It is well documented that farm households over the past several decades have increasingly relied on off-farm income sources and primarily off-farm employment. This trend of increasing off-farm labor participation rates and income is particularly important to those entering agriculture: young and beginning farmers. Much of the contemporary focus on young and new entrants to agriculture has been on the growth of various direct-to-consumer marketing channels. However, the continuance of traditional production agriculture relies on developing the next generation of farmers as well.

Record farm earnings during the late 2000s and early 2010s potentially created an opportunity to bring young people back to the farm to participate in a family operation or begin their own. During the recent agricultural boom—particularly in the cash grains arena—record net farm incomes were more than sufficient to sustain and grow most operations. Strong cash flows were a particular benefit to young and beginning farmers, whose barriers to entry can be quite high. While agricultural lenders still viewed off-farm income as a financial strength, it served as an ancillary income source.

Farm sector profitability peaked in 2013, and the sector is currently in a more moderate-income period driven by lower commodity prices. With the exception of weather or other unforeseen events, the forecast for the cash grain sector remains steady as the adjustment toward a more normal supply-demand situation continues.

As an example, University of Illinois at Urbana-Champaign’s corn, soybean, and wheat crop budgets for 2016 include highly productive cropland in northern and central Illinois—land that may yield 20% or more above the national average (Schnitkey, 2016). Considering the current costs of production, budgets show revenues will be high enough to provide a return to land; however, profits will not fully cover the costs of average cash rent. This shortfall affects young farmers in particular since they tend to rent a larger proportion of the acres they farm compared to other age groups due not only to the high cost of good cropland, but also to the lack of availability and competitiveness in certain land markets (USDA-NASS, 2012). Although cash rents will likely fall given sustained low prices, these adjustments will occur slowly.

The trend of increasing off-farm income and its growing role in farm household finances has enabled many young and beginning farmers the means to enter agriculture. It will play an even larger part in allowing these groups to maintain viable operations during this current period of adjustment. This is true not only in the cash grains sector, but also in other agricultural sectors in which income is moderating. Compared to earlier generations of farm households, off-farm income has shifted from a supplementary income source to an important risk management tool for young and beginning farm households, and the implications of this trend are only positive.

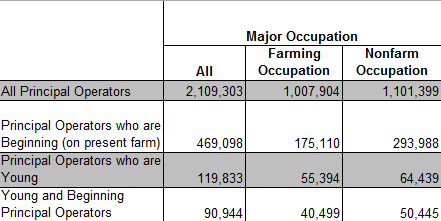

There has been a growing interest in understanding the challenges of the young and beginning farmer populations, especially those who spend the majority of their working time in farming. It is important to note, however, that although most young farmers are beginning farmers, most beginning farmers are not young farmers. Most farmers, especially those not operating large farms, spend the majority of their work time in off-farm jobs. That's an indication of how important access to off-farm jobs is for the farmer population, at large. However, the role of off-farm income can be just as important to farmers who spend the majority of their work time on the farm, especially the young and beginning farmers. Table 1 provides the U.S. Department of Agriculture (USDA) definitions of the various groups and respective population numbers from the 2012 Census of Agriculture.

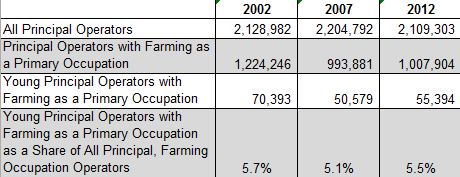

Even though there are fewer overall farmers than 10 years ago, the young farmer population today represents a proportionally similar percentage as in 2002 as shown in Table 2. Based on the latest USDA Census of Agriculture in 2012, nearly 6% of total principal operators who report farming as their primary occupation are less than 35. Although proportionally similar in 2002 and 2012, a slight increase in this segment occurred between 2007 and 2012 following a drop between 2002 and 2007. The 2012 Census of Agriculture estimates that young principal operators who report farming as their primary occupation grew nearly 10% from 2007. This growth from 2007 to 2012 was driven by young people managing sizable operations of sales levels of $250,000 and greater. It is reasonable to assume that record net farm incomes during this period drew some of these young farmers into agriculture or at least was an influential factor. Another influential factor may have been the 2008 Farm Act which authorized a Transition Incentive Program (TIP) to promote the transfer of Conservation Reserve Program (CRP) land coming back into production to beginning—and socially disadvantaged—farmers engaged in sustainable practices (USDA-ERS, 2013). The 2008 Farm Act also provided for management training programs specific to beginning farmers and other incentives to support beginning farmers (USDA-ERS, 2013).

Structural demographic changes may also be spurring growth in young farmer numbers. The much larger millennial generation, the oldest of which are now in their mid-30s, has replaced Generation X in the young farmer population. In fact, those born from the early 1980s to the early 2000s already represent the largest group of American workers and could make up half of the U.S. workforce within five years (Maguire, 2016). Many of the millennial generation are just beginning their careers, providing agriculture a large potential pool of young people to cultivate and retain in farming.

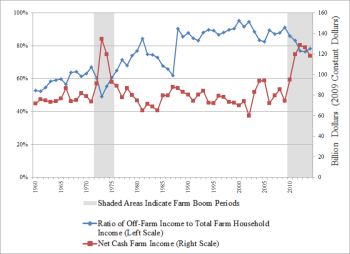

Farm households prior to the 1970s derived the majority of household income from the farm. In the 1970s, as the general labor force increased, off-farm income began to make a major contribution to farm household income levels. Figure 1 shows off-farm income as a percent of farm household income and in relation to U.S. net cash farm income (USDA-ERS, 2015). It is important to note that this chart considers all farms and that the majority of farms are very small and rely almost strictly on off-farm income (USDA-ERS, 2015). Although off-farm income for a household is, in general, a stable income source, it will fluctuate as a percent of the total due to swings in farm income from year to year. However, even in boom periods, it has still contributed substantially to household income. In 1973, the peak year of net cash farm income during the agricultural boom of the 1970s, a weighty 49% of total farm household income came from off-farm sources. Fast forward to 2012, another record year of net cash farm income, off-farm income comprised 77% of total farm household income.

In times of stress, off-farm income plays an even larger role. Most notable, in the severe agricultural crisis of the 1980s, off-farm income began to play a mitigating role, as it offset diminished farm returns. On average, the households with positive incomes had higher incomes from off-farm sources than those with negative incomes (Ahearn, 1986). In multiple low farm income years since, off-farm income has surpassed 90% of total household income.

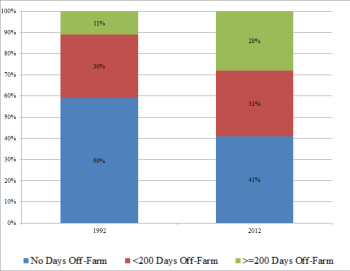

Over the past several decades, average off-farm household income gained parity with and now surpasses average U.S. household income. The USDA Census of Agriculture reports the percent of principal operators working off-farm has fluctuated around 50-60% since 1969, while the share reporting working 200 days or more, essentially full-time off the farm, increased from 32% to 40%. Among those reporting farming as their primary occupation, the shift has been more pronounced, as those working full-time equivalency off the farm more than doubled just in the past twenty years from 7% in 1992 to 16% in 2012. This trend, in part, explains the much faster 5.4% annualized growth in average off-farm income from 1980-2014 compared to 2.8% for total household income.

The increasing reliance on off-farm income extends to young and beginning farmers as well. Figure 2 illustrates this shift. According to the 1992 USDA Census of Agriculture, 41% of under-35-year-olds whose principal occupation was farming worked off-farm, with 11% working 200 or more days off-farm. Twenty years later, in 2012, 59% worked off-farm, with 28% working 200 or more days off-farm. Young farmers had a 15% higher rate of participation in off-farm work than the 35- to 64-year-old age group did in 2012. The trend with beginning farmers should reflect a similar pattern, as there are more young farmers who have been farming for fewer than ten years than in any other age groups.

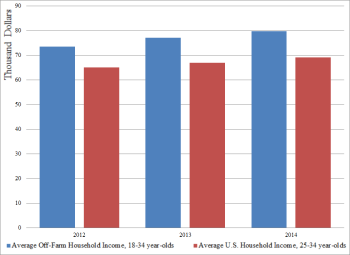

Higher off-farm labor participation rates may translate into higher average levels of income for the young farmer population. Average off-farm household income for young farmer households currently surpasses the average U.S. household income for the less than 35-year-old population, as shown in Figure 3. The 2014 USDA Agricultural Resource Management Survey (USDA-ARMS) estimates over $79,000 in average off-farm household income for all farm households with operators less than 35 years old. This includes both households with and without off-farm income. In comparison, the U.S. Census Bureau reports a lower $69,000 in average total household income for the 25-34 year old population segment.

As farm businesses are becoming more complex, the skills needed to profitably manage them often overlap with those skills in demand by non-farm businesses. A recent study found that when farm operators and their spouses work off-farm, they are more likely to hold a management or professional occupation. This is particularly true among operators of large farms (Brown and Weber, 2013). Wages among management or professional occupations are higher on average than in other occupations, thus boosting the farm household’s off-farm income. Among those who hold a management or professional position, more than half have a college degree. Technology is also opening avenues for professionals in rural areas. Telecommuting among the non-self-employed population has grown 103% since 2005 (Global Workplace Analytics, 2016). Many professional occupations now lend themselves to telecommuting. The link between managing a successful farming operation and more robust off-farm job opportunities is attractive to young and beginning farmers.

Off-farm income serves as both an income source and a risk management tool, because it reduces the impact that farm income variability has on household income. Farm income has been, is, and will likely remain volatile. Key, Prager, and Burns (2015) find that farm income is the most variable of all household income sources: farm income (77%), agricultural payments (3%), non-farm wage income (10%), and other non-farm income (10%). For crop farms, farm earnings range from 60% to 90% of total income variation as asset size increases. Off-farm income can stabilize income flows, because off-farm wages are much less variable than farm income. Off-farm income provides a steady source of funds for the farm household, particularly for young and beginning farmers who tend to face more variation relative to their assets than operators of larger, more established farms do.

In comparison to other risk management tools, off-farm income is truly a decoupled income flow. Although not a replacement for crop insurance, government payments, or other instruments that play an important role in managing the volatility of farm income in most crop operations, off-farm income is not dependent on changes in farm policy or commodity prices, yields, or input costs, making it a key proactive risk management tool. For example, young principal operators who report farming as their primary occupation today and grow field crops farm an average of nearly 400 acres of cropland (USDA-NASS, 2012). Thus, a corn farmer would have to receive an average payment, from a previously noted farm related risk management source, of more than $70 per acre annually on a 400-acre operation to equal the income that one or more farm household members would earn off-farm—if they were to earn the equivalent of the average per capita U.S. income (U.S. Census Bureau, 2014). While this level of payment could be realizable given extremely low revenues or yields, it is certainly not a sustainable source of long-term income. Only revenue or yield declines below a threshold level typically trigger payments, and the threshold level could continue to decline in future periods as prices fall below previous years’ levels. The given example in no way minimizes the need for government payments or other farm income risk management tools, but instead is intended to emphasize that payments are tied to variables which are independent of off-farm income. Legislative bodies and agencies design government programs and tools such as crop insurance to provide support, and with some programs, transition assistance to operations in periods of lower farm incomes. Off-farm income generates liquidity and builds earned net worth independent of yields and prices.

Off-farm labor participation often allows for other avenues of managing risk outside of the operation, but within the farm household, namely health insurance. Off-farm labor may provide employer-paid or subsidized health insurance. Employer-sponsored healthcare coverage motivates off-farm labor participation of farm operators and spouses (Ahearn, El-Osta, and Mishra, 2013). There is a strong positive relationship between the probability of health insurance coverage and off-farm employment. Although the Affordable Care Act (ACA) has provided more mechanisms for farmers to obtain insurance, the purchase of health insurance can place a higher cost burden on a young and beginning farmer’s operation. Any decline in off-farm labor participation resulting from the ACA is expected to be negligible as the majority of farm households with off-farm income rely on it as a major source of income (Ahearn, Williamson, and Black, 2015).

Multiple studies have found a relationship between off-farm income and farm household well-being. Farm households with off-farm income consistently have lower and less variable debt repayment capacity utilization ratios than farms without such income (Briggeman, 2011). Nehring and Hallahan (2015) find that U.S. rice farms with earned off-farm income have consistently higher farm and household returns. The effect of off-farm income is not only financial but also influences the allocation of time and resources as well. In the same study, they observe earned off-farm income generally boosts both scale and technical efficiency (Nehring and Hallahan, 2015). Fernandez-Cornejo (2007) finds that the adoption of managerial time-saving technologies significantly relates to higher off-farm income for U.S. corn and soybean farmers. As off-farm income-generating pursuits increase, household-level efficiency is higher across all corn and soybean farm sizes than farm-level efficiency alone.

The increasing role of off-farm income in the farm household over the past half century has not only helped sustain the farm household during periods of income volatility, but also encouraged more young and beginning farmers to enter into agricultural production by making credit more easily obtainable. One of the primary hurdles for young and beginning farmers is access to capital. Capital needs can often be more intense for those in production agriculture. Agricultural lenders recognize this need. The Farm Credit System has a legislated mandate and mission to provide sound and constructive credit to young, beginning, and small farmers. In 2001, when the Farm Credit System began reporting this information, they made 33,000 loans to young farmers, who are defined slightly differently than the USDA’s rule as less than 36 years old. In 2015, when the young farmer population was smaller, they originated nearly twice the loans, 62,000, for three times the amount as in 2001. Loans made to beginning farmers more than doubled over this period. According to the USDA Census of Agriculture data, the percent of young farmers, principal or otherwise, whose operations held debt increased from 2007 to 2012, indicating larger credit needs, credit that is more available, or likely a combination of both.

Many agricultural lenders utilize federal or state guarantee programs to extend credit to young and beginning farmers who may not otherwise qualify. Lenders may also use other credit tools such as exceptions to underwriting standards or specifically designed loan covenants. While lenders need these tools to continue to assist the next generation of farmers, many young and beginning farmer loans qualify for credit without concessions. This trend will likely continue, as a larger proportion than previous generations of young and beginning farm households generate significant off-farm income. Off-farm income can not only make credit more easily obtainable but can also preclude the need for guarantees, cosigners, or additional restrictions on credit that create more of an administrative burden on the farmer.

Lenders analyze the repayment capacity of a borrower. Typically, lenders factor all income—farm and off-farm—into this evaluation. A dollar of wages goes into the same pool as a dollar of net farm income. However, a lender may handle a dollar of farm income differently than a dollar of off-farm income. Agricultural lenders usually analyze multiple years of earnings to evaluate repayment capacity. Due to the volatility in farm income from year to year, lenders may sensitize farm earnings to obtain a more normal income projection for the operation. This means that lenders adjust farm earnings during boom years toward more normal trend levels. However, the sensitivity does not typically work in reverse; lenders are not likely to boost farm earnings up in lean years to increase repayment capacity measures. Earned off-farm income is unadjusted, unless a mitigating circumstance alerts the lender that it is going away or will substantially change. Given higher-than-average farm earnings, lenders may weigh a dollar of off-farm income in essence more heavily than a dollar of farm income. This is sound portfolio management, as the lender is accounting for the volatility factor in farm income that makes that repayment stream on average less stable on a per-dollar basis than other sources, such as earned off-farm income. The greater the dispersion of possible future outcomes in the form of varying farm income levels, the higher the farmer’s level of exposure to uncertain returns and the lender’s level of potential risk exposure.

According to data from the USDA, households operating commercial farms—defined as gross cash farm income of over $350,000—generated a $168,000 median net farm income and a $45,000 median off-farm income in 2014 (USDA-ERS, 2016). A farm household with the median level of off-farm income receives a greater than 25% increase in repayment capacity compared to having only farm income. USDA forecasts total net farm income in 2015 to fall close to 40% from 2014. Assuming stable off-farm income levels from 2014 to 2015, this translates to a 40–50% increase in farm household repayment capacity given a median level of off-farm income over farm income alone. This improvement in repayment capacity is proportionally greater for smaller operations in which farming is the operator’s primary occupation. Of course, aside from the income statement, the benefits of off-farm income to the young and beginning farmer flow over to the balance sheet side in terms of increased liquidity and equity.

For the young and beginning farmer sector, the implications of increasing off-farm work participation and incomes are very positive. The growing technical, financial, operational, and managerial skill set needed to run a farm translates into skills demanded off the farm. In addition, the availability and opportunities of off-farm employment continue to widen as more employers engage in flexible work arrangements valued by the young millennial generation. As more members of the farm household participate in off-farm employment, the demand for greater efficiency, both on the farm and in the household, increases. This, in turn, drives further productivity and innovation.

Off-farm income will sustain many young operations in smoothing the variability that farm income generates throughout the farm’s economic cycle, strengthening the probability of remaining, expanding, and succeeding in agriculture. It can diffuse the extent to which these operations experience financial stress in the current and near future. Those in agriculture can argue that as operation size grows—and farm income accounts for the majority of household income, bringing with it reserves and net worth—the need for off-farm income diminishes. However, industry participants must not overlook the importance of off-farm income in transitioning a young and beginning farmer’s operation to that stage. Off-farm income promotes the stability of the farm household’s finances. It generally makes capital more readily obtainable. Off-farm income is a viable and important risk management tool for today’s young and beginning farmers.

Ahearn, M.C. 1986. “Financial Well-Being of Farm Operators and Their Households.” U.S. Department of Agriculture, Economic Research Service. Agricultural Economic Report No. 563. September.

Ahearn, M., H. El-Osta, and A. Mishra. 2013. “Considerations in Work Choices of U.S. Farm Households: The Role of Health Insurance.” Journal of Agriculture and Resource Economics 38(1): 19-33.

Ahearn, M., J. Williamson, and N. Black. 2015. "Implications of Health Care Reform for Farm Businesses and Families." Applied Economics Perspectives and Policy. 37 (2): 260-286. Available online: doi:10.1093/aepp/ppu030

Briggeman, B.C. 2011. “The Importance of Off-farm Income to Servicing Farm Debt.”

Federal Reserve Bank of Kansas City. Economic Review. 96(1):83-102.

Brown, J.P., and J.G. Weber. 2013. “The Off-farm Occupations of U.S. Farm Operators and Their Spouses.” U.S. Department of Agriculture, Economic Research Service. Economic Information Bulletin No. 117. September.

Farm Credit Administration. Young, Beginning, and Small Farmer/Rancher Lending. Available online: http://fca.gov/info/ybs.html

Fernandez-Cornejo, J. 2007. “Off-farm Income, Technology Adoption, and Farm Economic Performance.” A. Mishra, R. Nehring, C. Hendricks, M. Southern and A. Gregory, Contributors. U.S. Department of Agriculture, Economic Research Service, Economic Research Report No. 36. January.

Global Workplace Analytics. 2016. “Latest Telecommuting Statistics, Analysis of 2005-14 American Community Survey (U.S. Census Bureau) Data.” Available online: http://globalworkplaceanalytics.com/telecommuting-statistics

Key, N., D. Prager, and C. Burns. 2015. “Household Income Volatility in U.S. Farm Households.” Selected Paper presented at the 2015 AAEA & WAEA Joint Annual Meeting, San Francisco CA.

Maguire, J. 2016. “U.S. Demographic Shifts Will Curb Economic Growth—At Least Until Millennials Get Up To Speed.” S&P Capital IQ Economic Research.

Nehring, R. and C. Hallahan. 2015. “The Impacts of Off-farm Income on Farm Efficiency, Scale, and Profitability Rice Farms.” Selected Paper presented at the Southern Agricultural Economics Association Annual Meeting, Atlanta GA.

Schnitkey, G. 2016. "Crop Budgets, Illinois, 2016." Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. Available online: http://www.farmdoc.illinois.edu/manage/2016_crop_budgets.pdf

U.S. Census Bureau. 2014. “Current Population Survey, HINC-02 Tables.” Available online: http://www.census.gov/hhes/www/income/index.html

U.S. Department of Agriculture, Agricultural and Resource Management Survey (USDA-ARMS). 2014. “ARMS Farm Financial and Crop Production Practices.” Available online: http://www.ers.usda.gov/data-products/arms-farm-financial-and-crop-production-practices/questionnaires-and-manuals.aspx

U.S. Department of Agriculture, Economic Research Service (USDA-ERS). 2013. “Beginning Farmers and Ranchers at a Glance.” Available online: http://www.ers.usda.gov/media/988138/eb-22.pdf

U.S. Department of Agriculture, Economic Research Service (USDA-ERS). 2015. “Farm Household Income and Characteristics Data Product.” Available online: http://ers.usda.gov/data-products/farm-household-income-and-characteristics.aspx

U.S. Department of Agriculture, Economic Research Service (USDA-ERS). 2016. “Farm Household (Historical).” Available online: http://www.ers.usda.gov/topics/farm-economy/farm-household-well-being/farm-household-income-(historical).aspx

U.S. Department of Agriculture, National Agricultural Statistics Service (USDA-NASS). 2012. “USDA Census of Agriculture.” Available online: http://www.agcensus.usda.gov/Publications/