Dedicated energy crops are considered promising sources of biomass for producing advanced biofuels because of their potential to provide high yields of biofuels per unit of land even if grown on land that has low productivity for producing conventional crops and with low chemical input application. These crops can also sequester more soil carbon per unit of land than conventional crops and lead to considerably large savings in life-cycle greenhouse emissions relative to oil while reducing soil erosion and nitrogen leaching (Hudiburg et al., forthcoming; and Dwivedi et al., 2014). Two energy crops, miscanthus (Miscanthus × giganteus) and switchgrass (Panicum virgatum), have been widely analyzed for their yields, carbon footprints, and costs of production. These crops are perennials and involve significant upfront investments in establishment, which can take one to three years, with returns to be earned over a 10- to 15-year life-span of the crop.

The production of these energy crops can expose farmers to various types of risks. Yield risk can differ across crops and for the same crop across regions depending on the tolerance of the crop to variability in temperature, precipitation, and soil fertility. Since they are perennials, yield risks could be significant if severe weather were to prevent re-emergence of the crops and require new investments in crop re-establishment. Moreover, energy crops used to produce biofuels are likely to receive a price that is linked to the price of oil and, hence, could be subject to considerable price volatility. Additionally, energy crop production involves an opportunity cost of land due to the foregone returns from conventional crop production or other alternative uses of that land. This opportunity cost of land can also fluctuate over time with variability in yields and prices of crops that would have otherwise been grown on this land, and thus contribute to additional variability in the net returns to energy crop production. Biomass is also costly to transport long distances and may face thin spot markets with few local buyers; thus their production makes farmers dependent on the capacity of local biorefineries and exposes them to risks of loss of demand due to refinery shut-downs. These risks described above are likely to create a demand for risk management strategies such as long-term contracts that provide an assurance of demand for farmers and guarantee feedstock supply for refineries. Fixed price contracts, which offer a guaranteed price for biomass production, are likely to emerge as one type of marketing contract to induce farmer participation in energy crop production.

In deciding whether to produce an energy crop, landowners can be expected to compare the net benefits (or utility) they obtain from energy crop production with that from the existing use of the land. We can use this comparison to determine the minimum fixed price of the energy crop that a landowner would need to receive in order to be willing to convert the land to energy crop production. Studies have determined these breakeven prices for producing energy crops assuming that the yield of these crops remains the same over their lifespan and that the opportunity cost of land is also fixed over time (Khanna et al., 2008; and Jain et al., 2010). These studies show that the breakeven price will be higher the larger the net returns that the landowner obtains from the existing use of the land and, thus, it will be higher for productive cropland and lower for low quality marginal land.

However, if landowners are risk-averse (that is, they are willing to accept a lower income with certainty than a higher but more variable income), then the decision to convert land from an existing use to an energy crop will depend not only on the average returns from the energy crop but also their riskiness relative to that of the current use of the land. We, therefore, expect that the breakeven price needed to induce a risk-averse landowner to convert the land to an energy crop will increase as the variability in returns with energy crop production increases relative to the variability in the returns from the existing use of the land.

In this article we focus on quantifying the yield risk associated with the production of miscanthus and switchgrass, and comparing it to the yield risk associated with corn or soybean production. In the absence of historically observed data for these crops, which are yet to be grown commercially on a large scale, we use county-specific simulated data on yields for the rainfed region in the United States. We analyze the temporal and spatial variability in energy crop yields and their implications on the relative yield risk for breakeven prices of biomass needed to induce landowners to convert land for energy crop production under various levels of risk aversion. We examine these breakeven prices for both cropland (that is assumed to be currently under a corn-soybean rotation in the Midwest and in continuous corn in the other regions) and marginal land (that might otherwise be enrolled in the Conservation Reserve Program (CRP)). We conclude by discussing the implications of this analysis for contract choices between landowners and biorefineries, and policy incentives needed to induce conversion of land to energy crop production.

We model energy crop yields using the DayCent model, a biogeochemical model that can simulate plant growth based on information of precipitation, temperature, soil nutrient availability, and land-use practice (Del Grosso et al., 2011). Observed data from field experiments growing miscanthus and several switchgrass cultivars were used to calibrate the productivity parameters in the model (Hudiburg et al., forthcoming; and Dwivedi et al., 2014). The model was then used to simulate yield of miscanthus and switchgrass on both high-quality land under crop production (cropland) and low-quality land likely to be under pasture (marginal land) in the rainfed areas of the United States for a 30-year period using county-specific historical weather information. We construct yield data for two rotations of miscanthus with a 15-year life-span and three rotations of switchgrass with a 10-year lifespan. Corn and soybean yield data over the same period are obtained from the U.S. Department of Agriculture’s (USDA) National Agricultural Statistics Service (NASS).

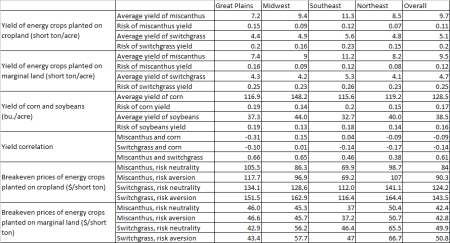

Table 1 presents summary statistics of crop yields across different regions in the rain-fed United States. Miscanthus yield is about twice as large as switchgrass yield on both types of land. The average yield of miscanthus on cropland across the rainfed United States is about 9.7 dry (with 15% moisture) short tons (hereafter referred to as tons) per acre while that of switchgrass is about 5.1 tons per acre. On marginal land, however, the average yields of miscanthus and switchgrass are 9.5 tons per acre and 4.7 tons per acre, respectively. Energy crop yields on marginal land are found to be only slightly lower than those on cropland, indicating that energy grasses can be grown productively on low-quality land.

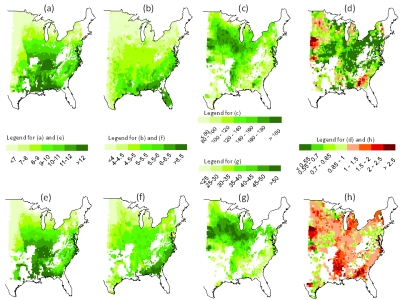

The average yields of both energy crops vary significantly across geographical regions (Figure 1). Both miscanthus and switchgrass yields are the highest in the Southeast region and low in the Great Plains and Northeast regions (Table 1). Unlike energy crops, corn and soybean yields are lowest in the Southeast. This indicates that the two energy crops require different growing conditions than conventional crops. This may explain why the yield correlation between the energy crop yields and row crop yields is small and negative.

We estimate the variation of yields around the 30-year average for each crop and find that yield risk was lower for miscanthus than for switchgrass. The yield riskiness of growing miscanthus on cropland was similar to that on marginal land, but the yield riskiness of switchgrass was lower on cropland (Table 1). In large areas of the lower Midwest and the South, the riskiness of miscanthus yield is lower than that of corn. In contrast, the yield risk of switchgrass is typically larger than that of corn in much of the rainfed region except for some areas in the southern Great Plains and Northeast (Figure 1(d) and 1(h)).

We estimate the breakeven price of an energy crop under two alternative assumptions about the risk preferences of the landowner. First, we consider a risk neutral landowner who compares the discounted value of expected profits from energy crop production to that from corn/soybeans and does not consider variations in crop profits. Then we consider a risk-averse landowner who obtains a disutility from variations in crop profits. The breakeven price is the constant price across years that equates expected utility (or profits for a risk-neutral farmer) from the energy crop to that from the alternative use of that land (Jain et al., 2010). In the case of cropland, the alternative land-use is a corn-soybean rotation in the Midwest and continuous corn in other regions, while in the case of marginal land, the alternative use is assumed to be an activity that yields a return equivalent to the soil rental rate for enrolling in CRP.

We find that, in general, the average breakeven price of miscanthus and switchgrass is about twice as high on cropland than on marginal land, suggesting that it would be economically rational for landowners to prefer growing these crops on their available marginal land (Table 1). Moreover, the breakeven price of miscanthus is typically lower than that of switchgrass across all regions because its yield is about twice as high as that of switchgrass on average. An exception is the Great Plains region where the yield gap between the two crops on marginal land is relatively low and insufficient to compensate for the higher costs of establishing miscanthus than switchgrass, making it more expensive to produce miscanthus. In the absence of risk considerations, the breakeven price of miscanthus grown on cropland is $84 per ton on average while that of switchgrass is $124 per ton. The corresponding values for breakeven prices on marginal land for miscanthus and switchgrass are $42 per ton and $50 per ton, respectively.

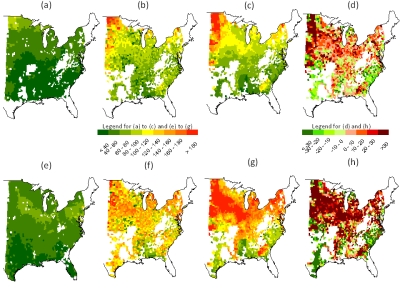

The breakeven prices of energy crops vary significantly across regions and even within a region. For both miscanthus and switchgrass grown on cropland, the breakeven prices are the lowest in the Southeast because corn yields in this region are the lowest and the energy grass yields are the highest among the four regions (Table 1). Breakeven prices for energy crops grown on cropland or marginal land are highest in the northern Great Plains because energy crop yields are very low in this area (Figure 2).

Risk-averse landowners require higher prices for energy crop production than those discussed above. We define risk premium as breakeven price with risk aversion minus the breakeven price with risk neutrality. If the risk premium is greater than zero then it indicates that returns with energy crops are riskier than returns with row crops. We find that the risk premium is positive, on average, in the rainfed United States, even though miscanthus has a lower relative yield risk than corn in most counties in the lower Midwest and large tracts of the South. This is because the high fixed costs of producing miscanthus increase the relative variability of profits in response to variability in yields. The risk premium needed to induce conversion of cropland to switchgrass is even higher than for miscanthus due to the larger variability in switchgrass yields and the high opportunity costs of cropland.

Figures 2(d) and 2(h) show the spatial variability in the risk premium for miscanthus and switchgrass grown on cropland, respectively. The risk premium varies considerably across regions, and is lowest in the Southeast and highest in the Great Plains (Table 1). The risk premium ranges from -76% to 152% of the breakeven prices under risk neutrality for miscanthus and -93% to 215% for switchgrass. The risk discount (or negative risk premium) for both energy crops is largely in the Southeast and the Southern Great Plains, which is in part due to the relatively lower yield risk of energy crops in these areas compared to corn. On average, the risk premium required to induce landowners to convert cropland to switchgrass is expected to increase its breakeven price by 15.6% compared to that required under perfect certainty; the corresponding increase in the breakeven price of miscanthus is by 7.6%.

We find that not only the breakeven prices of energy crops grown on marginal land are lower than that of energy crops grown on cropland but the risk premium on marginal land is lower too. Energy crop yields have a slightly higher yield risk on marginal land than on cropland. Moreover, energy crop production exposes farmers to risk compared to the riskless rental payments from CRP assumed here. It should be noted, however, that a higher risk of yield does not necessarily imply higher variance of utility, since the latter will also depend on the costs of production and the price of the crop. The risk premium for an energy crop depends on the yield risk and price of corn, as well as on the production costs of both the energy crop and corn. The low risk premium on marginal land is due to the low opportunity costs of growing energy crops on marginal land which require relatively low breakeven prices of energy crops and lower variability in utility with energy crop production on marginal land than on cropland.

Our analysis shows that opportunity costs of land can make a significant difference to the breakeven prices of biomass from energy crops under both risk neutrality and risk aversion. Additionally, the relatively higher yield risks associated with energy crop production as compared to corn/soybeans, particularly in the upper Midwest, can result in higher breakeven prices needed to induce risk-averse landowners to convert cropland to energy crops. However, in some regions, such as the Southeast, energy crops, particularly miscanthus, are less risky than corn/soybean production and the break-even price needed to induce a risk-averse landowner to produce them will be lower than that for a risk neutral landowner. The effects of yield risk on breakeven price are much smaller on land that may currently be under a crop/pasture rotation with a low and relatively constant opportunity cost of production. These findings suggest that landowners are more likely to first convert low-quality marginal land to energy crop production.

Based on data from 2007 Census of Agriculture (http://quickstats.nass.usda.gov/), the aggregate availability of land classified as cropland pasture or idle but not currently enrolled in CRP in the rainfed United States was estimated to be 21 million acres in 2007. However, its potential for conversion to energy crops will depend on its availability as contiguous acres that can be accessed by the equipment needed for planting and harvesting energy crops and transporting biomass. To the extent that production of biofuels will require plantation-style production of energy crops within a limited radius around a biorefinery, reliance solely on marginal land to meet the biomass needs of a refinery might involve trade-offs between costs of transporting biomass from low-cost land at further distances versus high-cost land nearby. Current use of this land for hunting, recreation, or as nature preserves, as well as the small size of individual holdings or ownership by absentee landlords could lead to high amenity values and transaction costs of converting this land for energy crop production. This could lead to much higher opportunity costs of converting marginal or idle land to energy crop production. Refineries may, therefore, have to rely on a mix of marginal land and cropland to meet their needs for biomass supply and the marginal-cost-based price of biomass is likely to be based on highest cost cropland that needs to be induced to produce energy crops in the proximity of the refinery.

The break-even prices estimated above can be interpreted as the terms of a fixed price contract that would need to be offered to landowners over the lifespan of the crop to induce them to convert land for energy crop production. While in some regions these prices are similar or even lower than those under risk neutrality, in other regions, such as Midwest, they can be 12% to 27% higher than under risk neutrality. A fixed price contract would put all the price risks associated with volatile oil prices on the refinery while leaving landowners to bear all the risks associated with the foregone returns from conventional crops.

Other types of contracts that result in alternative arrangements for sharing the yield and price risks between risk-averse landowners and a risk-neutral refinery might emerge to lower the cost of biomass for a refinery than indicated by the break-even prices estimated here. In regions where energy crop production is highly risky relative to conventional crops, a refinery that has a greater capacity to bear risk might prefer to lease land and bear all the yield and price risks rather than paying high risk premiums.

We assumed that all landowners have the same risk preferences. Heterogeneity in risk preferences across landowners would imply differences in the risk premium needed to induce production of energy crops under a fixed price contract across regions. Moreover, risk-loving landowners may even prefer price-indexed contracts that provide an opportunity for high returns. Yang et al. (2014) analyze the mix of contractual arrangements that can result in lower overall feedstock costs for a refinery by optimally sharing risks among landowners with heterogeneous risk preferences and with a risk-neutral refinery.

The breakeven prices estimated here, even under risk aversion, could be underestimated because they disregard the reliance by crop producers on subsidized yield, and revenue crop insurance and disaster relief payments for conventional crops like corn and soybeans. Such programs lower the down-side risk of producing these crops and will further increase the break-even price needed to induce farmers to switch to risky energy crop production without any safety-nets. We leave the analysis of the effects of crop price risks and the presence of instruments for mitigating risks associated with conventional crop production on the riskiness of producing energy crops to future research.

The Renewable Fuel Standard mandates the production of cellulosic biofuels and will create market incentives for obligated parties (oil refiners) to cover the costs of cellulosic biofuel production. Additional policy incentives for biomass production include the Biomass Crop Assistance Program (BCAP) and the Cellulosic Biofuel Production Tax Credit (CBPTC). BCAP provides cost-share payments to cover the costs of establishing energy crops and subsidies for collecting, harvesting, and transporting energy crops while the CBPTC subsidizes the blending of cellulosic biofuels with gasoline. However, none of these policies directly address the downside risks associated with the production of energy crops for landowners in a manner comparable to the safety net provided by subsidized crop insurance for corn and soybeans.

Our analysis has focused on the effects of risk on utility per acre of land. Further research is needed at the whole-farm level to examine the effects of risk preferences on the allocation of land operated by a farmer between energy crops and conventional crops. Moreover, to the extent that energy crop yields have a relatively low or negative correlation with corn/soybeans, their production can diversify the crop portfolio and potentially reduce overall riskiness of crop production. The risk premium needed in that case for growing energy crops will also depend on the share of annual farm income derived from energy crop production. A case study of a representative farm in Tennessee by Larson, English, and Lambert (2007) shows that contracts that shift the risk of switchgrass production to the processor can result in lower biomass prices than other contracts. The spatial variability in yield risks shown here coupled with whole farm analysis can be used to identify locations and the design of contracts for energy crop production that can result in higher net benefits for landowners and refineries.

Babcock, B.A., Choi, K.E.,and Feinerman, E. (1993). Risk and probability premiums for CARA utility functions. Journal of Agricultural and Resource Economics, 18(1), 17-24.

Census of Agriculture. (2007). Acres of cropland pastured only. Available online: http://quickstats.nass.usda.gov/.

Chen, X., Huang, H., Khanna, M. and Önal, H. (forthcoming). Alternative transportation fuel standards: welfare effects and climate benefits. Journal of Environmental Economics and Management.

Del Grosso, S.J., Parton, W.J., Keough, C.A, and Reyes-Fox, M. (2011). Special features of the Daycent modeling package and additional procedures for parameterization, calibration, validation, and applications, L.R. Ahuja and Liwang Ma (eds.) Methods of introducing system models into agricultural research, p. 155-176, American Society of Agronomy, Crop Science Society of America, Soil Science Society of America, Madison, Wis.

Dwivedi, P, Wang, W., Hudiburg, T., Jaiswal, D., Parton, W., Long, S., DeLucia,E., and Khanna, E. (2014). Cost of abating greenhouse gas emissions with cellulosic ethanol. Working Paper, Energy Biosciences Institute, University of Illinois, Urbana-Champaign.

Hennessy, D.A., Babcock, B.A., and Hayes, D.J. (1997). Budgetary and producer welfare effects of revenue insurance. American Journal of Agricultural Economics. 79(3), 1024-34.

Hudiburg, T.W., Davis, S.C., Parton, W., and DêLucia, E.H. (forthcoming). Bioenergy crop greenhouse gas mitigation potential under a range of management practices. Global Change Biology Bioenergy. doi: 10.1111/gcbb.12152.

Jain, A.K., Khanna, M., Erickson, M., and Huang, H. (2010). An integrated biogeochemical and economic analysis of bioenergy crops in the Midwestern United States. Global Change Biology Bioenergy. 2(5), 217-34.

Khanna, M., Dhungana, B., and Clifton-Brown, J. (2008). Costs of producing miscanthus and switchgrass for bioenergy in Illinois. Biomass and Bioenergy. 32(6), 482-93.

Larson, J.A., English, B.C., and Lambert, L. (2007). Economic analysis of the conditions for which farmers will supply biomass feedstocks for energy production. Agricultural Marketing Resource Center, Iowa State University, Ames, Ia.

Yang, X., Paulson, N., and Khanna, M. (2014). Contracting for energy grasses: effects of risk preferences and land quality. Paper presented at the 2014 Allied Social Science Associations (ASSA) meeting, Philadelphia, Pa., Jan. 3-5, 2014.