Following recent headlines from crisis countries in the Eurozone, fears of a credit crunch in the Italian farming sector loom large, and Spanish food producers worry about crumbling domestic demand. Indeed, many European economies and the European Union (EU), as a political and economic project, are currently in deep trouble. But how severely are EU farmers really hurt by the recent crisis? How much are they exposed to the threats emanating from the epicenters of recent economic turmoil? This article attempts to collect the available evidence to answer some of these questions. The insights are tentative because there is a lack of up-to-date data, and consolidated information on EU agricultural finance markets is not readily available.

Following years of an expansionary monetary policy of the Federal Reserve, the massive default of highly leveraged real estate loans marked the outbreak of the U.S. “subprime crisis” in spring 2007. As these loans had been distributed globally in the form of structured financial products, the bursting bubble hurt the portfolios of commercial banks and institutional investors worldwide and led to a massive loss of trust in the financial system. In waves, these financial institutions faced large losses and experienced difficulties in borrowing, epitomized by the collapse of Lehman Brothers in September 2008. As a response, central banks in the United States and Europe cut their lending rates, substantially increased the assets on their own balance sheets, and provided the banking sector with large amounts of liquidity. Governments stepped in to guarantee the solvency of financial institutions and set up stimulus packages to counteract the looming economic recession. Government bailouts and nationalizations in almost all euro area countries as well as Denmark and the United Kingdom led to an explosion of sovereign debt. In December 2009, Greece declared significant problems in its debt exposure, followed by Ireland, Portugal, and Spain in 2010. By mid-2011, also Italy had witnessed rising spreads of its government bond yields over those of Germany, which are typically considered as a secure benchmark. Amidst economic recession and rising unemployment rates, the Greece, Ireland, Italy, Portugal and Spain (GIIPS) countries moved center stage in the genuine Eurozone crisis (German Council of Economic Experts, 2012). The Eurozone governments reacted by implementing multibillion euro stability facilities, including the European Financial Stability Facility (EFSF) and its follower organization, the European Stability Mechanism (ESM). In a highly controversial act, the European Central Bank (ECB) declared in August 2012 that it would buy unlimited amounts of government bonds.

As this snapshot illustrates, it is useful to speak of a series of crises which recently disrupted economic growth in the Western world. See Shambaugh (2012) for a discussion of the interlinked crises currently affecting the Eurozone, which include:

What makes the situation so complex and difficult to resolve is that none of these crises can be dealt with in isolation. The massive bailout of banks by the public directly adds to sovereign debt. On the other hand, banks holding government bonds in their balance sheets suffer when sovereign default is imminent. If banks no longer supply sufficient credit, economic growth will slow. But increasing bankruptcies in the real economy also strain the banking sector. Austerity on the side of governments, as a result of mounting public debt, likely reduces growth. Finally, lacking economic dynamism in the economy also means reduced tax incomes for the government to solve its debt problems. Of course, not all problems are similarly acute in all Eurozone countries; the imbalances among them in fact add to the complexity. For example, while poor fiscal policies were a main cause of the crisis in Greece, problems of the banking sector predominated in Ireland and a collapsed housing boom dragged down Spain (Shambaugh, 2012, p. 161). Germany and other northern Eurozone countries, on the other hand, displayed positive growth rates and record-low unemployment levels.

This anatomy of the crisis suggests at least three ways in how it can distress EU farmers:

In the following, we concentrate on the first, most immediate effect of the crisis. We come back to the second and third pathways in the latter part of the article.

A closer look at the institutional settings on European agricultural credit markets reveals a multifaceted picture. Table 1 displays information on farming structures and main financial intermediaries for agriculture in selected EU member states. While highly simplifying, the table conveys an impression of the considerable heterogeneity across EU members. Denmark, France, Germany, and the UK tend to be characterized by relatively big commercial operations in agriculture. The GIIPS countries are dominated by smaller farms with comparatively low levels of investment and value creation. While some member countries have a long tradition of locally anchored savings and cooperative banks, state mandated agricultural sector banks or commercial banks prevail in others.

| Country | Farm structures | Degree of farm commercialization | Dominating agricultural banking institutions | Investment in farming assets |

| Denmark | Medium | High | Commercial banks | Traditionally high, recent decline |

| France | Medium | Medium | Centralised coops | Medium |

| Germany | Medium (West) | Medium (West) | Coops, savings banks | Medium |

| Large (East) | High (East) | |||

| Greece | Small | Low | Agricultural sector bank | Very low |

| Ireland | Small | Medium | Commercial banks | High before crisis |

| Italy | Small | Medium | Commercial banks | Very low |

| Poland | Small | Low | Coops | Low |

| Spain | Small to medium | Medium | Savings banks | Low |

| UK | Large | High | Commercial banks | Medium |

Farmers’ exposure to the financial crisis also depends on their past lending behavior, their current indebtedness, and the extent to which their local financial intermediaries are themselves subject to the crisis’ impacts. As the table shows, the countries most affected by the financial crisis may not be those with the most exposed farming sector. In particular, Greece, Ireland, Italy and Spain tend to be dominated by small farms exhibiting low investment levels in the past.

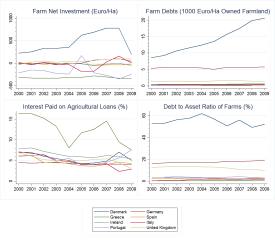

We now examine some of the financial indicators of EU farmers in further detail. Figure 1 displays the interest paid on agricultural loans, the debt-to-asset ratio of farms, farm debts per hectare (1 ha equals 2.4 acres), and net investment per ha for a sample of EU countries. We include the five GIIPS countries, Germany as a reference, as well as Denmark and the UK as non-euro members. Denmark is particularly interesting due to its developed agricultural banking system, whereas the UK’s banking sector was itself subject to turbulence during the financial crisis. The figures are based on Farm Accountancy Data Network (FADN) data for the last 10 years of observation that are publicly available. Unfortunately, there are no data for the very recent crisis years.

With regard to interest paid on agricultural loans, Greece stands out with the highest interest level and one with considerable fluctuation. This is despite the fact that the indicator is already an average of short- and long-term loans, which tends to level out the variation observed in newly concluded loan contracts. In all other countries, except Denmark and Portugal, farmers faced long-term declining interest rates until 2009.

In terms of indebtedness, farmers in Denmark lead the group by far. Not only did an average debt-to-asset ratio of 50% and more prevail over the recent decade, indebtedness per land owned more than doubled. While not a euro member, Denmark’s financial system has the reputation of being quite liberal and Danish farmers being very entrepreneurial. This is reflected in these figures. Traditionally, Denmark has a very large market for mortgage lending, to which farmers, up to the crisis, had easy access (Association of Danish Mortgage Banks, 2013). There is notable use of credit funding on British and German farms, but agricultural debt levels in all of the GIIPS countries were very low throughout the decade.

The chart on net investment confirms the leading role of Denmark. However, while there was still moderate growth in farm debt on Danish farms in 2009, investment almost collapsed that year. This is, very likely, a direct effect of the banking crisis in Denmark. In 2009, investment also went down in Ireland, one of the core crisis countries. Net investments in all other countries were close to zero throughout the observed period, which means that new investments just compensated for the depreciation of the existing capital stock. For Greece and Italy, the figures are significantly negative indicating that farmers are effectively running down their capital stock.

In sum, the picture that emerges from these indicators shows that farmers in all countries, except Denmark, exhibit very low debt levels. Those who did borrow benefitted from overall declining nominal interest levels. In 2009, impacts of the financial crisis were visible in the investment behavior of Danish and Irish farmers.

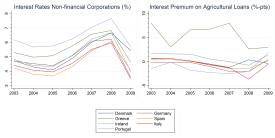

Next, we attempt to evaluate whether farmers pay higher interest rates than other business entities or whether they obtain less credit than they demand. We start with the former by comparing interest rates paid in agriculture with the rest of the economy. The right chart shows the difference between the interest rates paid in agriculture (Figure 1) and the former, or what may be called an “agri-premium.” Note that the two are not fully comparable, as the first only includes new business while the second is an average of all outstanding loans weighted by outstanding loan size. Thus it reacts with delay to changing market conditions. The left chart of Figure 2 shows the average interest rates of new loan contracts arranged between banks and non-financial corporations (i.e., firms) in selected EU countries.

One interpretation of the left chart is that lending rates grew with the increasing stress on financial markets in the mid-2000s, but then fell with significantly loosened monetary policies after September 2008. Spreads among countries reflect specific risk premiums and the institutional conditions on domestic financial markets. Greek and Portuguese banks stand out here for charging above-average loan rates. Denmark and Spain did not completely follow the interest drop in 2009 and thus reshuffled the order, but otherwise the lines mostly move in parallel.

If new contracts in agriculture closely followed the interest level in the general economy, the agri-premium should be slightly positive in years of falling overall interest levels and slightly negative in times of rising rates, due to the sluggish agricultural interest indicator. In our sample, this appears to be the case for most of the countries in 2006-8 (rising overall rates) and 2009 (falling rates), respectively. So, in fact, there seems to be no significant agri-premium for new loan contracts. Only Greece displays an excessively high interest rate level in agriculture. Portuguese farmers, on the other hand, tend to pay even lower rates than firms do in the rest of the economy.

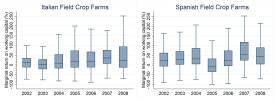

If there are constraints on credit supply induced by the crisis, farmers cannot realize profitable capital investments in their farm. In such cases, the return earned on the last euro actually invested in farming is likely to remain much above typical interest rates on credit markets. As detailed in Petrick and Kloss (2012; 2013), we calculated this marginal value of farm capital as a measure of the existing credit constraints for every farm in our sample. Figure 3 shows the distribution of internal returns on the last euro of working capital spent on field crop farms in Italy and Spain. Both countries reveal a similar picture. The median values suggest that the highest level of return on working capital were reached in 2007 and 2008 just after the onset of the financial crisis. In these years, the level was at 20% and above, and thus notably higher than the interest rates paid on loans (Figure 1). However, the dispersion of the farm-individual returns is considerable and tends to increase, at least for Italy. The evidence points to a moderate level of credit rationing towards the end of the period, when the crisis set in. As shown in the chart, after a peak in 2007, the median value went down again slightly in 2008. The charts also suggest that individual farms were affected quite heterogeneously.

Results for other EU member states reported in Petrick and Kloss (2013) show that marginal returns on working capital are much lower in some countries such as Denmark or Germany. They also suggest that the marginal return on fixed capital is substantially below the return on working capital in all countries; in fact, it is typically negative. In a long-run perspective, this is a sign of overcapitalization in agriculture and not of credit rationing.

It would be useful to complement these figures by more direct evidence on credit constraints based on farm surveys. While the ECB does collect data on the access to finance by small- and medium-sized enterprises (SMEs), the agricultural sector is excluded from these surveys.

As noted before, two other possible pathways of crisis impacts on EU agriculture include a decline in food demand and spending cuts in agricultural policy. During recessions, easy-to-substitute products are consumed less. In 2009, there were drops in the import of fruits and vegetables in some countries of Eastern Europe (particularly Russia) and the Near East because of the crisis (Schockemöhle and Würtenberger, 2010). European exporters suffered from them. More recently, while there were reports about temporary shocks in the demand for alcoholic beverages, sweets, and premium goods like duck meat, the European food industry seemed to have weathered the crisis relatively well.

In 2009, an immediate effect of the crisis played out in the European milk market. The year 2007 had seen a price surge in world dairy markets, partly due to exceptional weather events and a small supply from producers in Australia and New Zealand. The unfolding world financial crisis then led to a drastic decline in the demand for dairy products (USDA-FAS, 2008). As a result, dairy prices plummeted below pre-2007 levels and triggered what was perceived to be the EU dairy crisis in 2009. A crucial and widely discussed problem was that dairy prices failed to fully adjust at the consumer level. Margins for dairy processors and retailers increased, while consumer demand did not rise enough to buffer the price drop at the farm level.

These volatile and ultimately adverse price movements on the dairy market provoked protests and complaints from dairy farmers and interest groups. They induced policy makers to respond with a multimillion euro rescue package for EU milk producers. Some of this money was taken from direct payments which were one out of two pillars of the Common Agricultural Policy (CAP). Another share was available from the European Economic Recovery Plan (EERP), a stimulus package set up to mitigate the consequences of the global financial crisis in the EU. The co-financing requirement for these measures was lowered to 10% in the most economically disadvantaged regions of the EU (European Commission, 2010). Implementation of the support differed by member country, which typically funded extra premiums for dairy farmers and concessionary credit access. Ultimately, the dairy crisis also led the European Commission to promote a restructuring of dairy markets, including new regulations on contracting between farmers and processors (European Commission, 2013).

In retrospect, rescue measures at the EU level provided a significant safety net for farmers affected by the crisis. National co-financing requirements were substantially lowered to accommodate the difficult budgetary situation in some of the member states.

The evidence presented here suggests that some but definitely not the majority of EU farmers faced difficulties in credit access after the outbreak of the financial crisis. Low debt levels and declining interest rates insulated most farms in the crisis regions from excessive risk exposure. In Denmark, highly leveraged farm operations in the past led to perceivable credit constraints in agriculture. Increasing returns on farms’ internal uses of working capital in Italy and Spain were consistent with tightening credit constraints. Most farms in the other GIIPS countries used so little external funding that worsening credit terms due to the financial crisis were unlikely to be a major obstacle for their business.

The limited financial exposure of farmers in the crisis countries was a consequence of little borrowing in agriculture. This raises the question: to what extent is agricultural banking subject to deeper structural problems? For example, agricultural interest rates in Greece fluctuated much more than in other countries, and farmers paid much higher rates than businesses in other sectors of the economy. Both are signs of a lack of financial market integration with agriculture. On the other hand, net investment levels in agricultural assets have been consistently negative for years. What helped during the current banking crisis may turn out to be a bottleneck for future development of the sector. Institutional weaknesses in banking may slow down structural change and inhibit further modernization. Future institutional reforms thus should not bypass the agricultural banking sector.

The recent financial crisis coincided with increasing volatility in many commodity markets, some of them induced by demand drops because of the crisis. Even so, agricultural policy measures at the EU level provided farmers with a reliable stream of transfer payments. Following up on collapsing milk prices in 2009, the European Commission even set up a specific rescue program for dairy farmers. In all likelihood, this extraordinary level of public support for the agricultural sector will also be available in the near future, thus continuing to shield farmers from the most severe crisis impacts.

Association of Danish Mortgage Banks. (2013). Website information. Available online: http://www.realkreditraadet.dk.

European Central Bank, Statistics http://www.ecb.int/stats/html/index.en.html

European Commission. (2010). Overview of the CAP Health Check and the European Economic Recovery Plan. Modification of the RDPs. Luxembourg: European Commission. Available online: http://ec.europa.eu/agriculture/healthcheck/recovery-plan_en.pdf.

European Commission. (2012). Rural Development in the EU. Statistical and Economic Information. Report 2012. Luxembourg: European Commission. Available online: http://ec.europa.eu/agriculture/statistics/rural-development/index_en.htm.

European Commission. (2013). Agriculture and Rural Development - The "Milk Package." Available online: http://ec.europa.eu/agriculture/milk/milk-package/index_en.htm.

Farm Accountancy Data Network (FADN), Agriculture and Rural Development, http://ec.europa.eu/agriculture/fadn/index_en.htm

German Council of Economic Experts. (2012). Stable Architecture for Europe - Need for Action in Germany. Annual Report 2012. Wiesbaden: German Council of Economic Experts. Available online: http://www.sachverstaendigenrat-wirtschaft.de

Jansson, K.H., Huisman, C.J., Lagerkvist, C.J., and Rabinowicz, E. (2013). Agricultural Credit Market Institutions. A Comparison of Selected European Countries (Factor Markets Working Paper 33). Brussels: CEPS. Available online: http://www.factormarkets.eu/content/agricultural-credit-market-institutions-comparison-selected-european-countries .

Petrick, M., and Kloss, M. (2012). Drivers of agricultural capital productivity in selected EU member states (Factor Markets Working Paper 30). Brussels: CEPS. Available online: http://www.factormarkets.eu/content/drivers-agricultural-capital-productivity-selected-eu-member-states.

Petrick, M., and Kloss, M. (2013). Identifying Factor Productivity from Micro-data. The case of EU agriculture (Factor Markets Working Paper 34). Brussels: CEPS. Available online: http://www.factormarkets.eu/content/identifying-factor-productivity-micro-data-case-eu-agriculture.

Pietola, K., Myyrä, S., and Heikkilä, A.-M. (2011). The Penetration of Financial Instability in Agricultural Credit and Leveraging (Factor Markets Working Paper 2). Brussels: CEPS. Available online: http://www.factormarkets.eu/content/penetration-financial-instability-agricultural-credit-and-leveraging

Schockemöhle, U., and Würtenberger, E. (2010). Der Markt für Obst. German Journal of Agricultural Economics, 59, supplement, 79-89. Available online: http://www.gjae-online.de/news/pdfstamps/freeoutputs/GJAE-543_2010.pdf.

Shambaugh, J.C. (2012). The Euro's Three Crises. Brookings Papers on Economic Activity, 157–231.

United States Department of Agriculture-Foreign Agricultural Service (USDA-FAS). (2008). Dairy: World Markets and Trade. December 2008. Washington, D.C.: USDA. Available online: http://usda01.library.cornell.edu/usda/fas/dairy-market//2000s/2008/dairy-market-12-11-2008.pdf.