Meatpacking in the United States is a mature industry. Overall domestic per capita meat consumption levels have been stable for the past 25 years. As typical of mature industries, meatpackers compete by reducing costs through technical change, increasing in size and scope through acquisition or vertical coordination and by expanding into developing international markets. Meatpackers have also gained subtle product differentiation and pricing advantages and modest brand loyalty by vertically coordinating genetics, feeding, and processing. This has resulted in improved ability to meet consumer demands; enhancing revenues rather than simply competing on costs.

Although meatpacking is a mature industry, this is not to say that it does not face many dynamic forces of change. Entry into the U.S. market by foreign competitors has raised the global competitive ante. Environmental and social issues such as climate impacts on crops and water resources, the emergence of zoonotic diseases, and calls for improved animal welfare are changing management practices. Policy issues, including proposals to improve meat product safety, to reduce the use of antibiotics, and to place limits on animal ownership and contracting strategies, are also impacting packers. Our goal is to address the impact of these forces on meatpackers’ competitive strategies using Porter’s “Five Forces” analysis.

Porter’s 2008 article, The Five Competitive Forces that Shape Strategy, includes a side-bar about the importance of defining the relevant industry for completing a Five Forces analysis. We will use examples from industry to illustrate the expanding relevant market for meatpacking.

Meatpacking as a production process is defined by the North American Industry Classification System (NAICS #3116) as the stage from live finished animal delivery through carcasses and processed meats. However, meatpackers as firms extend activities far beyond the production process definition. For example, Tyson Foods’ 2009 Annual Report states that it is completely vertically integrated in chicken production from genetics to feed to broiler production and case-ready products. Similarly, Smithfield Foods reports in its 2010 Annual Report that it owns approximately 790,000 Smithfield Premium Genetics (SPG) breeding sows and is integrated from swine genetics to case ready pork products. However, Smithfield’s vertically integrated pork segment accounts for only 46% of its hog production. Beyond vertical integration, USDA market news reports show that 85% of hogs and 57% of cattle are purchased on some form of forward contract. Vertical integration is viewed by meatpackers as reducing their exposure to market volatility in adjacent segments and results in improved food safety and other quality attributes of products.

Vertical integration also brings packers into horizontal competition at stages of the supply chain other than meatpacking. On the sell side, meatpackers supply their fresh product from their slaughtering and fabrication operation to their own further processing operations which manufacture cooked and cured products. At the same time they sell fresh product to outside further processors such as Kraft Foods or Sara Lee who also manufacture cooked and cured products, resulting in horizontal competition at this stage. No information was found on the share of meat sales to outside meat processors, but these shares affect packers’ branding and revenue strategies. Clearly, this sort of horizontal competition also occurs with upstream genetics, animal production and feed operations as well.

Major meatpackers also have horizontal multi-species operations. Tyson, which purchased IBP in 2001, JBS, a recent Brazilian entrant to U.S. markets, and Cargill Meat Solutions (CMS) are most broadly diversified. Each has significant holdings in beef, pork, and chicken and, in the case of CMS, turkey production. Tyson and JBS each have about 45% percent of their sales in beef products, and 14-18% in pork products. JBS’s recent acquisition of Pilgrim’s Pride makes it the second largest chicken producer next to Tyson. Hormel Foods goes a step farther and competes in the broader food markets similar to nonmeat food companies. These strategies allow for broadening branding presence across meat categories as well as servicing the entire meat case for large national grocers.

Meatpackers’ relevant markets extend beyond the live animal to wholesale product stage. Vertical and horizontal coordination enhances their ability to capture improved returns to value added products. This scope also represents a complex web of supply chain competitive interactions between meatpackers and other players in the livestock and meat supply chain.

The expanding horizontal and vertical scope of meatpackers means that entry and rivalry can occur at any stage of the supply chain. New domestic entrants into the meatpacking industry have historically entered as single species firms. For example, IBP was founded in 1960 as Iowa Beef Packers and began as a single plant specializing in beef production. IBP’s growth into the largest red meat producer in the world resulted from a revolutionary technological development; “Cattle Pak” or boxed beef. In addition to improved distribution efficiencies, this also led to changing plant design into a more efficient, modern assembly line model that reduced labor costs. IBP managed to enter and dominate a mature industry based on “leapfrog” technological innovations that improved operation efficiencies and reduced costs. Tyson later acquired IBP as a way to efficiently capture large scale production in the red meat markets, which has been a more recent strategy for entry into U.S. markets.

Smithfield similarly specialized in pork markets when it began as a regional company in 1935. Growing through acquisitions of regional pork processors in the southeast, their major strategic change included vertical integration in pork production as well as horizontal brand expansion as they acquired firms. Eventually acquisitions lead to investment in beef processing, but in 2008 their beef assets were sold to JBS returning Smithfield’s primary focus to pork markets. Smithfield became a global competitor based on business organization innovations that aligned the supply chain rather than technological change as in the case of IBP.

Triumph Foods in St. Joseph, Mo. recently entered meatpacking using a hog producer led vertical integration strategy. Triumph Foods is a joint venture of swine production companies including Christensen Farms, New Fashion Pork, and Hanor. However, recent failed attempts by smaller scale producer groups, such as Meadow Brook Farms in Illinois or Prairie Farmers Cooperative in Minnesota, suggest that economies of scale in meatpacking still create major barriers to entry.

A major foreign entry into U.S. meatpacking occurred when the Brazilian meatpacker JBS acquired Swift & Company in the U.S. in 2007. Nippon Pork was an early example of foreign direct investment in U.S. meat markets. Nippon Pork’s strategy was one of gaining production resources to export pork products back to Japan. However, JBS now competes in pork, beef and chicken markets with Hormel, Cargill, Tyson and Smithfield on a global operations basis in countries and regions including Australia, China, The Philippines, South Korea, Argentina, Mexico, Europe, Japan and of course the United States.

The demand side of meat markets plays a key role in entry and rivalry. Meatpackers increasingly produce “case-ready” meats at the processing plant. Case-ready meat products integrate the traditional in-store retail fresh cut fabrication back to the meat packing plant. Case- ready fresh meat improves the efficiency of distribution and wholesaling, improves food safety with less handling and improves merchandising cost efficiency for retailers. This has resulted in meatpackers that are dedicated suppliers to specific retail chains. For example, Hormel Foods has a tying agreement with SuperValu to supply Cub Foods’ fresh pork category.

Private label meat products represent an additional tying arrangement between packers and retailers. Retailers often compete on the quality of their fresh meat and produce offerings, and outsourcing the meat case to the packer’s brand can reduce their ability to differentiate offerings. Private labels allow retailers to differentiate their case and for the packer to have a dedicated buyer. An example is Sutton & Dodge Steakhouse Quality Angus Beef sold by Target. Sutton & Dodge is produced under Precept Foods, LLC, which is a joint venture of Hormel Foods and Cargill Meat Solutions. Private labels create a trade-off for meatpackers. On the positive side, private label arrangements reduce revenue risk. On the negative side, private label products compete with packers’ own national brands and often are sold at a lower price point.

Both private labels and packer branded case-ready products may create barriers for smaller processors which lack the capacity to supply larger retail customers. Even larger packers may find them a barrier to entry because they must displace the incumbent supplier completely rather than incrementally or offer an entirely new private label product line.

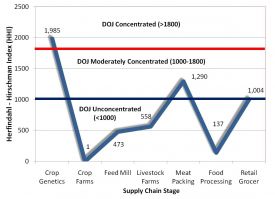

Figure 1 shows a simplified supply chain representation of concentration by using a line graph of Herfindahl-Hirschman Indexes (HHI) linking each stage of the meat supply chain. The HHI is defined as the sum of the squared market shares of the top four firms in the sector. Data used was collected from secondary sources including trade publications, firms’ annual reports and United States Department of Agriculture (USDA) data. The data was subjectively aggregated to form sectors such as “meatpacking” that includes beef, pork and poultry.

The disparity in the HHI between meatpackers and livestock producers is often viewed as evidence of the potential for monopsony power—control by one buyer. Recent horizontal and vertical mergers and acquisitions have added to these concerns. For example, JBS proposed to purchase National Beef in addition to Swift, but a threatened legal action by several states and the Department of Justice resulted in JBS abandoning the offer. As a response to these and other such concerns, in 2010 the USDA and Department of Justice held joint hearings on Agriculture and Antitrust Enforcement Issues in Our 21st Century Economy. The USDA Grain Inspection and Packers and Stockyards Administration (GIPSA) more proactively proposed a rule restricting meatpacker and livestock and poultry producer contracting and ownership.

While, an extensive literature examining monopsony power provides some evidence of market power, it is usually found to be at levels sufficiently low to be compensated by efficiency gains. For those interested, a Livestock and Meat Marketing Study completed by GIPSA in 2007 provides a thorough analysis of the implications of contracting in livestock and meat markets.

However, these analyses often ignore the broader supply chain perspective illustrated by Figure 1. The modern value and production chain for meat products is a complex web of interactions of crop and livestock genetics, animal nutrition and health, livestock rearing, crop nutrient management, meat and food ingredient production and human health. In this structure all stages of the chain impact other stages and while the product flows downstream, trait values must be passed upstream from the consumer. Focusing on the price impacts at a single node in the chain ignores the fact that the business organization of the supply chain is important for assigning value to where it is created, improving incentives for innovation and also for reinforcing quality incentives through the chain. Limiting these strategies has the potential to reduce packers’ ability to deliver on quality traits, potentially offsetting gains from competition.

Meatpackers have little ability to exert monopoly power. In Figure 1, food processors are relatively diffuse. However, the food sales of the top four supermarkets as reported by Supermarket News are almost 51%, and Wal-Mart alone has nearly a 29% market share. Sara Lee, Hormel Foods, Tyson Foods, ConAgra and Kraft all report between 11 and 16% of their net sales revenue is attributable to Wal-Mart. Only Smithfield Foods reports less than 10% of its net sales revenue derives from Wal-Mart.

This does not include restaurant or away from home venues that, according to the Bureau of Labor Statistics’ Consumer Expenditure Series, now account for about 42% of all food expenditures. According to the National Restaurant Association’s 2008 Restaurant Industry Review, restaurant industry sales reached about $588 billion in 2008 of which 10% were accounted for by McDonald’s worldwide sales. It’s unlikely that meatpackers can effectively maintain monopoly pricing against the countervailing size of retailers acting as agents with similar interests as consumers in obtaining lower prices.

A new form of socially driven market power is also emerging in the meat supply chain. For example, McDonald’s supports suppliers who phase out gestation crates in swine production. This resulted in Cargill Meat Solutions and Smithfield Foods, announcing plans to phase out gestation crates. Similarly, both Wal-Mart and McDonald’s have social responsibility statements for their suppliers as well as their own operations. In response meat processors’ have adopted publicly available sustainability or corporate responsibility statements. These include initiatives and goals on issues such as: human rights and ethics, environmental issues, animal welfare, community impacts, and corporate compliance.

From a market power perspective, the high profile restaurant chains represent a branded ‘point source’ to express consumer demands. This allows consumer interest groups to potentially express market power through retailers to the meat supply chain. Minority concerns that result in broad cost increasing production changes impact prices paid by a majority of consumers who have expressed no preference for these attributes. This represents a loss akin to monopoly power. To the extent that retailers and meatpackers are able to push these initiatives upstream to the producer, where many of the socially driven production traits are determined, this can also be interpreted as an expression of monopsony power.

Demand is inelastic for meats as for most food items. However, there is significant substitution within the meat category. Although chicken began displacing beef consumption beginning in the 1980’s, absolute per capita meat consumption in the United States has been relatively constant at 200-210 pounds per person.

Economic growth and rising incomes in key countries such as South Korea, Mexico and China have led to increasing substitution of meat for other food products. For the period 1990-2008 world beef, pork and chicken consumption increased at an annual average rate of 2.67%, more than double the world population growth rate of 1.32%. However, since 2008, the three year moving average of meat consumption has been equal to population growth and this has not occurred since 1992. This demonstrates the importance of world economic growth and income to the substitution of meat for other foods as incomes rise. Recent upward price pressures on all foods and expected continued slower economic growth could reduce the growth in meat consumption as worldwide consumers face financial pressures and respond by moving from meat consumption to other food choices.

The other long term factor affecting the substitution of other foods for meats is the resource intensiveness of meat production. Even as incomes rise, pressures on global water and land resources caused by rising human populations will likely increase the relative cost of meats. Improvements in animal production efficiencies as we have seen in the past half-century may alleviate some of this pressure.

Beyond Porters’ Five Forces of competition that affect firm behavior, there are external factors such as technology and policy that influence the meat packing industry. Key recent policies affecting packers include issues such as country of origin labeling, the recent passage of the new food safety bill, calls for reduced use of antibiotics, improved environmental practices, ongoing trade issues, policies promoting the use of feed-stocks for biofuels, and proposed rules to limit forms of packer contracting and integration. Incremental technologies in food safety, packaging and processing methods are simply part of continuous improvement, but advances in genomics and genetic marker technologies have the potential to be revolutionary.

From a policy perspective there is a subtle shift towards addressing socially acceptable production methods. These are often social issues raised such as animal welfare or country of origin labeling that directly impact meatpackers’ costs but with no direct compensating benefit to packers or meat consumers as would be the case with food safety regulations that clearly can benefit consumers. Proposition 2 ballot initiatives in California to regulate animal rearing practices and similar legislation elsewhere have altered the underlying production practices that often create efficiencies in the supply chain. The implication is that for the foreseeable future it may matter more how meatpackers are producing meat rather than what they are producing.

A key technological driver in meatpacking is the use of genetic information technologies to control product quality in a process replete with uncontrolled biological variation. Recent advances in identification of genetic markers for specific consumer traits such as tenderness hold the promise of dramatically improving meat quality along with production efficiency. Computer information technologies are complementary in that the combined information will allow the tailoring and matching of production methods to genetic traits, reducing inputs while improving the quality and quantity of meat produced. Ultimately this may result in managing the individual animal rather than the herd.

A final key factor driving the meat supply chain will be environmental and climate change issues. Life cycle analysis clearly includes meat production as having a role in climate change through intensive crop and energy use as well as greenhouse gas emissions. These are long term influences. However, in the short term the relationship between climate change, emergent zoonotic diseases and meat production will pose significant challenges. High profile examples of the consequences are provided by recent outbreaks of avian influenza and H1N1 influenza. Rising livestock production in proximity to human and wild animal populations creates conditions for increasing incidents of emergent zoonotic pathogens. Improved bio-security and herd health management are critical to managing what will likely be a growing threat to meat animal production and human health.

The meatpacking industry is a mature industry facing surprisingly dynamic forces of change. Increased globalization is resulting in new players entering the U.S. market to compete both nationally and internationally. At the same time rising economic growth in developing countries is resulting in increased demand for meat products, expanding the overall market.

Meatpackers are increasingly aligned throughout the meat supply chain from genetics through the retailer’s meat case. These vertical linkages result in economies of size and scope beyond the traditional technical economies of size. This enables packers to service large retail customers with consistent and known source products.

With greater integration of supply chains and rising demands for credence attributes—not directly observable by the consumer, such as organic production—and social traits, buyer and supplier requirements are evolving from traditional ‘pure pricing’ concerns to concerns regarding verification of production methods and practices. Increasingly, asymmetric information and externalities create the need for information transmission beyond that conveyed by prices, resulting in vertical integration and contracting to meet discerning consumers’ demands.

Demands for technical efficiency will relentlessly increase as growing world populations and climate change increase competition by the animal sector for scarce resources. Emergent zoonotic diseases will also continue to require improved treatment methods as well as production methods to improve animal health and food safety.

The meatpacking sector’s role as interface between the producer and consumer will gain greater importance as these forces accelerate. Those who navigate the multiple and sometimes conflicting demands for product costs and product attributes will remain competitive.

Federal Register. (Tuesday, June 22, 2010). “Implementation of Regulations Required Under Title XI of the Food Conservation and Energy Act of 2008; Conduct in Violation of the Act.” Vol 75., No. 119, 35338035354.

Porter, Michael, E. (2008). The Five Competitive Forces that Shape Strategy. Harvard Business Review. January: 79 – 93.

United States Department of Agriculture and United States Department of Justice. (2010). Public Workshops: Agriculture and Antitrust Enforcement Issues in Our 21st Century Economy. Public comments available online: http://www.justice.gov/atr/public/workshops/ag2010/index.htm.

United States Department of Agriculture, Grain Inspection, Packers & Stockyards Administration. (2007). Livestock and Meat Marketing Study. Available online: http://www.gipsa.usda.gov/GIPSA/webapp?area=home&subject=lmp&topic=ir-mms.