Compared with the other major players in the world pork market, Spain has experienced profound growth and transformation within its pork sector over the past 20 years. Between 1985 and 2003, pork production in Spain increased by 139%, reaching 3.3 million metric tons per year, and Spain became the second-largest pork producer in the European Union (EU). 1

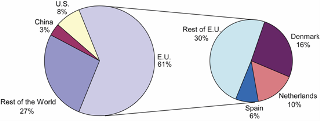

In the late 1980s, Spain was a net importer of pigmeat, producing slightly over 95% of its consumption. However, as a result of the substantial transformation experienced by its pork sector, Spain has become a large net exporter, shipping about 450,000 metric tons of pork (2001-2003 average) and 1.1 million live slaughter pigs (2002 total) per year. Spain's pigmeat production exceeded consumption by more than 15% in 2002. Although most of this trade occurs among EU member countries and total exports are small relative to those of Denmark and the Netherlands, Spain has attained an increasingly significant role in EU pork trade (see Figure 1).

The transformation in pig production in Spain was led by the feed industry, which consolidated into fewer, larger firms and became organized into private corporations or cooperatives. The greater resources of these larger firms allowed them to become integrators by entering into contracts with pig producers. Under most such contracts, the integrator owns the animals and provides feed, technical assistance, veterinary services, and other inputs, and the producer provides facilities and labor. These arrangements gave integrators the required scale to reduce costs by negotiating better terms with input providers.

Spain's pork sector faced several other challenges along the path to its current success. Spain's pork producers and processors now face new challenges in the form of a more regulated production environment. Will Spain be able to maintain its competitiveness within the EU? The following discussion addresses this question by looking at the results of earlier challenges, how new policies and regulations are changing the EU industry, and implications for the future success of Spain's pork sector.

Drivers of Change

Domestic Demand

A major driver of the significant expansion of Spain's pork sector has been domestic demand. Meat consumption, of pigmeat in particular, has grown at a remarkable rate in Spain over the last two decades. Between 1985 and 2002, annual per capita meat consumption in Spain increased by more than 50%, from 77.9 kg to 118.5 kg, and annual per capita pork consumption almost doubled, from 36.5 kg to 66.6 kg, over the same period. As a result, in 2003 Spaniards ranked as the world's second-largest consumers of pigmeat on a per capita basis, behind Austrians.

The noticeable increase in the domestic demand for pigmeat can be largely attributed to the substantial growth in per capita income experienced by Spain after it joined the EU. Spaniards have a strong preference for cured meat products. On a per capita basis, Spaniards are the world's largest consumers of cured ham, and cured products in general account for about half of the consumption of processed pigmeat. In turn, processed meat makes up 80% of total pigmeat consumption in Spain. Cured products are relatively expensive items and tend to be more responsive to increases in income than are more economical meat products. Thus, increasing income levels in Spain translated into higher demand for cured products such as "Serrano ham."

Spain's significant income growth is likely attributable, at least in part, to its accession into the EU. Given this, it is reasonable to expect Spain's income growth rate to fall to more normal levels, implying that domestic demand is unlikely to drive growth as prominently in Spain's pork industry.

Animal Disease

Outbreaks of classical swine fever (CSF) in 1997 and 1998 and the discovery of bovine spongiform encephalopathy (BSE) in the United Kingdom in 1997 had a noticeable impact on the rapid pace of transformation in Spain's pork sector. While more than 800,000 pigs were being culled in an attempt to eradicate CSF, many consumers were responding to the news of BSE by substituting pork for beef. The simultaneous drop in pork supplies and increase in pork demand led to a sizeable jump in pig prices, triggering a flurry of investment in new state-of-the-art production facilities.

Then, as output from the new facilities entered the market and the pork supply increased, prices fell to record lows, prompting the least profitable pig operations to exit the business. The outcome of this process was a swine sector consisting mostly of new operations with modern facilities and extremely efficient production practices. Small operations virtually disappeared; most medium-sized operations became associated with either cooperatives or corporations; and two or three large producers came to control more than 80% of pig production in Spain.

The CSF outbreaks also triggered vertical integration in the meatpacking industry. Reduced capacity utilization due to culling, together with the high pig prices, led the largest meatpacking firms to integrate with pig producers to ensure a steadier stream of animals for their operations. Some of these companies integrated vertically downstream as well, establishing their own chains of retail shops. Much of the integration took the form of cooperatives, associations, and corporations, although some meatpackers opted to establish their own pig production facilities to secure supplies.

Technological Change

Increased vertical integration and construction of new facilities allowed Spain's swine sector to become a technology leader within the EU. Prior to these changes, Spain's pig producers lagged other major EU producers in the use of technology. Now, more than half of Spain's pigs are produced in state-of-the-art facilities, some of which can house more than 10,000 sows.

This technological advancement has been accompanied by increased specialization, both in type and geographic location of production operations. Specialized farrowing and finishing operations are now far more common than are farrow-to-finish operations, and production has tended to concentrate in the regions of Catalonia (finishing), Castilla-Leon (farrowing), and Aragon (finishing). One likely driver of Castilla-Leon's farrowing specialization is its greater distance to ports, resulting in a higher relative cost of imported feed.

As noted, most of Spain's large-scale meatpacking operations became vertically integrated after the CSF outbreak. However, the processing industry remains very atomistic.2 As of 2000, there were about 900 slaughterhouses, 2,300 cold warehouses, 2,100 meatpacking plants, and 4,700 processing plants for the red meat sector as a whole. Pork makes up about 60% of all meat supplies, and the industry tends to be somewhat more concentrated for pork than for other meats. In 2003, the top 10 slaughterhouses accounted for 30% of pig slaughter, and the top 36 slaughterhouses accounted for 60%.

The large number of processing plants stems in part from the substantially larger share of processed pork (80%) sold relative to sales of unprocessed pork (20%). Still, there is evidence of inefficient use of processing plants, with capacity utilization estimated at less than 30%, although Catalonia's meat plants appear to be substantially larger and/or more efficiently utilized than is the average meat plant in Spain.

Product Differentiation

Spaniards have a strong preference for cured pork products and are the world's largest consumers of cured ham on a per capita basis. In recent years, the processed pork market has experienced a major shift toward quality differentiation. To target demand for high-quality products, the industry has begun to implement traceability systems throughout the pork market channel, and producers of cured pork products have been highly proactive in seizing opportunities and offering products with greater appeal to consumers. Among other initiatives, Spanish producers have taken advantage of EU legislation on geographical indications and traditional foods. As of January 2007, for example, Spain was one of only nine EU countries with protected designations of origin (PDOs), and one of only two with designations of traditional specialty guaranteed (TSGs) for pork products.3 Spain had the only ham TSG (Serrano ham) and held four PDOs for ham alone (surpassed only by Italy).

These efforts to promote high-quality cured products are exemplified by Serrano ham, a typical ham consumed by Spaniards. Historically, Serrano ham was not strictly standardized in terms of quality. Recognition of Serrano ham as a TSG changed this situation by providing legal protection to the Serrano ham designation and requiring stringent, standardized production processes and quality norms. The aggregate value of all hams marketed as PDOs increased by over 200% between 1991 and 2002, and the market for Serrano ham increased at a significantly higher rate than did markets for other pork products.

Government Support Programs

The EU Common Agricultural Policy (CAP) stipulates provisions to stabilize pork markets, mainly by setting up a price system and regulating trade with non-EU countries. To cushion large price declines, the CAP price system allows the EU Commission to issue aid for private storage and/or export refunds for pork products when prices drop below 103% of the basic price established by the EU. The price system also allows the EU Commission to authorize intervention purchases of pork when prices fall substantially below the basic price. Although intervention purchases have not been used for at least two decades, aid to private storage and export refunds have often been used. Also, pork imports from non-EU countries are subject to licenses and taxes, and additional import duties can be levied when there is a risk that imports could destabilize the EU market.

The EU also provides special financial assistance for animal disease emergencies. To prevent the spread of diseases such as CSF, the CAP forbids animal movement in affected areas and stipulates the purchase and destruction of animals in these areas. These operations are co-financed by the EU Commission and the member states. This type of financial assistance proved to be very important for Spain during the 1997 CSF outbreak.

Historically, EU producers of many commodities received government support in the form of direct payments, but this has not been the case for swine producers in Spain. In 2003, the EU announced a major reform of the CAP, including provisions designed to shift producer support from direct payments to decoupled payments (that is, from output-dependent payments to payments not linked to production volume). In the case of pigs, the impact of the CAP reform is estimated to be minimal because swine producers have not received direct payments.

Some sources predict that EU swine producers will benefit indirectly because the CAP reform will reduce the price of feed grains. However, others argue that cheaper feed grains will likely enhance the competitiveness of pig producers in countries that joined the EU in 2004. Thus, the overall impact on Spain's pig producers will most likely be very small, with any minor indirect benefit from lower feed prices being offset by stronger competition from some of the newly merged states.

Environmental and Animal Welfare Regulations

Concurrent with the development of Spain's swine sector, high population density and increased environmental concerns over intensive production systems have triggered tighter EU environmental regulations. Given the higher compliance costs associated with these regulations, many EU producers either reduced herd sizes or exited the business. In relative terms, Spain's lower population density and less-demanding regulations provided a more nurturing background for new investments in pig production than did other EU countries. Now, however, the increasing geographic concentration of pig production and limited availability of land on which to dispose of manure have heightened environmental concerns.

In response, EU and national legislation have imposed ever stricter environmental regulations. These regulations limit inventories and output in some of the most affected EU regions and provide incentives to induce pig producers to exit the industry. For example, new regulations for Catalonia restrict the maximum size of individual production facilities and require producers either to have a minimum amount of land available per animal for waste disposal or to invest in advanced manure-handling technologies. Some producers are forming cooperatives and using EU subsidies for alternative sources of energy to build waste disposal plants that transform livestock waste into electricity and fertilizer.

In addition, recent legislation at both the EU and national levels reflects public concern over animal welfare (see ECDGA, 2004). In 2001, the EU Council adopted two directives establishing new minimum animal welfare standards for pig production. Among other measures, the directives ban the use of tethers and individual stalls for pregnant sows and gilts, establish minimum light requirements and maximum noise levels, require that pigs have permanent access to materials for rooting and playing, and establish a minimum weaning age of four weeks. Such controls will be applied to producers in third countries exporting pork to the EU as well.

In 2004, the EU Council approved new regulations for the welfare of pigs during transport. The regulations include rules for trips lasting more than eight hours, significantly higher standards for vehicles used to transport live animals, and checks on vehicles using satellite navigation systems. Significantly for Spain, the EU Commission has agreed to propose new regulations before 2011 regarding maximum travel times and animal densities during transport.

The stricter transportation regulations will increase the cost of moving pigs, reduce the feasibility of transporting live animals, and will likely have a noticeable impact on Spain's swine industry because the geographic specialization of its production operations requires substantial movement of animals within the country. In addition, even though Spain is neither the EU's largest exporter nor the EU's largest importer of pigmeat, Spain is a major trader of live animals.4 In 2002, Spain imported 1.5 million pigs (mostly piglets from the Netherlands and France) and exported 1.1 million pigs for slaughter (mostly to France and Portugal).

Overall, this more demanding regulatory environment can be expected to limit the rate of growth of pig production in Spain, and in the EU in general. Further, the new rules will likely be easier to implement in new facilities, which may provide countries joining the EU in 2004 or later a relative advantage over traditional EU production regions as the former develop their pork sectors.

EU Enlargement

In May 2004, the EU enlarged to 25 member countries. The 10 new member countries immediately added 30.8 million pigs to the EU herd, an increase of about 25.4% from the previous inventory. In the near term, EU enlargement does not seem to pose a threat to Spain's pork production industry. Of the new members, Poland has by far the largest number of pigs, but production is highly fragmented, and only 10 of Poland's 3,000 pig slaughterhouses are authorized to export to the EU-15 (the 15 EU countries before expansion). Hungary added the second-largest number of pigs, but about 20% of these stocks are held on small family farms with aging facilities. Significant investment will be required to upgrade the pork sector in either country.

In the longer run, some of the same forces that promoted pork production in Spain (such as lower labor costs and more lenient environmental regulations) may favor relocation of production to new member countries. And, as noted, the competitiveness of producers in the newly merged countries will likely be enhanced if the CAP reform leads to cheaper feed grains. Competitive feed costs, lower environmental standards, and the proximity of large import markets (for example, in Russia and the Ukraine) should attract foreign investment to Poland, Hungary, and the Czech Republic. For example, U.S.-based Smithfield Foods, the world's largest pork processor and hog producer, has recently made significant investments in Poland (and in Romania, as well). According to its Web site (http://www.smithfieldfoods.com/home.asp), Smithfield Foods has anticipated "... that through its adoption of a market economy, Poland will resume its place as a premier and dominant supplier of meat and other agricultural products to Europe and other parts of the world."

Counteracting the impact of the potential competition from the new member countries in world markets is the prospect for a substantial increase in their domestic pork consumption. The 10 countries that joined the EU had a combined population of 74 million, all with a longstanding tradition of consuming pork. Although income levels in the new member countries are lower than those in the former EU15, they are likely to increase at a relatively rapid rate for the foreseeable future, which should help drive increased pork consumption.

Future Implications

Spain has achieved enviable success in modernizing and expanding its pork sector, but its producers and processors will need to continue along the path of rapid transformation to remain competitive. It appears, for example, that Spain's processing sector is ripe for consolidation. The high volume of slaughter pig exports, the large number of small plants, and the high level of underutilized capacity suggest significant inefficiencies in this sector.

Additionally, the costs of implementing increasingly restrictive environmental and animal welfare regulations in Spain will likely hamper the trend toward greater geographic specialization and growth in live pig exports. The regulations may also give pork producers in the 10 new EU member states an advantage as they incorporate provisions of the regulations in newly constructed facilities. Similarly, rationalization of the processing sector in those countries will likely involve the construction of state-of-the-art plants that have lower costs and are able to meet more stringent food safety regulations required by export markets.

Although the CAP reform is not expected to have a major impact on Spain's pork sector, the recent addition of 10 new member states to the EU may have a big effect. The magnitude of this impact will depend on the extent to which producers and processors in the new member countries obtain capital to build or upgrade facilities to meet increased consumption within their own countries.

Notes

1Unless otherwise stated, the term EU refers to the 15 member countries prior to the 2004 enlargement.

2It is worth pointing out, however, that in general the pigmeat processing sector in the EU is much less concentrated than in the United States. One notable exception is in Ireland, where the sector is dominated by two firms.

3Interestingly, none of the new EU members had PDOs or TSGs for pork products.

4The largest exporters of pigmeat in the EU are Denmark and the Netherlands, whereas the largest importers are Germany and Italy. In 2002, pigmeat exports by Denmark and the Netherlands were almost three and two times larger, respectively, than Spain's pigmeat exports, and pigmeat imports by Italy and Germany were about ten and eight times greater, respectively, than Spain's pigmeat imports.

For More Information

European Commission, Directorate-General for Agriculture (ECDGA). (2004). The meat sector in the European Union. Fact sheet, ECDGA, Brussels, Belgium. Available online: http://ec.europa.eu/agriculture/publi/fact/meat/2004_en.pdf (Accessed 11/706).

Lence, S.H. (2005). What can the United States learn from Spain's pork sector? Implications from a comparative economic analysis. MATRIC Research Paper 05-MRP 12, Midwest Agribusiness Trade Research and Information Center, Iowa State University, Ames, IA. Available online: http://www.card.iastate.edu/publications/synopsis.aspx?id=864 (Accessed 11/7/06).

|