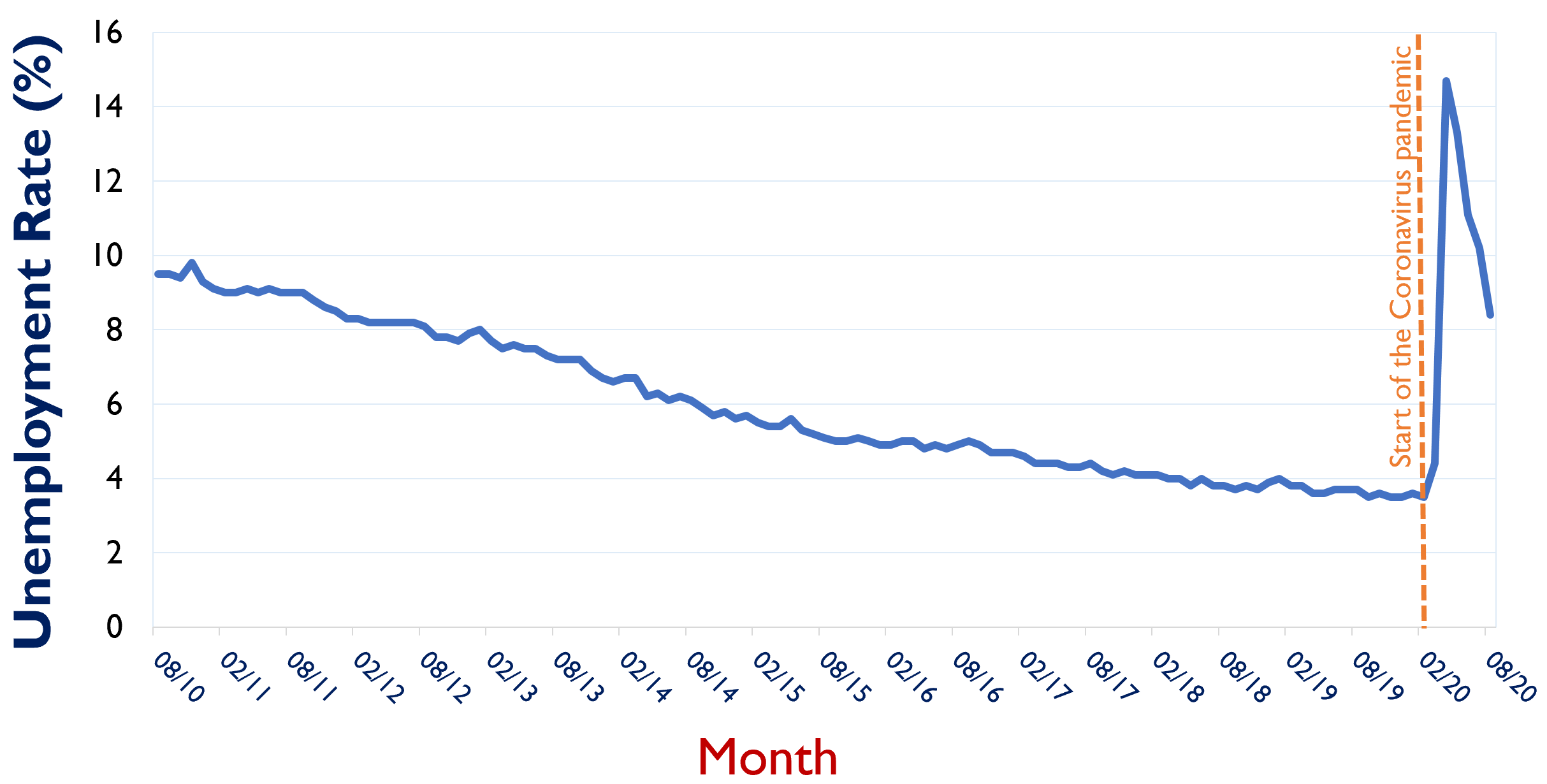

Source: U.S. Bureau of Labor Statistics (2020h).

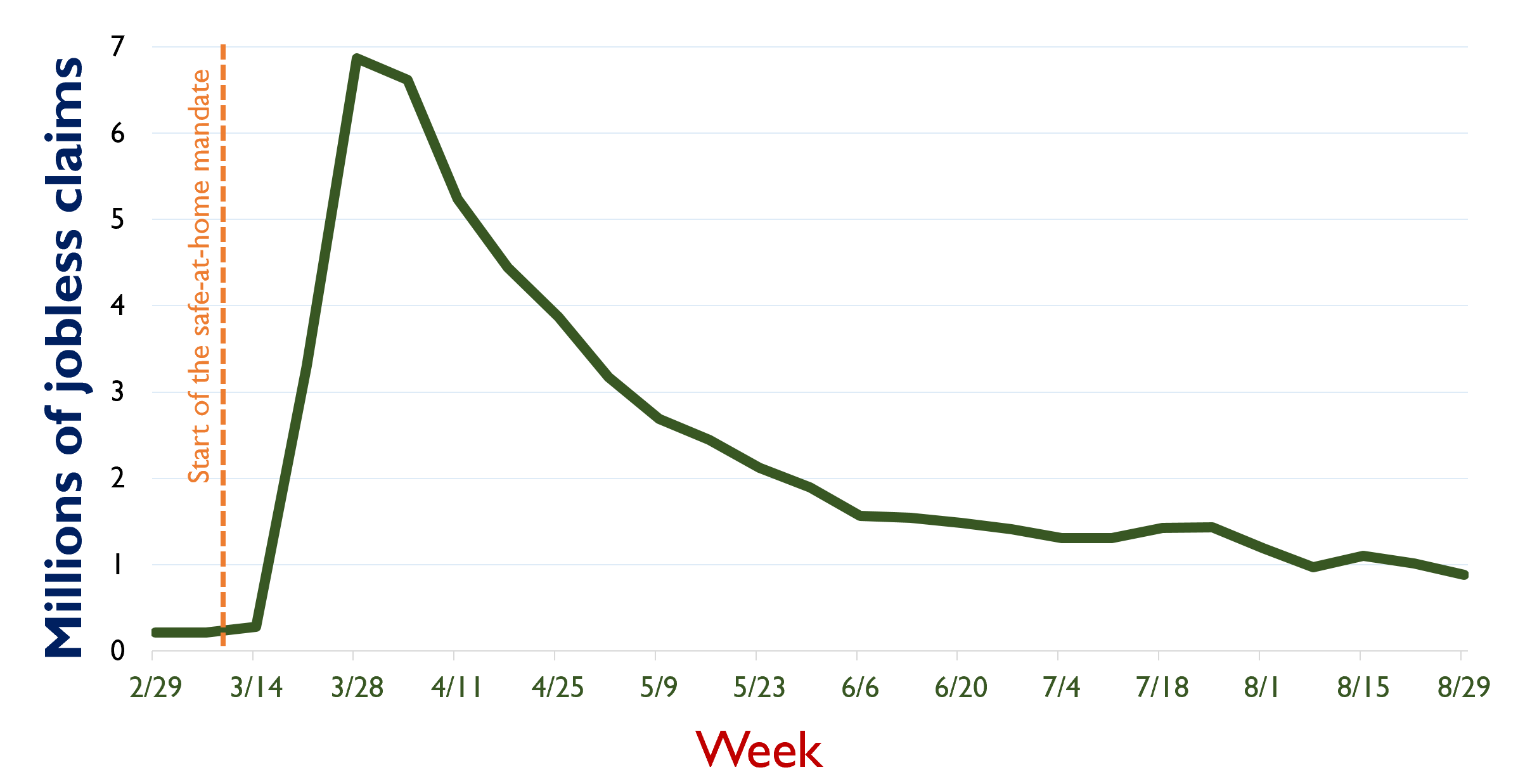

Source: U.S. Department of Labor (2020b).

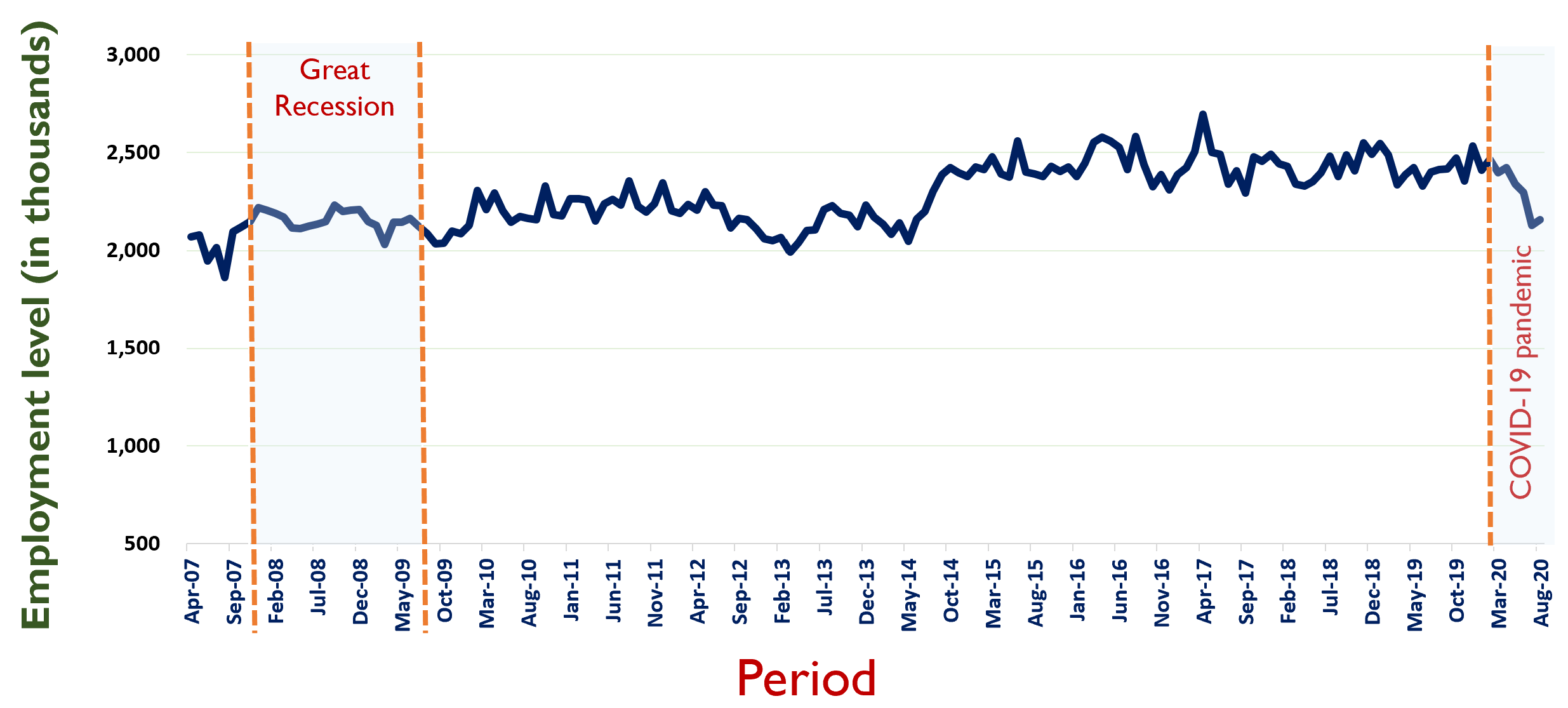

Note: The employment in agriculture is seasonally adjusted

and includes related private wage and salary workers.

Numbers are in thousands of workers.

Source: Federal Reserve Bank (2020).

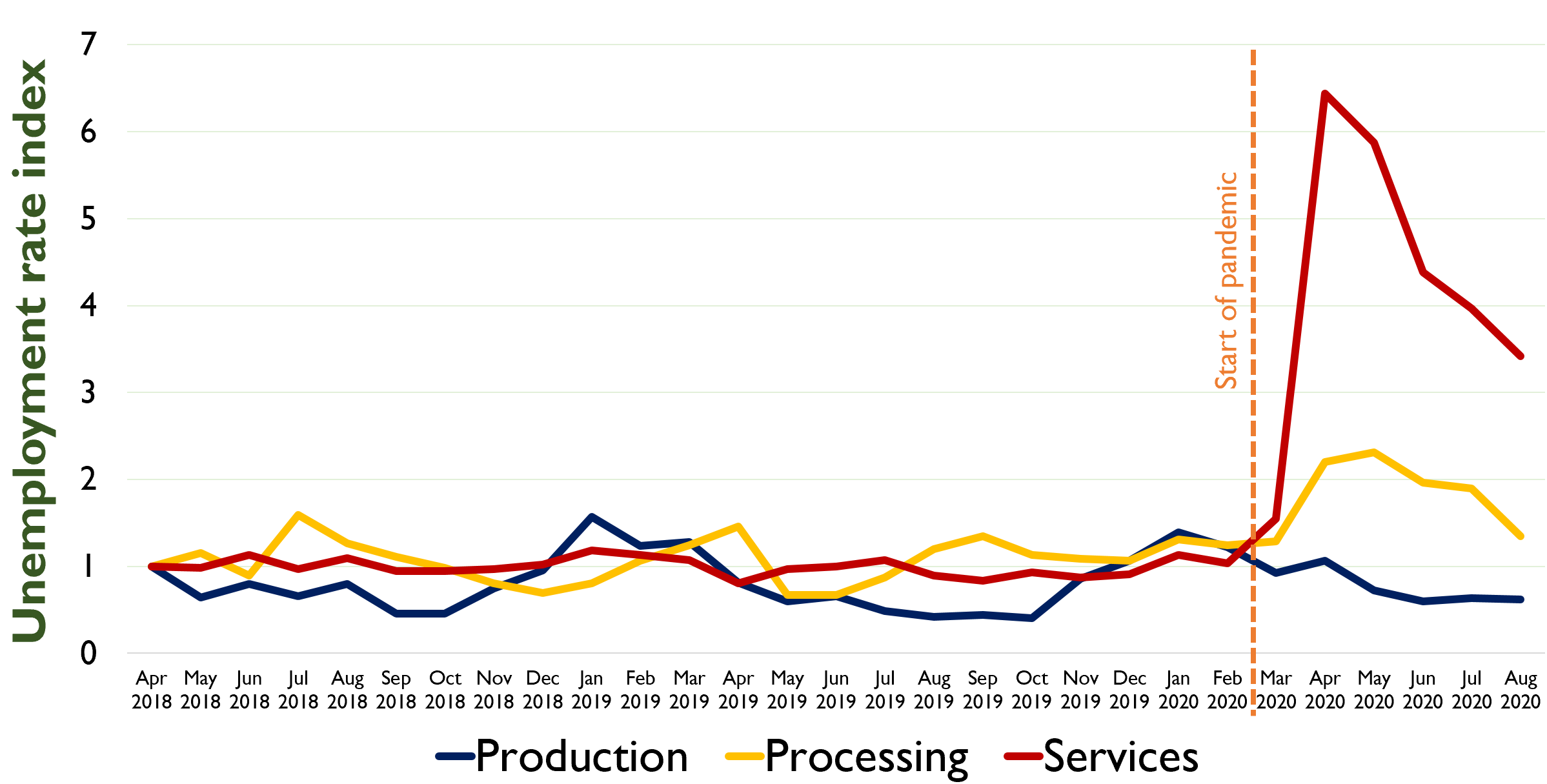

Note: The unemployment rate displayed in this figure uses

as reference April 2018.

Source: U.S. Bureau of Labor Statistics (2020e).

Since the onset of the coronavirus pandemic and the subsequent lockdown mandates, unemployment has surged in almost every sector of the economy. The U.S. unemployment rate rose from 3.5% in February 2020 to 14.7% in April 2020 (Figure 1). Consequently, 50 million individuals applied for unemployment benefits in the 16 weeks prior to July 4 (Figure 2). However, as several states began lifting stay-at-home orders and allowed business activities to resume, the number of weekly filings saw a steady decline, leading the unemployment rate to fall to 8.4% by the end of August.

The labor impact of COVID-19 is unique for each major sector of the economy (U.S. Bureau of Labor Statistics, 2020j). Manufacturing and service industries have been severely affected by the lockdown directive due to slumping domestic demand and reduction of exports (Reuters, 2020b). The agriculture industry, however, was declared “essential” to ensure food supply during the pandemic, keeping farm operations under social-distancing guidelines such as requiring workers to keep a distance of at least six feet between one another at work (Jordan, 2020). Figure 3 shows that the unemployment rate in the agriculture industry remained relatively unchanged.

Disaggregating agriculture into three subsectors—food services, processing, and production—shows that the impact varies within this industry. Figure 4 shows the monthly unemployment rate per subsector over a two-year period, indexed to April 2018. Food services suffered the largest loss of employment, as many restaurants closed operations, leading to an increase in the unemployment rate from 5.7% in February to 35.4% in April in this subsector. Food processing (including meat processing plants) suffered job losses as COVID-19 infections spread among workers (Plumer, 2020). The effect on unemployment in the food processing sector, while not as large as in food services, was still significant as the unemployment rate increased from 5.7% in February to 10.1% in April. In contrast, food production remained relatively unaffected as demand for seasonal farmworkers and the subsector being declared “essential” by the U.S. Department of Homeland Security partially offset the unemployment effect of COVID-19 (Jordan, 2020). Between February and April, the unemployment rate for the food production subsector fell from 11% to 9.6%, a 1.4 percentage point decrease. For comparison, the unemployment rate for this subsector decreased by 3.8 percentage points during the same period in 2019. By June, as most states lifted their economic lockdowns, all three subsectors started to show signs of recovery. The unemployment rate reported for August was down to 18.8% in food services, 6.2% in food processing, and 5.6% in food production.

This article reports how COVID-19 and the subsequent economic lockdowns have influenced employment in each of the three subsectors of agriculture. In addition, we describe the employment situation in three of the highest-impacted nonfarm sectors (i.e., healthcare, education, and professional and business services). We also outline the federal government response to the COVID-19-related unemployment issues and the heterogeneous impact on employment by race and ethnicity and discuss implications for the future of the agriculture industry.

The food services subsector includes restaurants, catering services, food trucks, and any other industry that offers “meals, snacks, and beverages to customer order for immediate on-premises and off-premises consumption” (U.S. Bureau of Labor Statistics, 2020f). In this sector, about 5.5 million servers, chefs, cashiers and bartenders lost employment due to states’ stay-at-home or shelter-in-place regulations (Franck, 2020). This is mainly attributed to labor-force downsizing by restaurants facing lower demand as consumers shifted food expenditure to food cooked at home (Plumer, 2020). The restaurants that did not close their doors began operating at partial capacity, relying on drive-through sales or delivery to survive during the pandemic (Wida, 2020).

Food trucks that typically cater to large-scale events and crowded venues such as festivals, business centers, and college campuses were also driven to change their marketing strategies during the lockdown mandate. Thus, food trucks were driving to residential neighborhoods or turned themselves into mobile grocery stores. In addition, in order to pursue areas of high foot-traffic, many chose to locate near workplaces of essential employees, such as hospitals, and even highway rest stops to market to truck drivers (Dingwall, 2020).

Catering is defined as providing food at places and events such as sports entertainment, hotels, airlines, and cruise ships. Several prominent venues and sports leagues throughout the country temporarily shut down or canceled events due to the pandemic (Mather, 2020). Hotel caterers were severely impacted by disruptions of leisure and work-related travel. The American Hotel and Lodging Association (2020) reported that at the end of July more than half of the rooms were vacant across the U.S, an occupancy rate considered to be worse than that during the Great Depression in the 1930s. Caterers who partnered with airline companies suffered a similar fate, with widescale flight cancellations and seat capacity reduced by 70% compared to previous seasons (Whitley, 2020). The catering industry was also indirectly affected by the “no sail” government order, which calls for cruise ships to cease admitting new passengers to avoid further COVID-19 outbreaks on cruise ships (Centers for Disease Control and Prevention, 2020).

Food processing was also severely affected by the pandemic, albeit to a lesser extent than food services. Although processing plants were required to continue production under the Defense Production Act (which mandates facilities that are considered essential to continue their operations during the pandemic) the unemployment rate almost doubled, from 5.7% in February to 10.6% in May (U.S. Bureau of Labor Statistics, 2020e). This can be partially attributed to a high risk of COVID-19 infection among workers (Restuccia and Bunge, 2020; Associated Press, 2020).

To prevent the spread of COVID-19 infections, most states have mandated social distancing in the workplace (Johansson, 2020). However, many stages in meat processing, such as separating organs and cutting and packaging meat, require employees to work in close proximity, which makes it difficult to implement social distancing regulations. Further, certain jobs cannot apply safety precautions efficiently due to the nature of the task. For instance, cleaners at a processing plant may inevitably get their masks wet, forcing workers to take them off and put themselves at risk (Bagenstose, Chadde, and Wynn, 2020).

These factors have caused processing plants to represent a large share of the COVID-19 cases in their respective counties, prompting facility closures by several large processors. A prominent example is Smithfield Foods, which temporarily closed its South Dakota meatpacking facility. This location processes 5% of the U.S. pork production (Huber, 2020). They resumed operations in May 2020 after approval by the Centers for Disease Control and Prevention, which helped to avoid pork shortages (Smithfield Foods, 2020). The seafood preparation and packaging industry faced a similar situation, with several seafood processors shutting down operations to avoid further COVID-19 outbreaks (Chase, 2020). Since the reopening of the economy in phases, seafood processors have been allowed to continue their operations as long as precautions are taken, workers are asymptomatic, and no more COVID-19 infections are recorded (Centers for Disease Control and Prevention, 2020).

Munshi (2020) reported dwindling inventory levels at cold-storage facilities that showed existing inventories amounting to only two weeks’ worth of the nation’s beef, pork, and poultry meat production. Thus, the closure of processing plants spurred fears of a possible meat shortage (Corkery and Yaffe-Bellany, 2020). On April 28, 2020, Restuccia and Bunge announced that meat production had decreased by 24.5% for the week ending April 25 compared to the previous week. To avoid possible shortages, a few large retailers set limits on the quantity of meat products that consumers were allowed to purchase during each visit while some fast food establishments opted not to sell products containing beef (Corkery and Yaffe-Bellany, 2020). However, the situation has received some relief due to the President invoking the Defense Production Act. By early June, various meat processing plants were operating at 95%–98% capacity (USDA, 2020).

Some processing companies have provided cash incentives to motivate employees to keep working. However, labor shortages continue to be substantial (Restuccia and Bunge, 2020). Some states have encouraged plants to reopen operations after a complete disinfection of the facility and to provide infected workers a reasonable time to recover before returning to work (Huber, 2020). Additionally, food manufacturers are incorporating new safety measures for their workforce, such as risk assessment, designating groups of workers (cohorts) for easier identification of an outbreak source, contact tracing, plastic barriers between workers at close range, slower production speeds to enable social distancing on conveyor lines, access to facemasks, education programs, and temperature checks (Bagenstose, Chadde, and Wynn, 2020; Chase, 2020; Huber, 2020). Nevertheless, restoring pre-quarantine production levels will take time.

The pandemic has added unexpected challenges to farmers. State social distancing mandates have decreased efficiency in labor activities (Newman, 2020). Farms hosting foreign guest workers under the H-2A program have faced additional costs as many growers must rent hotel rooms to quarantine workers or family members exposed to the virus (Newman, 2020). Despite these challenges, farm production has been least affected by the COVID-19 pandemic relative to other subsectors (Figure 4). This can be partially attributed to farm production being declared an essential activity needed to ensure food supply (Jordan, 2020).

| Beans | Cattle | Vegetables | Hogs | Chickens | Wheat | Rice |

| California | Texas | Texas | Texas | Texas | California | California |

| Washington | California | California | California | California | Texas | Texas |

| Minnesota | Iowa | New York | Iowa | Iowa | Illinois | Arkansas |

Note: Data as of July 4, 2020.

Source: Purdue University Department of Agricultural Economics (2020).

The impacts on food production are regionally concentrated and commodity specific. Tables 1 and 2 summarize the estimates from the Purdue Food and Agriculture Vulnerability Index (Purdue University Department of Agricultural Economics, 2020). In terms of infection among farmworkers (Table 1), California, Texas, Iowa, and New York exhibited the greatest number of agricultural workers with confirmed cases of coronavirus across most commodities included in the index as of July 2020. It should be noted that these lists have evolved rapidly as the number of cases in New York has declined and the number of cases in Texas has drastically increased. Table 2 highlights production losses provoked by labor disruptions during the pandemic for each selected commodity. At the national level, vegetables show the greatest losses (likely due to the labor-intensiveness of vegetable production), followed closely by chickens and cattle (including milking cows and calves).

| Beans | 0.63% |

| Cattle | 0.84% |

| Vegetables | 0.86% |

| Hogs | 0.81% |

| Chicken | 0.86% |

| Wheat | 0.78% |

| Rice | 0.67% |

Note: Data are as of July 4, 2020.

Source: Purdue University Department

of Agricultural Economics (2020).

Seasonal farm employment is expected to rise during the harvesting season of many commodities, raising concerns that the influx of farmworkers in rural areas may increase the virus’ spread, especially in areas where healthcare facilities tend to be limited in number and capacity. Production of labor-intensive commodities, such as fruits and vegetables, is expected to be the “potential” driver of COVID-19 infections in these areas, especially if the product requires packaging, as short distances between workers on conveyor belt lines resembles the case of meat processing plants (Reuters, 2020a).

Farm production may also be impacted by market conditions and consumer behavior. Fear of COVID-19 outbreaks at farms can cause “panic buying” at retail stores, which can drive up food prices (Faber, 2020). This is likely to affect specific farm products because at the onset of the pandemic, “panic buying” mostly included storable commodities, not perishable farm products like strawberries, eggs, and milk. In addition, school closures and reduced capacity at restaurants induced a sharp decline in sales of perishable commodities leading to an “oversupply” in the market. This has forced growers to dispose excess production and sell the remaining products at a low price (Kesling, 2020). A similar phenomenon occurred in the dairy industry, which has a supply chain designed to work at a constant flow without disruptions (Mak, 2020). With fewer buyers and constant milk production in the short term, many dairy farmers and cooperatives were forced to dump the excess milk (Huffstutte, 2020).

Farmers are implementing a host of measures to prevent a COVID-19 outbreak among farmworkers. These measures range from investing resources for worker education about safety practices to buying their workers’ groceries for them with the aim of encouraging observance of stay-at-home orders (Farm Bureau, 2020). Some farmers are entering temporary contracts with hotels to provide housing to workers in an effort to promote social distancing (Newman, 2020). Many agribusinesses are also offering medical care and paid sick leave for farmworkers who are infected with the virus (Jordan, 2020). However, one crucial uncertainty is the duration of the pandemic. Therefore, farmers are now beginning to formulate plans and procedures to address a COVID-19 outbreak if it occurs within their businesses (Farm Bureau, 2020).

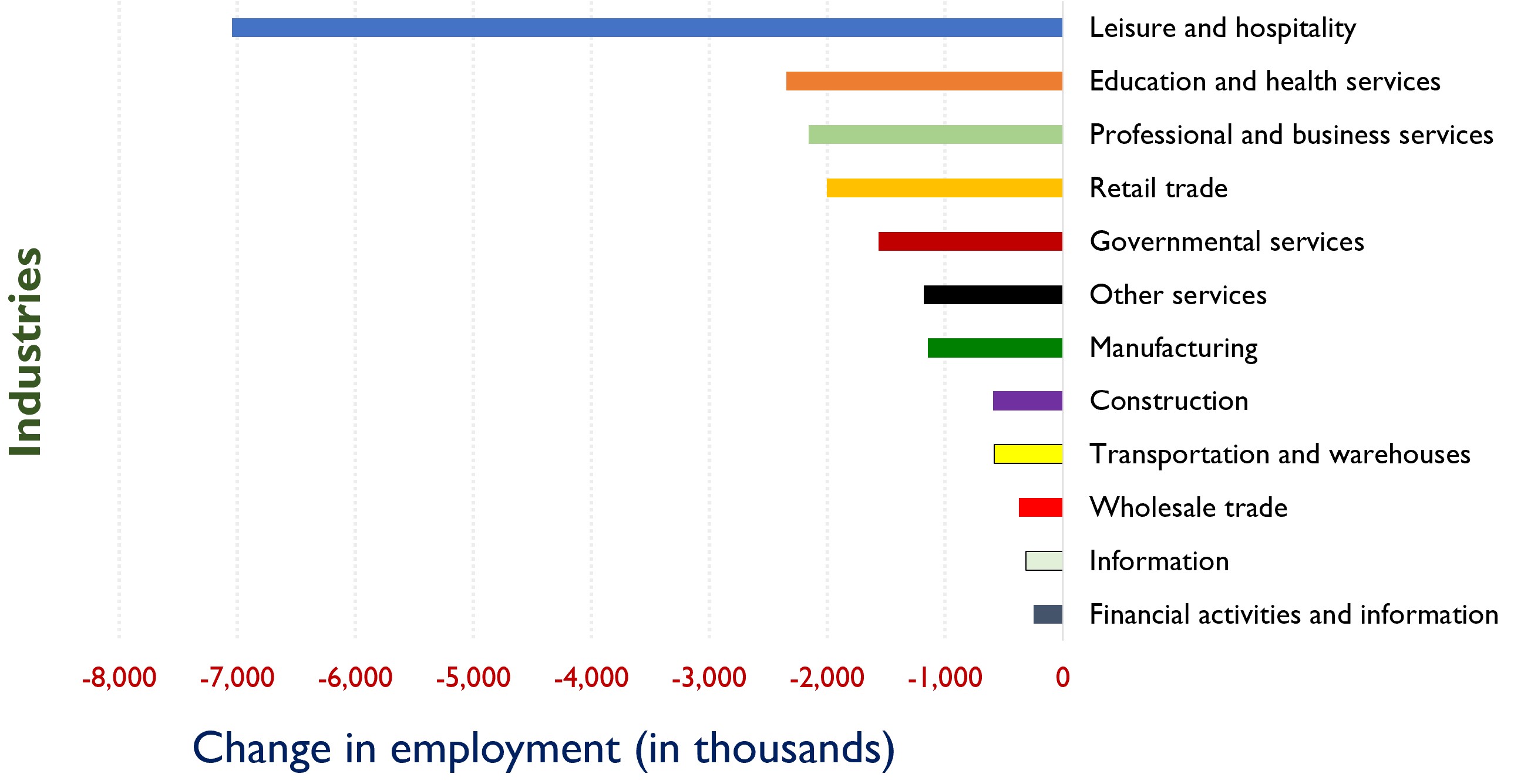

Note: The change unemployment level is seasonally adjusted

and represents the net three-month change from February to

May for every industry.

Source: U.S. Bureau of Labor Statistics (2020a).

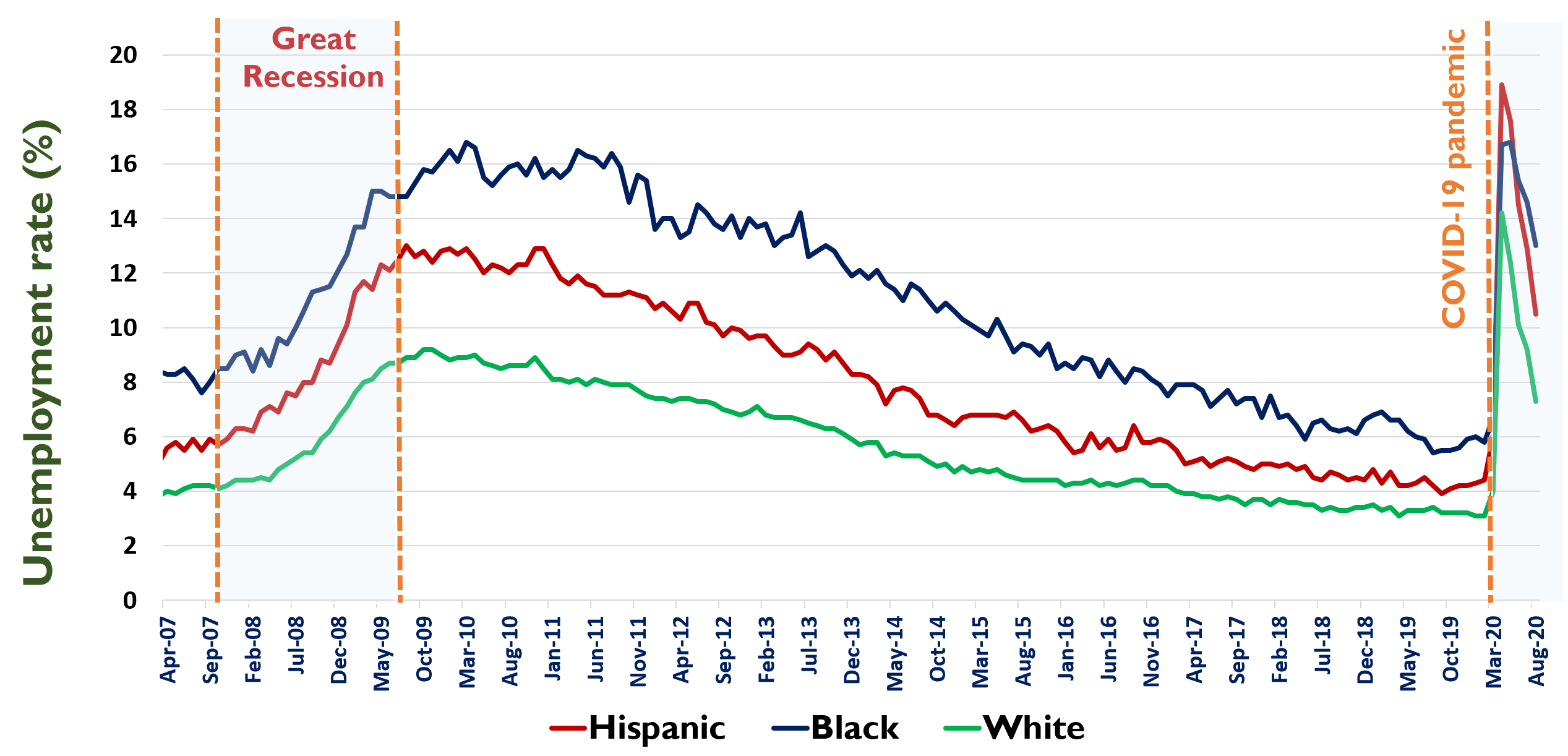

Note: The unemployment rate is seasonally adjusted for each

race and ethnicity.

Source: Federal Reserve Bank (2020).

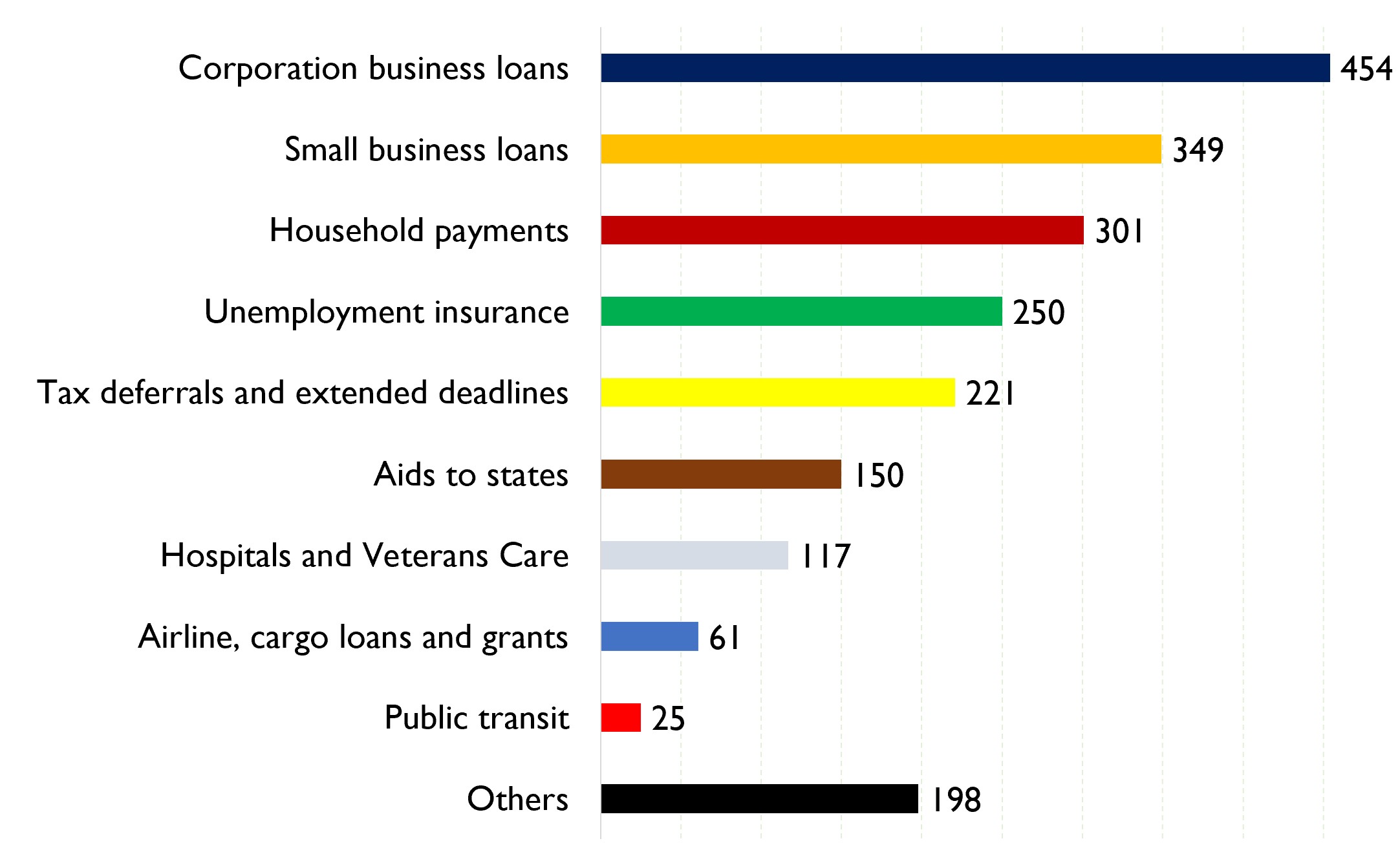

Source: Davidson and Mitchell (2020).

While the agriculture industry has been deeply affected by the COVID-19 pandemic, other sectors of the economy have also faced large spikes in unemployment. Figure 5 shows the situation for nonfarm sectors. For comparison, we explore the labor situation in three industries outside of agriculture that have been impacted most by COVID-19.

The health care and social assistance sector—which comprises hospitals, nursing homes, physician offices, and dentist offices—has seen its unemployment rate go from 2.2% in February 2020 to a peak of 10.4% in April (U.S. Bureau of Labor Statistics, 2020g). Cancelled elective surgeries and nonemergency visits due to the pandemic caused revenue losses for several hospitals and clinics (Karlamangla and Mason, 2020). About 27,000 health workers were furloughed or laid off between March and May 2020 (U.S. Bureau of Labor Statistics, 2020c). The reopening of states has allowed hospitals to perform their usual medical services. However, the number of doctor visits is slow to recover as people are afraid of exposure to COVID-19 (Howard, 2020).

Educational services—which includes K-12 schools and higher education institutions—also faced a rise in unemployment from 4.6% in March 2020 to 12.7% in April 2020 (U.S. Bureau of Labor Statistics, 2020b). Many school nurses and counselors were laid off due to budget reductions in public schools and classes moving online (Strauss, 2020).

The professional and business services subsector—which contains accountants, lawyers, engineers, and office clerks, among other professions—doubled its unemployment rate between February (4.4%) and May 2020 (9.0%) (U.S. Bureau of Labor Statistics, 2020i). In particular, almost half of these job losses during this period occurred in temporary positions (Franck, 2020).

COVID-19 has disproportionately affected unemployment among racial and ethnic minorities (Figure 6). Hispanic workers suffered the highest rise in unemployment, at 17.6% in May 2020, relative to other ethnicities (Bureau of Labor Statistics, 2020). This is attributed to the quarantine mandate that forced industries with large shares of Hispanic workers, such as hotels, restaurants and construction, to limit operations (Gogoi, 2020). In particular, Hispanic women faced a 21% drop in employment as leisure and hospitality services (food services, accommodation, arts and recreation) either closed or started operating at partial capacity (Kocchar, 2020). African Americans also faced a spike in unemployment (16.7% in April, relative to the national average of 14.7%), mainly attributed to the economic shutdown. Smialek and Tankersley (2020) reported that less than half of African American adults had jobs in April 2020.

The reopening of states is expected to reopen job positions across the nation. However, the U.S. Bureau of Labor Statistics (2020d) shows that changes in employment have not been uniform across races and ethnicities. The job situation for white Americans has started to improve, with unemployment rate decreasing from 14.2% in April to 12.4% in May 2020. In contrast, African Americans suffered a slight increase in the jobless rate, from 16.7% in April to 16.8% in May. Asian Americans also faced a rise in unemployment (+0.5%) for the same period. In August, unemployment rate for White, Black and Hispanic were reported to be 7.3%, 13.0% and 10.5%, respectively (U.S. Bureau of Labor Statistics, 2020d).

To address the economic crisis created by the pandemic, the federal government passed the Coronavirus Aid, Relief and Economic Security (CARES) Act, a $2 trillion-dollar stimulus package aimed at supporting small businesses, workers, and families (U.S. Department of the Treasury, 2020). Specifically, the CARES Act has provisions for corporate and small business loans, household payments, hospitals and veterans care, and unemployment insurance among others (Figure 7).

Funds totaling $349 billion are given to small businesses (with 500 or fewer employees) through the Paycheck Protection Program (PPP). These forgivable loans are used to support employment and payroll (Forde, 2020). A second version that was issued on June 4, titled the Paycheck Protection Program Flexibility Act (PPPFA), increased the funds of the program by $349 million. The PPPFA requires small business owners to use 60% of the loan to cover payroll costs while also extending the deadline for these expenses to be paid, giving employers more time to rehire employees (Hare, 2020). Larger businesses have access to the $500 billion fund granted through the Economic Stabilization Fund (ESF). Only U.S.-based corporations with revenues of less than $2.5 million or fewer than 10,000 employees are eligible (Forde, 2020).

The government also set up the Coronavirus Food Assistance Program, which provides $16 billion of direct payments to farmers and $3 billion to buy surplus harvests to stock food banks (Kesling, 2020). The maximum allowance is $250,000 per legal entity or person with an average annual gross income less than $900,000 in the years 2016–2018 (U.S. Department of Agriculture, 2020).

A number of relief efforts have been undertaken by the federal government to support workers affected by the COVID-19-related economic shutdown. One of the most notable provisions of the CARES Act was the “economic impact payments,” better known as stimulus checks, which provide tax credits to families depending on household income and number of household members. This program provides stimulus payments of $1,200 for a single person, $2,400 to a married couple, with an additional $500 for each dependent person younger than 17 years old as of December 31, 2020 (Consumer Financial Protection Bureau, 2020). The payment decreases incrementally for single people and married couples receiving income greater than $75,000 and $150,000 per year, respectively (Consumer Financial Protection Bureau, 2020).

The CARES Act also created the Federal Pandemic Unemployment Compensation program (FPUC), which gives an additional $600 per week in benefits for a maximum of 13 weeks to workers suffering from COVID-19-related job losses (U.S. Department of Labor, 2020a). Likewise, the Families First Coronavirus Response Act (FFCRA), broadens the coverage of the Family Medical Leave Act, adding a new paid sick leave law, and mandates private health insurers to cover COVID-19 testing (Parker and Ryan, 2020). None of these benefits are available for undocumented workers (Jordan, 2020).

A second program was discussed in Congress is the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act (U.S. Congress, 2020). With ongoing talks in Congress, the possibility and specific details of the next round of stimulus is currently uncertain.

Overall, our analysis has shown that employment in the food services subsector was most vulnerable to the economic fallout from the COVID-19 pandemic. Food processing was also impacted, although to a lesser extent than food services, driven primarily by closures at large processing plants. Farm production has so far been relatively successful at avoiding wide-scale layoffs of agricultural workers. This variation can be attributed to the nature of business at the three stages of the agricultural supply chain. While unemployment in food services is largely the product of demand-side shocks, such as restaurant and school closures, unemployment in food processing and production is related to supply-side factors such as issues of worker safety. Among nonagricultural industries, healthcare, education, and professional services were found to be the most affected. While unemployment has risen nationwide, racial and ethnic minorities were especially vulnerable to COVID-19 related layoffs, with Hispanic Americans experiencing the highest unemployment rate.

Despite the aggressive measures implemented by policy makers to combat the spread of the virus and the consequent economic fallout, a second wave of COVID-19 infections is not only possible, but it may have already begun. This is indicated by the recent uptick in the number of new daily COVID-19 cases reported by Florida, Texas, Arizona, and Oregon, among others. A second wave of infections may prolong the duration of the current economic crisis and lead to new disruptions in agricultural supply chains. While the probability and magnitude of a second wave is uncertain, the impact on employment may not be as severe as the first wave. Preventive measures taken by food processors, retailers, and producers in response to the first wave may avert large scale infections among agricultural workers. In addition, as new information about the coronavirus comes to light, proactive measures can be implemented across the supply chain to prevent, or at least slow, the spread of new COVID-19 cases in the agriculture industry.

This unprecedented crisis may have long-term implications for agriculture. For example, if higher costs of labor due to COVID-19 safety measures becomes the “new normal,” it may ultimately lead to higher food prices for consumers. Further, it may induce agribusinesses (including farms) to favor automation of production processes over manual labor, which may expedite the decades-long trend of farm and agribusiness consolidation, as smaller businesses may not be able to afford large capital investments to replace labor. Potential restrictions on temporary foreign agricultural workers may also contribute to increasing labor costs.

American Hotel and Lodging Association. 2020. COVID-19’s Impact on the Hotel Industry. Available online: https://www.ahla.com/covid-19s [Accessed September 5, 2020].

Associated Press. 2020, May 1. “Some Meat Plants Reopen, but Trump Order May Not Be Cure-All.” New York Times.

Bagenstose, K., S. Chadde, and M. Wynn. 2020, April 22. “Coronavirus at Meatpacking Plants Worse Than First Thought, USA TODAY Investigation Finds.” USA Today.

Centers for Disease Control and Prevention. 2020. CDC’s Role in Helping Cruise Ship Travelers during the COVID-19 Pandemic. Available online: https://www.cdc.gov/ [Accessed June 12, 2020].

Centers for Disease Control and Prevention. 2020, June 24. Protecting Seafood Processing Workers from COVID-19. Available online: https://www.cdc.gov/coronavirus/2019-ncov/ [Accessed June 30, 2020].

Centers for Disease Control and Prevention. 2020, June 13. Testing Strategy for Coronavirus (COVID-19) in High-Density Critical Infrastructure Workplaces after a COVID-19 Case Is Identified. Available online: https://www.cdc.gov/coronavirus/2019-ncov/ [Accessed June 30, 2020].

Chase, C. 2020, April 21. “High Liner Foods Suspends Portsmouth Plant Operations Due to COVID-19 Cases.” Seafood Source. Available online: https://www.seafoodsource.com/news/

Consumer Financial Protection Bureau. 2020, May 29. A Guide to COVID-19 Economic Stimulus Relief. Available online: https://www.consumerfinance.gov/about-us.

Corkery, M., and D. Yaffe-Bellany. 2020, April 18. “The Food Chainʼs Weakest Link: Slaughterhouses.” New York Times.

Davidson, K., and J. Mitchell. 2020, March 26. “Relief Package Would Limit Coronavirus Damage, Not Restore Economy.” Wall Street Journal.

Dingwall, K. 2020, May 18. “This Is What It’s Like to be a Food Truck Owner during COVID-19.” Forbes.

Faber, S. 2020, April 16. “What if Lots of Food and Farm Workers Get Sick at the Same Time?” EWG. Available online: https://www.ewg.org.

Farm Bureau. 2020, April 1. “Farmers Prioritize Worker Health and Safety.” American Farm Bureau Federation. Available online: https://www.fb.org/news/farmers.

Federal Reserve Bank. 2020. Current Population Survey (Household Survey). Available online: https://fred.stlouisfed.org/categories/12 [Accessed June 18, 2020].

Forde, M. 2020, April 1. “How the CARES Act Will Affect Supply Chains.” Supply Chain Dive. Available online: https://www.supplychaindive.com.

Franck, T. 2020, May 8. “Hardest-Hit Industries: Nearly Half the Leisure and Hospitality Jobs Were Lost in April.” CNBC.

Gogoi, P. 2020, May 10. “Why A Historic Wave of Latino Prosperity Is Under Threat Now.” NPR.

Hare, N. 2020, June 5. “Trump Signs New Law Relaxing PPP Rules: What You Need to Know.” Forbes.

Howard, J. 2020, April 22. “Covid-19 Fears Keep People from Hospitals, but Doctors Say Call 911 for Heart Attack and Stroke.” CNN.

Huber, M. 2020, April 13. “Smithfield Foods Closes One of Nation's Largest Pork Plants as Worker COVID-19 Cases Spike.” USA Today.

Huffstutte, P.J. 2020. “U.S. Dairy Farmers Dump Milk as Pandemic Upends Food Markets.” World Economic Forum. Available online: https://www.weforum.org/agenda/2020/04/dairy-.

Johansson, R. 2020, April 16. “Will COVID-19 Threaten Availability and Affordability of Our Food?” USDA Media Blog. Available online: https://www.usda.gov/media/blog/2020/04/16/.

Jordan, M. 2020, April 2. “Farmworkers, Mostly Undocumented, Become ‘Essential’ During Pandemic.” New York Times.

Karlamangla, S., and M. Mason. 2020, May 2. “Thousands of Healthcare Workers Are Laid Off or Furloughed as Coronavirus Spreads.” New York Times.

Kesling, B. 2020, April 26. “Coronavirus Forces Farmers to Destroy Their Crops.” Wall Street Journal.

Kocchar, R. 2020, June 9. “Hispanic Women, Immigrants, Young Adults, T

hose with Less Education Hit Hardest by COVID-19 Job Losses.” Pew Research Center. Available online: https://www.pewresearch.org/fact

Krugman, P. 2020, June 8. “Will the Jobs Report Destroy Jobs?” New York Times.

Mak, T. 2020, May 14. Millions of Pigs Will Be Euthanized as Pandemic Cripples Meatpacking Plants. NPR.

Mather, V. 2020, March 13. “Updates on Sports Canceled by Coronavirus.” New York Times.

Munshi, M. 2020, April 23. “Another Big Meat Plant Shutters with U.S. on Brink of Shortages.” Bloomberg.

Newman, J. 2020, May 3. “As Tight Living Conditions Bring Coronavirus Risks, Farms Secure Housing to Isolate Workers.” Wall Street Journal.

Parker, A.J., and A.L. Ryan. 2020, April. “A 10-Point Plan for Restaurant Employers during COVID-19 Crisis.” QSR. Available online: https://www.qsrmagazine.com/outside-insights/.

Plumer, B. 2020, April 22. “The Meat Business, a Big Contributor to Climate Change, Faces Major Tests.” New York Times.

Purdue University Department of Agricultural Economics. 2020. Purdue Food and Agriculture Vulnerability Index. Available online: https://ag.purdue.edu/agecon/Pages/.

Restuccia, A., and J. Bunge. 2020, April 28. “Trump Takes Executive Action to Keep Meat-Processing Plants Open.” Wall Street Journal.

Reuters. 2020a, June 11. “Coronavirus Spreads among Fruit and Vegetable Packers, Worrying U.S. Officials.” New York Times.

Reuters. 2020b, June 3. “U.S. Jobless Claims Dip Below 2 Million, Road to Recovery Rocky.” New York Times.

Smialek, J., and J. Tankersley. 2020, June 2. New York Times.

Smithfield Foods. 2020, May 6. Smithfield Foods to Reopen Sioux Falls, South Dakota Facility after CDC Conducts Thorough Site Inspection and Affirms Company Meets or Exceeds All Employee Health and Safety Guidance. Available online: https://www.smithfieldfoods.com/press-room.

Strauss, V. 2020, May 8. “K-12 School Leaders Warn of ‘Disaster’ from Huge Coronavirus-Related Budget Cuts as Layoffs and Furloughs Begin.” Washington Post.

USDA. 2020. June 9. America’s Meatpacking Facilities Operating More Than 95% of Capacity Compared to 2019. Available online: https://www.usda.gov/media/press-releases

U.S. Bureau of Labor Statistics. 2020a. Current Employment Statistics - CES (National). Available online: https://www.bls.gov/ces/ [Accessed June 18, 2020].

U.S. Bureau of Labor Statistics. 2020b. Educational Services: NAICS 61. Available online: https://www.bls.gov/iag/tgs/iag61.htm [Accessed June 17, 2020].

U.S. Bureau of Labor Statistics. 2020c. The Employment Situation - May 2020. Available online: https://www.bls.gov/news.release/pdf/empsit.pdf [Accessed June 17, 2020].

U.S. Bureau of Labor Statistics. 2020d. Employment Status of the Civilian Population by Race, Sex, and Age. Available online: https://www.bls.gov/news.release/empsit.t02.htm [Accessed September 5, 2020].

U.S. Bureau of Labor Statistics. 2020e. Food Manufacturing: NAICS 311. Available online: https://www.bls.gov/iag/tgs/iag311.htm [Accessed September 5, 2020].

U.S. Bureau of Labor Statistics. 2020f. Food Services and Drinking Places: NAICS 722. Available online: https://www.bls.gov/iag/tgs/iag722.htm [Accessed September 5, 2020].

U.S. Bureau of Labor Statistics. 2020g. Health Care and Social Assistance: NAICS 62. Available online: https://www.bls.gov/iag/tgs/iag62.htm [Accessed June 17, 2020].

U.S. Bureau of Labor Statistics. 2020h. Labor Force Statistics from the Current Population Survey. Available online: https://data.bls.gov/timeseries/LNS14000000 [Accessed September 5, 2020].

U.S. Bureau of Labor Statistics. 2020i. Professional and Business Services. Available online: https://www.bls.gov/iag/tgs/iag60.htm [Accessed June 18, 2020].

U.S. Bureau of Labor Statistics. 2020j. Unemployment Rate (2010-2020). Available online: https://data.bls.gov/timeseries/LNS14000000 [Accessed June 19, 2020].

U.S. Congress. 2020. H.R.6800 - The Heroes Act. Available online: https://www.congress.gov/bill/116th-congress/house-bill/6800 [Accessed June 13, 2020].

U.S. Department of Agriculture. 2020. Coronavirus Food Assistance Program. https://www.farmers.gov/cfap [Accessed June 13, 2020].

U.S. Department of Agriculture. 2020, June 9. America’s Meatpacking Facilities Operating More Than 95% of Capacity Compared to 2019. Available online: https://www.usda.gov/media/press-releases.

U.S. Department of Labor. 2020a. Unemployment Insurance Relief during COVID-19 Outbreak. Available online: https://www.dol.gov/coronavirus [Accessed June 30, 2020].

U.S. Department of Labor. (2020b). Unemployment Insurance Weekly Claims Data. https://www.dol.gov/ui/data.pdf [Accessed September 5, 2020].

U.S. Department of the Treasury. 2020. The CARES Act Works for All Americans. Available online: https://home.treasury.gov/policy-issues/cares [Accessed June 30, 2020].

Whitley, A. 2020, April 24. “How Coronavirus Will Forever Change Airlines and the Way We Fly.” Bloomberg.

Wida, E.C. 2020, March 16. “Which States Have Closed Restaurants and Bars Due to Coronavirus?” Today.