Craft brewers and their customers have transformed global beer markets over the past two decades, ending a century of consolidation that resulted in the domination of a few global multinationals and the homogenization of beer. They started small and isolated but ultimately transformed a global industry.

The terms “craft brewery,” “artisanal brewery,” “microbrewery,” “independent brewery,” “specialty brewery,” and “local brewery” are sometimes used to identify breweries that “recently” started brewing “different” types of beer on a “small” scale, distinguishing them from larger breweries mass-producing beer that often have been in business for more than a century and have survived the consolidation process of the 20th century. Given the diversities among countries and their historically different traditions in beer brewing, no single definition is generally accepted.

The American Brewers Association (ABA) defines a craft brewery as “small,” “independent,” and “traditional.” Small refers to the size (annual production less than 6 million barrels). Independent refers to ownership (less than 25% owned or controlled by an alcohol industry member that is not itself a craft brewer). Traditional refers to the beer production, in which 50% or more if the beer brewed derives its flavor from “traditional” or “innovative” brewing ingredients and their fermentation.

But in fact, any definition has its problems. For example, “tradition” and “innovation” are context-specific concepts. Many of the mass-produced beers, such as Budweiser or Stella Artois have a centuries-old history (tradition) much older than many craft beers. What is “innovative” in some environments can be standard (“traditional”) in other places. For example, producing stout beer may have been innovative in a small Californian brewery in the 1990s but probably not in Ireland, where Guinness dominates the beer market.

Also, the definitions of the scale of a “craft” or “micro”-brewery are related to the size of the country (beer market) in which they operate. For example, in Italy the maximum size is 200,000 hl (170,502 barrels), while in the United States it is 6 million barrels (7,038,000 hl). If the U.S. size limit is used as a benchmark, in many countries most mass brewers would satisfy this criterion. Any definition remains subjective and open for interpretation.

The craft beer revolution was preceded by a long period of consolidation and homogenization in the global beer industry that began in the late 19th or early 20th century and lasted for most of the 20th century (see Figure 1). Breweries merged, were acquired, went bankrupt, or simply stopped producing. In Belgium, the number of breweries declined from more than 3,000 in 1900 to 143 in 1980. This consolidation was even more extreme in the United States, where the number of macrobreweries fell from 421 in 1947 to only 10 by 2014, and a few beer styles dominated an increasingly homogenized market.

The reasons for this consolidation are well known (Swinnen, 2011; Tremblay and Tremblay, 2005). First, technological progress—such as automated production; the acceleration of packaging; more automated brewing, fermenting, and conditioning processes; and better distribution through improved road networks—led to greater economies of scale (Adams, 2006; Gourvish, 1994). Second, bottom-fermented beers (lagers)—which were introduced in the first part of the twentieth century—have higher fixed costs than top-fermented beers (ales) because they require artificial cooling during fermentation and a longer maturation time. This caused smaller breweries using bottom-fermented beers to exit the market. Third, large-scale advertising and promotional activities led to increases in advertising costs. Brewers with a large-scale operation (in terms of output and geographic availability) were able to advertise through expensive outlets, such as commercial television, has a significant marketing advantage (George, 2009). Fourth, global mergers and acquisitions contributed to a dramatic consolidation of the beer industry in the 1990s and 2000s, creating market-dominating global multinationals: AB Inbev, SABMiller, Heineken, and Carlsberg. As a consequence, beers became more standardized and homogeneous worldwide. The concentration was reinforced by the takeover of local breweries by multinational brewers such as AB Inbev, Heineken, and Carlsberg.

In some countries, it is relatively easy to identify the start of the craft revolution. In the United States, Elzinga, Tremblay, and Tremblay (2017) identify 1965, when Fritz Maytag bought the Anchor Brewing Company of San Francisco, as the beginning of the movement. Similarly, van Dijk, Kroezen, and Slob (2017) date the start of the craft beer revolution in the Netherlands to 1981, when the first new brewery since World War II was launched. The first brewpub in Italy was established in 1988 (Garavaglia, 2017), and in Australia, craft brewing started around 1980 (Sammartino, 2017). Almost everywhere, the early years were slow, but the movement picked up as more new craft brewers entered the market.

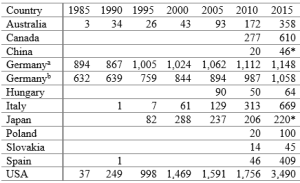

Note: Germanya and Germanyb are the

number of microbreweries if micros are

defined, respectively, as “breweries that

produce less than half of average production”

and “breweries with yearly production

<10.000 hl.” A single asterisk (*) indicates that

the number of microbreweries from 2014

was used.

Source: Swinnen and Emmers (2017).

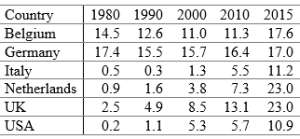

Source: Swinnen and Emmers (2017).

It is more difficult to identify a specific moment in countries with a long tradition of “specialty beers,” such as Belgium and the UK. In the UK, the origin of the craft beer movement is typically associated with the emergence of CAMRA (Campaign for Real Ale) in the 1970s. In Belgium, the current movement can also be traced back to the 1970s, although Belgium has always to some extent been a “craft beer nation” because of the number of small producers and its long tradition of producing a wide variety of beer styles (Swinnen and Briski, 2017). It is even more difficult to classify the beginning of craft beer movement in Germany, given the historical presence of small and local producers (Depenbusch, Ehrich, and Pfizenmaier, 2017). For these countries without a specific, identifiable moemnt, a good indication of the takeoff of the craft beer sector is the number of breweries. These countries all have a clear time period when new, mostly smaller, breweries started producing new specialty beers. Worldwide, the number of breweries declined during much of the 20th century, a trend that was not reversed until new craft breweries were established.

There are significant differences among countries in the emergence and growth of craft and microbreweries (see Figure 1 and Table 1). In countries where post-World War II brewery consolidation was stronger and where craft brewers emerged earlier—such as United States, the UK, and the Netherlands, where the total number of breweries was at its lowest point around 1980—the turnaround in the number of breweries occurred earlier than it did elsewhere. For example, in the United States the number of craft brewers (37) exceeded the number of macrobrewers (34) for the first time in 1985. Since then, the total number of breweries has grown to more than 3,500, the vast majority of which are craft-type breweries. In Germany and Belgium, recent growth in the number of breweries has not yet made up for their pre-1980 decline. The low point of the curve, when the number of breweries was at its lowest, was also significantly later in Germany and Belgium. Interestingly, Belgium and Germany had relatively low concentrations of breweries in the late 20th century, even though they had had the highest number (by far) of breweries per capita in the 1980s (Table 2): 17.4 (Germany) and 14.5 (Belgium) per million people compared to less than one per million people in the United States and the Netherlands.

Today, the number of breweries per capita is vastly different from that of the 1980s. In 2015, the number of breweries per capita in the UK and the Netherlands (23.0) was higher than that in Belgium (17.6) or Germany (17.0), a complete reversal of the situation in the 1980s and 1990s.

The birth and growth of the craft beer market was caused by several factors, including demand-side factors, supply-side factors, and the role played by pioneers, consumer organizations, the spread of information and knowledge through networks, and emerging capital and technology markets. The demand side of the beer market has changed significantly since the 1980s. Several factors played a role, but three have been particularly important: (1) increasing demand for more beer styles, (2) increasing incomes among beer consumers, and (3) the organization of consumers in associations focused on experiencing and dissemination information about different beers.

The craft beer revolution came at the end of a dramatic transformation in the beer industry. Macrobrewers chose product characteristics that appealed to as many consumers as possible, resulting in a more homogeneous and milder lager beer. As microbrewers consolidated, craft brewers began to enter the market, filling product niches left by the homogenization of macro beer. Consumers (and society as a whole) began showing an increased interest in local products and environmental and sustainability considerations and a rising sentiment against globalization (and products from giant and multinational firms). The diffusion of organic foods, the spread of geographical indications (such as the EU certifications P.D.O.—Protected Designation of Origin—and P.G.I.—Protected Geographical Indication), the success of the farmer markets, and the Slow Food movement are a few examples of these trends. The growth of the craft beer market is inherently associated with the growth in consumer desire for variety.

Craft beers are typically more expensive than standard lagers. Not surprisingly, studies show that high-income consumers are more likely to buy craft beer (Elzinga, Tremblay, and Tremblay, 2015; Gómez-Corona et al., 2016; Murray and O'Neill, 2012). Higher incomes not only stimulate an increase in demand for more expensive products but also stimulate demand for more variety. It is thus not surprising that the craft beer market expanded as incomes increased substantially in industrialized countries in the decades after World War II. This is demonstrated by Bentzen and Smith (2017), PokrivÄák et al. (2017), and Li et al. (2017) who discuss how increased incomes stimulated the craft beer market in Denmark, Slovakia, and China, respectively.

In several countries, consumers created associations to mobilize craft beer enthusiasts. The role of consumer associations and communities has contributed to the development of craft beer for at least two reasons. First, consumer associations stimulated the activity of the first entrants in the craft beer segment, sustaining demand for specialized products against mass-produced beer. Second, consumer associations often promoted home-brewing, which played an important role in developing experience among the first entrepreneurs. The best-known example of a consumer association is probably CAMRA in the UK. The success of CAMRA inspired similar organizations in other countries, such as PINT in the Netherlands and Humulus Lupulus in Spain.

The growth of the craft sector and the entry of increasing numbers of small brewers was enhanced by the growing availability of technical equipment and capital allowing brewing on a small scale. In the infancy of craft beer, entrepreneurs faced major difficulties financing their breweries and finding appropriate equipment. The early craft brewers regularly used capital equipment designed for other industries (such as dairy or wine) and adapted it to brewing and packaging or made use of contract brewing as an institutional mechanism to overcome capital and technology constraints. Today, there is a rapidly developing market for craft brewing equipment.

Similarly, as craft brewing revealed itself to be a profitable business, new sources of financing have developed and supported the start-up of new craft breweries. Banks became more familiar with the concept of craft brewing and started providing start-up capital. Crowdfunding has reduced entry barriers for starting up or expanding craft breweries. In addition, venture capital firms in the United States have determined craft brewing to be an interesting investment opportunity, and some regional authorities in Europe have begun providing public funds and incentives to start craft brewing if connected to the development of the local agricultural activities (e.g., barley and hops).

Craft beer pioneers often got inspiration from contacts with foreign countries with a strong beer tradition or where the craft beer scene had already developed. While the initial inspiration went from East to West across the Atlantic Ocean, inspiration currently flows both ways. For example, while the Belgian influence on the craft segment in the United States has been huge, Belgian brewers have recently started copying some U.S. craft beers, especially by using more hops and producing IPAs (Alworth, 2015). Similarly, the first Dutch craft breweries were focused mainly on producing Belgian-style ales, while later entrants have been increasingly inspired by American-style ales.

Beer in general has been the subject of many government regulations (Swinnen, 2017). Regulations serve several objectives: enhancing government revenues through beer taxes, protect ingconsumer health; protecting society from alcohol abuse; reducing the price of bread grains; and constraining market power. The growth of craft brewing has had two-way interactions with these regulations. On one hand, regulations have stimulated or constrained craft brewing compared to macrobrewers. Craft brewing has been hampered by restrictive regulations that were tailored to the mass producers, creating entry barriers for the first craft breweries. On the other hand, the growth of craft brewing has induced changes in regulations that have facilitated the subsequent entry of craft breweries. Legalizing homebrewing represented a key factor that facilitated entry of craft brewers in many countries.

As long as the craft breweries were considered too small to represent a real threat, macrobreweries did not strategically react to their presence. However, as the beer produced by craft breweries started to gain a larger market share and overall beer consumption either stabilized or fell in traditional beer markets, macrobrewers have responded in several ways.

One response among large brewers in many countries to the growing success of craft beer was to produce a craft-style beer themselves. In the United States, the major producers introduced new brands in mid-1990s; these brands explicitly did not display the name of the large company behind these brands in order to distance them from the macro connection. Arguably, the most successful of these brands has been Blue Moon by Coors, where Coors kept a close control on the craft initiative until it became really successful (Swinnen and Briski, 2017). In Denmark, market leader Carlsberg entered the segment of specialty beers with a craft production plant in 2005, the Jacobsen brewhouse. In Italy, the market leader, Heineken Italia, owns (among others) two traditional national brands, Ichnusa and Moretti, which have recently launched a non-pasteurized lager and new flavored beers, called “the regionals,” respectively (Garavaglia, 2010). Interestingly, Chlebicka, FaÅ‚kowski, and Lichota (2017) note that in Poland “twenty years ago small [breweries] tried to become similar to large [breweries], and nowadays we have a paradox that large [breweries] tell that they are like the small ones.”

Another strategic reaction among macrobrewers has been direct entry into the craft beer segment through acquisitions. While most initial acquisitions of craft breweries were domestic, they have become increasingly international. In the United States, Miller acquired the Leinenkugel Brewing Company in the late 1980s and Celis and Shipyard breweries in the 1990s. Anheuser-Busch acquired an interest in the Redhook Brewing Company in 1994 and Widmer Brothers Brewing in 1997. Interbrew/InBev (the Belgian roots of AB InBev) acquired Hoegaarden and Leffe (both Belgian craft breweries) in the 1980s and Hertog Jan, one of the first craft breweries of the Netherlands, in 1995.

In recent years, AB InBev has acquired, among others, Goose Island in the United States; the first craft producers in Brazil, Cervejaria Colorado; the biggest craft brewery in Colombia, the Bogotá Beer Company; the well-known Italian craft producer, Birra del Borgo; and the Belgian Bosteels brewery, a seventh-generation small family brewery and producer of award-winning Tripel Karmeliet. These acquisitions, in addition to several others, created a substantial portfolio of specialty beers in AB InBev’s “craft and specialty beer network.” SABMiller also participated actively in the craft takeover strategy: one of their takeovers was the Londoner Meantime Brewery in 2015. More recently, Heineken took over Lagunitas Brewing Company and declared that it would be expanding this brand into the world’s first global craft brand. Not surprisingly, these acquisitions have been criticized quite heavily by remaining craft brewers and consumers, who often consider such acquisitions to be a departure from craft origins. Consumer backlash may be one of the largest threats to the takeover spree.

Most craft breweries start off small and serve a small group of local customers. In order to grow they need to find access to customers through retailers and/or bars. This can be difficult if macrobrewers use their ties with bars and wholesalers to prevent craft beer sales (1) because they create competition for their own beers and (2) because they accuse the crafts of “free riding” on their infrastructure investments. Macrobrewers have used their control over bars and retailers to push their own portfolio of beers, including a growing list of own (formerly) craft beers. For example, most beer wholesaling in the United States is done by distributors who concentrate either on brands in the AB InBev portfolio or in the MillerCoors portfolio. Most wholesalers that are authorized to distribute either AB InBev or MillerCoors products also distribute craft beer, but AB InBev recently announced a plan that would incentivize some of its distributors to focus on the sale of AB InBev brands (Mickle, 2015).

The global beer industry is experiencing to a revolution which continues. Consolidation of the traditional breweries preceded the emergence and growth of craft breweries in all countries, but the extent of that consolidation and the size of the recent craft growth differs quite strongly among countries. Both demand and supply factors have driven the emergence and growth of craft beer, including a growing demand for variety of beers after the 1980s, when traditional beers became homogenized and consumer incomes increased. In all countries, craft breweries were initially started by pioneering entrepreneurs inspired by different beer varieties in other countries who often experimented first with home brewing. Associations of craft consumers, craft brewers, and homebrewers helped expand the market by spreading information and experiences and acted as a vehicle for new forms of marketing. Later, the development of specialized brewing technology markets and new forms of finance were important to stimulate the diffusion of craft breweries; in many countries regulations were adjusted in response to the growing craft sector.

This transformation of the global beer industry is not only important for people and researchers interested in beer and brewing but also for those interested in what determines industry structure and economic history. The emergence of new and small craft breweries, the consequent dynamic response of the beer industry, and the changes in consumption provide fertile material for studying industrial organization, institutional change, and economic development.

Adams, W.J. 2006. “Beer in Germany and the United States.” Journal of Economic Perspectives 20(1):189–205.

Alworth, J. 2015. The Beer Bible. New York: Workman.

Bentzen, J., and V. Smith. 2017. “Entry, Survival and Profits .The Emergence of Microbreweries in Denmark.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Chlebicka, A., J. FaÅ‚kowski, and J. Lichota. 2017. “From Macro to Micro: The Change of Trendsetters on the Polish Beer Market.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Depenbusch, L., M. Ehrich, and U. Pfizenmaier. 2017. “Craft Beer in Germany – New Entries in a Challenging Beer Market.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Elzinga, K.G., C.H. Tremblay, and V. Tremblay. 2015. “Craft Beer in the United States: History, Numbers and Geography.” Journal of Wine Economics 10(3):242–274.

Elzinga, K.G., C.H. Tremblay, and V.J. Tremblay. 2017. “Craft Beer in the United States: Strategic Connections to Macro and European Brewers.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Garavaglia, C. 2010. “Birra, Identità Locale e Legame Territoriale.” Agriregionieuropa 6(20). Available online: http://agriregionieuropa.univpm.it/

Garavaglia, C. 2017. “Birth and Diffusion of Craft Breweries in Italy.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Garavaglia, C., and J. Swinnen, eds. 2017. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan

George, L.M. 2009. “National Television and the Market for Local Products: The Case of Beer.” Journal of Industrial Economics 57(1):85–111.

Gómez-Corona, C., H.B. Escalona-Buendía, M. García, S. Chollet, and D. Valentin. 2016. “Craft vs. Industrial: Habits, Attitudes and Motivations towards Beer Consumption in Mexico.” Appetite 96(1):358–367.

Gourvish, T.R. 1994. “Economics of Brewing, Theory and Practice: Concentration and Technological Change in the USA, UK, and West Germany since 1945.” Business and Economic History 23(1):253–261.

Li, F., Y. Shi, M. Boswell, and S. Rozelle. 2017. “Craft Beer in China.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Mickle, T. 2015. “Craft Brewers Take Issue With AB InBev Distribution Plan.” Wall Street Journal Available online: https://www/wsj.com/articles/craft-brewers-take-issue-with-ab-inbev-distribution-plan-1449227668

Murray, D.W., and M.A. O'Neill. 2012. “Craft Beer: Penetrating a Niche Market.” British Food Journal 114(7):899–909.

PokrivÄák, J., D. LanÄariÄ, R. Savov, and M. Tóth. 2017. “Craft Beer in Slovakia.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Sammartino, A. 2017. “Craft Brewing in Australia, 1979–2015.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.

Swinnen, J., ed. 2011 The Economics of Beer. Oxford: Oxford University Press.

Swinnen, J. 2017. “Some Dynamic Aspects of Food Standards.” American Journal of Agricultural Economics 99(2):321–338.

Swinnen, J., and D. Briski. 2017. Beeronomics: How Beer Explains the World. Oxford: Oxford University Press.

Swinnen, J., and D. Emmers. 2017. Database on the Global Beer Industry, LICOS.

Tremblay, V.J., and D.H. Tremblay. 2005. The US Brewing Industry: Data and Economic Analysis. Cambridge, MA: MIT Press.

van Dijk, M., J. Kroezen, and B. Slob. 2017. “From Pilsner Desert to Craft Beer Oasis: The Rise of Craft Brewing in the Netherlands.” In C. Garavaglia and J. Swinnen, eds. Economic Perspectives on Craft Beer: A Revolution in the Global Beer Industry. London: Palgrave Macmillan.