3rd Quarter 2013

The Food, Conservation and Energy Act of 2008 has a plethora of price support, market development, and market stabilization programs designed to support dairy prices, enhance risk management, and improve farm revenues. Chief among programs that pay producers directly is the Milk Income Loss Contract Program (MILC), which functions similar to a counter-cyclical payment program by paying producers when milk prices are low. The MILC program was slated to expire on September 30, 2012 but was later extended retroactively by the American Taxpayer Relief Act of 2012, which authorizes MILC payments through September 30, 2013.

While a new farm bill was not realized in 2012, the Senate's failed 2012 Farm Bill proposal would have enacted a significant overhaul of the Dairy Title. Among other changes, it proposed replacing MILC with a new margin insurance program called the Dairy Producer Margin Protection Program (DPMPP). The DPMPP included a fully subsidized option that would pay producers if the margin between the bi-monthly All-U.S. Milk Price and a feed cost formula were to fall below $4.00, and also included partially subsidized buy-up options allowing producers to insure a margin of up to $8.00. In addition, participating producers in the DPMPP would be automatically enrolled in a new and controversial supply control program known as the Dairy Market Stabilization Program (DMSP). The DMSP had the intent to encourage producers to scale back production if specified national milk-feed margin triggers were exceeded, and would penalize producers if they did not cut production when the triggers were in effect.

The 2013 Dairy Title negotiations have largely picked up where they left off in 2012, and two competing proposals are in play. The first is billed as the Dairy Security Act (DSA). The DSA includes a DPMPP margin insurance program similar to the 2012 proposal to replace MILC, but with slightly different premium rates for buy-up coverage. It also includes a version of the DMSP supply control program. The competing proposal is the Goodlatte-Scott Amendment, or the Dairy Freedom Act (DFA). The DFA proposes a margin insurance program similar to the DSA, but most notably does not include a supply control program. DSA passed out of committee in the House but the Goodlatte-Scott Amendment was adopted on the floor. As of the writing of this article, the House has passed a farm bill, but with nutrition programs stripped out, and Senate leaders have indicated they are unlikely to move forward without the nutrition title included.

DFA also proposes slightly different producer premiums and coverage options in its DPMPP margin insurance program than DSA, and no free DPMPP option for operations that produce more than 4 million pounds of milk annually. While the DSA has been billed by supporters as a more "fiscally responsible" program, opponents generally view it as a heavy-handed government intervention that would only serve to limit farm growth and unfairly redistribute government support toward certain regions/farms. Some have even gone as far as to brand such programs as "Soviet" in nature.

Virtually all dairy groups support the margin insurance programs in the DFA and DSA; however, the DMSP supply management provisions in the DSA have been more controversial. The DMSP appears to typically be supported by cooperatives and opposed by other processing and retailer groups. However, stated support among prominent producer interest groups—non-cooperative producer groups—remains split. A cursory look at the supporters and opponents indicates that producer groups in states that tend to support the DMSP supply controls (e.g., California, Idaho, New Mexico, Washington, Oregon, and Arizona) tend to also have higher feed costs, import a large proportion of their feed, have a higher concentration of large farms, or may not currently be seeking to significantly expand production. Meanwhile, states/regions that have a higher proportion of small farms or that grow much of their own feed, on balance tend to reject the idea of supply controls (e.g., New York, Wisconsin, Pennsylvania, and Minnesota). While it is true that there is some mixing of producers, processors, and cooperatives within groups—as well as differences in opinion among producers within groups—and that group membership is not strictly cut and dry, we have used our best judgment in making qualitative assessments of membership and stated positions, and believe them to be reasonable on balance.

From an economic standpoint, it is perhaps not difficult to see why certain groups have partitioned into their respective camps regarding supply controls. Cooperatives likely view the DMSP as a useful program to buoy prices and perhaps aid in the management of marketing channels that can be negatively affected by temporary supply imbalances. Retailers and other food processors, on the other hand, arguably have the incentive to keep the cost of raw milk low, and may be concerned that they will be unable to make ongoing supply commitments if they have to worry about policy-driven reductions in their milk inputs.

Understanding the incentives of producers themselves is a bit more difficult. Many producer groups—that is, non-cooperative-based producer associations—purport to oppose supply controls due to the fundamental belief that the government should not engage in such interventions. However, other groups may oppose the program because it is counterproductive to the group’s ultimate goals. In New York State, for example, considerable momentum was created after Governor Cuomo’s Yogurt Summit in August 2012, a reflection of the growing demand for Greek yogurt processed in the region. Since 2000, New York has nearly doubled its total number of yogurt plants from 14 to 27 and has nearly tripled its production of Greek yogurt over the past six years to become the nation’s largest producer. As a result of this increase in yogurt production—coupled with the fact the popular Greek variety requires three times more milk than regular yogurt to produce—the commonly held notion in New York is that milk production must increase and that failure to do so will put the yogurt boom in jeopardy. Indeed, many producer groups in the Northeast, including the Northeast Dairy Producers Association, fear that a supply control program will limit the opportunity for regional farm growth. On the other hand, certain Western, Southwestern, and Southern states are perhaps approaching their peak capacity for dairy production in the current market environment, and so a supply control program would arguably not be perceived to be negative. The opposite is true for regions that see opportunity in growth.

While the "desire to grow" may be at play in determining producer preferences for supply controls, there is another explanation that relies on the fundamentals of how changes in variable and fixed costs impact profit margins and how farms are distributed in this respect throughout the United States. Many states in the West, South, and Southwest—which tend to be dominated by larger farms—have been exposed to episodes of very high feed costs—that is, variable costs—due to structural changes in grain prices in recent years. Coupled with the fact that farms in these areas typically do not grow as much of their feed as do farms in other regions, this has led to low margins for some. However, these farms also tend to have lower fixed costs per unit of capacity than do smaller farms, implying that they have a lower opportunity cost of idling production capacity. In other parts of the country, such as Wisconsin and New York, farms are significantly smaller on average, but also tend to produce more of their own feed. Therefore, they typically have higher fixed costs per unit of capacity, but are arguably less sensitive to increases in variable feed costs than the typical large farm in the West, South, or Southwest.

In this light, it is fairly obvious what producer incentives/preferences would be regarding a supply control program, on the margin, for a large farm with lower per-unit fixed costs that buys much of its feed vs. a small farm with higher per-unit fixed costs that grows much of its feed. The former has a lower opportunity cost of idling production and, on the margin, benefits more than the latter when a nationwide benchmark price margin widens. The process of halting production under supply controls will also decrease demand for feed, thus pushing down its price. On the margin, this is clearly more beneficial to the former type of farm than the latter. Considering where we tend to observe the presence and concentration of such farms across the U.S., it is no mystery why different producer groups tend to be on the side of the fence where they are regarding supply controls.

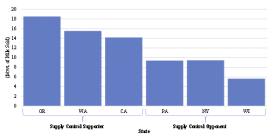

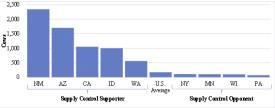

Several significant, non-cooperative-based state producer groups have declared their support or opposition to the DSA and its supply control measures. Figures 1 and 2 highlight several of these notable, high-production states. Figure 1 presents purchased feed costs by state for states with major proponents and opponents of DSA, and indicates that states with higher purchased feed costs tend to support supply controls under the DSA. The opposite appears to be true for states with producer groups who oppose the DSA. Figure 2 suggests a similar trend in those states with larger average herd sizes which tend to support the supply control measures in the DSA (New Mexico, Arizona, California, Idaho, and Washington), and vice versa for states with smaller herd sizes, such as those in New York, Pennsylvania, Wisconsin, and Minnesota. While there are exceptions—for example, Florida, which is a deficit and undeclared state—on balance, it is fair to observe this dichotomy is probably at play.

While much of the 2012 and 2013 farm bill debates regarding dairy have focused on the merits of supply controls, equity issues related to the redistribution of program benefits among producers of various sizes under the MILC program vs. the proposed DPMPP programs have perhaps received less attention recently. MILC functions economically as a broad price insurance program that pays producers when milk prices fall below a specified level, but has some aspects of a margin insurance program in that the base trigger price, $16.94/hundredweight (cwt.), is adjusted upward by a feed cost formula when feed prices are above a certain level. The DPMPP proposals incorporate a margin insurance scheme more explicitly and also allow producers to buy-up to higher coverage levels. The other major difference between the existing MILC program and the proposed DPMPP programs is that payments under MILC are capped to apply to a maximum of 2.4 million pounds of production over a 12-month period.

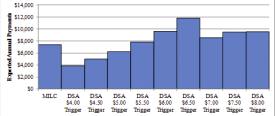

Between 2000 and 2012, the MILC program would have made payments in about 50% of the months (45% in years 2009-2012). Given that the average U.S. dairy farm produced just over 21,000 pounds of milk per cow in 2012, farms with more than 100 cows are at risk of hitting their 2.4-million-pound-payment cap in any given 12-month period under MILC. The new DPMPP proposals, on the other hand, have no such production caps on payments. The expected magnitude and frequency of payments also vary substantially between MILC and DPMPP. We calculated expected annual payments for a 100-cow dairy under MILC, and the basic DPMPP at the free $4.00 trigger in the DSA and DFA, assuming annual production of 21,000 pounds per cow. The results are derived from simulations of the various milk price and feed price complexes, and are calibrated with relevant futures and options market data in order to provide the best estimates of expected prices and volatilities looking forward. Expected basic DPMPP payments are approximately $3,900 and $3,600 per year for DSA and DFA, respectively, and are significantly lower than those for MILC ($7,400/yr), for smaller producers. DPMPP also has a lower payout frequency, about 30%, vs. about 63% for MILC. Note that these are forward-looking, not historical, estimates.

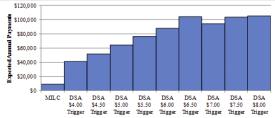

Figure 3 presents expected annual payments for a 1,000-cow dairy for DPMPP under the DSA proposal for all available buy-up coverage levels net of premium paid, as well as for MILC. In stark contrast to that for smaller farms, DPMPP payments are much higher than MILC for larger producers. For example, the net expected subsidy capture for the DSA $6.50 margin trigger coverage is over $104,000 for a 1,000-cow dairy, while total expected MILC payments are only about $9,000.

The divergence between large- and small-producer results is due to the production caps under MILC being lifted under DPMPP. Not taking into account production caps, expected payments per cwt are much lower under DPMPP than under MILC, and MILC will also pay out more frequently. However, larger farms can typically hit their payment cap when MILC is triggering in only a handful of months. The net effect is that payments are generally much lower under the basic DPMPP than under MILC for small producers, while the opposite is true for large producers. For large producers, the expected subsidy capture (net of premiums) is much greater under the DSA's DPMPP than under MILC—over 11 times larger in some cases for a 1,000 cow farm. For small producers, on the other hand, the expected payments net of premiums are typically less than what they are under MILC— except at high coverage levels (see Figure 4). Even then, the payment multiple is still not nearly that for larger producers.

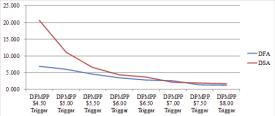

As a last point of comparison between the DSA and DFA proposals, Figure 5 presents expected loss ratios for the two programs for a 1,000-cow dairy. Note that under the DPMPP proposals in the DSA and DFA, a premium is required for buy-up coverage. The expected loss ratio is the ratio of expected payments divided by premiums and, thus, it represents the multiple of losses the government expects to pay relative to premiums paid by producers. In general, the government loss ratio is significantly higher for the DSA proposal than it is under the Goodlatte-Scott DFA proposal. For example, for $4.50 margin coverage, the expected loss ratio is 20.56 for DSA vs. only 6.71 for DFA. The loss rates converge above the $6.50 trigger, although the subsidy take is typically maximized at about the $6.50 trigger and it's not unreasonable to suspect that volume will be lower when above that trigger.

This comparative analysis was conducted under the assumption of common price volatility for both the DSA and DFA analyses, and the imposition of supply controls under DSA could perhaps alter the relative expected loss ratios presented here for the programs. However, it is questionable whether the supply controls will be effective enough on a national scale to sufficiently reduce the payments under the DSA relative to the DFA, particularly if producers in states dominated by smaller operations—such as those in the Northeast—choose not to participate in the program. In such a scenario, regional price/premium differentials may respond to supply controls, but perhaps not the national level prices upon which the DPMPP programs are based. This implies that DSA might not create the significant savings on the DPMPP portion of the program as claimed by proponents. This would result in a situation in which prices and, thus, costs of the DSA do not decline in tandem with the imposition of mandated supply cuts. The implication of this would be further government flows toward regions dominated by larger producers—many of which are arguably in the process of contracting production growth—at the expense of consumers, taxpayers, and regions dominated by smaller producers.

Schnepf, R., (September 18th, 2012). “Dairy Policy Proposals in the 2012 Farm Bill,” Congressional Research Service.

U.S. Department of Agriculture, Farm Service Agency (2013), Milk Income Loss Contract Program. Available online at http://www.fsa.usda.gov/FSA/webapp?area=home&subject=prsu&topic=mpp-mi