The Paycheck Protection Program (PPP)—a component of the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020—was designed to allow employers to continue paying employees, even if their businesses were closed or operating at less than full capacity, by providing forgivable loans. The program’s objective was to provide financial relief to small businesses, including farm operations, that were not generating enough revenue to cover payroll and overhead expenditures. The $2 trillion CARES Act included $659 billion for the Paycheck Protection Program. These funds were depleted rapidly because the program was extremely popular; additional monies were allocated later in multiple bills, including the Paycheck Protection Program and Health Care Enhancement (PPPHCE) Act of 2020 (Public Law 116-139, enacted April 24, 2020) and the Paycheck Protection Program Flexibility (PPPF) Act of 2020 (Public Law 116-142, enacted June 5, 2020). All of the allocated funds under these bills were distributed.

Under the PPP, businesses meeting the Small Business Administration’s definition of a small business could receive loans if they had positive payroll expenses and/or net profit in the previous year1. The maximum loan amount was 2.5 times the monthly average profit plus payroll costs, including eligible overhead costs (e.g., employer insurance payments, employer unemployment taxes) for most businesses (U.S Small Business Administration, 2022a,b). The exact amount of the loan was not under the control of the recipients but was determined by the SBA. PPP loans would only be (fully) forgiven if the loans were used on eligible expenses. Two labor-related requirements for the loan to be fully forgiven were i) that a firm use 60% or more of the loan for payroll expenses within 24 weeks of receiving the loan and ii) that a firm maintain its number of employees and its compensation level for them. PPP loans that did not meet the expenditure criteria would become low-cost loans for the recipient.

Statistical indicators reported by the Economic Research Service (ERS) provide guidance for policy makers, lenders, commodity organizations, farmers, and others interested in the financial status of the farm economy (U.S. Department of Agriculture, 2022). The September 1, 2022, release of farm income statement and balance sheet estimates and forecasts included only forgiven PPP loans in the government payment section (U.S. Department of Agriculture, 2022). The rationale was to provide more accurate data regarding the value of the PPP loans (U.S. Department of Agriculture, 2022c). The reported PPP data are to be updated as new PPP information becomes available (U.S. Department of Agriculture, 2022c).

In this paper, we analyze the forgiveness rate of the PPP loans made to the farm sector, especially differentiated by race. We examine forgiveness rates of PPP loans but do not investigate the causality behind any differences. We define the forgiveness rate as the monetary value of the forgiven PPP loans divided by the total amount disbursed:

| Amount of PPP Loan Forgiveness | |

| Forgiveness Rate= | ___________________________ |

| Total PPP Loan amount |

The unforgiven portion of a PPP loan turns into a regular loan, which can increase financial stress and have different impacts on creditors as well as borrowers. Green and Liu (2021) find that having multiple borrowing relationships could impose a default externality on creditors. Gaku et al. (2022) state that new debt could lower the repayment probability of existing loans, which could be even more true for unforgiven PPP loans because many borrowers may have expected the loan to turn into a grant as these were forgivable loans. Further, Bolton and Scharfstein (1996) find that if borrowers realize they can renegotiate their debt, they may engage in excessive risk taking. While PPP loans cannot be negotiated, the likely expectation that the loans would be forgiven may have given rise to moral hazard in the form of greater risk taking.

A borrower could apply for forgiveness once all loan proceeds for which the borrower was requesting forgiveness had been used (U.S. Small Business Administration, 2022). To qualify for full loan forgiveness, PPP recipients had to use their loan within 24 weeks of disbursement. The Paycheck Protection Program ended on May 31, 2021; 24 weeks after that date would be the end of November 2021. Therefore, by July 2022 (the data we use for our analysis) all PPP recipients were eligible to apply for full forgiveness of their loans, provided they met previously noted requirements.

One of the stated goals of the CARES Act, which included the PPP and the Economic Injury Disaster Loan (EIDL) Program, was to prioritize serving “underserved markets” and businesses owned by “socially and economically disadvantaged individuals” (Grotto, Mider, and Sam, 2020). Several studies (Couch, Fairlie, and Hu, 2020; Cowan, 2020; Fairlie, 2020; Montenovo et al., 2020) note that the economic impacts of the COVID-19 pandemic were especially severe for small businesses, workers, and communities of color. If the rate of loan forgiveness is lower for minority-owned farm operations, the goal of prioritizing such operations may be undermined. The EIDL program, like the PPP, was intended to extend financial assistance to small businesses by providing low-interest, unforgivable loans and forgivable advances (Giri et al., 2021).

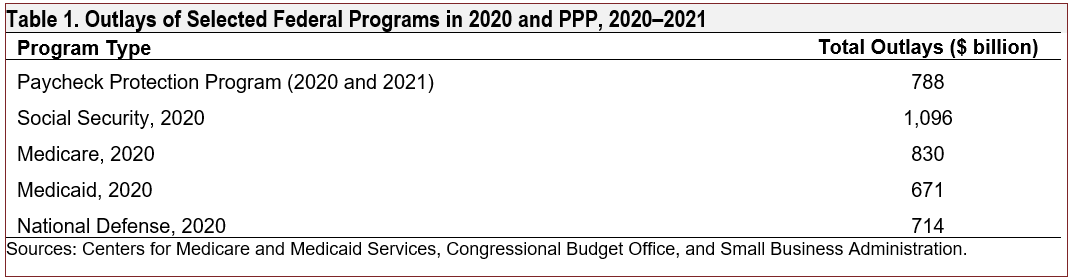

Table 1 shows the outlays of major U.S. government programs for 2020 and of the PPP for 2020 and 2021. The $788 billion spent under the PPP between 2020 and 2021 was higher than the outlays for national defense and Medicaid for 2020 but slightly lower than Medicare expenditures in that year and almost three-fourths of the Social Security program outlays. PPP was a very high-cost program, but it effectively disbursed a large amount of money in a very short period of time to the target businesses. It has the potential to be a blueprint for future responses to future pandemics and other disasters or to situations in which policy makers want to help offset labor expenses for certain businesses. Of the nearly $788 billion in PPP loans, more than $745 billion, or 95%, had already been forgiven as of July 2022 (U.S. Small Business Administration, 2022b).

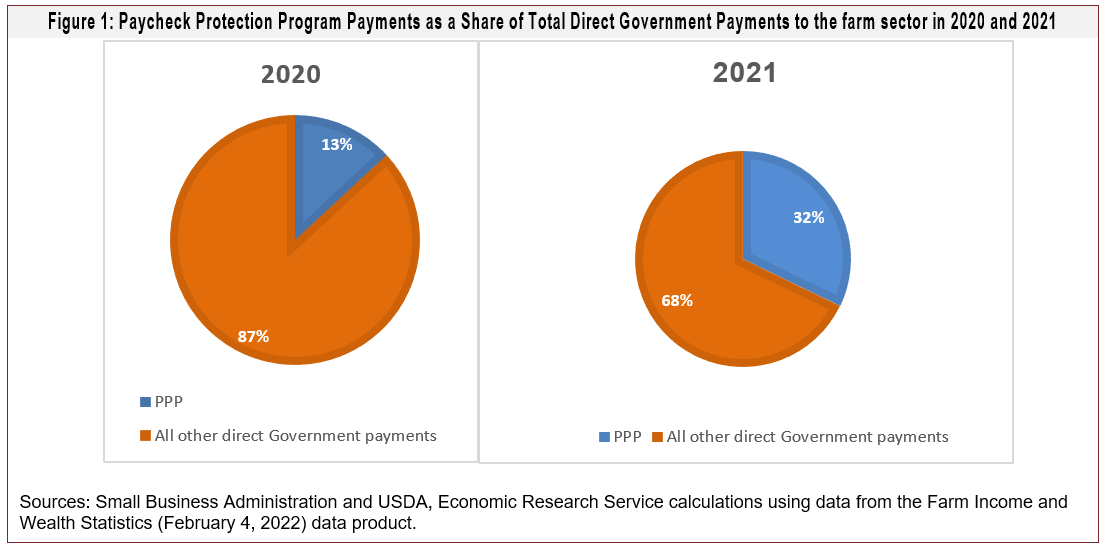

Giri et al. (2021) show that in 2020, out of the $35.7 billion that farmers could have received through the PPP, only about $6.0 billion was distributed. Altogether, the PPP provided a total of $14.7 billion ($6.0 billion in 2020 and $8.7 billion in 2021) in forgivable loans to the agricultural sector. The PPP was larger in magnitude and was a larger share of total direct government payments to the agricultural sector in 2021 than in 2020. Figure 1 shows that the PPP comprised almost one-third of total direct government payments to the farm sector of $27.1 billion in 2021, compared to 13% of total direct government payments of $47.7 billion in 2020. The PPP provided significant economic relief to the agricultural sector in both years. Other sources of government payments include payments from standing farm bill programs, such as the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC), and pandemic relief from the USDA, including from the Coronavirus Food Assistance Program (CFAP). Giri et al. (2022) analyze CFAP payments by race and find that they were aligned with the market value of agricultural products sold.

Data and Methodology

We use publicly available individual PPP loan data from the Small Business Administration (SBA) to analyze the forgiveness rate of PPP loans by race for PPP loans made to the farm sector. Individual loan data from the SBA database included demographic information such as the recipient’s race, North American Industry Classification System (NAICS) code (the standard that federal statistical agencies use in classifying business establishments), business name, and other details related to the loan (e.g., the approved loan amount and the amount forgiven). For our analysis, we extract the total number and total dollar amount of PPP loans for NAICS codes 111 (crop production sector) and 112 (animal production sector) for those who reported their race. The Office of Managementand Budget (OMB) requires the federal government to provide the opportunity to self-report race on a voluntarybasis. For the agricultural sector (NAICS 111 and 112), only about a quarter of recipients reported their race, which was significantly higher than the 10% reported for all PPP loans (Atkins, Cook, and Seamans, 2022). We find the lowest forgiveness rates among Black or African American recipients. Our analysis of the race variable showed the forgiveness rate was different across racial categories. To better understand the lower forgiveness rate for the African American recipients, we use analysis of variance (ANOVA) to test the effects of different characteristics on forgiveness rate.

Results and Discussion

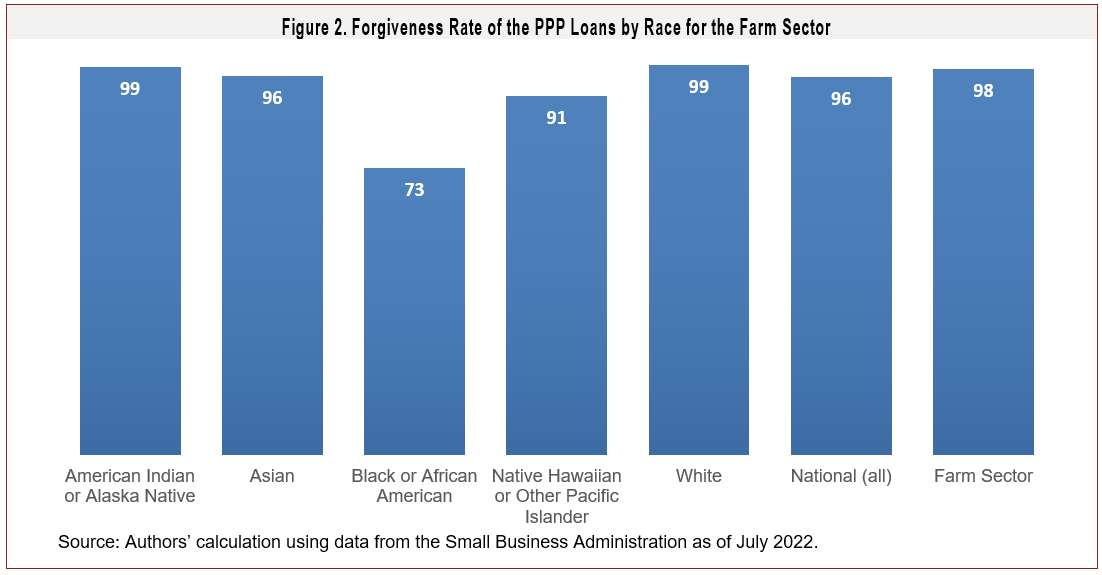

In aggregate, the rate of forgiveness for farm sector PPP loans (98%) was higher than that at the national level (96%) (SBA, 2022b). However, there was considerable heterogeneity in the loan forgiveness rate among different races within the farm sector. ANOVA tests show race to be a statistically significant factor (i.e., there was a difference in the forgiveness rates for different races when controlling for other factors) at the 1% confidence level.

Figure 2 shows that the forgiveness rate for Black or African American recipients was the lowest, at 68%. Among other races, White recipients had a higher forgiveness rate than the national forgiveness rate and farm sector rate, at 99%, although the difference is small. The remaining demographic categories had forgiveness rates lower than that of the farm sector. Native Hawaiian or other Pacific Islander, Asian, and American Indian or Alaska Native recipients of PPP loans had forgiveness rates of 88%, 94%, and 97%, respectively.

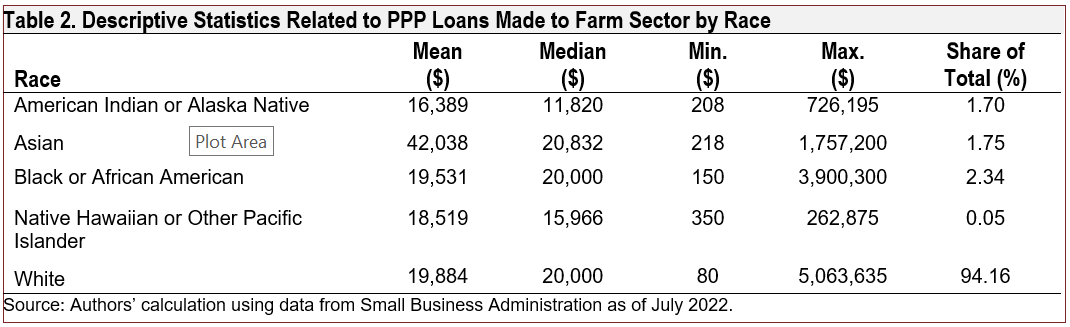

Table 2 reports descriptive statistics related to the PPP loans, differentiated by race. The average PPP loan value was lowest (highest) for Native Hawaiian or Other Pacific Islander (Asian) at $18,519 ($42,038). Average PPP loan amounts were statistically significantly different among the different racial categories. The median was lower than the mean for loans made to the Asian producers, suggesting that a few recipients received high amounts while many others received low amounts. For the remaining racial categories, the average and median values were close, suggesting less dispersion. Both the largest ($5.06 million) and the smallest ($80) PPP loans were made to white producers.

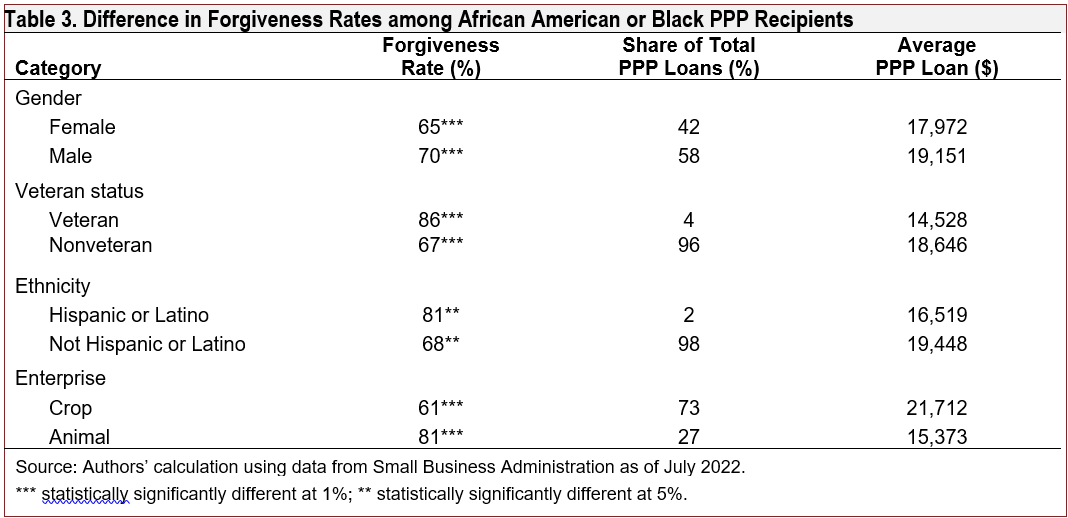

To better understand whether there was heterogeneity in the forgiveness rate among African American or Black recipients of PPP loans, we examine the difference by veteran status, gender, NAICS code or enterprise, and ethnicity. There were two possible answers for gender (female-owned or male-owned), NAICS (crop or animal sector), veteran status (veteran or nonveteran), and Hispanic status (Hispanic or non-Hispanic). Table 3 shows that the forgiveness rate across gender, veteran status,ethnicity, and enterprise varied significantly among African American recipients. The lowest rate of forgiveness was for the crop sector at 61%, even though almost three-fourths of total PPP loans went to that sector. The animal sector had a higher forgiveness rate at 81%. African American livestock producers received lower PPP loans ($15,373) compared with crop sector recipients ($21,712).

Table 3 also shows that farm operations owned by African American males had a higher rate of PPP loan forgiveness (70%) compared with farm operations owned by African American females (65%). Male recipients also had higher average PPP loan values ($19,151) compared with female recipients ($17,972). Additionally, 42% of PPP loans to African American farmers went to female-owned operations and the remaining, 58%, went to male recipients.

Conclusion

The USDA includes only the monetary value of forgiven PPP loans in its report of direct government payments. Unforgiven PPP loan amounts would turn into loans, which could increase the debt levels faced by some farm operations. Even though the loans made to the farm sector had a higher forgiveness rate compared to all PPP loans, there was still considerable heterogeneity in forgiveness based on the race of the recipient. In particular, African American or Black recipients had the lowest forgiveness rate. Further investigation of the forgiveness rate within Black or African American farm sector recipients showed male, veterans, Hispanic, or livestock producers fared better than those with the opposite characteristics (female, nonveterans, non-Hispanic, crop producers). Finally, with the exception of the gender category, average loan values were higher for the demographic categories that had lower forgiveness rates (nonveterans, non-Hispanic, crop producers).

There are multiple limitations of this study because of a lack of data on why loans were not forgiven, and we do not make any claims about the causes of the differences in loan forgiveness rates. In addition, this study only examines the forgiveness rate of PPP loans by race to the farm sector. Further, some recipients might not have met the requirements for forgiveness, which were stated when loans were disbursed by the SBA. However, there are multiple avenues to pursue further research, including examining the causality of loan forgiveness based on different characteristics, the geographical distribution of PPP loans and forgiveness rates along with the racial identification by PPP loan recipients, the share of loan disbursement by race, and the further breakdown of loans and forgiveness rates by NAICS subcode.

1The SBA defines small businesses by firm revenue (ranging from $1 million to over $40 million) and by employment (from 100 to over 1,500 employees).

Atkins, R., L. Cook, and R. Seamans. 2022. “Discrimination in Lending? Evidence from the Paycheck Protection Program.” Small Business Economics 58: 843–865.

Bolton, P., and D.S. Scharfstein. 1996. “Optimal Debt Structure and the Number of Creditors.” Journal of Political Economy 104(1): 1–25.

Couch, K.A., R.W. Fairlie, and H. Xu. 2020. “Early Evidence of the Impacts of COVID-19 on Minority Unemployment.” Journal of Public Economics 192: 104287.

Cowan, B.W. 2020. “Short-Run Effects of COVID-19 on U.S. Worker Transitions.” Working Paper No. w27315, National Bureau of Economic Research.

Fairlie, R. 2020. “The Impact of COVID-19 on Small Business Owners: Evidence from the First Three Months after Widespread Social-Distancing Restrictions.” Journal of Economics & Management Strategy 29(4): 727–740.

Gaku, S.A., J. Ifft, and L. Byers. 2022. “Farm Loan Concentration and Financial Risk.” Paper presented at Agricultural Applied Economics Association virtual annual meeting, July 31–August 2.

Giri, A.K., T.M. McDonald, D. Subedi, and C. Whitt. 2021. “COVID-19 Working Paper: Financial Assistance for Farm Operations and Farm Households in the Face of COVID-19.” AP-090, U.S. Department of Agriculture, Economic Research Service.

Giri, A.K., D. Subedi, and K. Kassel. 2022. “Analysis of the Payments from the Coronavirus Food Assistance Program and the Market Facilitation Program to Minority Producers.” Applied Economic Perspectives and Policy..

Giri, A.K., D. Subedi, E.W.F. Peterson, and T.M. McDonald. 2021. “Impact of the Paycheck Protection Program on U.S. Producers.” Choices 36(3): 1–7.

Green, D., and E. Liu. 2021. “A Dynamic Theory of Multiple Borrowing.” Journal of Financial Economics 139(2): 389–404.

Grotto, J., Z.R. Mider, and C. Sam. 2020, July 30. “White America Got a Head Start on Small-Business Virus Relief.” Bloomberg. Available online: https://www.bloomberg.com/graphics/2020-ppp-racial-disparity/

Kirwan, H. 2021, June 11. “Wisconsin Judge Halts Federal Loan Forgiveness for Farmers of Color.” Wisconsin Public Radio. Available online: https://www.wpr.org/wisconsin-judge-halts-federal-loan-forgiveness-farmers-color

Montenovo, L., X. Jiang, F.L. Rojas, I.M. Schmutte, K.I. Simon, B.A. Weinberg, and C. Wing. 2020. “Determinants of Disparities in Covid-19 Job Losses.” Working Paper No. w27132, National Bureau of Economic Research.

Ramirez, S. 2021, January 13. “Second Round of PPP Loans Focuses on Minority-Owned Businesses.” Chron Newspaper. Available online: https://www.chron.com/houston/article/how-to-apply-PPP-loans-application-second-round-15866895.php

U.S. Department of Agriculture. 2022a. “Inflation Reduction Act Investments in FPAC Programs.” Farmers.gov. Available online: https://www.farmers.gov/loans/inflation-reduction-investments [Accessed July 14, 2022]

U.S. Department of Agriculture. 2022b. “Data Files: US and State-Level Farm Income and Wealth Statistics.” Washington, DC: USDA Economic Research Service. Available online: https://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics/data-files-u-s-and-state-level-farm-income-and-wealth-statistics/ [Accessed September 27, 2022]

U.S. Department of Agriculture. 2022c. “Webinar: Farm Income and Financial Forecasts, September 22 Update.” Washington, DC: USDA Economic Research Service. Available online: https://www.ers.usda.gov/conferences/webinar-farm-income-and-financial-forecasts-september-2022-update/ [Accessed on September 1, 2022].

U.S. Small Business Administration (SBA). 2022a. “PPP Loan Forgiveness.” Available online: https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/ppp-loan-forgiveness [Accessed February 23, 2022]

U.S. Small Business Administration (SBA). 2022b. “Forgiveness Platform Lender Submission Metrics.” Available online: https://www.sba.gov/sites/default/files/2022-07/2022.07.17_Weekly Forgiveness Report_Public-508.pdf [Accessed July 21, 2022]