secure Fence Act of 2006 takes a step in this direction. However, there is considerable doubt raised in the literature about the effectiveness of previous efforts to reduce the flow of illegal workers across the border (Hanson, Robertson, & Spilimbergo, 2002). At the core of the problem are wage differentials between the United States and Mexico on the order of six to one (Freeman, 2006). When illegal workers are willing to risk their lives for the opportunity to work in the United States, it is highly questionable that fencing or other approaches will achieve the desired end. At best, the approaches can make it more difficult to enter, and therefore a higher risk to potential entrants. But, if immigrants are already willing to pay the ultimate price, the reduction may be less than hoped for by the policy's proponents. Moreover, rising deaths among border-crossers will eventually exceed a politically acceptable level for a "nation of immigrants."

Suppose for the moment that the border were effectively closed, all undocumented workers were deported, and no guest workers were permitted, much as the approach of H.R. 4437 (109th Congress). With the proposed two-year window for removal of illegals, the industry would be likely to adjust quickly to the new environment. Three likely adjustments would be changes in product mix, production techniques, and capital flows. While significant increases in the relative importance of specialty crops occurred with the inflow of foreign workers since the 1970s, it is questionable that the increase would be extensively reversed. A more likely scenario is that production techniques would adjust to the new environment, adopting more labor-saving technology. There might also be a flow of capital out of some specialty crops to production areas outside the United States.

The remaining question concerns potential changes in wage rates for agriculture under a scenario of no access to foreign workers. The wage rate that agriculture pays is largely dictated by the wage rate paid for unskilled labor in the much larger nonfarm economy. As indicated above, past levels of immigration have been estimated to have only minimal negative wage effects on unskilled native workers; most agricultural employment draws from the unskilled labor market. As long as agriculture employs largely unskilled labor, wage rates are not likely to significantly change in real terms, regardless of the level of foreign workers.5 The way that labor earns a premium above the unskilled wage rate is to develop skills that are in demand in the economy, thus moving out of the unskilled labor pool. In the absence of higher productivity, there is little basis to argue that a person's wage will increase. Only if agricultural employers shift to employ a more highly skilled labor force would the average real wage rate for the industry be expected to change significantly. Although this is a potential outcome of a highly restrictive immigration policy, it is not the same as a wage increase. The average wage rates may be higher, but they would be higher because the composition of the labor force had changed to be more highly skilled, on average. The wage rate of unskilled workers would still remain at its nearly constant level in real terms. In this scenario, technology and/or the product mix would have changed to require fewer unskilled workers and relatively more skilled workers. The important point to recognize is that the substitution of skilled for unskilled workers would not be one for one, but rather, fewer skilled workers substituting for a given number of unskilled workers. Consequently, the wage bill would not necessarily increase.

Legal Migration

If some flow of people across the border for work is currently inevitable, the more relevant issue is how to convert this to a legal flow and determine its effects. Legal migratory flows across borders consist of two types: permanent migration, or immigration, and temporary migration, technically, nonimmigrants of which those entering specifically for work are guest workers. Most recent permanent immigrants have been authorized under the family reunification provisions of the 1965 Immigration Reform Act. While most are of working age upon arrival in the United States, their admission is not on the basis of an employer request or a particular job skill. One potential reform would be to increase the number of legal immigrants, and to use employment skills as Canada does as a criterion for entry. Other possibilities are to auction visas to prospective immigrants (Freeman, 2006) to capture some of the gains that immigrants achieve through immigration, and assure that those with the greatest potential and desire are the ones who gain entry for immigration. Regardless of the approach, Congress would have to determine an upper limit to legal immigrants. Recent Congressional proposals have addressed formal immigration through potential paths to permanent residency for existing undocumented workers, their families, and proposed guest workers. There was no political sentiment prior to the November election, if at all, to adopt the latter proposals.

Nonimmigrant guest worker programs are an alternative to permanent immigration and serve as a means of augmenting the labor force typically to meet specific expressed employment needs. They are typically for limited employment duration and incorporate numerous regulations, as in the existing H-2A program for agriculture regulating the terms of employment, and particularly the minimum wage for guest workers and their domestic counterparts at the same employer.

Two sets of guest worker proposals were set forth in the 109th Congress: a general guest worker program, and a program specifically for agriculture (AgJOBS). Both appeared separately in various Senate bills, and both were encompassed in S. 2611. Two features of these proposals have been politically problematic: allowing illegal workers meeting certain requirements to become legal guest workers, and opening a path to permanent residency for guest workers meeting various employment criteria and law-abiding behavior.

A concern specific to agriculture is that if all currently illegal workers become authorized, there will be an immediate exodus from agriculture to nonfarm jobs. The available evidence on this issue does not support the contention. Perhaps most important is that employment in agriculture is no longer the primary source of employment for illegal workers. Over half are employed in three broad industry groups: construction (20%), leisure and hospitality (17%), and manufacturing (14%) (Passell, 2006). Moreover, available evidence is that illegal workers approach employment in agriculture in the same way that domestic U.S. workers have for generations: few look to manual labor in agriculture as a lifetime career. The present employment pattern with illegal workers does not appear greatly different than it has in the past with domestic workers: they remain in agriculture for a few years and then move on to some other mode of employment. Clearly, there are some who choose to work in agriculture for a lifetime; however, that is not the case for the majority of hired farm workers.

The AgJOBS proposal addresses the industry concern by incorporating required periods of work in agriculture if a formerly illegal worker authorized under the program is to be eligible for continued work in the United States, and subsequently a path to permanent residency. In addition, AgJOBS would maintain a streamlined H-2A program specifically for employment in agriculture. While there are clearly unique aspects of agricultural employment, restricting employment to one industry raises additional concerns. One of the ways that workers address working conditions and wages that they find unsatisfactory is by terminating their current employment and seeking employment elsewhere where working conditions better meet their preferences. Workers who are tied to a single employer or industry have limited ability to address work-related problems. As a result, they tend to be addressed by additional regulations, and often litigation. Freedom of movement by workers among employers and industries may be far more effective than regulations in establishing agreeable working conditions and wages.

In closing, there are two realistic options: do nothing, or establish a legal mechanism for migration. Closing the border is not a viable option: the economic pressures to enter the United States from neighboring countries are simply too great. While doing nothing is always an option, the approach goes against the national fabric of a "nation of laws." Instituting legal mechanisms for migration formalizes the process by removing workers from the shadows and employers from a guessing game about the legal status of their employees. Regardless of the approach taken, research has shown that technical changes in the production process and product mix changes address most of the required economic adjustments, leaving the structure of wages largely unaltered. Workers switching from an illegal status to a legal status will command a higher wage, but it is not unreasonable to argue that employers are already incurring that wage difference as a risk premium due to employees in an illegal work status. The nation gains overall through added economic activity of the temporary or permanent migration augmenting the labor force. The immigrants and complementary factors of production (land, capital, and complementary labor) capture the gains, and substitute labor absorbs any losses. Wage losses through migration, however, have been extremely difficult to demonstrate.

Notes

1 Note that the farm wage is largely determined by the nonfarm wage, and as noted earlier, research has largely shown that increased numbers of legal immigrants in the economy have had no significant effect on wage rates. Also, as summarized in the following section, research does not suggest an exodus from agriculture with legalization.

2 AFDC, Medicaid, food stamps, WIC, general assistance, or public housing.

3 Unemployment insurance, disability insurance, or Social Security.

4 The price index is a quality adjusted price index calculated from data provided by Eldon Ball, and deflated by the GDP deflator. See Ball et al. (1997) for the methodology.

5 All workers would now be earning the market wage; the undocumented group would no longer be present earning the market wage less the legal status penalty. To the extent that the legal status penalty is a risk premium for the employer, the employer's cost per worker would remain unchanged.

For More Information

Ball, V. E., Bureau, J-C., Nehring, R., & Somwaru, A. (1997). Agricultural productivity revisited. American Journal of Agricultural Economics, 79, 1045-63.

Borjas, G.J. (2003). The labor demand curve is downward sloping: reexamining the impact of immigration on the labor market. Quarterly Journal of Economics, 118, 1335-74.

Card, D. (2005). Is the new immigration really so bad? Economic Journal, 115, F300-23.

Card, D. (1990). The impact of the Mariel boatlift on the Miami labor market. Industrial and Labor Relations Review, 43, 245-57.

Carroll, D., Samardick, R., Bernard, S., Gabbard, S., & Hernandez, T. (2005). Findings from the National Agricultural Workers Survey (NAWS) 2001 - 2002. A demographic and employment profile of United States farm workers. Research Rpt. No. 9, Office of Programmatic Policy, Office of Asst. Secretary for Policy. U.S. Dept. of Labor. Available online: http://www.doleta.gov/agworker/report9/naws_rpt9.pdf.

Emerson, R.D., & Napasintuwong, O. (2002). Foreign workers in southern agriculture. Presented at the SAEA Annual Meeting, Orlando, FL.

Freeman, R.B. (2006). People flows in globalization. Journal of Economic Perspectives, 20, 145-70.

Gandal, N., Hanson, G.H., & Slaughter, M.J. (2004). Technology, trade, and adjustment to immigration in Israel. European Economic Review, 48, 403-28.

Hanson, G.H., Robertson, R., & Spilimbergo, A. (2002). Does border enforcement protect U.S. workers from illegal immigration? Review of Economics and Statistics, 84, 73-92.

Hashida, E., & Perloff, J.M. (1996). Duration of agricultural employment (working paper 779). Berkeley, CA: University of California Department of Agricultural and Resource Economics.

Hayami, Y., & Ruttan, V. (1970). Factor prices and technical change in agricultural development: the United States and Japan, 1880-1960. Journal of Political Economy, 78, 1115-41.

Isé, S., & Perloff, J.M. (1995). Legal status and earnings of agricultural workers. American Journal of Agricultural Economics, 77, 375-86.

Iwai, N., Emerson, R.D., & Walters, L.M. (2006a). Legal status and U.S. farm wages. Presented at the SAEA Annual Meeting, Orlando, FL. Available online: http://agecon.lib.umn.edu/cgi-bin/pdf_view.pl?paperid=19740&ftype=.pdf.

Iwai, N., Emerson, R.D. & Walters, L.M. (2006b). Farm employment transitions: a Markov chain analysis with self-selectivity. Presented at the AAEA Annual Meeting, Long Beach, CA. Available at: http://agecon.lib.umn.edu/cgi-bin/pdf_view.pl?paperid=23093&ftype=.pdf.

Iwai, N., Napasintuwong, O., & Emerson, R.D. (2005). Immigration policy and the agricultural labor market: The effect on job duration. Presented at the AAEA Annual Meeting, Providence, RI. Available online: http://agecon.lib.umn.edu/cgi-bin/pdf_view.pl?paperid=18193&ftype=.pdf.

Kossoudji, S.A., & Cobb-Clark, D. (2002). Coming out of the shadows: Learning about legal status and wages from the legalized population. Journal of Labor Economics, 20, 598-628.

Lynch, D. (1968). The revolution of California tomatoes. Canner/Packer, Western Edition, 137, 10A-10F.

Moretti, E., & Perloff, J.M. (2000). Use of public transfer programs and private aid by farm workers. Industrial Relations, 39, 26-47.

Napasintuwong, O., & Emerson, R.D. (2004). Labor substitutability in labor intensive agriculture and technological change in the presence of foreign labor. Presented at the AAEA Annual Meeting, Denver, CO. Available online: http://agecon.lib.umn.edu/cgi-bin/pdf_view.pl?paperid=14330&ftype=.pdf.

Passell, J. (2006). The size and characteristics of the unauthorized migrant population in the U.S. Research Report. Washington, D.C.: Pew Hispanic Center. Available online: http://pewhispanic.org/files/reports/61.pdf.

Schmitz, A., & Seckler, D. (1970). Mechanized agriculture and social welfare: The case of the tomato harvester. American Journal of Agricultural Economics, 52, 569-77.

Smith, J.P., & Edmonston, B. (1997). The new Americans: Economic, demographic, and fiscal effects of immigration. Washington, DC: National Academy.

Taylor, J. E. (1992). Earnings and mobility of legal and illegal immigrant workers in agriculture. American Journal of Agricultural Economics, 74, 889-96.

Tran, L.H., & Perloff, J.M. (2002). Turnover in U.S. agricultural labor markets. American Journal of Agricultural Economics, 84, 427-37.

U.S. Congress House of Representatives. (2006). Oversight Hearing on "The Reid-Kennedy Bill's Amnesty: Impacts on Taxpayers, Fundamental Fairness and the Rule of Law," Committee on the Judiciary. Oral testimony of John Young, Concord, NH. August 24. Available online: http://judiciary.house.gov/OversightTestimony.aspx?ID=685.

U.S. Department of Agriculture (USDA). (2004). 2002 census of agriculture. Available online: http://www.nass.usda.gov/Census_of_Agriculture/index.asp.

U.S. Department of Agriculture, Economic Research Service. (2006). Farm cash receipts, 1924-2005. Available online: http://ers.usda.gov/Data/FarmIncome/finfidmu.htm.

U.S. Department of Homeland Security Office (DHS), of Immigration Statistics. (2006). Yearbook of immigration statistics: 2005. Available online: http://www.uscis.gov/graphics/shared/statistics/yearbook/YrBk05NI.htm.

|

|

Other articles in this theme:

|

|

Table 1

Real average hourly earnings for U.S. agricultural workers: constant (2004) dollars.

| Authorized Workers |

7.49 |

7.97 |

8.31 |

| Unauthorized Workers |

6.90 |

7.26 |

7.25 |

| Difference |

|

|

|

| Dollars |

0.59 |

0.71 |

1.06 |

| % of Authorized |

8 |

9 |

13 |

|

|

Table 2

Summary of economic issues.

| Wage rates |

Minimal to none (wage penalty disappears) |

Minimal to none (wage penalty disappears) |

| Work duration |

Minimal |

Minimal |

| Technology |

Labor-saving technology developed and adopted |

Technology neutral among productive factors |

| Crop mix |

Shift away from labor-intensive specialty crops |

No change |

| Capital flows |

Potential production shift to other countries |

No change |

|

|