In the past few decades, agricultural input markets have evolved, and family–owned and other small businesses transformed into larger enterprises that integrated plant breeding, conditioning, production, marketing, and other functions. These dramatic changes have raised significant concerns regarding market power and its influence on agriculture, in general (Fernandez-Cornejo, 2004; Fernandez-Cornejo and Just, 2007). Currently, there is significant concern about two proposed mergers: DuPont/Pioneer with Dow and Monsanto with Bayer—the latter is sometimes referred to as an acquisition. In light of this concern, the Senate Judiciary Committee held hearings about this proposed consolidation on September 20, 2016 (U.S. Senate, 2016).

Along with industry evolution, there has been a rapid growth in private research and development, which shifted the roles of public research and development. Thus, research in the agricultural input industry became predominantly private, and private firms have transformed from small scale operations to large and integrated enterprises (Fernandez-Cornejo and Schimmepfennig, 2004). However, a relatively recent study conducted by Fuglie et al. (2012) shows that increased consolidation and concentration in the private seed industry over the past decade have slowed down the intensity of private research undertaken on crop biotechnology relative to what would have occurred without consolidation, at least for corn, cotton, and soybeans. As found by Schimmelpfennig, Pray and Brennan (2004), patents and concentration are substitutes, meaning more concentration is associated with fewer patents. As the input market became increasingly concentrated and firms developed market power, they had fewer competitors from which to protect their intellectual property.

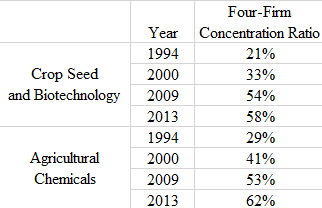

Over the last two decades, global market concentration—the share of global industry sales earned by the largest firms—has increased in the crop seed/biotechnology and agricultural chemical industries (Fuglie et al., 2012). These industries also invest heavily in research. Prior to the proposed mergers, the largest four firms in each of these industries accounted for more than 50% of global market sales. Growth in global market concentration over 1994-2013 was most rapid in the crop seed industry, where the market share of the four largest firms more than doubled from 21% to 58%. Table 1 outlines how four-firm concentration has changed over time in agricultural seed and chemical industries. The enormous growth in the concentration mainly came from acquisitions of other firms.

Due to the development and rapid producer acceptance of hybrid seeds and greater protection of intellectual property rights, the amount of private capital devoted to the seed industry and the number of private firms engaged in plant breeding grew rapidly until peaking in the early 1990s (Fernandez-Cornejo and Schimmelpfennig, 2004). Later, seed industry consolidation became widespread, with fewer firms capable of investing in research sufficient to develop new seed varieties. This resulted in increased concentration, with the majority of seed sales controlled by four large firms. The share of U.S. seed sales controlled by the four largest firms providing seed of each crop reached 91% for cotton, 82% for corn, and 76% for soybeans in 2014-2015. One contrast to this general trend was wheat, with more than 70% of the planted wheat coming from varieties developed in the public sector (Hayenga, 1998).

Over the last two decades, the big companies—that is, Monsanto, DuPont—have led the way with massive investments in biotechnology research and with seed and biotechnology company mergers and acquisitions. Historically, the seed-biotechnology companies have been dependent on numerous small and medium scale companies as major sources of innovation (Fuglie et al., 2012). The new small and medium-sized enterprises were specializing in developments of transgenic seed traits. By 2010, however, there were fewer than 30 active small and medium-sized enterprises that were specializing in crop biotechnology, primarily due to acquisitions by larger firms.

Because of the enormous number of mergers and acquisitions that expanded agricultural biotechnology, many remaining smaller companies could not compete with large firms that owned rights to much of the transgenic resource base in seed. Also, licensing transgenic traits from these firms was costly. Hubbard (2009) reports that at least 200 independent seed companies were lost in the 13 years prior to 2009. Moreover, biotechnology research has increasingly demanded financial resources that a majority of smaller firms do not have. Large firms investing in these technologies and earning royalties from licensing agreements quickly achieved a market advantage that led to many of the buy-outs.

There are several factors that can explain increased merging and acquisitions among agricultural input firms. One reason often discussed is the role of intellectual property rights, such as patents, which grant exclusive legal rights to market and license a new technology. Lesser (1998) argues that intellectual property rights have significant impacts on firm entry, and they make vertical integration in downstream industries essentially necessary, creating financial incentives for downstream mergers and acquisitions, including in the agricultural biotechnology industry.

Some chemical companies have vertically integrated into both the seed and biotechnology industries (Hayenga, 1998). The goal of such integration was to capture profits from biotechnology innovations which, in some cases, are also complementary to their chemical technology. In addition, these moves are an effort by the chemical companies to defend themselves against their competitors’ moves. Moreover, the increasing dominance of a few major players and the biotechnology and chemical patent restrictions on what competitors can do has raised questions regarding the potential for too much market power in parts of the seed and chemical industries.

Other motivations for increased mergers and acquisitions are economies of scale and scope (Fulton and Giannakas, 2001). Economies of scale and scope mean that larger, more diversified firms have lower average costs, which gives a clear incentive for firms to get large. Moreover, those that do not get large are vulnerable to being driven out of the market by larger and more cost efficient firms.

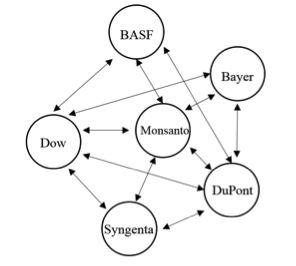

Agricultural chemical and seed industries are now consolidated and controlled by just 6 large multinational corporations. Until recently, these big corporations were focused on mainly producing agrochemicals. Howard (2009) points out that agrochemical corporations were experiencing declining profit opportunities as a result of increased regulations and fewer markets in which to expand. These companies were therefore motivated to enter new, more profitable markets, such as the market for seeds. The big companies’ strategy for this effort focused on acquisitions. These acquisitions not only expanded their market share, but also added to these companies’ seed distribution resources. After hundreds of acquisitions and mergers, the number of big multinational companies has been reduced to just six major firms. Industry consolidation is portrayed in Figure 1.

Figure 2 shows cross-licensing agreements involving pharmaceutical and chemical companies for transgenic seed traits. These arrangements among the big six agrochemical-seed companies are sometimes referred to as “non-merger mergers”, as there is no change in ownership, but they nonetheless raise important questions regarding cartel behavior and market dominance. This arrangement is similar to formation of a cartel that excluded other competitors and potential entrants, implying that many remaining small firms either must merge with the big six, license from the big six, or go out of business. Even though the big six may license to competitors or new entrants, they have no incentive to grant such licenses at attractive rates. This suggests a substantial barrier to new entry in the markets for transgenic seed.

A market is said to be contestable if there is freedom of entry and exit into the market and there are little to no sunk costs. Sunk costs are costs that cannot be recovered once they have been incurred. In this industry, examples of sunk costs include regulatory approval, expenditures on advertising, and expenditures on research and development. Because of the threat of new entrants, existing companies in a contestable market are constrained in the extent to which they are able to act anti-competitively, even if they are few in number.

Concentrated markets do not necessarily imply the presence of market power (Fulton and Giannakas, 2001; Henrickson and Heffernan, 2007). Key requirements for market contestability are: (a) potential entrants must not be at a cost disadvantage to existing firms, and (b) entry and exit must be costless. For entry and exit to be costless or near costless, there must be no sunk costs. If there were low sunk costs, new firms could enter an industry, undercut the price, and exit after a year or more, but before the existing firms have time to retaliate. We know of no examples of this strategy being employed in the seed industry. On the other hand, if there are high sunk costs, firms would not be able to exit without losing a significant portion of their investment; therefore, firms keep prices above average costs, and markets are not contestable. Fulton and Giannakas (2001) outline that substantial sunk costs exist in agricultural biotechnology, and firms charge prices above marginal cost—which is the incremental cost of producing one additional unit of output. They conjecture that the seed and chemical industry may not be contestable and the threat of entry may not be sufficient to keep profits at normal levels.

Comanor (1964) and Scherer (1984) both suggest that rapidly evolving and costly agricultural biotechnology innovations tend to limit entry. Investments in agricultural input markets are often risky, expensive, and long-term, and intellectual property protection in the seed industry helps inventors exercise market power and prevents the entry of imitators and competitors (King, 2001; Barton, 1998). The high costs of developing transgenic traits and identifying gene sequences creates a strong barrier to entry for smaller firms (Howard, 2009).

The cost of obtaining permission to use patented technology or genetic material often prevents smaller firms from participating in innovative research and creates significant barriers to entry (Brennan, Pray, and Courtmanche, 1999; Hubbard, 2009). Intellectual property lawsuits among agrochemical–seed companies are common (Boyd, 2003; Glenna and Cahoy (2009). This combination of circumstances creates “patent thickets,” in which broad claims overlap, and it is difficult to bring a new product to market without potentially infringing on a patent. This is a significant barrier to entry for small firms. Even though the original purpose of patents was to encourage innovation, increased concentration and intellectual property congestion may have had an opposite effect. Multinational agrochemical companies have control over many essential proprietary technologies that creates a barrier to entry for new start-ups (Moretti, 2006).

Prices for seed and some other agricultural inputs have consequently increased in recent years. From 1994-2010, U.S. seed prices increased more than any other farm input, more than doubling relative to the prices farmers received for their harvested crops (Fuglie et al., 2011). With a diminished ability to save seeds and fewer options in the market, the price of seeds has increased as much as 30% annually in recent years, significantly higher than the rate of inflation. In addition, transgenic seeds frequently require the purchase of proprietary inputs such as glyphosate herbicides, and this precedent is even being extended to non-transgenic seeds. These impacts have served to increase the profits and market capitalization of dominant firms, and they have also reduced options for farmers. For example, adoption of Roundup-ready seed effectively constrained producers to use Monsanto’s premium Roundup brand glyphosate herbicide for many years. Just and Heuth (1993) projected that chemical companies would develop biological innovations that increase dependence on the chemicals they sell.

Economists use a variety of approaches to evaluate the likely impacts of a proposed merger on the competitiveness of a market. Bryant, et al. (2016) consider the impacts of the recent proposed mergers on the corn, soybean and cotton markets. Two approaches include (1) measuring the changes in the Herfindahl-Hirschman Index (HHI) of market concentration for three seed sub-markets and (2) an approach which determines expected changes in market prices that would result from mergers in a market featuring differentiated products, in the absence of new entry. This approach is based on Hasuman, Leonard, and Zona (1994), Hausman and Leonard (1997), and Hausman (2010). Importantly, it is similar to the “upward pricing pressure” approach (Shapiro, 1996) that is employed under the Department of Justice and Federal Trade Commission’s 2010 Merger Guidelines.

The HHI market concentration measure is the sum of squared market share percentages. It therefore falls in the range 0 to 10,000, with 10,000 representing a pure monopoly market. The U.S. Department of Justice (DOJ) and Federal Trade Commission (FTC) have explicit guidelines related to this measure. Under DOJ/FTC’s Horizontal Merger Guidelines, a market is considered “moderately concentrated” if the HHI is between 1,500 and 2,500, and “highly concentrated” if the HHI is above 2,500 (U.S. Department of Justice, 2016). For an industry that is highly concentrated, any action that increases the HHI by 200 or more points is considered “likely to enhance market power.”

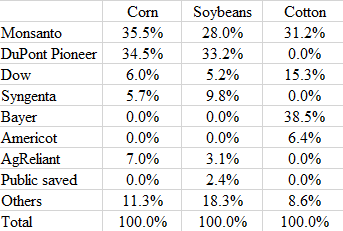

DuPont/Pioneer and Dow currently have similar market shares in both the corn and soybean seed markets: 34.5% and 6%, respectively in corn, and 33.2% and 5.2%, respectively, in soybeans (table 2). The merger would give Dow-DuPont about 41% of the market for corn seeds and 38% of the market for soybean seeds. In the seed market for cotton, Monsanto and Bayer hold 31.2% and 38.5% market shares, respectively, and the proposed merger would consequently give Monsanto-Bayer about 70% of this market.

Bryant et al. (2016) find the HHI is above 2,500 before the mergers for corn and cotton seed markets, with soybeans falling somewhat short of 2,500. In all three markets, the proposed mergers would increase HHIs by more than 300 points. The HHI change in the market for cotton seed increases particularly dramatically, with an increase of about 2,400 points. The seed markets for corn and cotton clearly both meet the DOJ/FTC criteria under which market power is likely to be enhanced as a result of the mergers.

The approach used to evaluate the changes in the seed costs essentially consists of determining a firm’s optimal price markups above the firm's marginal cost, both before and after a proposed merger, given the demand elasticities for all goods in the market. That is, it addresses the question of, given the tradeoffs that consumers are willing to make as the prices change for similar—but not perfectly substitutable—products, what will be the optimal new price charged by a firm that has subsumed one of its competitors?

For some markets the reduction in competition may be offset by a reduction in marginal costs. However, for seed markets, the marginal cost of production consists almost entirely of seed crop cultivation, which is conducted at high effort and input intensity (Fernandez-Cornejo, 2004). This implies that the cost of producing a marginal unit of seed is essentially the marginal cost of employing an additional unit of land, and is therefore expected to be essentially a fixed multiple of the additional quantity of seed produced. Moreover, seed crop cultivation is contracted out to independent growers (Fernandez-Cornejo, 2004), each of whom will be limited in their available land, and whose costs will not be affected by mergers among the technology companies. Given these considerations, it is reasonable to assume that the firms will not realize a decrease in the marginal cost of seed production. We do, however, show the sensitivity of this assumption, by presenting results from an analysis which assumes a decrease in marginal costs.

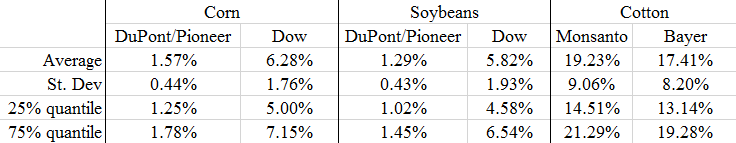

The impacts of the proposed merger between DuPont/Pioneer and Dow in the corn and soybean industries—since Bayer does not participate in the corn and soybean seed markets—are summarized in table 4. The estimated price increases in both markets would be modest. In corn, average price increases for the seed from the two merging firms are estimated to be 1.57% and 6.3%. In soybeans, the results are almost similar. Note that the seeds from each merging firm are differentiated products, therefore there are two price changes for each merger in Table 4. That is, the mergers are not assumed to result in a reduction in the number of products sold in the market. The average price increases for the seed of the merging firms are estimated to be 1.29% and 5.82%. The market-share-weighted expected price increases are 2.3% for corn seed and 1.9% for soybean seed. Soybean seed and corn seed account for about 31% of total variable costs for those crops (Iowa State University, 2016), implying less than a 1% increase in variable costs for corn and soybean producers.

The change in seed prices for cotton for the Monsanto-Bayer merger—since DuPont does not participate in the cotton seed market—are summarized in table 4. In contrast to corn and soybeans, the estimated price increases would be quite large. The average price increases by Monsanto and Bayer are estimated to be 19.2% and 17.4%, respectively. The market-share weighted expected increase in market price for seed for cotton is 18.2%. Seed for cotton accounts for 10% and 17% of total variable cost expenses for irrigated and dryland cotton producers, respectively (Texas A&M, 2016), therefore, based on the results from table 4, irrigated and dryland cotton producers would realize a 1.82%, and 3.09% variable cost increase, respectively.

The Bryant et al. (2016) results are based on the assumption that the proposed mergers will not decrease marginal costs for the firms, given the factors that make such reductions unlikely. However, this assumption can also be relaxed in the analysis to provide a sensitivity analysis of this main conclusion. For example, if the proposed mergers resulted in an alternative 5% reduction in marginal costs for the newly merged firms, the likely seed price changes can be re-estimated. Under this assumption, the expected price changes are -2.8% for corn seed and -3.2% for soybean seed. For cotton, the expected price change for seed is 12.3% under the alternative assumption. Thus, the qualitative result of increasing market prices for corn seed and soybean seed are sensitive to the assumption of zero reduction in marginal costs. However, a substantial increase in the price of seed for cotton from Monsanto and Bayer is expected, even if the merged firm unexpectedly achieves a reduction in marginal cost.

Agricultural seed markets are not contestable. Increased concentration among the few firms overseeing the major processes by which genetic manipulation occurs enables them to control the technologies and block their use by other firms. In addition, there are substantial sunk costs, including intellectual property cross-licensing and large R&D expenditures, which are a substantial barrier to new entry in these markets. The market power resulting from the structural changes in agricultural input industries makes farmers pay higher prices for purchased inputs. Seed prices in the United States have increased by larger percentages than other farm inputs in recent years.

The proposed DuPont/Pioneer-Dow merger would increase market concentration moderately in the markets for seed for both corn and soybeans. The change in market concentration in the corn seed market implies that the DOJ/FTC Horizontal Merger Guidelines would consider the DuPont/Pioneer-Dow merger likely to enhance market power. The change in concentration in the soybean market falls just short of the DOJ/FTC criterion. However, the changes in concentration are very similar to one another, and not likely to lead to substantially different market outcomes. In corn, the market-share weighted expected price increase is 2.3%. In soybeans, assuming no changes in marginal costs, the market-share weighted expected price increases is 1.9%.

The Monsanto-Bayer merger is projected to substantially increase seed prices for cotton. The merger would give Monsanto-Bayer about 70% of the market. The merger would increase market concentration dramatically, and easily qualifies the proposed Monsanto-Bayer merger as likely to enhance market power in the seed market for cotton under DOJ/FTC merger guidelines. The market-share weighted expected price increase is 18.2%, under the assumption of no reduction in marginal costs, and the expected price is still substantial under the assumption that marginal costs decrease. One possible outcome of the merger review process is Monsanto or Bayer being allowed to merge, but with one of the firms being required to spinoff their seed business for cotton. Our objective here, however, has not been to evaluate the probability of this outcome, but to simply report the consequences of a merger without such a divestiture.

Our results should be of particular concern to cotton producers. Any increase in seed prices would arrive in an already challenging environment: substantial declines in cotton prices in recent years, a strong U.S. dollar, and no Farm Bill program—such as Price Loss Coverage or Agricultural Loss Coverage. Seed price increases would likely result in further reductions in U.S. cotton acres and bankruptcies among cotton producers.

While we do not make policy prescriptions regarding regulatory approval of the proposed mergers, our results suggest that these proposals warrant careful scrutiny by regulators, including careful considerations of the potential effects on crop production costs and, ultimately, consumer prices for food and fiber.

Barton, J.H. 1998. “The Impact of Contemporary Patent Law on Plant Biotechnology Research.” In S.A. Eberhart, H.L. Shands, W. Collins, & R.L. Lower (Eds.), Intellectual property rights III, global genetic resources: Access and property rights. Madison, WI: CSSA.

Begemann, S. 2015. “Seed Competition Heats Up.” Available online: http://www.agweb.com/article/seed-competition-heats-up-naa-sonja-gjerde/

Boyd, W. 2003. “Wonderful Potencies? Deep Structure and the Problem of Monopoly in Agricultural Biotechnology.” In: R.A. Schurman and D. Kelso, editors, Engineering trouble: Biotechnology and its discontents. University of California Press, Berkeley, CA. p. 24–62.

Brennan, M.F., C. E. Pray, and A. Courtmanche. 1999. “Impact of Industry Concentration on Innovation in the U.S. Plant Biotech Industry.” Rutgers University, Department of Agricultural, Food and Resource Economics, working paper.

Bryant, H., A. Maisashvili, J. Outlaw, and J. Richardson. 2016. “Effects of Proposed Mergers and Acquisitions Among Biotechnology Firms on Seed Prices.” Working paper 16-2, Agricultural and Food Policy Center, Texas A&M University.

Comanor, W.S. 1964. “Research and Competitive Product Differentiation in the Pharmaceutical Industry in the United States.” Economica 31: 372-84.

ETC Group. 2013. “Putting the Cartel before the Horse…. and Farm, Seeds, Soil, Peasants, etc.” ETC Group Communique #111. Available online: http://www.etcgroup.org/sites/www.etcgroup.org/files/CartelBeforeHorse11Sep2013.pdf

Fernandez-Cornejo, J. 2004. “The Seed Industry in U.S. Agriculture: An Exploration of Data and Information on Crop Seed Markets, Regulation, Industry Structure, and Research and Development.” USDA-ERS Agriculture Information Bulletin No. (AIB-786), February 2004.

Fernandez-Cornejo, J., and R.E. Just. 2007. “Researchability of Modern Agricultural Input Markets and Growing Concentration.” American Journal of Agricultural Economics 89(5): 1269-1275.

Fernandez-Cornejo, J., and D. Schimmelpfennig. 2004. “Have Seed Industry Changes Affected Research Effort?” Amber Waves 2(1): 14-19.

Fuglie, K., P. Heisey, J.L. King, K. Day-Rubenstein, D. Schimmelpfennig, S.L. Wang, C.E. Pray, and R. Karmarkar-Deshmukh. 2011. “Research Investments and Market Structure in the Food Processing, Agricultural Input, and Biofuel Industries Worldwide.” USDA-ERS Economic Research Report, (130). Available online: http://www.ers.usda.gov/media/199879/err130_1_.pdf

Fuglie, K., P. Haisey., J. King., and D. Schimmelpfennig. 2012. Rising Concentration in

Agricultural Input Industries Influences New Farm Technologies. USDA-ERS Report. Available online: http://www.ers.usda.gov/amber-waves/2012-december/rising-concentration-in-agricultural-input-industries-influences-new-technologies.aspx#.V37C5fkrJhF

Fulton, M., and K. Giannakas. 2001. Agricultural Biotechnology and Industry Structure.” AgBioForum 4(2): 137-151.

Glenna, L.L., and D.R. Cahoy. 2009. “Agribusiness Concentration, Intellectual Property, and the Prospects for Rural Economic Benefits from the Emerging Biofuel Economy.” Southern Rural Sociology. 24:111–129.

Harl, N.E. 2000. “The Age of Contract Agriculture: Consequences of Concentration in Input Supply.” Journal of Agribusiness 18: 115–127.

Hausman, J.A., G. Leonard, and D. Zona. 1994. “Competitive Analysis with Differentiated Products.” Annales, D'Economie et de Statistique 34:159-180.

Hausman, J. A., and G.K. Leonard. 1996. “Economic Analysis of Differentiated Products Mergers Using Real World Data.” Geo. Mason L. Rev: 5: 321-343.

Hausman, J. A. 2010. “2010 Merger Guidelines: Empirical Analysis.” The Antitrust Source. Available online: http://economics.mit.edu/files/6603

Hayenga, M. 1998. Structural Change in the Biotech Seed and Chemical Industrial Complex.” AgBioForum 1(2): 43-55.

Hendrickson, M., and W. Heffernan. 1999. “Consolidation in the Food and Agriculture System.” Washington, DC: Report to the National Farmers Union. Available online: http://www.foodcircles.missouri.edu/whstudy.pdf

Howard, P.H. 2009. “Visualizing Consolidation in the Global Seed Industry: 1996–2008.” Sustainability 1(4): 1266-1287.

Howard, P.H. 2015. “Intellectual Property and Consolidation in the Seed Industry.” Crop Science 55(6): 2489-2495.

Hubbard, K. 2009. “Farmers Face the Consequences of a Consolidated Seed Industry.” The Farmer to Farmer Campaign.

Iowa State University, Extension and Outreach. 2016. “Estimated Costs of Crop Production in Iowa – 2016.” Available online: https://www.extension.iastate.edu/agdm/crops/html/a1-20.html

Just, R.E., and D.L. Hueth. 1993. “Multimarket Exploitation: The Case of Biotechnology and Chemicals.” American Journal of Agricultural Economics 75: 936–945.

Kalaitzandonakes, N., A. Maginer, and D. Miller. 2010. “A Worrisome Crop.” Regulation 33: 20-26.

King, J. L. 2001. “Concentration and Technology in Agricultural Input Industries.” U.S. Department of Agriculture.

Lesser, W. 1998. “Intellectual Property Rights and Concentration in Agricultural Biotechnology.” AgBioForum 1(2): 56-61.

Moretti, I. M. 2006. “Tracking the Trend Towards Market Concentration: The Case of the Agricultural Input Industry.” In United Nations Conference on Trade and Development: Geneva, Switzerland.

Scherer, F.M. 1984. “Innovation and Growth: Schumpeterian Perspectives.” Cambridge, MA: Massachusetts Institute of Technology Press.

Schimmelpfennig, D.E., C.E. Pray, and M.F. Brennan. 2004. “The Impact of Seed Industry Concentration on Innovation: A Study of U. S. Biotech Market Leaders.” Agricultural Economics 30: 157-167.

Shand, H. 2012. “The Big Six: A Profile of Corporate Power in Seeds, Agrochemicals, and Biotech.” The Heritage Farm Companion 10-15.

Shapiro C. 1995. “Mergers with Differentiated Products.” Antitrust: 10:23.

Shi, G., J.-P. Chavas, and K. Stiegert. 2008. “An Analysis of Bundling: The Case of the Corn Seed Market.” Staff Paper 529, Department of Agricultural and Applied Economics, University of Wisconsin-Madison, 2008.

Texas A&M, Agrilife Extension. 2016. “Estimated Costs and Returns per Acre.” Available online: http://agecoext.tamu.edu/files/2016/01/2016D2CottonPivot.pdf

U.S. Department of Agriculture, Agricultural Marketing Service (USDA-AMS). 2015. “Cotton Varieties Planted 2015 Crop.” Available online: https://www.ams.usda.gov/mnreports/cnavar.pdf

U.S. Department of Justice. 2016. “Herfindahl-Hirschman Index.” web page accessed August 19. Available online: https://www.justice.gov/atr/herfindahl-hirschman-index.

U.S. Senate. 2016. “Congressional Hearings on the Consolidation and Competition in the U.S. Seed and Agrochemical Industry.” Senate Judiciary Committee. September 20. Available online: http://www.judiciary.senate.gov/meetings/consolidation-and-competition-in-the-us-seed-and-agrochemical-industry

Zhang, W. 2014. “Product Differentiation Choices and Biotechnology Adoption: The U.S. Corn Seed Market.” Doctoral Dissertation, University of Wisconsin-Madison.