The United Nations estimates that today’s population of 7 billion will increase to 8 billion by the year 2025 and further increase to 9 billion by the year 2043 (United Nations, 2011). Feeding the growing world population remains a major challenge for governments and governmental institutions. Half of the U.S. land area of 2.3 billion acres is currently in agricultural uses (e.g., cropland, pasture, and rangeland) and agricultural land use is expected to change little over time. U.S. agriculture currently accounts for 8% of the world’s exports and is vital to meeting the challenges of a nearly 30% increase in population in the next three decades. Consequently, the transition of U.S. agriculture into the future remains an important public policy issue (Executive Office of the President, 2012).

Major features of U.S. agriculture for at least the past six decades have been rising productivity and an increase in the concentration of production on a relatively small share of farms. In 2007, 32,886 farms, or 1.5%, accounted for half of the production on the 2.2 million U.S. farms (U.S. Department of Agriculture (USDA), National Agricultural Statistics Service (NASS), 2009), driven, in part, by economies of size. As one indicator of their efficiency, farms produced half of this product on only 10% of the land in operation (USDA, NASS, 2009). The number of U.S. farms began declining in 1936, but has stabilized since 1978. The stabilization of farm numbers comes from increases in the number of the very smallest farms, as the number of midsized farms continues to decline. Currently, 60% of farms have sales under $10,000.

Because food is such a basic human need, many individuals and groups are invested in and concerned about our agricultural and food systems. For example, over the past decade, groups that have become more vocal are those less concerned with feeding the growing world population in an efficient manner and more concerned with producing agricultural commodities in the context of other objectives, such as animal welfare, food safety, and minimizing adverse environmental impacts. How these multiple objectives trade off with production objectives and develop with time will help to determine U.S. agriculture’s transition into the future.

In light of the multiple objectives associated with contemporary agriculture, it is very difficult to predict how many farmers and ranchers our country might need or have in the future. Global as well as domestic agricultural supply and demand forces will play major roles in shaping the structure of agriculture, as will public policy choices. However, it is also important to keep in mind the preferences and choices of the many individuals engaged in agriculture—farm families and farmland owners.

U.S. and global agricultural markets have changed dramatically in recent years. The combination of increased industrial demand for grain along with growing global food demand has led to higher crop and livestock prices, and increased demand and prices for agricultural inputs. Beginning in late 2006, rapid growth in U.S. biofuel production resulted in sharply higher and more volatile crop prices. This new demand for corn, combined with a backdrop of accelerating global food demand, has resulted in dramatic price increases from the 2005 crop year to the 2011 crop year for all major crops including corn (up 210%) and grain sorghum (up 228%); to wheat (up 111%), soybeans (up 119%), barley (up 111%), and oats (up 114%); to rice (up 84%), cotton (up 91%), and alfalfa hay (up 88%). Many crop producers have experienced profitability despite the fact that input prices have also jumped sharply with big increases in fuel, fertilizer, and other input prices.

Livestock industries have endured enormous shocks to adjust to feed prices that are double to triple historical levels. These shocks spawned adjustments in the beef, pork, dairy, and poultry industries that continue to this day and have precipitated long-term structural change in the beef and perhaps other livestock sectors that will take many years to complete. The increased competition for crop production not only results in reallocation of land among crops (corn acreage has increased over 20% since 2006, while most other crops are down in acreage), but is also inducing regional shifts of pasture and hay production out of major cropping areas of the Midwest and surrounding regions. The result is a measurable shift of beef cattle production out of the Midwest and into rangeland and more marginal cropland areas in the Great Plains and West.

The dramatic increase in crop prices is being reflected in increased cropland rental rates and land values. The jump in land values is most pronounced and widespread in the Midwest, which is the epicenter of increased crop production, but is spreading to other regions of the country and will eventually affect all agricultural land, including rangeland in the western United States.

Several factors from the previous discussion are important to the question of agricultural producer transition. First, the new higher plateau for agricultural product values appears to be permanent. While drought and a number of other short-term factors are part of the current agricultural market situation, the increased food and industrial demands for agricultural products are fundamental and permanent. U.S. agriculture evolved over the last 60 years in an environment of cheap energy that deeply affected the structure and function of agriculture. Agriculture in the future will adjust to operate in a higher energy cost climate that is significantly different from the past. While biofuel demand has been the catalyst of change in the past few years and will continue to be part of the agricultural market landscape, it is likely that growing global food demand will be more important in the long run. Emerging economic power and population growth in several developing countries, but especially China and India, will likely ensure that agricultural product values will remain elevated.

Increased volatility of product and input prices and the associated risk is the second major factor that makes future agricultural markets fundamentally different from the past. Resource demands from emerging economies will not only keep agricultural product values high but will also continue to push up input values as long as global incomes are increasing. Energy, fertilizer, feed, and other agricultural inputs will be increasingly demanded in global markets. While expanding global agricultural markets and high product values represent new opportunities, the associated risk implies new challenges for agricultural producers and the need for new approaches to business. Agricultural markets are increasingly subject to more shocks from external macroeconomic and global market factors compared to the past where internal market fundamentals were the biggest drivers of product prices. Many older agricultural producers, recognizing both the opportunities and challenges of this changing global market environment, may be unable or unwilling to make the managerial and business changes necessary to continue production.

The most basic decisions about transition, of course, are made by individual farm families—including both business and family decisions, often inter-related. Decisions about entry, expanding or shrinking operations, and whether or how to pass on the business or farm assets (including farmland) led to our current industry structure. Likewise, how the older generation plans for income for the surviving spouse and inheritances for off-farm children impacts asset ownership and use. Not unlike the general population, farm family structures are changing as are income needs in retirement for health care. At the same time, individual farm viability is threatened by age-old challenges such as death, disease, disability, or divorce of a principal operator.

The life-cycle of a farm business is closely linked to the life-cycle of the farm operators. It is widely recognized that farmers are an aging population. More than 30% of principal farm operators are age 65 or older. The average age of operators has been greater than 50 since at least the 1974 Census of Agriculture, and in 2011, was 58. In some regions of the country and in some types of agricultural production, these demographic trends are much more pronounced. For example, the proportion of older producers is higher in the South and West and among beef cattle producers. As farmers choose to remain actively farming longer, the succession issue may be exacerbated as opportunities for direct heirs may be limited; generation-skipping could become more prevalent. In some cases, no family successor is apparent and finding an interested party, particularly one with farm experience, is a challenge. Likewise, generating income sufficient for both parties to enjoy a certain lifestyle from the beginning of the transfer can be problematic.

| Age of principal operator | |||||

| Item | Less than 35 | 35-54 | 55-64 | 65+ | All |

| Number of family farms | 83,741 | 667,208 | 683,845 | 679,874 | 2,114,668 |

| Percent of family farms | 4 | 32 | 32 | 32 | 100 |

| Average age, principal operator | 30 | 47 | 59 | 73 | 58 |

| Percent of principal operators retired from farming | 2 | 4 | 11 | 38 | 17 |

| Percent of total value of production | 6 | 41 | 35 | 18 | 100 |

| Average farm size (operated acres) | 390 | 422 | 397 | 332 | 384 |

| Percent of acres | 4 | 35 | 33 | 28 | 100 |

| Percent | |||||

| Share of beginning farms | 76 | 33 | 17 | 8 | 22 |

| Farm household finances | Dollars | ||||

| Farm income, average | 16,426 | 16,608 | 18,816 | 8,237 | 14,623 |

| Off-farm income, average | 51,503 | 83,352 | 75,736 | 61,696 | 72,665 |

| Total income, average | 67,929 | 99,959 | 94,552 | 69,933 | 87,289 |

| Total income, median | 56,310 | 70,186 | 59,602 | 43,610 | 57,050 |

| Net worth, mean | 527,969 | 857,296 | 1,140,142 | 1,092,453 | 1,011,326 |

| Net worth, median | 263,558 | 491,932 | 663,914 | 675,990 | 597,767 |

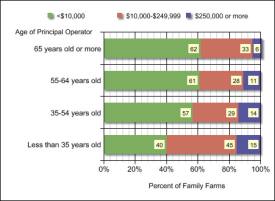

Only 4% of farm operators are under 35 years and they account for 6% of production on U.S. family farms. While a small share of the total farms, young operators are more likely than older operators to operate large farms—15% of young operators had farms that grossed $250,000 or more in 2011. This is in contrast to the 32% of senior farmers (65 years old or more) who accounted for 18% of production and only 6% of farms that grossed $250,000 or more in 2011. The senior-operated farms had half of the farm income, on average, of the young farmers but more than double the net worth.

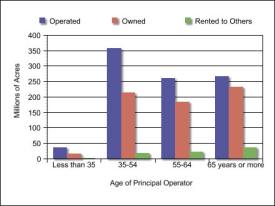

Most agricultural producers place a very high value on owning the assets they use for production. Indeed, asset ownership is very often viewed as a principal measure of success for farmers and their peers and is reflected in the high net worth of senior farmers. However, the drive to own assets can be counterproductive in generating cash returns. According to the 2007 Census of Agriculture, there were 922 million acres of land in farms, and farm operators owned 646 million of those acres. The population of senior farmers owned 36% of the farmland owned by operators. But rents on pastureland, for instance, provide relatively low cash returns on investment, limiting potential retirement income. For beginning operators, too, the cultural preference for asset ownership can be limiting. While common in some enterprises or geographic regions, leasing or custom farming is not the preferred mode of entry, even if it offers the beginning operator better cash flow prospects and risk-sharing opportunities.

A successful farming career can result in a barrier to exit in senior years. Farmers often find that, having spent a lifetime accumulating wealth in agricultural assets, it is difficult and costly to withdraw equity or to provide for succession to heirs. These farmland owners currently have few financial incentives to transfer the control of their farmland to others who may be interested in actively farming the land, such as new entrants into farming or established farmers who may be interested in expanding their operations. Market uncertainties, as well as the tax and legal uncertainties and complexities, have compounded senior farmers’ challenges in developing their succession plans. Moreover, since 2008, farming investments have been very lucrative in most regions, compared to nonfarm investment options. For example, while the median net worth of U.S. families declined by nearly 40% from 2007-2010 (Bricker et al., 2012), farm net worth was at record levels (USDA, 2013).

Another reason for the advanced age structure of farmers is the farm's status as the family home. Agriculture is a way of life for many producers and, very often, the thought of leaving the farm or ranch is not even a consideration. Nearly 20% of farm operators report they are retired, even while they continue to farm, albeit at reduced levels of production in many cases. Farmers often abhor the thought of having neighbors right next door but are nevertheless strongly attached to close knit, if widely spaced, rural communities. Living anywhere else and doing anything else is unthinkable for many farmers. For them, the challenge of separating the home and lifestyle from the business is very great indeed.

For eight decades, government policies have been focused on the performance of the agricultural sector—supporting incomes, managing the volatility in supply, and otherwise offering protection from the various risks of agriculture, as well as reducing agriculture’s environmental impacts. Other policies have addressed tax and legal issues to foster agricultural performance. Collectively, though, these policies have generally not provided incentives for senior farmers to transition out of agriculture and may have even provided incentives to hold assets. Similarly, economic research has focused on narrow aspects of the transition issue, such as measuring economies of size, without considering the linkages to the larger question of the implications of structural change. In addition, the Extension community within the land grant university system has extensive expertise on succession planning, and, more broadly, transition planning, but is focused on advising the farming clientele, rather than drawing public policy implications regarding the larger transition issue. Grants to support beginning farmer educational programs have sometimes focused on encouraging farm ownership, which some would argue is not the most viable means of entry.

Since 1992, the government began targeting loans to beginning farmers and various programs have been included in farm legislation (Ahearn, 2013). One small, but innovative, program was included in the 2008 farm legislation that recognized the link between entering and exiting farmers: the Conservation Reserve Program (CRP)-Transition Incentive Program, or TIP. The CRP was established in 1985 and provided an opportunity for farmland owners to receive rental payments for maintaining land in conserving uses. Consequently, the program is especially attractive to senior farmers with eligible land who are interested in retiring from full-time production activities. In 2011, principal farm operators who owned land enrolled in the CRP were more likely to be 65 years old or older (44%), compared to the general farmer population. Under the 2008 TIP provisions, retiring farmers are eligible to receive extended rental payments if they sell or rent their land to beginning farmers. The future use of land currently enrolled in the CRP will likely continue to be of interest since the current cap on CRP enrollment of 32 million acres is likely to be reduced. For example, U.S. Senate bill 3240—the Agriculture Reform, Food and Jobs Act of 2012 (reintroduced as S. 954 in 2013) —proposed to reduce the cap on CRP acres to 25 million by 2017, and many producer and processor groups are calling for even lower caps on the program. The National Oilseed Processors Association has called for a 15-million-acre cap. As further evidence of interest in investing in the next generation of farmers and in anticipation of a 2013 Farm Bill, a bipartisan and bicameral bill, the Beginning Farmer and Rancher Opportunity Act, was passed in April 2013 to address the needs of beginning farmers and ranchers (United States Congress, 2013).

While structural change appears to move slowly over time according to aggregate statistics, the transition is likely not going to always be smooth, particularly for some farmers in some regions. An example of this is in the Southern Plains in 2011 which experienced a severe drought, forcing significant liquidation of beef cattle. A more widespread drought occurred in 2012, somewhat less severe in the Southern Plains, but causing significant crop losses and some livestock liquidation over a much larger proportion of the country. Successive droughts caused many older beef cattle producers in the Southern Plains to sell their herds, thus forcing a decision that was looming large for many in the near future even in the absence of a drought. While livestock were sold, land typically was not.

Shifts in land ownership, possibly to nonfarm investors (Kauffman and Akers, 2012), are likely to be extensive in the next decade as senior operators (65 years or older) who operate nearly 270 million acres, or 30% of land in farms, transition out of agriculture. More land is likely to come out of CRP as well, given market demands and policy shifts. Who will invest in and control (either through ownership or rental markets) this valuable, but expensive, asset?

A final unknown involves breakthroughs in technology made possible by investments in public and private research. Will society choose to invest in public research and development in the face of competing demands on government revenues? The importance of productivity-enhancing technologies is critical, given the projected growth in world population and the potential for climate change impacts on agriculture. The structure and productivity of U.S agriculture will be profoundly impacted by transition decisions that will be made in the coming years. Those decisions will be influenced by market forces, cultural preferences, and public policies.

Ahearn, Mary. Beginning Farmers and Ranchers at a Glance. (2013). Washington, D.C.: U.S. Department of Agriculture, Economic Research Service, EB No. 22.

Bricker, Jesse, Kennickell, A.B., Moore, K.B., and Sabelhaus, J. (2012). Changes in U.S. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances, Federal Reserve System, Board of Governors, June, Vol. 98, No. 2. Available online at: http://www.federalreserve.gov/pubs/bulletin/2012/pdf/scf12.pdf

Executive Office of the President of the United States. (2012). Agricultural Preparedness & the United States Agricultural Research Enterprise. President’s Council of Advisor’s on Science and Technology. Available online at: http://www.whitehouse.gov/sites/default/files/microsites/ostp/pcast_agriculture_20121207.pdf.

Kauffman, Nathan and Akers, Maria. Irrigated Crop Lands Surge with Drought. Federal Reserve Bank of Kansas City, Agricultural Credit Conditions. Available online at: http://www.kansascityfed.org/publicat/research/indicatorsdata/agcredit/AGCR4Q12.pdf

United Nations, Department of Economic and Social Affairs, Population Division (2011). World Population Prospects: The 2010 Revision. Available online at: http://esa.un.org/wpp/.

United States Congress. (2013). Beginning Farmer and Rancher Opportunity Act (S. 837 and H.R. 1727). Library of Congress. Available online at: http://thomas.loc.gov/cgi-bin/query/z?c113:S.837:

United States Congress. (2012). Agriculture Reform, Food, and Jobs Act of 2012 (S. 3240). Library of Congress. Available online at: http://thomas.loc.gov/cgi-bin/query/D?c112:5:./temp/~mdbs3qUmwz::

U.S. Department of Agriculture, Economic Research Service. (2013). Topic Page on “Farm Sector Income & Finances”. Available online at: http://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances.aspx.

U.S. Department of Agriculture, National Agricultural Statistics Service. (2009). 2007 Census of Agriculture. United States Summary and State Data, Vol. 1, Part 51. Washington, D.C.: Government Printing Office.

U.S. Department of Agriculture, Office of the Chief Economist, World Agricultural Supply and Demand Estimates (various issues), 2005-2012.