The starting point for discussion on the next farm bill will be the commodity title in the 2014 farm bill as well as the crop insurance program. While a new infusion of Federal money is possible, a more likely scenario is for reduced Federal spending on crop safety net programs. The extent to which Federal safety net outlays need to be reduced will depend on expected commodity prices. A low and high price scenario are discussed. The debate over farm safety net programs likely will focus on reducing outlays from Price Loss Coverage (PLC) program and crop insurance. This debate will have a regional dimension, as often happens in farm bills. Producers of cotton, rice, peanuts, and wheat will prefer to protect spending under PLC. Producers of corn and soybeans will desire to protect crop insurance spending.

The 2014 farm bill dramatically changed commodity programs, ending direct payments, a program with average outlays of $5 billion from 1996 to 2013. Direct payments faced scrutiny because payments did not vary with different prices or yields, resulting in the same direct payment even when revenue was high (Orden, Blandford, and Josling, 2010). In its place, commodity programs now are justified as providing risk management to farmers.

The 2014 commodity program consists of two tiers (Figure 1). The first contains marketing loan and loan deficiency payment programs which have fixed price targets in the form of loan rates. For most crops, loan rates are low relative to expected prices, leading to low expectations of Farm Safety Net protection. The second tier are producer elected, irrevocable choices between Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC). Payments by these programs are made on historical base acres and yields, which are fixed for the life of the 2014 farm bill. Corn, soybeans, and wheat have the largest number of base acres. Base acres for the other program crops are notably smaller.

PLC makes payments when national, crop year prices are below reference prices set by Congress. The 2014 farm bill reference prices were increased relative to the same, but differently named target prices, in the 2008 farm bill. The increase varied by crop, ranging from 8% for peanuts to 88% for barley, with the increase in general being 35% to 50% (Zulauf and Orden, 2014). The effective increase is even larger—generally 50% to 75%—since counter-cyclical payments in the 2008 farm bill were triggered when market price was below the crop’s target price minus its direct payment rate. As noted above, the direct payment rate no longer exists.

ARC has county (ARC-CO) and individual farm (ARC-IC) versions. ARC-CO is a significant modification of the Average Crop Revenue Election (ACRE) program instituted in the 2008 farm bill. ARC-CO makes payments when county revenue falls below a guarantee. The guarantee is based on five-year moving averages of national prices and county yields, except that prices used to calculate the guarantee cannot be less than the reference price for the crop. ARC-IC has its genesis in the Supplemental Revenue Assistance Payment (SURE) program of the 2008 farm bill. ARC-IC makes payments when the farm’s revenue is below the farm’s revenue guarantee. The farm’s revenue guarantee is for all program crops on the farm based on the same prices as ARC-CO but moving averages of the farm’s yields for program crops.

Existence of three programs represents a political compromise as agricultural constituencies could not agree on the preferred counter-cyclical program (Orden and Zulauf, 2015). In general, producers of peanuts and rice in southern states supported PLC. Producers of corn in the Midwest states preferred ARC-CO. ARC-IC reflects a Great Plains perspective. Preferences likely reflect a number of factors. Peanut and rice producers see low prices as a concern while corn and soybean producers see revenue as a concern. Another factor is the reference prices in PLC. Peanuts and rice have relatively small base acres. Having high reference prices relative to market prices results in large payments to rice and peanut acres, but relatively small Federal budget impacts. The same is not true for corn and soybeans which have much larger base acres.

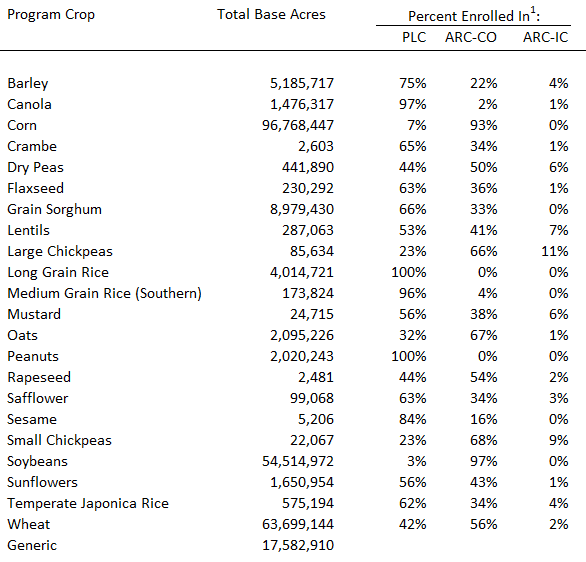

Over 90% of base acres in corn and soybeans were enrolled in ARC-CO while 90% peanuts and rice were enrolled in PLC (Table 1), leading to regional enrollment differences. Over 90% of base acres in the Midwest states were enrolled in ARC-CO while the majority of base acres in southern, southwest, and Mountain states are in PLC (Schnitkey et al., 2015b). ARC-IC had larger enrollment numbers for small chickpeas, large chickpeas, dry peas, lentils, and mustard, crops with base acres centered in the Great Plains. While geography played some role in decisions, so did expected payments from the programs. In general, farmers’ enrollment was positively correlated with expected payments (Schnitkey et al., 2015a). As a result, enrollment may not so much model program preferences as it does expected payouts. Whatever the explanation, existence of three programs and their regional dimensions will carry over to the next farm bill.

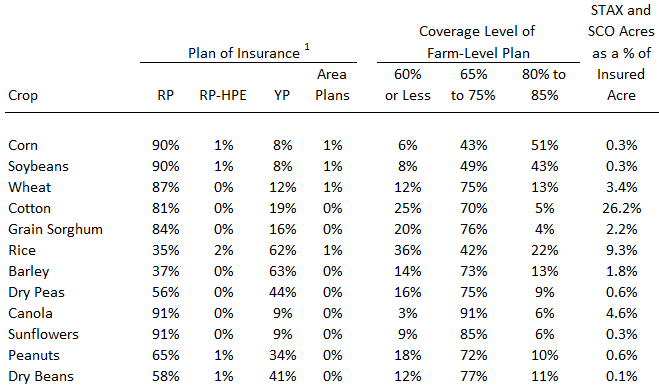

As has occurred in previous farm bills, tradeoffs will be made between commodity title and crop insurance programs. Farmers purchase crop insurance, paying a portion of the premium with the remaining portion subsidized by the Federal government. Premium subsidies are a large portion of the Federal outlays on insurance. Farmers are given a choice of products, with 98% of acres insures with farm-level products which indemnify based on farm yields (Table 2).

Within farm-level products, farmers can choose between Revenue Protection (RP), Revenue Protection with the Harvest Price Exclusion (RP-HPE), and Yield Protection (YP). As its name implies, RP offers revenue protection, with prices calculated off of futures contracts. RP has a feature that allows its guarantee to increase between insurance sign-up and harvest if prices rise. RP is a popular product being used to insure over 80% of acres planted to canola, sunflowers, corn, soybeans, wheat, grain sorghum, and cotton (Table 2). Like RP, RP-HPE is a revenue insurance. Unlike RP, RP-HPE does not increase its guarantees if price rise. RP-HPE is not widely used (Table 2). YP makes payments when yields fall below a guarantee. YP use is highest for rice (70%) and barley (57%). Use of the different types of insurance likely indicates the types of risks farmer wish to protect against.

Corn and soybean farmers tend to elect high coverage levels, with 51% of corn policies and 43% of soybean policies at 80% or higher coverage levels (Table 2). Comparable shares are 13% for wheat, 5% for cotton, 4% for grain sorghum, and 22% for rice. Higher coverage levels are consistent with corn and soybeans producers viewing crop insurance as more important than producers of other crops, potentially leading to a debating point in the next farm bill.

Over time, steps have been taken to make crop insurance more attractive to farmers by reducing the share of premiums paid by farmers and increasing coverage levels. Relative to farmer paid premiums, the 2008 farm bill increased the share of premium subsidized for farm-level products that insured all of a crop in a county—that is, enterprise units. Examples of increase in coverage include introducing revenue products, increasing coverage levels, and increasing t-yields. A t-yield is the minimum yield used in calculating guarantees. Higher t-yields lead to higher guarantees. The 2014 farm bill increased coverage by introducing Yield Exclusion, cotton Stacked Income Protection Plan (STAX), and Supplemental Coverage Option (SCO).

Yield Exclusion allows a producer to exclude a yield from the guarantee calculation in a county where the county yield was below 50% of the ten-year average yield or an adjacent county had a yield with a 50% reduction. Impacts of Yield Exclusion on guarantees varies geographically. Many counties in the Midwest have no or at most one year eligible for exclusion. Producers in the southern Great Plains typically have many more. Having more excludable yields potentially raises guarantees more than when excludable yields are limited.

Cotton STAX is a crop insurance program available to producers on acres planted to cotton (Shields, 2016), coming into existence with support from the National Cotton Council (NCC) due to special circumstances discussed in the next section. STAX is an area plan of insurance. STAX’s range of coverage is from 90% down to the higher of 70% or the coverage level of the underlying farm-level cotton insurance policy. Purchase of a farm-level product is not required. Maximum coverage level under a farm-level plan is 85%. Premiums under STAX have a subsidy level of 80%, meaning that the Federal government pays 80% of the premium while the farmer pays 20% of the premium.

SCO is similar to cotton STAX but is less attractive (Zulauf and Orden, 2014). The maximum coverage level under SCO is 86% compared to the 90% coverage level under STAX. Unlike SCO, STAX requires purchase of a farm-level product and is either yield or revenue based on the underlying product. STAX is always revenue based. SCO has a premium subsidy rate of 65% compared to 80% under STAX. SCO does not have a protection factor while STAX does. The protection factor scales up payments when they occur and farmers can choose from within a range. Suppose a farmer chooses the highest protection factor and a 90% coverage level. In this scenario, a $30 difference in the guarantee and revenue results in a $78 payment, 75% larger than the difference.

Popularity of STAX and SCO have been relatively low. In 2016, cotton STAX was used on 26.2% of insured cotton acres. SCO use on all crops was below 10.0% of insured acres. Rice has the highest use at 9.3% of insured acres, followed by canola at 4.6% and wheat at 3.4% (Table 2). Some of the low use of SCO reflects the provision that SCO is not an option for a crop for which ARC was elected. It also likely reflects the unpopularity of area plans with farmers.

Cotton faced particular issues during the 2014 farm bill negotiations. Brazil successfully challenged U.S. cotton programs at the World Trade Organization (WTO). To settle the dispute, several changes were enacted in the 2014 farm bill, with NCC playing an active role in designing cotton support programs (Schnepf, 2014). The cotton programs do not include PLC, ARC-CO, and ARC-IC. Rather, they consist of generic base acres, the aforementioned cotton STAX program, and marketing loans. The first two are new; the third is a continuing program.

Generic base acres are former cotton base acres. Generic acres do not receive cotton payments. Rather, they can receive payments for other program crops planted on generic acres. Commodity title payments likely enter profitability calculation, potentially causing planting decisions on generic acres to be impacted by commodity program payments. This possibility is problematic when farmers choose to plant crops with high expected commodity title payments, leading to more supply, further price declines, and higher commodity title payments. This concern is especially prevalent with regard to peanuts (Schnepf, 2016). Rice and corn also were planted extensively on generic base acres.

The next farm bill debate likely will begin with a Congressional Budget Office (CBO) estimate of Federal outlays for the above programs assuming that they continue into the future. Then, the U.S. Congress will give the House and Senate Agricultural committees a target for Federal outlays, with the expectation that the target will be less than the CBO estimated outlays. If targeted outlays are above CBO estimated outlays, a very different debate will occur to that presented below. If targeted outlays are below CBO estimates, farm bill debates will become more contentious as the need to reduce Federal outlays on field crop safety net programs from CBO estimates become larger. Size and composition of CBO outlay estimates will depend on commodity prices used in CBO estimates. Outlays will be large if commodity prices are low -- with low being expected prices near or below reference prices. This scenario is tackled in the next “Low Price” section. A high price scenario then is discussed.

Under low prices, most spending for commodity title programs will be in PLC. PLC’s expected payments per base acre increase relative to those for ARC-CO as commodity prices decrease. This occurs because PLC’s payments increase as prices fall below reference prices and do not decrease over time. On the other hand, ARC-CO payments are limited to 10% of the guarantee and guarantees will decrease until the reference price becomes binding on guarantee prices used in guarantee calculation. Moreover, while choice of program cannot be changed during the life of the current farm bill which runs through 2018, after 2018 farmers likely will be allowed to choose between PLC and ARC, either in an extension of the 2014 farm bill or in a new farm bill. Given changes in expected payments, shifts of acres to PLC should be expected. For example, in their most recent projection, CBO (2016) estimates that ARC-CO enrollment of corn base will decrease from 97% under the 2014 farm bill to 51% after 2019.

CBO estimates average yearly spending for 2019 through 2023 at $8.92 billion for crop insurance, $3.01 billion for PLC, $1.42 billion for ARC-CO, $.04 billion for ARC-IC, and $0.30 billion for marketing loans. Taken together, crop insurance and PLC account for 87% of commodity title and crop insurance spending. In its March 2016 baseline, CBO used expected prices that average above the reference prices for corn and soybeans for the years from 2019 through 2023. Even at expected prices above reference prices, focus of cuts will be on PLC and crop insurance because of their high percentage of total spending. At lower expected prices, PLC and crop insurance spending becomes an even higher proportion of total spending.

For PLC, several mechanisms exist for making cuts: reference prices could be lowered, reference prices could be tied to a moving average of previous prices, a tighter per acre cap could be instituted, or the percent of base acres that receive payments could be reduced. Given experiences with previous farm bill debates, much of the debate likely will focus on reference price levels, leading to a discussion of relative reference prices across crops. Some crops – notably peanuts, long-grain rice, and wheat—have reference prices above expected prices, leading to relatively high per base acre payments. This situation then leads to equity concerns across crops as well as public concerns for the purpose of the program. Continuing large payments for a crop look more like an income support program similar to direct payments, rather than as a counter-cyclical risk management program. Tying reference prices to moving averages of prices could eliminate this issue.

For crop insurance, one approach for lowering costs would be to reduce or eliminate crop insurance provisions added over the years to increase coverages. However, each will receive support from specific crops and regions, making it difficult to change these provisions. Yield Exclusion and t-yield provisions have larger impacts in high yield-risk areas such as the Great Plains. Trend-adjusted yields aid areas with high yield growth such as corn and soybeans in the corn belt. The harvest price option is widely used for many crops (Table 2). High coverage levels are purchased on many corn and soybean acres. SCO and STAX could be eliminated, but would offer only small budget savings given their low use and may generate significant opposition among current users.

Lacking specific crop insurance provisions to cut, the focus could turn to reducing Federal subsidies on premium. Cutting these subsidies by the same percentage point(s) across all policies would be a way to distribute cuts to crop insurance across all farmers, crops, and regions. Cutting subsidies would likely result in farmers lowering coverage levels of crop insurance purchases, leading to further reduction of crop insurance spending, and also reducing risk protection offered by insurance.

Under any low price environment, ARC-CO will not face as much budgetary issues as does PLC. It has a 10% cap on per acre payments and its coverage level was set at 86% of its revenue target, which in a low price environment depends on the reference price. In contrast, PLC has a much higher per acre payment cap that is a function of the difference between the reference price and the loan rate and its coverage level was set at 100% of the reference price. The reason for these different parameters is that the 2014 farm bill was discussed with an expectation of a downward moving price environment but prices were not expected to average much below the reference prices. Under a low price environment, a potential issue could be changing ARC-CO parameters so that expected payments are nearly the same as those from PLC.

Where budgetary cuts in the commodity and crop insurance titles come from will have crop and geographical implications. Producers of peanuts, rice, and wheat will have more of an interest in preserving PLC spending. Given the high levels of crop insurance use, producers of corn and soybeans will wish to protect crop insurance. A north-south divide is likely: with the south protecting commodity title spending and north protecting crop insurance spending.

Higher prices would likely result in higher Federal outlays on crop insurance, but significant reductions in spending in commodity title programs. Moreover, there would be a shift in spending from PLC to ARC.

Low expected outlays could lead to relatively easy negotiations on the commodity title as there simply is relatively little Federal outlays to argue about. On the other hand, high prices along with a need to cut Federal outlays could lead to a much larger focus on crop insurance. Crop insurance could represent over 70% of Federal outlays on farm safety net programs for field crops. Significant cuts in farm safety net costs would have to come from insurance.

Whether prices are low or high, cotton will be an issue. Adding a cottonseed program will increase costs in a likely environment where reductions in Federal outlays need to occur. Thus, cotton interest groups likely will have to offer cuts in other programs to pay for it. Options include elimination of cotton STAX, lower cotton loan rates, and elimination of generic acres. Eliminating generic acres could potentially reduce the quantity produced of crops with the highest expected government payments per acre, such as peanuts, rice, and corn; thus, providing savings. However, it could increase the acres of other crops, notably soybeans; thus reducing their price and potentially increasing expenditures on them. A second issue is what should be the cottonseed oil reference price, both its level and relative to the “other oilseed” reference price. A third issue is how to determine the base acres for cottonseed oil. Historical cotton base acre reflects neither how many nor where acres are planted to cotton today (Zulauf et al., 2016).

As the preceding paragraph implies, a cottonseed oil program will face opposition. Such a program could have been instituted in the 2014 farm bill. Instead, the NCC supported STAX and generic acres. There also likely will be concerns about whether a cottonseed program could again cause trade concerns with Brazil. The following question will need to be answered: “Given this legislative history, why institute a cottonseed commodity program now?”

The current dialogue leads to an expectation that a new program for cotton, cuts to commodity title spending, and cuts in crop insurance spending will likely be key topics in the debate over the crop safety net in the next farm bill. If Federal outlays need to be reduced, contentious debates could ensue between cutting PLC or cutting crop insurance. As price expectations decrease, the pressure to cut spending on PLC will increase, with a particular focus likely to be the level of the reference prices. A potential debate along crop and geographical lines looms that pits supporters of crop insurance, notably Midwest corn and soybeans, against supporters of PLC, notably the Southern crops. While this geographical division is a historical feature of farm bill debates, it would be the first time that target price programs, in the form of PLC, will be pitted against crop insurance. This new twist in the age old crop policy saga will create new opportunities for economic analysis and dialogue.

Clayton, C. 2016. “Farmers Question ARC Yield Payment Prices Lawsuits Possible -- DTN.” AgFAX., Available online: http://agfax.com/2016/02/09/151329/.

Congressional Budget Office (CBO). 2016. “CBO’s March 2016 Baseline for Farm Programs.” Available online: https://www.cbo.gov/sites/default/files/51317-2016-03-USDA.pdf.

National Cotton Council (NCC). 2016. “NCC Appreciates Senators’ Cottonseed Designation Request.” Available online: http://www.cotton.org/news/releases/2016/cssen.cfm.

Orden, D. and C. Zulauf. 2015. “Political Economy of the 2014 Farm Bill.” American Journal of Agricultural Economic, 97(5): 1298-1311.

Orden, D., D. Blandford, and T. Josling. 2010. Determinants of Farm Policies in the United States. In Political Economy of Distortions to Agricultural Incentives. Ed. K. Anderson, 162-190. Washington D.C.: World Bank.

Schnitkey, G., J. Coppess, C. Zulauf, and N. Paulson. 2015a. "Expected Payments from ARC-CO and PLC." farmdoc daily (5):15, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign.

Schnitkey, G., J. Coppess, N. Paulson, and C. Zulauf. 2015b. "Perspectives on Commodity Program Choices Under the 2014 Farm Bill." farmdoc daily (5):111, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign.

Schnepf, R. 2014. Status of the WTO Brazil-U.S. Cotton Case. CRS Report R4336.

Schnepf, R. 2016. U.S. Peanut Program and Issues. Congressional Research Service, CRS Report R44156.

Shields, D. 2016. Crop Insurance Provisions in the 2014 Farm Bill (P.I. 113-79). CRS Report R43494.

U.S. Department of Agriculture, Risk Management Agency (USDA-RMA). Summary of Business. Available online: http://www.rma.usda.gov/data/sob.html.

Zulauf, C. and D. Orden. 2014. “The U.S. Agricultural Act of 2014: Overview and Analysis.” IFPRI Discussion Paper 01393, December 2014.

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. 2016. "Cottonseed and U.S. Oilseed Farm Program Issues." farmdoc daily (6):18, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign.