The 2014 farm bill is the latest chapter in a legislative history that dates to 1933. It secured large bipartisan majorities: 255-166 in the House of Representatives and 68-32 in the Senate, despite a difficult path through Congress amid the general gridlock of recent years. This long-running yet still contemporary saga spans constant threads, ever-changing content, and dynamic processes. While cumulative evolution over time has been sizable by many metrics, legislative experience suggests the next farm bill is likely to have more continuity than change, even after the heated 2016 elections and probable enactment of a farm bill by an undivided government for the first time since 1977 (Democratic control) and for the first time since 1954 under Republican control.

Three threads weave their way through the history of U.S. farm bills: farmers, food, and land. The farmer thread started with the dire economic situation of farm families combined with farming’s importance to recovery from the Great Depression that began in 1929. Over one-fifth of gainfully employed Americans worked on farms (U.S. Bureau of the Census, 1954) while per capita farm income was only one third of nonfarm per capita income (USDA-ERS, 1982). The food thread started with concern over food security growing out of the Great Depression and Dust Bowl droughts of the 1930s. Public stocks and disposal of surplus food supplies were the initial mechanisms for addressing food security. The land thread started in part because land is hard to hide. Acres became a mechanism for controlling supply, which increased prices received by farmers. The Dust Bowl also drew attention to the need to conserve soil. In response to the 1936 Supreme Court ruling that the original New Deal farm program was unconstitutional, land retirement conservation programs became part of the farm bill. The on-going importance of these threads is underscored by the commodities, crop insurance, nutrition, and conservation titles of the 2014 farm bill accounting for all but 1% of the bill’s projected outlays (CBO, 2014).

During the 1950s and 1960s, idled land and public stocks grew increasingly larger, making it clear that depression-era and post-World War II policies were inefficient and costly. Reforms followed. The 1973 farm bill introduced price flexibility via a program that made payments to farmers when market prices were below a target price. By 1996, the farm bill had ended most public stocks programs and had eliminated annual acreage controls, which was largely replaced by planting flexibility. This reform process has been called a “cash out” of farm policy (Orden, Paarlberg, and Roe, 1999) as payments replaced annual land set-asides and public stock programs.

Source: USDA-FSA, 2016

Note: Not included in commodity payments by the

Commodity Credit Corporation are operational and

interest expenses, and payments by conservation,

export, livestock assistance, tree assistance, and tobacco

trust fund programs.

Besides being payment based, U.S. farm policy since 1973 is best described as countercyclical. Farm support outlays by the Commodity Credit Corporation (CCC) were essentially zero during the high price/revenue periods of the mid-1970s and mid-1990s, as well as during 2007-2014, after separating out the fixed direct and production flexibility payments that by policy design did not vary with market conditions after 1996 (Figure 1). In contrast, outlays reached $20-$25 billion during the mid-1980 and late 1990 and early 2000 low price and revenue periods. CCC is the primary government agency through which programs in the commodities title are funded.

Reform of farm policy has not narrowed the coverage of commodities. Coverage in the 2014 farm bill is at a level last seen during World War II. The 2002 farm bill added target prices for soybeans and other oilseeds, and a title for forestry. The 2008 farm bill added marketing loan rates and target prices for dry peas, lentils, and small and large chickpeas; as well as a number of programs desired by horticultural and organic farms. A Supplemental Disaster Assistance Program was added for livestock, honeybees, farm-raised catfish, orchard trees, and nursery stock; then funded permanently in the 2014 farm bill.

The scope of farm programs has also expanded. An energy title was added in the 2002 farm bill, and insurance has emerged as a twin pillar, along with commodity programs, of the farm safety net. Begun as an experimental program in 1938, the modern insurance program dates to The Federal Crop Insurance Act of 1980. Although an insurance title was included in the 1991 farm bill, insurance was largely addressed by separate legislation until the 2008 and 2014 farm bills. It looks set to remain in future farm bills. Between 1989 and 2015, insured acres increased from 101 to 296 million while federal premium subsidies increased from $0.2 to $5.8 billion (USDA-RMA, 2016).

Turing to the food thread, starting in the 1960s, the Food Stamp Program (FSP) progressively became the primary mechanism to improve food security for low income individuals and families. The 1996 farm bill renamed the food stamp title, nutrition; while the 2008 farm bill renamed FSP, the Supplemental Nutrition Assistance Program (SNAP). Names of programs and titles are rarely happenstance. Changes in names acknowledge past trends, in this case the changing focus of food programs from calories to nutrition. More importantly, they signal a desire for future change.

FSP and SNAP in essence provide targeted income transfers and are countercyclical to an extent. During the recent recession SNAP’s budget rose from $37.6 billion in 2008 to $79.9 billion in 2013 before starting to decline as the economy improved (USDA, 2016).

Depression-era long-term land idling conservation programs were ended when demand for commodities rose during World War II but reappeared in the mid-1950s. The programs again were ended during the 1970s price run up as a fence row–to–fence row planting mentality dominated. The farm financial crisis of the early 1980s provided another reentry point, this time for an enlarged portfolio consisting of a land retirement Conservation Reserve Program (CRP), restrictions on bringing environmentally fragile grassland and swampland into production, and environmental compliance criteria for land receiving commodity program payments.

Current land programs can be described as an environmental pyramid. Its four sides are (1) retiring environmentally sensitive land from farm production—CRP; (2) enhancing environmental performance of farms—environmental compliance, Conservation Stewardship Program, and Environmental Quality Incentives Program; (3) buying easements to protect natural resources or agricultural use—Agricultural Conservation Easement Program; and (4) fostering private-public partnerships to address environmental issues—Regional Conservation Partnership Program. Reflecting a clear change in policy perspective, Congress chose to reduce but not eliminate CRP in the 2008 and 2014 farm bills written during the post 2006 price run up.

Other titles have also been added to the farm bill over time. Titles are a shorthand guide to a bill’s major issue themes. Titles may reflect issues of the moment or of on-going importance. The latter include research and extension, credit, rural development, and trade; all of which have appeared as titles in all farm bills since 1981. These added titles are important for building coalitions to move the farm bill forward. The 2014 farm bill reduced projected spending on the commodities, conservation, and nutrition titles below the so-called baseline spending if then-current programs were reauthorized while increasing projected spending above the baseline by 6% on crop insurance and by 50% on average for the other titles. This shift involved only about 1% of total projected spending, but helped the 2014 farm bill pass with bipartisan majorities (CBO, 2014).

The evolutionary reform and expansion of the farm bill resulted in a 2014 farm bill with a commodities title that claimed only 5% of projected spending. Its share was dwarfed by the 79% share of the nutrition title and was even less than the share for the crop insurance (9%) and conservation (6%) titles. Nevertheless, the commodities title remains at the core of the farm bill. Primary reasons are the historical roots in serving the farmer thread and the permanent laws on commodity support that the modern countercyclical programs amend.

The permanent laws are production-restricting and high support-price programs enacted in the 1930s and 1940s. As noted above, they have been largely abandoned by evolutionary reform. Elimination of the permanent laws was considered but rejected in the 1996 farm bill. The House of Representatives made another attempt in the 2014 farm bill, again abandoned after a diverse coalition of organizations urged Congress to retain the permanent laws. Most farm bill actors recognize that the permanent legislation framework creates a powerful incentive to pass a new farm bill, thus creating opportunities to pursue their policy agendas. It also facilitates compromise. Policy actors may not get all they want in the current farm bill, but the permanent laws make a new farm bill likely, giving them opportunity to revisit on-going issues.

Reinforcing the role of permanent legislation is that one or more commodities title issues are often highly contentious. In the 2014 farm bill debate, despite often rancorous deliberations surrounding SNAP and an eventual 1% cut to its projected cost, the last issues resolved were the crop and dairy commodity title programs. Congressional conference committees usually address the most contentious issues last. Contention occurs because constituents and their Congressional representatives are passionately committed to the alternatives framing the issue. Their resolution is often driven by the collective acceptance that time for closure has come.

The farm bill can be viewed as the outcome of the policy process mediating the interplay of two types of markets. One is the set of economic markets encompassing farm commodities, food, and environmental services. The second is the political market encompassing organized interests, institutions, and ideas. Moreover, since farming is now a small and concentrated sector, U.S. farm policy can be viewed as an equilibrium result of organized group lobbying (Orden, Paarlberg, and Roe, 1999; Anderson, Rausser, and Swinnen, 2013).

Source: USDA-FSA, 2016

Note: Not included in commodity payments by the

Commodity Credit Corporation are operational and

interest expenses, and payments by conservation,

export, livestock assistance, tree assistance, and

tobacco trust fund programs.

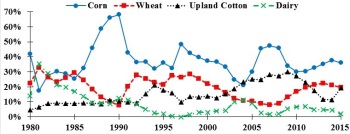

Most farm bills are negotiated under a relatively tight budget, with constraints set within rules adopted by Congress. As organized interests compete for scarce budget, they are quick to point out when their share is abnormally low or when the share of others is abnormally high. As a result of this competition, a commodity’s share of commodity program spending tends to exhibit mean reversion over time. For example, the share of spending on dairy reached 24% for Fiscal Years (FY) 1981-1985 versus a lower long-term average of 8% for FY 1978-2014 (Figure 2). To bring dairy spending into line, Congress reduced milk support prices before and in the 1985 farm bill, which also contained a producer funded “whole herd buy-out” program.

Upland cotton’s share of farm bill commodity spending reached 25% for FY 2005-2012 versus. an average of 15% for FY 1978-2014, due in part to parameters enacted in the 2002 farm bill. The 2014 farm bill sharply altered upland cotton’s support. Countercyclical assistance was limited to marketing loans and the Stacked Income Protection Plan, a within-year county insurance product with premium subsidies of 85%, was authorized. A proximate cause of this policy shift was the World Trade Organization (WTO) dispute ruling in favor of Brazil against the 2002 farm bill cotton program, but the underlying cause was the program’s largesse. The mean reversion attribute of spending share by commodity suggests upland cotton policy likely would have been revised in some manner even without the WTO case.

Policy debates often occur because information is incomplete. Furthermore, enacting a law often creates new outcomes, information and understandings, including unexpected and unintended consequences. Since Congress can amend, even replace, existing law, it is thus useful to view U.S. policy as an on-going series of experiments undertaken to fit circumstances of the time. While ideas can be so powerful that they drive the policy process, the usual case is the unglamorous slow progression of evaluation and dialogue that inform leaders and create marginal adjustments to policy. Nonetheless, little steps over time can accumulate into powerful evolutions, as comparing recent farm bills to those from the 1930s and 1940s demonstrates.

Economic analysis serves several roles in this dynamic and experiment driven policy process. One is to tell compelling stories using broad picture data. Gardner (1992) underscored the importance of this role in his examination of the changing economic perspective of the farm problem between 1933 and 1990. He particularly emphasized the importance to the farm policy debate of the discussion and analysis drawing out the improving income of farm households relative to non-farm households.

A second role is to identify variations of current policy that reduce inefficiencies, outcomes often not evident until after a policy is enacted. Identification and quantification of economic inefficiencies of farm policy that negatively impacted the U.S. economy and its agribusiness sector critically guided the evolutionary reform of commodity programs toward increased planting and price flexibility. Increased flexibility, combined with low government spending on countercyclical programs during the several periods of high farm prices and revenue since 1970, have allowed U.S. farmers to adjust production to market conditions, thus blunting the potential for serious long-term inefficiencies. Yet few established ideas that serve political actors disappear completely. Sugar policy remains an exception to the evolutionary reform of U.S. farm policy as New Deal style programs continue with high supports relative to global market prices and with marketing and international trade restrictions to control supply.

A third role of economic analysis is to preclude harmful policy options completely from the idea set in the political market. This preclusion role is important because political actors often seek economic rents and because it is easier to sustain a policy option once it is enacted than to get it enacted initially. However, this role of economics becomes muted when economic evidence is debatable or when reputable economic experts disagree on interpretation.

The 80-year—and counting—lifespan of the farm bill reflects in part its extensive reach. Every American is touched by at least one of its constant threads: farmers, food, and land. Equally important has been the willingness to adapt farm bills not just to changes in U.S. society and the U.S. farm sector, but also to our understanding of economic inefficiencies. These attributes facilitate the farm bill’s ultimate bipartisan support. That compromise is facilitated by preserving a permanent law framework largely unworkable for contemporary America bears consideration if the desire is a government that enacts laws which address contemporary issues.

Little is known with any degree of certainty at the time this article was written—December 2016—about how the next chapter in this farm bill saga will unfold. It is known that Congress has signaled in recent farm bills a desire to move calorie based food programs to broader nutrition wellness programs and land conservation programs to broader environmental services programs. It is not known if a Republican Senate, House, and newly-elected President that will likely write the next farm bill share these desires.

It is known that many members, perhaps a majority, of the House would like to split the nutrition title away from the farm bill as separate legislation. Some have said or hope this dismantling of the farm bill could make farmer and conservation programs vulnerable to reductions and reign in nutrition spending. Whether the farm bill is split, and if so, the consequences are yet to be determined. However, farmers and environmentalists potentially form a coalition with enough breadth to make a new style of farm bill sustainable. For example, many farmers and their supporters would like to increase acres in CRP to booster low crop revenues. Open questions are whether farmers and environmentalists can agree on specifics and how to pay for it. For the food thread, cutting nutrition spending may run counter to congressional interest in strengthening working class families and governing with compassion toward the least advantaged.

Focusing on the farmer thread, it is known that cotton would like a new cottonseed oil program to reestablish a presence in the commodities title, but open questions include how to pay for this program and how Brazil and other foreign cotton producers will react. Dairy farmers also are calling for more support, and confronting the same question of how to pay for it. However, based on what is currently known about spending on commodity programs in FY 2016 and 2017, the mean reversion characteristic of the share of spending by commodity suggests that these efforts may prove successful to some degree.

The 2014 farm bill gave farmers the choice between Price Loss Coverage (PLC), a fixed price target program, and Agricultural Risk Coverage (ARC), a revenue program with a hybrid market flexible-fixed target. ARC’s revenue target in part flexes with market conditions but its downward flexibility is limited by the inclusion of the fixed PLC reference target prices as price minimums in its payment formulas. The choice applies only through the 2018 crop. Past experience suggests farmers will be allowed to make a new choice for the 2019 crop. It also suggests farmers will elect the program expected to pay more at decision time, as they did initially selecting between ARC and PLC (Schnitkey et al., 2015).

If prices in future years remain near the levels of late 2016, PLC is likely to pay more over the course of the next farm bill. ARC’s benchmark revenue is moving lower for most crops as their high price years of 2009-2013 move out of the 5-year olympic average calculation window. PLC coverage starts at 100% of the reference price while ARC coverage starts at 86% of its benchmark revenue, which in a low price environment depends on the reference price. PLC’s cap on per acre payment is set by the difference between the reference price and marketing loan rate, which is much larger than ARC’s 10% cap on per acre payment.

Assuming late 2016 price levels, PLC payments under the next farm bill could be large, approaching $10 billion per year (Zulauf et al., 2016). Thus, the projected baseline for the farm commodity title could be high. In contrast, the potential baseline for the commodity title in the next farm bill could be small if prices are expected to average above the reference prices.

A high baseline for the commodities title will give the next farm bill flexibility, with or without a nutrition title, to fund meaningful support in the commodities title while providing some new money for other titles notably conservation. In such a scenario, ARC and PLC may need to be changed to reduce their largess. Potential changes in reference prices, coverage levels, and per acre payment caps will likely draw attention. ARC and PLC may even be merged into a single program, a potential outcome signaled by inclusion of PLC reference prices in ARC’s calculation formulas. How these decisions play out will determine if the reform concept in ARC, that support is provided when revenue falls over multiple years but less so when revenue stabilizes even at a relatively low level, takes hold. On the other hand, a low commodity baseline will reduce pressure to change ARC and PLC but increase pressure to save money on crop insurance, the other pillar of the crop safety net. Thus, as has historically been true, the commodities title likely holds the key to how the next farm bill is written.

Anderson, K., G. Rausser and J. Swinnen. 2013. “Political Economy of Public Policies: Insights from Distortions to Agriculture and Food Markets.” Journal of Economic Literature 51 (2): 423-477.

Congressional Budget Office (CBO). 2014. “Letter from D.W. Elmendorf, Director, to the Honorable F.D. Lucas, Chair, House of Representatives Committee on Agriculture (Budget Estimates For 2014 Farm Bill).” January 28. Available online: http://www.cbo.gov/publication/45049.

Gardner, B. 1992. “Changing Economic Perspectives on the Farm Problem.” Journal of Economic Literature 30 (1): 62-101.

Gardner, B. 2002. American Agriculture in the Twentieth Century: How it Flourished and What it Cost. Cambridge MA: Harvard University Press.

The National Agricultural Law Center. 2016. United States Farm Bills. http://nationalaglawcenter.org/farmbills/ (contains legislative text of all farm bills)

Orden, D., R. Paarlberg, and T. Roe. 1999. Policy Reform in American Agriculture: Analysis and Prognosis. Chicago: University of Chicago Press.

Orden, D. and C. Zulauf. 2015. “The Political Economy of the 2014 Farm Bill,” American Journal of Agricultural Economics 97:5 (October): 1298-1311.

Robinson, K.L. 1989. Farm and Food Policies and Their Consequences. Englewood Cliffs, NJ: Prentice Hall.

Schnitkey, G., J. Coppess, N. Paulson, and C. Zulauf. 2015. "Perspectives on Commodity Program Choices under the 2014 Farm Bill." farmdoc daily (5):111, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 16. Available online: http://farmdocdaily.illinois.edu/2015/06/perspectives-on-commodity-program-choices.html

Tweeten, L. 1989. Farm Policy Analysis. Westview Press: Boulder, Colorado.

U.S. Bureau of the Census. 1954. Statistical Abstract of the United States: 1954. 75th Edition. Washington, D.C.: U.S. Government Printing Office.

U.S. Department of Agriculture (USDA). 1934-1937. Yearbook of Agriculture. Available online: http://naldr.nal.usda.gov/NALWeb/Publications.aspx

U.S. Department of Agriculture (USDA). 2016. Program Data: Supplemental Nutrition. Available online: http://www.fns.usda.gov/pd/SNAPsummary.htm.

U.S. Department of Agriculture, Economic Research Service (USDA-ERS). 1984. History of Agricultural Price-Support and Adjustment Programs, 1933-84. Agriculture Information Bulletin No. 485. (Report prepared by D.E. Bowers, W.D. Rasmussen, and G.L. Baker). Washington, D.C.

U.S. Department of Agriculture, Economic Research Service (USDA-ERS). 1982. Economic Indicators of the Farm Sector: Income & Balance Sheet, 1982. ECIFS 2-2.

U.S. Department of Agriculture, Farm Service Agency (USDA-FSA). 2016. CCC Budget Essentials. October. Available online: http://www.fsa.usda.gov/FSA/webapp?area=about&subject=landing&topic=bap-bu-cc

U.S. Department of Agriculture, Risk Management Agency (USDA-RMA). 2016. Summary of Business Reports and Data. October. Available online: http://www.rma.usda.gov/data/sob.html.

Zulauf, C. J. Coppess, G. Schnitkey, and N. Paulson. 2016. "Baseline for Next Farm Bill’s Crop Commodity Programs: An Early Perspective." farmdoc daily (6):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 3. Available online: http://farmdocdaily.illinois.edu/ .