Federal regulations and programs have been crafted over the last 80 years to address the farm level markets for milk. These programs share the basic underlying motivations behind other agricultural policies and, likewise, rely on combinations of price support, income support, regulation of competition, product promotion and market development, and a complex system of grades, standards and quality criteria. The particular ways in which dairy policy is implemented end up being quite different from other agricultural programs, and these differences are driven by the physical, institutional and economic characteristics of milk and dairy markets. The Dairy Subtitle of the typical Farm Bill tends to focus on price and income programs, but all aspects of dairy policy are subject to the review and consideration of the Congressional agriculture committees, the U.S. Department of Agriculture (USDA), and other regulatory agencies, such as the Food and Drug Administration (FDA). The Agricultural Act of 2014 (2014 farm bill) was especially notable for dairy as it replaced existing price and income programs with the Margin Protection Program for Dairy Producers (MPP-Dairy).

MPP-Dairy combines elements of the Milk Income Loss Contract (MILC) with the Livestock Gross Margin for Dairy Cattle (LGM-Dairy) insurance product. MILC was a traditional deficiency payment program that originated in the 2002 farm bill. It offered payments triggered if a benchmark milk price was less than a legislatively specified threshold price, up to a payment limit defined by pounds of milk sold. After grain prices rose dramatically in conjunction with the demand for corn to make ethanol, the MILC trigger was modified in the 2008 Food, Conservation and Energy Act. When a national average dairy feed ration cost increased above a certain level, the trigger price would be adjusted upward to reflect a portion of the increased cost. Dairy farmers faced few restrictions to participate, but total payments were limited. MILC expired with passage of the 2014 farm bill.

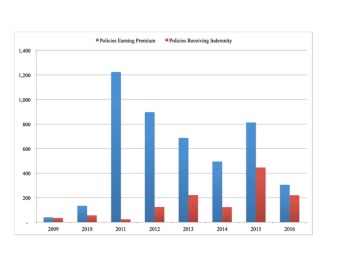

Source: USDA-RMA.

* All Active Policies and Policies Receiving an

Indemnity Payment (a policy may have covered

more than one unit or time period during a year).

LGM-Dairy dates to 2008 when it was added as a pilot program offered by the Risk Management Agency of USDA. It is a true insurance program that provides indemnities based on the differences between the Federal Milk Marketing Order minimum Class III price of milk and prices of corn and soybean meal using futures prices. Since FY2011, premiums have been subsidized, with additional reductions based on a farmer-selected deductible to make the product more attractive to farmers, but the funding for these subsidies is so limited that it has resulted in LGM-Dairy contracts only being available for short time periods and few producers. The number of farmers that have taken out one or more LGM-Dairy contracts is illustrated in Figure 1, which also shows the number of farmers that received an indemnity payment. The data do not reveal individual producers across years, but we can say that the number of farmers that used LGM-Dairy since its inception in 2009 is at least 1,224 and could be as many as 4,595—assuming no farmer bought a policy more than once. The number of farmers activating a policy reached over 800 in FY15 when some very favorable contracts were available near the end of 2014 and 55% of participants received an indemnity payment. Farmers generally describe LGM-Dairy as overly complex and too expensive. LGM-Dairy remains available to producers, but once they enroll in MPP-Dairy they can no longer use LGM-Dairy for that operation during the life of the 2014 farm bill.

MPP-Dairy makes payments to producers when the cost of feed is high relative to the price of milk. Like MILC, MPP-Dairy is offered through the Farm Service Agency (USDA-FSA) but has some features more in common with USDA-RMA's insurance products. The MPP-Dairy milk price is set to the published U.S. All Milk Price and feed cost is benchmarked using U.S. average corn and hay prices, as estimated by NASS, and the Central Illinois soybean meal price, as surveyed by Agricultural Marketing Service (AMS). Participating producers pay an annual fee of $100, for which they automatically receive $4/cwt (hundredweight) margin coverage on 90% of their program quantity. They can choose to buy-up to higher margins in $0.50/cwt increments to a maximum of $8/cwt. Buy-up coverage can be applied to 25-90% of the program quantity in 5% increments. The $8/cwt maximum coverage level is near the average of ADPM since 2000. The $4/cwt minimum is well below the "normal" lows experienced in 2000, 2002-2003 or 2006 but above the extreme $2 levels experienced in 2009 or 2012. If the bimonthly average ADPM falls below the selected margin coverage, a payment is triggered on the amount of eligible milk. Once enrolled, as long as they remain active in the dairy business and have paid their premiums, producers are obliged to remain in the program through 2018. They may change their coverage levels annually. Premium levels are fixed by the farm bill and therefore invariant to risk (Newton et al., 2015).

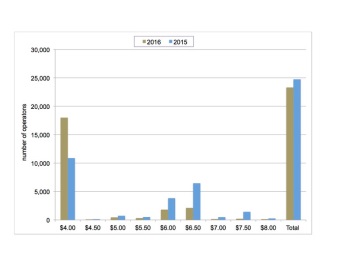

Source: USDA-FSA.

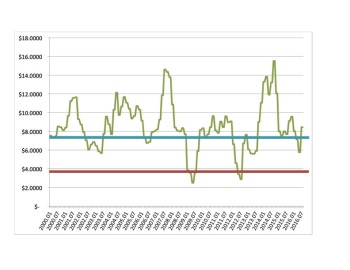

Sources: USDA-FSA for 2014 and later. Early

years calculated from ADPM formula,

USDA-NASS and USDA-RMA.

* Lines denote upper and lower bounds for

coverage under MPP-Dairy.

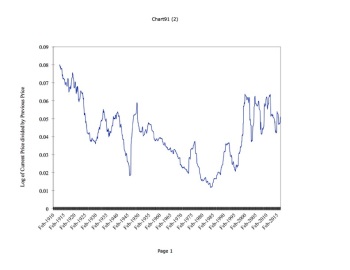

Sources: USDA, NASS.

In 2015, just over half of the eligible operations elected to participate in MPP-Dairy. About 44% chose to participate at the minimum, and cheapest, coverage level (USDA-FSA, 2016). Although dairy farmers generally regarded 2015 as a down year, MPP-Dairy provided only trivial payments to about 260 farmers who chose the highest coverage level. As illustrated in Figure 2, somewhat fewer farmers enrolled in 2016 and coverage levels shifted to lower amounts. The share of farms that elected the minimal coverage jumped to 77%, and participation at every buy-up level was lower in 2016. Insofar as market expectations for 2016 were pessimistic, the movement by so many enrollees towards the minimum and cheapest level of coverage has been widely interpreted as a clear indication that many farmers were dissatisfied with the performance of the program in 2015.

The ADPM dropped precipitously from the unusual highs of Fall 2014 into early 2015, as shown in Figure 3. ADPM is estimated for 2000 through February 2014, with the official ADPM shown subsequently. Despite the dramatic decline, the magnitude of the ADPM was consistently near a 15-year average. It did fall to well below that average in several months of 2016. As will be discussed in a following section, farmers generally contended that 2015 and 2016 were considerably worse than the ADPM measure suggested, either in the absolute or relative to previous years. This raised questions about the reliability of ADPM as an accurate indicator of actual farm financial performance. It also begs the question how do farmers gauge their financial status, such as by changes in the price of milk by itself or by liquidity as opposed to profitability.

MPP-Dairy is a stark contrast from previous and long-standing government programs to support milk prices or dairy farm incomes. From the 1940s to the 1990s, the primary safety net tool for dairy farmers was the Milk Price Support Program, which created a floor under milk prices by essentially establishing a perfectly elastic demand for certain dairy commodities that USDA purchased, held, and later disposed of outside of commercial markets—butter, cheese, and non-fat dry milk. The support program was part of a suite of agricultural price supporting programs permanently authorized in the Agricultural Act of 1949. Whereas similar programs for major program crops were abolished in the 1970s, the dairy support program was active through the 1980s. Massive surpluses and government costs in the 1980s resulting from an overly aggressive price support in the 1970s led to a political evisceration of the half-century old milk price support program. It continues to remain part of permanent law and serves as a serious threat should Congress fail to pass a new farm bill in a timely manner.

Figure 4 illustrates the effect of the price support program on dramatically restraining price variation. It presents the volatility of the all milk price—as the standard deviation of the log change in the all milk price between consecutive months—starting in 1910. The high degree of price volatility prior to the implementation of price supports in the 1940s helps to understand the justification for price supports and Federal Milk Marketing Orders introduced in the 1930s. It also vividly shows the significant reduction in price volatility from its introduction during the 1940s until its essential demise in the late 1980s. Since U.S. dairy markets were opened following the Uruguay Round, milk price volatility has resurfaced at levels comparable to the pre-World War II period. Moreover, as suggested by the short-term variations that are more pronounced in the current time period, the nature of these variations is also different. Earlier price variations were large but almost entirely seasonal and hence quite predictable. Since the mid-1990s, the seasonal variation in monthly prices has been compounded by cyclical and other effects that are more difficult to anticipate (Nicholson, Stephenson, and Novakovic, 2009). This has led to a heightened concern about volatility.

Transitioning from a program designed to prevent prices from going below a minimum to one that provides income subsidies when prices inevitably fall made sense when dairy markets were opened to world trade in the mid-1990s. Dairy farmers disliked the more overt subsidy of countercyclical payments but nonetheless felt justified in receiving some degree of support in a marketplace that had become increasingly volatile.

Two events led dairy farm advocates and policy makers to seek an alternative to either MILC or LGM-Dairy. The first was the prolonged regime of higher grain prices in the second half of the 2000s. The second was the precipitous decline in milk prices in 2009, during the depths of the Great Recession. Although both programs were designed to protect farmers against unfavorable variations in the prices of feeds relative to the milk price, MILC was judged to be too anemic and LGM-Dairy too complicated and expensive. The political assessment was that it would be better to start with a clean slate.

Milk production supply controls were also seriously considered and proposed. Some farmers and advocates felt and still feel strongly that supply interventions are both necessary to quickly address low milk prices and are more fair than simply letting low net income force some farms out of business. Ultimately, those approaches lacked sufficient Congressional support. On the other hand, proposals that looked like an insurance product held appeal as public and Congressional sentiment was moving towards favoring crop insurance over direct payments types of programs. Key factors that favored MPP-Dairy over LGM-Dairy or other forms of crop insurance were:

Although MPP-Dairy was designed to provide very low premiums to farms of average size or smaller, it was a priority of the developers to have a program that would be more relevant and fully available than MILC to all sizes of dairy farms, as it was clear that size offered no immunity to precipitously low milk prices and high feed costs.

Satisfaction with MPP-Dairy is believed to be low based on feedback from extension educators, farm media, cooperative economists and farmers. Dairy farmers had grown somewhat accustomed to not receiving a lot of assistance from federal programs, but they expected more from MPP-Dairy (Dickrell, 2016; Stephenson, 2016). On top of that, farmers resented being asked to pay premiums for a program many felt had failed on its promise. Although payments from MILC would have been meager, many farmers said at least they wouldn't have had to pay for it. Even for farmers who paid only $100 for the lowest level of coverage, they felt the insult of payment with no help for the injury of low net farm income.

As shown in Figure 2, the ADPM has not fallen below the base level of $4/cwt since 2014. In the 12 payment periods during the first two full years of the program, six have had an ADPM below $8/cwt, the highest coverage level. However, five of these have been between $7 and $8 and one was calculated as $5.76/cwt. With very few producers signing up at the $8 or $7.50 level, the number of program beneficiaries has been about 4,500 over the two years compared to some 24 thousand enrollees and over 40,000 dairy farms nationwide. Of that 4,500, 4,000 or more received only one payment during that one exceptional period in 2016. While every analyst is quick to point out that the success of an insurance program is not to be measured by the number of times it pays out, the fact remains that many producers apparently believe that MPP-Dairy should have paid out far larger and more frequent benefits than it did. Many dairy farmers would say that 2015 and 2016 felt to them like years when many more farmers deserved assistance.

Increasing milk and feed price volatility in recent years has led to the development and use of dairy forward pricing tools, such as the Dairy Options Pilot Program and LGM-Dairy insurance. Dairy farmers also have purely private risk management tools at their disposal including forward contracts from their buyers or futures and options contracts for milk and feed that are available via the Chicago Mercantile Exchange. Despite the variety of tools available few farmers take advantage of risk management tools other than MPP-Dairy. Although exact numbers are unknown, industry reports indicate that something like 10-15% of farms have tried private sector risk management tools and only a small subset use them with any consistency although those farms represent a disproportionately large share of milk production (Wolf and Widmar, 2014). This is consistent with Figure 1, which suggests that 3-7% of U.S. farmers have even tried LGM-Dairy. This is not to say that dairy farmers are oblivious to risk, but what farmers tend to emphasize is:

Most dairy farmers also market their milk through a cooperative. While this does not necessarily result in higher prices, it does tend to effectively deal with the risk of losing one's market (buyer). The discussions around the development and launch of MPP-Dairy increased awareness of price and income risk by dairy farmers, but it may not have swayed them to take a more active role in their own price risk management.

The logic behind using a milk price less feed cost margin to trigger dairy farm assistance is sound. Milk is by far the largest source of revenue on dairy farms and feed the largest cost. Past research has shown that the ADPM is correlated with profitability on dairy farms (Wolf et al., 2014). However, there are issues with the ADPM including the fact that a general correlation with farm profitability hardly guarantees that the ADPM will accurately or even approximately reflect the financial conditions of all farms or even most farms.

Farmers expect that income above feed costs will be sufficient to pay for all other inputs—for example, hired labor, replacements, utilities—and generate a sufficient return to the unpaid factors including management, labor and capital. There is a large amount of heterogeneity across dairy farms in the United States that might affect the efficacy of the ADPM to reflect farm level risk. These factors include variations in production technologies or size, capital structure, and management. By using spot prices on a monthly basis, the ADPM implicitly assumes the farm is operating in the cash market for its output and inputs. Many dairy farms grow their own crops to meet feed needs—particularly forages. They do so because they can generally grow crops more cheaply than they can buy feed. In years when this is true, the ADPM would tend to understate their actual income over feed costs. Historically, operations in the Great Lakes and Northeast regions have this characteristic, whereas very large herds typical of the West have a much higher reliance on purchased feeds, especially grains and oilseeds. Another factor is that the differences in prices of milk and purchased inputs and thus margins are not constant across regions over time. For example, droughts in the Southwest and Pacific regions have driven up feed prices beyond normal regional relationships with the rest of the county.

The policy debate in the next couple of years is likely to focus on whether MPP-Dairy can be modified to make it a more acceptable instrument to dairy farmers. In its current form it seems likely that many would desert the current program if a new sign-up is required under the next farm bill. At present, primary attention is being paid to "fixing" the current program, including four major changes.

The first is to return to the ADPM formula using feed price weights as proposed in the original House bill. In a cost cutting move, the Senate bill reduced the weighting factors on all feed prices by 10%. This had the effect of inflating the margin. Returning to the original ADPM formula would have decreased the monthly ADPM an average of $0.95 in 2015 and 2016, ranging from $0.86 to $1.03 across all months.

A second change would be to reduce premiums, especially at the higher coverage levels. This could also include raising the minimum catastrophic coverage from $4/ cwt to a higher amount.

A third change might be to add coverage levels above $8 per cwt.

Lastly, some groups would like to use regional prices instead of national prices to make the ADPM reflective of regional differences in prices. A specific proposal has already been introduced to use regionally differentiated input prices. It seems unlikely that a regional approach would ignore regional differences in the milk price.

Each of these proposals has budget consequences that may make them difficult to implement in the current climate. They certainly would make the program more appealing to producers but it is not at all clear how favorably producers would react.

A different suggestion for change is to recast MPP-Dairy as a proper insurance program under the auspices of USDA-RMA, not USDA-FSA—for example: rate the premiums at sign up based on current market situation. How this would relate to the ongoing pilot LGM-Dairy has not been much articulated or explored. This would make the program cost part of the overall crop insurance program, not the dairy title. Lacking any specifics on its structure, it is not possible to anticipate how such a program would be received by producers.

The oldest and most active federal intervention is Federal Milk Marketing Orders. Federal Orders regulate farm level markets for milk primarily through a complex system of minimum prices that are applied to the buyers of farm milk according to the products they make. A complex set of regulations, Federal Orders are frequently discussed and often criticized, even within the industry. However, there is no consensus on how they might be improved or even that legislative changes are necessary, as opposed to the conventional method of regulatory hearings. A pending decision on a brand new Federal Milk Marketing Order to encompass the California market and displace the current system based in State law, could lead to new discussions about Federal Orders elsewhere. The issue will be the extent to which USDA accepts California producer proposals to retain certain features of the existing California regulation that are quite different in design or execution from what is used elsewhere in the Federal system. A recommended decision on a California Order is expected in 2017.

As noted earlier, numerous other areas of government regulation are of keen interest to dairy farmers, including immigration reform, environmental regulations, animal and other management practices, and food laws ranging from GMOs to the use of beverage milk in child nutrition programs. Some of these may be on the agenda of the new Republican administration, but it is premature to speculate on what those might be or what direction they might take.

U.S. agricultural policy has shifted towards insurance and other risk management tools and away from traditional income subsidies and price supports in recent years. Dairy policy has been a part of this shift including encouraging the use of dairy options contracts, dairy revenue insurance, and MPP-Dairy, a new program established in the Agricultural Act of 2014. Despite these policy trends, dairy farmers have not embraced conventional price or margin risk management tools. Although over half of U.S. dairy farms enrolled in MPP-Dairy, the current impression is that this program has not lived up to farmer expectations. Policy-makers and industry advocates have begun to consider ways in which the current program could be improved, but many farmers are skeptical and will be looking for dramatic changes. Whether or not Congress can afford to be more generous with dairy programs is probably a more relevant question than their desire to offer dairy farmers a more appealing package.

Federal Milk Marketing Orders, another and long-standing component of U.S. dairy policy remains, but also faces various criticisms. After resisting trade for most of the 20th Century, the U.S. dairy industry from farmers to processors, has become quite bullish on trade and generally supportive of increased trade liberalization, while of course retaining a strong sense of the need for "fair" trade rules. Looming ever larger above familiar issues related to volatile prices are consumer driven issues related to production practices, environment, health, animal welfare, nutrition and other issues directly related to dairy foods.

Report of the Dairy Industry Advisory Committee (Andrew Novakovic, chair), U.S. Department of Agriculture, special report, March 2011.

Dickrell, J. 2016. “Can the Dairy Margin Protection Program be Fixed?” Farm Journal Milk Business. Available online: http://www.milkbusiness.com/article/can-dairy-margin-protection-program-be-fixed

Newton, J., C.S. Thraen, and M. Bozic. 2015. “Evaluating Policy Design Choices for the Margin Protection Program for Dairy Producers: An Expected Indemnity Approach.” Applied Economic Perspectives and Policy doi: 10.1093/aepp/ppv033

Nicholson, C., M. Stephenson, and A. Novakovic. 2009. "Spectral Decomposition: What Can It Tell Us About Milk Price Cycles?" Briefing Paper BP 09-6, Cornell Program on Dairy Markets and Policy.

Stephenson, M. 2016. “Can We Fix the Margin Protection Program?” Hoard’s Dairyman Intel. Available online: http://hoards.com/article-19981-Can-we-fix-the-Margin-Protection-Program.html?utm_medium=email&utm_campaign=161121-169&utm_content=161121-169+CID_a28b2c709ddbd4e6e6fed8f5b68ac32a&utm_source=Intel&utm_term=Can%20we%20fix%20the%20Margin%20Protection%20Program

U.S. Department of Agriculture, Agricultural Marketing Service (USDA-AMS). 2016. State Grain Reports. Monthly Central IL Soybean Processor Report. Available online: https://www.ams.usda.gov/market-news/state-grain-reports#Illinois.

U.S. Department of Agriculture, Farm Service Agency (USDA-FSA). 2016. Dairy Margin Protection Program. Available online: https://www.fsa.usda.gov/programs-and-services/Dairy-MPP/index

U.S. Department of Agriculture, National Agricultural Statistics Service (USDA-NASS). 2016. “Charts and Maps.” Agricultural Prices. Available online: https://www.nass.usda.gov/Charts_and_Maps/Agricultural_Prices/.

U.S. Department of Agriculture, Risk Management Agency (USDA-RMA). 2016. Summary of Business Datafiles. Available online: http://prodwebnlb.rma.usda.gov/apps/SummaryofBusiness/ReportGenerator/Results?CY=2016,2015,2014,2013,2012,2011,2010,2009&CM=0847&IP=82&ORD=CY,IP,CM&CC=L

Wolf, C., A. Novakovic, M. Stephenson, and W. Knoblauch. 2014. “Indicators of Dairy Farm Financial Condition as Policy Triggers.” Journal of Agribusiness 32: 127-143.

Wolf, C. and N. Olynk Widmar. 2014. “Dairy Farmer Adoption of Forward-Pricing Methods.” Journal of Agricultural and Applied Economics 46: 527-541.