Cacao markets—like those for coffee and several other commodity crops—have seen a growing demand for differentiated, high-quality products. Now, traders are directly purchasing the beans from farmers, paying premiums for the most sought-after varieties, those that are classified as fine or flavor by the International Cocoa Organization ICCO (Blare and Useche, 2014; ICCO, 2016). Many local cacao varieties in Latin America meet this standard and are highly sought after in international, regional, and even local markets (Gayi and Tsowou, 2016; Cornejo et al., 2018). Growth in these local markets is notable in the region’s major cities, like Mexico City and Lima, with new chocolate shops and brands becoming prevalent in upper-income neighborhoods (Aybar Huayanay, 2018). In fact, Peruvian chocolate makers expect its national market for high-end chocolates made from its own cacao to grow by 20% between 2018 and 2021 (Flores, 2019). This market for local cacao varieties may indeed be an opportunity for smallholders and their organizations as buyers seek out these local varieties of cacao conserved by smallholders, who make up 95% of Latin American cocoa producers (CBI, 2018; Fountain and Huetz-Adams, 2018).

Due to consumers’ growing social awareness and demand for sustainably and ethically produced chocolates, buyers have become more concerned not only about sourcing quality cacao and but also about supporting the rural communities that produce this cacao (Blare and Useche, 2014; Barrientos, 2016; WCF, 2018). The changes in the market have become so prominent that some of the large cacao traders, including ECOM, Olam, Nestlé, Hershey’s, Mars, and Pronatec, have created units to source these high-quality products for gourmet chocolate makers. This article evaluates this growing market for local cacao varieties in Peru and Mexico. We examine how smallholders are becoming involved in these new value chains for this fine or flavored cacao and the challenges they face in further exploiting these markets. We compare the development of these markets in Peru and Mexico and provide insights into what actions can be taken to ensure that smallholders can take advantage of these opportunities.

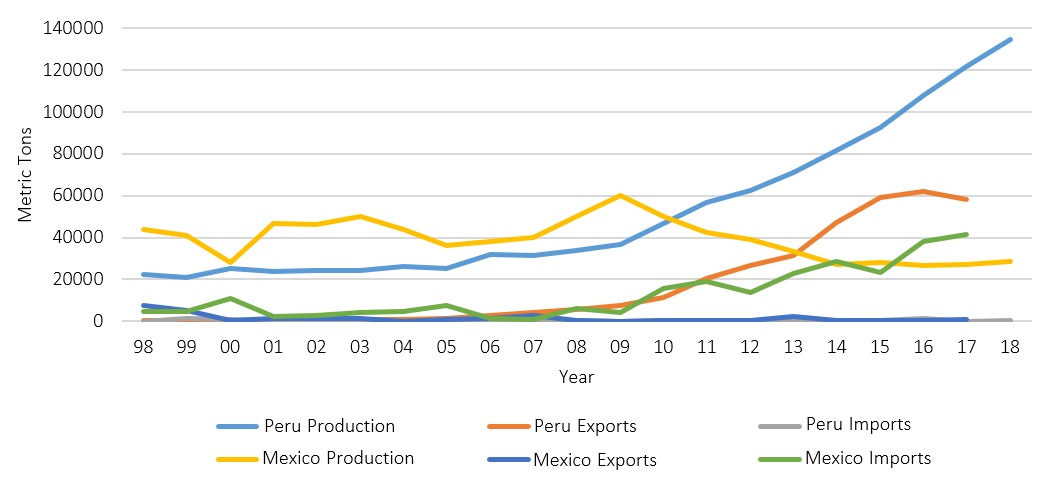

Source: FAO (2020b).

Peru has a long history of cacao production. In fact, the Peruvian and Ecuadorian Amazon is the genetic origin of cacao (Fountain and Huetz-Adams, 2018). As of 2018, it was the eighth largest cacao producer in the world and third largest in Latin America, behind Brazil and Ecuador, producing 134,000 metric tons (MT) of cacao (FAO, 2020a). Cacao production in Peru has grown six-fold in the last 20 years, from just over 22,000 MT of cacao in 1998 (Figure 1). The area dedicated to cacao production went from a little less than 34,000 hectares in 1998 to over 160,000 hectares in 2018 (FAO, 2020b). While the department of Cusco had been the historical center of cacao production up until the late 1990s, the center of production in Peru shifted to the Amazon region in the early 2000s due to a United Nations–led alternative crop program. This program encouraged farmers to switch from coca to cacao production in the Amazonian departments of San Martin and Ucayali, as part of the pacification agreements in the 1990s and early 2000s (Salzer, 2015). This region went from producing virtually no cacao in the late 1990s to the department of San Martin producing 42% of all cacao in Peru by 2016 (León Carrasco, 2018).

Much of this increased production in Peru was due to adoption of the hybrid CCN-51 variety, which—although resistant to diseases and more productive—does not have the flavor characteristics of local cacao varieties. The planting of this more productive cacao variety increased yields by a third from around 600 kg/ha in the late 90s to over 800 kg/ha in 2018 (FAO, 2020b). However, the widespread adoption of this variety led to the degradation of Peru’s status as a source of the highest-quality, fine, or flavored cacao. In 2008, the International Cocoa Organization (ICCO) classified 100% of Peru’s exports as fine or flavored cocoa. In 2011, the ICCO downgraded Peru’s share of fine or flavored cacao to 90% of total production (ICCO, 2015). As more and more of the CCN-51 variety came into production, the ICCO once again reclassified Peru’s cacao production as being only 75% fine or flavored (ICCO, 2016).

Even with the downgrading, Peru has the potential to further expand into the growing market for fine or flavored cacao because of the local cacao varieties still grown by its farmers. Two of the best-known varieties are cocoa porcelana, with a honey flavor, found on Peru’s northern coast in the Piura department and cacao chuncho, with a floral and fruity flavor, grown in the Amazon area of the Cusco department. European chocolate makers have been directly purchasing cacao porcelana for about 2 decades. Over the last 5 years, international traders have made connections with farmers and their organizations in Cusco to source cacao chuncho (Morelos et al., 2015). This growing international demand has been coupled with an explosion of Peruvian chocolate makers. Just a decade ago one, well-established firm, Iberia, had supplied nearly all of Peru’s chocolates since the early 1900s with cacao sourced from Cusco. At the last cacao and chocolate fair in Lima in 2019, over 50 Peruvian chocolate makers targeted Peru’s growing middle class. As Peru’s per capita income increased 2.5 times, from 1,956 USD in 2000 to 6,977 USD in 2019, Peruvian consumers now have the means to purchase higher quality chocolates at higher prices (World Bank, 2020).

This growing national consumption is reflected in the falling export volumes of cacao, starting in 2016 (Figure 1). Even as cacao production rose from about 108,000 MT in 2016 to 122,000 MT in 2017, exports fell from around 62,000 MT to 58,000 MT in 2017, with the domestic market absorbing 20,000 MT of cacao. A majority of Peru’s cacao, 57%, was exported in 2016 but only a minority, 48%, was exported in 2017, while imports remained negligible. The expanding market has allowed farmers to a receive a price much higher than the actual world market price, from two to four times the market price (Homann, 2016). From interviews we conducted in 2018 with six Peruvian chocolate makers, three international buyers, and three farmer co-operatives in Piura, Cusco, and San Martin, we found that buyers paid farmers at least twice the going market price for these local cacao varieties. Sometimes, the farmers’ organizations, especially those that supply the highly sought-after cacao porcelana in Piura, can set their own prices; they have oligopsony power. However, as more farmers enter these lucrative markets, this pricing power may diminish as new plantations come into production in next 3–5 years.

Farmers or their associations still must complete the proper postharvest activities in fermenting and drying their cacao to have access these markets, but they face difficulties in meeting these quality requirements. They lack the infrastructure and knowledge to complete this process, so buyers have had to invest in co-operatives’ capacities to complete post-harvesting activities or build their own facilities. There is also a growing concern about the high concentrations of cadmium in Peruvian cacao, which is concerning as the European Union started limiting the levels of cadmium that it will accept in the cacao it imports. Higher cadmium concentrations have been found in products originating from Latin America, particularly in the Andean countries (Abt et al., 2018). A recent study has shown that 40% of Peruvian cacao beans studied had cadmium readings above the accepted European standards (Arévalo-Gardini et al., 2017).

Cacao has been an important part of Mexican culture since the Mayans used it in ceremonial drinks and is still used in many traditional dishes (Marcano et al., 2007; Badrie et al., 2015). Cacao production in Mexico, as in the rest of Latin America, is dominated by smallholders (Franzen and Borgerhoff, 2007). With at least 37,000 producers in Mexico and a national production of approximately 28,000 MT in 2018 (SIAP, 2016), it is the world’s 14th largest producer (FAO, 2020a). The southern state of Tabasco produces the most cacao: 17,000 MT in 2016 (SIAP, 2016). Tabasco and its neighbor Chiapas produce more than 99% of the cocoa supply in the country (SAGARPA, 2010).

Production has declined over the last few years from a high of 50,000 tons in 2003. This decline is due mostly to falling yields, which went from over 650 kg/ha in 2007 to 490 kg/ha in 2018 (FAO, 2020b). Diseases, frosty pod and witches’ broom, and a failure to renew plantations’ trees has lowered productivity (SAGARPA, 2010). Farmers have been discouraged from investing in these plantations because of declining cacao commodity prices (40% decline from January 2010 to July 2020) and higher input costs. Further, aging farmers, who were on average 57.9 years old, and a labor shortage in the region due to migration pressures provide few prospects for smallholder families to see a long-term future in their plantations and invest in them (Díaz-José et al., 2013).

Nearly all the cacao produced in Mexico is consumed domestically. In 2019, exports totaled only 4% of Mexico’s cacao production, just 472 MT (SIAVI, 2020). In fact, much of the cacao needed to meet Mexico’s national needs is imported. National production satisfies only 41% of the country’s demand (SAGARPA, 2017). Many small and medium enterprises throughout Mexico process this cacao (70 large and medium-sized firms and around 250 small firms with 10 or fewer employees) and are important to Mexico’s rural economy, as they employ approximately 7,200 people. However, more than 90% of processors have yet to enter the lucrative market for high-quality cacao products, chocolates, and drinks. They are dedicated to producing low-cost products with intense price competition (Beganović, 2010).

Even with these challenges in production and in the traditional and commercial markets, there is hope that the Mexican cacao farmers will be able to expand their presence in these specialty markets with the associated price advantages. Gourmet chocolate makers in the United States and Europe are seeking out local, Mexican cacao varieties and are willing to pay a premium for them (García-Alamilla et al., 2013). In fact, the ICCO classifies 100% of Mexicans cacao as fine or flavored (ICCO, 2016). Export prices have ranged between 1.80 and 4.00 USD/kg, much higher than national prices and the international commodity prices reported by the ICCO (SIAP, 2019). Managers from two farmers’ co-operatives in Chiapas claim they received double the international price for their cocoa in 2019, 4.80 USD/kg in the export markets versus 2.40 USD/kg paid in the national market. Opportunities also exist for high-end cacao products in Mexico’s cities. These managers in Chiapas also pointed out that elite, national markets pay 2–3 times more than they receive in export markets.

Peru and Mexico are at very different stages of taking full advantage of these specialty cacao markets. The Peruvian government, international donors, NGOs, and international research centers have promoted cacao as a rural development strategy in the Amazon. For instance, the USAID office in Peru established the Alianza Cacao project to support the planting and marketing of fine or flavored cacao (Morelos et al., 2015). While Peru has become concerned about its reputation among exporters of producing fine or flavored cacao, due the widespread adoption of hybrid varieties, Mexico has maintained this classification by conserving its local cacao varieties, desired in these high-end international and national markets. However, few institutions outside of some environmental NGOs that support cacao agroforestry practices have yet to fully realize the potential of these markets and support farmers, their associations, and rural enterprises in accessing them.

While efforts to develop the cacao value chains often have an eye toward export markets, the large national market for cacao products in Mexico, including an expanding market for quality chocolates, and the rapidly growing market in Peru provides real opportunities for smallholders and national processors. Earlier studies in Colombia and Ecuador have pointed out the limited opportunities for all farmers to take advantage of these specialty export markets due to their stringent requirements and logistical challenges (Abbott et al., 2018; Villacis, Alwang, and Barrera, 2020). While there may be limited opportunities in the export markets, our analysis of the cacao markets in Peru and Mexico points to a nascent but rapidly growing local market for chocolates made from local cacao varieties. These markets have the potential to be at least as lucrative as these export markets, providing an opportunity for smallholders and rural communities to capture additional value in the cacao value chain by offering cacao to national consumers.

The growing middle class in Latin America provide an ideal customer base to market these products, especially because of the cultural ties that these consumers have to these products. There is an opportunity for this market to expand as chocolate consumption remains relatively low in Peru and Mexico compared to other countries in the region. In 2018, the average Mexican only consumed 750 g of chocolate annually and the average Peruvian just 500 g of it each year, while the average Brazilian and Chilean consumed 1.5 kg and 2.5 kg of chocolate annually, respectively (La República, 2018; Vega, 2019). Such national markets are particularly attractive to Peruvian farmers as they are challenged to meet the new cadmium requirements in the European Union. These national markets may supplicate some of this lost market until farmers can implement production methods to produce cacao that meets the EU standards, which may take several years (Arévalo-Gardini et al., 2017). However, recent market disruptions due to the COVID-19 pandemic should be considered, as consumers may opt to spend their dwindling income on staple food products and not on luxury items like gourmet chocolates.

This analysis of the value chain for local cacao varieties in Peru and Mexico revealed some of the well documented challenges in connecting smallholders with lucrative markets. Farmers’ and their associations have limited access to credit, which inhibits their ability to invest in their plantations and post-harvest infrastructure, and insufficient training opportunities not only to address production challenges but also to develop post-harvest and marketing skills. Assisting farmers and small business who are used to selling in informal markets to become compliant with tax and sanitary regulations, especially for export markets, is a difficulty that has been noted many times in the literature and often mentioned by buyers in both countries (Beg et al., 2017; Donovan, Blare, and Poole, 2017; Rueda et al., 2018). However, the exporters, processors, and chocolate makers in these specialty cacao markets believe they can overcome these challenges. As these specialty markets allow them to pay much higher prices, they feel these price premiums will more than compensate for the additional transaction costs incurred by farmers in becoming formalized and organized. Only time will tell if this bet pays off. In order to access these markets and obtain these prices, major investments are required by these businesses, farmers, and their organizations in collection and post-harvest infrastructure. Individual farmers produce their cacao in small quantities, creating a complex logistical challenge. Co-operation all along the value chain—including among financial institutions, transportation services, extension providers, and researchers—is needed to deliver the high-quality cacao that meets buyers’ standards. Even with all these challenges, the promises of this expanding market are an opportunity that cannot be ignored, as they have the potential to enhance the well-being of many smallholder farmers and rural communities.

Abbott, P.C., T.J. Benjamin, G.R. Burniske, M.M. Croft, M. Fenton, C.R. Kelly, M. Lundy, F. Rodriguez Camayo, and M.D. Wilcox. 2018. “An Analysis of the Supply Chain of Cacao in Colombia.” West Lafayette, IN: Purdue University International Center for Tropical Agriculture (CIAT).

Abt, E., J. Fong Sam, P. Gray, and L.P. Robin. 2018. “Cadmium and Lead in Cocoa Powder and Chocolate Products in the US Market.” Food Additives & Contaminants: Part B 11(2): 92–102.

Arévalo-Gardini, E., C.O. Arévalo-Hernández, V.C. Baligar, and Z.L. He. 2017. “Heavy Metal Accumulation in Leaves and Beans of Cacao (Theobroma cacao L.) in Major Cacao Growing Regions in Peru.” Science of the Total Environment 605: 792–800.

Aybar Huayanay, G.A. 2018. “Análisis del Consumo de Chocolate Fino en Lima.” BS Thesis, Universidad Peruana de Ciencias Aplicadas.

Badrie, N., F. Bekele, E. Sikora, and M. Sikora. 2015. “Cocoa Agronomy, Quality, Nutritional, and Health Aspects.” Critical Reviews in Food Science and Nutrition 55(5): 620–659.

Barrientos, S. 2016. “Beyond Fair Trade.” In M.P. Squicciarini and J. Sinnnen, eds. The Economics of Chocolate. Oxford, UK: Oxford University Press, pp. 213–227.

Beg, M.S., S. Ahmad, K. Jan, and K. Bashir. 2017. “Status, Supply Chain and Processing of Cocoa - A Review.” Trends in Food Science and Technology 66: 108–116.

Beganović, J., J.P. Chauvin, H. García, S. Khan, and C. Ramírez-Bulos. 2010. “The Mexico Chocolate Sector: The Microeconomics of Competitiveness.” Boston, MA: Harvard University. Available online: http://citeseerx.ist.psu.edu/viewdoc/download? doi=10.1.1.564.3293&rep=rep1&type=pdf.

Blare, T., and P. Useche. 2014. “What Does It Mean to be Socially Responsible? Case Study on the Impact of the Producer Plus Program on Communities, Women, and the Environment in Ecuador.” Washington, DC: U.S. Agency for International Development (USAID), Monitoring, Extension and Advisory Services, Case Study 11.

Center for the Promotion of Imports (CBI). 2018. “Exporting Fine Flavour Cocoa Beans to Europe.” The Hague, Netherlands: Netherlands Enterprise Agency, Center for the Promotion of Imports.

Cornejo, O.E., M.C. Yee, V. Dominguez, M. Andrews, A. Sockell, E. Strandberg, D. Livingstone, C. Stack, A. Romero, P. Umaharan, and S. Royaert. 2018. “Population Genomic Analyses of the Chocolate Tree, Theobroma cacao L., Provide Insights into Its Domestication Process.” Communications Biology 1(1): 1–12.

Díaz-José, O., Aguilar-Ávila, J., Rendón-Medel, R., and Santoyo-Cortés, V. H. (2013). Situación actual y perspectivas de la producción de cacao en México. Ciencia e investigación agraria, 40(2), 279-289.

Donovan, J., T. Blare, and N. Poole. 2017. “Stuck in a Rut: Emerging Cocoa Cooperatives in Peru and the Factors That Influence Their Performance.” International Journal of Agricultural Sustainability 15: 169–184.

García-Alamilla, P., P.A. López-Andrade, V.W. González-Lauck, and L.M. Lagunes-Gálvez. 2013. “Cacao Criollo Extrafino de Aroma.” In J.R. Velázqez-Martínez, E. López-Hernández, and P. García Alamilla, eds. Desarrollo Científico y Tecnológico de los Recursos Alimentarios en Tabasco. Villahermosa, Tabasco, México: Universidad Juárez Autónoma de Tabasco, pp. 91–103.

Gayi, S.K., and K. Tsowou. 2016. Cocoa Industry: Integrating Small Farmers into the Global Value Chain Cocoa Industry. New York, NY, and Geneva, Switzerland: UN Conference on Trade and Development.

Food and Agriculture Organization of the United Nations (FAO). 2020a. FAOSTAT, Commodities by Country. Available online: http://www.fao.org/faostat/en/#rankings/countries_by_commodity. [Accessed June 11, 2020].

Food and Agriculture Organization of the United Nations (FAO). 2020b. FAOSTAT, Compare Data. Available online: http://www.fao.org/faostat/en/#compare. [Accessed June 11, 2020].

Flores, C. 2019, February 13. “Peruanos Gastarán S/ 1200 Millones en Chocolate: El Consumo por Persona es de 500 Gramos en el País, en Promedio, Frente a los 3 Kilos de Chile y 10 de Argentina.” Correo. Available online: https://diariocorreo.pe/economia/peruanos-gastaran-s-1200-millones-en-chocolate-870473/?ref=dcr.

Fountain, A., and F. Huetz-Adams. 2018. Cocoa Barometer 2018. Available online: https://www.voicenetwork.eu/wp-content/uploads/2019/08/ Cocoaborometer2018_web4.pdf [Accessed June 11, 2020].

Franzen, M., and Æ.M. Borgerhoff. 2007. “Ecological, Economic and Social Perspectives on Cocoa Production Worldwide.” Biodiversity and Conservation 16: 3835–3849.

Homann, F. 2016. “Fine Cocoa Market Dynamics—Bid for the Future.” Paper presented at the International Cocoa Organization (ICCO) World Cocoa Conference, May 22–25, Punta Cana, Dominican Republic.

International Cocoa Organization (ICCO). 2015. “Report by the Chairman on the Meeting of the ICCO Ad Hoc Panel on Fine or Flavour Cocoa to Review Annex ‘C’ of the International Cocoa Agreement, 2001.” London, UK: ICCO Ad Hoc Panel on Fine or Flavour Cocoa.

International Cocoa Organization (ICCO). 2016. “ICCO Panel Recognizes 23 Countries as Fine and Flavour Cocoa Exporters.” Available online: https://www.icco.org/about-us/icco-news/319-icco-panel-recognizes-23-countries-as-fine-and-flavour-cocoa-exporters.html.

La República. 2018, July 26. “El Consumo de Chocolate en el Perú es Uno de los Más Bajos en América Latina.” Available online: https://larepublica.pe/economia/1286290-consumo-chocolate-peru-bajos-america-latina.

León Carrasco. J.C. 2018, March 15. “El 93% de la Producción Peruana de Cacao se Concentra en 7 Regiones.” Agencia Agria de Noticas. Available online: https://agraria.pe/noticias/ el-93-de-la-produccion-peruana-de-cacao-se-concentra-en-7-re-16171.

Marcano, M., T. Pugh, E. Cros, S. Morales, E.A.P., Páez, B. Courtois, J.C. Glaszmann, J.M. Engels, W. Phillips, C. Astorga, and A.M. Risterucci. 2007. “Adding Value to Cocoa (Theobroma cacao L.) Germplasm Information with Domestication History and Admixture Mapping.” Theoretical and Applied Genetics 114(5): 877–884.

México, Secretaria de Agricultura, Ganaderia, Desarrollo Rural, Pesca y Alimentacion (SAGARPA). 2017. “Planeación Agrícola Nacional 2017-2030.” Ciudad de México, México: SAGARPA. Available online: https://www.gob.mx/cms/uploads/attachment/file/256425/B_sico-Cacao.pdf

México, Secretaria de Agricultura, Ganaderia, Desarrollo Rural, Pesca y Alimentacion (SAGARPA). 2010. “Plan Rector Nacional Sistema Producto Cacao.” Ciudad de México, México: SAGARPA.

Morales, O., Borda, A., Argandoña Martínez, J. A., Farach Cardeña, R., García Naranjo Loayza, L. F., & Mercedes Lazo Galdos, K. J. 2015. “La Alianza Cacao Perú y la Cadena Productiva del Cacao Fino de Aroma.” Surco, Lima, Peru: Universidad ESAN.

México, Servicio de Información Agroalimentaria y Pesquera (SIAP). 2016. Available online: https://www.gob.mx/siap. [Accessed April 29, 2020].

México, Servicio de Información Agroalimentaria y Pesquera (SIAP). 2019. Panorama Agroalimentario 2019. Ciudad de México, México: SIAP. Available online: https://nube.siap.gob.mx/ gobmx_publicaciones_siap/pag/2019/Atlas-Agroalimentario-2019. [Accessed April 29, 2020].

México, Sistema de Información Comercial Vía Internet (SIAVI). 2020. Estadísticas de Comercio. Ciudad de México, México: SIAVI. Available online: http://www.economia-snci.gob.mx/sic_php/vp3/desarrollo/ Sistemas/siavi/genera.php?fraccion=18062099. [Accessed April 29, 2020].

Rueda, X., A. Paz, T. Gibbs-Plessl, R. Leon, B. Moyano, and E.F. Lambin. 2018. “Smallholders at a Crossroad: Intensify or Fall Behind? Exploring Alternative Livelihood Strategies in a Globalized World.” Business Strategy and the Environment 229(27): 215–229.

Salzer, F. 2015. “The Performance of Smallholder Collective Enterprises: Lessons from the Cacao Sector in Peru.” MS Thesis, University of Humbolt, Berlin, Germany.

Vega, M. 2019, September 2. “México Sabe a Cacao y Chocolate.” Mexico Food and Travel. Available online: https://foodandtravel.mx/mexico-sabe-a-cacao-y-chocolate/.

Villacis, A., J. Alwang, and V. Barrera. 2020. “Does the Use of Specialty Varieties and Post-Harvest Practices Benefit Farmers? Cocoa Value Chains in Ecuador.” Paper presented at the annual meeting of the Southern Agricultural Economics Association, February 1–4, Louisville, Kentucky.

World Bank. 2020. “GDP Per Capita (Current US$) – Peru.” Available online: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=PE [Accessed October 22, 2020].

World Cocoa Foundation (WCF). 2018. “2018 World Cocoa Foundation Learning Meeting Report.” July 10–13, Accra, Ghana.