Uruguay is a small beef-exporting country. It is located between Argentina and Brazil, both of which rank among the world's largest beef producers and exporters. Uruguay has approximately 57,000 agricultural/livestock operations, of which 29,000 (52%) are pasture-based beef and sheep ranches. Of these, about 19,000 specialize in breeding (cow-calf operations), 6,000 are calf-to-beef type operations, and 4,000 specialize in finishing. Over half the ranches are classified as family farms with less than 200 acres, while another quarter are considered transitional farms with less than 900 but more than 200 acres. About 5% are farms of over 3,500 acres (MGAP-DIEA, 2005).

Uruguay's new sanitary status opened its access to several important markets, which until then had been closed to the country's noncooked beef exports. Fueled by improved market access, exports became even more important to the economy. In 2005, meat exports accounted for about 26% of the total value of Uruguayan exports, with beef accounting for 22%.

Uruguay beef serves as an example of one industry's effort to obtain international certification for its grass-fed beef production system. Certification, in conjunction with Uruguay's already highly developed cattle identification and tracking system (the DICOSE system), is viewed as central in the development of a national brand image for Uruguayan beef, analogous to that associated with New Zealand lamb.

Industry Expansion

Uruguayan beef production expanded following the achievement of FMD-free status in 1995. Expansion was facilitated by a significant decline in sheep numbers due to falling wool prices. Sheep numbers declined from 26 million in 1991 to 10.8 million in 2005. As of June 30, 2005, the cattle inventory was at a record high of 11.95 million head. Slaughter rose to a record 2.39 million head in 2005, almost triple the levels registered in 1990.

Beef exports grew because of improved market access, productivity gains, and small and decreasing domestic consumption. Exports averaged 138,000 metric tons, carcass weight, from 1990 to 1994—about 40% of total production. Between 1995 and 2000, exports jumped to an average of 232,000 metric tons, accounting for about 60% of production in 2000. In 2005, exports reached a record 478,699 metric tons carcass weight (equivalent to 292,248 metric tons shipped weight), accounting for 80% of beef production, and only 15% was exported chilled. Chilled exports have increased in the last three years, as most organic and natural beef is shipped as chilled. Normally, frozen beef is mixed with U.S. beef to increase its leanness. There is no difference in quality between frozen and chilled beef.

Notwithstanding the dramatic growth in exports, Uruguay still supplies only around 5% of the approximately 6 million metric tons of beef traded internationally, although beef represents 75% of total Uruguayan production. In recent years, the United States has become the largest export market for Uruguayan beef, accounting for 52% and 76% of total tonnage of beef exports in 2004 and 2005, respectively. The market share decreased in 2006 due to increased demand from Russia in the first six months of 2006. Other major markets include Canada, European Union (EU) countries (United Kingdom, Germany, Spain, and Portugal), Israel, Russia, and Mercosur members (Argentina, Brazil, and Chile).

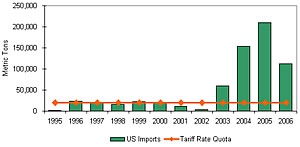

Beef exports to the United States are regulated by a World Trade Organization (WTO) negotiated tariff rate quota (TRQ) currently set at 20,000 metric tons per annum for chilled and frozen beef, as shown in Figure 1. Exports within the quota are subject to a nominal fixed tariff of 4.4¢ per kilogram (approximately 2¢ per pound), while above-quota exports are subject to an ad valorem tariff of 26.4%. Between 1995 and 2002, exports to the United States were generally limited by the quota. However, between 2003 and 2005, tight beef supplies and higher prices in the United States led to a significant increase in U.S. imports from Uruguay (nearly 210,000 metric tons in 2005). The above-quota imports, on which the 26.4% tariff was paid, consisted primarily of lower-quality beef destined for the hamburger market. The structure of the U.S. market for Uruguayan beef has also changed in recent years. Between 2001 and 2004, the number of U.S. importers handling Uruguayan beef increased from 29 to 67, while the share for the top five importers fell from 86% to 56%.

The DICOSE Traceability System

In 1973, the Uruguayan government created the División de Controlar de Semovientes, today known as DICOSE, within the Ministry of Livestock, Agriculture, and Fisheries, to account for domestic animal stocks and movements (Marshall, Boland, & Conforte, 2002). The objective was to curtail smuggling and help with the eradication of FMD. Under the DICOSE system, farmers are given a code consisting of a region number, a police station number, and a farm number. Every time an animal is moved, bought, or sold, the movement must be recorded and the animal accompanied by its paperwork. The system is similar to having a passport. Police sign all sales documentation, with copies going to the seller, the buyer, the Ministry, and the police. Ministry inspectors check all trucks and documentation at each slaughter plant before unloading. Farmers are audited at random every year, and they must present an annual animal stock balance.

With DICOSE, Uruguay was one of the first countries in the world to be able to trace animals back to their origins, and the Ministry could use the system to ensure that farmers and slaughter plants were complying with sanitary requirements. Once animals reach the carcass disassembly stage, however, it is virtually impossible to track each cut because of multiple cutting lines in most plants. Thus, while an individual cut cannot be traced back to an individual animal, it can be traced to a specific lot number. A system that would maintain individual identity for each animal as it moves through the carcass disassembly stage would be costly to implement, and there are currently no economic incentives for such a system. However, processors are now projecting plant layouts capable of tracing each individual cut in the deboning line. Some plants already provide this service for specific European consumers.

In September of 2006, Uruguay began a mandatory individual cattle traceability program. All animals born in September 2006 or later must be ear tagged (one visual tag and one radio frequency identification tag) for traceability purposes. The basic components of the Sistema de Indentificacíon y Registro Animal (Animal Identification and Record System) are

individual animal identification,

farm identification (for example, geographic identification; unique identification; and the DICOSE for farms, plants, and auction yards),

recorded information, and

ownership and cattle movement records.

Thus, Uruguay currently is able to track individual animals until they reach the plant and by animal lot in and after they leave the plant. In 2010, Uruguay will implement post-plant meat traceability. Individual animal traceability has been mandated by Japan, South Korea, Canada, Australia, New Zealand (after October 2007), and the EU (only France, the United Kingdom, and Ireland are in compliance).

In the United States, 90% of cattle go through a feedlot system in which growth hormones are used to enhance feed efficiency and lower production cost. In contrast, Uruguayan cattle are fed primarily on pasture alone, and while some supplemental grain-based feed may be used, the use of growth hormones is strictly prohibited. Thus, Uruguay is also in compliance with EU rules on hormone use. In addition, antibiotics in feed are not used in pasture-based systems.

Product Differentiation and Certification

Product differentiation is recognized as a key factor in enhancing demand for Uruguayan beef in export markets (Perez, Boland, & Schroeder, 2003). In 2001, the National Meat Institute (INAC— Instituto Nacional de Carnes) of Uruguay developed the "Certified Natural Meat Program of Uruguay," with the dual objectives of differentiating and increasing consumer confidence in Uruguayan meat products. The program involves international certification of compliance with various protocols in both the animal production and industrial phases of meat production. In August 2004, USDA announced that Uruguay's Certified Natural Beef is "Process Verified." In other words, the beef is verified according to this process of compliance (see Figure 2). The main components of the Certified Natural Meat Program of Uruguay are food safety, traceability, animal welfare, and environmental sustainability. These are expressed in the following claims made for animals marketed under the program:

Source verified—All cattle can be fully traced from ranch to harvest, fabrication, and packaging. Identification of animals is by means of individual plastic ear tags.

No added hormones—No growth hormones of any kind or equivalent growth promotants have ever been administered to the animals.

Not fed antibiotics—No sub-therapeutic antibiotics have been fed or administered as a supplement in feed or water for the purpose of growth promotion.

No animal proteins in feed—The animals have never been fed proteins of animal origin except maternal milk.

Grass fed—All animals in the program have been grown, raised, and fattened on a grass diet. Restricted supplementation levels are accepted to support grazing.

Open range—Animals have never been confined to yards or feedlots at any time in their lives, and are raised in open pastures year round.

The program is voluntary; members (farmers and slaughter plants) join with the objective of adding value to their product. Independent certification firms verify that members are in compliance with protocol claims, and thus certification involves the entire production chain from animal production to meat cutting, packing, and labeling. The country brand is "Uruguay Certified Natural Beef" and the label, shown in Figure 2, is the intellectual property of INAC. Its use is granted subject to endorsement of the accredited certifying firm.

Certification under this program links the product with its country of origin and essentially attempts to establish Uruguayan beef as a brand identity similar to that of New Zealand lamb as described by Clemens and Babcock (2004). However, there is one important difference. Uruguay is attempting to use a broad certification program based on USDA standards, whereas New Zealand is marketing the country without a formal certification program. Ultimately, the intent is a quality assurance program to certify that the whole country conforms to a process of producing high-quality grass-fed beef. Table 1 shows the progress of the certification program.

Benefits of Certification

The objective of certification is to differentiate Uruguayan beef from that of competitors and thereby enhance demand. To illustrate the potential benefits, consider the impact on exports to the United States. As noted, the majority of Uruguayan beef shipments to the United States in 2004 and 2005 were out of quota, as the country has only 2.8% of the quota compared with 54% for Australia and 30.6% for New Zealand, and these shipments were subject to the 26.4% tariff. Given the differential treatment of in- and out-of-quota exports, exporters minimize tariff exposure by reserving the quota for higher-value chilled beef exports and shipping lower-priced manufacturing beef out of quota. Thus, demand for its beef outside the quota has changed Uruguay from a small to a major exporter of beef to the United States, and since 2003, the United States has been Uruguay's principal market.

In general, it is not economical to ship high-quality beef out of quota because the tariff would not allow the product to compete with U.S. domestic producers, with other exporters to the U.S. with more quota, or eventually with the alternatives for those cuts that Uruguayan exporters have in other international markets. However, because chilled beef still comprises only a small fraction of Uruguayan beef exports, the 20,000 ton quota is not yet a limiting factor. For example, in 2004, only 7,562 metric tons of high-quality chilled beef were shipped to the United States, and the remainder of the quota was filled with lower-quality frozen beef.

Lessons for the Future

Since eradicating FMD in 1995, Uruguay has been expanding its beef exports, particularly to the United States. In addition, acceptance of the DICOSE traceability system and the Uruguayan ban on growth hormones provide access to the EU market. Exports to the United States are constrained by a TRQ, and exports to the European Union are constrained by a WTO-negotiated Hilton quota. Uruguay has 6,300 carcass tons in the quota, which must be boneless. Eligible animals must have been exclusively pasture raised since their weaning. The beef is produced from animals kept on registered and approved farms that comply with conditions of production of animals eligible for the European Union as determined and verified by Uruguayan authorities.

To date, Uruguay has filled its U.S. TRQ with a combination of high- and low-quality beef. Certification of Uruguayan natural grass-fed beef would differentiate and enhance demand for high-quality Uruguayan beef and would be expected to lead to a situation in which the entire TRQ is filled with high-quality beef. Additional enhancements in demand as a result of certification would benefit the holders of the TRQ permits, but because overall demand for Uruguayan beef would not increase, there would be no price benefit for Uruguayan producers. Producers would, however, benefit from a negotiated increase in the TRQ.

What lessons does the Uruguayan example hold for domestic and international producers responding to opportunities in the United States? In the past few years, almost a dozen producer alliances in the United States have become process verified, and a number of other initiatives are underway. In March 2005, the state of South Dakota implemented the first state-certified beef program in the United States. Under that program, consumers will be able to trace a product back through the meatpacking plant, to the feedlot where the animal was fed, and to the ranch where the animal was born. A similar initiative in Iowa would create a label for "Iowa-80" beef. The success of such programs hinges on their ability to market a brand name tied to a distinct set of desirable attributes. Given the range of attributes that some consumers appear to value (for example, traceability, hormone free, grass fed, no antibiotics, no genetically modified grain), there appears to be room in the market for several such differentiated products.

However, as programs proliferate and face competition from foreign programs such as Uruguay's, the initial benefits are likely to diminish. Similarly, domestic efforts such as the Iowa-80 certification program might prevent loss of market to Uruguayan imports. Regional programs such as this would not exclude imports or impede other countries in developing their own brand identities, with the possible exception of EU products developed under terroir labels, which are only applicable for EU countries. But that is a regional label using legislation and not a private effort for differentiation. Alternatively, U.S. producers could seek alliances with producers in other countries such as Uruguay to provide beef of this type, or U.S. producers could invest in processing facilities in other countries, as they have done in Uruguay. Clearly, some countries such as Uruguay may have highly differentiated products that will become more competitive with U.S. beef. Producers involved in alliances seeking to differentiate their beef by geographic origin or by the process with which the beef was produced must realize that producers in other countries can develop similar products and that in a global beef market domestic certification programs are not likely to present significant barriers to market entry.

For More Information

Clemens, R., & Babcock, B. (November 2004). Country of origin as a brand: The case of New Zealand lamb. Briefing Paper 04-MBP 9, Midwest Agribusiness Trade Research and Information Center, Iowa State University.

Marshall, M., Boland, M.A., & Conforte, D. (2002). Exporting U.S. and Uruguayan beef to the European Union. In J. Caswell (Ed.), Consumer Demand for Quality Conference. Boulder, CO: Westview Press.

MGAP-DIEA. (March 3, 2005). Censo General Agropecuario 2000. Ministerio de Ganadería Agricultura Y Pesca. Available online: www.mgap.gub.uy/Diea/ (Accessed 11/4/06).

Perez, L., Boland, M.A., & Schroeder, T. (2003). Country of origin labeling in Uruguay. International Food and Agribusiness Management Review 6(4), 1-13.

Note: A complete set of references is available from the authors upon request.

|

|

Other articles in this theme:

|

|

Table 1

Progress of the Uruguayan certification program, 2004 to June 2006.

| Certified farms |

56 |

186 |

277 |

| Animals in certified farms |

90,000 |

300,000 |

550,000 |

| Certified slaughterhouses |

1 |

3 |

10 |

| Exports (metric tons) |

0 |

17 |

482 |

|

|