Futures markets play a key role in price discovery and risk transfer in many agricultural markets. Concerns have been raised about the performance of Chicago Board of Trade (CBOT) grain futures contracts in a number of recent forums, most prominently at the Agricultural Forum hosted by the Commodities Futures Trading Commission (CFTC) on April 22nd, 2008. Market participants have expressed concern that futures prices have been artificially inflated since the Fall of 2006, contributing to weak and erratic basis levels and a lack of convergence of cash and futures prices during delivery. In this article, we focus on the nature and consequences of recent convergence problems in CBOT (now CME Group, Inc.) corn, soybean and wheat futures contracts. We also briefly comment on proposals for changing the contracts to address the problems that have surfaced recently.

Convergence problems at delivery locations are not necessarily identical to nondelivery basis performance issues, which are not addressed in this article. Basis in some nondelivery markets may be influenced by lack of convergence, but that is not uniformly the case. Corn basis at interior processing markets, for example, is less influenced by the Illinois River basis (delivery location) than cash markets close to the River. Basis at nondelivery locations is influenced by transportation costs, storage and ownership costs, supply of and demand for storage in the local market and merchandising risk (margin risk). All of these factors have likely contributed to weaker basis at many nondelivery markets.

The delivery process is an essential component of futures contracts with physical delivery, as it ties futures and cash prices together. In a perfect market with costless delivery at one location and one date, arbitrage should force the futures price at expiration to equal the cash price. If futures were above the cash price, the cash commodity would presumably be bought, futures sold and delivery made. If the cash price exceeded futures, users could buy futures and stand for delivery. This type of arbitrage should prevent the law of one price from being violated.

In reality, delivery on grain futures contracts is not costless and is complicated by the existence of grade, location and timing delivery “options” that have a demonstrated value to sellers of contracts. A more realistic approach is to think of a zone of convergence between cash and futures prices during delivery periods, with the bounds of convergence determined by the cost of participating in the delivery process. Previous estimates of the direct costs of delivery are in the range of 6 to 8 cents per bushel. (i.e., barge load out, storage and interest opportunity costs).

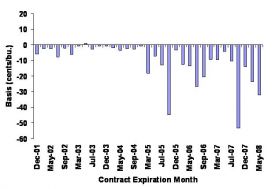

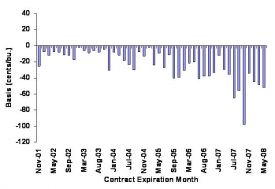

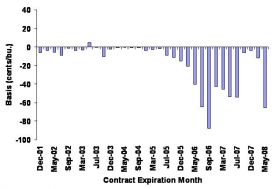

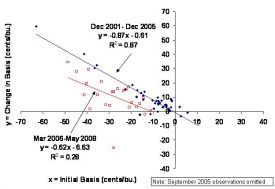

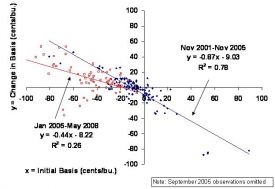

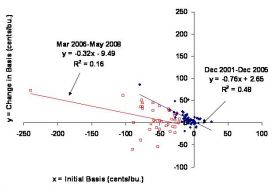

Figures 1 through 3 show the difference between cash and futures prices (the basis) on the first day of the delivery period for corn and wheat futures contracts expiring between December 2001 and May 2008 and soybean futures contracts expiring between November 2001 and May 2008. Note that a negative basis means the futures price is greater than the cash price and a positive basis means that futures price is less than the cash price. For these calculations, grade and location adjustments are made to the cash prices where appropriate. Convergence patterns at the presented location are representative of convergence behavior at other delivery locations.

Ignoring problems created by Hurricane Katrina in September 2005, convergence weakness first surfaced with the July 2006 wheat contract. Nonconvergence in wheat is extremely large by historic standards, reaching a low in September 2006 when the Toledo cash price ended up 90 cents below futures on the last day of the delivery period. This weakness in wheat persists through July 2007. Convergence is relatively good in September 2007, December 2007 and March 2008, but poor performance re-emerges in May 2008. Convergence in soybeans is poor beginning with the March 2007 contract, especially poor in September 2007, improves to almost acceptable in November 2007, but returns to very poor performance in January, March and May 2008. In general, convergence since July 2006 is better for corn than for wheat and soybeans. Convergence performance is weakest for corn in September 2007 and March 2008.

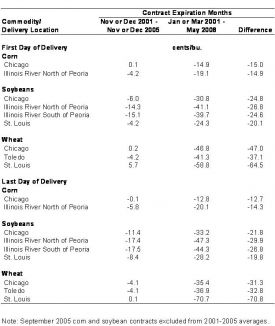

Table 1 presents average convergence performance at all delivery locations for corn, soybeans and wheat before and after 2006. Average basis levels on the first and last day of the delivery period during 2001-2005 generally are +/- 6 to 8 cents per bushel, with the exception of Illinois River delivery locations for soybeans. This is within the range of previously mentioned estimates of the direct costs of delivery. Average basis at delivery locations during 2006-2008 deteriorated (weakened) substantially in all three markets. The deterioration averaged about 14 cents per bushel in corn, 25 cents in soybeans and 50 cents in wheat.

While recent convergence failures are dramatic, in isolation each episode is not necessarily damaging to the overall economic functioning of markets. Real economic damage is associated with increased uncertainty in basis behavior as markets bounce unpredictably between converging and not converging. As first noted by Holbrook Working many years ago, this is damaging because basis in storable commodity futures markets should provide a rational storage signal to commodity inventory holders. A weak basis should be a signal to store and vice versa. However, this depends on the predictability of the subsequent change in basis. That is, the basis should strengthen over time thereby earning “the carry” for someone holding stocks of the commodity and simultaneously selling the futures.

The reliability of basis signals can be quantified by measuring the level of basis at some point before the delivery period and comparing this “initial” basis to the change in basis from that point forward through the delivery period. Perfect predictability of delivery location basis is illustrated in Figure 4.

Note that when delivery location basis is perfectly predictable, the relationship between initial basis and the change in basis has a slope of -1 and runs through the origin. In other words, if basis is -50 cents/bushel two months before expiration, the change in the basis over the subsequent two months should be +50 cents/bushel. Additionally, all points lie directly on the line, which indicates that storage hedges over the interval are perfectly effective in eliminating storage return risk.

Figures 5 through 7 show the predictability of delivery location basis for CBOT grain futures contracts for two periods: December 2001 - December 2005 vs. March 2006 - May 2008 for corn and wheat and November 2001- November 2005 vs. March 2006 - May 2008 for soybeans. The horizontalaxis in each chart measures the level of the delivery location basis on the day after the preceding contract expires. The verticalaxis measures the change in the delivery location basis from the day after the preceding contract expires to the first day of delivery. Note that observations for all delivery locations (see Table 1) and expiration months for a given commodity are pooled together in the analysis and that observations for new crop December and November contracts in corn and soybeans start on the first trading day of October, rather that the first day after preceding September contracts expire in order to avoid old/new crop cash price instabilities. In addition, September 2005 contracts are omitted for corn and soybeans due to the effects of Hurricane Katrina.

The charts indicate a sharp decline in basis predictability for all three markets over March 2006 – May 2008. In corn, the upper right regression line indicates the futures market performs reasonably well in terms of basis predictability before 2006, as the slope and intercept are near -1 and 0, respectively, and hedging effectiveness (R2) is a respectable 87%. The lower left regression line shows the precipitous drop in basis predictability over the last two years in corn. The slope declines moderately, but the intercept increases substantially, and hedging effectiveness drops to 28%. (Similar results are found if the outlier observation in the lower left quadrant is dropped from the 2006-2008 regression.)

Basis predictability results for soybeans are even more dramatic. The lower left regression line indicates delivery location basis during March 2006 – May 2008 changes much less than the initial basis (slope = -0.44) and hedging effectiveness drops to 26%. Results for wheat are different from corn and soybeans, in that basis predictability was poor before 2006. Nonetheless, predictability over March 2006 – May 2008 followed the pattern of corn and soybeans and deteriorated substantially relative to the earlier period.

The bottom line from the predictability analysis is that delivery location basis in corn, soybeans and wheat generally is weaker and far less predictable over March 2006 through May 2008 compared to the preceding period. This potentially has far-reaching implications for hedging use of these markets. In particular, Holbrook Working argued persuasively that futures markets for storable commodities depend primarily on hedging for their existence. The long-run viability of a futures market may be threatened if the market does not provide an efficient hedging mechanism for producers, merchants and processors. Over the last two years, these hedgers have found the corn, soybean and wheat futures markets to be increasingly inefficient for making storage decisions and managing the risk of market positions. Since trading volume has been setting records during the same time period, this is offset to some degree by the high degree of liquidity (ease of buying and selling) available in these markets. However, if liquidity advantages do not outweigh hedging inefficiencies, decreased hedging use may result, as commercial hedgers seek alternative mechanisms for transferring and managing price risks.

There has been no shortage of proposed solutions to the convergence problems of CBOT grain futures contracts. The solutions suggested to date tend to focus on:

In our view, all of the proposed solutions put the cart before the horse because we have yet to nail down exactly what caused the convergence problems observed over the last couple of years. A relevant observation in this regard is that the nature of convergence problems has been inconsistent through time and across markets. Convergence in wheat was weakest during 2006 but recovered somewhat in late 2007 and early 2008, only to return to very poor performance with the most recent contract expiration (May 2008). Convergence in soybeans was weakest in the second half of 2007 and the first half of 2008. The inconsistency makes it difficult to identify a single cause and difficult to accept a one-solution remedy.

Without a consensus as to the causes of poor convergence performance, it is questionable whether substantial changes in contract specifications are appropriate at the present time. Unintended consequences could be worse than a poorly designed remedy, particularly if market conditions change in the near future. Tweaking some contract specifications and monitoring performance makes sense, but may not be palatable to market participants who would like an immediate fix.

Agricultural economists have played a key role in analyzing similar controversies about delivery specifications in the past. Examples include onion futures contracts in the 1950s, Maine potato futures contracts in the 1970s and live hog futures contracts in the 1990s. This rich literature points to a number of variables that need to be carefully investigated with respect to CBOT corn, soybean and wheat futures contracts, such as transportation differentials, storage rates, congestion during delivery, deliverable stocks and arbitrage incentives of the different firms regular for delivery. We are currently in the process of investigating the impact of these variables on the delivery performance of the grain futures contracts.

Agricultural Forum (2008) Commodity Futures Trading Commission, April 22, http://www.cftc.gov/newsroom/cftcevents/2008/oeaevent042208.html

The authors thank Nicole Aulerich, Tracy Brandenberger, Fabio Mattos, and Robert Merrin for their assistance in collecting the data for this study.