Citrus fruits are consumed throughout the world, but production is concentrated in a few countries. The United States is a leading producer, behind Brazil and China (Jegede, 2019; Zhang, 2019). The total value of the U.S. citrus industry is about $3.33 billion (U.S. Department of Agriculture, 2020b). Major citrus crops grown in the United States are oranges, grapefruit, tangerines, and lemons. Based on the average value of production between 2013 and 2018, oranges are by far the leading citrus fruit (59%), followed by lemons (19%), tangerines (15%), and grapefruit (7%) (U.S. Department of Agriculture, 2020b). Though oranges are the leading citrus fruit, only 17% of oranges enter the fresh market; the remainder are used for processing. By contrast, about 76% of lemons, 73% of tangerines, and 55% of grapefruit are used for fresh consumption and the remaining are utilized for processing. With fruit and juice combined, citrus consumption exceeds that of any other fruit in the United States (Flores-Gonzalez et al., 2019).

However, in the past two decades, the U.S. citrus industry has faced many challenges—serious disease problems, weather damage, import competition, dwindling farm-retail price spread, and labor shortages—threatening its survival. Very recently, scientists have discovered a potential cure for citrus greening—a particularly devastating bacterial disease—that could revive the citrus industry. This article focuses on these issues, current status, and trends of the U.S. citrus industry.

With the spread of pests and diseases, frequent winter freezes, and health factors, it is worth examining trends and volatility in citrus acreage, production, consumption, trade, and prices over the last three decades.

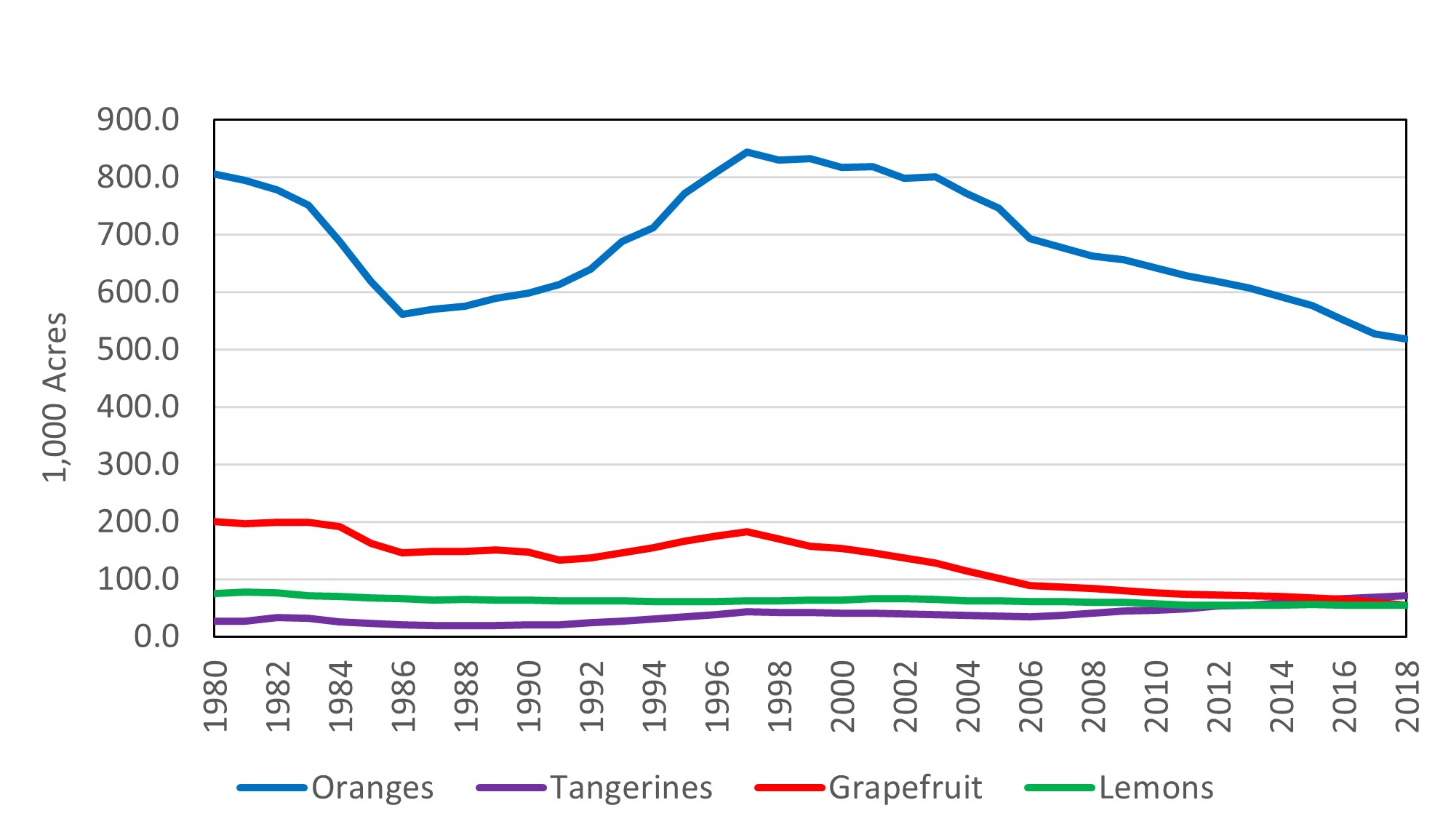

In the United States, much of the citrus acreage is devoted to orange production, while tangerine, grapefruit, and lemon acreages lag behind (Figure 1). The trend in orange acreage varies considerably, falling in the first half of the 1980s from 800,000 acres to about 550,000 acres, growing to more than 800,000 acres by 1998, and then steadily declining to about 500,000 acres by 2018. Grapefruit bearing acreage experienced some fluctuations from 1980 to 1997 but has since decreased persistently. Tangerine and lemon bearing acreages are relatively stable. The decline in orange and grapefruit acreages should be of significant concern to growers, processors, and policy makers.

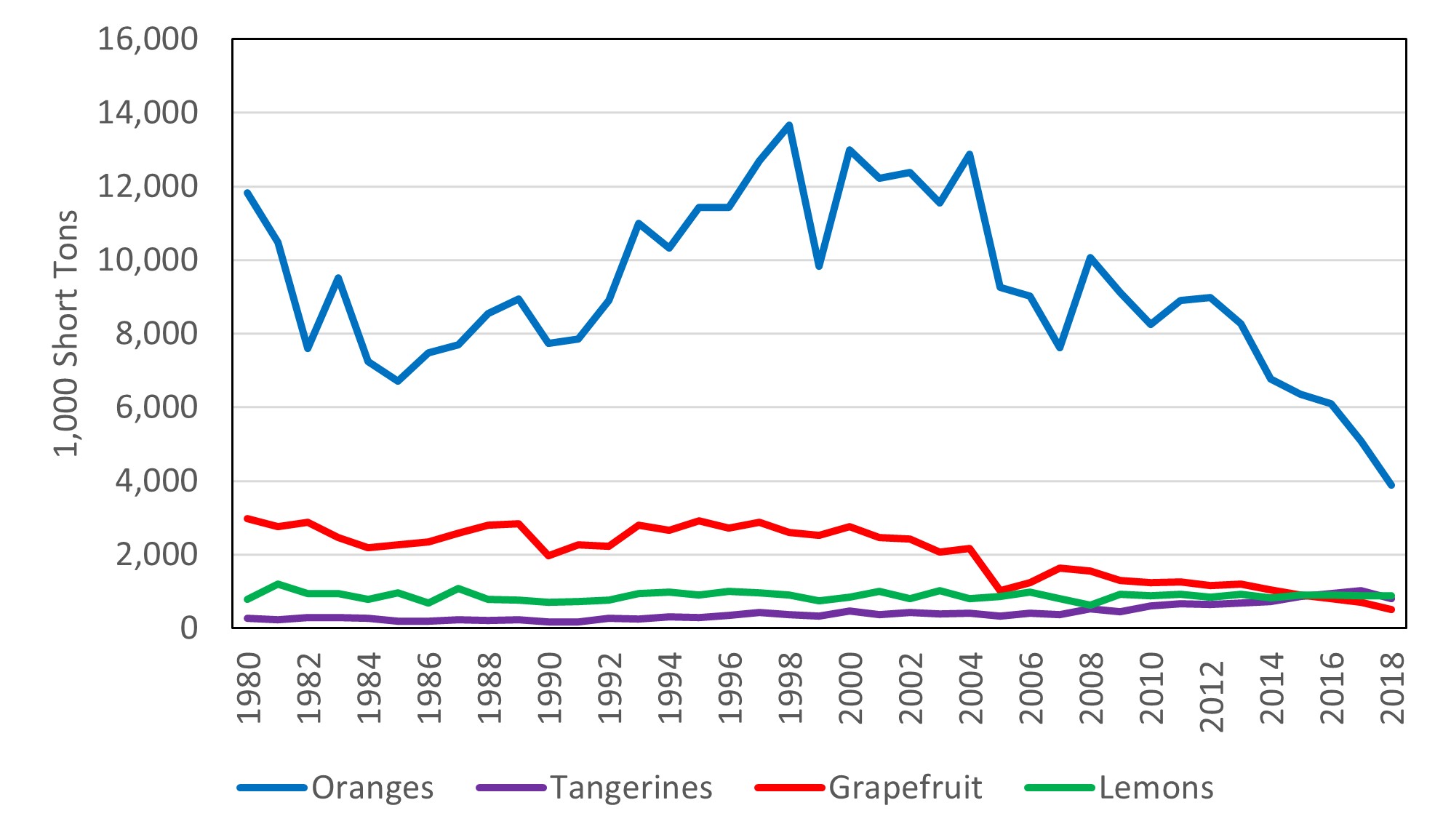

The trend in the volume of production for all four fruits follow the general pattern of the bearing acreages (Figure 2). However, production does exhibit greater year-to-year fluctuations, which could be attributed to the susceptibility of these fruits to frequent pest and disease outbreaks and weather problems. Flores-Gonzalez et al. (2019) note that the steep declines in production in 2005 and 2015 are due to the endemic presence of the citrus greening disease. Total citrus production has fallen precipitously by 65.3% from its peak in 1998. Orange and grapefruit lead the way, with declines of 71.6% and 80.4%, respectively. By contrast, tangerine production has steadily increased and surpassed grapefruit production. The increase in tangerine production is attributed to a shifting trend in consumers’ preference for fruits that are easier to peel, segmented, and seedless (Forsyth and Damiani, 2003).

Oranges are grown mostly in Florida and California, with Texas producing only about 2% of total production. The two major orange varieties grown in the United States are Valencia and navel. Florida is the major producer of Valencia oranges, at about 78% in term of value of production, while California accounts for about 20%. California is the leading producer of navel oranges, at about 65%, and Florida produces the remaining 33% (U.S. Department of Agriculture, 2020e). In Florida, more than 90% of Valencia and navel orange production is used for processing, and the remaining enter the fresh market (U.S. Department of Agriculture, 2019). By contrast, in California, about 80% of navel oranges and 74% of Valencia oranges are used for the fresh market, and the remaining are utilized for processing (U.S. Department of Agriculture, 2019). Though navel oranges are grown in the winter and Valencia in the summer, the growing seasons overlap some in the spring.

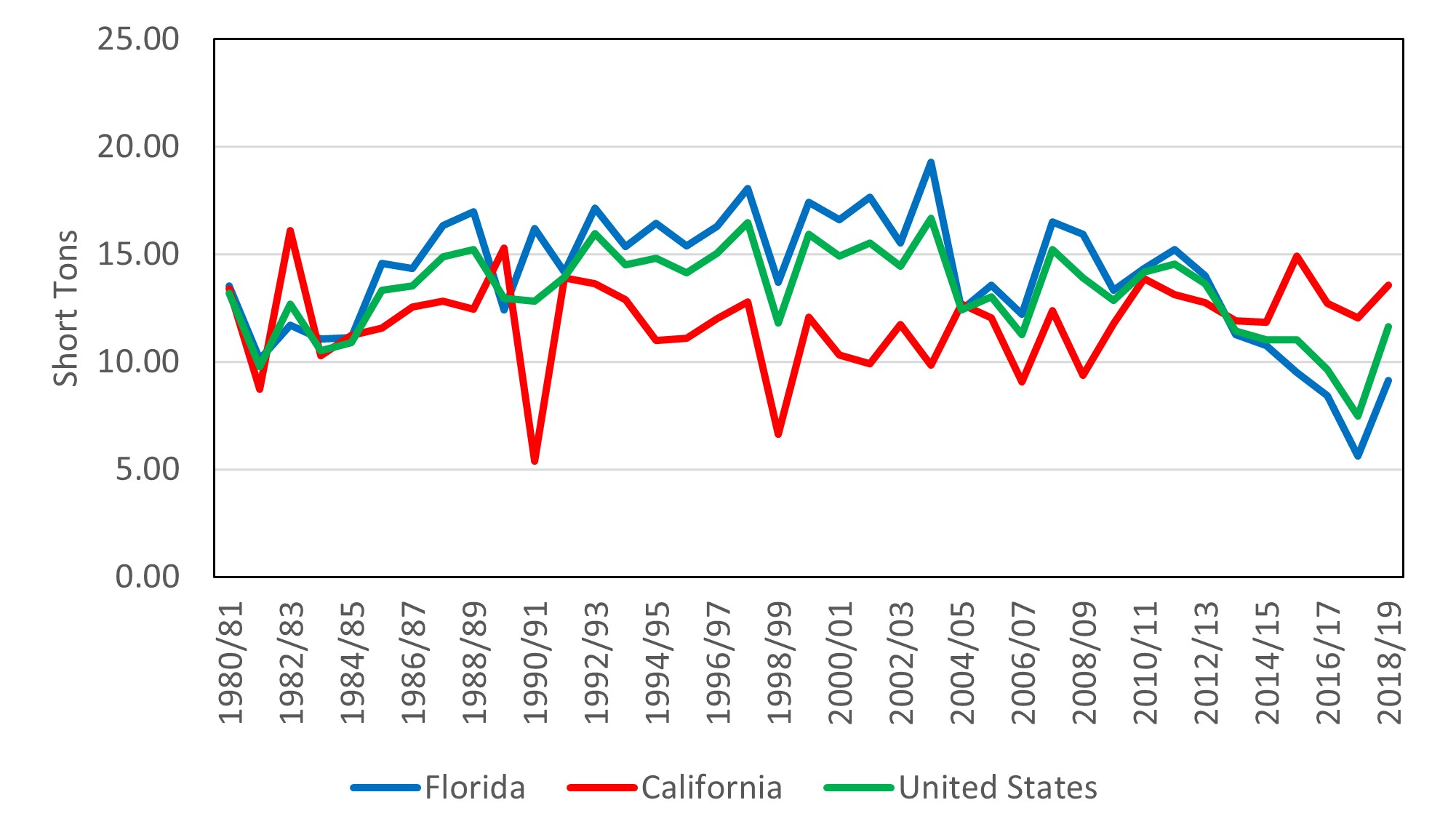

Florida orange yields are generally higher than those in California (Figure 3). However, since 2013/14, California’s yields have exceeded Florida’s because citrus canker and citrus greening diseases have drastically lowered yields in Florida. Further, yields in both states exhibit considerable fluctuations, which are largely attributable to winter freezes, pests, and diseases. The large drops in California’s yield in the 1990/91 and 1998/99 seasons are attributable to major freeze events that adversely impacted fruit and vegetable production alike (Brooks, 1991; Rural Migration News, 1999).

Costs of production differ between Florida and California. In Florida, the per acre cultural cost in 2015 for central Florida was $1,554.55, of which $953.33 was spent on materials, $390.34 on labor, and $180.88 on irrigation (Singerman, 2015). In California, the per acre cultural cost in 2015 for the San Joaquin Valley was $2,140, of which $1,172 was spent on customs and rental, $524 on materials, $392 on labor, and $52 on fuel, lubricants, and repairs (O’Connell et al., 2015). It is worth noting that categories included in the cultivation costs for Florida and California differ considerably and are therefore not directly comparable.

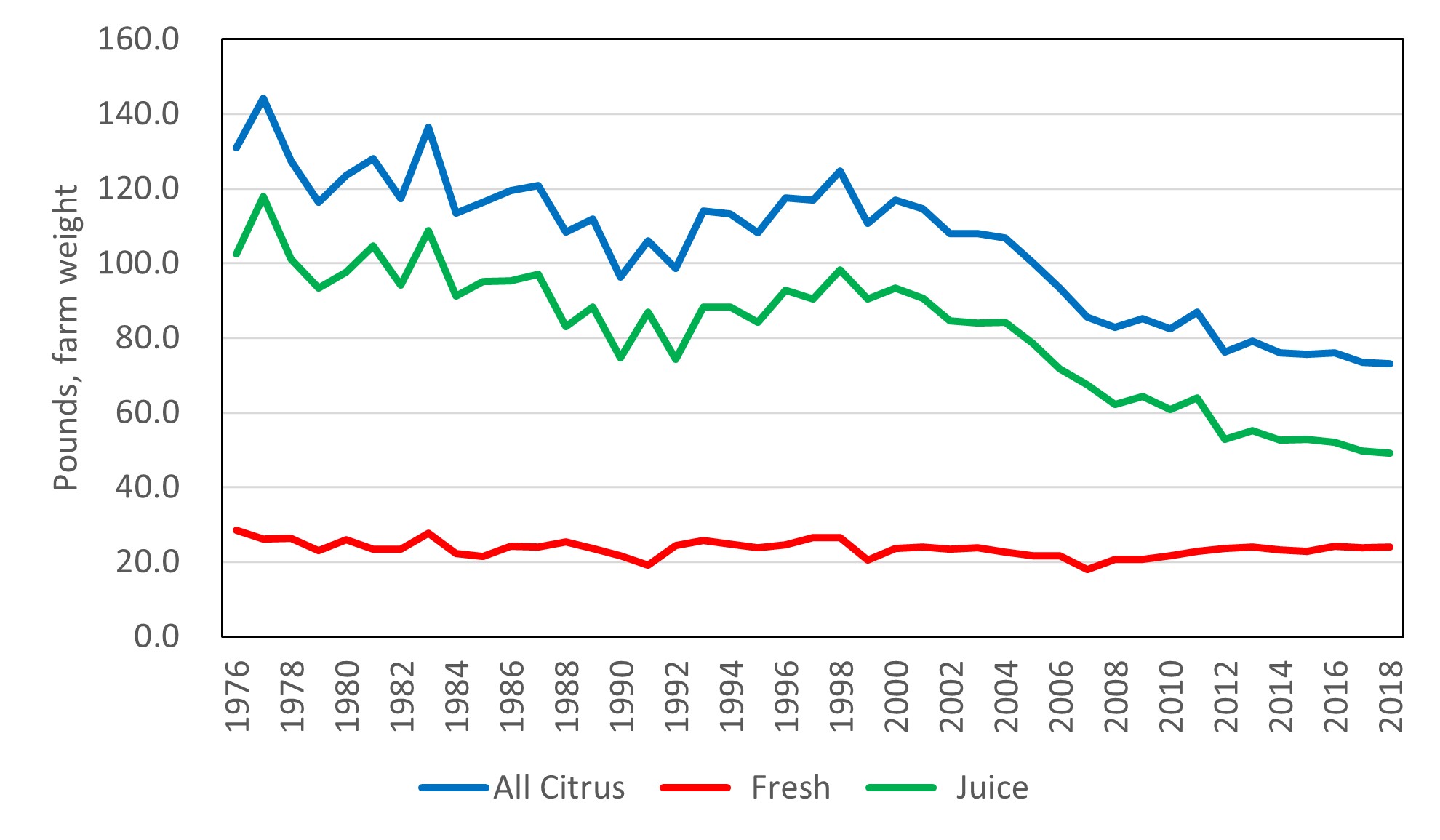

Figure 4 plots per capita consumption of all citrus fruits, both fresh and juice. U.S. consumers tend to consume considerably more juice than fresh fruits. However, in the last two decades, juice consumption has fallen steadily because of health concerns and due to more availability of substitute beverages such as energy drinks, flavored water, and exotic fruit-based drinks with low or no added sugar; by contrast, fresh consumption remained stable, with a slight positive trend in recent years (Fox, 2019). This trend generally holds for oranges and grapefruit; however, lemons and other citrus exhibit a positive trend both in fresh fruit and juice consumption (not plotted).

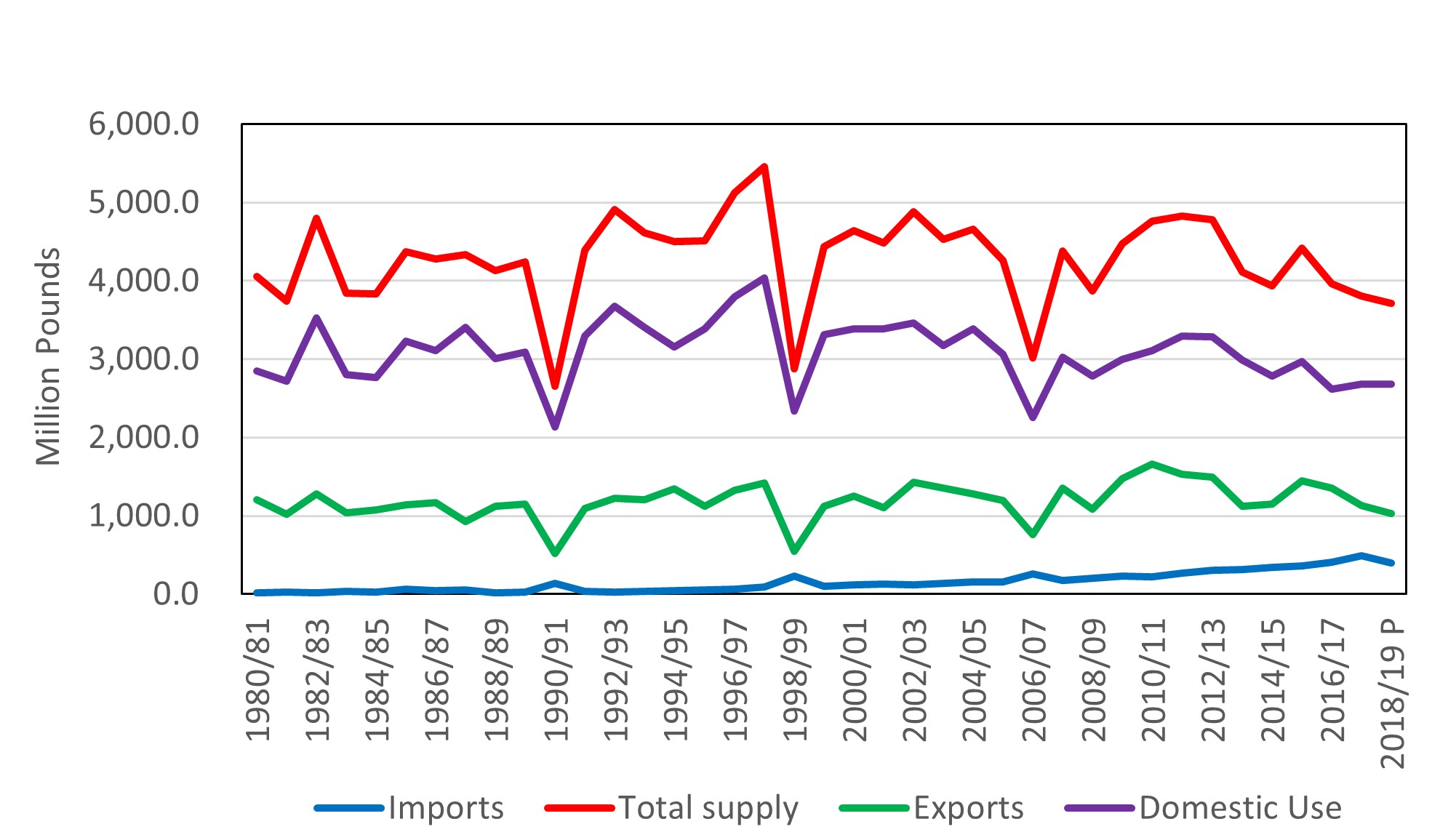

Figures 5 and 6 plot U.S. supply, utilization, and trade of fresh market oranges and orange juice, respectively. Because of seasonal differences, the United States both exports and imports fresh oranges. U.S. imports of oranges for fresh consumption are generally small but have increased over the last 10 years. These fresh orange imports come largely from Chile, South Africa, and Mexico (U.S. Department of Agriculture, 2020c). As pest and disease mitigation increases production costs, growers struggle to compete with imports, highlighting the competitive pressures that U.S. growers face with several other major foreign citrus producers. Total supply of fresh oranges, which consists of both domestic production and imports, fluctuates considerably. Domestic consumption and exports of oranges closely follow supply fluctuations. On average, 72% of supply goes to domestic consumption and the remaining 28% of supply is exported (U.S. Department of Agriculture, 2020b), with South Korea, Canada, Japan, and Hong Kong/China comprising the largest export destinations (U.S. Department of Agriculture, 2020c).

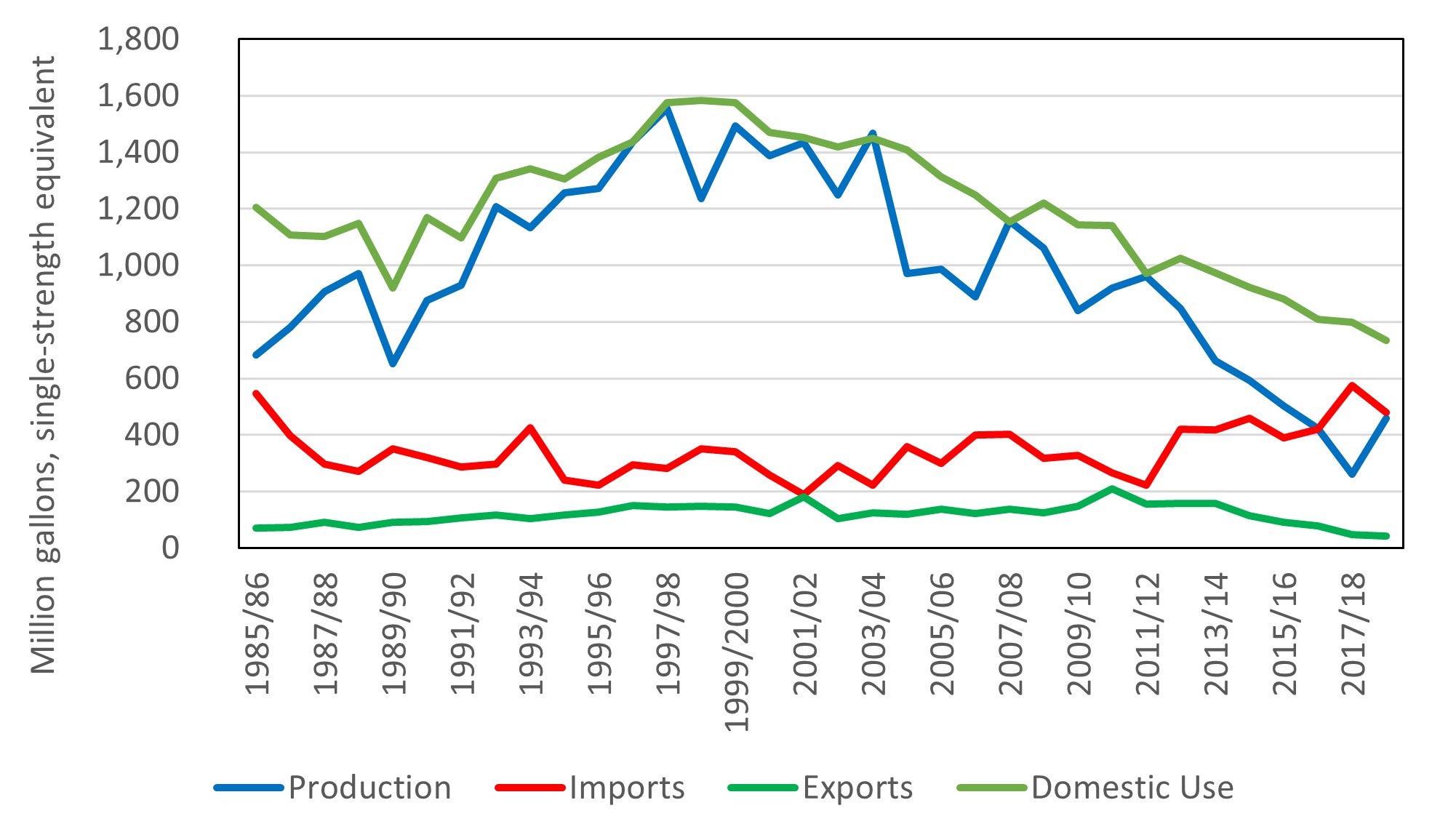

Juice production has steadily declined since 2000 (Figure 6), mirroring orange production (Figure 2). Domestic consumption of juice exceeds domestic production, and the excess demand is met by imports, primarily from Mexico and Brazil (U.S. Department of Agriculture, 2020c). Imports of concentrated juice from these countries are often blended with U.S. juice for domestic sales because of minimal product differentiation between regions. Increased imports of oranges and juice in the last 10 years highlight the import competition to U.S. producers as foreign suppliers fill in the gap of declining U.S. production. The United States exports a very limited amount of orange juice because of its high level of domestic consumption. Major export destinations for U.S. orange juice are Canada, South Korea, the European Union, and the Dominican Republic (U.S. Department of Agriculture, 2020c).

The United States is the leading consumer of orange juice, followed by Europe (Hart, 2004). The São Paulo region in Brazil is a major supplier of orange juice and, along with Mexican suppliers, competes for U.S. market share (Luckstead, Devadoss, and Mittelhammer, 2015). São Paulo is also the major supplier of orange juice to the European Union. Because only a few processors operate in São Paulo and Florida, they exert market power both in purchasing oranges and selling orange juice (Hart, 2004).

The orange juice markets in the United States and Europe are insulated through import tariffs. The U.S. tariff on orange juice imports is $0.2971 per single-strength gallon, and the European Union imposes an average ad valorem tariff of 20.36% (World Trade Organization, 2020). A reduction in the U.S. tariff would benefit U.S. consumers and São Paulo’s producers at the expense of U.S. producers (Dhamodharan, Devadoss, and Luckstead, 2016). By contrast, trade liberalization by the European Union would cause São Paulo processors to divert their exports from the United States to the European Union; consequently, Florida orange juice producers are likely to expand their market share in the United States (Luckstead, Devadoss, and Mittelhammer, 2015).

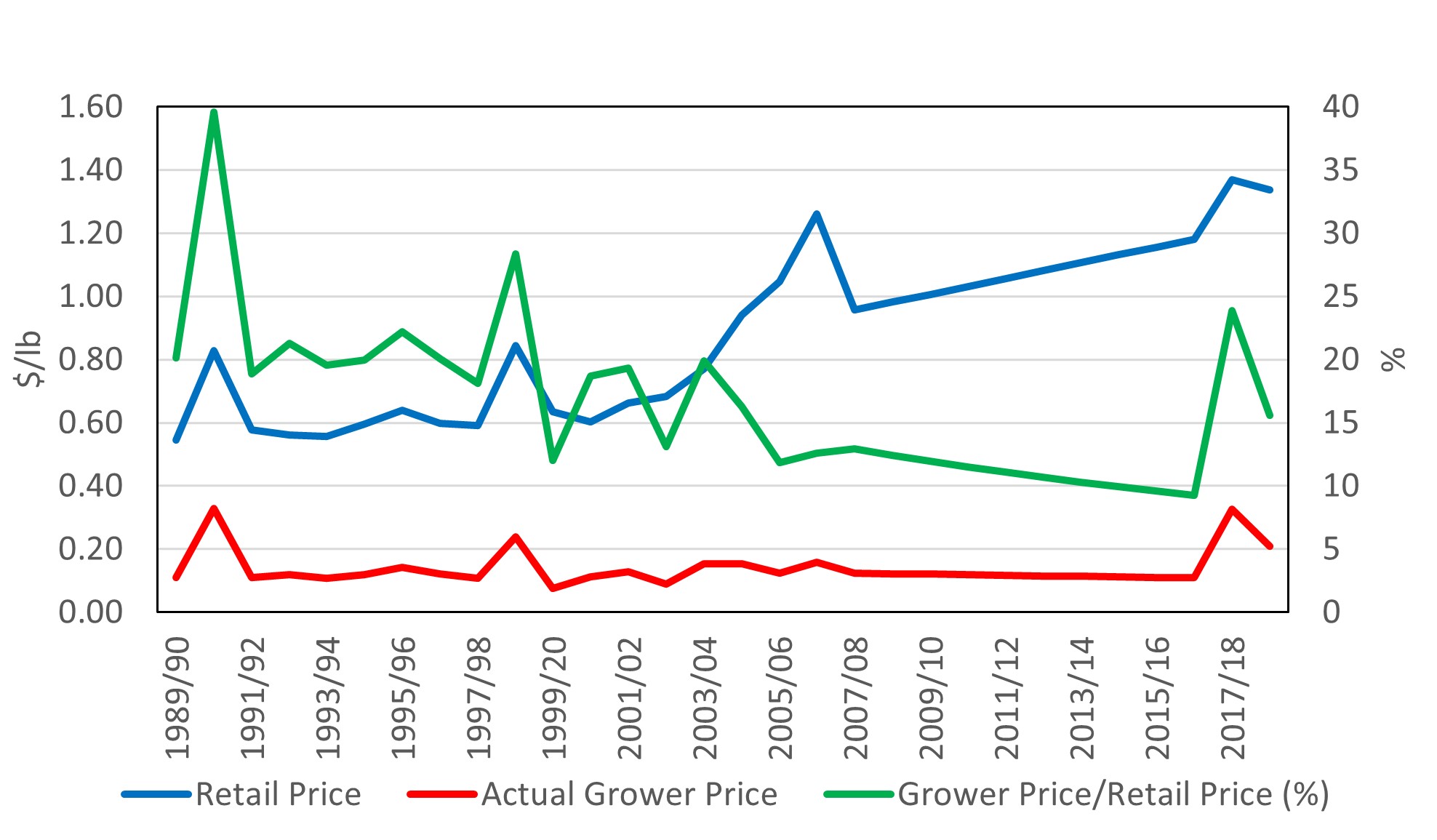

Figure 7 illustrates the trends in orange prices at the farm and retail level. Though grower prices are generally low and stable, retail prices exhibit considerable variation and a generally positive trend since 2000. Growers received an average of 20.80% of the retail price between the 1989/90 and 2002/03 seasons but only 13.10% since 2003/04. Further, increases in retail prices are not readily transmitted to growers. This can be seen between 2007/08 and 2016/17, when retail prices trended steadily upwards, but grower prices remained largely flat. This could be attributed to the fact that orange processors and buyers tend to exert oligopsony power in purchasing oranges from growers.

In summary, the steep downward trend in orange acreage and production have caused serious setbacks to the citrus industry as many growers and processors have exited the industry. This trend has provided more incentive for imports to enter the United States, further depressing the price received by growers.

While many common pests and diseases inflict damage to citrus trees, since the mid-2000s, the survival of the U.S. citrus industry has depended on the treatment of two exotic diseases: citrus greening and citrus canker.

Citrus greening, also commonly known as Huanglongbing (HLB) or yellow dragon disease, was first identified in the southern Chinese province of Guangdong in 1919 (Zhang, 2019). The Asian citrus psyllid vector and infected plant materials spread the bacterium Candidatus Liberibacter asiaticus, which causes the disease (U.S. Department of Agriculture, 2020a). HLB is one of the most destructive plant diseases to ever enter the United States. Common symptoms include stunted and sparsely foliated trees, premature defoliation, yellow shoots, dieback of twigs, splotchy mottling of leaves, and abnormally hard fruits (U.S. Department of Agriculture, 2020a). The fruits from infected trees taste bitter, have an unusual green color, and are not suitable for fresh consumption or processing.

This incurable and lethal disease affects all citrus fruits, and infected trees generally die within a few years. Consequently, HLB has wiped out millions of acres of citrus trees throughout the world. Citrus greening reached Florida in 2005, and rapidly infected most of the state’s citrus farms in a matter of three years, wreaking havoc and putting the iconic industry in peril (U.S. Department of Agriculture, 2020a). Though HLB has been detected in all citrus-growing U.S. states, it has not yet invaded commercial orchards in California (Zhang, 2019).

Because of the public-good nature of controlling this disease, degree of risk tolerance, and lack of coordinated policies, many citrus growers in Florida did not remove the infected trees, which resulted in rapid spread to most groves in Florida. As a result, citrus greening infected more than 90% of Florida’s citrus trees, which reduced production for the fresh market by 21% and for the juice market by 72% (Dala-Paula et al., 2019). This led to a loss of 30,000 jobs and $4.6 million in revenues (Court et al., 2017). As a result, about 5,000 out of 7,000 growers have exited the industry since 2004, and two-thirds of citrus processors have also closed their businesses (Fears, 2019). From 2003 to 2017, the number of packinghouses fell from 79 to 26 (Singerman, Burani-Arouca, and Futch, 2018).

To mitigate the impact and spread of this disease, some growers use a four-pronged mitigation strategy—plant bacteria-free saplings, remove infected trees, control psyllids, and manage nutrition—which triples the cost of production and yields only half as much fruit (Zhang, 2019). This makes it difficult for growers to compete with imported oranges. Given the pervasive spread of HLB in Florida, these mitigation strategies so widely used in China and Brazil have had limited effectiveness. In Jiangxi, China’s leading orange-producing province, 25% of crops in 2018 succumbed to this disease (Zhang, 2019). In Brazil, HLB destroyed 52.6 million of the country’s sweet orange trees, a third of the country’s total, between 2004 and 2019. If these two countries had not implemented the preventive measures, the destruction would have been more severe.

California growers and policy makers have been assessing the experience of Florida, China, and Brazil and taking preventative measures to avoid extensive destruction to citrus groves. California currently spends $40 million annually to implement mitigation strategies to control the disease’s spread (Zhang, 2019). Without such strategies, the U.S. citrus industry would be decimated, which would not only adversely impact growers and allied industries but also cause consumers to become heavily reliant on imports.

Though HLB is currently incurable, scientists have recently made progress toward a solution. A natural antimicrobial peptide developed from Australian fingerlimes, an exotic but close relative to oranges, shows great promise in killing the bacterium Candidatus Liberibacter asiaticus (Allen, 2020). The application of this antibiotic to infected trees improves HLB symptoms as new, healthy foliage growth occurs. The peptide acts as a vaccine against the disease in young trees. While this peptide will be environmentally safe, cost effective, and one of several other peptides under development, commercialization may still be several years away (Allen, 2020; Bernstein, 2020). Scientists have also turned to gene editing in recent years but have not yet found a solution (Zhang, 2019). Another bright spot in tackling this disease is the Sugar Belle® orange variety, which is known to be tolerant of citrus greening because the trees grow a healthy dose of new phloem after being infected (Deng et al., 2019).

Citrus canker is another highly contagious bacterial disease originating in Asia that infected U.S. citrus in the early part of the twentieth century. The symptoms of this disease include corky and scabby lesions on fruit, leaves, and twigs; branch dieback; and death of the tree in severe cases. Dark and water-soaked lines surround the lesions, and younger leaves are more susceptible to infection (University of California Agricultural and Natural Resources, 2020). Among citrus fruits, lime and grapefruit trees have been the worst hit by this disease. While the disease was initially eradicated in the United States, it resurfaced in the 1990s and is a continuing threat (Cooksey and Hoddle, 2020). Though citrus canker is commonly found in Australia, Brazil, Southeast Asia, and the southeastern part of the United States, it has not yet spread to California. The 1995 outbreak in Florida led to the removal of 16 million trees (Cooksey and Hoddle, 2020). However, legal challenges by residential owners of backyard trees between 1995 and 2004 stymied the tree eradication program carried out by the USDA and Florida Department of Agriculture and Consumer Services. Further, the 2004–2005 hurricane season caused the disease to spread rapidly throughout Florida’s citrus-growing regions (Irey et al. 2006); the USDA deemed complete eradication to be impossible and abandoned the tree removal program. Since all trees in the range of 260 acres surrounding a single infected tree have to be removed, the cure became worse than the disease for Florida citrus growers (Lowe, 2009). In all, 87,000 acres of citrus trees were destroyed; the government spent $600 million on eradication efforts and $700 million to compensate growers between 1995 and 2006 (Lowe, 2009).

With rampant spread of HLB and citrus canker, Florida growers have abandoned 64,000 acres of orange groves. Unfortunately, these abandoned groves have become enormous bastions of both diseases.

Winter freezes also cause extensive damage to citrus groves. Particularly, if citrus groves endure below-freezing temperature even for a short period of time, fruits and foliage are likely to be damaged. Freeze-hit fruits can drop from trees and rot on the ground. Temperatures below 28oF, even for a few hours, can be detrimental to fruit, and ice formation in citrus tissues affects both trees and fruits. Frozen, but not spoiled, fruits are often used for juice production.

U.S. citrus groves, unlike those in Brazil, are susceptible to winter freezes. In the 1980s, four winter freezes occurred in Florida: 1981, 1983, 1985, and 1989. The freezes in 1985 and 1989 were particularly severe, killing both young and mature trees across Florida (Florida Citrus Mutual, 2017). Winter freezes in 1997 (New York Times, 1997), 2010 (Fletcher, 2010), and 2012 (Josephs, 2012) also caused extensive crop damages. California citrus groves are also beset by winter freezes. Frosts in 1990 and 1998 caused extensive crop losses, and a deep freeze lasting more than seven days in December 2013 decimated California citrus groves (Gorman, 2013). A late-season freeze in February 2019 had a mild impact on California citrus crops (Fresh Fruit Portal, 2019).

While the persistent decline in orange production (see Figure 2) is the result of the two exotic diseases and more imports, the year-to-year variation in production is due to pests, diseases, and winter freezes. Research has been ongoing in developing cold-hardy citrus varieties to mitigate the winter-freeze losses (Inch et al., 2014).

Florida citrus growers adopted machine harvesting until the mid-2000s, but they stopped machine harvesting to minimize undue stress on infected trees following the devastation caused by citrus greening disease (Onel and Farnsworth, 2016). With much of the harvesting of citrus fruits done by hand, citrus growers have increasingly turned to H-2A workers to mitigate the problems associated with hiring undocumented workers due to aggressive enforcement of immigration policies and the dearth of domestic farmhands. The new E-Verify law that takes effect on January 1, 2021 will compound citrus producers’ labor woes (Lambert et al., 2020). Of the total guest workers employed in Floridan agriculture, 85% work in citrus groves (Luckstead and Devadoss, 2019). Simnitt, Onel, and Farnsworth (2017) observe that more than 80% of the citrus grove labor force is made up of guest workers. About 91% of citrus workers are from Mexico. This highlights the difficulty of growers to find alternate labor sources and the unwillingness of domestic workers to perform hard labor.

As the survey by Simnitt, Onel, and Farnsworth (2017) found, employers can help avoid labor shortages by ensuring good housing accommodations for guest workers, maintaining a positive working environment (by treating workers fairly and valuing their work), and paying workers in a timely manner.

The citrus industry has been experiencing hard times as production has been declining since the mid-1990s. As a result, many have gone out of business and exited the industry. Pests and disease and weather incidences seem to threaten the livelihood of citrus growers, particularly in Florida. California growers can learn from the problems that Florida growers are experiencing to safeguard their groves. Unless significant progress is made in research and development to control diseases such as citrus canker and citrus greening and develop freeze-hardy varieties, the U.S. citrus industry will continue its downward trend in production and succumb to foreign competition. To prevent this declining trend and reverse the course of falling acreage and production, continued support for research and development, removal of abandoned citrus groves, and support for growers that have been adversely affected by citrus greening are crucial.

Since progress in mechanization has slowed, growers depend heavily on workers. Labor shortages and high wage rates are serious problems that increase production costs and cut into citrus growers’ profits. As the number of undocumented and domestic workers in the citrus industry has sharply declined, growers now mainly rely on guest workers. Consequently, growers must adapt to worker shortages, rising wages, and the high cost of guest workers. Growers should be aware of evolving immigration policies and proactive in addressing labor-supply issues.

Citrus growers also face intense competition from imports from foreign countries, where the cost of production is considerably lower than in the United States. This makes it even more imperative for U.S. growers to innovate by developing varieties that are pest and disease resistant and cold hardy so that growers can effectively implement mechanized harvesting methods.

Allen, G. 2020, July 27. “Exotic Australian Fruit May Help Save Florida's Citrus Industry.” NPR. Available online: https://www.npr.org/2020/07/27/895775625/exotic-australian-fruit-may-help-save-floridas-citrus-industry.

Bernstein, J. 2020, July 7. “UC Riverside Discovers First Effective Treatment for Citrus-Destroying Disease.” UC Riverside News. Available online: https://news.ucr.edu/articles/2020/07/07/uc-riverside-discovers-first-effective-treatment-citrus-destroying-disease.

Brooks, N.R. 1991, January 6. “Agriculture: Despite Heavy Damages from Drought and Cold, 1990 State Farm Revenues Are Expected to Show an Increase.” Los Angeles Times. Available online: https://www.latimes.com/archives/la-xpm-1991-01-06-fi-10871-story.html.

Brown, M.G., T.H. Spreen, and J.Y. Lee. 2004. “Impacts on U.S. Prices of Reducing Orange Juice Tariffs in Major World Markets.” Journal of Food Distribution Research 35: 26–33.

Cooksey, D., and M. Hoddle. 2020. Asiatic Citrus Canker. Riverside, CA: University of California Riverside, Center for Invasive Species Research. Available online: https://cisr.ucr.edu/invasive-species/asiatic-citrus-canker.

Court, D.C., A.W. Hodges, M. Rahmani, and T.H. Spreen. 2017. Economic Contributions of the Florida Citrus Industry in 2015-16. Gainesville, FL: University of Florida, Food and Resource Economics Department, Economic Impact Analysis Program.

Dala-Paula, B.M., A. Plotto, J. Bai, J.A. Manthey, E.A. Baldwin, R.S. Ferrarezi, and M.B.A. Gloria. 2019. “Effect of Huanglongbing or Greening Disease on Orange Juice Quality, a Review.” Frontiers in Plant Science 9: 1976.

Deng, H., D.S. Achor, E. Exteberria, Q. Yu, D. Du, D. Stanton, G. Liang, and F.G. Gmitter. 2019. “Phloem Regeneration Is a Mechanism for Huanglongbing-Tolerance of ‘Bearss’ Lemon and ‘LB8-9’ Sugar Belle® Mandarin.” Frontiers in Plant Science 10: 277.

Dhamodharan, M., S. Devadoss, and J. Luckstead. 2016. “Imperfect Competition, Trade Policies, and Technological Changes in the Orange Juice Market.” Journal of Agricultural and Resource Economics 41(2): 189–203.

Fears, D. 2019, November 9. “The End of Florida Orange Juice? a Lethal Disease Is Devastating the State’s Citrus Industry.” The Washington Post.

Fletcher, P. 2010, December 28. “Cold Snap Freezes Florida Citrus.” Reuters. Available online: https://www.reuters.com/article/us-florida-citrus-freeze/cold-snap-freezes-florida-citrus-idUSTRE6BR1J620101228.

Flores-Gonzalez, M., P.S. Hosmani, N. Fernandez-Pozo, M. Mann, J.L. Humann, D. Main, M. Heck, S. Brown, L.A. Mueller, and S. Saha. 2019. “Citrusgreening.Org: An Open Access and Integrated Systems Biology Portal for the Huanglongbing (HLB) Disease Complex.” bioRxiv: 868364.

Florida Citrus Mutual. 2017. “Timeline of Major Florida Freezes.” Florida Citrus Mutual. Available online: http://flcitrusmutual.com/render.aspx?p=/industry-issues/weather/freeze_timeline.aspx.

Forsyth, J., and J. Damiani. 2003. “Citrus Fruits: Types on the Market.” In B. Caballero, ed. Encyclopedia of Food Sciences and Nutrition, 2nd ed. Address:Oxford. Academic Press, pp. 1329–1335.

Fox, J. 2019, September 27. “The Fall of Juice and the Rise of Fresh Fruit.” Bloomberg. Available online: https://www.bloomberg.com/opinion/articles/2019-09-27/american-shoppers-spurn-orange-juice-for-for-fresh-fruit.

Fresh Fruit Portal. 2019. “US: Freezing Temperatures could Decrease California Citrus Crop in 2018-19.” Fresh Fruit Portal. Available online: https://www.freshfruitportal.com/news/2018/02/21/u-s-freezing-temperatures-decrease-california-citrus-crop-2018-19/.

Gorman, S. 2013, December 12 “Deep Freeze Damages California Citrus Crop.” Reuters. Available online: https://www.reuters.com/article/usa-citrus-california/deep-freeze-damages-california-citrus-crop-idUSL1N0JR01X20131212.

Hart, E. 2004. “The U.S. Orange Juice Tariff and the “Brazilian Invasion” of Florida: The Effect of Florida’s Brazil-Based Processors on the Political Debate over the U.S. Orange Juice Tariff.” Ph.D. thesis, Tufts University, Fletcher School of Law and Diplomacy.

Inch, S., E. Stover, R. Driggers, and R.F. Lee. 2014. “Freeze Response of Citrus and Citrus-Related Genotypes in a Florida Field Planting.” HortScience 49(8): 1010–1016.

Irey, M., T.R. Gottwald, J.H. Graham, T.D. Riley, and G. Carlton. 2006. “Post-Hurricane Analysis of Citrus Canker Spread and Progress Towards the Development of a Predictive Model to Estimate Disease Spread Due to Catastrophic Weather Events.” Plant Health Progress 7(1).

Jegede, A. 2019, January 1. “Top 10 Largest Citrus Producing Countries in the World.” Daily Records. Available online: http://www.thedailyrecords.com/2018-2019-2020-2021/world-famous-top-10-list/world/largest-citrus-producing-countries-world-statistics-states/6867/.

Josephs, L. 2012, January 5. “Cold Snap Heats Up Orange Juice Futures.” Wall Street Journal.

Lambert, J.B., S.G. Hanagan, and M.M. Snowden. 2020, July 6. “Florida’s New Mandatory E-Verify Law.” Jackson Lewis. Available online: https://www.jacksonlewis.com/publication/florida-s-new-mandatory-e-verify-law.

Lowe, D. 2009. Current Situation, Management and Economic Impact of Citrus Canker in Florida. Washington, DC: U.S. Department of Agriculture, Animal and Plant Health Inspection Service. Available online: http://www.calcitrusquality.org/wp-content/uploads/2009/05/current-situation2.pdf.

Luckstead, J., and S. Devadoss. 2019. “The Importance of H-2A Guest Workers in Agriculture.” Choices 34(1).

Luckstead, J., S. Devadoss, and R.C. Mittelhammer. 2015. “Imperfect Competition between Florida and São Paulo (Brazil) Orange Juice Producers in the U.S. and European Markets.” Journal of Agricultural and Resource Economics 40(1): 164–178

New York Times. 1997, January 24. “Worst Freeze in Years Ruins Florida Crops.” New York Times. Available online: https://www.nytimes.com/1997/01/24/us/worst-freeze-in-years-ruins-florida-crops.html.

O’Connell, N., C.E. Kallsen, K.M. Klonsky, and K.P. Tumber. 2015. “Sample Costs to Stablish an Orange Orchard and Produce Oranges: Navels & Valencias.” University of California Cooperative Extension.

Onel, G., and D. Farnsworth. 2016. Guest Workers: Past, Present and the Future. Gainesville, FL: University of Florida, UF/IFAS Citrus Extension, Citrus Extension Trade Journals, Technical Report.

Porter, M.E., and M. Sakakibara. 2004. “Competition in Japan.” Journal of Economic Perspectives 18(1): 27–50.

Simnitt, S., G. Onel, and D. Farnsworth. 2017, September. “Retaining High-Skilled Harvest Workers.” Citrus Industry, 16-18.

Singerman, A., 2015. “Cost of Production for Processed Oranges Grown in Southwest Florida, 2015/16.” Gainsville, FL: University of Florida, IFAS Extension.

Singerman, A., M. Burani-Arouca, and S. Futch. 2018. “The Profitability of New Citrus Plantings in Florida in the Era of HLB.” Hortscience 53(11): 1655–1663.

Rural Migration News. 1999. “California: Citrus Freeze Effects.” Rural Migration News 5(2). Available online: https://migration.ucdavis.edu/rmn/more.php?id=354.

University of California Agricultural and Natural Resources. 2020. Citrus Diseases and Disorders of Leaves and Twigs. University of California Agricultural and Natural Resources, Statewide Integrated Pest Management Program. Available online: http://ipm.ucanr.edu/PMG/C107/m107bpleaftwigdis.html.

U.S. Department of Agriculture. 2019. Citrus Fruits 2019 Summary. Washington, DC: U.S. Department of Agriculture, National Agricultural Statistics Service. Available online: https://www.nass.usda.gov/Publications/Todays_Reports/reports/cfrt0819.pdf.

U.S. Department of Agriculture. 2020a. Citrus Greening. Washington, DC: U.S. Department of Agriculture, Animal and Plant Health Inspection Service. Available online: https://www.aphis.usda.gov/aphis/resources/pests-diseases/hungry-pests/the-threat/citrus-greening/citrus-greening-hp.

U.S. Department of Agriculture. 2020b. Fruit and Tree Nut Yearbook Tables. Washington, DC: U.S. Department of Agriculture, Economic Research Service. Available online: https://www.ers.usda.gov/data-products/fruit-and-tree-nut-data/fruit-and-tree-nut-yearbook-tables/.

U.S. Department of Agriculture. 2020c. Global Agricultural Trade System. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/gats/default.aspx.

U.S. Department of Agriculture. 2020d. Quick Stats. Washington, DC: U.S. Department of Agriculture, National Agricultural Statistics Service. Available online: https://quickstats.nass.usda.gov/.

World Trade Organization. 2020. Tariff Analysis Online: HS Subheading Duties. Available online: http://tao.wto.org/report/TariffLinesHS6.aspx.

Zhang, C. 2019. “Citrus Greening Is Killing the World’s Orange Trees. Scientists Are Racing to Help.” Chemical and Engineering News 97(23). Available online: https://cen.acs.org/biological-chemistry/biochemistry/Citrus-greening-killing-worlds-orange/97/i23.