Wine purveyed on the World Wide Web joined many similar ventures with a big splash in the late 1990s. And, as with such ventures, some swam, some just bobbled, while others simply sank.

The Web has revolutionized communication and it provides the platform for e-commerce, defined as the use of the Web for buying and selling goods and services (OECD, 2003). Winery Web sites that are listed on Google or on other search engines make it easy for buyers to find their favorite winery. If properly designed and programmed, the Web site may provide customers with rich information about the wines that are offered, although wine, unlike books, music CDs, and DVDs, cannot be sampled on the Web. Maintaining a wine shop on the Web, where customers may purchase wines online, reduces information costs for wineries and their customers, but because wine is a physical product, distribution costs per bottle of wine remain largely unaffected by e-commerce. Nevertheless, the changes in the composition of marketing costs brought about by the Web may be large enough to cause wine sales to increase, to shift a significant part of total wine sales from conventional sales channels to the Web, or to shift the composition of wine consumption.

California wineries were early adopters of e-commerce, providing an opportunity to study the adoption, use, and impact of the technology. Moreover, because e-commerce has not spread evenly through all branches of U.S. agriculture, lessons learned from the wine industry may provide useful insights for entrepreneurs and policymakers concerned with accelerating the uptake of e-commerce in the rest of agribusiness. We decided to conduct an empirical study of the practice of e-commerce by wineries in California. We also included in our study wineries from Australia and Germany so that we can compare e-commerce practices across wine industries. Here, we summarize the key results (see Stricker, 2004, for more information).

Online Winery Survey

We surveyed wineries in California, Australia, and Germany during the third quarter of 2003. We contacted by e-mail 1,690 wineries, asking them to fill out a questionnaire on the Web, and received 268 online responses: 89 from California, 70 from Australia, and 109 from Germany. In addition, we received 100 survey responses for German wineries through telephone interviews.

Wineries in California, Australia, and Germany

The wine industries of the three regions differ with respect to the size composition of their wineries and the significance of direct sales. California wineries (which number about 2,500) are predominantly family owned and operated businesses. A few large wineries, such as E. & J. Gallo Winery, Robert Mondavi Winery, Sebastiani Vineyards & Winery, and Bonny Doon Vineyard, have established brands that are well known, and they market most or all of their wine through established retail channels. Many of the smaller wineries produce insufficient quantities to supply large supermarket chains, and they sell much of their wine directly to consumers and restaurants.

The wine industry in Australia has been growing at a rapid pace, and it, like the wine industry in California, is characterized by a small number of larger wineries and a large number of smaller ones. As of 2003, there were 1,625 wine producers in Australia of which only 324 crushed 50 tons or more of grapes. Of the 324 wineries, the smallest 122 jointly crushed less than 1% of all grapes, and the largest 11 winemaking businesses accounted for more than two-thirds (68.6%) of the national grape crush in 2003. The size distribution of wineries in Germany is less skewed because there are hardly any large wineries with well-established brands while there are very many small wineries.

The wine industries in general are reflected in our sample. The respondent wineries from California are mostly family owned and operate large vineyard areas compared to the wineries in Australia and Germany. California wineries also employ the most full-time labor, on average. Median wineries in Australia and Germany are of comparable size - in total as well as in our sample, but the share of family-owned wineries is much smaller in Australia than in Germany.

Web Site Diffusion and Use for Wine Sales and Tourism Promotion

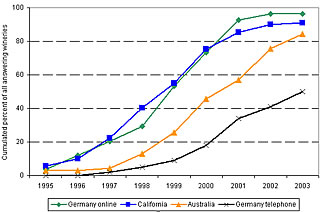

The diffusion of Web sites among wineries in California, as well as in Australia and Germany, has the typical sigmoid shape (Figure 1). Wineries in California created Web sites as soon as the Web began to expand into commerce in 1995. Diffusion was slow until 1997, when only about 20% of the respondent California wineries maintained a Web site of their own. After 1997, it took only four years until more than 80% of the California wineries had established a presence on the Web. After 2001, few additional California wineries joined the ranks of wineries with an online presence. In California, Web site diffusion is nearly complete, with 98% of the respondent wineries operating a Web site.

Most Web sites of California wineries (75%) are designed for online sales. The share of wineries that use their Web sites for selling wine is considerably lower in Australia (59%) and in Germany (42%). Web sites can also be used for promoting a winery's tourism activities, such as winery tours, restaurant and barbecue facilities, or accommodations. Given the low cost of Web space, we were surprised that California wineries made such limited use of the Web to promote tourist activities aligned with their wineries. Although nearly two-thirds (61.8%) of California wineries offer winery tours, only 40.4% advertise winery tours on their Web sites, and only about half of the wineries that offer accommodations or picnic facilities make visitors to their Web sites aware of what is available.

Lessons Learned

We can highlight five lessons from our survey on winery e-commerce.

1. Marketing wine on the Web works

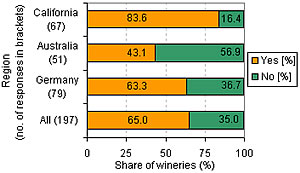

More than 80% of California wineries claimed that their Web site had increased their direct wine sales (Figure 2). The percentage of wineries with increased direct wine sales from their Web site is particularly high in California. In Australia and Germany, Web sites boosted direct wine sales for only about half of the wineries surveyed.

The results in Figure 2 should be interpreted with care. If wineries that are particularly successful on the Web are more likely to participate in online surveys than those with indifferent or worse impacts of their Web sites on wine sales, our results put winery e-commerce in a better light than it actually deserves.

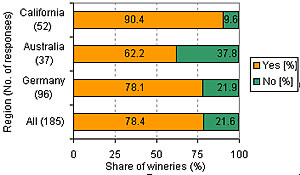

2. Winery Web sites stimulate tourism activities

Most wineries in California that promote tourism activities on their Web sites reported that tourism activities have increased (Figure 3). We do not know whether the increase can be fully attributed to the Web site. However, most wineries in Australia and Germany also reported increased tourism activities, and Web site promotion most likely increases tourism activities at a winery.

3. Web site usability and maintenance are key

Web sites must be both functional and easy to use, and visiting them should be a pleasant experience. The designs of winery Web sites varied widely, and we did not attempt to measure the impact of design characteristics on Web site impact. We found, however, a significant relationship between the frequency of Web site maintenance and direct wine sales and tourism activities. If the frequency of Web site maintenance is a reliable indicator of the effort and attention a winery gives to its Web site, this effort seems worthwhile.

4. Sales channel conflicts must be resolved

All wineries that sell wine on the Web also use conventional sales channels, and the Web channel overlaps with conventional channels with regard to the products and customers. Moreover, marketing wine on the Web may constrain pricing of wine in conventional channels because prices posted on a Web site can be so easily monitored. However, only about half (52%) of the California wineries offered the same collections online and offline, and California wines sold on the Web are, on average, $1.45 per bottle more expensive than all wines offered by our respondent wineries. We cannot say whether the higher prices, on average, are caused by the desire to avoid channel conflicts or whether they are the result of high shipping costs in direct wine sales in the United States.

5. Transport costs still limit the size of the market

When e-commerce was an infant industry, pundits foresaw the 'death of distance.' Direct marketing on the Web is, however, best suited for goods that can be digitized. For these goods, the Internet reduces both transaction and delivery costs. In contrast to words, music, video, and air tickets, wine cannot be digitized and must be shipped in its bulky form. Moreover, delivery of wine must comply with U.S. alcohol laws.

Delivery costs for wine are still high, and the costs of shipping small consignments of wine internationally are prohibitive. In 2003, it cost between $11 and $17 to ship a 12-bottle case of wine within California, and between $13.50 and $54.00 per case outside of California. High international shipping costs keep most wineries from accepting orders from abroad. A California winery that once accepted an order from the United Kingdom reported shipping costs of $140 for eight bottles. Compared to bulk shipments, which cost less than $1 per bottle shipped from California to a re-seller in Europe, shipping costs for small consignments typical of direct marketing orders are grossly unattractive. Selling wine on the Web is therefore an activity that continues to be strictly conscribed by distance and is only feasible at the upper end of the price range.

Outlook: Long-tail Opportunities for Wineries

Information technology advances rapidly. The Web site technologies available in 2003, at the time the survey for this study was conducted, are now known as Web 1.0 technology, which is currently being superseded by Web 2.0 technologies. The new technologies enable users to interact with each other by means of blogs, wikis, public Web spaces, and allow monitoring of Web users' behavior in the Web-sphere. The new technologies further extend users' capacities to search for suitable products, and they allow users to share information about products and producers. Examples of the new technologies are book reviews not by editors but by normal readers on Amazon.com and ratings of sellers by buyers on eBay or on Amazon. Similarly, given the opportunity, we would expect wine connoisseurs to make public their opinions of wines that are sold on the Web, thereby complementing wine recommendations and ratings provided by wine gurus and vendors. Publicly accessible information of this kind allows buyers to venture into the long tail of markets that consists of highly diversified market niches that may not be provided by established middlemen (Anderson, 2006).

Since we conducted our survey, the U.S. Supreme Court has struck down state laws that prohibited California wineries from selling wine directly to out-of-state consumers, and many states have now liberated direct interstate wine sales. Whereas these new laws will benefit all California wineries, the new Web technologies will be mostly to the advantage of small boutique wineries.

For More Information

Anderson, C. (2006). The long tail. London: Random House Business Books.

Organisation for Economic Co-operation and Development (OECD). (2003). 'Measuring the Information Economy 2002.' Paris: OECD. Available online: http://www.oecd.org/dataoecd/16/14/1835738.pdf (Accessed 01/31/07).

Stricker, S. (2004). Wine on the Web. Kiel, Germany: doctoral dissertation. Available online: http://e-diss.uni-kiel.de/diss_1202/d1202.pdf (Accessed 01/31/07).

Sumner, D.A., Bombrun, H., Alston, J., & Heien, D. (2004). The wine and winegrape industry in North America. Chapter 10 in K. Anderson (Ed.), Globalization of the world's wine markets. London: Edward Elgar. Available online: http://aic.ucdavis.edu/research1/Winegrape.pdf (Accessed 01/31/07).

|