1st Quarter 2013

Canada, with a smaller population than California and an enormous agricultural land base of 1.34 hectares per person compared with 0.53 per person in the United States, has always focused on international markets. Without competitive access to international markets, a large part of our land base would be uneconomic, as our small Canadian population simply cannot absorb a major part of what our farmers can produce. Arguably, the success of Canadian agriculture has been linked to preferential competitive access to large foreign markets and developing the ability to supply what those international markets demanded.

As far back as the 1850s, the pioneering Canadian pork producer William Davies was importing British hog breeds such as Yorkshire and Suffolk into Ontario to develop higher quality pork with longer loins and smaller hams and shoulders for export to Britain. This business strategy was considered risky at the time, as the hog favored in the U.S. market was the more rounded, corn-fed lard pig. Davies and other Canadian pork producers became the unintended beneficiaries of U.S. protectionism, following the enactment of the McKinley Tariff in 1890. While the tariffs made it more difficult to export Canadian pork to the United States, they also diverted Canadian grain that would have otherwise been exported from Canada to the United States to hog farmers in Canada. As a result, new packing plants sprang up along the Canadian side of the Great Lakes, including the large William Davies plant in Toronto, which later became part of Canada Packers, and pork exports to Europe rapidly expanded. By 1892, Canada’s shipments to the United Kingdom alone had grown to 24 million pounds of bacon and 8 million pounds of ham (Letters of William Davies Toronto, Toronto University Press 1945 pg. 25).

Up until 1973, the Canadian meat business depended on preferential tariff access to the British market and Canada’s disease-free status with respect to foot and mouth disease (except for 1951-52). At that same time, Canada faced costly but surmountable tariff access to the United States. As a consequence, Canadian meat exports flowed profitably to the United States, Europe, and the West Indies. Up to the late 1970s, Canada Packers Ltd. led the world in a number of meat technologies and was a rapidly growing player offshore.

With the end of preferential access to Britain and the Commonwealth, Canadian meat exporters desperately needed new markets. Fortunately, within a few years of the loss of the British market, Japan began to open its market to more beef and pork imports. Canada enjoyed tremendous success in Japan, largely because it produced high quality pork due to its longstanding emphasis on breeding and because throughout the 1980s and much of the 1990s, the United States was a net importer of pork. It is worth noting that the first commercial shipments of chilled pork from North America to Japan originated from Dubuque, Iowa as a result of the Canada Packers International group working with Hormel. However for the reasons mentioned, the technology was more successfully exploited from Canada in the 1990's.

By the end of the 1980s, we had the Canada-U.S. Free Trade Agreement (CUSTA), which expanded into the North American Free Trade Agreement (NAFTA) in 1994 with the inclusion of Mexico. With a head start in Asia led by Canada Packers (now called Maple Leaf Foods Inc.) and increasing demand pull from Canada’s NAFTA partners, the last decade of the 20th century was initially an expansionary period for the Canadian livestock and meat industries.

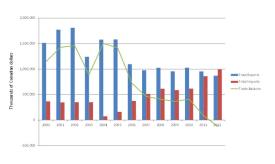

However, things in the newly integrated North American market have not always gone smoothly for Canada. From 1985 to 1999, the Canadian hog industry had to deal with a U.S. countervailing duty on live hogs imported from Canada. In 2004, the Canadian swine industry was back battling a renewed U.S. industry attempt to impose countervailing and antidumping duties on Canadian hogs. And from October 1, 2008 until the present, Mandatory Country of Origin Labeling (MCOOL) imposed by the United States has succeeded in placing a systemic cost on Canadian livestock, beef and pork. A study by Ron Gietz released in January 2013 by the Canadian Pork Council details the massive reduction in live swine exports and the suppression of prices in Canada resulting from MCOOL (Figure 1).

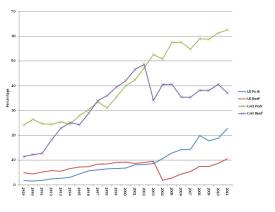

Despite the seemingly incessant border challenges faced by Canadian livestock and meat exporters, NAFTA and the World Trade Organization (WTO) remain far more critical to the Canadian livestock and meat industry than to its U.S. counterpart, as can be seen in the comparison of percentage of red meat production exported by Canada and the United States (See Figures 2 and 3).

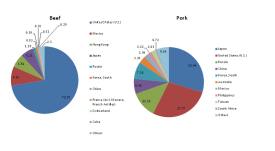

Given the proximity of the United States and the tariff- and quota-free access to the U.S. market afforded by NAFTA, it is understandable that the Canadian beef and pork industry has focused on the U.S. market. In 2011, the United States alone represented 85% of our total beef and cattle exports. These exports to the United States included about Canadian $1 billion worth of beef and although not part of the following chart, $800 million worth of cattle. The United States remained also a large foreign market for pork, although other markets accounted for over 72% of the pork exports by value.

One questionable side effect of the growing importance of the U.S. market for the Canadian livestock industry has been a gradual shift to larger Canadian hogs and cattle in order to remain in economic alignment with U.S. packer bids. This emphasis on size is quite a departure from the traditional Canadian approach to market positioning which focused on quality rather than quantity when serving export markets.

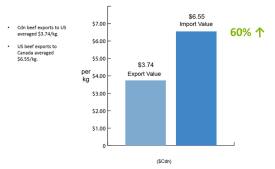

The Canadian beef industry’s historical focus on an integrated North American market and harmonization of product specifications with the United States began to be questioned when Canada actually moved into a trade deficit on beef with the United States in 2012 (See Figure 4).

One upshot of this trade with the United States, particularly in beef, is that Canada is essentially backfilling supply to the greater benefit of the United States (Canadian Agri-Food Policy institute, 2012). Thanks in part to imports of Canadian cattle and beef, the United States has been able to increase its beef exports to several markets, while shipping boxed beef back to Canada at a higher value. In fact, the value of Canadian beef exports to the United States is on average only 60% of the value of U.S. beef exports to Canada. This statistic suggests that the Canadian industry is potentially foregoing significant value-added processing by exporting cattle rather than beef to the United States. Moreover, U.S. beef exports to countries other than Canada have increased by 280% from 2005 to 2011, while Canadian beef exports to countries other than the United States have only expanded by 45% during the same period (See Figure 5).

Unfortunately, the Doha Development Round of multilateral trade negotiations at the World Trade Organization (WTO) has not yet reached a successful conclusion. Nevertheless, the WTO process remains the logically preferred route for pursuing freer trade for a country of Canada’s size. Bilateral free trade agreements (FTAs) are now extremely important to Canada because this is the path that others, including the United States, Australia, and even the European Union (EU), have pursued in the key markets that Canada also shares. The issue which has arisen is the competitive liberalization of bilateral agreements, which bring advantages to one NAFTA member while disrupting and diverting the trade flows of the others. Each bilateral agreement layers on an additional set of rules; for example, around country of origin which has had the consequence of complicating exports from United States packers using Canadian slaughter cattle and hogs and in some cases breaking cross-NAFTA supply chains. Proliferation of such agreements will progressively undermine the value of NAFTA.

A clear case in point was the United States gaining market access for beef to South Korea in June 2008. The agreement restricted exports to South Korea to beef from cattle under 30 months (UTM) old and fed in the United States for at least 100 days. This seriously complicates the processing of Canadian slaughter cattle by United States packers as it requires significant segregation and tracing capabilities for packers exporting to multiple markets. Beef began being exported from the United States to South Korea in July 2008. The negotiations with South Korea were not conducted using a unified North American front, leaving Canada without an agreement and without market access. Canada was forced to take its lack of access to South Korea for beef to the WTO and only achieved access in the spring of 2012. However, with the U.S.-South Korean FTA by then completed, gaining access for Canadian beef was a pyrrhic victory. Leaders of the Canadian cattle and beef industry initially held back support for Canada’s effort to conclude an FTA with South Korea and succeeded in getting the Canadian House of Commons Standing Committee on Trade in its Study of the Canada-Korea FTA to recommend: “That the Government of Canada make any free trade agreement with Korea conditional on restoring access for Canadian beef exporters to the Korean market”. Strategically it would have been wiser to vigorously support the Free Trade Agreement and then deal with the access issue via the WTO.

Canada is effectively cut out of the Korean market for beef and pork due to the substantial Korean tariff and the preferential market access enjoyed by U.S. exporters. The continuing effect on Canadian pork exports is disastrous. Canadian pork exports to South Korea dropped by over $100 million in 2012 (Agriculture and Agri-food Canada Hog Statistics at a Glance, Feb. 9 2013) despite help from a Korean duty free period. It is hard to see any of Canada’s $233 million in 2011 pork sales to South Korea remaining as the duty gap widens. The Korean situation coming on top of COOL is forcing the Canadian industry to rethink its strategy based around the concept of one North American industry.

Canadian discussions with South Korea have been shelved for several years, but feelers continue in hope of reengaging where the negotiations left off in 2008. If the negotiations are not resumed, Canada’ pork industry will remain at a tariff disadvantage to South Korea’s top three foreign suppliers of pork: the EU, Chile, and the United States. Similarly, we will write that market off for the foreseeable future. If Canada is unable to close the tariff gap rapidly, we may see Canadian and U.S. meat exports take quite different paths, with the United States gravitating toward markets where it will have an advantage and to some extent away from other markets. This will create opportunity for Canada to become a reliable supplier to those markets where the United States does not have an FTA. The experience of William Davies and his contemporaries, who sought out new market opportunities when trade barriers blocked access to the most logical ones, is once again instructive.

The EU market—with 500 million people and annual economic activity of over $17 trillion—holds significant opportunities for Canada. Canada and the EU are nearing completion of a Comprehensive Economic and Trade Agreement (CETA). The negotiating text is now well-advanced, and the remaining obstacles largely come down to agricultural issues. The Government of Canada has made the CETA negotiations a priority in its international trade agenda. Having missed the original end of a 2012 target both sides remain hopeful of concluding in 2013.

The CETA discussions are important to the Canadian beef industry, as the EU currently applies a 20% tariff on imported beef. However, the discussions are also important for addressing the sanitary issues influencing trade. The EU has now approved North American carcass washes which clears away one of several non-tariff barriers. Depending on the size of the quotas that the EU allows for beef and pork, and what percentage of these quotas are designated for chilled as opposed to frozen product, a Canada-EU CETA could become a catalyst for significant change in the Canadian meat industry. Should the quotas for chilled meat be large enough, they would spur a transition to the production of more hormone-free beef and pork in Canada and begin to differentiate Canadian product from its U.S. counterpart. The economic prospect for hormone-free product is growing in both emerging foreign markets and domestic niche markets.

On March 25, 2012, Prime Ministers Harper and Noda announced that Canada and Japan had initiated work on an economic partnership agreement between the two countries. This initiative is recognized within the Canadian agricultural industry as being critical to success as Japan is Canada’s largest or second largest market for many of its agriculture and food products. Interestingly, it poses no significant issues for Canada’s supply managed industries (eggs, poultry, and dairy). There would be strategic advantages for both Canada and Japan finalizing an economic partnership before moving into the Trans-Pacific Partnership (TPP) as both have interests to protect and precedents to establish and both envisage a wider partnership beyond trade negotiations.

Japan has a 40% tariff on beef and a small tariff on pork but a very significant, indirect tariff-like mechanism on imported pork via the gate price on fresh/frozen pork imports. Pork which arrives in Japan below the minimum gate value of $4.28/kg for half carcasses or $6.25/kg for pork cuts is automatically charged the difference to bring the value of the shipment up to the gate price. Duty is then charged in addition to that measure. The upshot is that it encourages the shipment of high valued cuts and penalizes the export of lower valued cuts. Japan also traditionally pays a premium for better meat quality and ractopamine-free pork making a Japan Economic Partnership Agreement, combined with CETA, supportive of a quality versus quantity strategy.

In the TPP negotiations, Canada has a similar geographic focus as the United States: Asia. The big question is whether Japan will ultimately enter the TPP negotiations and whether the TPP can really achieve “free trade”. In some respects, the TPP is a necessary distraction for Canada, even if it is not successful, because there is a chance that Japan might join. Without Japan, the TPP simply takes time and energy away from more important bilateral agreements that Canada could secure for its agricultural and agri-food sectors. Timing is critical, as other countries are trying to create market advantages, such as the announcement of the Comprehensive Regional Economic Partnership (CREP). This deal would bring together the ten members of the Association of Southeast Asian States (ASEAN) plus New Zealand, Australia, India, China, Japan, and South Korea. For Canada to be at the front of the cutting edge of meaningful improvements in market access for agricultural and agri-food products, a Canada-Japan agreement and the TPP remain important and in that order.

Growth in demand is going to come from international markets outside North America. Beneficial market access to Asia will be vital to the success of the Canadian meat industry. In the absence of a workable multilateral solution, FTAs have become critically important. Key meat importing countries have significant tariffs, and a reduction of tariffs will increase trade and improve the economic welfare of their consumers. Reductions of those tariff rates allow countries with natural advantages and rigorous health and sanitary systems such as Canada to gain market share.

FTAs influence trade, as there is always more than one potential foreign supplier to a country. As it appears today, the United States will gain a larger market share of South Korea. But to do so, the United States is likely to export less to other markets. Likewise, Canada’s FTAs will influence its future exports.

The Canadian industry is at a crossroads, as the Canadian Agri-Food Policy Institute’s report on Canada’s Beef Food System underscores. In the future, Canada may be less willing to see itself as the backfilling partner of the United States and more likely to focus on securing price premiums for its meat exports, along the lines of the industry’s traditional emphasis on selling a high quality product, by perfecting its ability to use information collected by its animal traceability systems to focus on the most valuable markets. This approach would essentially take the Canadian beef and pork industry back to its roots, as exemplified by William Davies and his contemporaries more than a century ago. At the same time, Canada will move to offset the Korean disadvantage by securing FTAs with countries where the United States would find it difficult to achieve a similar agreement. A preferable alternative, of course, would be for the NAFTA partners to negotiate trade agreements as one entity and to allow product to flow freely in North America. This approach, which is just beyond our collective grasp, has yet to truly happen.

A Study of the Canada-Korea Free Trade Negotiations, Report of the Standing Committee on International Trade, House of Commons Canada, March 2008)

Canadian Agri-Food Policy Institute, Canada’s Beef Food System Sept. http://www.capi-icpa.ca/pdfs/2012/CAPI_Beef-Food-System_2012.pdfCanadian Pork Council, Estimate of MCOOL Damages on Canada’s Pork Industry, Gietz, Ron. January 2013.