Despite growth in local food sales, the definition of “local,” a term that is not defined or regulated by the federal government, remains unclear (Martinez et al. 2010; Low et al. 2015). Although there is no official national designation for “local” food, some individual USDA programs use a broad (maximum) definition of less than 400 miles from product origin or within the state in which the product is produced (Tropp, 2013). State branding programs can fill this gap, designating products as locally grown or processed (Onken and Bernard, 2010). State branding programs are the broadest, most inclusive messaging for local foods. These programs are commonly publicly funded and therefore need to be inclusive of a wide range of agricultural and food businesses. Accordingly, the criteria to qualify (geography), rigor of membership (license agreement vs. detailed application) and level of oversight (laissez faire vs. audit or inspections) may vary across programs. One might hypothesize that more targeted or focused definitions of local may resonate with some consumers; depending on their standards, state branding programs will vary in effectiveness. Subsequently, the most particular consumers may perceive that state brands do not provide sufficient information and instead choose to shop at specific locations that align with their perceptions of authentically local (i.e., farmers’ markets, on-farm stands). Yet little research examines how consumers interpret state brands.

This article focuses on how state branding programs interact with consumers’ product choices and, more specifically, whether those factors and motivations vary by type of shopping location (e.g., retail, direct markets). Overall, we find that the factors that affect consumers who purchase Colorado Proud products and the factors that affect consumers who shop at direct markets are not closely related. This implies the need for targeted marketing strategies to influence consumers’ purchases depending on food buyers’ differing perceptions.

State branding programs—initiatives intended to increase sales of locally grown and processed products by differentiating products produced within the state—exist in all states across the United States. Since each state operates its own program, each is unique in terms of funding, criteria and requirements to participate, level and type of promotional activity, and oversight (Onken and Bernard, 2010). One common aspect is that state branding programs use logos to indicate to consumers where the product was produced (Figure 1).

These programs generally reflect the most all-encompassing definition of local, both in terms of their statewide geographic designation and the inclusion of locally processed or manufactured items in addition to items grown or raised in the state. As 90% of these programs are maintained by each state’s Department of Agriculture (Onken and Bernard, 2010), such public agencies must be inclusive of the broadest range of stakeholders.

The Colorado Proud program, established in 1999, is run by the Colorado Department of Agriculture through their Markets Division. Any agricultural or food item that is grown, raised, processed, or produced by a company operating within the state of Colorado is eligible to use the Colorado Proud logo on its packaging. There is no charge to participate, and members are given access to no- or low-cost promotional materials, market development, and promotional opportunities. Approximately 2,500 companies are currently part of the Colorado Proud program (Colorado Department of Agriculture, 2017). Similar to other states, the Colorado Department of Agriculture has clear guidelines on the use of the logo, but there is no standard oversight or enforcement of the program or use of the logo (Colorado Department of Agriculture, 2017). The program is well known and recognized by Coloradans: 86.6% of state residents reported awareness of the Program in a 2016 statewide survey (Colorado Department of Agriculture, 2016).

Previous research on U.S. consumers details how the products they buy and where they make food purchases are changing. For example, in 1990, 80% of food for at-home consumption was purchased at supermarkets; by 2014, that number dropped to 65% (Ver Ploeg, Larimore and Wilde, 2017). The USDA Economic Research Service has calculated food at home expenditures since 1987, and annual data are available starting in 1929. In their calculation, production value or sales is equal to total expenditures. Food at home expenditures include food stores (excluding sales to restaurants and institutions), other stores (including eating and drinking establishments, trailer parks, commissary stores, and military exchanges), home delivery and mail order, farmers, manufacturers and wholesalers, home production, and donations.

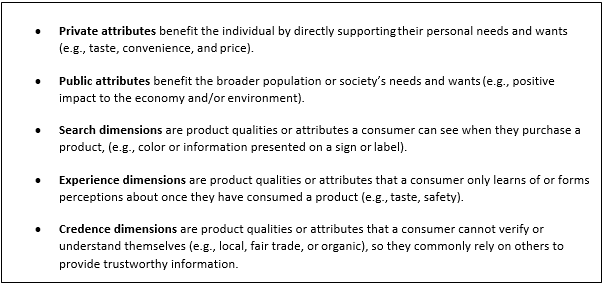

Other studies focus on how consumers make decisions about where to shop and what products to buy. We divide these drivers into various categories to more effectively categorize how consumers make choices (Box 1). These drivers include private and public attributes and can be classified by search, experience, and credence dimensions. These attributes and dimensions can influence consumers during different stages of purchasing and consuming a product or influence where they choose to purchase foods, thereby aligning with some important elements of state branding programs. Consumers often use a combination of private and public attributes as well as search, experience, and credence dimensions to choose what products to purchase as well as where to shop (Grunert, 2002).

Figure 2 highlights how private and public attributes may overlap with the three types of dimensions but not with one another. Private attributes are most likely discovered through search and experience history, as one can discern eating quality, freshness, and safety from purchase, preparation, and consumption of the product. In contrast, public attributes are more likely perceived and discovered through credence dimensions, such as labels and information from trusted third parties (Martin et al., 2016). These dimensions may not only influence product choices but also influence and be influenced by where food is purchased.

A 2016 survey of 1,000 Coloradans provides an interesting opportunity to explore how food product attributes (including source information) and other consumer issues affect decisions to purchase Colorado Proud products as well as where consumers choose to shop. The Public Attitudes about Agriculture in Colorado survey conducted by the Colorado Department of Agriculture and Colorado State University’s Department of Agricultural and Resource Economics is the most recent data from a continuing effort that has taken place every 5 years since 1996. This survey asks Coloradans to answer questions on a variety of topics, including perception of the safety of the food produced by Colorado farmers and ranchers, consumer’s trust of information from particular source, how consumers define local, trust of products labeled as local, familiarity with Colorado Proud, factors that are important to consumer purchasing decisions, and consumer motivations for purchasing more Colorado produce. A national survey group, TNS (www.tns-usa.com) conducted the Internet-based survey using a panel of Colorado residents between August 24 and September 6, 2016.

Our sample includes 992 usable responses and is representative of Colorado’s demographic profile according to the U.S. Census data. The only area where this dataset is not representative is among 18–24-year-old males; the market research group confirmed that this is to be expected, as this group tends to be less engaged overall in responding to surveys. Among respondents, the average length of residency in Colorado was 16 years, the average age was 48, 58% of respondents were female, and median household income was $50,000–$75,000. Beyond demographics (and relevant to our analysis), respondents reported that an average 4.5% of their total household food expenditures were spent at direct markets (farmers’ markets, farm stands, and CSAs). And 59.6% of respondents had heard of or and purchased Colorado Proud products.

We used a probit model to examine the search, experience, and credence factors that influenced the purchase of Colorado Proud products. We then used a negative binomial model to do the same for the purchase of fruits and vegetables through direct markets. Interestingly, we found some important differences between these groups, indicating that consumers purchasing Colorado Proud products are motivated by different dimensions than consumers interested in purchasing Colorado-grown vegetables and fruits through direct buying transactions at farmers’ markets and other venues that farmers may operate. These buyer groupings are not completely independent, as some direct buyers also look for Colorado Proud (though they are a much smaller group), so this overlap should be considered when interpreting the results.

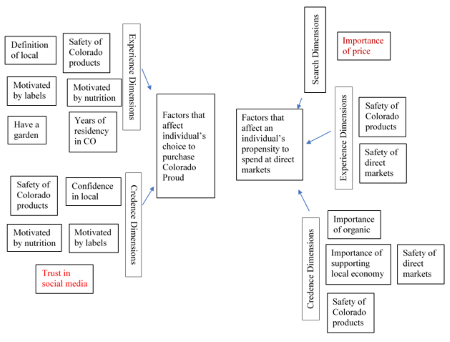

Note: Items in red have a negative impact.

Figure 3 provides information about the factors that either positively or negatively (in red) and significantly affect a consumer’s decision to purchase local products, with the left describing key factors for Colorado Proud buyers and the right describing factors influencing consumers who choose to buy direct from producers. To facilitate discussion of what these patterns may signal about different types of Colorado food buyers, we consider some (but not all) of the significant factors, motivations, and perceptions that describe these buyers.

As discussed previously, Colorado Proud incorporates a broad definition of local, and the differences we find may be a result of consumers’ own definitions and perceptions of that program’s standards. We find that an individual who believes local to be defined as “products that are produced within the state of Colorado” is 6.3% more likely to purchase Colorado Proud products than individuals with a different definition. However, consumers buying direct want an even closer source of produce or do not perceive all products labeled with Colorado Proud to align with their definition of local. Alternatively, since Colorado Proud only requires processing in the state, some consumers may instead seek products that are both produced and processed in-state, information they could more likely validate through a buying relationship with the producer or manufacturer.

Because differential perceptions of Colorado products and information sources is a key differentiator among food buyers, we integrated several concepts, including motivations (importance of), perceptions (confidence in), and sources of (labels) information on search, experience, and credence attributes.

We find that Colorado Proud consumers are most frequently influenced by experience dimensions, especially perceptions of safety, nutrition, and labeling. Consumers can evaluate these factors after consuming the product, but their confidence in some of those perceptions could be strengthened through labels that are more aligned with credence attributes such as Colorado Proud. Beyond product attributes, we found that years of residency in Colorado significantly influenced experience dimensions, perhaps because an individual who has lived in Colorado longer has had more opportunities to try, evaluate the quality of, and develop confidence in at least a subset of Colorado Proud offerings.

A key credence dimension that positively influences consumers who seek out Colorado Proud products is their definition and confidence in the authenticity of local products. Since the consumers who purchase Colorado Proud products are motivated by labels (and do not trust social media), they find value from labels that indicate information (even if imperfectly aligned with the program’s primary focus of local). It is interesting to note that the less an individual trusts social media, the more likely they are to purchase Colorado Proud products. This group broadly trusts information from official sources rather than informal networks such as social media, consistent with previous findings on trust (Martin et al., 2016).

The Colorado Proud label is intended to verify that a product is grown, raised, or processed in-state, per the Colorado Department of Agriculture license agreement signed by all who use the logo; without this verification, consumers would have no information from a third-party organization that the product is local. However, depending on perceptions related to the effectiveness of the license agreement and whether it is sufficient to verify local with no direct policing or monitoring of participants, the Colorado Proud program may not be sufficient for some consumers. For a comparison, we now turn to how direct market shoppers’ perceptions, motivations and values may differ from those seeking Colorado Proud labels (although there may be overlap across these groups, direct market shoppers are a more narrowly defined group).

Compared to Colorado Proud consumers, direct market shoppers value credence dimensions more in their food buying decisions, including assigning a higher level of importance to organic methods or fair returns to producers and their communities. Given that producers and direct market shoppers interact directly at these markets, producers themselves can speak to and provide evidence for a variety of credence dimensions. In short, a label may not be enough evidence to provide assurances for this subset of consumers; instead, they turn to producers for information.

Direct market consumers place higher importance on organic and supporting the local economy than Colorado Proud consumers. Similarly, these direct buyers report higher perceptions of safety for Colorado products and, more specifically, products from direct markets. The safety of Colorado products and of products at direct markets, however, could be considered either a credence or experience dimension. The categorization of safety relies on whether past experiences (good or bad) or third-party audits are more influential in the formation of a consumer’s perception; which criterion is used may vary by consumer.

Surprisingly, the only search dimension found to be statistically significant for direct buyers was price; those who place a high importance on price are less likely to spend their food dollars at direct markets. It appears that individuals are negatively influenced by prices at direct markets due to perceptions of higher prices (whether accurate or not).

Overall, we find that the factors that affect consumers who purchase Colorado Proud products and the factors that affect consumers who shop at direct markets are not closely related, or, perhaps, those who shop directly have a more complex set of motivations and perceptions than the broader Colorado Proud consumer group. Individuals purchasing state-branded products are more likely to look for a combination of experience and credence dimensions due to their individual experiences with local food as well as the certification guaranteed through the Colorado Department of Agriculture. On the other hand, individuals shopping at direct markets focus more on credence dimensions. We believe that consumers’ direct interaction with individual producers allows producers to testify to certain attributes of the products or outcomes associated with consumers’ buying dollars (i.e., improving the farm’s viability and/or economic benefits to the community or environment). Thus, direct markets may provide a marketing service of value to the subset of consumers seeking local foods.

These findings imply potentially different marketing strategies to influence various local food consumers’ purchases, including clearer approaches to reach, inform, and verify the authenticity of local food offerings to consumers. Perhaps it is fine to continue to let state brands be a substitute for direct markets, giving sufficient assurances to consumers who are satisfied with the product dimensions, quality, and labels available for local foods in retail markets. Another option is to explore whether state branding programs could look into framing higher standards and oversight of state-branded local products to further strengthen consumer confidence in the products across a wider range of food buyers. However, such programming (and its associated costs) would only make sense if there is evidence for participating producers that they will receive higher price premiums or market access through a more nuanced and well-regarded state brand.

Colorado Department of Agriculture. 2016. 2016 Public Attitudes of Colorado Agriculture. Broomfield, CO: Colorado Department of Agriculture. Available online: https://www.colorado.gov/pacific/sites/default/files/2016 Public Attitudes Report Final.pdf

Colorado Department of Agriculture. 2017. Colorado Proud. Broomfield, CO: Colorado Department of Agriculture. Available online: https://co.foodmarketmaker.com/catalog/affiliation/7

Grunert, K.G. 2002. “Current Issues in the Understanding of Consumer Food Choice.” Trends in Food Science and Technology 13:275–285.

Low, S.A., A. Adalja, E. Beaulieu, N. Key, S. Martinez, A. Melton, A. Perez, K. Ralston, H. Stewart, S. Suttles, S. Vogel and B.B.R. Jablonski. 2015. Trends in U.S. Local and Regional Food Systems. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Administrative Publication AP-068, January.

Martin, M., R. Hill, A. Van Sandt, and D. Thilmany. 2016. “Colorado Residents Trusted Sources of Agricultural, Biotechnology and Food Information.” Ag BioForum 19:1–10.

Martinez, S., M. Hand, M. Da Pra, S. Pollack, K. Ralston, T. Smith, S. Vogel, S. Clark, L. Lohr, S. Low, and C. Newman. 2010. Local Food Systems: Concepts, Impacts, and Issues. U.S. Department of Agriculture, Economic Research Service, Economic Research Report ERR-97, May.

Onken, K.A., and J.C. Bernard. 2010. “Catching the ‘Local’ Bug: A Look at State Agricultural Marketing Programs.” Choices 25(1).

Tropp, D. 2013. Why Local Food Matters: The Rising Importance of Locally-Grown Food in the U.S. Food System. Washington, DC: U.S. Department of Agriculture, Agricultural Marketing Service Technical Resource. Available online: https://www.ams.usda.gov/sites/default/files/media/Why Local Food Matters.pdf

Thilmany McFadden, D. 2015. “What Do We Mean by ‘Local Foods’?” Choices 30(1).

Ver Ploeg, M., E. Larimore, and P. Wilde. 2017. The Influence of Foodstore Access on Grocery Shopping and Food Spending. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Information Bulletin EIB-180, October.