Producers and users of steel are a perfect example of competing special interests: Both groups have lobbied the government on behalf of their sectors, respectively arguing for and against the tariffs on imported steel imposed by the Trump administration in 2018. One group on the “against” side is the U.S. canned food sector, which has relied on imported tinplate (tin-plated steel) for production. Tin-plated steel has been subject to both tariffs and quotas since 2018. In this article, we explore the impacts of these tariffs and their implications for canned food prices and domestic food security.

Economists are more likely to argue for complete trade liberalization (i.e., free and open trade) than for the protectionist policies favored by President Trump. As noted by Friedman and Friedman (1997), “Ever since Adam Smith there has been virtual unanimity among economists, whatever their ideological position on other issues, that free trade is in the best interests of trading countries and of the world.” However, arguments for trade liberalization are often framed in the context of producers versus consumers, where protection benefits special interests (producers) at the expense of the broader, general interest of society. Consequently, protectionism is often viewed through the concentrated benefits/diffused costs lens, where the concentrated group (i.e., producers) has far more incentive to lobby for protection than the diffused group (i.e., consumers) to lobby against it. However, this does not fully apply to specific trade actions where there are competing special interests and concentrated gains (or losses) and lobbying efforts on both sides of the issue.

The current tariff situation and lobbying efforts of the U.S. canned food and steel sectors provide an ideal case for examining trade protections in this context (i.e., competing special interests). In the United States, the canned food sector was valued at an estimated $17.8 billion in 2019 (Statista, 2023), with tin-plated steel being the primary packaging material. The data suggest that the impacts of the section 232 tariffs on the canned foodsector have not been negligible. However, more research is needed for a more quantitative assessment of their impacts and implications.

During his time in office, President Trump advocated for greater trade protections, imposing tariffs on a broad range of products. In March 2018, President Trump signed a proclamation to impose a 25% tariff on all imported steel, based on a Department of Commerce report that indicated that imports had the potential to threaten U.S. national security. Section 232 of the Trade Expansion Act of 1962 allows the president to use trade barriers for national security concerns (The White House, 2022). A major concern was the unprecedented growth in China’s crude steel production, which exceeded 1 billion metric tons in 2020, accounting for more than half of global production. Note that the next highest country (India) produced around 100 million metric tons and the United States produced around 70 million metric tons (World Steel Association, 2022). While higher prices via import quotas and tariffs benefited the U.S. steel sector, the negative impacts on downstream steel-consuming companies exceeded any gains. For instance, 75 times as many jobs were estimated to have been lost in downstream steel-consuming sectors compared to jobs gained in the steel-producing sector (Russ and Cox, 2020).

Food canning can be traced back to the 18th century in France, and the basic principles have not changed significantly since. Clearly, the direct benefit of canning is food preservation, in that the process allows for converting perishable food items into shelf-stable food, allowing for quality and nutritional properties to be maintained for years after being processed (Canned Food Alliance, 2023). The long-lasting nature of canned foods reduces food waste, common for fresh and perishable food items. Food waste and loss—caused by many factors from the farm through the final consumerand representing 30%–40% of the food supply—is aproblem because a significant amount of food is sent to landfills, which also contributes to greenhouse gas emissions from activities prior to and during disposal (U.S. Department of Agriculture, 2023).

Food preservation and convenience make canned foods suitable for food security in times of crisis, such as natural disasters or pandemics. For instance, at the beginning of the COVID-19 pandemic, households could secure food by increasing canned food purchases when restaurants were in lockdown and trips to grocery stores were less frequent (Hillen, 2021; Pigott, 2022). Unfortunately, the steel tariffs lasted throughout the pandemic, a time when consumers would have benefited from relatively lower prices for shelf-stable food items. As discussed in the next section, canned food prices significantly increased after the steel tariffs were imposed in 2018, exceeding overall inflation in recent years.

It was fitting that when the steel tariffs were first introduced, then-Commerce Secretary Wilbur Ross used a canned food item to defend the tariffs, suggesting a negligible impact on consumers and prices. In 2018, Secretary Ross noted (Horowitz, 2018),

This is a can of Campbell’s soup, there’s about 2.6 cents, 2.6 pennies, worth of steel. So, if that goes up by 25 percent, that’s about six-tenths of one cent on the price of the can of Campbell’s soup.

Interestingly, canned food prices increased by more than Secretary Ross speculated they would. We asked the CEO of a U.S. canned food company why have prices increased significantly more than “six-tenths of one cent.” He indicated that due to the tariffs, companies were paying significantly more for cans for several reasons. First, he noted the difficulties in transporting empty cans: shipping empty cans is tantamount to shipping air. Therefore, can manufacturing should be as close as possible to canning facilities. Import restrictions and tariffs make purchasing steel and producing cans more difficult, causing canned food companies to contract with can production facilities at greater and greater distances. Additionally, tinplate makes up a small share of U.S. steel production, and there is limited capacity to expand. This limited capacity has resulted in regional market power, allowing for higher mark-ups and putting additional upward pressure on prices.

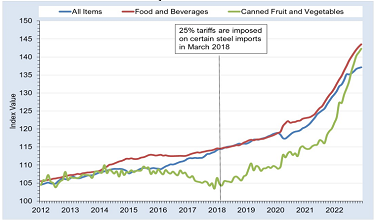

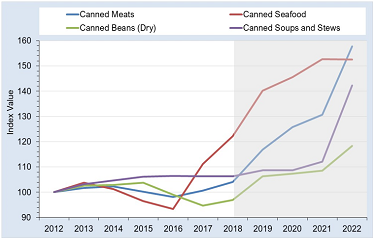

To better understand how the steel tariffs might have affected canned food prices, we examined the consumer price indices for all items (CPI), food and beverages, and canned fruit and vegetables over the last decade (January 2012–December 2022) (see Figure 1). If thesteel tariffs were inconsequential, then it could be argued that canned food prices would have followed a similar pattern as the CPI or food prices overall. Interestingly, the canned fruit and vegetables price index decreased from 2015 to 2018, even as the price indices for all goods and food and beverages increased. Even more interesting, the canned fruit and vegetables price index persistently declined right up to the point when the steel tariffs were imposed in March 2018, suggesting that the steel tariffs resulted in relatively higher canned food prices. Since the COVID-19 pandemic also caused prices to rise, Figure 1 might be capturing both the effects of the pandemic and the tariffs. However, the relatively faster price growth and the increase during 2018 and 2019 are likely due to the steel tariffs. Note that similar patterns occurred for other canned foods. Figure 2 shows the producer price indices for canned meats, seafood, beans, and soups and stews. Although canned seafood prices were rising before 2018

and the price of canned soups and stews did not significantly increase until 2022, both canned meats and canned bean prices (at the producer level) followed a similar pattern as the price index for canned fruits and vegetables: steady or decreasing prices until 2018, followed by a persistent upward trend thereafter. This provides even further evidence that the steel tariffs increased canned food prices.

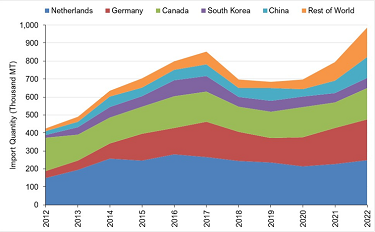

Last, we considered U.S. tin-plated steel imports since 2012, as defined by three Harmonized System (HS)categories (72101200, 72121000, and 72101100) (see Figure 3). The Netherlands, Germany, and Canada supply a major share of U.S. tinplate imports, but South Korea and China also account for a significant share. The data show that imports were trending upward until 2018 and then declined and remained low throughout 2020. Compared to 2017, U.S. tinplate imports during this three-year period (2018–2020) were down 19% overall and down 35% for imports from South Korea, 23% for Germany, 15% for China, 13% for the Netherlands, and 9% for Canada. The relatively smaller decline in imports from Canada could be due to their tariffs being lifted in 2019. Interestingly, imports have fully recovered in recent years, which could be due to the United States and European Union reaching an agreement that converted the steel tariffs to tariff-rate quotas (Fefer, 2021). Is it important to note that Figure 3 includes tin-plated steel for all uses, so it is not clear whether the recovery in imports benefited the canned food sector specifically.

Producers in the U.S. canned food industry compete on price, making the industry one of the lowest-margin sectors (Wood, 2023). Thus, the proclamation by President Trump imposing 25% tariffs on imported steel caused concern for the canned food sector. The data in this study show that sector was likely impacted beyond the negligible expectations of the previous administration. This was in part evidenced by the relatively larger increases in canned food prices since 2018 compared to overall food prices and inflation.Downstream industries like the canned food sector that faced steel tariffs experienced declines due to higher production costs, decreased profits, and even decreased sales due to higher prices. However, a more quantitative assessment is needed to assess the degree to which all of these have occurred.

Bureau of Labor Statistics. 2023. Data Tools, Inflation and Prices. Available online: https://www.bls.gov/data/#prices

Canned Food Alliance. 2023. “Canned Food Fact Sheets.” Available online: https://www.mealtime.org/fact-sheets/

Fefer, R.F. 2021. What’s in the New U.S.-EU Steel and Aluminum Deal? Report IN11799. Washington, DC: Congressional Research Service.

Friedman, M., and R.D. Friedman. 1997. “The Case for Free Trade.” Hoover Digest. Available online: https://www.hoover.org/research/case-free-trade

Hillen, J. 2021. “Online Food Prices during the COVID-19 Pandemic.” Agribusiness 37:91–107.

Horowitz, J. 2018. “Wilbur Ross defends Trump tariffs with a can of Campbell's soup.”

CNN Business (March 2, 2018). Available online: https://money.cnn.com/2018/03/02/news/economy/wilbur-ross-soup-cnbc-interview/index.html

Pigott, M. 2022. Metal Can and Container Manufacturing in the US. IBISWorld Industry Report 33243.

Russ, K., and L. Cox. 2020. “Steel Tariffs and U.S. Jobs Revisited.” EconoFact. Available online: https://econofact.org/steel-tariffs-and-u-s-jobs-revisited

Statista.com. 2023. “Estimated Canned Food Market Value in the United States from 2014 to 2025.” Available online: https://www.statista.com/statistics/1009399/us-canned-food-market-value/

U.S. Department of Agriculture. 2023. Food Waste FAQs. Available online: https://www.usda.gov/foodwaste/faqs

U.S. International Trade Commission. 2023. DataWeb. Available online: https://dataweb.usitc.gov/

The White House. 2022. A Proclamation on Adjusting Imports of Steel into the U.S. (March 31, 2022) Available online: https://www.whitehouse.gov/briefing-room/presidential-actions/2022/03/31/a-proclamation-on-adjusting-imports-of-steel-into-the-united-states-2/

Wood, G. 2023. Canned Fruit and Vegetable Processing in the US. IBISWorld Industry Report 31142.

World Steel Association. 2022. “World Steel in Figures.” Available online: https://worldsteel.org/steel-topics/statistics/