Some of the best songs are about beer drinking. They tell you to drink a six-pack of beer for breakfast because you’d have a better time with a drink in your hand since it makes you a jolly good fellow. A “B-double-E-double-R-U-N“ can bring you 40 ounces to freedom. Whether it’s in Mexico or at the lake, beer makes vacation better. But for as many songs as have been written about the pleasures of drinking beer, other songs convey a different, more tragic message. As famously crooned by Jerry Lee Lewis, too much beer drinking can make a loser out of you. Demon alcohol can ruin your family’s Christmas.

Given the tension between the positives and negatives of beer drinking, it should come as no surprise that beer markets have long been a target for government intervention. Just as beer has always been a part of American cultural history, so too has beer regulation been interwoven into American political history. In the United States, government intervention has largely been motivated by concern for the health of American citizens and as a way to generate tax revenue. According to the Centers for Disease Control and Prevention (2017), 88,000 adults die from alcohol consumption each year, with heavy drinkers generating a potential social cost of $2 per beer consumed (Sacks et al., 2015). These negative consequences are especially dire for certain portions of the population. As noted by Case and Deaton (2015), the mortality rate for white middle-aged non-Hispanics has increased over the past few decades, with some of the largest increases attributed to chronic liver diseases and drug and alcohol poisoning. Student grades tend to fall upon being able to drink legally (Lindo, Swensen, and Waddell, 2013). These and other social costs can translate to economic consequences, as Cesur and Kelly (2014) find that reducing per capita beer consumption might lead to a significant increase in per capita GDP growth.

Because it is often more difficult for governments to directly influence demand for a product, policymakers often opt to indirectly influence demand by enacting supply-side restrictions, passing regulations with the potential to restrict producers. These regulatory constraints are particularly burdensome for brewing, as estimates suggest that the beer value chain is subject to more than 90,000 federal regulatory constraints (Malone and Chambers, 2017). Brewers are acutely aware of this government tendency: in the mid-19th century, they founded the first-ever trade association in the United States as a response to new government regulations (Mittelman, 2008). In the modern era, changes in social norms coupled with economic development goals have led policymakers to reconsider Prohibition-era policies, which have unintentionally restricted the emergence of craft breweries. Unfortunately, understanding the side effects of beer policy is likely even more difficult than identifying the positive and negative consequences associated with beer drinking.

In part because beer has often historically been safer than drinking water, beer—and alcohol more generally—played a pivotal role in many of the most famous events in American political history (Cheever, 2015). Instead of continuing their voyage to Northern Virginia as planned, the Pilgrims landed illegally at Plymouth Rock because they had run out of beer. One of the first policies implemented by the government of the British Crown on the American colonies was a tax on alcohol. Drinking in pubs and taverns was instrumental to the development and dissemination of American ideals during the years leading up to the American Revolution (Scribner, 2013). In fact, the first battle of the American Revolution occurred just outside Buckman Tavern in Lexington, Massachusetts, where the colonial minutemen had been drinking tankards of rum. After the war, federal alcohol regulations fell to the newly formed government. The first domestic tax (and warrantless search-and-seizure) imposed by the American federal government was implemented by Alexander Hamilton to curb alcohol consumption and raise money; it unfortunately incited the infamous “Whiskey Rebellion.”

As Americans moved westward, alcohol remained a crucial link to civilization. By the 1830s, American per capita alcohol consumption was the world’s highest. Americans drank an array of alcohols during this period, including hard cider. Johnny “Appleseed” Chapman famously planted apple orchards to help meet this demand. Even babies and young children were provided alcoholic beverages to help them sleep or to provide them with sustenance. As one historian describes it, “They drank from the crack of dawn to the crack of dawn” (Rorabaugh, 1981, p. 21).

The American perspective on beer and alcohol drastically changed over the course of the 19th century. The Industrial Revolution made inebriation far more dangerous, as a drunken factory worker was far more likely to be maimed or killed on the job than was a drunken farmer. Concurrently, a powerful political movement emerged with temperance at its core and Protestant American women on its front lines. By the 1830s, many Americans were members of temperance societies, and there was growing sentiment that the government needed to curb alcohol consumption. Not coincidentally, the federal government implemented the first beer excise tax during the Civil War, a step taken both to raise revenue and to discourage beer consumption (Mittelman, 2008).

By the early 20th century, anti-drinking fervor and the belief in women’s suffrage reached new levels of national popularity. Women such as Carrie Nation and Susan B. Anthony had become folk heroes in part for their radical stance against alcohol, thereby interconnecting temperance with women’s rights. At the time, taxes levied on alcohol accounted for approximately 30% of the federal budget, so the goal of prohibition depended in part on new revenue streams. Congress obliged in 1913 when it passed the 16th Amendment, which created a huge new revenue source: a federal income tax.

Source: University of Richmond (2014).

As is the case with some alcohol laws today, many well-intentioned people believed prohibition was a solution to the destruction of American family values. But there were also a few dark reasons for prohibition’s popularity. Xenophobia played an important role in America’s push toward prohibition. Italian, Irish, and German immigrants were commonly portrayed as alcoholics, so some politicians and voters supported prohibition in an effort to restrict immigration. German-American brewers experienced some of the most substantial anti-immigrant pressure, as they dominated the U.S. brewing industry and had emigrated from what had become America’s biggest enemy in World War I (Ogle, 2007). Organizations such as the Anti-Saloon League eagerly generated anti-German propaganda, contributing to the bureaucratic search-and-seizure of German-American brewers (Figure 1). In one of the most notorious cases, agents of the federal government conducted a warrantless body cavity search of then 74-year-old Lilly Anheuser Busch upon her return to American soil in 1918 (Ogle, 2007). A few months later, Congress ratified the 18th Amendment, which set the stage for Prohibition.

Although the implicit goal was to restrict drinking, the 18th Amendment and the corresponding Volstead Act did not explicitly mention drinking. Instead, they prohibited businesses from selling, manufacturing, and transporting most alcohol. This legislation created many grey areas. For example, cider and homemade fruit brandies were exempted, while wine was allowed for religious purposes and physicians could (and frequently did) provide prescriptions for alcohol. Not surprisingly, these laws created many unintended consequences: As Prohibition left consumer demand for alcohol unchanged, the supply of beer consequently shifted onto the black market, thereby greatly increasing profits for organized crime. As explained by Raab (2016; p. 36), “Prohibition had been the catalyst for transforming the neighborhood gangs of the 1920s into smoothly run regional and national criminal corporations.” Yandle’s (1983) bootlegger-and-Baptist narrative was born: Even when the intentions of some lawmakers are pure (the Baptists), business interests have an incentive to subvert the law and use it for their own gain (the bootleggers). Not only did Prohibition contribute to the rise of violent organized crime, it also increased the production of sometimes-deadly homemade alcohol. The number of deaths annually associated with poisonous alcohol rose from 98 at the beginning of Prohibition in 1920 to 4,145 in 1925.

By most accounts, Prohibition was only partially successful in reducing drinking. In the early 1920s, even President Harding hosted booze-filled parties in the White House. Perhaps more troubling for policymakers was the decline in tax revenue, a need exacerbated at the end of the decade with the onset of the Great Depression. The economic collapse of the late 1920s and early 1930s led many policymakers to favor the repeal of Prohibition so the brewing industry could employ workers and the government could collect business, income, and excise taxes.

As policymakers began to prepare for the repeal of Prohibition, they set to work crafting the regulations that would guide the alcohol industries. Some of the largest breweries actively advocated for policies that might promote their own standing, sometimes to the detriment of smaller brewers (Stack and Gartland, 2005). After prohibition, many beer laws were delegated to the states, but the federal government made producing beer at home illegal until 1978, when President Jimmy Carter signed H.R. 1337, which allowed state governments to determine the legality of homebrewing. While many states quickly voted to permit homebrewing, a few did not capitalize on this opportunity; Mississippi and Alabama only legalized homebrewing in 2013 (Brewers Association, 2013). Those restrictions constrained growth in the craft beer market for decades (McCullough et al., 2015).

In the decades leading up to prohibition, some brewers had engaged in a series of “price wars,” where large breweries would enter a new city and offer their beers at a deeply discounted price in an effort to drive rival breweries out of the market (Ogle, 2007). Worried that these low prices encouraged consumption, federal and state policymakers increased excise taxes on brewery production. Today, federal excise taxes vary from $7.00 per barrel (a barrel is equal to 31 gallons) to $18.00 per barrel depending on the size of the brewery (Alcohol and Tobacco Tax and Trade Bureau, 2017), while state excise taxes range from $0.62 per barrel in Wyoming to $40.00 per barrel in Tennessee (Drenkard, 2016).

Regulators were also concerned about youth consumption of alcohol, and whether the alcohol level in beer was too high. Although it was later overturned by the Supreme Court in 1995, a 1935 federal law prohibited displaying alcohol content on beer labels in hopes of reducing the average alcohol content in beer. While the law was largely unsuccessful in changing consumer behavior, the spirit of the law lives on. To this day, states such as Kansas, Oklahoma, and Minnesota attempt to curb alcohol consumption through alcohol content restrictions, while other state regulatory agencies restrict how brewers can label their beers (Brown, 2016). As established by the passage of the Cullen-Harrison Act in 1933, these content restrictions are calculated as alcohol by weight (ABW), while alcohol content is traditionally defined as alcohol by volume (ABV). Mathematically, 3.2% ABW is equal to 4% ABV. As such, contrary to popular belief, the actual difference in an American-style lager beer (i.e., Bud Light) is very slight across state lines, as it traditionally contains 4.2% ABV.

States also implemented an array of rules regarding the minimum drinking age (Carpenter and Dobkin, 2011). For example, until Craig v. Boren ruled the law unconstitutional in 1976, the drinking age in Oklahoma had been 21 for men and 18 for women. In 1984, the federal government passed the Uniform Drinking Act, which cut transportation funds to states that allowed for under-21 drinking. Groups such as Mothers Against Drunk Driving continue to lobby for an array of alcohol restriction, including higher excise taxes, random alcohol checkpoints, and reduced blood-alcohol content limits for DUI offenders.

Anti-drinking groups have long complained that brewers market their beers too aggressively. Before Prohibition, nearly all beer was sold on draft in bars and saloons that were controlled by individual breweries, or “tied houses.” This relationship contributed to a substantial number of drinking establishments: Manhattan Island was home to more than 9,000 bars and fewer than one million people, for example (Lender and Martin, 1987). To increase beer sales, some bar owners would reportedly resort to tricks as simple as selling (or even giving away) overly salty foods and as sinister as offering low-priced prostitution. In an effort to curb the problems attributed to the tied houses, post-Prohibition policymakers mandated that breweries could only sell alcohol through a wholesaler. For many states, this three-tier system of brewery to wholesaler to retailer remains in effect today (Burgdorf, 2016). However, this regulatory system, which was designed for the 1930s, created significant barriers for the craft beer industry that began to emerge in the 1980s. For example, state three-tier systems did not allow brewpubs, since these would allow breweries to sell their beer directly to consumers, bypassing wholesalers. Early entrepreneurs had to lobby state legislatures for exemptions from or changes to state distribution laws.

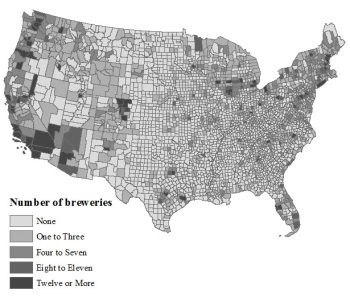

Source: Malone and Lusk (2016).

Crafting a government policy that successfully reduces overconsumption of alcohol can be difficult, especially because the American beer market has undergone such drastic changes over the past few decades. In 1980, there were fewer than 100 breweries in the United States; today many counties are home to more than a dozen. The United States currently has more than five thousand breweries (Figure 2), with thousands more planned.

While many alcohol regulations may be based on good intentions, they often lead to unintended consequences. For example, dry counties are also home to more meth labs (Fernandez, Gohmann, and Pinkston 2016) and mandating that bars close earlier might actually increase traffic accidents (Green, Heywood, and Navarro, 2014). Similarly, banning the sale of alcohol in grocery stores might actually increase negative outcomes: According to Rickard, Costanigro, and Garg (2013), legalizing the sale of wine in grocery stores is actually correlated with decreases in traffic fatalities.

Not surprisingly, some policies were passed to protect the profits of existing breweries (Gohmann, 2016). For example, the “Come to Rest” clause embedded in Nebraska Bill LB632 requires all beer to be placed within a wholesaler’s warehouse before it goes to retail outlets, forcing small breweries to ship their beer upwards of 200 miles before it can be sold in their own taproom (Pluhacek, 2017). The outcome of bills such as these is obvious: States that do not allow breweries to distribute their own beer have fewer craft breweries (Malone and Lusk, 2016). Conversely, when states choose to legalize self-distribution, they experience a significant increase in the number of breweries. Loosening distribution laws can also promote tourism and service revenues within a county. For example, when legislators in West Virginia allowed on-premises sales, counties with breweries experienced an increase in tourism-related wages (Malone and Hall, 2017).

Of course, not all proposed beer laws are so blatantly crony capitalist in nature. But even the most well-intentioned restrictions can have negative consequences. As noted, one objective of alcohol taxes is to reduce the quantity of beer consumed by raising prices (Cook and Durrance, 2013). Unfortunately, because beer demand is relatively inelastic and does not respond significantly to small price changes, modest tax increases are unlikely to substantially reduce consumption. Furthermore, taxes specifically on beer typically encourage consumers to purchase beverages with a higher alcohol content (Malone and Lusk, 2017). Finally, beer taxes can also influence the number of breweries that might open in a given state: Elzinga, Tremblay, and Tremblay (2015) find that increases in state excise taxes tend to decrease the number of breweries.

A couple of common themes emerge when considering beer laws as they relate to economic growth. First, the history of beer regulation runs parallel to a history of unintended consequences, making it near impossible to find a clear answer to the title question. Restricting the sale of alcohol is likely to reduce tax revenue, which has historically played a key role in government funding. As was the case during Prohibition, American beer policymakers often overlook the economic consequences of their newly formed regulations. When considering the entrepreneurial nature of craft breweries, restrictions on self-distribution seem especially onerous and counterproductive. A second theme emerges if one considers the structure of many beer laws: While the stated purpose of these laws is often to promote consumer health, many alcohol laws are targeted at the supply side rather than the demand side. As is the case for self-distribution laws, Prohibition sought to reduce the supply of alcohol but did little to target consumer demand.

Thankfully, it appears that modern government policies have started taking note of these unintended consequences. From 1997 to 2012, the number of federal restrictions within the beer value chain decreased slightly (Malone and Chambers, 2017). More recently, the Craft Beverage Modernization & Tax Reform Act has generated further discussions of reductions in excise tax rates and further reductions in regulatory burdens for breweries. Although some local governments remain hesitant to embrace craft brewing, many states have become much more welcoming to brewing, particularly as they see the potential gains in tourism and entrepreneurship. As such, future policy discussions would benefit by more thoroughly considering both the benefits and the costs associated with beer regulation.

Alcohol and Tobacco Tax and Trade Bureau. 2017. Tax and Fee Rates. Available online: https://www.ttb.gov/tax_audit/atftaxes.shtml

Brewers Association. 2013. Homebrewing Officially Legal in all 50 States. Available online: https://www.brewersassociation.org/press-releases/homebrewing-officially-legal-in-all-50-states/.

Brown, E.N. 2016. “Flying Dog Brewery Wins First Amendment Battle, Uses Proceeds to Promote Free Speech.” Reason Magazine. Available online: https://reason.com/blog/2016/05/13/flying-dog-brewery-wins-first-amendment

Burgdorf, J. 2016. “Trouble Brewing? Brewer and Wholesaler Laws Restrict Craft Breweries.” Mercatus Center: On Policy. Available online: https://www.mercatus.org/publications/trouble-brewing-brewer-and-wholesaler-laws-restrict-craft-breweries

Carpenter, C., and C. Dobkin. 2011. “The Minimum Legal Drinking Age and Public Health.” Journal of Economic Perspectives 25(2):133–156.

Case, A., and A. Deaton. 2015. “Rising Morbidity and Mortality in Midlife among White Non-Hispanic Americans in the 21st Century.” Proceedings of the National Academy of Sciences 112(49):15078–15083.

Centers for Disease Control and Prevention. 2017. Alcohol Deaths. Available online: https://www.cdc.gov/features/alcohol-deaths/index.html

Cesur, R., and I.R. Kelly. 2014. “Who Pays the Bar Tab? Beer Consumption and Economic Growth in the United States.” Economic Inquiry 52(1):477–494.

Cheever, S. 2015. Drinking in America: Our Secret History. New York: Twelve Publishing.

Cook, P.J., and C.P. Durrance. 2013. “The Virtuous Tax: Lifesaving and Crime-Prevention Effects of the 1991 Federal Alcohol-Tax Increase.” Journal of Health Economics 32(1):261–267.

Drenkard, S. 2016. “How High Are Beer Taxes in Your State?” Tax Foundation. Available online: https://taxfoundation.org/how-high-are-beer-taxes-your-state/

Elzinga, K.G., C.H. Tremblay, and V.J. Tremblay. 2015. “Craft Beer in the United States: History, Numbers, and Geography.” Journal of Wine Economics 10(3):242–274.

Fernandez, J.M., S.F. Gohmann, and J.C. Pinkston. 2016. “Breaking Bad in Bourbon Country: Does Alcohol Prohibition Encourage Methamphetamine Production?” Unpublished. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2650484&download=yes

Gohmann, S.F. 2016. “Why Are There so Few Breweries in the South?” Entrepreneurship Theory and Practice 40(5):1071–1092.

Green, C.P., J.S. Heywood, and M. Navarro. 2014. “Did Liberalising Bar Hours Decrease Traffic Accidents?” Journal of Health Economics 35:189–198.

Lender, M.E., and J.K. Martin. 1987. Drinking in America: A History. New York: Simon and Schuster.

Lindo, J.M., I.D. Swensen, and G.R. Waddell. 2013. “Alcohol and Student Performance: Estimating the Effect of Legal Access.” Journal of Health Economics 32(1):22–32.

Malone, T., and D. Chambers. 2017. “Quantifying Federal Regulatory Burdens in the Beer Value Chain.” Agribusiness: An International Journal 33(3):466–471.

Malone, T., and J. Hall. 2017. “Can Liberalization of Local Food Marketing Channels Influence Local Economies? A Case Study of West Virginia’s Craft Beer Distribution Laws.” Economics and Business Letters 6(2):54–58.

Malone, T., and J.L. Lusk. 2016. “Brewing Up Entrepreneurship: Government Intervention in Beer.” Journal of Entrepreneurship and Public Policy 5(3):325–342.

Malone, T., and J.L. Lusk. 2017. “Releasing the Trap: A Method to Reduce Inattention Bias in Survey Data with Application to U.S. Beer Taxes.” Unpublished.

McCullough, M., J.P. Berning, J.L. Hanson, and H. Block. 2015. “Home Brewing Legalization and the Craft Brewing Industry.” Paper presented at the 4th biennial Beeronomics Conference, September 7–9, Seattle, Washington.

Mittelman, A. 2008. Brewing Battles: A History of American Beer. New York: Algora.

Ogle, M. 2007. Ambitious Brew: The Story of American Beer. Orlando, FL: Houghton Mifflin Harcourt.

Pluhacek, Z. 2017, February 10. “Craft Brewers Hope to Bottle Up Controversial Legislative Bill.” Lincoln Journal Star. Available online: http://journalstar.com/legislature/craft-brewers-hope-to-bottle-up-controversial-legislative-bill/article_edc903ec-7e09-5cf9-89d8-fa5748061b05.html

Raab, S. 2016. Five Families: The Rise, Decline, and Resurgence of America's Most Powerful Mafia Empires. New York: St. Martin’s Press.

Rickard, B.J., M. Costanigro, and T. Garg. 2013. “Economic and Social Implications of Regulating Alcohol Availability in Grocery Stores.” Applied Economic Perspectives and Policy 35(4):613–633.

Rorabaugh, W.J. 1981. The Alcoholic Republic: An American Tradition. Oxford: Oxford University Press.

Sacks, J.J., K.R. Gonzales, E.E. Bouchery, L.E. Tomedi, and R.D. Brewer. 2015. “2010 National and State Costs of Excessive Alcohol Consumption.” American Journal of Preventive Medicine 49(5):73–79.

Scribner, V.P. 2013. Imperial Pubs: British American Taverns as Spaces of Empire, 1700–1783. PhD dissertation. University of Kansas, Lawrence.

Stack, M., and M. Gartland. 2005. “The Repeal of Prohibition and the Resurgence of the National Breweries: Productive Efficiency or Path Creation?” Management Decision 43(3):420–432.

University of Richmond. 2014. The History Engine: From Civil War to World Stage. Available online: https://historyengine.richmond.edu/episodes/view/6243.

Yandle, B. 1983. “Bootleggers and Baptists - The Education of a Regulatory Economist.” Regulation 7:12–16.