Livestock inventories and meat production in Latin America (LA) have grown at a rapid pace over the last nearly two decades, far outstripping corresponding growth rates in both the United States and worldwide. Growth of the livestock industry is a welcome economic boon to Latin America, generating economic growth, mitigating nutritional deficiencies, promoting food security, and helping support small farmers. However, with that growth have come complex, potentially detrimental, and unintended consequences whose costs need to be carefully considered against the benefits of growth. This article first characterizes the rapid growth of the Latin American livestock industry since 2000 and then focuses on key challenges accompanying that growth. Both the quality and consistency of international data on livestock and products are problematic across countries and data sources. To ensure consistency, this analysis of the LA livestock industry relies primarily on data from OECD-FAO (2019), supplemented by data from the FAOSTAT database (FAO, 2019b). Consistent with OECD-FAO (2019), Latin America includes the countries of South America, Central America (including Mexico), and the Caribbean.

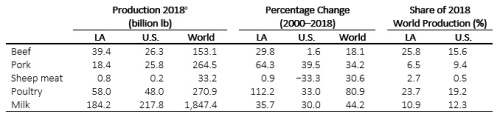

Note: aEstimated by OECD-FAO (2019).

Source: Developed by authors with data from OECD-FAO (2019).

Growth in LA meat production over nearly two decades (2000–2018) has been led by poultry (112.2%) and pork (64.3%), with milk and beef production not far behind (35.7% and 29.8%) (Table 1). Although representing only about 8% of the world population, LA countries produce more than a quarter of the world’s beef, nearly 24% of the world’s poultry, 11% of the world’s milk, and 7% of world’s pork (Table 1). Latin America is clearly emerging as a major world supplier of livestock protein.

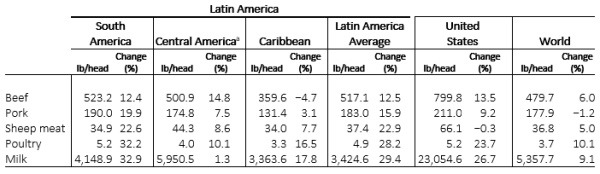

Note: Mexico is included with Central America and the Caribbean

with Latin America.

Source: Developed by authors with data from FAO (2019b).

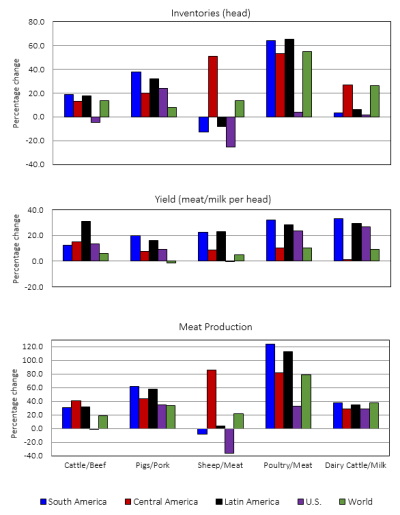

Much of the growth in LA meat and milk production has been the result of a general increase in livestock inventories rather than yields across all LA regions (Central and South America and the Caribbean) (top section of Figure 1). Even so, adoption of new production technologies and practices, including improved breeds, has fostered production efficiency gains across all livestock species and LA regions (middle section of Figure 1). In contrast, U.S. meat and milk production growth has come primarily from efficiency gains rather than inventory expansion.

South American inventories of beef cattle grew nearly 19% from 2000 to 2017, while U.S. inventories declined nearly 5% (top section of Figure 1). South American inventories of pigs and dairy cattle grew 38% and 3% over that period, somewhat above the 24% and 2% growth of the corresponding U.S. inventories. South American poultry inventories over that period, however, climbed sharply by 64%, compared to only 4% in the United States. Central America kept pace with South America in livestock inventory growth, with the exception of sheep, where Central America experienced substantial growth (51%) over the same period while South America sustained a sizeable loss (−13%). Nevertheless, Central America underperforms South America in production efficiency (yield) growth of all livestock except beef (Table 2).

With nearly six times more milk-producing cattle, South America produces only four times more milk than Central America because South American production efficiency is 30% lower than in Central America (Table 2). Although underperforming the United States in meat production efficiency, Latin America particularly underperforms the United States in milk production efficiency (Table 2). Despite having the second largest dairy herd in the world, Brazil has continually struggled to boost its milk output because a large share of Brazilian dairy farms have small herds of crossbred cows that are milked by hand (Costa et al., 2004). Milk production efficiency in South America, however, grew much more rapidly (33%) than in either Central America (1.3%) or the United States (26.7%) from 2000 to 2017 (Table 2).

Note: a Mexico is included with Central America.

Source: Developed by authors with data from OECD-FAO (2019b).

In pork, LA yield growth pushed production per head (183 lb) to 87% of the U.S. level and to higher than the world average in 2017 (Table 2). In addition, LA beef and sheep meat production per head (517 lb and 37 lb, respectively) were both around 60% of U.S. levels and exceeded average world levels for both meats in 2017. LA poultry production more than doubled over 2000–2018, compared to 33% in the United States and over 80% globally (Table 1), with dynamic growth in both poultry inventories (64%) and yield (30%) that outstripped the corresponding growth rates in both the United States and the world (Figure 1). Much of the growth in both LA poultry and pig productivity since 2000 has been the result of scale of production and vertical integration efficiencies, which have also led to greater numbers of animals in the hands of fewer producers, as in the case of Chile (Herrera, 2013).

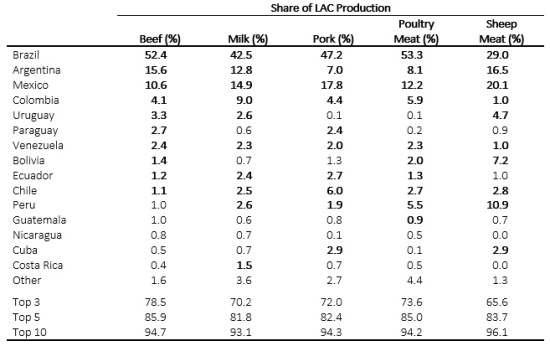

Note: The shares accounted for by the top ten countries in each column are

highlighted in bold.

Source: Developed by authors with data from FAO (2019b).

Not surprisingly, LA meat production is concentrated in relatively few countries. The top three producing countries (Brazil, Argentina, and Mexico) account for 65%–80% of all LA meat production (Table 3) and about 70% of the land area in Latin America (OECD, 2019b). The top five countries account for over 80% of LA production, while the top ten countries account for all but 3%–4% of total LA meat production and all but 11% of the land area in Latin America.

Brazil is the largest beef producer in Latin America, accounting for 52% of all beef produced in the region (Table 3). Brazilian beef production increased about 45% between 2000 and 2018 as a result of a 24% increase in inventories and a 17.5% increase in yield. Government financial support for the expansion of private enterprise, herd reconstruction, genetic improvements, livestock breeding programs, grassland improvements, and sustained prices of cattle have improved the competitive advantage of the Brazilian cattle industry over the years. Brazil is also the largest LA producer of pork (47%), poultry (53%), sheep meat (29%), and milk (43%).

Argentina is the second largest LA producer of beef (16%), but Mexico is the second-largest producer of pork (18%), poultry (12%), milk (15%), and sheep meat (20%) (Table 3). Argentina accounted for nearly 17% of LA sheep meat production in 2017, while Peru, Bolivia, Uruguay, and Cuba (in that order) together accounted for about 25% of that production (Table 3). Livestock production in Central America was hit hard again in 2018 by drought along the so-called Dry Corridor that runs through Guatemala, El Salvador, Honduras, and Nicaragua after struggling to recover from a severe drought in 2014 and the strongest El Niño phenomenon registered in recent history in 2015 (FAO, 2019a). The droughts have forced some livestock producers, and particularly young people, to abandon their operations and migrate to the north, creating additional pressure along the U.S.–Mexico border (FAO, 2019a; Baez et al., 2017). Up to 82% of the families living in the Dry Corridor over the last several years have had to sell their agriculture tools and animals to buy food; some also may skip meals or eat less nutritious foods (FAO, 2019a).

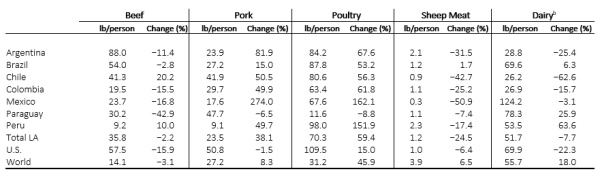

Notes: a Estimated by OECD-FAO (2019).

b Fresh dairy products as defined by OECD-FAO (2019).

Source: Developed by authors with data from OECD-FAO (2019).

FAO data indicate that 25% of the calories and 15% of the protein consumed by Latin Americans are of animal origin (Milesi, 2016), compared to about the same share of calories but 64% and 33% of the protein consumed in the United States and globally, respectively (FAO, 2019b). The average LA household spends 19% of its food budget on meat and dairy products (FAO, 2017). The livestock product composition of Latin American diets, however, has been changing from beef and dairy products to poultry and pork, facilitated by the rapid increases in their production.

The per capita consumption of poultry and pork increased by nearly 60% and 40%, respectively, from 2000 to 2018 (Table 4). In contrast, LA per capita consumption of beef and dairy products declined by 2% and 8%, respectively, across the region over the same period despite the robust growth in the production of both. These trends are consistent with the 16% and 22% decline in U.S. beef and dairy product per capita consumption over that period. The global average per capita beef consumption also declined 3%, while that of dairy products rose by 18% over the period. Notable exceptions across the region include Chile, which achieved a 20% increase in per capita beef consumption and Brazil, Paraguay, and Peru, which all registered substantial increases in per capita consumption of fresh dairy products (6%, 26%, and 64%, respectively) over that period.

Source: Developed by authors with data from OECD-FAO (2019).

Although producing 12% of the meat and milk consumed in the world, Latin America exported only about 7% that production in 2018 (OECD-FAO, 2019). Importing countries like China, Russia, and others experiencing economic growth with growing consumer markets, however, have been increasingly attracted by the robust quality–price ratio of LA meat products, leading to substantial growth of LA livestock product exports. Even though Brazil and Argentina compete with the United States in global meat markets, the United States is also a large potential market for their livestock products.

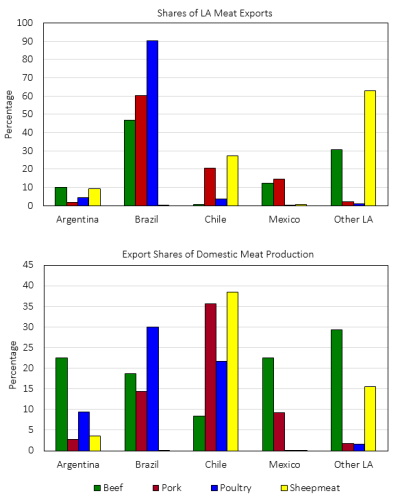

Brazil dominates LA beef, pork, and poultry exports, accounting for 47%, 60%, and 90% of the respective exports from the region (Figure 2). Consequently, Brazil exports a substantial share of its production of the three meats (19%, 14%, and 30%, respectively). The substantial production growth allowed Brazil to emerge as the world’s largest beef exporter in 2018, accounting for almost 20% of global beef exports (Zia et al., 2019). LA beef exports increased markedly (175%) between 2000 and 2018, pushed primarily by the 440% increase in Brazilian beef exports over that period. In contrast, Argentina’s beef exports fell about 1% over that period, largely due to a severe drought in 2008 that led to a sell-off of cattle in 2009 and subsequent beef shortages (Joseph, 2012). Argentine farmers subsequently were reluctant to reinvest in cattle production because of government restrictions on exports and control of beef prices. In early 2016, the government lifted the restrictions to help ensure reasonable domestic prices (Marsh, 2016). Argentine beef exports have not recovered to former levels yet, however. Central American countries continue to suffer a general lack of livestock product export competitiveness despite the many free trade agreements to which they are signatories owing, at least in part, to perceived weak animal health and food safety systems (Rojas and Romero, 2017).

The growth in LA exports of pork and poultry over the last two decades has been remarkable. Pork exports by Argentina, Brazil, Chile, and Mexico expanded by more than 500% over that period, an average annual growth rate of 25% (OECD-FAO, 2019). Chile’s pork exports have rebounded substantially as a result of efforts to eradicate Porcine Reproductive and Respiratory Syndrome (PRRS) disease, which have reduced the incidence to less than 5% (Martínez Herráez, 2016). Driven by red meat supply problems, new export demand, lower feed prices, and improved sanitary conditions, Argentina’s poultry production increased by over 130% between 2000 and 2018. Even so, the rapid growth achieved in Argentina’s poultry exports began to stall in 2014 due to rapid increases in production costs and strong competition from Brazil. Argentina lowered the value-added tax to poultry producers in 2018 to provide some relief to the poultry sector (Meador and Yankelevich, 2018).

Growth of LA livestock systems has created pressure for enhanced infrastructure, generated employment and income, and fostered economic multiplier effects that have supported economic development efforts across the region. The livestock sector now accounts for 46% of the agricultural GDP of Latin America, which is growing at an annual rate of 3.7%, higher than the corresponding 3.4% average global GDP growth rate (FAO, 2017; World Bank, 2019). Even so, mounting challenges for the region have accompanied the growth of the industry.

The rapid growth in LA livestock and meat production over the last two decades might well have been expected to improve quality of life for many of the approximately two-thirds of the region’s population devoted to agriculture, whose livelihoods depend partly on livestock production. Livestock is produced on 84.5% of the area devoted to agriculture in the region (Díaz and Valencia, 2014). Those most dependent on livestock for at least a part of their livelihoods include indigenous groups, small farmers, and subsistence and landless farmers (García-Winder and Chavarría, 2017). However, the extent to which the growth of the industry alleviates poverty and strengthens smallholder and family farming in Latin America depends on multiple factors. For example, many smallholders who depend on livestock as a mainstay of their livelihoods are not engaged in commercial markets and instead are focused on survival. They rely on family labor, including children, in essential livestock production activities like herding (FAO, 2013). Consequently, the availability of new livestock production technologies, development of more efficient production systems, growth of market demand, and related changes that foster the development of the LA livestock industry have had little effect on many smallholder operations. Small, poor livestock producers face critical barriers—including lack of access to technology, credit, resources, markets, information, and training—to participating in the potential benefits of a growing livestock industry. Other challenges include the high cost of animal feed, limited availability of quality forage, and growing incidence of animal disease outbreaks (FAO, 2017).

Poor LA farmers are more likely to raise small stock like poultry, pigs, sheep, and goats rather than cattle for various reasons, including the lower capital investment required and their higher meat production efficiency (Otte, Costales, and Upton, 2005). The gains from scale and vertical integration efficiencies that have fostered growth (particularly of small ruminant production) in Latin America have not spread much beyond relatively few enterprises, as demonstrated by the case of poultry production in Chile. LA family farmers who live close to urban areas are better able to take advantage of the rapid growth in demand for meat and other animal products in the region (García-Winder and Chavarría, 2017). These farmers tend to benefit from contract production or directly supply urban food wholesalers and retailers. In more remote areas, where conditions and infrastructure are unsuitable for large-scale commercialization of livestock production, small households may benefit from the spillover effects of urban growth in demand but are more likely to service the needs of local economies.

Concerns about the environmental impacts, particularly the rate of deforestation, related to LA livestock production growth are intensifying. Unlike the other main tropical rainforests in the Congo Basin and Southeast Asia, about 80% of the Amazon forest is intact (Boucher, Roquemore, and Fitzhugh, 2013). The conversion of forests into cropland for soybeans and pastures for extensive cattle production is responsible for up to 80% of the deforestation that has occurred in Latin America (Tyrell, 2019). About 75% of agricultural land in Central America and about 50% in South America is already degraded (Ballantyne, 2012). About 70% of deforested land in the Amazon is used as pasture, with feed crops planted on much of the rest.

Besides the South American Amazon forest, the clash between cattle production and its environmental threat has been increasingly severe in the semi-arid region of the Chaco in Argentina, Paraguay, and Bolivia and the arid and semi-arid zones in Argentina and Chile (Davies, 2014). The dilemma also has affected Central America, where the extensive production of dual-purpose livestock (milk and meat) is leading to soil degradation, deforestation, and high levels of greenhouse gas (GHG) emissions per unit of output (van der Hoek et al., 2016). The social costs of deforestation in Latin America and the consequences—soil degradation and erosion, water pollution, loss of biodiversity, and loss of carbon contributing to global warming—are potentially enormous (FAO, 2013).

Despite the incentives of high international prices, export demand, and the availability of cheap land in the Amazon pushing for continued deforestation, the rate of deforestation in the Brazilian Amazon dropped by more than two-thirds in recent years (Boucher, Roquemore, and Fitzhugh, 2013). While cattle production continues to expand in Brazil and elsewhere in Latin America, effective protection extended to indigenous reserves and other protected areas, which now make up over half of the area of the Brazilian Amazon, is responsible for the reduced rate of deforestation. A complex collaboration of governments, industries, indigenous peoples, and non-governmental organizations (NGOs) put in place new policies and enforcement actions that have provided some effective counterbalance to the persistent economics of livestock and crop production in the Amazon (Boucher, Roquemore, and Fitzhugh, 2013). Future efforts to constrain livestock and crop production in Brazil may include agro-ecological zoning regulations such as those used to restrict the growth of Brazilian sugarcane to zones that are environmentally suitable for sustainable production.

Some changes in livestock systems in LA countries toward more intensive mixed-crop/livestock systems and dairy production fostered by investments in transportation infrastructure, new silvopastoral techniques, and the conversion of pastureland into cropland also are helping reduce livestock’s environmental impact in the region (García-Winder and Chavarría, 2017). Relatively high feed prices, however, are currently cutting into the profitability of fattening cattle in feedlots and, therefore, the incentive to intensify cattle production across Latin America. Although assisting efforts to forestall deforestation due to cattle production in the region, the continuing shift of LA livestock production toward nonruminants and away from cattle and the rapid growth in nonruminant production also reinforce pressures not only to convert deforested pastureland to crops in Brazil and elsewhere in Latin America but also to clear forestland specifically for crops like soybeans for the production of livestock feed (Herrero et al., 2009). At the same time, the abundance of fertile land, particularly in South America, inhibits the adoption of productivity-enhancing technologies in the LA livestock industry (Thorton, 2010).

Success in combating animal diseases such as foot and mouth disease (FMD) and classical swine fever (CSF) has facilitated growth of Latin American livestock product exports in recent years. At the same time, however, increasing outbreaks of animal diseases and other sanitary concerns have accompanied the growth of the LA livestock industry, which constrain the rate of export growth and the accompanying export benefits. Climate change will likely create new issues of expansion or reemergence of livestock diseases in the region (Short, Caminade, and Thomas, 2017). A persistent deficiency of resources to combat the spread of infectious diseases is the most critical factor for current and future LA livestock disease issues. Most needed are resources to determine the drivers of the growth and outbreak of diseases and to understand the vectors of disease transmission to humans.

FMD has been endemic in many areas of South America for more than 100 years. The United States began limiting imports of Brazilian beef to cooked or processed products in 2003 due to Brazil’s continuing FMD problems. Following a multiyear, science-based review, the USDA Food Safety and Inspection Service (FSIS) announced in 2016 that the Brazilian food safety meat inspection system was equivalent to that of the United States and that fresh beef could be imported safely (USDA, 2016). However, the U.S. again blocked imports of fresh Brazilian beef one year later, after finding abscesses in the meat and signs of systemic failure of Brazilian meat inspections (Gardner, Mano, and Polansek, 2017). Earlier in that same year, some Brazilian meatpackers were hit with a scandal involving alleged bribery of health officials, which briefly shut down Brazilian meat exports. After years of effort by the private and public sector to control FMD, Brazil was certified in 2018 by the World Organization for Animal Health (OIE) as being free of FMD with vaccination (de la Hamaide, 2018). The certification is opening up new export possibilities for Brazilian beef, such as the recent clearance of Brazilian beef imports by Indonesia. The United States, however, has yet to lift the ban on imports of Brazilian fresh and chilled beef (Flake and Silva, 2019). Argentina lost access to the United States and many other global beef markets following a 2000 FMD outbreak. Even though two zones in Argentina have since been certified FMD free with vaccination and the other three zones as free without vaccination and an FMD outbreak in Argentina has not been reported since 2005, the United States did not lift its ban on Argentina beef imports until November 2018. A number of countries in the region—such as Chile, Mexico, Cuba, and the countries of Central America and the Caribbean—are certified as FMD free without vaccination (Rojas and Romero, 2017).

In addition to FMD, other disease issues affect Latin America’s ability to export cattle and beef. For example, cattle fever ticks and the threat of babesiosis hamper Mexican live cattle exports to the United States. A confirmed a case of atypical bovine spongiform encephalopathy (BSE) in the state of Matto Grosso in Brazil in 2019 led to only a brief suspension of Chinese imports of Brazilian beef (Henderson, 2019).

Avian influenza (AI) continues to be a problem in Mexico despite government efforts. An AI outbreak in 2012 and 2013 forced the destruction and disposal of millions of chickens, reduced chicken and egg consumption, and raised their prices (Kapczynski et al., 2013). The latest AI outbreak in Mexico occurred in 2019 and reportedly led to the loss of half a million head of poultry (Linden, 2019). AI outbreaks in Chile have also been a continuing concern.

Research in Mexico, Chile, and Colombia indicates that porcine peproductive and respiratory syndrome (PRRS) remains a major challenge for pig health in Latin America (Rojas and Romero, 2017). In April 2013, swine epidemic diarrhea virus (PEDv) was identified for the first time in the United States and spread rapidly to other countries in North and South America, including Mexico, Peru, the Dominican Republic, Canada, Colombia, and Ecuador, leading to the death of millions of piglets (Lv et al., 2016). Other swine disease issues of concern include CSF and trichinellosis.

The growing LA livestock industry supports wide-spread economic growth and contributes to some poverty reduction and increased food security in the region. Trade-offs abound, however, particularly in the attainment of economic growth versus environmental objectives in the region. The main limitation to continued growth of the LA livestock industry is lagging production efficiency and the availability and incentives to adopt technologies, management techniques, and improved genetics to enhance productivity and profitability. In addition, disease outbreaks such as foot-and-mouth disease and avian influenza will hinder growth of production and exports. Sustainable beef production is a continuing challenge, although deforestation rates in the Amazon from growing cattle production have declined markedly in recent years. Continued growth and maturity of the LA livestock industry will intensify challenges long faced by livestock industries in more developed countries, such as animal welfare, end-product quality and palatability, traceability, and communication among industry segments.

Baez, J., G. Caruso, V. Mueller, and C. Niu. 2017. "Droughts Augment Youth Migration in Northern Latin America and the Caribbean." Climatic Change 140(3):423-435.

Ballantyne, P. 2012, March 1. “Climate-Smart Crop-Livestock Systems for Smallholders – Livestock and Fish Project to Intensify Agriculture and Mitigate Climate Change.” CGIAR Research Program on Livestock and Fish. Available online: http://livestockfish.cgiar.org/2012/03/01/climate-smart-crop-livestock-systems-for-smallholders-livestock-and-fish-project-to-intensify-agriculture-and-mitigate-climate-change/.

Boucher, D., S. Roquemore, and E. Fitzhugh. 2013. “Brazil’s Success in Reducing Deforestation.” Tropical Conservation Science 6(3): 426–445. Available online: https://doi.org/10.1177/194008291300600308

Costa, D., D.J. Reinemann, N. Cook, and P. Reugg. 2004. “The Changing Face of Milk Production, Milk Quality, and Milking Technology in Brazil.” Discussion Paper No. 2004-2, Madison, WI: University of Wisconsin Babcock Institute for International Dairy Research and Development.

Davies, W. 2014, November 26. “Uruguay’s World First in Cattle Farming.” BBC News. Available online: http://www.bbc.com/news/world-latin-america-30210749 [Accessed October 2019].

Díaz, T., and P. Valencia. 2014. “Lineamientos para el Fortalecimiento de la Producción Pecuaria Familiar en América Latina.” In S. Salcedo and L. Guzmán, eds. Agricultura Familiar en América Latina y el Caribe: Recomendaciones de Política. Santiago, Chile: Food and Agriculture Organization, pp. 165–175.

de la Hamaide, S. 2018, May 24. “OIE Declares Brazil Free of Foot-and-Mouth with Vaccination.” Health News, Reuters. Available online: https://www.reuters.com/article/us-brazil-beef-disease/oie-declares-brazil-free-of-foot-and-mouth-with-vaccination-idUSKCN1IP2CD.

Flake, O., and J.F. Silva. 2019. Livestock Products Semi-Annual. Washington, DC: U.S. Department of Agriculture, Foreign Agriculture Service, GAIN Report BR−1904, February.

Food and Agriculture Organization of the United Nations (FAO). 2013. “Children’s Work in the Livestock Sector: Herding and Beyond.” Rome, Italy: Gender, Equity and Rural Employment Division, Economic and Social Development Department. Available online: http://www.fao.org/docrep/017/i3098e/i3098e.pdf.

Food and Agriculture Organization of the United Nations (FAO). 2017. “Livestock Production in Latin America and the Caribbean,” Regional Office for Latin America and the Caribbean. Available online: http://www.fao.org/americas/perspectivas/produccion-pecuaria/en/

Food and Agriculture Organization of the United Nations (FAO). 2019a. “Adverse Climate Events in the Central American Dry Corridor Leave 1.4 million People in Need of Urgent Food Assistance.” Regional Office for Latin America and the Caribbean. Available online: http://www.fao.org/americas/noticias/ver/en/c/1191838/

Food and Agriculture Organization of the United Nations (FAO). 2019b. FAOSTAT. Rome, Italy. Available online: http://faostat.fao.org/.

García-Winder, M., and H. Chavarría, eds. 2017. The Outlook for Agriculture and Rural Development in the Americas: A Perspective on Latin America and the Caribbean 2017-2018. San José, Costa Rica: Economic Commission for Latin America and the Caribbean (ECLAC), Food and Agriculture Organization of the United Nations (FAO), and Inter-American Institute for Cooperation on Agriculture (IICA). Available online: https://repositorio.cepal.org/handle/11362/42282.

Gardner, T., A. Mano, and T. Polansek. 2017, July 17. “U.S. Says No Timeline to Restore Brazil Beef Imports.” Reuters Business News. Available online: https://www.reuters.com/article/us-usa-brazil-beef-idUSKBN1A2260.

Herrera, M.J. 2013. Chile: Food Processing Ingredients, Chile’s Food Processing Sector. Washington, DC: U.S. Department of Agriculture, Foreign Agriculture Service, GAIN Report CI1318, October.

Herrero, M., P.K. Thornton, P. Gerber, and R.S. Reid. 2009. “Livestock, Livelihoods and the Environment: Understanding the Trade-Offs.” Current Opinion in Environmental Sustainability 1(2):111–120. Available online: https://doi.org/10.1016/j.cosust.2009.10.003

Henderson, G. 2019, June 14. “Brazil Lifts Ban on Beef Exports to China.” Dairy Herd Management. Available online: https://www.dairyherd.com/article/brazil-lifts-ban-beef-exports-china.

Joseph, K. 2012. Argentina: Livestock Products Annual. Washington, DC: U.S. Department of Agriculture, Foreign Agriculture Service, GAIN Report AR2017-1519, September.

Kapczynski, D.R., M. Pantin-Jackwood, S.G. Guzman, Y. Ricardez, E. Spackman, K. Bertran, D.L. Suarez, and D.E. Swayne. 2013. “Characterization of the 2012 Highly Pathogenic Avian Influenza H7N3 Virus Isolated from Poultry in an Outbreak in Mexico: Pathobiology and Vaccine Protection.” Journal of Virology 87(16):9086–9096. Available online: https://jvi.asm.org/content/87/16/9086

Linden, J. 2019, August 2. “Four More Avian Influenza Outbreaks Confirmed in Mexico.” Poultry Health and Disease, Latin America, Industry News and Trends. WATTAgNet.com. Available online: https://www.wattagnet.com/articles/38407-four-more-avian-flu-outbreaks-confirmed-in-mexico

Lv, C., Y. Xiao, X. Li, and K. Tian. 2016. “Porcine Endemic Virus: Current Insights.” Virus Adaptation and Treatment 8:1–12. Available online: https://doi.org/10.2147/VAAT.S107275

Marsh, S. 2016, January 11. “Argentina Lifts Beef Export Quotas, Agriculture Secretary Says.” Reuters. Available on-line: http://www.reuters.com/article/argentina-beef-idUSL8N14V4NC20160111.

Martínez Herráez, N. 2016, June 29. “Chilean Pork Industry Has Grown 800% in Last 30 Years.” The Pig Site. Sheffield, England: 5m Publishing. Available online: http://www.thepigsite.com/swinenews/41974/chilean-pork-industry-has-grown-800-in-last-30-years/.

Meador, M.M., and A. Yankelevich. 2018. Argentina: Poultry and Products Annual. Washington, DC: U.S. Department of Agriculture, Foreign Agriculture Service, GAIN Report, September.

Milesi, O. 2016, September 4. “Livestock-Opportunity and Threat for a Sustainable Latin America.” Food and Agriculture, Inter Press Service News Agency. Available online: http://www.ipsnews.net/2016/09/stockbreeding-opportunity-and-threat-for-a-sustainable-latin-america/.

Organization for Economic Cooperation and Development and the Food and Agriculture Organization of the United Nations (OECD-FAO). 2019. OECD-FAO Agricultural Outlook 2019–2028. OECD Agriculture Statistics (database). Available online: http://www.agri-outlook.org/data/.

Otte, J., A. Costales, and M. Upton. 2005. Smallholder Livestock Keepers in the Era of Globalization. Reading, UK: University of Reading, Earley Gate, Pro-Poor Livestock Policy Initiative, Living from Livestock Research Report RR Nr.05-06.

Rojas, H. and J.R. Romero. 2017. “Where to Next with Animal Health in Latin America? The Transition from Endemic to Disease-Free Status.” Scientific and Technical Review of the Office International des Epizooties 36(1):331–348. Available online: doi: 10.20506/rst.36.1.2633

Short, E. E., C. Caminade, and B.N. Thomas. 2017. “Climate Change Contribution to the Emergence or Re-Emergence of Parasitic Diseases.” Infectious Diseases: Research and Treatment 10:1–7. Available: doi: 10.1177/1178633617732296

Thornton, P.K. 2010. “Livestock Production: Recent Trends, Future Prospects.” Philosophical Transactions of the Royal Society B: Biological Sciences 365:2853–2867. Available online: https://doi.org/10.1098/rstb.2010.0134

Tyrell, M., ed. 2019. Global Forest Atlas: Cattle Ranching in the Amazon Region. New Haven, CT: Yale University, School of Forestry and Environmental Studies, Global Institute of Sustainable Forestry. Available online: https://globalforestatlas.yale.edu/amazon/land-use/cattle-ranching.

U.S. Department of Agriculture (USDA). 2016, August 1. “USDA Announces Reopening of Brazilian Market to U.S. Beef Exports.” Washington, DC: U.S. Department of Agriculture, Press Release No. 0175.16.

van der Hoek, R., M. Mena, R. Corrales, M.A. Mora, and J. Ojango, J. 2016. “Sustainable Milk and Beef Production in Nicaragua: Actions and Opportunities for an Inclusive Value Chain.” Poster prepared for the Tropentag 2016 Conference on Solidarity in a Competing World—Fair Use of Resources, Vienna, Austria, September 19–21.

World Bank. 2019. “Agriculture, Forestry, and Fishing, Value Added (% of GDP).” World Bank databank. Available online: https://data.worldbank.org/indicator/nv.agr.totl.zs.