With the passage of the 2018 Farm Bill, growing hemp became a legal option for U.S. farmers (Johnson, 2019a). Their response has been enthusiastic. The data on U.S. licensed hemp acreage for 2019 are staggering, both in relative and absolute terms—relative in terms of previous years’ acreage and absolute in terms of the current limited capacity of upstream/downstream market channel links to absorb this potential level of increased production. Advocates for the industry have been emphatically optimistic about the financial incentives and market opportunities of hemp and its many and varied end-products. Farmers are about to discover the degree to which that optimism was justifiable. Ex ante economic analysis presented in this article predicts near-term outcomes, unfortunately, will likely be yet another example of an over-hyped, under-delivered boom–bust promise for U.S. farmers. Those economic predictions are presented and explained to provide a cautionary voice to help assess both the near-term and long-term market potential of hemp production for U.S. farmers.

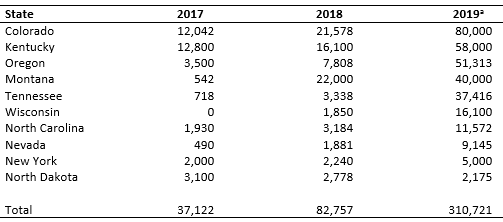

a2019 data are estimates, as of July 2, 2019.

Source: Hemp Industry Daily (2019), Cowee and Nichols (2019), and Nichols (2018).

Table 1 summarizes land licensed for hemp cultivation for the past two years and the estimated licensed acreage for 2019 for some of the top hemp-growing states. In these states alone, total area licensed for hemp production has increased from 37,122 acres to an estimated 310,721 acres, a nearly 10-fold increase in the amount of licensed land. Additional reports indicate that as of September 2019, licensed land for the current year aggregated across all U.S. states is estimated to be 511,442 acres (Vote Hemp, 2019). Granted, not all of this land will be used to cultivate and harvest hemp, as data from recent years indicate considerable slippage between the amount of acreage licensed compared to acreage harvested. For example, data from Kentucky for 2016–2018 show that harvested acreage ranges from 20% to 43.5% of licensed acreage (Kentucky Department of Agriculture, 2019). Yet with strengthening downstream market demand, shifting government policy and more farmers working through the learning curve of growing a new crop, the gap between licensed and harvested acres is likely to lessen.

Favorable market conditions in 2018 were driven by high demand for processed hemp products, especially cannabidiol (CBD) oil and certified hemp seed. The open question now is whether aggregate demand across all hemp markets (CBD oil, hemp seed, and hemp fiber) will be strong enough in 2019 to absorb a massive increase in production capacity without lowering or possibly eliminating the potential for positive margins for farmers.

To address this question, this article draws upon the ideas of three economists—Michael Porter, Oliver Williamson and A. Allan Schmid. Porter (1979) introduced the idea of “five forces” that can affect a firm’s ability to protect margins and maintain profitability: rivalry among existing firms, the threat of new entrants, the bargaining power of suppliers and buyers, and the threat of product substitutes. Williamson (1975) introduced a set of variables that could affect the organization of firms as a consequence of transaction costs, including bounded rationality, asset specificity, frequency/potential recurrence of transactions between parties, and opportunism. Schmid (2004) provided a framework for analyzing economic outcomes. Key variables within this framework include the analysis of interdependencies among economic actors that are a consequence of exclusion costs, incompatibility in use, economics of scale, and information costs. The following assessment of the current and future state of the U.S. hemp industry draws upon these concepts.

As noted by Porter (1979), the basis of competition and rivalry among an industry’s existing firms can have a direct effect on those firms’ potential margins and profitability. If competition is primarily price-based, margins are squeezed as each firm attempts to capture market share by lowering prices while attempting to maintain margins by cutting costs. Alternatively, market rivalry can be based upon product differentiation, product–service bundling, or other nonprice market strategies. In the case of the emerging U.S. hemp market, in which market demand has far exceeded available supply, rivalry has been more focused on firms competing to secure input supplies and accessing post-harvest processing services.

The physiology of hemp plants (Cannabis sativa L.) require special attention for at least two critical reason. First, choose the wrong variety and THC levels will exceed the legal 0.3% maximum allowable limit for hemp (delta-9 THC is the regulated intoxicant naturally occurring at varying levels in all varieties of C. sativa L.). Second, for those farmers wanting to target their hemp production for the CBD oil market, the production of CBD is greatly enhanced if farmers only plant feminized seeds or clones. “Male” plants lead to pollination and diminished CBD oil content of hemp floral material, the primary source of a hemp plant’s CBD content. Demand for certified seed and clones of specific feminized varietals has far exceeded supply, which has led to and will likely continue to create problems for farmers looking to meet the market demand being driven by the CBD oil craze. Supply shortages mean farmers who can access these inputs will likely pay higher prices for them. Farmers who use inputs that have not been certified assume the risk of high information costs in terms of both the actual viability of their inputs as well as the often unnegotiated terms of compensation should these uncertified seeds and clones yield crops that either exceed legal limits of delta-9 THC or have low CBD oil production.

Post-harvest, the need for downstream processing, especially dryers and drying barns (and to a lesser degree, CBD oil extractors), is an additional bottleneck in the market channel. These types of equipment and assets are both expensive (they create high fixed costs) and have a moderately high level of “asset specificity” (they are not easily deployable for other uses). As such, farmers who invest in their own drying capacity (either by purchasing a dryer or building a drying barn) assume the risk that market conditions will generate sufficient returns to recover their investments. Under these conditions, there are economies to scale, which create incentives for farmers to “get big fast” or—more likely—to contract out processing services to neighboring farmers to increase the amount of hemp they process.

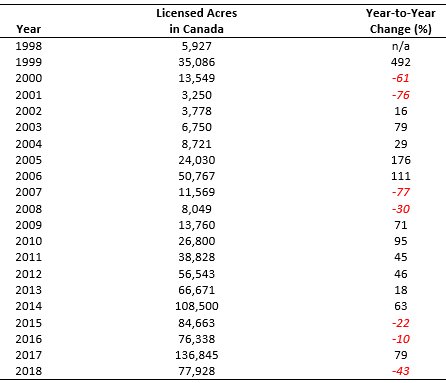

Source: Health Canada, various years—“Industrial Hemp Licensing

Statistics” reports.

A general lack of market information creates risks for farmers who are thinking about making these investments. If too few farmers are willing and able to purchase processing equipment, then hemp farmers will compete with other, similar farmers, paying higher prices to secure access to processing services. If too many farmers invest in dryers and barns, then there will be excess processing capacity and farmers who expected to custom dry for others to capture the economies of scale needed to recoup their investments in the equipment and facilities will not be able to do so.

Porter also identified the threat of new entrants as another market force that has the potential to lower margins and reduce a firm’s profitability. The actual entry is of secondary importance relative to the possibility of entry, as Porter asserted that firms will take proactive measures to increase barriers to entry, even if those measures lower short-term profits. The nearly ten-fold increase in licensed acres between 2017 and 2019 noted in Table 1 provides clear evidence that there are relatively few perceived barriers to entry in the U.S. hemp industry. And yet, given the nature of rivalry just described, there are actual barriers in the market that will limit a new entrant’s ability to be profitable.

Schmid (2004, p. 16) states, “incompatibility in use means that the opportunity of one person is limited by the opportunity of others. In other words, there is scarcity.” With limited supplies of inputs and post-harvest processing capacity, there are strong incentives for both existing farms and new entrants to attempt to “lock in” these scarce market resources, thus limiting the opportunities of other hemp farmers to access these same resources. This creates strong incentives for new entrants to attempt to undercut their competitors by offering to pay higher prices for both inputs and processing services. Plus, by the very nature of its “newness,” there is little to no history in the U.S. hemp industry upon which relationships, trust, and long-term commitments have been established. In combination, these market conditions create strong incentives for opportunistic behavior among input suppliers and processors in the form of price gouging, breach of verbal agreements, and other short-term strategies to extract money from hemp farmers. The end result will be low returns for many new entrants, who may then choose to exit the industry after only one production cycle. This appears to be what happened in Canada, which legalized the production of hemp in 1998. As noted in Table 2, there was a very similar explosion in licensed acres between 1998 and 1999, with acreage going from 5,927 to 35,086 acres. This was followed by a significant contraction in the subsequent two years, with only 3,250 acres licensed in 2001.

A third force identified by Porter is the bargaining power of input suppliers vis-à-vis the negotiating position of a firm: The greater the bargaining power of a firm’s suppliers, the greater is the threat to a firm’s margins and ability to be profitable. As already noted, certified seeds and clones have been in short supply, creating a constraint on industry growth. In general, certification of seed strengthens the bargaining position of suppliers, as they can charge a premium price for the lowered risk/lowered uncertainty that is a result of certification. For hemp farmers that are reliant on this source of inputs, these price premiums are yet again a threat to their margins.

But there are other factors at play in this newly emerging industry. Many CBD oil extractors and would-be marketers of CBD oil–based consumer products have recognized that farmers need high-quality seeds and clones to produce and meet their demand for higher volumes of CBD oil. This has created alternative market arrangements that have curtailed some supplier bargaining power. Anecdotal evidence provides examples of downstream firms contracting directly with farmers, offering to supply seed and more importantly, to bear some of the production risks, either through crop share or cost share arrangements. In some cases, farmers have entered into contract farming arrangements in which they negotiated direct payment for their “services” (land, labor, and equipment to grow hemp) while their partners supplied inputs and assumed most of the production risks to retain ownership of the harvested crop. Hence, with these alternative market arrangements, some farmers have been able to curtail the bargaining power of others and thus have a management strategy for protecting profitable margins for their operations.

As an emerging market, there are additional market power issues to consider. The 2019 hemp market presents a textbook example of “bounded rationality,” a market condition in which the seller, buyer, or both are trying to make market decisions with very incomplete and inadequate information. A history of basic market benchmarks is lacking, so expectations about prices, yields, and derived demand from downstream consumer markets are difficult for hemp farmers to determine accurately (Shepherd and Mark, 2019a). With imperfect information, the ability to make good choices is impeded and mistakes will be made, but the burden of those mistakes will likely be disproportionately borne by farmers. Given the ten-fold increase noted in Table 1, the market conditions in 2019 are flipped from previous years and now farmers will be competing for buyers. Any mistakes made during production and harvest will rest with the farmer—THC levels too high? Buyers are legally obligated to seek other sellers, and farmers are left with a harvest that has no viable market. CBD oil production too low? Buyers can find other farmers with higher oil content in their plant biomass, while those farmers with raw product that has relatively low CBD content become the suppliers for a residual, secondary market; their crop will be price-discounted or not purchased at all. And even those farmers with viable product are at a disadvantage as there is little information about market prices, which favors their buyers who, as market aggregators, are in a better position to gauge market conditions, estimate demand, and opportunistically take advantage of inadequate price information.

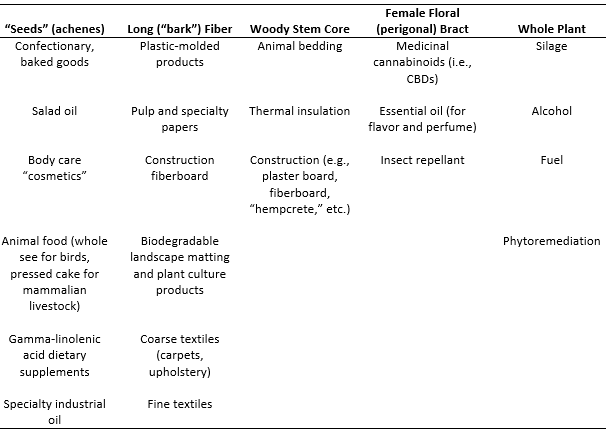

Source: Adapted from Small and Marcus (2002, p. 285, Table 2).

Much of the hype for hemp focuses on the wide range of potential products and downstream markets that have been proposed for processed hemp. Table 3 summarizes these, providing an important reminder about the future of hemp production: Farmers in different regions of the United States are likely to target different downstream markets relative to the growing conditions of each region. For example, those in the Pacific Northwest and Montana see the greatest potential in the CBD oil market and its related array of downstream products and uses, while those in other regions are focused on hemp as a source of fiber for a very different array of downstream products and uses. Still other U.S. farmers will compete with Canadian farmers, who have worked for the past two decades primarily targeting consumer food markets for hemp seed and hemp seed oil.

The potential for hundreds or even thousands of hemp-based products across multiple product categories, unfortunately, often overwhelms the underlying economic question, which is explicit in Porter’s framework. The critical question for processors, manufacturers, and other end-users in terms of profitability is not “What can you do with processed hemp?” but rather “When are hemp-based products a more profitable, cost-effective option?” As long as cheaper, more abundant (and in the case of animal feed, legal) product substitutes exist, the market potential for hemp is, at best, speculative. A quick review of Table 3 provides many examples where product substitutes already exist in well-established markets and production practices. Until markets mature and relative pricing can be determined, which hemp-based product categories will have a relative advantage over product substitutes is a major source of uncertainty for the hemp-processing and manufacturing industry.

The possibility for long-term development of large-scale end-user markets, therefore, will rely upon the development of hemp-based products for which there are few if any product substitutes. Two of the most likely candidates are dehulled hemp seed for food and CBD oil.

With hemp seed, a general interest in “eating well,” “functional foods,” and “super foods” have been major food trends in the United States for over a decade. Determining that hemp seed meets this established consumer preference in a unique manner would suggest significant upside market potential. As Cherney and Small (2016, p. 13) note, “The dietary advantages of hempseed and hempseed oil are quickly gaining acknowledgment in North America, and sales of hempseed products are rapidly increasing.” Similarly, Small and Marcus (2002, p. 306) note, “Hemp seed is astonishingly nutritional.”

Source: Small and Marcus (2002, pp. 304–307).

Table 4 summarizes the key nutritional attributes of hemp. In combination, the factoids quoted in Table 4 suggest that hemp seed has strong potential to be a nutritional “super food” with few substitutes, as it offers consumers a food product that (i) is an excellent source of omega-3 and omega-6 fatty acids, (ii) is a plant-based protein with all essential amino acids, and (iii) contains antioxidants, vitamins, and other nutritional benefits. No other food product offers this combination of attributes, which in Porter’s framework translates into a low potential threat of product substitutes.

The medicinal uses of cannabidiol (CBD) are still being researched. In 2018, the FDA approved the first-ever legal use of a CBD-based drug treatment, Epidiolex, a medication for certain forms of epilepsy. Additional clinical trial work has researched CBD as a treatment for anxiety, insomnia, chronic pain, and nearly 30 other medical applications (Schluttenhofer and Yuan, 2017). These research efforts are ongoing and these medical uses have not yet been granted Food and Drug Administration (FDA) approval. Pharmaceutical products generally have low threats of product substitutes, since they are typically protected as patentable intellectual property. As such, the potential for profitability and strong market demand for medical uses of hemp products are reasonably plausible, at least in the longer term. In the short term, however, the current, mostly unregulated CBD health supplement market has greater risks for unintended market outcomes due to fraud, inconsistent product quality, and product contamination (for example, hemp plants are excellent phytoremediators; while growing, hemp plants will absorb synthetic chemical compounds and heavy metals in the soil). For these reasons, there are notable market risks for farmers producing for the CBD oil market in 2019.

Porter’s framework is an analytic tool that is used to make a static assessment of an industry’s market conditions, particularly in terms of a given firm’s ability to maintain margins and profitability. In terms of the current state of the U.S. hemp industry, the conclusions of this assessment for farmers producing hemp are disconcerting, especially for the current production year. Rivalry among hemp farmers who began farming before 2019 is intensifying. The threat of new entrants bidding up the costs of inputs and the prices for post-harvest services is high. With the large increase in licensed acreage, the bargaining positions of both input suppliers and downstream buyers of harvested hemp have been strengthened. And readily available substitutes for most potential products and uses of processed hemp already exist, threatening the short-term market viability of these hemp products. In combination, these forces are very likely to exert considerable downward pressures on hemp farmers’ margins, lowering or even eliminating anticipated profits for near-term growing seasons.

In the longer term, the prognosis is less negative, as hemp-based products find niche market opportunities or experience significant market growth in specific, defendable market spaces (such as hemp seed food products and medicinal uses of CBD). A more longitudinal view of the market is beyond the limits of Porter’s framework, but additional information may provide longer-term insights. For example, Malone and Gomez (2019) review past and potential changes in the regulatory context for U.S. hemp, as these authors explicitly look at how the hemp industry has changed over time. The Canadian hemp industry may also provide insights.

Hemp production was legalized in Canada in 1998, which now provides a 20-year history of that industry’s development and evolution. The Canadian market has seen considerable year-to-year variability in the amount of land licensed for hemp cultivation (Table 2). On average, two out of every three years farmers increased their licensed acreage, sometimes considerably, ranging from 16% to 492% increases from the previous year’s acreage. Similarly, in one out of every three years, Canadian farmers reduced their licensed acreage, sometimes considerably, ranging from 10% to 76% reductions. Yet the overall trend is positive, with strong market growth over the 20-year period. A review of the legal and regulatory setting for hemp provides a clear relationship between changes in regulatory constraints on Canadian production and marketing with the dips and spikes in the amount of licensed land, typically with a one- to two-year lag between these changes and the supply response. These dips and spikes also reflect the sorting-out process by which the market has emerged as input supplies, market channels, and end-markets have come into being over time.

Though there are many differences between the Canadian market of the past 20 years and the current emerging U.S. market, the salient lesson to learn is that (i) as the U.S. legal-regulatory setting continues to evolve and (ii) as market channels grow from infancy to maturity, U.S. farmers are likely to experience expanding market opportunities in the coming years but not without a fair share of volatility, risks, and “growing pains” along the way.

To conclude, the old farming adage, “high prices will cure high prices” is likely to be reaffirmed in the 2019 and perhaps the 2020 production years for U.S. hemp farmers. And as Snell, Mark, and Shepherd (2019, p. 4) add, “Without any safety net for this crop and [with] the infancy of the industry, producers need to understand and be willing to lose their investment in the crop if it fails, the processor goes out of business, or the policy environment changes.” Beyond 2020, the economic dynamics of this multifaceted emerging market will create both opportunities and significant threats and risks for farm profitability. The long-term prognosis is generally favorable across a range of product categories and downstream markets, but the road getting there is likely to be a rough-and-tumble ride, with as many losers and there will be winners.

Cherney, J., and E. Small. 2016. “Industrial Hemp in North America: Production, Politics and Potential.” Agronomy 6(4): 58.

Cowee, M., and K. Nichols. 2019, February 4. “Chart: America’s Hemp Acres Hit Almost 80,000 in 2018.” Hemp Industry Daily. Available online at http://www.hempindustrydaily.com/.

Health Canada. Industrial Hemp Licensing Statistics [annual reports]. Available online at https://www.canada.ca/en/health-canada.html

Hemp Industry Daily. 2019, July 2. “U.S. Hemp Prices and Supplies.” Hemp Industry Daily. Available online at http://www.hempindustrydaily.com.

Johnson, R. 2019a. 2018 Farm Bill Primer: Hemp Cultivation and Processing. Washington, DC: Congressional Research Service,Report 7-5700, January.

Johnson, R. 2019b. “Defining Hemp: A Fact Sheet.” Washington, DC: Congressional Research Service, Report 44742, March.

Kentucky Department of Agriculture. 2019. “Industrial Hemp Research Pilot Program Overview.” Available online at https://www.kyagr.com/marketing/hemp-overview.html.

Malone, T., and K. Gomez. 2019. “Hemp in the United States: A Case Study of Regulatory Path Dependence.” Applied Economic Perspectives and Policy 41(2): 199–214.

Nichols, K. 2018, April 2. “Hemp Report: Top 10 U.S. States” Hemp Industry Daily. Available online at http://www.hempindustrydaily.com/.

Porter, M. 1979. “How Competitive Forces Shape Strategy.” Harvard Business Review 1979(3). Available online at https://hbr.org/1979/03/how-competitive-forces-shape-strategy.

Schluttenhofer, C., and L. Yuan. 2017. “Challenges towards Revitalizing Hemp: A Multifaceted Crop.” Trends in Plant Science 22(11): 917–929.

Schmid, A.A. 2004. Conflict and Cooperation – Institutional and Behavioral Economics. Malden, MA: Blackwell.

Shepard, J., and T. Mark. 2019a. “The Economics of Hemp Production in Kentucky.” Economic & Policy Update 19(3): 1–3.

Shepherd, J., and T. Mark. 2019b. “Hemp and Enterprise CBD Budget Model.” Lexington, KY: University of Kentucky. Available online at https://hemp.ca.uky.edu.

Small, E. and D. Marcus. 2002. “Hemp: A New Crop with New Uses for North America.” In J. Janick and A. Whipkey, eds. Trends in New Crops and New Uses. Alexandria, VA: ASHS Press, pp 284–326.

Snell, W., T. Mark, and J. Shepherd. 2019. “Economists' Viewpoints Surrounding the Hemp Boom: Part 1.” Economic & Policy Update 19(2): 1–4.

Vote Hemp. 2019, September 5. “2019 U.S. Hemp License Report.” Available online at http://www.votehemp.com/.

Williamson, O. 1975. Markets and Hierarchies - Analysis and Antitrust Implications. New York, NY: Free Press.