The potential for conflict over conservation policy is arising as Congress works to reauthorize the programs contained in the Agriculture Act of 2014 (the “2014 Farm Bill”). Written at a time of high crop prices and intense political pressure on mandatory spending, the 2014 Farm Bill reduced the acreage cap for the Conservation Reserve Program (CRP) over multiple years to its current 24-million-acre level. Lower crop prices going into this re-authorization are contributing to calls seeking expansion of CRP acres and increasing the cap (Good, 2017). At the same time, pressure on farmers to reduce nutrient losses and water quality degradation continues to increase (Coppess, 2016). Congressional Budget Office (CBO) spending estimates, however, will again occupy a large role in farm bill deliberations, pitting priorities against each other; any expansion of the CRP will have to be offset with spending reductions from other programs and could pit them against the CRP.

Congressional attempts to control federal spending, reduce the deficient, and discipline the budget date to 1974 with the formation of the Congressional Budget Committees, the CBO, and the budget process (Porter, 1978; Walter, 1978). Congress went further in the 1980s with the Balanced Budget and Emergency Deficit Control Act of 1985 and more recently with “pay-as-you-go” (PAYGO) rules and the Budget Control Act of 2011 (Heniff, Rybicki, and Mahan, 2011; Heniff, Lynch, and Tollestrup, 2012). The combined effect of budget disciplines for mandatory spending programs, such as those contained in the farm bill, is a zero-sum legislative game under the CBO baseline. Each year, the CBO creates its baseline by projecting federal outlays for mandatory or entitlement programs over 10 years, assuming that the programs operate in the manner specified in the statute and without changes (2 U.S.C. §907). The PAYGO process enforces discipline for mandatory spending by requiring any changes to existing law that increase spending (or decrease revenues) above the baseline to be offset by corresponding changes that decrease spending (or increase revenues).

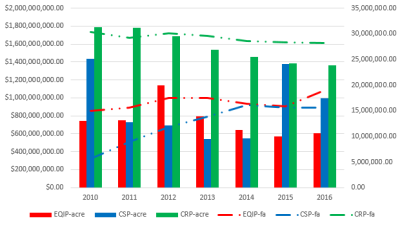

For the farm bill, CBO projects the 10-year outlays for the authorized mandatory programs, which includes commodity support, crop insurance, conservation and the Supplemental Nutrition Assistance Program (SNAP). The 2018 baseline, typically produced in March, would apply to the 2018 farm bill reauthorization process (Monke, 2017). The most recent CBO projections were published June 29, 2017; while not applicable to the next farm bill debate, these projections provide the best indications of the funding levels available to the farm bill (Coppess et al., 2017). CBO projects an increase in conservation spending from $5 billion to over $6 billion per fiscal year, with most of the outlays going to the CRP, the Conservation Stewardship Program (CSP), and the Environmental Quality Incentives Program (EQIP). Figure 1 illustrates CBO outlay projections for those programs as well as the entire conservation baseline. It also compares the projections for the major commodities programs—Price Loss Coverage (PLC) and Agriculture Risk Coverage, county (ARC-CO)—and for crop insurance. Together, commodities, crop insurance and conservation constitute the main mandatory spending items in the farm bill baseline that are directly applicable to producers.

The conservation programs and policies in the farm bill are built from the landmark provisions of the Food Security Act of 1985, which created the modern CRP and instituted conservation compliance (Coppess, 2016; Malone, 1986). Soil erosion was the primary concern underlying the 1985 provisions; CRP’s 10-to-15-year rental payments were designed to remove highly erodible and environmentally sensitive land from production, coupled with compliance provisions that eliminated eligibility for Federal payments for breaking sod, farming highly erodible land without a plan to control erosion and draining wetlands (Malone, 1986). Congress subsequently added easement programs designed to restore and maintain wetlands as well as protect grasslands and farmland. Together, CRP and easement programs constitute reserve policy that seeks to achieve conservation goals by removing land from production. Since 1985, these programs have worked in conjunction with compliance to prevent production on the most sensitive land.

Congress created EQIP in the 1996 Farm Bill and CSP in 2002. Together they are known as working lands conservation programs, and both represented shifts in conservation policy. Instead of reserving land from production, these programs provide direct cash assistance to farmers for adopting conservation measures on land that remains in production. EQIP, for example, provides cost-share assistance to farmers who adopt specific conservation practices on their farm and has a heavy emphasis on livestock production and manure management. CSP looks to conservation across the entire farming operation, requiring a certain level of conservation to be eligible for the program and an agreement to increase conservation over the course of the five-year contract payments.

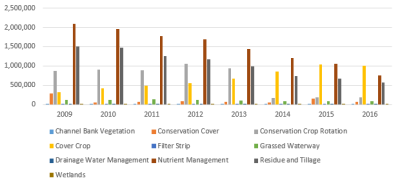

Source: USDA, Natural Resources Conservation Service,

RCA Reports – Program Reports.

Data from the USDA’s Natural Resource Conservation Service (NRCS) provides a comparison for CRP, EQIP, and CSP in terms of acres and outlays (NRCS, 2017). The CRP remains the largest program in terms of acres under contract and federal outlays, but it has been trending downward; the 2014 Farm Bill reduced its acreage cap to 24 million acres. EQIP and the CSP (which is statutorily designed to grow by 10 million acres each year) have demonstrated increases in both acreage and outlays but remain lower than the CRP. Figure 2 charts NRCS data for the three programs in terms of acres under contract (active and completed) and federal financial assistance obligations for the most recent years (2010–2016).

The potential for conflict is rooted in these fundamental differences in conservation policies and the particular challenges from nutrient loss and water quality. The CRP has been designed primarily to control erosion by taking sensitive or highly erodible land out of production. Combined with compliance, the policies have demonstrated effectiveness in reducing soil erosion from farming (Claassen et al., 2017; Stubbs, 2014). Research has found, however, that commodity prices can create challenges for these policies. For example, CRP acres tend to decrease when prices are high, as land goes back into production (Morefield et al., 2016). In addition, compliance has been most effective when program benefits are expected to be the highest, which is often when crop prices are relatively low. CRP requires federal outlays for the rental payments but compliance, if it impacts the baseline at all, would be expected to reduce spending.

The CRP is a relatively blunt policy instrument that is limited and expensive. Removing land from production for 10–15 years is a long-term commitment. Market conditions, production issues (e.g., weather or drought), and prices can change significantly during that time, creating issues for the policy in operation. One example surfaces when drought strikes a region and farmers demand emergency haying and grazing on CRP acres that are otherwise precluded from commodity production (U.S. Department of Agriculture, 2017b). Another example is crop price pressures: High prices create demand to bring CRP acres back into production, which may have environmental consequences. Lower prices tend to increase demand from landowners to put acres into the program and may impact adjustment of cash rental rates to the lower prices as well as land values (Jones, 2017; Garr and Taylor, 2016).

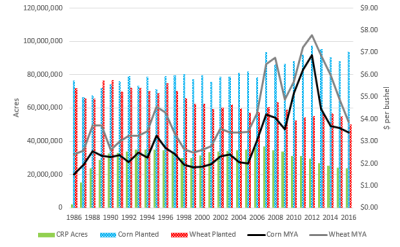

Source: CRP Acres, USDA 2017a; planted acres and MYA

prices, USDA-NASS Quick Stats.

The CRP is limited in part because it is expensive. By design, it also does not respond quickly to market conditions. Figure 3 charts CRP acres as reported by USDA’s Farm Service Agency (FSA) with planted acres and marketing year average prices reported by USDA’s National Agricultural Statistics Service (NASS) for corn and wheat. The figure provides only a snapshot of acreage responses to prices. For the upcoming farm bill debate, both prices and CRP acres have declined since the 2014 Farm Bill. These trends are notable because lower prices historically increase the demand for CRP acres but the 2014 Farm Bill lowered the acreage cap.

Nutrient loss—and the water quality degradation that results—is a conservation issue directly tied to production: Farms lose nutrients that are applied to grow crops. The fields that are most likely to export nutrients are the most productive lands, drained by subsurface tiles and fed by sufficient rains (Coppess, 2016). Putting land into the CRP would certainly reduce nutrient export as well as soil erosion (Morefield et al., 2016). Intuitively, however, rain-fed, tile-drained, productive fields are the least suitable for 10-to-15-year retirement and the least likely to go into the program. As such, the CRP provides limited effectiveness for helping farmers reduce nutrient losses. Conservation compliance is also less effective in addressing nutrient loss for similar reasons. The tile-drained, productive farms losing nutrients are less likely to be highly erodible; nitrogen loss, at least, is predominantly due to subsurface tile rather than surface erosion. Conservation plans to control erosion to meet compliance are less likely to address nitrogen losses. Finally, the vast majority of these lands were drained long before compliance was put in place and are thus likely to be exempt from compliance.

Source: USDA, Natural Resources Conservation Service,

RCA Reports – Program Reports.

The gap between the nutrient loss challenge and the CRP or compliance is where working lands conservation programs would be expected to have the most impact. EQIP provides a straightforward example because it provides cost-share assistance for specific conservation practices within categories, notably nutrient management in crop production. Examples include cover crops, residue and tillage management, filter strips, grassed waterways, drainage water management, and wetlands work. The biggest challenge for working lands programs when it comes to nutrient loss, however, is one of scale and scope: the 2012 Census of Agriculture indicates over 48 million tile-drained acres spread across 217,931 farms (U.S. Department of Agriculture, 2016). The CSP averaged 15.8 million acres (2010–2016) while selected EQIP practices reach relatively few acres. Figure 4 charts acres receiving EQIP funds for selected water quality practices. All practices were on fewer than 2.5 million acres in any year, and NRCS notes accompanying the data indicate that land unit acres may be counted multiple times.

The CBO baseline creates a zero-sum policy scenario, including for conservation programs; changes that require additional outlays for one program will require offsets out of other programs. If Congress wants to increase the CRP acreage cap, the baseline cost could be substantial. For example, the national average per acre rental payment from 2010 to 2016 was $61.28, increasing from $50.76 per acre in 2010 to $72.61 per acre in 2016 (U.S. Department of Agriculture, 2017a). Adding a million acres to the CRP at that national average rental rate could cost $614 million in the baseline (over 10 years). The last period of sustained low crop prices coincided with the 2002 Farm Bill, which set the CRP acreage cap at 39.2 million acres. Returning the CRP to that acreage cap at the average national rental rate of $61.28 per acre could cost over $933 million per year or $9.3 billion over the 10-year baseline. Using the CBO’s June baseline, the CSP baseline is only $18 billion from 2018 to 2027. EQIP’s baseline is lower at $16.5 billion, and 60% of EQIP funds are designated for livestock. The zero-sum game’s cost for adding CRP acres could be devastating to one or both working lands programs.

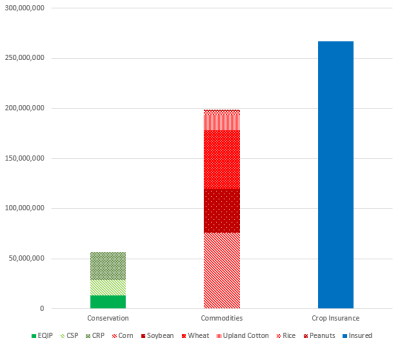

Source: Conservation acres from USDA, Natural Resources

Conservation Service, RCA Reports – Program Reports;

Commodities are CBO payment acres (85% of base acres);

crop insurance acres, RMA net acres insured, summary of

business (all averaged, 2010–2016).

The potential from increasing CRP is where a significant conflict could arise, especially as it pertains to the need to address nutrient loss in the Mississippi River Basin. Under current budget disciplines, Congress cannot expand CRP acres without harming working lands programs unless it takes the even more politically difficult (and unlikely) path of seeking cuts outside of Title II, such as from commodities or crop insurance. From a conservation perspective, such a conflict over federal funds has far-reaching implications for programs that, combined, reach far fewer acres than either farm programs or crop insurance. Figure 5 compares average acres under conservation contracts from 2010 to 2016 with average base acres receiving commodities program payments and average acres insured. Notably, base acres and insured acres are both subject to conservation compliance provisions. It is also notable that the total conservation acres under contract compares to the estimated 48 million tile-drained cropland acres.

Because an intra-conservation conflict under the baseline would be expected to create a significant setback, the situation calls for creativity, especially as it concerns the CRP. This discussion highlights how the traditional program design that retires whole fields for 10–15 years may not be the best policy option for conservation goals such as nutrient loss reduction. If Congress and interest groups want to avoid this conflict, they will need to seek out creative solutions, which would probably need to incorporate working lands concepts into any expansion of CRP acres.

Senator John Thune (R-SD) has introduced legislation that could provide an alternative to traditional CRP enrollment. Called the Soil Health and Income Protection Program (SHIPP), his proposal would provide for short-term (3–5 years) reserved acres with a maximum of 15% of the cropland on a farm (Thune, 2017; S.499, 2017). The shorter contract period would make the program more responsive to market conditions. In addition, it permits some harvesting activities on the acres while under contract. From a baseline perspective, the proposal is designed to reduce the costs of enrolling acres. For one, it would limit rental payments to 50% of the average rental rate for the county. Senator Thune’s proposal has some historical precedent as well. Early farm bills used conservation rental payments to rent land out of production for a single crop year, but this policy was part of controversial efforts to control production through limiting acres.

Other alternatives could also be considered. Congress has previously incorporated nontraditional concepts in the program. For example, the 2002 Farm Bill added a pilot program for enrolling wetland and buffer acreage, revised by the 2008 Farm Bill, including for wetlands designed to provide nitrogen removal. While these were also long-term reserve policies within the CRP, they do point to the potential for creative solutions in the program. Certainly shorter-term and lower-cost options could be considered, especially for buffer or grassed waterway acres, but these may not increase effectiveness for nitrogen loss from subsurface tile.

At its core, the CRP makes rental payments to landowners for conservation benefits or environmental services. In the traditional setting, these come from the landowner agreeing to place a field under permanent perennial cover for 10–15 years and not producing a commercial crop on it. Working lands programs have demonstrated alternative conservation policy designs, such as cost-share assistance for planting cover crops or other practices. A creative combination from a nutrient loss perspective would be to use the CRP to rent cover crop acres in a single crop year or over multiple crop years at significantly reduced rental rates. This would add acres to the CRP but with a much lower baseline impact. It would also achieve conservation goals during the fallow months between crops but permit the farmer to continue producing on the land.

The CBO baseline creates the potential for conflicts over programs in the next farm bill. For conservation policy, in particular, increasing CRP acres would come at a significant cost in the CBO baseline that would have to be offset. Using other conservation programs to provide those offsets could create conflicts among supporters of the different programs. As discussed, this could pit working lands conservation program spending against reserve program spending if the CSP or EQIP are reduced to pay for the CRP. The potential for conflict over these programs in a farm bill debate should counsel a search for creative solutions that help achieve a variety of conservation goals. Incorporating working lands policy concepts into an expansion of CRP acres might prove successful on multiple fronts.

Claassen, R., M. Bowman, V. Breneman, T. Wade, R. Williams, J. Fooks, L. Hansen, R. Iovanna, and C. Loesch. 2017. Conservation Compliance: How Farmer Incentives Are Changing in the Crop Insurance Era.” Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Research Report 234, July.

Coppess, J. 2016. "The Next Farm Bill May Present Opportunities for Hybrid Farm-Conservation Policies." Choices 2016(4).

Coppess, J., C. Zulauf, G. Schnitkey, and N. Paulson. "Reviewing the June 2017 CBO Baseline." farmdoc daily (7):127. Available online: http://farmdocdaily.illinois.edu/2017/07/reviewing-the-june-2017-cbo-baseline.html

Garr, D., and Taylor, M. (2016). “The Presence of Conservation Reserve Program Contracts and Their Effect on Kansas Agricultural Land Values.” Paper presented at the 2016 annual meeting of the Southern Agricultural Economics Association, Feb 6–9, 2016, San Antonio, TX (No. 230146).

Good, K. 2017. “House Ag Subcommittee Examines Conservation Issues.” Farm Policy News. Available online: http://farmpolicynews.illinois.edu/2017/03/house-ag-subcommittee-examines-conservation-issues/

Heniff, Jr., B., M.S. Lynch, J. Tollestrup. 2012. Introduction to the Federal Budget Process. Washington, DC: Congressional Research Service, CRS Report 98-721, December.

Heniff, Jr., B., E. Rybicki and S.M. Mahan. 2011. The Budget Control Act of 2011. Washington, DC: Congressional Research Service, CRS Report R41965, August.

Jones, M. 2017. Testimony of Misty Jones, Director, Conservation and Environmental Programs Division, Farm Service Agency, U.S. Department of Agriculture before the Agricultural, Nutrition and Forestry Committee of the United States Senate. Available online: https://www.agriculture.senate.gov/hearings/conservation-and-forestry-perspectives-on-the-past-and-future-direction-for-the-2018-farm-bill-1

Malone, L.A. 1986. “A Historical Essay on the Conservation Provisions of the 1985 Farm Bill: Sodbusting, Swampbusting, and the Conservation Reserve.” University of Kansas Law Review 34:577–597.

Monke, J. 2017. Farm Bill Programs without a Budget Baseline beyond FY2018. Washington, DC: Congressional Research Service, CRS Report R44758, February.

Morefield, P.E., S.D. LeDuc, C.M. Clark and R. Iovanna. 2016. “Grasslands, Wetlands, and Agriculture: The Fate of Land Expiring from the Conservation Reserve Program in the Midwestern United States.” Environmental Research Letters 11(9):094005.

Porter, L. 1978. “Congress and Agricultural Policy, 1977.” In D.F. Hadwiger and W.P. Brown, eds. The New Politics of Food. Lexington, MA: Lexington Books.

S.499. Soil Health and Income Protection Program of 2017. 115th Congress, 1st Session (March 2, 2017). Available online: https://www.congress.gov/bill/115th-congress/senate-bill/499

Stubbs, M. 2014. Conservation Reserve Program (CRP): Status and Issues. Washington, DC: Congressional Research Service, CRS Report R42783, August.

Thune, John. 2017. Thune Begins Farm Bill Rollout, Introduces New Income Protection Program for Farmers. Available online: https://www.thune.senate.gov/public/index.cfm/2017/3/thune-begins-farm-bill-rollout-introduces-new-income-protection-program-for-farmers

U.S. Department of Agriculture. n.d. Quick Stats. Washington, DC: U.S. Department of Agriculture, National Agricultural Statistics Service. Available online: https://quickstats.nass.usda.gov/

U.S. Department of Agriculture. n.d. RCA Report – Program Reports. Washington, DC: U.S. Department of Agriculture, Natural Resources Conservation Service. Available online: https://www.nrcs.usda.gov/wps/portal/nrcs/detail/national/technical/nra/rca/ida/?cid=stelprdb1187042

U.S. Department of Agriculture. n.d. Summary of Business Reports and Data. Washington, DC: U.S. Department of Agriculture, Risk Management Agency. Available online: https://www.rma.usda.gov/data/sob.html

U.S. Department of Agriculture. 2016. 2012 Census of Agriculture: Land Use Practices. Washington, DC: U.S. Department of Agriculture, July. Available online: https://www.agcensus.usda.gov/Publications/2012/

U.S. Department of Agriculture. 2017a. Conservation Reserve Program Statistics: CRP Enrollment and Rental Payments by State, 1986–2016. Washington, DC: U.S. Department of Agriculture, Farm Service Agency. Available online: https://www.fsa.usda.gov/programs-and-services/conservation-programs/reports-and-statistics/conservation-reserve-program-statistics/index

U.S. Department of Agriculture. 2017b. USDA Opens More Land for Emergency Haying and Grazing. Washington, DC: U.S. Department of Agriculture. Available online: https://www.usda.gov/media/press-releases/2017/07/20/usda-opens-more-land-emergency-haying-and-grazing

Walter, A.S. 1978. “Impacts of the Congressional Budget Process on Agricultural Legislation.” In D.F. Hadwiger and W.P. Brown, eds. The New Politics of Food. Lexington, MA: Lexington Books.