The Association of Southeast Asian Nations (ASEAN) region represents an important market for agricultural products due both to its relative share of global population and its income growth potential, with per capita GDP increasing at an average annual rate of 3.74% in nominal terms from 2000 to 2021 (World Bank, 2023). Unlike food products, however, cotton is an industrial good with a complicated web of interconnected supply chains that depend on different comparative advantages, complex international and domestic policies, and factor availability. We discuss here the trends in U.S. cotton exports to the region as well as some of these complicated factors that both offer opportunities and challenges to U.S. cotton exports.

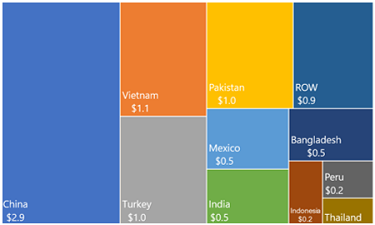

From 2010 to 2022, U.S. cotton exports to ASEAN countries increased from $838 million to more than $1.5 billion, mostly driven by increased exports to Vietnam, which is currently the second largest market for U.S. cotton exports (USDA-FAS, 2023) (Figure 1). A primary advantage for U.S. cotton exports is that the ASEAN region is not a major cotton-producing region. In 2020, the region produced approximately 325,000 bales of cotton, roughly the equivalent of a few counties in the Texas High Plains (FAOSTAT, 2023). The low production level means that if the region is to be a significant producer of cotton textiles it must rely on imported cotton. In fact, four ASEAN countries (Vietnam, Indonesia, Thailand, and Malaysia) were among the world’s top ten cotton importing countries in 2021, with Vietnam being the second largest importing country at almost $3 billion (United Nations, 2023).Overall U.S. cotton exports to ASEAN countries experienced a rapid expansion starting in 2012, peaking in 2018, and have rapidly contracted since then (Figure 1). U.S. regional market share has averaged around 16%, peaking at 20% in 2018 (for the United States, exports to ASEAN countries represents about 15% of total U.S. exports, on average). But the aggregatenumbers can be misleading, as almost all that growth was in Vietnam and Indonesia. More importantly, however, is what happens to that cotton once it arrives in those countries. That is, to assess export potential for cotton to ASEAN nations, it is helpful to understand why they are importing cotton from the United States.

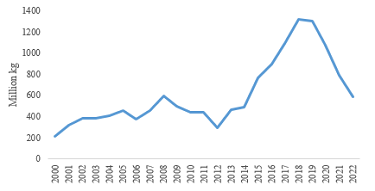

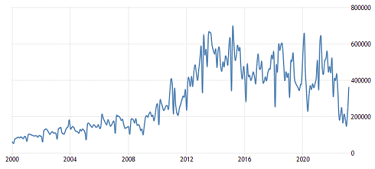

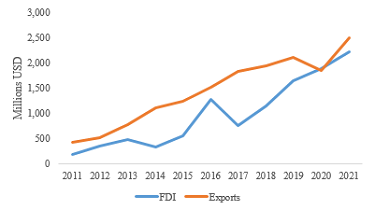

China remains the largest consumer of cotton in the world (and the largest exporter of products that contain cotton). Because China’s mill use of cotton is larger than its domestic production, China has a large import demand to meet the requirements of its domestic textile and apparel production. But China maintains a complex import two-tier tariff scheme that favors domestic cotton over imports. However, China has no such tariff scheme for imports of cotton yarn; the result has been an increasing reliance on imports of cotton yarn (Davis David and Gale, 2022) (Figure 2).Figures 2 and 3 shows the correlation between the rapid rise in yarn imports from 2012 and the U.S. cotton exports to ASEAN countries in the same year. There is also a corresponding decline in Chinese yarn imports along with the decline in U.S. cotton exports over the latter part of the period. Again, Vietnam is the primary exporter of yarn to China representing 78% of export value to China from ASEAN countries (United Nations, 2023). The bypassing of the two-tier cotton import policy in China is demonstrated also by the correlation between Chinese foreign direct investment in Vietnam and Vietnamese exports of yarn to China (Figure 4). Of course, not all Foreign Direct Investment (FD) FDI from China was aimed at textile mills, but a significant portion has been, and this investment makes sense when you consider that even Chinese textile mills must be concerned about the cost of materials used in meeting contracts for textiles and apparel.It appears from the data, then, that the ASEAN countries (especially Vietnam) are at least in part currently importing U.S. cotton to be spun into yarn and then exported to China. According to FAS data, U.S. cotton exports averaged about 600 million kilograms from 2000 to 2022. Over that same period, according to UN COMTRADE data, ASEAN countries exported an average of about 328 million kilograms of yarn to China alone. Accounting for differences in data, wastage, etc., ASEAN countries exported well over half of the U.S. cotton they imported to China in the form of yarn. It would seem than that as Chinese textile and apparel production and exports go, so go U.S. cotton exports to ASEAN countries.

But are U.S. exports to the region going to be that closely tied to regional exports to China for the long-term? The answer to that is a bit more complicated.First, as noted, regional income growth has beenrelatively strong at an annual rate of nearly 5%. Typical estimates of the income elasticity of demand for cotton have been between 0.80 and 1.20, suggesting that regional income growth will lead to greater cotton consumption even for local use (not exported). This income growth trend is a positive for U.S. export potential, but—like most regions of the world in recent years—regional real income has stagnated or declined due to inflation. But the expectation is that, overall, regional income growth will contribute to greater opportunities for U.S. cotton exports. And with installed spinning capacity in part from Chinese FDI, ASEAN countries have capacity to produce more goods for local consumption. Likewise, population growth favors greater total demand, though per capita demand is likely more closely tied to real income growth. That means that unless the real income declines faster than population grows, total cotton consumption should grow as well. Because none of the ASEAN countries are major cotton producers, any growth experienced in regional cotton consumption will need to be filled by imports.

Second, and a challenge to U.S. exports, is the regional proximity to Australia, a major producer/exporter of cotton. Lower transport cost, tighter business relationships due to proximity, and cultural exchange that has occurred through time between Australia and ASEAN countries offers Australia a distinct advantage insupplying cotton to the region. However, due to its greater reliance on rainfed production systems, greater production volatility in Australia offers its own set of challenges to Australian cotton exports to the region. To some extent, Australia and U.S. cotton are complementary in regional textile production owing to the different growing/harvest seasons in the two countries. U.S. exports fill requirements part of the year and Australia another part. Brazil is also entering the global market as a major competitor to the United States, but logistics challenges remain an impediment to textile mill imports to ASEAN countries from Brazil. Additionally, Brazilian cotton exports compete more directly with Australian exports because it they enter the market at the same time.

Third, China remains the global leader in textile and apparel production. However, China is facing its own issues with labor availability/cost, environmental concerns, and aging infrastructure that supports textile production. Southeast Asia writ large, and ASEAN countries (especially Vietnam and Cambodia) have been targets for investment in textile capacity. But Thailand, Malaysia, Indonesia, and the Philippines have also seengrowth in textile production and have represented areas of U.S. export growth. The current U.S. (and European) moves toward “de-coupling” with China will, if they continue, offer opportunities for these countries to become larger textile producers in the global economy. But de-coupling of supply chains will not happen overnight and will require developing new productive capacity (for example, fabric manufacture and cutting and sewing operations) that are largely prevalent in those countries. Resourcing outside of China will likely lead to greater U.S. exports to the region over the longer-term.Finally, international policy has a role to play in the future location of production of cotton and textiles. The Uyghur Forced Labor Prevention Act (UFLPA) bans U.S. imports of products sourced from the Xinjiang region of China, or the primary cotton-producing region of China. Europe has taken similar, though less aggressive, steps toward the same outcome. Designed to disincentivize the use of forced labor and other human rights violations in China, the policy restricts the importation of cotton textiles (and other products) from cotton sourced or processed in Xinjiang. At first blush, this policy would seem to enhance U.S. exports to textile processors attempting to meet the requirements of the policy. But the outcome is far less certain.

First, there is the obvious issue that China may simply manipulate their data so that products meet requirements on the surface (Yin Yiu, 2022). Second, while the policy may place a temporary constraint on Chinese activity it may only serve to increased Chinese FDI in cotton producing regions such as Central Asia, West Africa, and others so that China can source cotton from those areas, comply with international policies, and simply utilize Xinjiang cotton for domestic consumption purposes. We have already witnessed increase Chinese sourcing of Brazilian and Australian cotton because of this policy. The upshot is that the Law of Unintended Consequences applies in this situation as well.

The complexity of the global supply chain for cotton-containing textiles and apparel presents real challenges for understanding, much less predicting, export potential for a specific region of the world. ASEAN regional economic growth is likely a net positive for U.S. cotton exports to the region. However, further development in textile processing (fabrics, cutting, and sewing) are necessary if the region is going to be a reliable source of future demand outside of the “demand pull” from the Chinese textile industry. The region has ample labor supply and logistics to be a reasonable target for U.S. supply chains wishing to “de-couple” from China, but areas of political instability likely will hinder any U.S. or European investment in the near term. Therefore, while the region remains an important customer for U.S. cotton, future growth potential is uncertain at best.