2nd Quarter 2013

When compared with the European Union (EU), many of the Europe and Central Asia Economies in Transition (ECAEiT) countries have seen both a larger economic decline and a stronger economic recovery after the global economic crisis that started with the 2008-09 recession. However, many of the ECAEiT are increasingly linked by goods, services, capital, and even labor markets to the economic performance of the EU, so the sustainability of their recovery is influenced by the Eurozone and broader EU economic performances, which has been also confirmed by a number of recent studies. As an example, the headline on the European Bank for Reconstruction and Development’s (EBRD) Regional Economic Prospects report for January 2012 was “Eurozone Crisis Takes the Steam out of Emerging Europe’s Recovery.” The headline in the HSBC Bank’s October 2012 report on macroeconomics of the Central and Eastern Europe and Sub-Saharan Africa (CEEMEA) region declared that “weak demand from the Eurozone is dragging down exports while deleveraging pressures are weight on domestic lending.”

It is still too soon to conduct more detailed quantitative analysis to establish cause and effect of the EU crisis on the ECAEiT countries, so we rely heavily on assessments that EBRD and others have already conducted on the Eurozone crisis as it has unfolded, as well on the larger financial crisis of 2008-09. The degree of market integration with the Eurozone, and thus impacts of its crisis, varies greatly across this region since some countries are already in the EU, some are candidates for accession, many have preferential trade agreements, and some are far less linked to the Eurozone economy. An extreme example may be Uzbekistan, which resists globalization and shows very few effects of either positive or negative global economic shocks.

The opening article in this series on the Eurozone provides the background on the focus of this and other contributions to the topic. We will explore the main transmission mechanisms through which Eurozone financial troubles have disrupted or could disrupt economic recovery and agricultural growth in the ECAEiT. The usual transmission mechanisms likely to be relevant are trade, investment, credit flow, and remittances. So these will be explored in terms of their impact on ECAEiT economies, and on their agricultural growth, whether directly or indirectly. For most of these factors, the double-dip recession in many countries of the EU and the persistence of financial instability in the Eurozone has negative consequences for economic performance in the ECAEiT. A more severe shock, such as the collapse of the euro or even the exit of one or more countries from the Eurozone, would have even more stark, contagion effects on the analyzed countries, and the magnitude of these impacts would clearly be greater for those countries closer in geography and in economic integration with the EU. The 2013 outlook for the euro area was revised downward by the International Monetary Fund (IMF) (2013) and the uncertainty about its future continues to create large downside risk, especially for neighboring regions. This assessment will conclude with risk factors and issues of concern for the ECAEiT

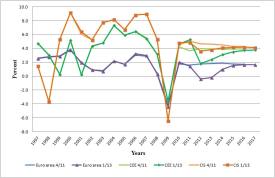

Data clearly shows that the recovery from the 2009 financial crisis was stronger in Central and Eastern Europe (CEE) and in the Commonwealth of Independent States (CIS) than in the EU or Eurozone areas, which always lagged slightly behind the total EU average (Figure 1). But when the Eurozone went into a double-dip recession in 2012, which likely continued into 2013, it clearly slowed the recovery in neighboring regions. Generally, the geographically closer and more economically integrated CEE is more affected by this recession than was the CIS.

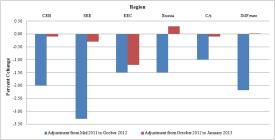

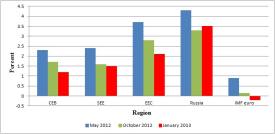

It is helpful to see the disaggregated analysis of the EBRD, which shows the sub-regions are affected differently. Its analysis of GDP growth in 2012, done at different points in time, found that South-Eastern Europe (SEE) and Eastern Europe and the Caucasus (EEC) economies are influenced by the second Eurozone recession more than Russia and Central Europe and the Baltics (CEB) (Figure 2). EBRD found that impacts on the Central Asia (CA) region were relatively small. A similar pattern seems to be emerging for 2013, though the relative size of the impacts of reduced economic activity in the disaggregated regions is expected to be smaller than in 2012 (Figure 3).

In both years the economic performance of the other regions is significantly better than that of the Eurozone. In fact, three of the countries in CEB are actually in the euro area, but two of them—Estonia and Slovakia—are growing well above the regional average and one—Slovenia—has even been below the Eurozone average growth rate both years.

This comparison may only show the difficulty of doing economic projections and by itself does not prove causality; but given the sequence of economic events and size of the Eurozone economy relative to others, even including Russia, the case for such significant influence on other economies in the region is strong.

To the extent that neighboring countries in SEE, EEC, Russia, and CA have become more integrated with the Eurozone economy, the impacts of economic and financial developments in the euro area naturally have a greater significance. An assessment of exposure of these economies to the Eurozone via foreign direct investment (FDI), external debt, and exports found, for example, that Ukraine, Kazakhstan, and Russia had a higher exposure than one or more of the EU member states in CEB (EBRD, 2012d). If we consider the main pathways through which the Eurozone economic crisis can affect neighboring regions, the principal linkages are trade, investment, credit flow, and remittances. We explore each of these and consider how they may alter the agriculture sectors in the region.

One early impact of the euro crisis was its depreciation. In this instance, that was offset by the fact that currencies in the neighboring regions, in general, depreciated relative to the Euro. The main trade impact, therefore, would be through the decline in demand in the Eurozone, which would translate into declining exports from these regions. There are neighboring countries, including all those in SEE, where the share of exports to the Eurozone during 2007-10 was 40% or more, and exceeded even some of the countries inside the EU. In fact, an analysis by the EBRD (2012d) found that from September 2011 to July 2012, when a major economic decline in the Eurozone took place, exports from SEE countries declined from 0.5% to 3.0%, and some countries in the EEC and CA regions were also affected. Of course other factors can be at play here, but there is at least a pattern of greater export declines in countries that had a larger share of exports to the Eurozone in the 2007-10 period.

As with the financial crisis of 2008-09, capital inflow was also reversed as a consequence of the Eurozone crisis. According to EBRD, capital flow turned negative in the second half of 2011 and FDI dropped by about 50% in the SEE and EEC regions. These coincided with a drop in outward investment from the Eurozone (EBRD, 2012d). Once again, this correlation does not prove cause and effect, but a statistical analysis was conducted on this question with data on bilateral flows from six Eurozone countries to countries in the transition region from 2001 to 2010. The results showed that an increase in the source country’s growth rate by 1.0 percentage point increases its stock of FDI in the receiving country by 5.9% (EBRD, 2012d).

The third quarter of 2011 saw large outflows of funds from transition countries as banks reduced lending in response to the financial crisis in the bank’s home country. The early credit contraction was most severe in CEB countries that are part of the EU. However, the most persistent credit contraction has been in the SEE region where credit growth remains close to zero (EBRD, 2012d). This was even more severe in the 2008-09 financial crisis, but the lending activity began to increase before the onset of the 2011 Eurozone crisis, then decreased again. It is likely more severe in countries with a large share of foreign-owned banks, and for most countries in CEB and SEE, foreign-owned banks have well over half of all bank assets and over 90% in some cases (HSBC, 2011).

The impacts of remittances are much more selective than other effects. For example, the decline in remittances is largely affecting SEE countries, especially Serbia, Albania, Kosovo, and Romania where they declined by double-digits in 2012 (World Bank, 2012). Albania and Moldova, in particular, are heavily dependent on remittances from two of the most troubled EU countries—Greece and Italy. The other possible remittance effect would be indirect, as in the case where Russia’s economy is negatively affected and, in turn, there is a decline in remittances from Russia to other countries in the region. That does not seem to be likely except in the case of a contagion effect from a much larger Eurozone crisis. At the present time the growth in remittances from Russia are offsetting the weak remittances from Western Europe (World Bank, 2012).

The potential impacts on agriculture can be viewed in terms of effects on supply and demand, and we should consider both positive and negative effects. First of all, it is important to recognize that there is a huge diversity of farm sizes, ownership structures, and degrees of commercialization in these neighboring regions, ranging from subsistence farms to the large-scale, commercial agriholdings in Russia and Ukraine. In part, the current farming structures are a consequence of the methods and speed of transformation and, in part, due to differences in the pre-reform structures and heritage of different countries (Goychuk and Meyers, 2013). The one common feature is that all of them have undergone a massive transition from the forms under which they operated prior to 1989 and the current farming structures and management systems. Thus, generalizations are difficult to make. But the main focus of our comments relate to those farming systems that are commercialized and engaged in the supply and demand marketing chain.

It is important to note that in many countries of this region, especially those not in the EU, agriculture is still a significant share of their economies, ranging from 10% in Ukraine to 34% of GDP in Serbia. As has been emphasized by Petrick and Kloss (2013), the banking crisis, recession, and sovereign debt crisis associated with the Eurozone troubles have different effects depending on the farm structures and degree of commercialization. They already touched on those countries from this region that are already in the EU, so we will tend to focus more on those that are not EU members.

As with the 2008-09 financial crisis, the most direct impacts on agriculture would most likely be reduced credit access, reduced FDI, and reduced market demand (World Bank, 2009). Of course, the size of these effects would have been proportionately bigger during that global financial crisis. In some respects, the current effects are essentially a prolonging of the impacts of the earlier and larger financial crisis. A good example is the reversing of credit flow due to reduction of lending that was very severe after the 2008-09 financial crises. In many countries in these regions it was the EU-based banks that were more engaged in agricultural credit, so their withdrawal contributed to a sharp rise in interest rates and constrained credit access. The July 2011 analysis found hope in the positive capital flow into the region (EBRD, 2011), but this reversed again as the Eurozone went into its second dip.

With regard to FDI, this has been significant in the growth of large-scale farming enterprises that have been especially successful in expanding agricultural production and increasing exports from Russia and Ukraine (Liefert, Liefert, and Luebehusen, 2013). When FDI slows, therefore, it slows these investments and production growth. One could perhaps argue that investors could leave poor performing economies in the Eurozone to invest elsewhere and this may be advantageous to the neighboring regions. However, EBRD (2012d) found that “FDI flows into these countries over the previous decade had been affected by economic conditions in the source country rather than by prevailing or past growth rates in the recipient state.”

On the demand side, exports to the EU from neighboring regions have clearly declined since the onset of the Eurozone crisis, and these are most likely transmitted via reduced demand rather than via exchange rates and apply to agricultural exports as well as to total exports. It is too early in the process to measure or compare the magnitude of different effects, but larger declines may be seen for products more sensitive to income, such as high-value fruit and vegetable exports from the SEE region, for example, than for bulk grain exports from the EED region. The largest demand effects in many countries, however, would be the decline in their internal demand due to slower domestic GDP growth. Finally, budget constraints are leading to a first-ever reduction in funding for agricultural supports in the EU. In addition to cuts in the Common Agricultural Policy (CAP) budget, proposed capping of payments and increased production costs associated with greening constraints would both have the effect of reducing production incentives in the EU. This may give advantage to neighboring countries that have far lower levels of support for agriculture. However, these countries also face more budget austerity, so their support for agriculture may also suffer.

It is still premature to carefully measure causality with any degree of confidence. Regardless, the patterns of change observed during the second Eurozone recession suggest that neighboring regions are, indeed, negatively affected and remain vulnerable to Eurozone economic shocks through the normal economic mechanisms. These impacts are much smaller than those of the bigger and broader 2008-09 financial crisis, but clearly have significantly slowed what was a robust recovery from the 2009 recession and have greater effects on those regions that are more closely integrated with Eurozone economies. It is even more difficult to quantify the impacts on agriculture specifically, but capital flow to investment and credit could be more significant than demand effects—except in those countries that have a large share of high-value exports going into EU markets. Finally, it must be said that the crisis is not over, and the January assessment by EBRD concluded that the largest downside risk to this region is a further deterioration of the Eurozone crisis.

European Bank of Reconstruction and Development (EBRD). (2013). Regional Economic Prospects in EBRD Countries of Operations, January. Available online: http://www.ebrd.com/downloads/research/REP/REP-210113.pdf.

EBRD. (2012a). Regional Economic Prospects in EBRD Countries of Operations, January. Available online: http://www.ebrd.com/downloads/research/REP/REP-210113.pdf.

EBRD. (2012b). Regional Economic Prospects in EBRD Countries of Operations, May. Available online: http://www.ebrd.com/downloads/research/REP/regional-economic-prospects1205.pdf.

EBRD. (2012c). Regional Economic Prospects in EBRD Countries of Operations, October. Available online: http://www.ebrd.com/downloads/research/REP/regional-economic-prospects1210.pdf.

EBRD. (2012d). Transition report 2012: Integration Across Borders. Available online: http://www.ebrd.com/downloads/research/transition/tr12.pdf.

EBRD. (2011). Regional Economic Prospects in EBRD Countries of Operations, July. Available online: http://www.ebrd.com/downloads/news/rep0711.pdf.

Goychuk, K. and Meyers, W.H. (2013). Eastern European Agriculture. In P. Thompson and D. Kaplan (Ed.) Encyclopedia of Food and Agricultural Ethics. Springer, New York.

HSBC Bank. (2012). Macroeconomics CEEMEA, HSBC Global Research, Q3. Available online: http://www.news1.co.il/uploadFiles/94555079936982.pdf.

HSBC. (2011). Emerging CEEMEA Economics: the impact of Eurozone deleveraging. December 20, p. 7.

International Monetary Fund (IMF). (2013). World Economic Outlook Update: Gradual Upturn in Global Growth During 2013. Available online: http://www.imf.org/external/pubs/ft/weo/2013/update/01./

IMF. (2012a). World Economic Outlook:Growth Resuming, Dangers Remain. Available online: http://www.imf.org/external/pubs/ft/weo/2012/01/.

IMF. (2012b). World Economic Outlook: Coping with High Debt and Sluggish Growth. Available online: http://www.imf.org/external/pubs/ft/weo/2012/02/.

IMF. (2011). World Economic Outlook. Tensions from the Two-Speed Recovery: Unemployment, Commodities, and Capital Flows. Available online: http://www.imf.org/external/pubs/ft/weo/2011/01/.

Liefert, O., Liefert, W., and Luebehusen, E. (2013). Rising Grain Exports by the Former Soviet Union Region: Causes and Outlook, Economic Research Service, U.S. Department of Agriculture. Available online: http://www.ers.usda.gov/media/996699/whs13a01.pdf.

Petrick. M. and Kloss, M. (2013). Exposure of EU Farmers to the Financial Crisis. Choices,Q2,2013

World Bank.(2012). Migration and Development Brief, Migration and Remittances Unit, Development Prospects Group, Vol. 19. Available online: http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934-1288990760745/MigrationDevelopmentBrief19.pdf.

World Bank. (2009). Turmoil at Twenty - Recession, Recovery, and Reform in Central and Eastern Europe and the Former Soviet Union, Washington, D.C.