In the food safety arena, a clear role for government is to adopt sanitary and phytosanitary (SPS) measures to protect human, animal, and plant life or health. Relative to developing countries, developed countries tend to adopt more stringent food safety standards and regulations with a broader scope and to rely increasingly on certification and traceability. The additional costs of compliance for meeting international SPS requirements are higher for firms operating in developing countries because they must take additional steps to meet international food safety regulations and standards. Therefore, their comparative advantage, achieved through lower production costs, will tend to be reduced because of high incremental compliance costs. Given that a high proportion of developing countries' exports are agricultural and food products and that export destinations are mainly developed countries, concerns have arisen that SPS measures are affecting developing countries' access to export markets.

Sanitary and Phytosanitary Issues for Agricultural Exports

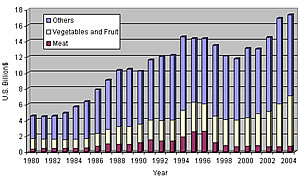

After 15 years of negotiations, China became the 143rd full member of the World Trade Organization (WTO) on December 11, 2001. Since then, with eliminated or lowered tariffs, China's bilateral trade has grown significantly. In 2004, the value of Chinese exports of agricultural products exceeded $17.3 billion (see Figure 1). As shown, fruits and vegetables represent a growing share of agricultural exports.

Despite prospects for economic rewards from expanded trade, several problems have emerged. Chinese farmers and exporters had anticipated a large, positive impact on domestic production with accession to the WTO, especially for labor-intensive agricultural products such as vegetables, fruits, livestock and poultry products, and seafood. However, these products have been hardest hit by the need to meet significant SPS standards, and this has dampened substantial growth in these agricultural exports. According to a recent investigation by China's Ministry of Commerce, about 90% of China's exporters of foodstuffs and agricultural products were affected by foreign technical trade barriers; exporters suffered losses totaling US$9 billion a year.

China's recent experiences with SPS barriers have been mainly with the European Union, Japan, and the United States. They are the leading importers of China's agricultural products, accounting for about 68% of total Chinese vegetable and fruit exports over the 1998-2000 period. But, at the same time, these three markets accounted for 41%, 30%, and 24%, respectively, of the trade losses attributable to SPS measures in 2002. An illustrative example is Japan's ban on China's frozen spinach in July 2002 after pesticides called chlorpyrifos were found in the product. Prior to the ban, imports from China accounted for 99% of Japan's annual imports of 40,000 to 50,000 metric tons of spinach. Because failure to pass SPS inspections often leads to closer inspection of future exports, China's agricultural products have confronted much stricter inspection in these markets following several of the SPS-related problems. Currently, Chinese exports of seafood, vegetables and fruits, tea, honey, poultry meats, and red meats are creating the most frequently encountered SPS problems. Excessive pesticide residues, low food hygiene, unsafe additives, contamination with heavy metals and other contaminants, and misuse of veterinary drugs have been major issues.

Current Sanitary and Phytosanitary Conditions

China's SPS problems can be attributed to many factors, most of which are common to developing countries. Although there is a dual system of production, with some export-oriented enterprises co-existing with primarily domestically oriented production, it is hard to keep the two separate in the national supply chain, and the overall level of food safety in domestic production will inevitably affect the expansion of China's agricultural exports.

Regulatory and Oversight Systems

Because the Chinese government is still working to perfect its SPS regulatory and oversight systems, regulation and supervision of food product quality do not yet provide the necessary guidance for agricultural and food production. Some industries and commodities have no technical standards, and there is no sound food safety law to support and upgrade inspections. With respect to restrictions on pesticide residues, Codex has over 2,500 maximum residue levels, the European Union has over 22,000, the United States has over 8,600, and Japan has over 9,000. By comparison, China has only 484, and fewer than 20% of these conform to Codex levels.

Many technical standards and regulations in China are outdated, duplicative, or inconsistent with international standards. Moreover, the establishment of agricultural standards involves 10 government ministries, with little coordination from the central government down to the county level. As a result, each level of government has developed its own standards. This dispersed structure neither facilitates coordination nor supports effective implementation of food safety regulations. In addition, the lack of technical, institutional, and managerial capacity to control and ensure compliance makes the regulations and standards less effective.

The Production Environment

The lack of effective regulation of quality, coupled with widespread noncompliance with existing regulations, has resulted in Chinese producers often misusing or abusing chemicals and drug inputs (for example, chemical fertilizers, pesticides, and antibiotics). Antiquated production techniques and technology, environment pollution, and a low-quality input supply make production conditions worse. According to inspection reports of agricultural produce sampled by China's Ministry of Agriculture in July 2005, over 10% of vegetables in farmers markets and supermarkets contained excessive pesticide residues based on Codex food standards.

In animal production, there are persistent violations of regulations on drug additives and quality standards. In 2005, China's Ministry of Agriculture conducted sample inspections nationally on feed and feed additives and veterinary medicine. About 9% of samples drawn from feed and feed additives production, marketing, and utilization firms or households were substandard. Besides prohibited drug additives, lead, aflatoxin B1, and Salmonella were the most common adulterants or types of contamination found. In addition, 25% of veterinary medicine samples were substandard in terms of quality.

The small scale of fresh produce and livestock operations in China and the fact that they are relatively scattered across producing areas contribute to the abuse of agricultural chemicals and noncompliance with regulations. For example, 66% of swine producers had an annual production of less than 50 pigs in 2005. Controlling the use of chemicals and veterinary drugs in such a vast country—with more than 700 million farmers and many more household farming operations—is extremely difficult.

Poor machinery and low management levels in household operations also contribute to SPS problems. Small-scale farmers have little or no motivation to comply with SPS regulations if they do not face penalties for noncompliance as they face increased production risks. Even when large-scale, standardized production might develop, compliance with SPS standards can lead to significant increases in production costs, and, in the short term, the potential loss of revenue can be a significant barrier to change. With such an unfavorable situation, meeting higher food safety and quality standards leads to higher costs, which constrain expansion of China's agricultural product exports.

Inspection Technology and Information Transfer

Lack of up-to-date inspection equipment limits China's ability to conform to internationally accepted assessment procedures. Much of China's current inspection and testing technologies and instruments are antiquated and unable to meet the demand for services in terms of quality and scale of operation, especially when pesticides and veterinary drug residue tolerances are set at very low doses (for example, parts per billion and parts per trillion).

In addition, inefficient information systems and isolated domestic markets mean that market information and other technical requirements may not be communicated in an efficient manner. The lack of effective information channels across governments, industries, and regions means that even if some firms or industries confront SPS problems in export markets, other firms or industries are not likely to be informed on a timely basis. Many farmers do not have access to information about SPS standards, let alone to the resources required to comply with these standards, such as appropriate technologies and scientific and technical expertise. Most producers have only a limited awareness of SPS measures in general and lack an understanding of their importance.

China's Progress on Resolving Problems

With increasing interaction with world markets, China's government and traders have recognized SPS problems and are taking actions to improve the production and marketing environment. Recent investment in state-of-the-art processing facilities, transportation and distribution infrastructure, and improved testing and product control have improved quality and supported increased development of food markets (in particular, dairy, meat, fruits, and vegetables). These improvements contribute to the expansion of exports by increasing the overall supply available to both domestic and export markets. In the dairy sector, for example, companies are beginning to invest in technologies to increase milk quality, and emerging national brands are establishing credible reputations for quality and safety (Fuller et al., 2005). Some of this product is available for export. In addition to efforts to update agricultural and food standards and regulations and to educate producers on requirements for production methods in international markets, the Chinese government is trying to attract foreign investment, support large enterprises, and promote good agricultural and manufacturing practices. In the meantime, the private sector is working to coordinate international standards and thus increase access to world markets.

Foreign Direct Investment, Dragon-Head Enterprises, and Industry Associations

With relatively scarce capital internally, the government has encouraged foreign direct investment (FDI) in agriculture. Such investment can introduce capital, advanced technology, and management and marketing skills to improve product quality, increase exports, and assist in the transition from traditional to modern agricultural operations. Currently, agricultural production and food processing sectors each account for only about 2% of total FDI. Except for a few inland provinces, FDI in general has been concentrated in the southeast coastal areas. The Chinese government has further opened its agricultural sector to the outside world and has provided favorable polices and terms to attract FDI through preferential taxes and improved infrastructure.

China's government has supported the development of leading, large-scale enterprises, or "dragon-head" enterprises, as these targeted enterprises can bring along many enterprises and farmers by involving them in their supply chains and providing them guidance on production practices that improve food safety and quality. Currently, about 500 key dragon-head enterprises have formed at the national level, and over 2,000 have formed at the province level. Approximately 30% of all farm-households sold products to these industrial enterprises. The national- and provincial-level key dragon-head enterprises are mainstays of the move toward a more industrialized agricultural system. Because it is difficult for an enterprise to deal directly with thousands of dispersed farm-households or for a farmer to directly contact or negotiate with these enterprises, more and more industry associations have been formed voluntarily by producers and processors. These national or local industry associations are acting as a bridge and link between the government, enterprises, and farmers. And they are effective in working out strategies for industry development, safeguarding members' rights, improving cooperation and experience exchange among members, and conveying information on food safety standards and requirements.

Additional FDI, key dragon-head enterprises, and industry associations also offer some hope to small-scale farmers with low management skills and poor production techniques that they might benefit from expanded export markets. Small-scale farmers organizing to operate as single large-scale entities allows them not only to gain economies of scale but also to more easily standardize production and comply with SPS measures at lower costs. This improved organization and investment may allow small-scale producers to remain competitive in the stricter food safety environment required in international markets.

Hazard Analysis and Critical Control Point Systems and Good Practices

Following the lead (and requirements) of the United States and other countries, China has turned to implementation of Hazard Analysis and Critical Control Point (HACCP) systems as another approach for reducing SPS and food safety problems and improving access to world markets. In 2002, China's General Administration of Quality Supervision, Inspection, and Quarantine introduced regulations requiring export-oriented enterprises producing six kinds of food (canned food, aquatic products [excluding fresh, frozen, air-cured, and pickled/salted products], meat and meat products, frozen vegetables, fruit/vegetable juice, and frozen convenience food containing meat or aquatic products) to pass a HACCP system examination for hygiene certification before producing, processing, or storing exported food. As expected, firms wanting to enter export markets have rapidly embraced the use of HACCP systems. As microbial contamination is the number one food safety issue (43% of illnesses caused by food poisonings were linked to microbial contamination in 2005), improved risk-based control systems, such as HACCP, along with frequent inspections by government agencies, can reduce the risks of microbial contamination on the supply side. To the extent that HACCP is successful in improving the quality of the manufacturing process, the use of HACCP systems is expected to greatly improve the sanitary condition of those exported foods.

However, because producers of most exported products and production services at various stages of the supply chain are not required to adopt HACCP or to use good manufacturing practices in processing or good agricultural practices in the fields, the responsibility for improving SPS conditions comes through self- or market-oriented discipline. Producer efforts toward good practices are motivated primarily through incentives to earn more revenues by way of foreign exchange in export markets, and through the threat of lost payments and business from foreign customers should problems occur.

Opportunities and Challenges for China

Although SPS conditions as a whole in China are low, a number of enterprises, especially those that are export-oriented in the coastal and open provinces and regions, have reached SPS levels consistent with international levels. The improvements in food quality and product safety are a result of their operating in relatively open markets and exporting to developed countries, as well as their investment in modern food production, processing, and distribution industries. These markets are now mostly controlled by the "invisible hand" of international market forces, and producers can quickly adjust production to market signals. Their good practices can have spillover effects on domestic production and potentially expand supply sources available to export markets. This provides an optimistic prospect for China's food quality and safety. Recent estimates show that China has an opportunity to compete successfully because of low production costs that offset relatively high internal marketing costs (USDA, 2006). However, large regional differences limit prospects for broad participation in international markets, and it will take a long time for China to make the necessary adjustments to improve the overall SPS conditions in the country. During the transition, the potential for exports of China's agricultural products will vary, depending on the destination countries (which have different levels of SPS requirements), product varieties, and the capacity of producers to conform to SPS standards.

Although the WTO SPS Agreement requires members to ensure that SPS measures are based on sufficient scientific evidence, there are some well-founded concerns that countries may abuse SPS measures by using them as trade barriers. As China works to respond to the SPS regulations of other countries, concerns have risen that some countries will use SPS barriers to keep out lower-cost Chinese products, which are very competitive in world markets. Consequently, importing countries may look to restrict imports from China by setting relatively high standards or strict inspections in order to protect domestic markets. As China faces continuing SPS conflicts, the government has looked to bilateral negotiations to resist unfair trade restrictions and discrimination and is likely to call upon the WTO to coordinate and resolve trade disputes. As a member of the WTO, China can participate in the negotiation and establishment of international regulations and standards. What remains to be seen is whether China will improve its market opportunities under its new access to scientific review processes.

Asia has been the dominant destination for China's seafood, meat, vegetable, and fruit exports, accounting for over 50% of China's total exports in each category. Since U.S. exports have been of a different type, or seeking different destinations or market niches, China's exports of processed fruits and vegetables, which account for 60% of its total value of fruit and vegetable exports, generally had not posed challenges to U.S. exports. However, notable competition to U.S. exports brought about by China's increasing exports has been seen in the U.S. apple juice market and in Asian fresh fruit and vegetable markets, especially apples, onions, and edible brassicas (mainly broccoli and cabbages).

The value of China's apple juice exports to the United States increased from $1 million in the early 1990s to $108 million during the 2002-2004 period, and China has replaced the United States as the leading exporter of apple juice to Japan and Canada (USDA, 2006). And, due to low production costs and proximity to Japan, China's fresh vegetables are more price competitive than are U.S. vegetables. Declining U.S. market share in other Asian markets is also coinciding with increased vegetable exports from China.

At the same time, growth in China's domestic market, fueled by increased consumer income, modernization in the retail food system, and better transportation and distribution networks, has begun to compete with export outlets for the country's high-quality and processed food products, and this may dampen the expansion of products destined for international markets.

For More Information

Dong, F., & Jensen, H.H. (2004). The challenge of conforming to sanitary and phytosanitary measures for China's agricultural exports. MATRIC Working Paper 04-MWP 8, Midwest Agribusiness Trade Research and Information Center, Iowa State University. Available online: http://www.card.iastate.edu/publications/synopsis.aspx?id=514.

Fuller, F.H., Huang, J., Ma, H., & Rozelle, S. (2005). The rapid rise of China's dairy sector: Factors behind the growth in demand and supply. CARD Working Paper 05-WP 394, Center for Agricultural and Rural Development, Iowa State University. Available online: http://www.card.iastate.edu/publications/synopsis.aspx?id=760.

United States Department of Agriculture (USDA). (February 2006). China's rising fruit and vegetable exports challenge U.S. industries. Outlook Report No. (FTS32001). Washington, DC: Economic Research Service. Available online: http://www.ers.usda.gov/Publications/FTS/2006/02Feb/FTS32001/fts32001.pdf.

|

|

Other articles in this theme:

|

|