The Internal Revenue Code (IRC) plays a large role in the management of the farm business and the well-being of the farm household. The IRC can affect farm businesses at every stage of a farm’s life cycle, including influencing decisions about investments, their character, amount, and timing of their acquisition or sale. By its treatment of respective business entity types, the IRC can affect farm business formation. Because farm income and income from other sources are almost always combined in a farm household for tax purposes, the treatment of farming activity can affect off-farm labor and investment decisions as well. Finally, the tax treatment of land and other farm assets in estates affects dissolution or succession decisions.

Policymakers and stakeholders are once again calling for reform, citing a tax code that is difficult to administer and comply with, inefficient, and inequitable. To accomplish such goals, reform proponents often refer to “broadening the tax base” or amending the IRC to include more income as taxable by eliminating tax expenditures or preferences. Tax expenditures are defined as federal revenue losses attributable to special tax exclusions, exemptions, and deductions, as well as preferential tax rates, credits, and deferrals of tax liability (Office of Management and Budget, 2012). Tax expenditures are sometimes known as “tax preferences,” evoking an image that the benefits accrue to a small group or a narrowly defined activity. However, in many cases, an individual tax expenditure benefits a large proportion of taxpayers. The exclusion from income allowed for the employer contribution toward health insurance is one example.

Despite recent tax legislation that amended, extended, or made permanent key pieces of the IRC, proponents of tax reform still see a need for a comprehensive overhaul of the tax system. Published reform plans differ in specifics, but all are predicated on limiting or eliminating deductions, restructuring or creating new credits, and changing statutory marginal rates for ordinary income, capital gains, and dividends. Proponents of reform argue that tax preferences for certain activities or types of income complicate the federal tax system and create differences in tax liability between taxpayers with similar incomes and filing status—a violation of the principle of horizontal equity—as well as reduce the progressivity of the tax system because its value depends on the taxpayer’s marginal tax rate, generally reducing tax liability more for a high-income taxpayer than for a low-income taxpayer.

Broadening the tax base by eliminating tax expenditures could reduce complexity and computational burden, and perhaps increase efficiency and equity, and, as this article will show, have a significant effect on investment, management, and production decisions in the agricultural sector at each stage of the farm life-cycle (Kay, Edwards and Duffy, 2011).

From the perspective of farmers, the individual income tax is significantly more important than the corporate income tax for understanding how taxes affect most farm businesses. According to the 2007 Census of Agriculture (U.S. Department of Agriculture (USDA), National Agricultural Statistics Service (NASS)), sole proprietorships accounted for 86.5% of all farms and 50% of total sales. Partnerships comprise 7.9% of farms and 20% of sales. Sole proprietorships and partnerships are taxed at the individual level, as are partnerships and subchapter S corporations. Farms organized as subchapter C corporations are taxed under the corporate system and account for less than 4% of all farms, though they account for about 30% of farm sales. In all, more than 96% of all farms and over 75% of farm sales are taxed under the provisions of the individual income tax.

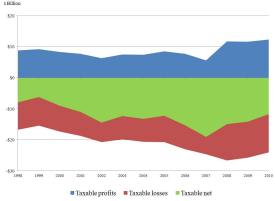

Farm households may receive income from farm earnings and off-farm labor, as well as other business or investment activities, and, in fact, income sources other than farming account for a significant share of the farm household’s total income. Because the family is the typical unit of taxation for a farm business, farm and nonfarm income are combined for the purpose of computing federal income taxes for farm households. In 2011, the average farm household income reported in the USDA Agricultural Resource Management Survey (ARMS) was $87,289, and off-farm sources accounted for a majority of the income (84.3%). Since 1980, farm sole proprietors, as a group, have reported negative aggregate net farm income for tax purposes, and, over the last decade, both the share of farmers reporting losses and the amount of losses reported have increased. In 2010 (the last year for which complete IRS data is available), nearly three of every four farm sole proprietors reported a farm loss. For those who reported a loss, the average loss was $18,079 for a total of $24 billion.

Because only about 30% of farm sole proprietors report a profit, and with just 60% of those reporting a farm profit owing any federal income taxes, only about 19% of farm sole proprietors paid any federal income tax on their schedule F farm income in 2010. Consequently, despite farm sole proprietors reporting an average gross income and taxes of $85,021 and $12,664, respectively, they also reported a net farm loss of $6,064. Further, because taxes on farm income are paid at the individual level, under the proposed changes to the individual income tax system, farm households could experience significant changes to their after-tax incomes. Proposed changes to the system of deductions and credits will expand the taxpayer’s tax base, and proposed changes to tax rates on dividends and capital gains, in particular, will raise current tax rates for some farmers, even if the plan is designed to be revenue neutral.

Starting a farm operation can be an expensive endeavor, particularly if the farmer chooses an asset ownership model. Startup requires access to land and capital equipment, and these costs are particularly prohibitive for beginning or low-equity farmers. In 2010, the average farm (with “farm” defined as any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year) operated 416 acres and held just under $1 million in assets, the vast majority of which was in land and structures.

Established farmers also routinely make capital purchases, and in 2010, 43% of U.S. farms made a capital investment of $32,000 on average, for a total of $29 billion. In general, the size of the capital purchase varied with the size of the operation; the greater the sales revenue of the operation, the more likely it was to make a capital investment in a given year. Based on 2010 ARMS data, 83% of very large commercial farms—farms with at least $500,000 in annual sales—reported they made such an investment in 2010, while only 36% of farms classified as rural residences (less than $250,000 in sales and a reported major occupation other than farming) made a capital investment.

Under the current tax system, much of those costs may be expensed immediately, with the remainder capitalized and depreciated over time. This reduces the income subject to tax. The amount that can be expensed is subject to a limit, and the investment amount above the limit must be depreciated over a specified recovery period, generally seven years for farm machinery and equipment.

The tax treatment of these investments is of considerable importance to the farm sector, especially to established commercial farms (farm sales above $250,000). Over the last decade, the amount that a farmer could immediately expense has changed. Beginning with the Economic Growth and Taxpayer Relief Reconciliation Act of 2001 (2001 Act), which set the expensing amount at $25,000, the amount of capital purchases eligible for immediate expensing has steadily increased. The amount was raised from $25,000 to $100,000 in 2003, and then again in 2008 to $250,000 through stimulus legislation. The Small Business Jobs Act of 2010 doubled the expensing amount to $500,000 for property placed into service in 2010 and 2011. Recently, the American Taxpayer Relief Act of 2012 temporarily reinstated the amount to $500,000 for 2013.

Along with the expensing provision, the ability to take an additional first-year depreciation deduction also benefits farmers making capital purchases. When combined with the expensing amount, the ability to accelerate depreciation has meant that much of the capital purchases made during the past decade have been completely deducted in the first year, offering a substantial tax savings. For tax years 2012 and 2013, the first-year depreciation allowance is 50%.

Under current law, the expanded expensing and accelerated first-year depreciation allowances are considered tax expenditures and are candidates for reform. The impact of tax reform on U.S. agriculture will depend on how the expensing and depreciation provisions change. Currently, less than 1% of farmers annually invest more than the 2013 annual expensing limit of $500,000. Investments above this amount are eligible for the 50% additional first-year depreciation, so nearly all capital investment by farmers can be written off in the current year. The expensing allowance reduces the effective tax rate on income from farm capital and simplifies the recordkeeping burden associated with the depreciation of capital purchases, with commercial farmers the primary beneficiaries. Eliminating or lowering the expensing amount would raise the cost of capital purchases for some farms.

As well as raising the cost of capital investment, lowering or eliminating expensing and additional first-year depreciation could increase the farm’s tax base, potentially increasing its taxable income. On average, farmers reported depreciation expenses of $21,259 in 2010. Farms with $500,000 or more of annual sales had an average depreciation expense of $94,000. Farmers who had previously been able to write off most or all of their capital investment in the first year due to the expensing and first-year depreciation provisions will find that their taxable incomes are higher with the scaling back or elimination of these provisions, whether they adjust their investment levels or not, and this could result in higher tax burdens.

The IRC also offers assistance to some first-time farmers with their purchasing of land and equipment. An “Aggie Bond,” as it is sometimes called, is another source of financing for farmers who wish to establish or expand an operation. Aggie Bond programs currently operate in 16 states and the program is authorized through a provision in the IRC covering private activity bonds (National Council of State Agricultural Finance Programs). Such programs rely on private lenders to make loans to eligible farmers; in return, the lender receives a tax exemption on the interest received from the loan. The benefit to beginning farmers is that the tax-exempt status of the loan is an incentive to lenders to provide access to credit they might not otherwise provide and at rates that may be below the market rate.

Limiting the value of the interest deduction could affect Aggie Bond loans. Currently the value of the bond to the bondholder is a function of their marginal tax rate—the tax liability saved on the last dollar earned—and limiting or removing the exemption of interest income from such bonds would effectively raise the rates on loans made through Aggie Bonds because bondholders would require a higher rate in return for the reduced value of the deduction.

Reform would likely alter the tax treatment of capital gains. The federal income tax system has historically taxed gains on the sale of assets held for investment and certain business purposes at lower rates than on other sources of income. The current tax rate on capital gains is zero for taxpayers in the 10% and 15% income tax brackets; 15% for taxpayers in the 25%, 28%, 33%, and 35% income tax brackets; and 20% (plus an additional 3.8% surtax) for those in the 39.6% income tax bracket.

Many of the assets used in farming or ranching are eligible for capital gains treatment. For example, raised cattle used for breeding, dairy, draft, or sporting purpose, as well as certain other livestock, are gain property and their sale may generate income eligible for treatment as a capital gain for tax purposes. Furthermore, capital gain income is a nontrivial and important source of income to some farmers, particularly established farms. In 2010, about 38% of U.S. farmers reported income in the form of capital gains—nearly three times the share for all other taxpayers—totaling $28.4 billion. For those who reported capital gains, this accounted for 21.5% of their total taxable income. The average amount of capital gain reported by farmers was also more than double the average capital gain reported by other taxpayers. In 2010, the last year for which complete IRS data is available, farmers reported capital gains of $28.4 billion.

Two important deductions that are likely to affect established farm businesses are for domestic production activities and self-employment health insurance. The domestic production activities deduction allows famers to deduct the lesser of 9% of adjusted gross income for domestic production activities income or 50% of wages paid to produce such income. While the wages-paid limitation reduces the deduction for many smaller farms that hire little or no labor, farm sole proprietors deducted nearly $1.25 billion in 2010. The average deduction for eligible farm households was $8,926. Among farms, commercial farm households are the primary beneficiaries since they are more likely to report positive farm income and wages paid to hired labor.

Since 2003, farmers and other self-employed taxpayers have been allowed to deduct 100% of the cost of providing health insurance for themselves and their families as long as they are not eligible for any employer-sponsored plan. Among the general population of taxpayers, few use the deduction, but IRS tax data show about one out of seven farmers use the deduction in any given year, deducting an average of $6,173 for a total of $1.684 billion in health insurance premiums.

Farmers often wish to pass the farm business to their heirs or otherwise preserve the nature of their farm and the IRC contains provisions that help do this in an orderly manner, while reducing the estate tax liability. Special provisions in the Federal estate tax, such as a rule that allows farm assets of an estate to be valued at their farm-use value rather than a higher market value, facilitate the transfer of farm estates from one generation to the next.

The estate tax has never affected a large percentage of taxpayers, including farmers. In fact, in no year since 1916 has the percentage of adult deaths generating a taxable estate surpassed 8% (Jacobson, Raub, and Johnson, 2012). A number of targeted provisions help to reduce the burden of the estate tax on farms and small businesses and facilitate the transfer of a farm or other small business to the next generation.

Farmers can choose to preserve farmland by making a donation of a qualified conservation easement, and this can be done while the farm is still an active operation. The deduction provision allows the farmer to create a separate, special right on the designated land stipulating that it will be used only for certain purposes, such as agricultural production. The farmer or rancher can continue to use the land for production, knowing that in the future, it will continue to be used in the same manner. In return for placing the land into a qualified conservation easement, the landowner may deduct the value of the easement from his or her income for tax purposes.

Renewed calls for tax reform have highlighted a tax system that, while complex, offers substantial benefits to farm businesses at every stage of the farm life-cycle. Reform could reduce the after-tax income of many farm households. In particular, reducing or eliminating deductions for capital purchases and raising capital gains taxes could increase the farmers’ tax base and raise the tax rate paid on a significant portion of their income. These effects will vary by farm size and type. Offsetting these effects, though, is the proposed reform of the marginal tax rate structure. A reduced number of brackets and lower rates will mitigate the effect of a potentially larger tax base for U.S. farm households.

Jacobson, D., Raub, B., and Johnson, B. “The Estate Tax: Ninety Years and Counting” in Compendium of Federal Estate and Personal Wealth Studies, Volume II, Internal Revenue Service, Statistics of Income 2012. Available online at http://www.irs.gov/pub/irs-soi/11pwcompench1aestate.pdf

Kay, R., Edwards, W., Duffy, P. (2011). Farm Management, 7th ed. New York: McGraw Hill Book Co.

National Council of State Agricultural Finance Programs. 2010 Biennial Directory. Available online at www.stateagfinance.org

Office of Management and Budget. 2012. The Fiscal Year 2013 Budget of the United States Government: Analytical Perspectives: http://www. whitehouse.gov/sites/default/files/omb/budget/fy2013/assets/spec.pdf

Williamson, J, Durst R, Farrigan, T (2013) The Potential Impact of Tax Reform on Farm Businesses and Rural Households, USDA, Economic Research Service, February 2013.”