While local livestock auctions and grain elevators remain important locations of exchange, agricultural producers in many sectors increasingly rely on negotiated contracts. As both sellers in commodity and product markets and buyers in input markets, U.S. agricultural producers negotiate a surprisingly diverse set of complex contracts, stipulating price, quantities and qualities delivered, and other terms of sale. See the Glossary of Economic Terms provided in a box with this article, for further explanation. Examples include forward contract sales of feeder cattle, malt barley production contracts with brewers, feedstock corn contracted to ethanol plants, and fertilizer purchases prior to crop planting. Fresh produce marketing contracts and poultry and pork production contracts often specify a price and quantity delivered as well as details of the production process. While increased contracting offers the chance to forward-price products and perhaps reduce price volatility, privately negotiating sales may create risks for producers that affect profitability. These risks may include potential costs associated with unsold inventory and related bargaining disadvantages, limited opportunities to match with trading partners, negotiating with a more experienced buyer, and renegotiating incomplete contracts. Such marketing issues that could result in a price negotiation disadvantage for producers receive relatively little attention in agricultural policy and lack relevant funding for risk management education.

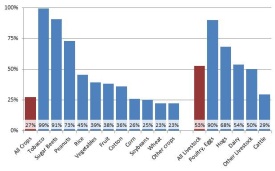

Source: USDA, ERS using data from the

Agricultural Resource Management

Survey, 2008, as reported in MacDonald

and Korb, 2011.

Market concentration as well as vertical coordination through contracting between firms increasingly dominates transactions in the agricultural supply chain (MacDonald and McBride, 2009). The use of marketing contracts—governing the terms of product sale and delivery—and production contracts—specifying the production process—to link producers with processors has increased steadily, stabilizing in recent years at around 40% of the total value of U.S. agricultural production (MacDonald and Korb, 2011). The frequency of contracting varies considerably across common crop and livestock commodities (Figure 1). Production contracts in poultry and hog sales as well as marketing contracts for sugar beets, tobacco, and peanuts, for example, cover the majority of production. In other sectors, contracting is still important, accounting for at least a fifth of production value.

Reasons for contracting in U.S. agricultural markets relate to risk management and transaction costs with potential benefits for both producers and processors (Katchova, 2013). Contracts facilitate an improved ability to provide assets for specialized production techniques; specify, monitor, and trace food and food ingredient attributes; and coordinate delivery of geographically specific perishable commodities.

The shift from open, spot auction markets—with commodities sold in public markets after production—to private contracting—often stipulating sales terms before production—presents today’s agricultural producers with both opportunities and potential risks. Producers may be able to negotiate higher prices and reduce market uncertainty for production if negotiated contracts meet buyers’ needs related to such issues as timely delivery, consistent quality, and production practices that tailor inputs to specific processing requirements or consumer tastes (Sexton, 2013). While production contracting is suited to link markets increasingly driven by product quality, differentiation, traceability, and timeliness, potential problems relate to disparities in bargaining power between buyers and sellers, coupled with risk transfer and the potential for contract failure.

Related spot auction markets and reported prices provide the foundation for many contract prices or price formulas, but fewer transactions conducted in open auction settings, and related price information impacts, create concerns. This is an issue of market thinness. Furthermore, producers contracting a single sale with a more experienced buyer may be at a bargaining disadvantage. Disparities in market information, skills, and experience, as well as incomplete contracts, can all impact the respective bargaining power of parties contracting a sale. Overall, producer risks introduced by increased contracting include production shortfalls and hold-up liabilities, limited price information in thinning spot markets, and potential for market power and bargaining power disadvantages.

Given these changes in agricultural markets, including both potential opportunities and risks associated with contract sales, a relevant question to ask is whether producers are better off. Research on contract pricing in concentrated markets indicates that contract sales do not necessarily leave producers at a disadvantage. In hog markets, despite thin price reporting and time required to evaluate and negotiate beneficial terms of trade, marketing contracts can actually offer higher, more stable net prices than spot markets (Plain and Grimes, 2010). In fact, in a range of sectors, the absence of buyer competition or cash markets did not lead to statistically lower prices offered by an individual processor (Katchova, 2010). Further, research results generally suggest that price levels in concentrated markets do not deviate greatly from competitive prices (Key, 2011; Vukina, Shin, and Zheng, 2009; and Muth et al., 2008).

Market concentration in specific agricultural sectors, on the other hand, has led to concerns about the potential for larger firms exercising market power in contract negotiations and related impacts on overall market efficiencies and income distributions within the supply chain (Swinnen and Vandeplas, 2013; and Crespi, Saitone, and Sexton, 2012). Agricultural producers’ economic freedoms, potential disadvantages for sellers relative to buyers, and a decrease in market price information remain potential issues as markets move toward more privately negotiated contracts and away from price transmission via auction institutions (Fuglie et al., 2012).

While increased concentration or vertical coordination through contracting does not seem to greatly impact overall price levels, additional attention needs to be directed toward comparing buyer versus seller outcomes in private negotiation trading. The research discussed above generally focuses on average market price levels. Such research often cannot compare outcomes across different groups of buyers or sellers facing alternative bargaining situations, particularly how available surplus in the market—that is, total buyer plus seller earnings—is divided between buyers and sellers. Information regarding relative earnings can contribute to better understanding the comparative negotiation advantages of buyers and sellers in agricultural markets where negotiated contracts are prevalent.

Researchers pay participants in cash based on their trade results. Each experimental session consists of 20 or more trading periods—each period corresponding to a year or production cycle—in which paired buyers and sellers negotiate prices over a computer network to make profitable trades. The computer re-matches buyers and sellers several times during each trading period.

Data recorded from these negotiations can identify outcomes such as prices, buyer earnings, seller earnings, and quantities traded. Standardized recruitment and laboratory procedures, paying out real earnings to motivate market decisions, anonymity, and random matching of bargaining partners control for social biases. Experimental markets link economic incentives, trading rules, and behavioral norms allowing us to capture human tendencies in economic settings.

Actual data for contract transactions are often difficult to obtain. Economists use experimental markets to evaluate private negotiations in agricultural markets when transaction data are unobtainable. Moreover, the approach of creating a market in a laboratory setting allows researchers to evaluate influences of selected factors on market outcomes that other research methods may not be able to isolate. A well-designed experimental market captures market behavior in response to specific factors of interest while avoiding any confounding influences. In the market experiments described in the accompanying box, buyers and sellers negotiate sales for identical goods in a laboratory.

A simple market or exchange consists of a trading institution coupled with a method of delivery. The trading institution defines the rules by which buyers and sellers interact and arrive at trades. For instance, a hay auction with the sale going to the highest bid placed by a buyer, retail prices posted by competing supermarkets from which consumers choose, and a land lease negotiated between a tenant and landlord are all examples of different trading institutions—English auction, posted offer, and private negotiation, respectively. As discussed, many agricultural markets have increasingly shifted away from open auction trading to trading through privately negotiated contracts.

Two delivery methods generally dominate goods traded in agricultural markets: advance production or forward delivery.

In advance production sellers enter a market with inventory in stock for which they have already incurred production costs. Also referred to as spot or cash markets, with advance production, sellers bring commodities to market after production for immediate delivery. Producers often sell feeder cattle, grains, and other commodities after production costs have been incurred.

In a forward market transaction—also known as production-to-demand—buyers and sellers agree on price, quantity, and delivery specifications before production occurs. Sales conducted before production with forward delivery are often integral to contract agriculture. Markets for fresh fruits and vegetables, malt barley, poultry, and agricultural products with specialized production attributes provide examples of products often associated with forward delivery. The level of perishability, storage capability and related costs, and seasonality of demand often impact delivery methods and related risks.

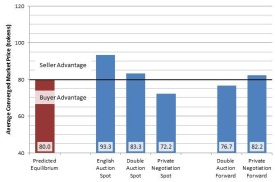

A body of experimental evidence suggests that prices, trading levels, and resulting relative buyer and seller earnings may depend on the trading institution coupled with the delivery method. In the experiments described here, identical underlying supply and demand conditions allow for comparisons across institutional settings. One piece of research concludes that sellers do particularly well in competitive spot auctions (Menkhaus, Phillips, and Bastian, 2003). In either a double auction—with simultaneous bids and offers—or an English auction—with ascending bids—as the trading institution and with production before sale, sellers were able to earn considerably more than buyers. An auction setting involves multiple buyers competing to purchase goods coupled with sellers having full price information while trading. This environment improves prices and allows sellers to make informed decisions about the best available prices in the market when agreeing to a sale. Results also suggest that advance production sellers, as a group, are cautious about costs associated with unsold goods and, therefore, tend to produce less. Fewer resulting sales also push prices up contributing to higher seller earnings.

Source: Experimental market data

reported in Menkhaus, Phillips, and

Bastian, 2003.

This seller advantage is lost, however, when trading is conducted via private negotiation. With this one-on-one bargaining institution, the price advantage shifts to the buyer. Limited opportunities to match and trade with individual buyers foster buyer bargaining power in repeated private negotiations. Figure 2 illustrates average converged trade prices reported in laboratory spot and forward markets, with sellers garnering the highest prices in spot auction settings. The authors conclude that, in addition to potential buyer bargaining advantage gained from consolidation or information advantages in agricultural markets, “another important source of bargaining power for processors is the private negotiation trading institution itself, coupled with spot delivery of products” (Menkhaus, Phillips, and Bastian, 2003).

Once sellers incur production costs they are at a bargaining disadvantage for several reasons. First, sellers are pressured to recoup production costs. Thus, when negotiating with a single buyer, sellers may be willing to take a price that is lower than might be seen in an auction with multiple buyers—even perhaps below their production costs just to avoid losing their production investment. Advance production risk is somewhat mitigated by forward delivery—selling before production costs are incurred—and seems to result in better prices for sellers in private negotiation, but they are not necessarily at the level of auction prices.

A growing body of experimental evidence suggests that sellers—that is, farmers and ranchers—are generally disadvantaged in private negotiations relative to buyers—integrators or processors—in many different types of private negotiation settings (Phillips et al., 2014; Donohue and Taylor, 2007; Menkhaus et al., 2007; and Menkhaus et al., 2003). In addition to advance production risk, other factors such as lack of price information, limited opportunities to match with buyers, trading partner choices, and potential behavioral differences in sellers versus buyers are pointed to in the literature as reasons for this phenomenon. Individual bargaining abilities and experiences also impact individual outcomes more in a private negotiation than in an auction setting, given the lack of competition during the bidding process. Taken together, these results imply agricultural producers may be negatively impacted by the move to more contract sales and that inventory loss risks and sunk production costs weaken the bargaining position of sellers negotiating sales with buyers one-on-one.

Given the perishable nature of agricultural products and the prevalence of production decisions made by sellers prior to a sale, it seems likely the risks observed in experimental markets also apply to sellers in agricultural markets. For example, producers who have committed considerable investments in specialized equipment or facilities such as in the production of vegetables, broilers, or hogs, may have limited production alternatives and may be in a weaker bargaining position when negotiating contracts compared to others who could easily choose to produce something else—as might be the case with grains or cattle. Moreover, less specialized commodity producers may have more marketing choices with the ability to choose between auctions, elevators, or privately negotiated contracts. Wheat or corn producers, for example, may have opportunities to market their commodities under multiple contracts as well as in cash or spot auction markets.

Government policy plays an important role in facilitating fair marketing and contractual practices. U.S. policy reactions to evolving agricultural markets address pricing transparency, competition in vertically integrated markets, as well as contract fairness and incomplete contracts.

Government reporting on sales of cattle, swine, lambs, as well as dairy and livestock products aims to provide more transparency in pricing, contracting, and supply and demand conditions to encourage competition in livestock markets (Armbruster, 2013). While specific impacts from voluntary versus mandatory price reporting are difficult to gauge (Koontz and Ward, 2011), the benefits of clear, accurate, and available market information are indispensable for buyers and sellers negotiating fair, efficient prices.

Antitrust and countervailing power laws, prohibiting anticompetitive practices while allowing agricultural producers to work together when dealing with larger marketing firms, likewise are designed to ensure competition and fairness in agricultural markets. A series of workshops on competition in agricultural markets held by the U.S. Department of Justice (U.S. DOJ) in 2010 concluded that “antitrust enforcement has a crucial role to play in fostering a healthy and competitive agriculture sector” (U.S. DOJ, 2012).

A number of state laws include provisions stipulating fair and transparent practices for agricultural production contracts (Peck, 2006). However, mandated criteria for fair contracting for poultry and swine growers included in the Food Conservation and Energy Act of 2008—resulting in proposed rules published by the Grain Inspection and Packers and Stockyards Act and continued in the Agricultural Act of 2014—have never been implemented (Chite, 2014; Greene, 2014; and Monke, 2014).

The body of research described suggests new opportunities as well as marketing and pricing risks for both producers and agribusinesses to consider as agricultural markets move to more contract sales. A central question researchers must address is whether the benefits of moving to private negotiations outweigh the costs for many market participants. Research conducted largely in experimental settings clearly indicates that sellers generally do not do as well as buyers in privately negotiated transactions. Producers deciding whether to enter into contract sales can certainly benefit from an understanding of available market price information and common pricing mechanisms, the impacts of market concentration on the relative bargaining power of negotiating parties, as well as the role of government policies involved in the evolution of agricultural exchange mechanisms. However, they must also have an understanding of their own bargaining abilities and whether making a choice which reduces their market outlets is worth it.

When producers enter into privately negotiated contracts for specialized production, for example, they are more likely in a weaker bargaining position and may accept lower prices than they might otherwise. Investment in specialized equipment or facilities or other costs associated with production before negotiating prices potentially exacerbates this bargaining position. It is important to recognize that negotiations, when entering these contracts, may center around issues other than price, but the producer must be able to evaluate benefits of contracting relative to these other issues.

Government policy regarding evolving agricultural markets centers largely around transparency of price information and regulating anticompetitive forces. Perhaps policymakers should expand the role of marketing education that addresses the negotiation process and market behavior. For example, current outreach efforts regarding contracts focus largely on contract terms rather than price negotiation. Producers may also benefit from education regarding negotiation skills, as well as a broad awareness of changing market structures, policies, and research into market behavior. This could easily be done through expanded resources and efforts related to risk management education.

Current agricultural policy has devoted many resources to risk management and risk management education. Efforts could be expanded to include a better understanding of how prices are negotiated and trading behaviors observed in evolving agricultural markets. Moreover, education could inform producers about potential risks affecting bargaining across market choices. Such education may help them assess and improve their own bargaining abilities. Risk management-related education would be beneficial to producers capitalizing on opportunities in agri-food supply chains increasingly linked through contractual agreements.

Armbruster, W.J. 2013. “Market Structure, Trade Practice Regulation, and Competition Policy.” Chapter 4 in US Programs Affecting Food and Agricultural Marketing, W.J. Armbruster and R.D. Knutson, eds., New York: Springer Science.

Chite, R.M. 2014. “The 2014 Farm Bill (P.L. 113-79): Summary and Side-by-Side.” Report issued by the Congressional Research Service. Available online: http://www.farmland.org/programs/federal/documents/2014_0213_CRS_FarmBillSummary.pdf

Crespi, J.M., T.L. Saitone, and R.J. Sexton. 2012. “Competition in U.S. Farm Product Markets: Do Long-Run Incentives Trump Short-Run Market Power?” Applied Economic Perspectives and Policy 34(4):669-695.

Donohue, W.A., and P.J. Taylor. 2007. “Role Effects in Negotiation: The One-Down Phenomenon.” Negotiation Journal 23(3):307-331.

Fuglie, K., P. Heisey, J. King, and D. Schimmelpfennig. 2012. “Rising Concentration in Agricultural Input Industries Influences New Farm Technologies.” Amber Waves 10(4).

Greene, J.L. 2014. “USDA’s ‘GIPSA Rule’ on Livestock and Poultry Marketing Practices.” Report issued by the Congressional Research Service. Available online: http://nationalaglawcenter.org/wp-content/uploads/assets/crs/R41673.pdf

Katchova, A.L. 2010. “Agricultural Contracts and Alternative Marketing Options: A Matching Analysis.” Journal of Agricultural and Applied Economics 42(2): 261-276.

Katchova, A.L. 2013. “Agricultural Contracting and Agrifood Competition.” Chapter 9 in The Ethics and Economics of Agrifood Competition, edited by H.S. James Jr.. New York: Springer Science.

Key, N. 2011. “Does the Prevalence of Contract Hog Production Influence the Price Received by Independent Hog Producers?” Journal of Agricultural and Food Industrial Organization 9(1).

Koontz, S.R., and C.E. Ward. 2011. “Livestock Mandatory Price Reporting: A Literature Review and Synthesis of Related Market Information Research.” Journal of Agricultural and Food Industrial Organization 9(1):Article 9.

MacDonald, J.M., and P. Korb. 2011. Agricultural Contracting Update: 2008. Washington, D.C.: U.S. Department of Agriculture, Economic Research Service Economic Information Bulletin No. EIB-72. Available online: http://www.ers.usda.gov/publications/eib-economic-information-bulletin/eib72.aspx

MacDonald, J.M., and W.D. McBride. 2009. The Transformation of U.S. Livestock Agriculture: Scale, Efficiency, and Risks. Washington, D.C.: U.S. Department of Agriculture, Economic Research Service Economic Information Bulletin No. EIB-72. Available online: http://www.ers.usda.gov/media/184977/eib43.pdf

Menkhaus, D.J., O.R. Phillips, A.F.M. Johnston, and A.V. Yakunina. 2003. “Price Discovery in Private Negotiation Trading with Forward and Spot Deliveries.” Review of Agricultural Economics 25(1):89-107.

Menkhaus, D.J., O.R. Phillips, and C.T. Bastian. 2003. “Impacts of Alternative Trading Institutions and Methods of Delivery on Laboratory Market Outcomes.” American Journal of Agricultural Economics 85(5):1323-1329.

Menkhaus, D.J., O.R. Phillips, C.T. Bastian, and L.B. Gittings. 2007. “The Matching Problem (and Inventories) in Private Negotiation.” American Journal of Agricultural Economics 89(4):1073-1084.

Monke, J. 2014. “Agriculture and Related Agencies: FY2015 Appropriations.” Report issued by the Congressional Research Service. Available online: http://nationalaglawcenter.org/wp-content/uploads//assets/crs/R43669.pdf

Muth, M.K., Y. Liu, S.R. Koontz, and J.D. Lawrence. 2008. “Differences in Prices and Price Risk Across Alternative Marketing Arrangements Used in the Fed Cattle Industry.” Journal of Agricultural and Resource Economics 33(1):118-135.

Peck, A. 2006. “State Regulation of Production Contracts.” National Agricultural Law Center, University of Arkansas School of Law. Available online: http://nationalaglawcenter.org/wp-content/uploads/assets/articles/peck_contractregulation.pdf

Phillips, O.R., A.M. Nagler, D.J. Menkhaus, S. Huang, and C.T. Bastian. 2014. “Trading Partner Choice and Bargaining Culture in Negotiations.” Journal of Economic Behavior and Organization 105:178-190.

Plain, R. and G. Grimes. 2010. “Marketing Slaughter Hogs Under Contract.” Pork Information Gateway Factsheet. Available online: http://www.pork.org/filelibrary/Factsheets/PIGFactsheets/NEWfactSheets/11-03-01g.pdf

Sexton, R.J. 2013. “Market Power, Misconceptions, and Modern Agricultural Markets.” American Journal of Agricultural Economics 95(2):209-219.

Swinnen, J., and A. Vandeplas. 2013. “Price Transmission and Market Power in Modern Agricultural Value Chains.” LICOS Centre for Institutions and Economic Performance. Discussion Paper 347/2014:1-29. Available online: https://lirias.kuleuven.be/bitstream/123456789/439320/1/LICOS+DP347.pdf

U.S. Department of Justice. 2012. “Competition and Agriculture: Voices from the Workshops on Agriculture and Antitrust Enforcement in our 21st Century Economy and Thoughts on the Way Forward.” Report issued by the U.S. Department of Justice. Available online: http://www.justice.gov/atr/public/workshops/ag2010/

Vukina, T., C. Shin, and X. Zheng. 2009. “Complementarity among Alternative Procurement Arrangements in the Pork Packing Industry.” Journal of Agricultural and Food Industrial Organization 7(1):1-24.