In 2018, the Chinese government implemented a series of wide-ranging retaliatory tariffs on many U.S. export products (U.S. Department of Agriculture, 2019a). Many of the new tariffs targeted U.S. agricultural products, including soybeans. When enacted, the new tariffs briefly drove the soybean price ratio between New Orleans and Paranagua, Brazil’s principal port for soybean exports, to historic levels (CEPEA/ESALQ, 2019; FAO, 2018) and dropped U.S. soybean prices to under $9/bu, their lowest market level of the decade (U.S. Department of Agriculture, 2019b). In late 2018 and early 2019, U.S. soybean exports to China ground to a near halt, dropping by 20 million tons, or nearly 70% over the previous 12 months (U.S. Department of Agriculture, 2019c). U.S. exports had been largely supplanted South American soybeans. Brazil alone increased exports to China by approximately 10 million tons (SECEX, 2020).

Recent research has suggested that Chinese tariffs on U.S. soybean exports have added an effective 4%–5% “subsidy” to market prices for non-U.S. soybeans (Taheripour and Tyner, 2018). This subsidy has endowed foreign producers, and especially the Brazilian soybean sector, with additional investment capital and incentives for land clearing. In Brazil, where the country’s soybean acreage has been shown to be especially sensitive to price changes (Barr et al., 2011), the new tariff structure is likely to accelerate land use change.

Unfortunately, soybean expansion in Brazil has long been associated with greenhouse gas (GHG) emissions and deforestation. This occurs both directly, through the conversion of natural land covers to agriculture, and indirectly, through the sector’s impact on rural land markets and the spatial redistribution of the cattle sector (Barona et al., 2010; Richards et al., 2014; MAPA, 2018; Yao, Hertel and Taheripour, 2018).

We estimated land use changes and GHG emissions associated with the new tariff systems by introducing a simulated 25% tariff on U.S. soybean exports to China in the widely applied GTAP-BIO model. Our simulations suggested that the tariffs will lead to a 4 million hectare (mha) increase in Brazilian soybean acreage, or a 12% increase over 2016 levels. The vast majority of this simulated new soybean acreage was derived from the conversion of other croplands or pasture areas to soybeans or from intensification on existing agricultural lands. The simulations also suggested, over a medium-term time horizon, that the tariffs would lead to the loss of 67,000 ha of natural land cover (the equivalent to approximately 7%–10% of forest loss in the Brazilian Amazon in a given year). Our results, however, were highly sensitive to potential changes in land use governance. We show that if existing structures for forest governance and other incentives for agricultural intensification are not maintained, the effect of the tariffs on land use change on forest cover and GHG emissions could be significantly higher.

The Chinese tariffs and their impact on the U.S. farm sector and the global soybean trade have been widely discussed in popular and academic publications (Adjemian et al., 2019; Grant et al., 2019; Hitchner et al., 2019, Zheng et al., 2018). The Brazilian soybean sector, the principal competitor to U.S. soybean farmers, is widely expected to reap a competitive advantage to the new tariff structure (Taheripour and Tyner, 2018; Yao, Hertel and Taheripour, 2018; Grant et al., 2019). Unfortunately, the specter of rapid growth in Brazil’s soybean sector has raised concerns over the potential environmental costs of the new tariff structure (Fuchs et al., 2019).

Historically, expansions in Brazil’s soybean area have correlated with losses in natural land cover and the release of greenhouse gas (GHG) emissions (Morton et al., 2006). In the early 2000s, when Brazil’s soybean sector expanded by nearly 10 mha (CONAB, 2019; IBGE, 2019), some 13 mha of forest were razed in the Amazon (PRODES, 2020; Qin et al., 2019). At that time, anthropogenic land use changes in Brazil accounted for as much as half of Brazil’s GHG emissions (Galford et al., 2011).

While soybean expansion has long been thought to be a driver of deforestation in Brazil, the linkages underlying this coupling have been widely debated. Remote sensing studies have shown that the vast majority of newly razed forests, particularly in the biomass-rich humid tropical Amazon region, have been cleared for pasture, not soybean farming (Macedo et al., 2012; Morton et al., 2006). Empirical evidence, however, suggests that growth in the soybean sector has driven forest loss indirectly, largely through the displacement of ranching capital and technical skills or through the impact of soybean-generated profits on rural land markets (Arima et al., 2011; Barona et al., 2010). High soybean prices have contributed to rapid land appreciation in the Amazon and Cerrado and incentivized new investments in land clearing (Richards et al., 2014; Souza and Azevedo, 2017).

In the mid-2000s, a series of anti-deforestation programs, many instituted as components of Brazil’s Plans for Preventing Amazon Deforestation (PPDCAM), were enacted to reduce anthropogenic forest loss. A combination of these programs, and the dedication of the Brazilian government to their enforcement, have been widely credited with reducing forest loss in the late 2000s and early 2010s (Arima et al., 2014; Assunção, Gandour, and Rocha, 2013; Assunção and Rocha, 2014; Gibbs et al., 2015; Macedo et al., 2012; Nepstad et al., 2014; Soares-Filho et al., 2014).

In more recent years, notwithstanding the lowest soybean prices of the decade, a series of political and economic shifts have led to macroeconomic conditions more favorable for Brazilian farmers and simultaneously diminished environmental regulations. A weakened Brazilian currency counteracted otherwise low global prices for many agricultural products and increased local soybean prices. Moreover, in 2018, the Brazilian electorate selected a presidential administration that has spoken out vocally against environmental protections and promised reforms and infrastructure favored by Brazil’s agricultural lobby. The 2018 soybean tariffs, in this sense, were put into place at a time when political and macroeconomic conditions were already shifting to favor Brazil’s soybean sector.

To estimate the impact of the tariffs on Brazil’s land use system, we turned to the GTAP-BIO model, a widely used, global-scale, computable general equilibrium (CGE) model suited for modeling the effect of the new tariff structure on the global agricultural system (Hertel et al., 2010; Peña-Lévano et al., 2016; Yao, Hertel, and Taheripour, 2018). The model incorporates a broad range of policy drivers as well as country-specific information on land use and land productivity (see Yao, Hertel, and Taheripour, 2018, for a detailed description of data sources and drivers utilized by GTAP-BIO). GTAP-BIO’s conceptualization of the global economy as an interlocking and interdependent system of independent economies, each with its own independent environmental and economic governance and resource portfolio, is particularly appropriate for understanding the secondary or indirect effects associated with policy change (Hertel et al., 2010).

For this analysis, the input data for GTAP-BIO model were aggregated into six key agricultural regions: the United States, Brazil, China, the European Union (EU27), the rest of South America (RoSA) and the rest of the world (RoW). Tariff rates, with the exception of the recently imposed tariffs on U.S. agricultural exports to China, were set according to levels reported via the Tariff Analytical and Simulation Tool for Economists (Horridge and Laborde, 2008). Following Yao, Hertel, and Taheripour (2018), we applied a larger trade elasticity for soybeans to adopt the most recent estimate for this elasticity. The GTAP-BIO model uses an Armington structure, in which trade elasticities are a measure of the degree of substitution between home and imported goods and differentiation by exporting country. Our approach allows for some degree of differentiation by country of origin for a given product (Armington, 1969). The larger trade elasticity for soybeans implies that importing countries can more easily shift among foreign sources of imports. This is a reasonable parameterization for the case of soybeans, because soybeans are a standard product with little difference in terms of quality among exporters. It is also important to note that CGE models reflect long-run equilibrium conditions in which countries have time to adjust their supply chain.

Our use of GTAP-BIO to estimate the impact of the new tariff structure contrasts sharply with previous efforts. Notably, Fuchs et al. (2019), whose simulations suggested that the tariffs on U.S. soybeans could lead to the addition of more than 13 mha of new soybean land, relied on a less dynamic conceptualize of the global soybean trade. In their estimates, they suggested that Brazilian farmers (or in a second scenario, all non-U.S. soybean countries) would simply replace U.S. soybean exports to China in addition to supplying existing markets elsewhere. Our approach differs from these earlier efforts by conceptualizing the global soybean trade as a relatively dynamic and interconnected set of flows, where U.S. soybeans will eventually reach ports once primarily supplied with Brazilian produce. We also acknowledge a degree of land use substitution, where new soybean acreage is as likely to be created from other croplands or pastures as it is from natural vegetation. We believe that the interconnected trade system at the heart of the model provides a more realistic portrayal of the global soybean trade and a better portrayal of the impact of the new tariff structures.

GTAP-BIO is subject to its own limitations. This model does not account for ad hoc purchase agreements or tariff waivers by China for U.S. agricultural products. This is particularly notable, as China has agreed to purchase $32 billion in U.S. agricultural goods over 2020–2021. Similarly, our analysis does not account for major changes in demand occurring since 2016, such as the recent loss of nearly half of China’s soy-consuming swine herd due to African Swine Fever or disruptions associated with COVID-19. Our model also assume that the tariffs are applied over a medium-term time horizon, despite their relative uncertainty and continued negotiations.

For this analysis, using the 2016 global economy as the basis year, we simulated a 25% tariff on U.S. soybeans. We examined the effect of the tariff shock under the three land governance scenarios for Brazil. The first scenario more fully resembles the economic and governance landscape of 2016; however, the second and third scenarios offer insight into the potential impact of the tariff system under a reduction in public commitment to the anti-deforestation policies put in place over the preceding decade. For these latter scenarios we adjusted land use change parameters for forest clearing to levels estimated from the 2000–2006 period, prior to the institutionalization of many of the environmental policies touted for reducing deforestation levels in the Amazon.

The GTAP-BIO model uses several parameters to allocate land across uses and govern the intensification and expansion of agriculture land. First, it uses a set of regional land transformation elasticities to govern land allocation among land cover items (pasture, cropland, and forest) across the world. Taheripour and Tyner (2013) have tuned the land transformation elasticities of this model according to the data provided by the Food and Agricultural Organization (FAO) of the United Nations (UN). In addition, the model uses a set of regional coefficients to take into account changes in harvest frequency, again according to the FAO data (Taheripour, Cui, and Tyner, 2018). It also uses a set of regional parameters to determine the productivity of new versus exiting cropland (Taheripour and Tyner 2013). Finally, it uses a set of parameters that governs crop yields per harvest (Taheripour, Cui, and Tyner, 2018).

This scenario assumes no change in land governance. The land transformation elasticities that control allocation of land among the land cover items (including cropland, pasture, and forest) and distribution of cropland between crops plus the rate of cropping intensity (due to multiple cropping and/or using abandoned land for crop production) govern land allocation and intensification in the GTAP-BIO model. For this first scenario, these parameters were tuned to recently observed trends in land allocation across the world (Taheripour and Tyner, 2013).

This scenario sets land transformation elasticities for Brazil to values observed during times of higher historical rates of deforestation.

This case sets back the land transformation elasticities Brazil to values observed during times of higher historical rates of deforestation. It also reduces the likelihood of continued investments in multi-cropping.

Finally, it is important to note that the version of GTAP-BIO used in this analysis, in addition to identifying changes in principal land uses (cropland, forest and pasture), identifies changes in harvested area across 11 major crop types as well as double-cropping systems (Taheripour, Zhao, and Tyner, 2017). All land use changes were disaggregated by country and individual agro-ecological zones (AEZ). We then converted the land use effects of the tariff structure to GHG emissions using the AEZ-EF model developed and deployed by Plevin et al. (2014), where carbon fluxes from land use change are calculated across specific AEZs. Emissions are calculated in megagrams (1 Mg = 1,000,000 g) of carbon dioxide (CO2) equivalent (CO2e).

Imposing a 25% tariff on U.S. soybean exports in GTAP-BIO yields strong shocks to both the U.S. and Brazilian soybean systems. Simulations suggested a 4.2 mha reduction in U.S. soybean area over a 3-to-8-year (medium-term) time horizon. Planted soybean areas in Argentina, Paraguay, and Uruguay increased by a combined 1.2 mha. Planted soybean acreage in Brazil, meanwhile, increased by 4 mha. This simulated acreage change, while still significant, is less than other projections (notably, Fuchs et al., 2019).

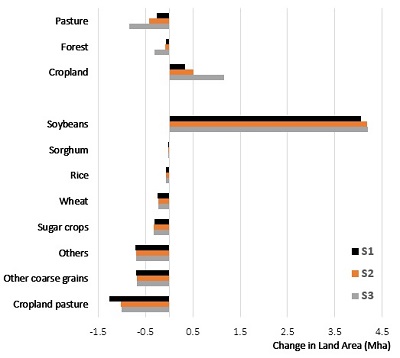

GTAP-BIO also assesses the broader impact of the new tariff structure on Brazil’s land use system. In our base scenario, in which we simulated some 4mha of new soybean acreage, much of the new acreage was derived from other agricultural lands or pasture. Approximately half of new acreage was established from areas already used for cropland (e.g., sugar, wheat, or other coarse grains), while the remainder was formed from pasture (8%) or via the intensification of existing cropland or pastures (Figure 1). In this base scenario, forest area declined by only 67,500 ha. While significant, this relatively muted deforestation response to a 4 mha increase in soybean production is a testament to the effectiveness of Brazil’s policies on land use clearing during the early 2010s and Brazil’s capacity to expand soybean areas without incurring significant losses in natural forest loss.

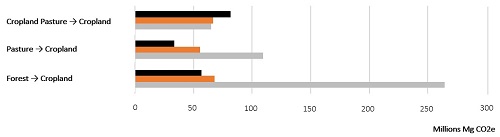

Under the base scenario, we estimated the release of 172 million Mg of CO2 in response to the new tariff structure. The largest source of emissions (80 million Mg CO2e, or 47% of total emissions) was derived from the conversion of cropland pasture to new soybean acreage. This was followed by emissions derived from losses in natural land cover (57 million Mg CO2e, 33% of total) and the conversion of pastures to soybean production (34 million Mg CO2e, 20% of total; Figure 2).

In recognition of recent concerns over the extent to which Brazil’s environmental regulations are being, or are likely to be, implemented or enforced, our second and third scenarios simulate land use change under scenarios of less stringent environmental protection. For the second scenario, we adjusted land use change parameters, a measure that accounts for environmental governance structures, to levels derived from 2000-2006, a period that precedes the environmental regulations put in place in the decade. The third scenario adjusted both the governance parameter and intensification parameters back to the 2000-2006 period.

In these second and third simulations, soybean areas again expanded by approximately 4 mha. However, the source areas from the new soybean acreage include more natural land cover. In the second scenario, deforestation and emissions increased (over the base scenario) from 67,000 ha to 84,000 ha and from 172 million MG to 190 million Mg of CO2. In the third scenario, which perhaps best captures today’s regulatory environment and troubled economy, the increase was perhaps more striking. In total, this simulation suggested the loss of more than 315,000 ha of natural land cover. GHG emissions more than doubled over the base scenario, to 439 million Mg CO2e, largely due to losses in natural land cover and the conversion of pasture to cropland (25%).

Our results suggested that Chinese tariffs on American soybeans are likely to wield a relatively small (if still significant) impact on land use change in Brazil. The relatively small effects on natural land cover reflect the relative substitutability of the global soybean trade.

Our results, in their assessment of impact, are in general agreement with other recent research on the directionality of the impacts of the new tariff structure (e.g., Fuchs et al., 2019). However, they differ in magnitude. Notably, where others suggested “a surge of tropical deforestation” (Fuchs et al., 2019, p. 451), our simulations suggest a relatively small effect on forest loss. The 67,000 ha of total natural land cover losses, simulated over a multiyear period in our base scenario, for example, amounted to roughly 7% of annual forest loss in the Amazon.

While our projections suggest relatively small impacts on forest cover in Brazil, they do suggest significant impacts on the county’s soybean sector. Brazil’s soybean farmers, already buoyed by a favorable exchange rate and, arguably, a favorable political environment, are now sowing new areas and reaping record harvests. Our models suggest that Chinese tariffs on American soybeans are likely accelerating this process.

In late 2019 the agricultural season in Brazil was preceded by widespread forest fires in the Amazon. When deforestation levels for the year were fully tallied, 2019 forest loss had risen by 25% from 2018 (PRODES, 2020). The new tariff structure, insofar as it raises market value for Brazilian soybeans, even if slightly, will only heighten incentives for land clearing and inject additional investment capital into Brazil’s agricultural sector at a time when land clearing incentives are already high. Our results, where land use change and associated emissions are largely contingent on the extent to which existing environmental policies remain in place and enforced, highlight the importance of maintaining Brazil’s existing structures for environmental governance.

Adjemian, M.K., S. Arita, V. Breneman, R. Johansson, and R. Williams. 2019. “Tariff Retaliation Weakened the U.S. Soybean Basis.” Choices 34: 1–9.

Arima, E.Y., P. Barreto, E. Araújo, and B. Soares-Filho. 2014. “Public Policies Can Reduce Tropical Deforestation: Lessons and Challenges from Brazil.” Land Use Policy 41: 465–473.

Arima, E.Y, P. Richards, R. Walker, and M.M. Caldas. 2011. “Statistical Confirmation of Indirect Land Use Change in the Brazilian Amazon.” Environmental Research Letters 6: 024010.

Armington, P.S. 1969. “A Theory of Demand for Products Distinguished by Place of Production.” IMF Staff Papers 16: 159–178.

Assunção, J., C. Gandour, and R. Rocha. 2013. “DETERring Deforestation in the Brazilian Amazon: Environmental Monitoring and Law Enforcement.” Climate Policy Initiative: 1–36.

Assunção, J., and R. Rocha 2014. “Getting Greener by Going Black: The Priority Municipalities in Brazil.” Rio de Janeiro, Brazil: Climate Policy Initiative (2014)

Barona, E., N. Ramankutty, G. Hyman, and O.T. Coomes. 2010. “The Role of Pasture and Soybean in Deforestation of the Brazilian Amazon.” Environmental Research Letters 5: 024002.

Barr, K.J., B.A. Babcock, M.A. Carriquiry, A.M. Nassar, and L. Harfuch. 2011. “Agricultural Land Elasticities in the United States and Brazil.” Applied Economic Perspectives and Policy 33: 449–462.

Bigelow, D., and A. Borchers. 2017. Major Uses of Land in the United States, 2012. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Information Bulletin, ERR-178, August.

CEPEA/ESALQ. 2019. “Indicador da Soja ESALQ.” In Indicador da Soja, ESALQ ed. Administração e Sociologia Centro de Estudos Avançados em Economia Aplicada. Piracicaba, Brasil: Escola Superior de Agricultura Luiz de Queiroz.

CONAB. 2019. Série Histórica das Safras. Brasilia, Brazil: Companhia Nacional de Abastecimento.

FAO. 2018. Food Price Monitoring and Analysis Global Information and Early Warning System Tool. Rome, Italy: Food and Agricultural Organization of the United Nations.

Fuchs, R., P. Alexander, C. Brown, F. Cossar, R.C. Henry, and M. Rounsevell. 2019. “Why the US–China Trade War Spells Disaster for the Amazon.” Nature. Available online: https://www.nature.com/articles/d41586-019-00896-2

Galford, G.L., J.M. Melillo, D.W. Kicklighter, J.F. Mustard, T.W. Cronin, C.E.P. Cerri, and C.C. Cerri 2011. “Historical Carbon Emissions and Uptake from the Agricultural Frontier of the Brazilian Amazon.” Ecological Applications 21: 750–763.

Gibbs, H.K, L. Rausch, J. Munger, I. Schelly, D.C. Morton, P. Noojipady, B. Soares-Filho, P. Barreto, L. Micol, and N.F. Walker. 2015. “Brazil's Soy Moratorium.” Science 347: 377–378.

Grant, J., S. Arita, C. Emlinger, S. Sydow, and M.A. Marchant. 2019. “The 2018– 2019 Trade Conflict: A One-Year Assessment and Impacts on U.S. Agricultural Exports.” Choices 34: 1–8.

Hertel, T.W., A.A. Golub, A.D. Jones, M. O'Hare, R.J. Plevin, and D.M. Kammen. 2010. “Effects of US Maize Ethanol on Global Land Use and Greenhouse Gas Emissions: Estimating Market-Mediated Responses.” BioScience 60: 223–231.

Hillman, J.S., and M.D. Faminow. 1987. “Brazilian Soybeans: Agribusiness ‘miracle.’” Agribusiness 3: 3–17.

Hitchner, J., K. Menzie, and S. Meyer, 2019. “Tariff Impacts on Global Soybean Trade Patterns and U.S. Planting Decisions.” Choices 34: 1–9.

Horridge, M., and D. Laborde. 2008. “TASTE: A Program to Adapt Detailed Trade and Tariff Data to GTAP- Related Purposes.” West Lafayette, IN: Purdue University, Centre for Global Trade Analysis, GTAP Technical Paper.

IBGE. 2019. Municipal Agricultural Production: Temporary and Permanent Crops. Brasilia, Brazil: Instituto Brasileiro de Geografia e Estatística.

Macedo, M.N, R.S. DeFries, D.C. Morton, C.M. Stickler, G.L. Galford, and Y.E. Shimabukuro. 2012. “Decoupling of Deforestation and Soy Production in the Southern Amazon during the Late 2000s.” Proceedings of the National Academy of Sciences 109: 1341–1346.

MAPA. 2018. Projeções do Agronegócio 2017/2018 - 2027/2028. Brasilia, Brazil: Ministério da Agricultura, Pecuária e Abastecimento.

Morton, D.C., R. DeFries, Y.E. Shimabukuro, L.O. Anderson, E. Aral, F. del Bon Espirito-Santo, R. Freitas, and J. Morisette. 2006. “Cropland Expansion Changes Deforestation Dynamics in the Southern Brazilian Amazon.” Proceedings of the National Academy of Sciences of the United States of America 103: 14637–14641.

Nepstad, D., D. McGrath, C. Stickler, A. Alencar, A. Azevedo, B. Swette, T. Bezerra, M. DiGiano, J. Shimada, R. Seroa da Motta, E. Armijo, L. Castello, P. Brando, M.C. Hansen, M. McGrath-Horn, O. Carvalho, and L. Hess. 2014. “Slowing Amazon Deforestation through Public Policy and Interventions in Beef and Soy Supply Chains.” Science 344: 1118–1123.

Paarlberg, R.L. 1978. “Food, Oil, and Coercive Resource Power.” International Security 3: 3–19.

Peña-Lévano, L.M., F. Taheripour, and W.E. Tyner. 2016. “Climate Change Interactions with Agriculture, Forestry Sequestration, and Food Security.” Environmental and Resource Economics: 1–23.

Plevin, R.J., H.K. Gibbs, J. Duffy, S. Yui, and S. Yeh. 2014. Agro-Ecological Zone Emission Factor (AEZ-EF) Model (v47). West Lafayette, IN: Purdue University, Centre for Global Trade Analysis, Global Trade Analysis Project.

PRODES 2020. Monitoramento da Floresta Amazônica Brasileira por Satélite. Campinas, Brazil: Instituto Nacional de Pesquisas Espaciais Projeto Prodes.

Qin, Y., X. Xiao, J. Dong, Y. Zhang, X. Wu, Y. Shimabukuro, E. Arai, C. Biradar, J. Wang, and Z. Zou. 2019. “Improved Estimates of Forest Cover and Loss in the Brazilian Amazon in 2000–2017.” Nature Sustainability 2: 764–772.

Richards, P.D., R.J. Myers, S.M. Swinton, and R.T. Walker. 2012. “Exchange Rates, Soybean Supply Response, and Deforestation in South America.” Global Environmental Change 22: 454–462.

Richards, P.D., R.T. Walker, and E.Y. Arima. 2014. “Spatially Complex Land Change: The Indirect Effect of Brazil's Agricultural Sector on Land Use in Amazonia.” Global Environmental Change 29: 1–9.

SECEX. 2019. Grupos de Produtos: Exportação (Séries Históricas). Brasilia, Brazil: Ministério da Economia do Brasil.

Soares-Filho, B., R. Rajão, M. Macedo, A. Carneiro, W. Costa, M. Coe, H. Rodrigues, and A. Alencar. 2014. “Cracking Brazil's Forest Code.” Science 344: 363–364.

Souza, C., and T. Azevedo. 2017. MapBiomas General Handbook. São Paulo, Brazil: MapBiomas.

Taheripour, F., and W. Tyner. 2013. “Biofuels and Land Use Change: Applying Recent Evidence to Model Estimates.” Applied Sciences 3: 14–38.

Taheripour, F., and W.E. Tyner. 2018. “Impacts of Possible Chinese 25% Tariff on U.S. Soybeans and Other Agricultural Commodities.” Choices 33: 1–7.

Taheripour, F., X. Zhao, and W.E. Tyner. 2017. “The Impact of Considering Land Intensification and Updated Data on Biofuels Land Use Change and Emissions Estimates.” Biotechnology for Biofuels 10: 191.

U.S. Department of Agriculture. 2019a. China Raises Tariffs on U.S. Agricultural Products. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service, GAIN Report CH19030.

U.S. Department of Agriculture. 2019b. Prices Received: Soybean Prices by Month, US. Washington, DC: U.S. Department of Agriculture, National Agricultural Statistics Service.

U.S. Department of Agriculture. 2019c. Global Agricultural Trade System. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/gats/default.aspx.

Yao, G., T.W Hertel, and F. Taheripour. 2018. Economic Drivers of Telecoupling and Terrestrial Carbon Fluxes in the Global Soybean Complex.” Global Environmental Change 50: 190–200.

Zheng, Y., D. Wood, H.H. Wang, and J.P.H. Jones. 2018. “Predicting Potential Impacts of China’s Retaliatory Tariffs on the U.S. Farm Sector.” Choices 33: 1–6.