Beef cattle production is vulnerable to economic losses from various uncontrollable events like drought and disease, but the primary source of uncertainty impacting U.S. cattle producers has historically been losses due to price declines (Hart, Babcock, and Hayes, 2001; Hall et al., 2003). The most recent example of this phenomenon was the supply-chain disruptions caused by COVID-19, which are estimated to have caused billions of dollars in losses to U.S. beef cattle producers (Martinez, Maples, and Benavidez, 2021). One way producers that can protect themselves against economic losses from price declines is by using Livestock Risk Protection (LRP) insurance.

LRP was made available to cattle producers by the U.S. Department of Agriculture (USDA) Risk Management Agency (RMA) in 2003 to help producers of various sizes (U.S. Department of Agriculture, 2021a). We discuss LRP in more detail in the next section, but LRP is basically an insurance policy. Producers pay a premium for certain coverage level and insurance period and the policy provides producers an indemnity payment if price declines below an insurance price level. Several studies have analyzed the effectiveness and use of LRP (Coelho, Mark, and Azzam, 2008; Feuz, 2009; Burdine and Halich, 2014; Merritt et al., 2017; Wei, 2019) and generally show that LRP provides similar protection from price declines as a put option contract, but LRP is more accessible and preferred than a put option by small cattle producers (Feuz, 2009; Wei, 2019). These studies also show that unless price declines are large over a short period, producers are likely better off not purchasing LRP (Burdine and Halich, 2014; Merritt et al., 2017). These findings are supported by survey data showing feeder producers rarely purchase LRP (Hill, 2015). However, premium subsidies were increased in 2019. Previously the subsidy for LRP was 13% of the premium, but subsidy rates increased starting in 2019 and further increases were made in 2020. Thus, previous findings are a function of the previous subsidy rates. Nonetheless, the studies suggest LRP could be an effective way to protect against sudden, large price declines such as those experienced during the COVID-19 pandemic.

This paper presents a unique analysis of how LRP could have been used to mitigate 2020 price declines for the U.S. feeder cattle producer. Specifically, we look at daily offerings of LRP and explore LRP indemnity payments that could have been paid during 2020 and compare those to prior year payments. The results demonstrate to producers the possible price protection offered by LRP as well as how effective LRP was during COVID-19. Also, the results demonstrate to policy makers the effectiveness of LRP and how this policy could be improved.

LRP allows a producer to insure between 1 and 12,000 head in one federal crop year (July 1–June 30), making it accessible to small producers who can choose the exact number of animals to hedge. The producer also has the flexibility to select the coverage level and the length of time of the insurance period. Coverage levels range from 70% to 100% and insurance periods can be 13, 17, 21, 26, 30, 34, 39, 43, 47, or 52 weeks. For instance, a producer could purchase LRP insurance for 20 steers under 600 pounds over a 13-week period at 90% of the expected ending price at the stated ending date. Producers purchase policies that end close to their expected marketing date for their cattle. Each day, LRP contracts are offered with an expected ending price, which is the projected feeder cattle price at the end of the insurance period and is based on the Chicago Mercantile Exchange (CME) Feeder Cattle Index, a seven-day weighted average price of 700–899 pound steer cattle sold in 12 states. LRP premiums vary based on date of purchase, coverage level, and insurance period. Like most insurance products, premiums increase as coverage level increases. When the policy expires, the CME Feeder Cattle Index price is noted as the actual ending price. If the expected ending price multiplied by the coverage level is less than the actual ending price, the indemnity is zero. Conversely, the indemnity is the difference between the coverage price and actual ending price if the actual ending price is less than the coverage price.

LRP data were found on the U.S. Department of Agriculture (2021b) website. The U.S. daily offerings were downloaded using R Studio from January 2014 through December 2020. These data included date the LRP insurance policy was offered, insurance period, expected ending price when the LRP policy was purchased, coverage level, coverage price, insurance premium, ending date of the insurance period, and actual price at the ending date. We only consider feeder cattle, which includes steers and heifers between 600 and 900 pounds. This excludes Alaska, Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont for this analysis. Also, few of the contracts exceeded 30 weeks and coverage levels under 85% were less than 2% of the data. Therefore, we exclude contracts over 30 weeks and coverage levels under 85% from these data presented, leaving us with 5,128,664 observations from 2014 to 2020.

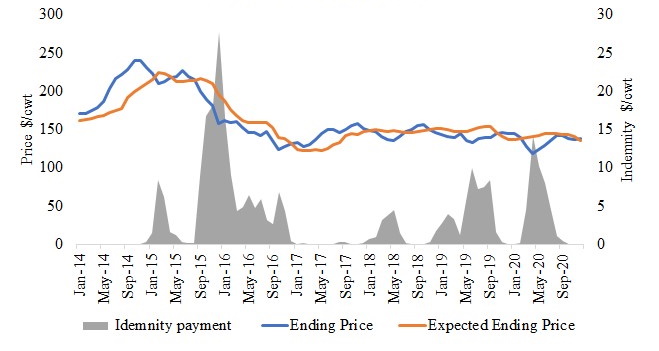

Figure 1 shows the average monthly expected ending price when the policy was purchased, the actual ending price when the policy expired, and LRP indemnity payment from 2014 to 2020. The expected ending price is the price U.S. feeder cattle were expected to be in the month the contract expires across all coverage levels. Ending price is the CME Feeder Cattle Index price on the day the LRP contract is terminated. The indemnity is the average payment across all contract lengths and coverage levels in the month the LRP contract expired. It is important to note that these are not actual indemnities producers received but the average indemnity payments that could have been received through offered LRP contracts.

The price decline, which started in June 2015 and ran through roughly October 2016, showed that LRP could have paid indemnities as much as $28/cwt, which would have occurred in December 2015. These were losses coming off historically high feeder cattle prices that peaked in the LRP data in February and March 2015. From December 2016 to May 2019, average LRP indemnities were $1/cwt. In August 2019, there was also a sudden and rapid decline in U.S. feeder cattle prices in response to the Finney County Tyson Foods slaughterhouse fire; of the available LRP contracts, the average payment for contracts expiring in August 2019 was $7/cwt. Looking at Figure 1, the ending price in August 2019 was $139/cwt and the expected price was $154/cwt. This means the feeder cattle price was $15/cwt below the anticipated ending price, which is two times greater than the average indemnity of $7/cwt. By October 2019, average LRP indemnities decreased, and payments were near zero until March of 2020 when COVID-19 losses were first seen. On average, LRP could have paid out $14/cwt, $10/cwt, and $8/cwt for feeder cattle sold in April, May, and June 2020, respectively. In August 2020, LRP average indemnity payments were near zero as cattle prices started to stabilize.

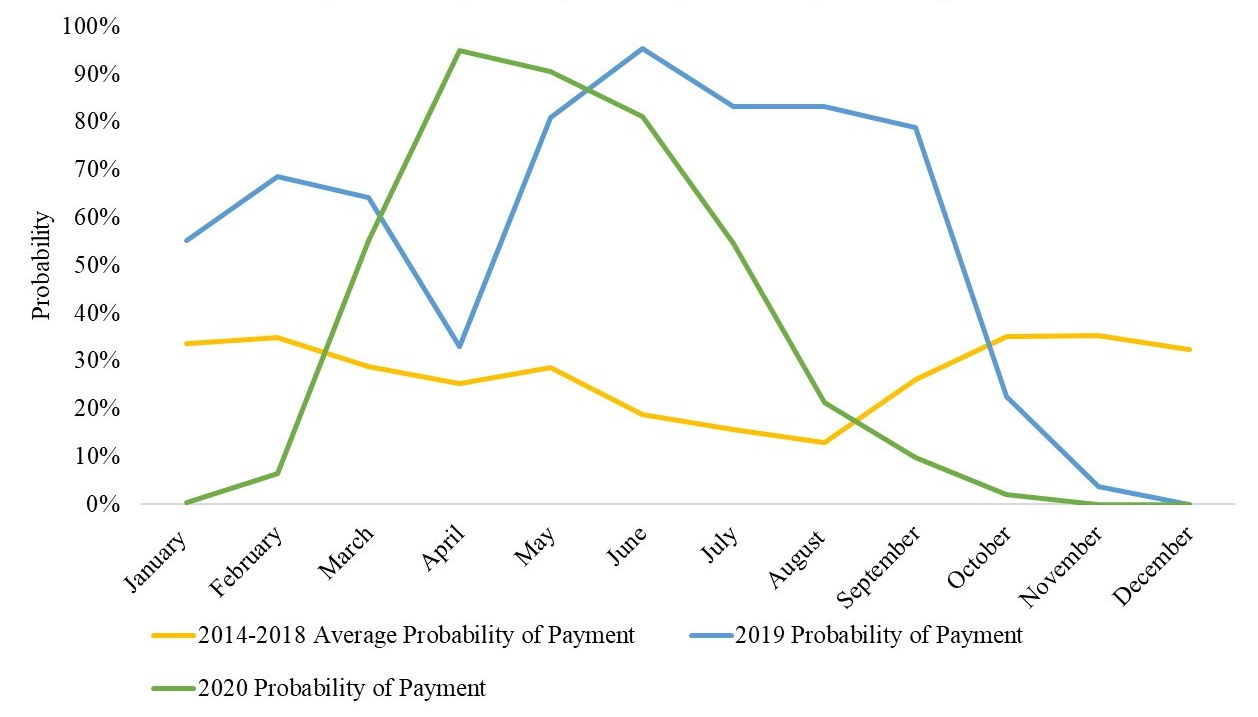

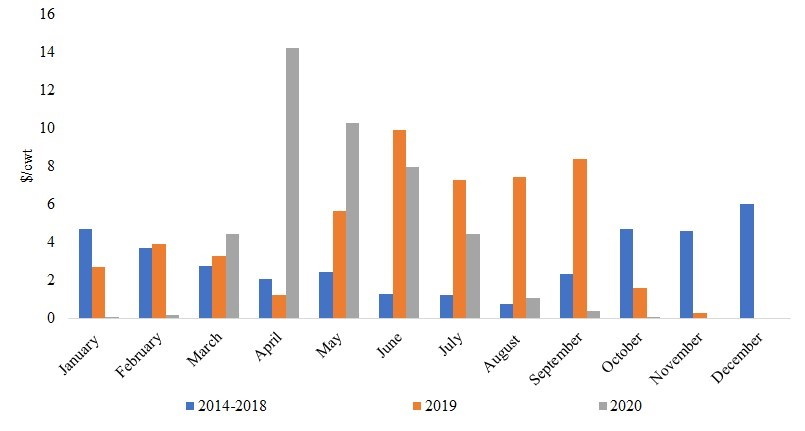

Figure 2 shows the average probability an indemnity was paid by month and Figure 3 shows the average monthly LRP indemnity payments. These figures show how LRP responded to COVID-19 relative to its historical performance. The average indemnity payments from 2014–2018 were seasonal; payments declined from January ($4/cwt) to August ($1.50/cwt) and increased from September ($2.67/cwt) through December ($3.83/cwt). The likelihood of receiving a LRP payment from 2014 to 2018 was between 13%, in August, and 35%, in February, October, and November. Remember these are averages for what LRP policies could have provided in indemnities had producers purchased insurance and not actual producer indemnities they received. These probabilities drastically changed in 2019 and 2020. The probability of LRP policies paying an indemnity was between 81% and 79% from May to September of 2019. An interesting observation from 2019, LRP indemnity payments peaked in August ($10/cwt), which is when LRP is traditionally less likely to provide a payment. The historical low probability of receiving a LRP payment from May through September corresponds with the typical seasonal increase in feeder cattle prices and thus the CME Feeder Cattle Index price.

In 2020, LRP contracts terminating in April had a 95% chance of receiving an indemnity payment, with an average payment of $14/cwt. The April payment corresponds directly with the onset of COVID-19 and the partial shutdown of the U.S. economy that sent cattle prices plunging. These payments and the likelihood of a payment declined after April as cattle markets began a slow recovery. These results clearly demonstrate that LRP was effectively setting a price floor in months when prices declined. Like 2019, LRP is shown to pay indemnities in months during 2020 when LRP is historically less likely to provide a payment, but it also corresponds to a period in which there was an unexpected shock to the market. Another important observation from Figure 2 is that the likelihood of receiving a payment in 2020 had declined below the 2014 to 2018 average by September. Therefore, producers who purchase LRP with expectations of protection in October, November, and December based on historic performance would not have received the same level of protection. This is likely due to the continued volatility in cattle prices in 2020 and the fact that contracts for October through December that had been established from April through June had relatively low expected ending prices due to negative market expectations and uncertainty.

Another key metric in the effective use of LRP as a risk management tool is comparing the cost of LRP relative to the indemnity paid or sometimes called the net price or LRP price (Burdine and Halich, 2014; Merritt et al., 2017). This is a way of doing a cost–benefit analysis of LRP with costs being producers’ premiums and benefits being indemnities. Premium costs used in our analysis were the producer’s premium (total premium minus subsidy). From 2014 to 2018, the LRP subsidy was 13% of the premium, but subsidy rates increased to 20% in 2019. In 2020, subsidies further increased to 35% for a 95%–100% coverage level, 40% for 90%–94.99% coverage, 45% for 85%–89.99% coverage, 50% for 80%–84.99% coverage, and 55% for 70%–79.99% coverage (U.S. Department of Agriculture, 2021a).

Figure 4 shows the average difference in indemnity minus costs by month. A positive value means indemnities were greater than costs and a negative value means the converse. On average from 2014 to 2018, LRP indemnity is greater than the producer’s premiums in January, February, October, November, and December, but the opposite is true in the other seven months. These differences range between negative and positive $3/cwt. During 2019, the difference was positive from May to September and negative from October through December, which is opposite from the 2014–2018 trends. In 2020, the indemnity was higher than the premium from April to July and was negative the remaining months of 2020. Again, a negative value in October through December is a change from the 2014–2018 trends.

We recognize these figures are averages across all coverage levels and contract lengths and do not present outcomes from specific insurance periods and coverage levels. The results do suggest LRP could have partially reduced economic losses due to price declines during COVID-19 but also highlight a potential shortcoming of LRP. More research is needed to explore ways to adapt LRP to be more flexible and more attractive for producers to use. Future research might explore how these lower premium costs impacts the likelihood of net LRP price being greater than the actual ending price. That is, does the new subsidy change make LRP more likely to pay indemnities greater than the premiums? Further, research is needed on how a producer might select a LRP contract to match their production system. These types of data would likely need to be collected through a producer survey specifically about price risk management. This could develop a discussion about how producers’ needs vary by region, how various production systems match with LRP alternatives, and how LRP could be modified to better impact all producers. A survey would also be a great method to explore producer perception of LRP and ways to adapt LRP to encourage adoption. These types of data might provide insight into future designs of LRP for cow–calf verses stocker producers.

Burdine, K., and G. Halich. 2014. “Payout Analysis of Livestock Risk Protection Insurance for Feeder Cattle.” Journal of the American Society of Farm Managers and Rural Appraisers 2014: 160–173.

Coelho, A.R., D.R. Mark, and A. Azzam. 2008. “Understanding Basis Risk Associated with Fed Cattle Livestock Risk Protection Insurance.” Journal of Extension 46: 1.

Fuez, D.M. 2009. “A Comparison of the Effectiveness of Using Futures, Options, LRP Insurance, or AGRLite Insurance to Manage Risk for Cow-Calf Producers.” Paper presented at the NCCC-134 Conference on Applied Commodity Price Analysis, Forecasting, and Risk Management Proceedings, St. Louis, Missouri.

Hall, D.C., T.O Knight, K.H. Coble, A.E. Baquet, and G.F. Patrick. 2003. “Analysis of Beef Producers’ Risk Management Perceptions and Desire for Further Risk Management Education.” Review of Agricultural Economics 25: 430–448.

Hart, C.E., B.A. Babcock, and D.J. Hayes. 2001. “Livestock Revenue Insurance.” Journal of Futures Markets 21: 553–580.

Hill, S. 2015. “Exploring Producer Perceptions for Cattle Price and Animal Performance in the Stocker Industry.” Masters Thesis, Department of Agricultural Economics, Kansas State University.

Martinez, C.C., J.G. Maples, and J. Benavidez. 2021. “Beef Cattle Markets and COVID-19.” Applied Economic Perspectives and Policy 43(1): 304–314.

Merritt, M.G., A.P. Griffith, C.N. Boyer, and K.E. Lewis. 2017. “Probability of Receiving a Payment from Feeder Cattle Livestock Risk Protection.” Journal of Agricultural and Applied Economics 49(3): 363–381.

U.S. Department of Agriculture. 2021a. Livestock Insurance Plans. Washington, DC: U.S. Department of Agriculture, Risk Management Agency. Available online: https://www.rma.usda.gov/Policy-and-Procedure/Insurance-Plans/Livestock-Insurance-Plans [Accessed December 2020].

U.S. Department of Agriculture. 2021b. Adm_Livestock. Washington, DC: U.S. Department of Agriculture, Risk Management Agency. Available online: https://ftp.rma.usda.gov/pub/References/adm_livestock/ [Accessed December 2020].

Wei, H. 2019. “A Comparative Analysis of Expected Utility of Futures, Options, and Livestock Risk Protection Insurance: Which Hedging Tool Is Desirable for Small, Medium, or Large Sized Feeder Cattle Producers Whose Farms Are Low, Average, or High Management Risk.” Masters Thesis, Department of Agricultural Economics, Oklahoma State University.