Despite claims of economic impact by local and regional food system promotors, sufficient data have only recently become available to directly assess the contributions of these food systems to various community-based goals. Consumer research on local food shoppers has shown that the perceived benefits from buying local are aligned with quality, expectations of fair returns to farmers, preserved farmland, fair treatment of workers, and general economic benefits to communities (Onozaka, Nurse, and Thilmany McFadden, 2010). This would suggest that consumers purchasing locally branded food differentiate it from conventionally produced foods due to the additional attributes associated with the locally produced items and therefore are willing to pay a higher price for the items. Arguments that suggest local food systems are inefficient due to comparative advantages (Lusk and Norwood, 2011) assume perfect substitution between local and conventional foods.

Numerous economic impact analyses have been performed on various dimensions of local and regional food systems (see Box 1). These analyses provide welcome insight into potential job creation and other economic benefits from small-scale, locally, or regionally branded food production, but they provide little detail about how farmers’ decisions and management practices affect farm and ranch profitability. We summarize recent work focused on the workforce and farm financial performance implications of local food initiatives, providing insight into why positive economic impacts might arise from a particular producer operating in this niche.

Producers’ marketing choices and management practices should be key elements that inform policies and programs supporting local and regional food system initiatives. For example, local decision makers may better utilize public funds by understanding management decisions of successful producers in local markets. Accordingly, we use results from an analysis of U.S. Department of Agriculture’s (USDA) Agricultural Resource Management Survey (ARMS) 2013 data to examine patterns among the roughly one thousand usable responses from participants selling in direct-to-consumer (DTC) and/or intermediated markets. In this paper, DTC sales are sales of products by the farmer to the final consumers such as farmers’ market sales, CSAs, or farm stands. Intermediated sales are those sold directly to retail establishments (e.g., restaurants, grocery stores), institutions (e.g., schools, hospitals), or distributors (e.g., food hubs). The ARMS data have limitations given the relatively small sample size (there are nearly 18,000 total responses annually in the ARMS survey; while the sample frame is meant to be nationally representative across all farms, it is not nationally representative across farms producing for local channels). However, ARMS data do allow us to examine local marketing channels across regions and with a much larger sample size than previously available. This is a significant advantage over much of the previous research, which has relied upon geographically and/or observationally limited samples. The results discussed below provide critical, generalized insights into producers operating in the local and regional food niche.

Overall, the articles summarized here show that local food producers spend proportionately more on labor, other variable expenses (including hand tools, supplies, and farm shop power equipment; other unrecorded expenses; and vehicle registration fees) and utilities than do commodity producers; moreover, as scale of production increases, labor’s share of variable costs also increases. An implication of these findings is that local food production may create jobs as well as stimulate proportionately larger spillover impacts on the local economy than nonlocal production. The results show that profitable local food producers exist across all sales classes and market channels, signaling there are viable business models for a variety of farms and ranches to pursue within this niche. Finally, analysis focusing on the most profitable producers sheds light on what types of business models enable producers to flourish in this market segment and provide guidance for future programming and policies.

Source: USDA 2013 Phase III ARMS.

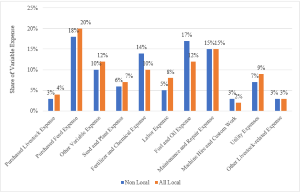

To explore patterns of viability and profitability among local food producers, we first divided 2013 USDA ARMS data into nonlocal and local subsamples to compare the average expenditure patterns of each (Figure 1; Thilmany et al., 2018). Not surprisingly, local producers were, on average, different from nonlocal producers. Unfortunately, the small sample size of local food producers in ARMS limited our ability to further divide the local sample by commodity. Additionally, ARMS does not collect data by marketing function (e.g., time and materials used for packaging or labeling, time spent retailing at a farm stand or farmers’ market), which might explain differences in expenditures between local and nonlocal producers.

Average values were statistically different across several expense categories: Fertilizer and chemical and fuel and oil expenses were found to be lower, on average, among local producers. Higher average expenses for local food producers include labor, utilities, and other variable expense. Since local producers tend to be less mechanized and use sustainable agricultural practices (like organic fertilization and pest management), it is not surprising that nonlocal producers spent more on average for fertilizer and chemicals and fuel than local producers. However, it was interesting to discover that local producers spend proportionately more on some categories, specifically labor, since labor payrolls may have larger economic implications for the community.

Source: USDA 2013 Phase III ARMS.

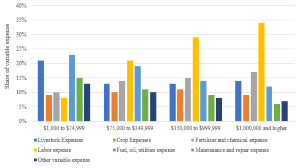

Perhaps most surprising, particularly when compared to conventional agricultural systems, labor expenditures as a share of total variable costs increase as sales increase (shares of variables costs, rather than levels of labor costs, were used to control for scale effects). As Figure 2 illustrates (Thilmany et al., 2018), labor expenses increase their average share of total variable costs as sales grow, going from less than 10% of variable costs in the <$75,000 sales category to nearly 35% of variable costs among those with >$1,000,000 in sales.

Of note, labor expenses in ARMS capture hired labor and do not include unpaid labor from family members or owners (which is typical for many small enterprises). This likely explains, at least in part, why labor costs rise with local food producer sales. This appears to be consistent with other research that shows increased utilization of labor in nonproduction activities among local producers (King et al., 2010) and higher wages paid by local producers (suggesting that the labor provided is either more specialized or more skilled than conventional agricultural producers; Jablonski, Bauman and Thilmany McFadden, unpublished manuscript, 2018).

In addition to the higher percentage of variable costs on labor, analysis of USDA ARMS data also shows relatively high average wage rates for employees of operations that sell through local markets. This is likely due to the integration of marketing and distribution functions requiring higher skilled workers. Further, though average wages are slightly higher in metro areas ($26 vs. $23 and $21 in metro-adjacent and nonmetro areas, respectively; Jablonski et al., unpublished manuscript, 2018), there are no significant differences between metro (urban) and nonmetro (rural) farm locations. For comparison, Marré (2017) showed that rural median earnings ranged from 75% to 93% of urban median earnings, depending on education level, while Cromartie (2017) found that rural median household income was 25% lower, on average, than urban median household income. Accordingly, the lack of significant differences in wage rates in urban and rural local food farms is unexpected.

It is important to understand whether these differing business models and the choice to pay higher wages to employees allow local producers to be financially viable. Profitability is a key metric for evaluating financial performance; because of the diverse number and type of producers who sell to local food markets, we divided farms in each sales category farms into quartiles using return on assets (ROA), calculated as net income divided by the value of assets the farm owns, so that higher percentages indicate that a producer is more effective at utilizing his or her assets to create profits. Again, the small sample size only allows us to categorize data by market channel and sales categories; for many commodities, there was not enough data to make useful comparisons.

Source: USDA 2013 Phase III ARMS.

Table 1 reports the mean value of ROA for each quartile, sales class, and marketing channel. One can see that scale does matter, since ROA generally increases as sales increase. However, every market channel and sales category has at least one profitable quartile, yielding a minimum of 4% to a maximum of 39% ROA. The fact that all of the farms in the 3rd quartile essentially reported 0 average profits indicates that these farms were roughly breaking even. Thus, 50% of farms and ranches selling through local food markets, regardless of scale, appear to break even. Further, strong ROA in the highest performing quartile (quartile 4) across all sales classes and market channels is particularly notable in an industry characterized by low profit margins; average rates of return for conventional agriculture between 1960 and 2001 were estimated to range from −0.76% to 10.19% (Erickson, Moss, and Mishra, 2004).

Source: USDA 2013 Phase III ARMS.

Source: USDA 2013 Phase III ARMS.

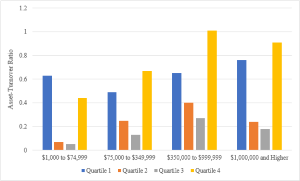

While ROA is a useful measure of profitability, asset turnover and business debt-to-asset ratios are also useful in examining patterns among managerial choices and their impacts on business performance. Asset-turnover ratios, measured as total sales divided by total value of assets, measure a farmer’s ability to convert his or her owned assets into sales (Figure 3). These values are sensitive to the application of one or more business strategies, such as leasing rather than owning assets (e.g., land and equipment rentals), strong customer loyalty and markets that allow for higher pricing, or adopting intensely managed production models (e.g., succession planting, season extension, or full carcass utilization for livestock).

Higher asset turnover values suggest that the farmer is more effective in generating sales for a given level of assets. Not surprisingly, except for the category of farms with less than $75,000 in sales, the highest performing farms (i.e., those with the highest ROA) also had the highest asset turnover values.

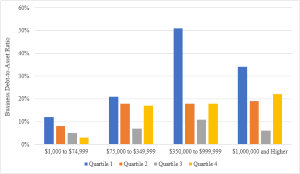

The bimodal nature of the asset-turnover ratio (Figure 3) suggests that both the least (quartile 1) and most (quartile 4) profitable farms were good at generating sales from their assets. However, the asset-turnover ratio does not integrate costs. Accordingly, it may be that the lowest performing farms have large debt burdens and interest payments from buying equipment, so profits may still be low. This seems reasonable given the higher debt-to-asset ratios carried by the least performing quartiles across sales categories (Figure 4). In contrast, more profitable farms may lease, purchase used equipment, or no longer make payments on land or equipment, thereby decreasing cost burdens.

Interesting patterns emerged in debt usage across the groups (Figure 4). Namely, within sales class average debt ratios were highest among the 1st and 4th quartiles, signaling that the worst and best performing producers used the most debt. One could imagine two different uses for such debt: Among top performers, debt may allow them to continue to grow and expand into new markets. For lower performers, debt may help cover cashflow shortfalls if expenses persistently outweigh sales.

Beyond financial ratios, we explore the efficiency of local food producers when controlling for other important factors: scale, costs, and producer characteristics. Using a more rigorous statistical approach (efficiency frontier analysis), we identified farm management decisions that are most likely to increase a farm’s profitability. In brief, efficiency frontier analysis is a technique that compares all farms in a sample to the most profitable farms. This is done to identify differences between the two groups, isolating the impact of one factor while all others are held constant. For example, we can evaluate the impact of the choice of market channel on economic efficiency while holding scale, primary commodity, and operator characteristics constant. While the above results suggest that there are profitable opportunities for local producers across scale and marketing channel, we found that scale (measured as gross cash farm income) is the largest contributor to profitability for direct marketing producers. Although it is possible to be profitable at any scale, being larger makes an operation more likely to be profitable. Other operator decisions that could improve profitability included (in descending order of relative impact on profitability) decreasing total variable costs, decreasing share of land ownership, and decreasing labor expenses. Interestingly, changing marketing channels (i.e., changing from DTC only to intermediated markets only, or vice versa, or engaging both channels) was not a statistically significant driver of profitability after controlling for the other factors.

Farm viability is important to many, but the broader impacts to the communities where farms are located is important because of its broader reach and connections to rural development. The differences in expenditure patterns between local and nonlocal producers reported here are consistent with what Jablonski and Schmit (2015) found in New York state and have potentially interesting implications for economic development. As one example, local producers are not only paying higher wages on average—potentially creating jobs that pay livable wages (especially for the $350,000 and more sales classes)—but they may also be indirectly increasing household spending in the local economy. This spending may ultimately increase demand for goods and services throughout the local economy. While there is evidence that these differential spending patterns will have an impact, the size of the impact may be small overall (e.g., Gunter and Thilmany, 2012; Hughes and Isengildina-Massa, 2015; Hughes et al., 2008; Jablonski, Schmit, and Kay, 2016; Schmit, Jablonski, and Mansury, 2016; Swenson, 2010).

Other research (e.g., Winfree and Watson, 2017; Rossi, Johnson, and Hendrickson, 2017) has found that “buying local” or local food production can have a greater proportionate impact on the local economy than conventional retail/production when certain conditions are met. However, not all local and regional food sales will contribute equally to community economic development. As mentioned previously, not all local and regional producers are profitable. The results presented in Table 1 suggest that marketing channel decisions can affect producers’ profitability. Local and regional production operations tend to be smaller than nonlocal operations. While proportionate expenditures might be higher, local producers’ actual expenditure levels are likely smaller than those of their nonlocal counterparts.

This summary of research on farms and ranches that participate in local and regional food sales paints an interesting picture. These markets may influence farm performance, labor markets, and broader contributions to the local economy. By maintaining profitable businesses, local producers make economic contributions through their local business expenditures and tax payments. Perhaps more importantly, there is evidence that they create jobs for community members that pay competitive wages relative to less skilled agricultural labor work.

There is also evidence that sales through intermediated markets could bolster profitability. Encouraging institutional purchasing by governments (such as farm-to-school or food sales to hospitals and prisons) or supporting initiatives that foster food hub development to aggregate and distribute food from small and mid-scale producers may lead to higher economic impacts than public actions that support only DTC sales, like a farmers’ market pavilion.

A share of local producers has adopted a profitable model of lean growth through renting or leasing land and equipment. Such strategies may be useful for smaller or less financially established farmers and ranchers selling through local food markets, helping to establish and position themselves for longer-term growth. Moreover, strategies that balance low or slower asset accumulation (such as land use policies that allow production on small plots of public land or establishing equipment-sharing organizations) while also coaching on the wise use of debt may align with increased profitability among local food producers.

Bauman, A., D. Thilmany McFadden, and B.B.R. Jablonski. 2018. “The Financial Performance Implications of Differential Marketing Strategies: Exploring Farms That Pursue Local Markets as a Core Competitive Advantage.” Agricultural and Resource Economics Review: in publication process.

Bauman, A., D. Thilmany McFadden, and B.B.R. Jablonski. 2017. “Evaluating Scale and Technical Efficiency among Farms and Ranches with a Local Market Orientation.” Renewable Agriculture and Food Systems: in publication process.

Cromartie, J. 2017. Rural America at a Glance, 2017 Edition. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Information Bulletin 182, November.

Erickson, K.W., C.B. Moss, and A.K. Mishra. 2004. “Rates of Return in the Farm and Nonfarm Sectors: How Do They Compare?” Journal of Agricultural and Applied Economics 36(3): 789–795.

Gunter, A., and D. Thilmany. 2012. “Economic Implications of Farm to School for a Rural Colorado Community.” Rural Connections 6: 13–16.

Hughes, D.W., and O. Isengildina-Massa. 2015. “The Economic Impact of Farmers’ Markets and a State Level Locally Grown Campaign.” Food Policy 54: 78–84.

Hughes, D.W., C. Brown, S. Miller, and T. McConnell. 2008. “Evaluating the Economic Impact of Farmers Markets Using an Opportunity Cost Framework.” Journal of Agricultural and Applied Economics 40(1): 253–265.

Jablonski, B.B.R., A. Bauman, and D. Thilmany McFadden. 2018. “Exploring the Underlying Economics of Local Food Producers: Opportunities for Rural Economic Development.” Unpublished manuscript.

Jablonski, B.B.R., and T.M. Schmit. 2015. “Differential Expenditure Patterns of Local Food System Participants.” Renewable Agriculture and Food Systems 31(2): 139–147.

Jablonski, B.B.R., T.M. Schmit, and D. Kay. 2016. “Assessing the Economic Impacts of Food Hubs on Regional Economies: A Framework That Includes Opportunity Cost.” Agricultural and Resource Economics Review 45(1):143–172.

King, R., M.S. Hand, G. DiGiacomo, K. Clancy, M.I. Gomez, S.D. Hardesty, L. Lev, and E.W. McLaughlin. 2010. Comparing the Structure, Size, and Performance of Local and Mainstream Food Supply Chains. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Research Report ERR-99, January.

Lusk, J. L. and F. B. Norwood. 2011. “The Locavore’s Dilemma: Why Pineapples Shouldn’t Be Grown in North Dakota.” The Library of Economics and Liberty, January. Available online: https://www.econlib.org/library/Columns/y2011/LuskNorwoodlocavore.html

Mann, J., S. Miller, J. O’Hara, L. Goddeeris, R. Pirog, and E. Trumbull. 2018. “Healthy Food Incentive Impacts on Direct-to-Consumer Sales: A Michigan Example.” Journal of Agriculture, Food Systems, and Community Development 8(1): 97–112.

Marré, A.W. 2017. Rural Education at a Glance, 2017 Edition. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Information Bulletin 171, April.

Onozaka,Y., G. Nurse, and D. Thilmany McFadden. 2010. “Local Food Consumers: How Motivations and Perceptions Translate to Buying Behavior.” Choices 25(1): 1–6.

Rossi, J.D., T.G. Johnson, and H. Hendrickson. 2017. “The Economic Impact of Local and Conventional Food Sales.” Journal of Agricultural and Applied Economics 49: 555–570.

Schmit, T.M., B.B.R. Jablonski, and Y. Mansury. 2016. “Assessing the Economic Impacts of Local Food System Producers by Scale: A Case Study from New York.” Economic Development Quarterly 30: 316–328.

Swenson, D. 2010. Selected Measures of the Economic Values of Increased Fruit and Vegetable Production and Consumption in the Upper Midwest. Ames, IA: Iowa State University Leopold Center for Sustainable Agriculture Publication.

Swenson, D. 2011. The Regional Economic Development Potential and Constraints to Local Foods Development in the Midwest. Ames, IA: Iowa State University Leopold Center for Sustainable Agriculture.

Thilmany, D., A. Bauman, B.R.R. Jablonski, and D. Shideler. 2018. The Role of Labor and Other Variable Expenses in Local Food Markets. eXtension, Local Food Economics Fact Sheet. Available at https://www.localfoodeconomics.com/wp-content/uploads/2018/03/labor-role_3-18.pdf

Watson, P., S. Cooke, D. Kay, G. Alward, and A. Morales. 2017. “A Method for Evaluating the Economic Contribution of a Local Food System.” Journal of Agricultural and Resource Economics 42(2): 180–194.

Winfree, J., and P. Watson. 2017. “The Welfare Economics of ‘Buy Local.’” American Journal of Agricultural Economics 99(1): 971–987.