Trade conflicts have recently erupted between the United States and China, and the battle over newly announced tariffs has escalated quickly. At the beginning of 2018, the United States imposed tariffs on imported solar panels and washing machines; China responded by initiating an anti-dumping investigation into U.S. sorghum. In early March, President Trump announced steel and aluminum tariffs, with China one of the primary targets. Within 2 weeks, China had responded by announcing a list of 128 U.S. products as the targets of retaliatory tariffs, effective April 2, 2018. The list included pork products and ethanol, which are of critical importance to the U.S. Midwest. As those tariffs went into effect, the U.S. Trade Representative (USTR) announced 25% tariffs on $50 billion in Chinese imports, investment restrictions, and the submission of a case to the World Trade Organization (WTO) over China’s trade practices (Trump, 2018; USTR, 2018). The Chinese government responded immediately with its own tariff package, targeting roughly $50 billion in U.S. imports, including the largest agricultural import, soybeans. For both the United States and China, tariffs on $50 billion worth of goods are scheduled to take effect in several months. The volleying may continue, as President Trump has mentioned the possibility of another round of proposed tariffs on a list of Chinese imports valued at $100 billion (Davis, 2018).

It is difficult to overestimate the importance of the U.S.–China agricultural trade relationship. The United States exports over $24 billion in agricultural and related products to China annually (USDA-FAS, 2018b) and has an approximate $13.6 billion agricultural trade surplus. Stakeholders in U.S. agriculture are nervously speculating China’s next move, fearing that the already announced tariffs will be put in place, as has happened for sorghum and pork, and that additional tariffs or other trade barriers will be erected. The dispute has already captured the vast majority of U.S. agricultural trade with China, with soybeans alone accounting for 66% of total U.S. agricultural exports to China (USDA-FAS, 2018b). While speculation is abundant, there is a scarcity of data-driven analysis and insights to help understand China’s actions during these trade tensions.

This article sheds light on some of China’s agricultural trade retaliation principles by analyzing previous cases. China’s responses follow three principles: (1) responding proportionally with restraint, (2) targeting substitutable products when possible, and (3) inflicting economic and political costs. With a more concrete understanding of China’s motives and potential actions, U.S. policy makers and stakeholders can better evaluate the potential consequences of applying trade measures on China. Furthermore, as the trade dispute continues, any deviation from these principles on China’s part may serve as a signal of the Chinese government’s intention to escalate or deescalate the situation.

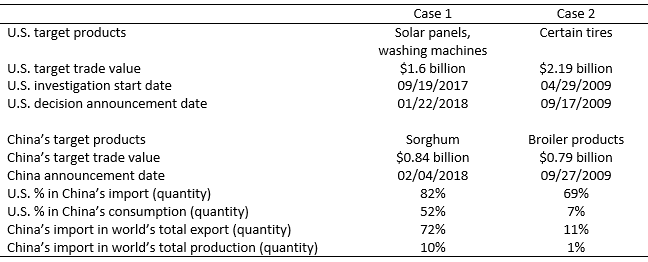

In April 2009, the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union filed a complaint against China with the United States International Trade Commission (USITC), which determined that some Chinese tires were being imported in quantities or under conditions that were causing market disruption for domestic producers (USITC, 2009). In September 2009, President Obama announced a tariff increase—35% the first year, 30% the second year, and 25% the third year—on tires from China, which at the time were valued at $2.1 billion annually (Andrews, 2009).

China filed a WTO complaint, which it ultimately lost, and initiated its own anti-dumping investigations into U.S. broiler-chicken products (MOC, 2009). China’s Ministry of Commerce (MOC) began their investigation days after the U.S. announcement, and a year later announced that China would impose an anti-dumping tariff of 50.3%–105.4% on U.S. broiler products (Associated Press, 2010). The value of U.S. broiler products exported to China had been $800 million in the previous year, which constitutes a smaller but somewhat comparable trade flow to the Chinese tires targeted by the United States.

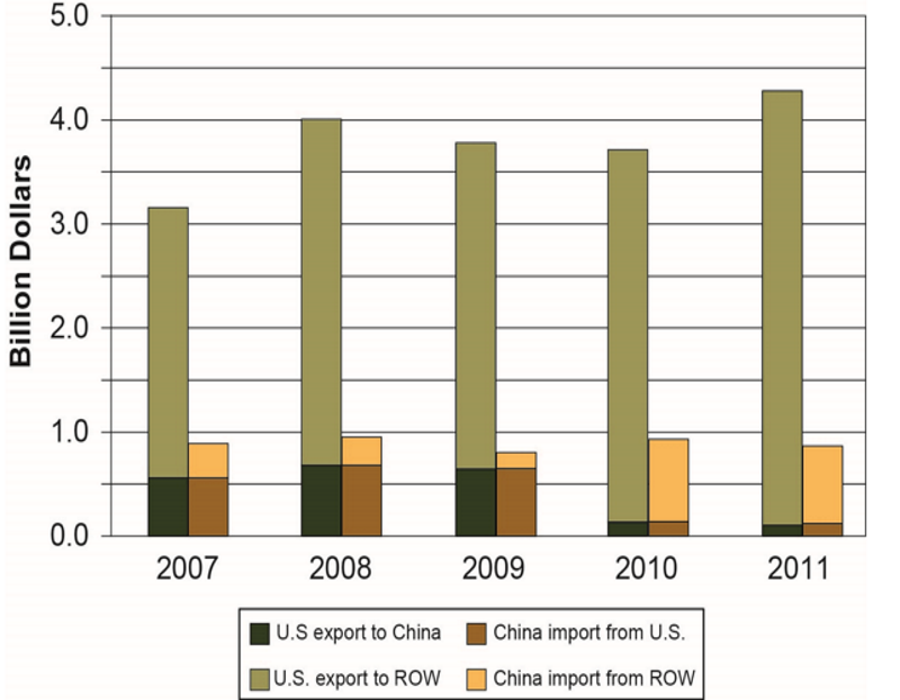

The U.S. tariff against Chinese tires effectively limited Chinese exports: the trade value of Chinese tires exported to the United States decreased 23% from 2008 to 2010 (UN, 2018). However, China’s tariff on U.S. broilers was even more effective: the value of U.S. broiler exports to China dropped 83% from 2009 to 2010 ($660 million). Before the tariff, U.S. broilers were the third-most valuable agriculture-related commodity exported to China (USDA-FAS, 2018b), but after the tariff they fell to thirteenth. Soon after, a further round of sanctions decreased U.S. broiler exports to China to almost zero. While China only accounted for 18% of total U.S. chicken exports in 2009, it was a crucial market for U.S. producers. About half of the chicken exported to China was in the form of chicken feet, which have a near-zero value for U.S. consumers but are considered a delicacy in China. Selling chicken feet to China had been an important source of profit for a U.S. industry with thin profit margins.

The replacement of U.S. broiler products was done at little cost to China. Although popular, chicken feet are a snack food and far from an essential product for China’s consumers. Furthermore, China was able to shift imports from the United States to other countries. Figure 1 shows that the $511 million decrease in U.S. imports was accompanied by a $636 million increase in imports from other countries.

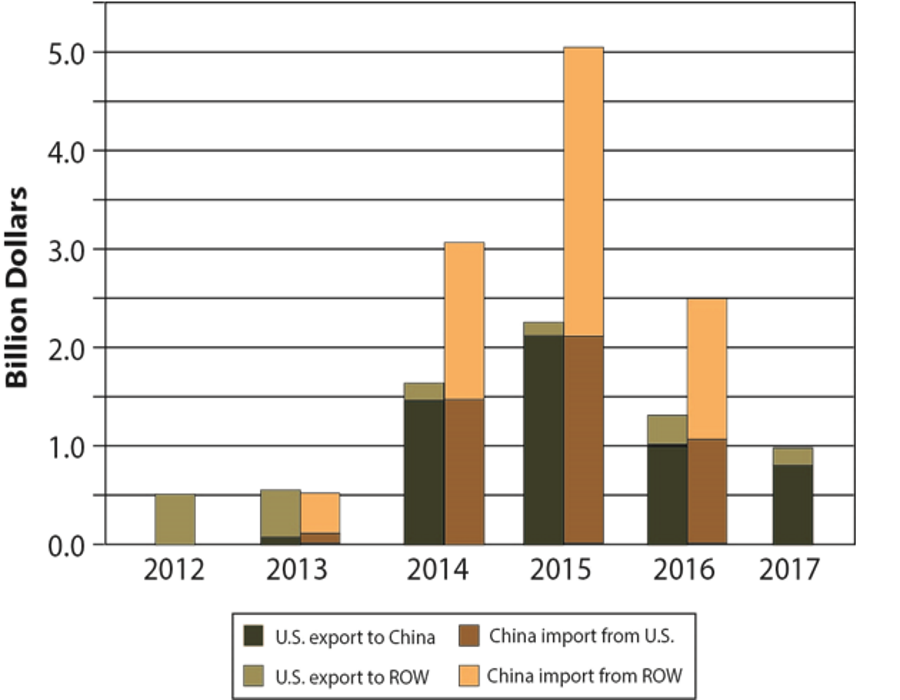

In January 2018, after a 3-month anti-dumping investigation, President Trump approved a 30% tariff on solar panels, most of which come from China, and a 20% tariff on washing machines. Within 2 weeks, China responded by initiating an anti-dumping investigation on U.S. sorghum (MOC, 2018a). The preliminary ruling announced in mid-April 2018 decided that the surge of U.S. sorghum import constitutes dumping and causes harm to China’s domestic producers. Temporary measures became effective immediately, requiring all Chinese importers of U.S. sorghum to pay a deposit equal to 178.6% of the value of the cargo (MOC, 2018b). As with chickens, China responded proportionally by choosing a commodity with a smaller but still comparable trade value ($837 million) relative to the U.S. targets ($1.4 billion for solar panels and $0.2 billion for washing machines) (UN, 2018). If China does impose an import tariff on U.S. sorghum, it is expected be significant: 38% of the sorghum produced in the United States and 81% of total U.S. sorghum exports go to China. Although China relies heavily on U.S. sorghum (82% of imports and 51% of domestic consumption), it is mainly used for livestock feed, for which there are plenty of substitutes, such as other coarse grains and corn (Reidy, 2018). Therefore, the domestic cost to China is likely to be small.

The sorghum retaliation especially sheds light on China’s intentions due to the striking similarity between sorghum and soybeans. China imported minuscule amounts of U.S. sorghum before 2013. However, as China’s price support policies for corn significantly drove up corn prices for feed and U.S. corn shipments were found to have an unapproved genetic trait, China’s demand for feed grains was directed to sorghum (Wu and Zhang, 2016), as shown in Figure 2. China immediately became the dominant importer and driver of U.S. sorghum production growth. At its peak in 2015, U.S. sorghum production reached 2.4 times the 2012 level, mostly due to China’s import demand (USDA, 2018). It is fair to say that China’s market and policy developments have wildly swung the U.S. sorghum industry. The rise of U.S. soybean production due to China’s import demand is an exaggerated version of the sorghum story, raising concerns about the effects of potential tariffs on U.S. soybeans.

Source: Author calculations from USDA-FAS (2018b) and UN (2018).

As the world’s second-largest importer of agricultural and related products after the United States, China wields significant power in trade. Beyond these two retaliations on the United States, China has also used agricultural trade as a weapon against other countries, often for political rather than economic reasons. For example, China refused bananas from the Philippines amid the territorial dispute over the Scarborough Shoal Islands in 2012 (Perlez, 2012) and blocked salmon from Norway in 2010 after a Nobel Peace Prize was given to Chinese dissident Xiaobo Liu (Huang and Steger, 2017). In both cases, health concerns were cited, and sanitary and phytosanitary trade barriers utilized. Salmon and bananas accounted for 21% and 34% of the total agricultural and related product exports to China by Norway and the Philippines, respectively, before the restrictions (USDA-FAS, 2018b). By choosing these products, China exhibited more assertiveness in trade disputes with smaller countries.

China has also used non-tariff measures on the United States (although these were not clear cases of retaliation). For example, China banned all U.S. poultry and related product imports in 2015 due to avian influenza (Waters, 2015). More recently, China imposed more stringent phytosanitary standards, such as restricting the amount of allowable foreign material on imported soybeans from 2% to 1%, causing trouble for some U.S. soybean exporters (Hirtzer, 2017). China’s domestic regulations, such as the 2015 China Food Safety Law, offer apparatuses for these measures. In trade disputes, the United States should expect China to use both tariff and non-tariff tools.

Currently, China has a huge overall trade surplus with the United States, and thus naturally wants to maintain the status quo and avoid dispute escalations. As the two cases above demonstrate, China tends to target agricultural commodities with trade flows comparable to U.S. targets in order to send a clear message. At the same time, China has often carefully avoided escalation by choosing targets with smaller trade values. The two previous cases also show that China is inclined to target the U.S. agricultural sector, which now holds a trade surplus with China. Interestingly, the Chinese ambassador to the United States, Tiankai Cui, announced in an interview on April 3, 2018, that Beijing will take “proportionate” counter-measures of the “same proportion, same scale and same intensity” if Washington imposes more tariffs on Chinese goods from a trade probe (Reuters Staff, 2018).

In these two cases, China chose commodities that are easily substitutable across products, across sources, or via domestic production. Half of the U.S. broiler products were chicken feet, a replaceable snack food, and sorghum is commonly used for feed and can be replaced by corn or other coarse grains. In terms of substitutability across sources, China was able to source chicken from its large domestic production base and other international markets; the same is true for sorghum if we consider its close substitutes. The Chinese government actively pursues substitutability across sources by import diversification. For example, China allowed sorghum imports from Argentina in 2014 after U.S. imports soared in the previous year.

From the perspective of China’s government, the ultimate goal of retaliatory tariffs is to inflict economic loss on politically influential interest groups in the United States, turning them into lobbyists for easing trade restrictions. For retaliation measures to be effective, China’s market as an export destination for targeted commodities has to be important for U.S. producers, as is the case for broiler products and sorghum. Furthermore, the Chinese government has long recognized the political significance of the U.S. agricultural industry, which partly explains why it targets U.S. agricultural exports in trade spats.

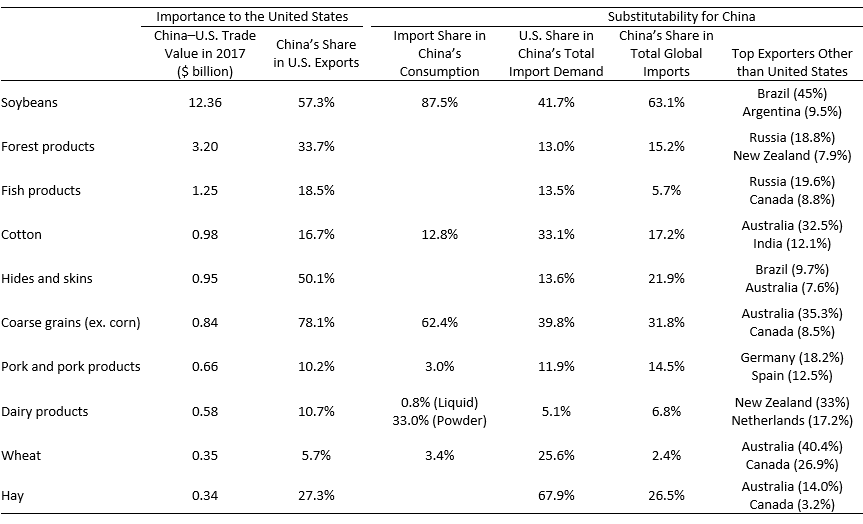

Table 2 demonstrates the importance and substitutability of top agricultural and related products that the United States currently exports to China. The proportional response principle suggests that China will choose commodities with proportional trade values. By the substitutability principle, China is more likely to choose commodities with a lower import share in Chinese domestic consumption, a lower U.S. share in China’s total import demand, and a lower Chinese share in total global import.

Source: USDA-FAS (2018b), USDA (2018), UN (2018), and authors’ calculations.

Table 2 provides a starting point to measure importance and substitutability. To more precisely measure importance, we must account for potential impacts on producers’ profit margins, political importance (Are producers concentrated in important political districts?), and symbolic importance (Has the commodity received recent media attention or was the commodity recently highlighted in previous trade deals?). The substitutability information is mainly concerned with substitution across source countries for Chinese imports. To better measure substitutability, we also have to consider substitution across products as well as nuances such as China’s trade relationship with competing suppliers and product seasonality.

Looking at China’s response to the U.S. steel and aluminum tariffs, we argue that the Chinese government has followed the three aforementioned trade retaliation principles. First—consistent with the “proportional response” doctrine—China’s retaliation included dried and fresh fruits, nuts, grape wine, pork, and ethanol products but not soybeans. While China exports $2.8 billion in steel and aluminum products to the United States, it imports more than $12 billion of U.S. soybeans. Choosing soybeans would have been a dramatic escalation and deviation from China’s past strategy. Instead, China opted to combine 128 agricultural and non-agricultural products with total trade value of $3 billion (MOC, 2018c; USDA-FAS, 2018a), matching the U.S. targets.

Second, most of the 128 products are not difficult to substitute. France and other European countries could well supply the growing Chinese demand for wine, and the United States is not an irreplaceable supplier of dried and fresh fruits and nuts. When it comes to pork, China is not only the largest pork-producing country in the world, but it also currently supplies 97% of its pork demand domestically (Table 2) and is already in expanding production. In addition, U.S. pork exports to China in recent years were dwarfed by the exports from Europe, providing another venue for China to substitute.

Third, China’s 128-product list from the steel and aluminum round included many agricultural products with different economic and political implications. Midwestern states such as Iowa and Illinois, along with North Carolina, will be most impacted by the 25% tariff on pork products, while California, the Pacific Northwest, the Northeast, and Florida are disproportionally affected by the 15% tariff on fruits and wine. In addition, ginseng is mainly produced in Wisconsin, and recycled aluminum and steel products are mainly produced in the U.S. Rust Belt.

As this tit-for-tat trade battle keeps growing, both sides have left room for negotiation. China’s original statement following the steel and aluminum announcement held that the 25% tariffs on pork products and recycled aluminum would only be effective after “proper evaluation of the impacts of U.S. measures.” However, the Chinese government eventually made the tariffs on all 128 products effective as the United States escalated the dispute.

China announced a list of 106 products to be targeted by retaliatory tariffs in response to the proposed U.S. tariffs on $50 billion worth of goods. In terms of proportionality, the total trade value of these products exactly matches the U.S. targets. Since the total value of U.S. agricultural exports to China (including related products) is only $24.1 billion, soybeans have to be on the table to produce a proportional response. Furthermore, a tariff on U.S. soybeans would inflict great economic cost, not only because soybeans represent the majority of U.S. agricultural exports to China but also because China is the destination of 57.3% of U.S. soybean exports. In terms of substitutability, China relies on U.S. soybeans to supply 41.7% of its soybean consumption, predominately for feed. The sheer volume of Chinese soybean imports makes it more difficult to displace than other products. However, if need be, China could shift a significant share of imports to other countries such as Brazil and Argentina, produce more soybeans domestically, and look to replace soybeans with other products. Cotton and wheat, two other top ten U.S. agricultural exports to China, are also on this list, meaning that China has targeted five (sorghum, pork, soybeans, cotton, and wheat) of its top ten U.S. agricultural imports thus far.

As the trade dispute escalates, both countries will inevitably target commodities that are more difficult to substitute, such as soybeans for China. As the side with a trade surplus, China is at a disadvantage in terms of proportional tariff retaliations because it will be the first to run out of commodities on which to put tariffs. For example, if China’s tariffs on $50 billion worth of goods are eventually imposed, $16.5 billion of Chinese imports of U.S. agricultural and related products will be affected, out of a total of $21 billion. At that point, if the United States continues to escalate (for example, if the additional tariffs on $100 worth of goods proposed by President Trump are implemented), China will have to look outside of agriculture, or even outside of trade, for a response.

Above we have outlined three principles that have guided Chinese reactions to trade disagreements. Through each round of the current dispute with the United States, China has reacted consistently with these principles. As the trade dispute continues, we should expect the Chinese government to continue following these principles. Any deviation from these principles will provide U.S. trade negotiators with a signal of China’s intentions to escalate or deescalate the situation.

Trade relations worldwide are in a period of flux right now. The trade-dependent U.S. agriculture system has been dragged into trade drama before and unfortunately is being targeted again. The tariffs that have been imposed and threatened have already impacted agricultural markets, driving prices lower on the prospects of reduced trade flows. However, with the delayed implementation of the tariffs from the $50 billion announcements on both sides, there is some time for trade negotiations to reduce or eliminate these tariffs. But both sides will need to step up to the negotiating table.

Andrews, E. L. 2009, January 12. “U.S. Adds Tariffs on Chinese Tires.” New York Times. Available online: http://www.nytimes.com/2009/09/12/business/global/12tires.html

Associated Press. 2010, September 27. “China Imposes Tariff on US Chicken.” CBS News Moneywatch. Available online: https://www.cbsnews.com/news/china-imposes-tariff-on-us-chicken/

Davis, B. 2018, April 5. “Trump Weighs Tariffs on $100 Billion More of Chinese Goods.” Wall Street Journal. Available online: https://www.wsj.com/articles/u-s-to-consider-another-100-billion-in-new-china-tariffs-1522970476

Hirtzer, M. 2017, December 20. “China Tightens Import Specifications on U.S. Soybeans.” Reuters. Available online: https://www.reuters.com/article/usa-soybeans-china/update-2–china-tightens-import-specifications-on-u-s-soybeans-usda-idUSL1N1OK1KG

Huang, E., and Steger, I. 2017, June 14. “Norway Wants China to Forget about the Human Rights Thing and Eat Salmon Instead.” Quartz. Available online: https://qz.com/1000541/norway-wants-china-to-forget-about-the-human-rights-thing-and-eat-salmon-instead/

Ministry of Commerce of the People’s Republic of China (MOC). 2009. “Announcement for Initiating Anti-Dumping Investigation into Imported U.S. Poultry Products.” Public Announcement No. 74. Available online: http://www.mofcom.gov.cn/article/b/g/200911/20091106600585.shtml

Ministry of Commerce of the People’s Republic of China (MOC). 2018a. “Announcement for Initiating Antidumping and Countervailing Investigations on Imported Sorghum from the United States of America.” Public Announcement No. 13. Available online: http://english.mofcom.gov.cn/article/policyrelease/buwei/201802/20180202710853.shtml

Ministry of Commerce of the People’s Republic of China (MOC). 2018b. “Announcement for the Preliminary Decision on Antidumping Investigations on Imported Sorghum from the United States of America.” Public Announcement No. 38. Available online: http://www.mofcom.gov.cn/article/b/c/201804/20180402733178.shtml

Ministry of Commerce of the People’s Republic of China (MOC). 2018c. “Announcement for the U.S. 232 Measure on Imported Steel and Aluminum and Call for Comments on China’s Response.” Available online: http://www.mofcom.gov.cn/article/au/ao/201803/20180302722670.shtml

Perlez, J. 2012, May 11. “Dispute between China and Philippines over Island Becomes More Heated.” New York Times. Available online: http://www.nytimes.com/2012/05/11/world/asia/china-philippines-dispute-over-island-gets-more-heated.html

Reidy, S. 2018. “China’s Appetite for Sorghum Continues.” World-Grain.com. Available online: http://www.world-grain.com/articles/news_home/World_Grain_News/2018/01/Chinas_appetite_for_sorghum_co.aspx?ID=%7B97A50C7A-4971-4CA8-80BD-24A1605155E6%7D&cck=1

Reuters Staff. 2018, April 2. “China Diplomat Says Any New U.S. Tariffs to Draw ‘Same Proportion’ Response—State TV.” Reuters. Available online: https://www.reuters.com/article/usa-trade-china-tariffs/china-diplomat-says-any-new-u-s-tariffs-to-draw-same-proportion-response-state-tv-idUSS6N1R201M

Trump, D. 2018. “Presidential Memorandum on the Actions by the United States Related to the Section 301 Investigation.” Available online: https://www.whitehouse.gov/presidential-actions/presidential-memorandum-actions-united-states-related-section-301–investigation/

United Nations (UN). 2018. Comtrade Database. Available online: https://comtrade.un.org/data/ [Accessed April 4, 2018]

U.S. Census Bureau, 2018. USA Trade Online. Available online: https://usatrade.census.gov/ [Accessed April 4, 2018]

U.S. Department of Agriculture (USDA), Production, Supply, and Distribution. 2018. Available online: https://apps.fas.usda.gov/psdonline/app/index.html [Accessed April 4, 2018]

U.S. Department of Agriculture, Foreign Agricultural Service (USDA-FAS). 2018a. China Targets U.S. Agriculture in Response to U.S. Trade Actions. Washington, D.C.: U.S. Department of Agriculture, Economic, Statistics and Cooperatives Services, Foreign Agricultural Economics GAIN report CH1812, March. Available online: https://gain.fas.usda.gov/Recent%20GAIN%20Publications/China%20Targets%20U.S.%20Agriculture%20in%20Response%20to%20U.S.%20Trade%20Actions_Beijing_China%20-%20Peoples%20Republic%20of_3-23-2018.pdf

U.S. Department of Agriculture, Foreign Agricultural Service (USDA-FAS). 2018b. Global Agricultural Trade System. Available online: https://apps.fas.usda.gov/gats/ [Accessed April 4, 2018]

U.S. International Trade Commission (USITC). 2009. Certain Passenger Vehicle and Light Truck Tires from China. Washington, DC: U.S. International Trade Commission Investigation No. TA-421-7, Publication 4085. Available online: https://www.usitc.gov/investigations/title_7/2015/certain_passenger_vehicle_and_light_truck_tires/final.htm

U.S. Trade Representative (USTR). 2018. “Under Section 301 Action, USTR Releases Proposed Tariff List on Chinese Products.” Washington, DC: Office of the U.S. Trade Representative, Press Release, April. Available online: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2018/april/under-section-301-action-ustr

Waters, T. 2015. “China Bans U.S. Poultry, Eggs Imports amid Avian Flu Fears: USDA.” Reuters. Available online: https://www.reuters.com/article/us-usa-china-poultry/china-bans-u-s-poultry-eggs-imports-amid-avian-flu-fears-usda-idUSKBN0KL28L20150113

Wu, Q., and W. Zhang. 2016. “Of Maize and Markets: China’s New Corn Policy.” Agricultural Policy Review. Available online: https://www.card.iastate.edu/ag_policy_review/article/?a=59