During the recent decades the organizations of agricultural producers in the national dairy and potato industries developed and implemented supply management programs. Agricultural production control practices, which affected the quantity of agricultural output produced, were the core elements of these supply management programs. Agricultural over-supply is a common problem in these industries, which may cause output prices received by agricultural producers to be below production costs. The primary objective of the supply management programs was to address the over-supply problem by balancing supply and demand and to achieve a fair output price level received by agricultural producers and an agricultural output price stability. The organizations of agricultural producers acted under the Capper-Volstead Act (1922), a limited antitrust exemption from the Sherman Antitrust Act (1890).

A number of direct and indirect purchasers of milk and potatoes have challenged the legal status of agricultural output control practices in a number of recent and on-going antitrust lawsuits (Ondeck and Clair, 2009; Frackman and O’Rourke, 2011; Hibner, 2011; Manning and Welle, 2012; Peck 2015). The plaintiffs claim that they had to pay higher milk and potato prices caused by output control agreements implemented by the organizations of milk and potato producers. The plaintiffs allege that a practice of controlling agricultural output with the purpose of increasing output price violates Section 1 of the Sherman Antitrust Act.

For violations of the federal antitrust laws, direct purchasers of the affected products may recover "treble" damages. Treble damages are equal to three times the overcharge that direct purchasers paid. In addition, in a number of states, indirect purchasers may recover up to three times the overcharge.

The economic forces leading to the idea of implementing supply management programs, which included agricultural output control at the pre-production and production stages, were similar in the dairy and potato industries. First, an over-supply of agricultural commodities caused agricultural output prices received by producers to be below their production costs. Second, the level and volatility of agricultural input prices were increasing, often at a higher rate than the level and volatility of agricultural output prices. Third, during recent decades, domestic potato and dairy industries became much more affected by the competition from international agricultural commodity markets and by the volatility transpiring from these markets. In the case of the dairy industry, an additional economic force and the most significant one was a substantial decrease in the government milk price support level, which in the past provided a price floor on the milk price received by dairy farmers. As a result, at the very beginning of the 1990s milk price volatility began to increase.

To deal with the economic forces adversely affecting the profitability of individual milk and potato producers, the organizations of these producers developed and implemented supply management programs that affected production and marketing of milk and potatoes. These were large-scale private, industry-funded and administered programs. The participation of agricultural producers was on a voluntarily basis. There was no government involvement or assistance in the implementation of these programs. They were funded by the assessments from participating producers.

In the dairy industry, the National Milk Producers Federation (NMPF) and the Cooperatives Working Together (CWT) developed and implemented the CWT program, which included a herd retirement program and an export assistance program (Parkinson, 2008; Brown, 2009; Siebert and Lyford, 2009; Brown et al., 2010; McCay, 2011). The herd retirement program (2003-2009) was used to remove from production the entire milking herds of selected dairy farmers. Nine rounds of this program were held during the period of 2003-2009. Prior to the implementation of each round, dairy farmers who were willing to participate had to submit to CWT their bids on how much money they would accept to remove from the production (to slaughter) their entire milking herds. The export assistance program (2003–present) helps the U.S. dairy farmers expand foreign markets for manufactured dairy products by allocating subsidies to participating dairy cooperatives on export of selected products. The CWT program has been funded by the assessments from participating producers. The originally introduced in July 2003 assessment was $0.05 per hundredweight (cwt), and it was increased to $0.10 per cwt in July 2006.

The CWT program led to milk price increases. For example, Brown (2009) reports the milk price increase range of $0.22 per cwt to $1.54 per cwt, with the average of $0.67 per cwt. The herd retirement program contributed $0.59 per cwt to the reported average price increase, and the export assistance program added $0.08 per cwt.

The estimated milk price increases vary depending on the assumption on milk demand elasticity. For example, Parkinson (2008) reports the nation-wide milk price increase range of $0.28 per cwt to $0.51 per cwt, with the average of $0.36 per cwt. As a percentage increase in price, the reported price increases represent 2.03%, 3.71%, and 2.63%, respectively. On the other hand, McCay (2011) reports milk price increases hypothetically caused by the herd retirement program that are in the range of $0.03 per cwt to $0.62 per cwt. As a percentage increase in price, the estimated milk price increases fall in the range of 0.2% to 5.4%.

Despite the reported estimated milk price increases hypothetically attributed to the CWT program effects, milk prices received by dairy farmers were practically below the total milk-production costs. For example, during the period of 1995-2010, the all-milk price was in the range of $12.11 per cwt (2002) to $19.13 per cwt (2007) (McCay, 2011). During the period of the CWT program implementation (2003-2009), the total milk production costs ranged from $18.46 per cwt in 2005 to $24.04 per cwt in 2008 (USDA/ERS, 2015). The changes in the total milk production and milk price over time are reflected in Figure 1.

The idea of implementing the supply management program in the potato industry originated in Idaho—a leading potato producing state in the country. A nation-wide system of marketing cooperatives representing leading potato producing regions in the country, and the United Potato Growers of America (UPGA), the national level cooperative performing a coordinating function, developed and implemented the potato supply management program (Bolotova et al., 2008, 2010; Guenthner, 2012). The originally developed potato supply management program included a potato acreage management program and a set of marketing programs. The latter involved a potato flow control program, which affected the shipments of fresh potatoes throughout the marketing year, and secondary marketing strategies, which diverted the excess of already produced potatoes from the market.

The potato acreage management program (2005–2010) was used to control the number of (originally fresh) potato acres planted each year. The guidelines developed by the cooperatives established the potato acreage reduction target. During the first years of the program implementation, the potato planting area was to be reduced by 15% relative to the 2004 year base. Each base acre was assessed at $50. Potato growers in the cooperatives who reduced their potato planting area by 15% did not owe any assessment. Potato growers in the cooperatives who reduced their potato planting area by less than 15% were assessed a pro-rated percentage of $50. While the potato acreage management program originally targeted fresh potato market, it later began affecting processing and seed potato markets.

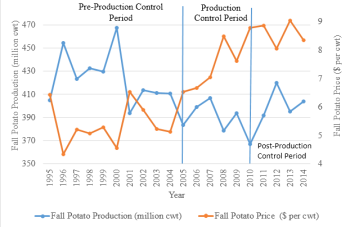

Source: USDA/NASS, 2015.

The potato supply management program led to price increases. The reported price increases are associated with the first few years of the program implementation (Bolotova et al., 2008, 2010; Guenthner, 2012). The positive price effects diminished over time. Bolotova et al. (2008) reports increases in fresh potato prices and decreases in a fresh potato price volatility during the first few years of the program implementation. The average monthly fresh potato price—aggregated over all potato varieties—received by growers in Idaho increased from $3.89 per cwt in the period before the program was implemented (the pre co-op period) to $6.63 per cwt (a 70% increase) during the first few years of the program implementation (the co-op period). The average monthly pre co-op period price of $3.89 per cwt was below the minimum level of potato production costs reported for the same period, $4.63 per cwt. The average monthly co-op period price of $6.63 per cwt was above the maximum level of potato production costs during the same period, $5.96 per cwt. The average monthly fresh potato price received by potato growers in the United States increased from $7.78 per cwt in the pre co-op period to $10.19 in the co-op period (a 31% increase). The changes in the U.S. potato production and potato price over time are reflected in Figure 2.

Guenthner (2012) reports that fresh potato growers in Idaho received higher prices during the first years of the program implementation. In particular, in 2008 when the potato planting area was reduced by 13%, Idaho fresh potato prices increased to $19.00 per cwt for potato varieties harvested early in the marketing season. However, due to a record high potato yield, by the end of the same marketing season prices fell below 6.00 per cwt, while the potato production and storage costs averaged $7.61 per cwt. The situation continued to change in 2009, when Idaho potato growers increased potato planting area by 5%, despite the recommended by the guidelines decrease in the potato planting area. At the same time, potato yield also increased causing the total potato production to increase by 13%. As a result, fresh potato price received by growers decreased from $8.00 per cwt early in the marketing season (August 2009) to $4.90 per cwt during the main harvest (October 2009) and to $2.90 per cwt in March 2010.

In general, the efforts of the organizations of agricultural producers in implementing the supply management programs were somewhat effective in correcting the over-supply market situation and achieving a fair price level and price stability. However, the positive price effects of agricultural supply control from the producers’ perspective tend to be observed in a short-term period. The uncertainty and complex nature of agricultural production and constantly increasing yield over time are the main factors that diminish the feasibility of the effective agricultural output control.

In light of the antitrust law and economics, the organizations of agricultural producers implementing agricultural supply control practices act as cartels. A cartel is a group of firms, otherwise competitors, who join together with the goal of controlling the output quantity and/or output price in order to increase the joint profit of cartel participants. Typically, cartel participants aim to decrease the output quantity with the purpose of increasing output price.

The agreements among competitors aiming to restrict output quantity or to control market price are considered to be illegal per se under the U.S. antitrust laws. Section 1 of the Sherman Antitrust Act (1890) prohibits contracts, combinations and conspiracies in restraint of trade. Price-fixing and output control agreements are considered to be the most damaging practices, because their typical market effects are a decrease in output quantity, an increase in price paid by consumers and a deadweight loss. There are no market and economic (from the societal perspective) benefits resulting from a pure output control or a price-fixing agreement, such as a classic illegal cartel. This is the reason why these types of agreements are considered to be illegal per se rather than being analyzed by courts using the rule of reason.

The joint activities of agricultural producers acting through their organizations, which might affect agricultural output quantity and prices, would potentially be subject to Section 1 of the Sherman Act. Agricultural producers are competitors, and the programs that they implement through their cooperatives are agreements. The Capper-Volstead Act (1922) provides a limited antitrust immunity to the joint activities of agricultural producers implemented through their organizations. Section 1 of the Capper-Volstead Act defines in general terms the scope of activities protected by the Act. In particular, “persons engaged in the production of agricultural products…may act together in associations… in collectively processing, preparing for market, handling, and marketing …such products”. Case law is used to interpret each individual activity on a case by case basis.

The plaintiffs—direct and indirect purchasers of milk and potatoes in the recent and on-going antitrust lawsuits argue that agricultural output control practices, otherwise known as “production restrictions”, violate Section 1 of the Sherman Antitrust Act. A legal issue to be resolved is whether agricultural production restrictions are within the scope of the Capper-Volstead Act immunity. While the defendants’ position is that agricultural supply control practices are protected by the Capper-Volstead Act, the plaintiffs’ position is that these practices are not immune from the antitrust laws. One of the arguments is that Section 1 of the Capper-Volstead Act does not mention this particular form of collective activities of agricultural producers. A further argument is that “collective marketing” mentioned in Section 1, does not cover agricultural production control, but provides immunity to only “post-production” joint activities of agricultural producers. This legal dispute takes place because there is no well-established case law interpreting legal status of various supply management practices— in particular agricultural production restrictions, in light of Section 1 of the Capper-Volstead Act.

The outcomes of the recent and current antitrust litigations involving various agricultural supply control practices are large settlements that the organizations of agricultural producers have to pay. Dairy and potato industries are not the only industries that implemented agricultural supply control practices and were targets of antitrust lawsuits. The national mushroom and egg industries had a similar experience. For example, Land O’Lakes Inc. and two subsidiaries settled an antitrust lawsuit alleging production control and price-fixing in the egg industry for $25 million in 2010 (Forbes, 2010). A recently announced preliminary settlement to be paid by a cooperative of potato growers was $25 million (Capital Press, 2015).

The legal status of various agricultural supply management practices implemented by the organizations of agricultural producers, and in particular the legal status of various forms of pre-production and production restrictions have raised a debate that has important policy implications.

A detailed analysis of agricultural production restrictions was conducted by Christine Varney, a former Assistant Attorney General of the Antitrust Division of the United States Department of Justice (2010). Her analysis presents a set of arguments for holding agricultural production restrictions both outside and within the scope of the Capper-Volstead Act immunity.

According to this analysis, one of the main arguments for classifying agricultural production restrictions as a practice falling outside the Capper-Volstead Act immunity is that Section 1 of this Act does not specifically mention any form of collective agricultural production or supply control—that is, farmers acting collectively in crop planting or raising animals. Also, it is pointed out that in the Supreme Court cases, exemptions from the antitrust laws are interpreted narrowly. The antitrust law enforcement agencies, the Department of Justice and the Federal Trade Commission have historically taken a position that the Capper-Volstead Act does not immune agricultural production restrictions from the antitrust laws. On the other hand, one of the main arguments which is in favor of the Capper-Volstead Act immunity of agricultural production and supply restrictions is that terms “processing, preparing for market, handling, and marketing” used in Section 1 of the Act should be interpreted more broadly and should include decisions on how much to produce.

The existing case law interpreting the Capper-Volstead Act has implications for antitrust enforcement efforts of the Department of Justice and the Federal Trade Commission. There is a well-developed case law interpreting the Capper-Volstead Act and in particular some forms of collective marketing. For example, pricing practices of the organizations of agricultural producers were subjects to a comprehensive legal analysis. It is well established that the organizations of agricultural producers can set output prices, as output pricing is an element of marketing activities that Section 1 of the Capper-Volstead Act aims to protect. However, until recently the legal status of agricultural production restrictions was not directly addressed in the courts’ legal opinions.

In December 2011, a U.S. district court for the first time in history of the Capper-Volstead Act evaluated the legal status of production—planting—restrictions in a lawsuit against a group of cooperatives of potato growers and individual potato growers—in Re: Fresh and Process Potatoes Antitrust Litigation. After conducting a comprehensive analysis, in its advisory opinion the court concluded that “acreage reductions, production restrictions, and collusive crop planning are not activities protected by the Capper-Volstead Act.” One of the main arguments of the defendants, the cooperatives, was that if the Capper-Volstead Act cooperatives were allowed to fix prices, they should be allowed to restrict production. This argument did not persuade the court, which response was to state that “Individual freedom to produce more in times of high prices is a quintessential safeguard against Capper-Volstead Act abuse, which Congress recognized in enacting the statute.”

Both Christine Varney (2010) and the Court advisory opinion in Re: Fresh and Process Potatoes Antitrust Litigation inform that agricultural production and supply controls are possible under the Agricultural Marketing Agreement Act (1937). This Act authorizes marketing orders and agreements for milk, fruits, vegetables, and specialty crops.

The experience of the dairy and potato industries in implementing supply management programs point out key implications for the decision making process as well as production, marketing and pricing strategies of individual agricultural producers and their organizations in all agricultural industries.

First, it is important to distinguish between supply management practices implemented at the pre-production, production, and post-production stages of the supply chain. Apparently, pre-production and production restriction practices are not within the scope of the Capper-Volstead Act protection, according to the most recent legal analysis presented in Re: Fresh and Process Potatoes Antitrust Litigation. However, various supply management practices at the post-production stage are more likely to be protected by the Capper-Volstead Act, because they are likely to be characterized as “marketing” activities described in Section 1. It is “safer” to use only those agricultural supply management practices that, according to the existing case law, are likely to be immune. For example, a practice of withholding already produced agricultural output from the market is likely to be protected by the Capper-Volstead Act.

Secondly, evaluating and developing alternatives to agricultural supply management practices, including production restrictions, deserve consideration. There is a well-developed case law establishing that price-fixing, or price-setting, activities of the organizations of agricultural producers are protected by the Capper-Volstead Act because they are elements of marketing. The issue for some of the organizations of agricultural producers to evaluate is whether some form of price-setting at the farm gate may be a viable alternative to production restrictions at the pre-production and production stages of the supply chain.

Finally, it is important to re-evaluate the role and functions that the organizations of agricultural producers—such as associations, cooperatives, and federations—may perform for the joint benefits of their members in the modern agribusiness environment. Some of these organizations may be purely bargaining organizations, which would represent agricultural producers in the contract negotiation processes with processors, distributors, retailers, and other buyers. Some of these organizations may be actually involved in various marketing activities, including some form of supply management and exchange of marketing information, as is the case with the U.S. dairy and potato industry experience. The specific market structural characteristics and the nature of contractual relations between agricultural producers and buyers of agricultural commodities would define the role and functions that the organizations of agricultural producers should perform in the case of each individual industry.

Bolotova, Y. 2014. “Agricultural Supply Management and Antitrust in the United States System of Agribusiness.” International Food and Agribusiness Management Review 17(3): 53-76.

Bolotova, Y., C.S. McIntosh, K. Muthusamy, and P.E. Patterson. 2008. “The Impact of Coordination of Production and Marketing Strategies on Price Behavior: Evidence from the Idaho Potato Industry.” International Food and Agribusiness Management Review 11(3): 1-29.

Bolotova, Y., C.S. McIntosh, P.E. Patterson, and K. Muthusamy. 2010. “Is Stabilization of Potato Price Effective? Empirical Evidence from the Idaho Russet Burbank Potato Market.” Agribusiness: An International Journal 26(2): 177-201.

Bolotova, Y., J.M. Connor and D.J. Miller. 2007. “Factors Influencing the Magnitude of Cartel Overcharges: An Empirical Analysis of Food Industry Cartels.” Agribusiness: An International Journal 23(1): 17-33.

Brown, S. 2009. “The Economics Effects of the CWT Program.” Power-point presentation. University of Missouri, College of Agriculture, Food and Natural Resources. Available online: http://www.agweb.com/assets/import/files/ScottBrownCWTNovember2009.pdf

Brown, S., B. Cropp, B.W. Gould, and E. Jesse. 2010. “Dairy Policy Issues for the 2012 Farm Bill.” Dairy Policy Analysis Alliance. The University of Missouri Food and Agricultural Policy Research Institute (FAPRI) and the University of Wisconsin-Madison Department of Agricultural and Applied Economics. Available online: http://www.iatp.org/files/258_2_107651.pdf

Capital Press. 2015. “Potato Growers Reach $25 Million Antitrust Settlement.” Available online: http://www.capitalpress.com/Nation_World/Nation/20150622/potato-growers-reach-25-million-antitrust-settlement

Forbes. 2010. “Land O’Lakes Settles Egg Antitrust Action for $25M.” Available online: http://www.forbes.com/sites/docket/2010/06/08/land-olakes-settles-egg-antitrust-action-for-25m/

Frackman, A.J., and K.R. O’Rourke. 2011. “The Capper-Volstead Act Exemption and Supply Restraints in Agricultural Antitrust Actions.” Presented to New York State Bar Association, Antitrust Section Executive Committee, New York, N.Y., 16 February. Available online: http://www.nysba.org/Sections/Antitrust_Law/Resources/Resource_PDFs/Capper_Volstead_Act_presentation.html

Guenthner, J. 2012. “The Development of United Potato Growers Cooperatives.” Journal of Cooperatives 26: 1-16. Available online: http://accc.k-state.edu/ncera210/jocpdfs/v26/Guenthner.pdf

Hardesty, S. 2008. “Enhancing Producer Returns: United Potato Growers of America.” University of California-Davis, Department of Agricultural and Resource Economics and Giannini Foundation of Agricultural Economics. Available online: http://giannini.ucop.edu/media/are-update/files/articles/v11n3_4.pdf

Hibner, D.T. 2011. “Allegations of Conspiracy to Limit Crop Production: Ripe for Analysis Under Capper-Volstead.” Available online: http://www.martindale.com/antitrust-trade-regulation-law/article_Sheppard-Mullin-Richter-Hampton-LLP_1400560.htm

Hovenkamp, H. 1994. Federal Antitrust Policy: The Law of Competition and Its Practice. Hornbook Series, Thomson West.

Manning, B.D., and A. Welle. 2012. “Cooperative Production Limits: A 4-Course Antitrust Meal.” Available online: http://www.rkmc.com/~/media/PDFs/Cooperative%20Production%20Limits%20A%204%20Course%20Antitrust%20Meal.pdf

McCay C.J. 2011. “Effect of Cooperatives Working Together Herd Retirements on the U.S. Dairy Herd Size.” Departmental Honors Thesis, Department of Agricultural Economics, Purdue University. Available online: http://www.agecon.purdue.edu/undergrad/counseling/pdf_files/CarissaMcCayThesis.pdf

Ondeck, C.E., and K. Clair 2009. “Justice Department and Private Plaintiffs Take Aim at Capper-Volstead Act's Protections for Agriculture.” The Bureau of National Affairs, Inc. Antitrust & Trade Regulation Report, 97 ATRR 512. Available online: https://www.crowell.com/documents/Justice-Department-and-Private-Plaintiffs-Take-Aim-At-Capper-Volstead-Act.pdf

Parkinson, S.N. 2008. “A Critical Analysis of the Cooperatives Working Together Program.” All Graduate Theses and Dissertations Paper 166, Utah State University. Available online: http://digitalcommons.usu.edu/cgi/viewcontent.cgi?article=1156&context=etd

Peck, A. 2015. “The Cost of Cutting Agricultural Output: Interpreting the Capper-Volstead Act.” Missouri Law Review 80: 451-498.

Siebert, J., and C. Lyford. 2009. “U.S. Dairy Industry Supply Control: Managing the Cooperatives Working Together Program.” Review of Agricultural Economics 31(4): 999-1013.

Varney, C.A.2010. “The Capper-Volstead Act, Agricultural Cooperatives, and Antitrust Immunity.” The Antitrust Source: 1-8. Available online: http://www.americanbar.org/content/dam/aba/publishing/antitrust_source/Dec10_FullSource.authcheckdam.pdf

U.S. Department of Agriculture, National Agricultural Statistics Service (USDA/NASS). 2015. Quick Stats. Available online: http://www.nass.usda.gov/Quick_Stats/

U.S. Department of Agriculture, Economic Research Service (USDA/ERS). 2015. Milk Cost-of-Production Estimates: 2000-2013. Available online: http://www.ers.usda.gov/data-products/milk-cost-of-production-estimates.aspx

U.S. Department of Agriculture. 2002. Antitrust Status of Farmer Cooperatives: The Story of the Capper-Volstead Act. Rural Business-Cooperative Service. Cooperative Information Report 59, Washington, D.C.. Available online: http://www.uwcc.wisc.edu/pdf/CIR59.pdf

Agricultural Marketing Agreement Act (1937): 7 U.S.C. §601, 602, 608a-608e, 610, 612, 614, 624, 627, 671-674.

Capper-Volstead Act (1922): 7 U.S.C. §291- §292.

Sherman Act (1890): 15 U.S.C §1-2.

In Re: Fresh and Process Potatoes Antitrust Litigation No. 4:10-MD-2186-BLW (D.Id.).