The statement that “1.3 billion times any number is a BIG number” has fueled optimism, speculation, and prognostication throughout the U.S. farm sector for years. While China has been the “market of the future” for decades, the future is now. It became the largest overseas buyer of U.S. agriculture goods in 2012. . China’s 1.3 billion people are joining global consumerism in waves, and income growth for many Chinese still lies ahead. Diets are evolving and expanding, opening doors for foreign food suppliers.

From a meat, poultry, and livestock standpoint, China is a world superpower. According to USDA’s Foreign Agriculture Service (FAS) database in 2011, 60% of the world’s hogs resided in China versus only 8% in the United States (USDA/FAS Production, Supply and Distribution Tables). Twenty three percent of the world’s beef cows are in China versus only 15% in the United States (USDA/FAS PSD Tables). While this production scale is huge, China’s export influence in global pork is minimal. China’s meat exports only amount to 3% of global exports, versus 28% for the United States. China’s trade policy shows their strong desires to be self-reliant in the meat, poultry, and dairy sectors but in reality, they are becoming bigger importers of beef, pork, and poultry.

| Arable land (acres per capita) | 0.04 | 0.24 |

| Average farm size (acres) | 0.2 | 68.4 |

| Wage per day of on-farm labor | $10.50 | $86.56 |

| Cropland per agricultural worker (acres) | 0.2 | 31.8 |

| Annual per capita renewable water resources (m3) | 2,138 | 10,231 |

| Percent of harvested land irrigated | 47% | 18% |

| Tractors per 100 square mi of arable land | 91 | 154 |

| Cereals yield (pounds / acre) | 4,938 | 5,910 |

From a self-sufficiency standpoint, China is largely self-reliant in most products but by a very narrow margin. Rising demand for meat products, mainly pork, has increased the demand for livestock and poultry feed. While China’s corn crop has steadily grown, 71% of growth has come through planting more acres. Only 29% of the total growth has been gained from higher yields (USDA/FAS PSD Tables). And while some believe that yield growth has a limit, we all know acreage growth is limited. China maintains corn self-sufficiency rates near 100%, but such levels of sustainability are questionable due to rising demand for feed grains and limited potential for acreage expansion to meet the ever-increasing demand for meat and dairy products.

Although prices continue to rise, so does the Chinese demand for pork, dairy, poultry, and beef. Meat price inflation in China has outpaced overall food price inflation in recent years. The calendar year 2011 saw a basket of retail meat prices rise by 24%; beef leg prices at retail averaged 35% annual inflation in November 2012 according to National Bureau of Statistics China.

Prices are central to this story. China’s producers have attempted to expand to meet rising demand, but supplies of feed grains and forage are limited. Higher feed prices are manifest in meat prices. Additionally, China’s new-found interest in enhancing domestic food safety and environmental regulations has resulted in the closure of 5,000 small and unlicensed slaughterhouses in the past year; the goal being to consolidate production into larger processing plants. Moreover, the exodus of rural laborers to work in cities has undermined the traditional low-cost “backyard” mode of production. All lead to rising Chinese food prices.

Most of China’s meat prices continue to run above U.S. meat prices, and both China’s inflation rate growth and per-capita income growth rates are outpacing the equivalent U.S. growth rates. As an example, China’s pork prices could double over the next 10 years, and using current Chinese income growth rates, consumers would continue to pay the same proportion of their income for pork during that time. U.S. consumers would need 24 years of current per-capita income growth rates to absorb the same 100% price hike. Chinese citizens’ ability to pay for food is outpacing the United States. A growing price disparity between domestic and imported foods leads to more imported meat, poultry, and dairy products. Any market with domestic prices well above U.S. prices or global prices will import products if access is granted. However, this stands in stark conflict to China’s self-reliance aims.

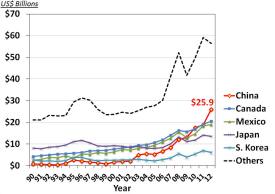

Abundant feed supplies, economies of scale and production gains have allowed U.S. agriculture exports to thrive over the past two decades. The stage was set through global tariff reductions granted through the conclusion of the Uruguay round of the General Agreement on Trade and Tariffs (GATT), and subsequent establishment of the World Trade Organization (WTO) in 1995. In the nearly two decades since, U.S. agriculture exports have thrived as shown in the chart below.

China became the single largest buyer of U.S. agriculture products in 2012. China imported $25.9 billion in 2012, up 38% from 2011. China’s appetite for U.S. agriculture products grew a staggering twelve-fold since 2002. With rising incomes and the massive population base, China’s influence on U.S. commodity prices will continue to grow.

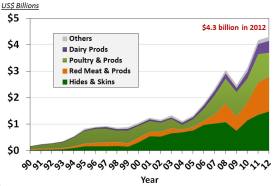

The following chart shows the dollar value of U.S. livestock and product exports to China and Hong Kong over the 1990-2012 time period (Hong Kong is included due to the large volume of “inter-trade” with China). These export values have more-than-tripled over the past decade to an estimate of $4.3 billion in 2012. U.S. success in exporting livestock products to China has been partially due to Chinese demand for raw hides to be processed into leather and leather products, often for reexport. Hide and skin exports to China and Hong Kong topped $1.48 billion in 2012, slightly ahead of red meat exports of $1.31 billion.

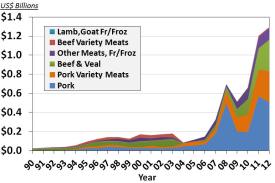

Pork comprised 39% of all U.S. red meat exports to China and Hong Kong in 2012. These U.S. pork exports have found growing acceptance in the Chinese processing sector. Variety meat items such as ears, stomachs, and intestines bring a much higher value in China than here in the United States. Whole muscle cuts of pork have been imported for further processing into sausage and other processed products. The following chart breaks out the $1.3 billion exported to China and Hong Kong as red meat.

Chinese demand for U.S. pork rocked U.S. markets in 2008 when food inflation rates topped 23% in China. During May and June of 2008 the United States exported 8% of the nation’s total domestic pork production to China and Hong Kong, a six-fold increase from the prior year levels. While that peak soon ebbed, Chinese demand skyrocketed again in 2011 following a year of significant disease issues in Chinese pig production. In October and November of 2011, 7% of U.S. pork production was exported to China.

These volatile scenarios will likely continue into the future. The massive scale of China’s pork sector makes even small declines in production translate into significant demand-pull from the much smaller U.S. pork supply. The U.S. hog/pork markets of the future may be more driven by decisions in Beijing than by the decisions in Washington D.C.

U.S. broiler exports have also found success in China. An estimated 85% of U.S. chicken paws (feet) have been exported to China and Hong Kong in recent years. U.S. leg quarter exports were also increasing until Chinese antidumping and countervailing duty cases were brought against U.S. exporters resulting in punitive import duties.

The U.S. beef industry continues to stand by, watching pork’s phenomenal growth into China. Following the discovery of Bovine Spongiform Encephalopathy (BSE) in a dairy cow in Washington State in December 2003, China closed their doors to U.S. beef and has yet to reopen them. U.S. beef is exported to neighboring Vietnam, Macau, and Hong Kong, but ten years later, China remains closed.

Dairy exports continue to rise, led by demand for dry milk powder. A Chinese scandal involving melamine (a suspected carcinogen) being added to milk by Chinese processors seeking higher protein values broke in 2008, leading to a massive national investigation. As a key component of baby formula, Chinese dairy product demand plummeted. However, the scandal resulted in sharply higher demand for imported milk power, baby formula and related products. That demand remains strong today as China has restricted the amount of baby formula which may be purchased in Hong Kong and brought across the border. Total U.S. dairy exports surpassed $440 million in 2012, up nine-fold in the past 10 years. It is expected that we will continue to see rapid future growth of dairy product exports to both China and Hong Kong for use as an ingredient in infant formula, candies, sport drinks and numerous other products.

An untenable relationship currently exists between China’s commodity economics and government policies. China’s commodity price inflation above world levels continues to spur import demand, even while Chinese officials seek food self-reliance; and the United States seeks more liberal Chinese agricultural import policies. The graphic below shows these factors as an “inconsistent triad” where any two factors can coexist so long as a third factor does not exist. That is, China cannot 1) be self-sufficient in food production, while 2) having food prices above world market prices, and 3) allow unfettered import access for food products. For example, self sufficiency can be maintained while China’s prices remain above world prices, but only if imports are constrained. Or, these higher price levels can exist in China, with unfettered import access, but self-sufficiency rates will fall. The third scenario would be that self-sufficiency can be maintained, with unfettered access to agriculture imports, but only if China’s commodity prices drop to a point that they are steady with or below world prices. Chinese and American policy makers must be willing to either sacrifice one point on the triangle or be willing to relent to some degree on multiple points.

Current trade friction between the United States and China has its roots in economics, politics, miscommunication, mistrust and retaliation. Today U.S. meat and poultry exports to China are constrained by countervailing duties and dumping margins; restrictions imposed on the U.S. use of Codex approved veterinary drugs (e.g. ractopamine) and a long-standing political impasse on BSE and food safety concerns. On the U.S. side, Chinese poultry exports to the United States are blocked as no processing or slaughter plants in China have been approved by USDA's Food Safety Inspection Service (FSIS) and food products face close import scrutiny at U.S. ports due to food concerns (residues, toxins, melamine, etc.). Add to this mix the drive by Chinese leaders for food security, often translated to mean self-reliance, and you have a challenging trade environment to say the least. These challenges must be addressed in a manner that establishes a strong base of trust and provides for regular and open dialogue at the highest levels of both governments.

A healthy and important debate continues within China’s academic and policy structure as to the future direction of agricultural production and self-sufficiency. China must realize that policies promoting self-sufficiency, food security, low prices, and meeting their international trade obligations under the WTO are not congruent.

Chinese top officials have long stressed the need for China to feed itself. Yet, the reality that imports will need to become an integral part of any food security model is finally being discussed and debated. While this debate is focused mainly on pork and grain production, it has large implications for animal production and trade in animal products.

The Chinese and U.S. agricultural trading relationship will certainly grow. There is no doubt that the United States will continue to further develop its sales of feed, beef, pork, dairy and poultry products to China. China will also enhance its output through land consolidation, technological adoption in grain and animal production, better water and waste management, and improved food processing. The path forward, however, is one where a new dialogue is required to light the way.

Before discussion of new engagements between USDA and China’s Ministry of Agriculture, it should not be forgotten that many scientific and technological exchanges are currently taking place. In addition, FAS cooperators provide significant capacity-building and information exchange programs for their counterparts in China. While focus is often on the negative side of trade; USDA, China’s Ministry of Agriculture (MOA) and the private sector in both nations should be more vocal about such exchanges and the benefits provided to producers, processors, exporters and consumers in each nation.

What structural changes could the two governments undertake to enhance confidence between the two systems while bolstering regular and productive talks that will lead to an understanding that trade is in fact an integral component of secure food supplies?

First, trust must be renewed and strengthened between U.S. agriculture and Chinese policy makers. Secretary Vilsack and Minister Han have begun this process with the February 2012 U.S.-China High Level Agricultural Symposium in Des Moines, Iowa. Agricultural production and trade policy in China is set by many players outside of the Agriculture Ministry and the U.S. government needs to expand engagement to include other Ministries, Commissions, Agencies, “think-tanks”, and provincial officials.

Second, the U.S. Congress needs to recognize that FSIS and the Food and Drug Administration (FDA) are professional and highly-competent food safety agencies. As science-based safety agencies they should be permitted to move forward on risk-assessment and regulations unimpeded by political influences not contrary to WTO principles. The United States must not be viewed as a nation which talks of science-based trade but passes laws curtailing imports without scientific justification.

Third, Chinese officials should embrace international standards and provide full transparency per their WTO obligations. As a nation which chairs two Codex Alimentarius Committees (Food Additives and Pesticide Residues) we would argue that China has a greater obligation to adopt Codex standards, announce and provide adequate comment periods for regulatory changes, and promote science-based regulatory development than many other nations.

China and the United States have a strong and vibrant agricultural trading relationship. It will only grow stronger in the future. It must be recognized in the United States that a relatively small percentage change in Chinese demand can have profound influences on U.S. and global agriculture markets. Chinese policy makers need to realize that their country may be better served by open, transparent, and science-based polices and regulations on food. Such a change in China will provide greater food security for the nation and allow the United States to prepare for future global demand in feeds, meat and poultry. One way to strengthen the relationship is to have more regular and deeper interaction among high level policy makers and with producer groups.

Global Trade Information Services, available online at http://www.gtis.com

National Bureau of Statistics China, available online at: http://www.stats.gov.cn/english/

United States Department of Agriculture, Foreign Agriculture Service, PSD Online Database: http://www.fas.usda.gov/psdonline/psdHome.aspx

United States Department of Agriculture, Foreign Agriculture Service, Global Agricultural Trade System: http://www.fas.usda.gov/gats/default.aspx