E-commerce refers to the use of the Internet to market, buy and sell goods and services, exchange information, and create and maintain web-based relationships between participant entities (Fruhling and Digman, 2000). Based on its demonstrated impact in industrial retail markets (Elia, Lefebvre, and Lefebvre 2007), e-commerce is believed to have the potential to increase profitability in agricultural markets by increasing sales and decreasing search and transactions costs. The creation of electronic markets that are expected to be more transparent and competitive than physical markets may attract more consumers by increasing demand and improving the firm’s strategic position with customers seeking specific niche products or having geographical restrictions (Batte and Ernst, 2007; and Montealegre, Thompson and Eales, 2007). However, due to the relatively new state of e-commerce in agriculture, its impact has not been widely measured and documented. We developed an evaluation framework and applied it to measuring the performance of the agricultural e-commerce platform MarketMaker. The analysis focuses on the impact of MarketMaker on producers and farmers’ markets and consists of both the perceived impacts based on survey responses and a willingness–to-pay analysis, as well as the examination of factors that affect the impacts of the website. Our findings provide guidance for future development of agricultural e-commerce-enabling platforms like MarketMaker, as well as future evaluation efforts of these platforms.

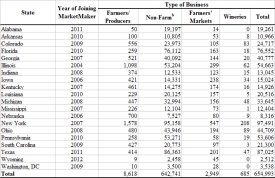

MarketMaker is an interactive e-commerce platform that provides food marketing information to food entrepreneurs—agricultural producers, buyers, processors, wholesalers, food retailers, restaurants—and their customers. The site was created in 2000 by a team of University of Illinois Extension personnel with the goal of building an electronic infrastructure that would easily connect Illinois food producing farmers with economically viable new markets. In 2005, a multi-state partnership of land grant institutions and agriculturally focused organizations was formed to build a national network of interconnected MarketMaker sites. By December 2012, 19 states and the District of Columbia became part of the national network (Table 1). The site currently includes nearly 660,000 profiles of food-related enterprises including 8,618 agricultural producers and experiences about 1 million hits per month from over 85,000 users. The original MarketMaker project was funded by the Illinois Council on Food and Agricultural Research and the Illinois Department of Agriculture. As other states have joined the MarketMaker network, funding has typically come from state departments of agriculture and land grant universities along with other sources such as Sea Grant.

MarketMaker provides information about product availability by geographic location and market orientation to help inform decisions of both producers and consumers. As an electronic farm directory/food marketing tool, MarketMaker directly competes with other websites such as Local Harvest, Eat Well Guide, Rural Bounty, Local Farm Link, Chef Collaborative, Agricultural Business, Green People, Pick Your Own, various state locally grown promotion websites, Farm Bureau, local food directories supported by a host of local organizations, and directories provided by state departments of agriculture. Different from some food marketing websites, such as Local Harvest, MarketMaker does not have a selling feature, meaning that users cannot purchase products directly through the website. In contrast to farm directory websites, such as Rural Bounty, Chef Collaborative, Agricultural Business, and Pick Your Own, MarketMaker provides the benefit of displaying the information about food producers/retail outlets on a map. Moreover, MarketMaker provides the ability to map consumer data related to several demographic characteristics. Thus, for farmers, it provides information to help better target markets and identify potential businesses with which to collaborate. For consumers—households, processors, handlers, retailers, and wholesalers—MarketMaker provides information to help make decisions about where to purchase products or to identify business-to-business opportunities all along the supply chain.

Previous studies that looked at several aspects of MarketMaker performance reported that 63% of Ohio registered users including producers, farmers’ markets, and wineries believed that the MarketMaker site was helping keep more food dollars in the regional economy (Fox, 2009). Cho and Tobias (2009) found that the average increase in annual sales attributed to MarketMaker among 374 New York farmers was between $225 and $790. Additionally, 12% of the respondents reported receiving marketing contacts through MarketMaker and using the MarketMaker directory to contact other food industry business partners.

In order to more clearly understand how an e-commerce platform such as MarketMaker can produce useful results, one must consider more than the platform itself. A useful way to analyze the components of a complex program such as MarketMaker is to develop logic models which demonstrate the links between inputs, activities, outputs and outcomes of a program. Logic models also facilitate the identification of relevant evaluation measures and are frequently used as project planning and evaluation tools (W.K. Kellogg Foundation, 2004). Therefore, logic models were developed for each of the major identified MarketMaker user groups (Lamie et al., 2011): producers, consumers, food retailers, food wholesalers, restaurants/chefs, and farmers markets. However, given funding constraints, only producers and farmers’ markets were included in the current evaluation effort. Results from a survey of MarketMaker administrators and partners identified producers and farmers’ markets among the primary users of the website. Farmers’ markets were also included due to their growing importance as an alternative food distribution system connecting producers and consumers.

The logic model for producers is presented in Figure 1. The inputs on the national and state levels of MarketMaker include human resources; adequate technological expertise to support program requirements; funds to support planned activities—training, promotion, and networking; and availability of related public and private data such as the National Census and survey data from independent studies. These inputs are used to conduct a series of activities such as developing, updating and improving content, and usability and functionality of the platform. MarketMaker purchases, gathers, manages, and distributes relevant existing data such as consumers’ socio-demographic characteristics. MarketMaker also conducts training and promotional sessions at national, state, and regional levels in order to create awareness and prepare producers to successfully participate in MarketMaker. The adequate combination of inputs and activities leads to accomplishing the desired outputs, which include the complete MarketMaker website as well as the registration and participation of new producers in the MarketMaker program.

The outcomes of the platform, which we believe should be the main focus of the evaluation efforts, can be classified as short-, intermediate-, and long-term. In the case of MarketMaker, short-term outcomes comprise the creation of an initial web presence for some producers, additional web presence for others, and active participation in the site. In the intermediate-term, producers should be easily identified by wholesalers, retailers, and other consumers who choose to use MarketMaker. In the long-term, MarketMaker portends to assist producers to increase profitability as a result of reduced marketing transaction costs and increased revenues via increased purchases from new and existing customers. The tested logic model outcomes can be used to identify quantifiable metrics. For example, the time and other resources a business devotes to the management of MarketMaker can be used as measures of short-term outcomes. The number of new contacts and new customers can be used as metrics of intermediate-term outcomes. The changes in total sales and marketing costs or changes in profits can be used as metrics for long-term outcomes of the platform. We followed a similar approach for the development of the logic model for the farmers’ markets segment of users and the subsequent identification of quantifiable evaluation metrics.

The data on the metrics describing the impact of MarketMaker on producers was collected through a survey that was distributed by email and postal mail to 4,264 producers registered on MarketMaker between April 2011 and March 2012. The farmers’ market managers’ survey was distributed by email to 1,295 managers registered on MarketMaker websites (May–June 2011). Both surveys were distributed in all 15 participating (as of 2010) states: Arkansas, Colorado, Florida, Georgia, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Nebraska, New York, Ohio, South Carolina, and Washington D.C. The response rates were 18% for producer survey and 10.2% for farmers’ market managers' survey.

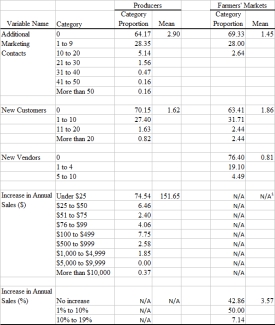

Survey results (discussed in more detail in Zapata et al., 2011; and Carpio et al., 2013) indicate that the perceived impact of MarketMaker on producers and farmers’ markets outcomes are presently relatively modest (Table 2). As a result of their participation with MarketMaker, producers have received an average of 2.9 new marketing contacts, and have gained an average of 1.6 new customers. Additionally, MarketMaker has assisted producers in increasing their annual sales by an average of $152. Nearly 87% of producers registered in MarketMaker participate in direct marketing to individual consumers and wholesale buyers. MarketMaker has helped these producers receive an average of 2.9 new marketing contacts and increase their annual direct sales to individual consumers by 1.1% and to wholesale buyers by 0.8% on average. Our findings for farmers’ markets indicate that, as a result of their participation with MarketMaker, managers have been contacted, on average, about 1.6 times by customers and vendors, and obtained an average of 0.8 new vendors and 1.9 new customers. The average annual increase in sales due to participation in MarketMaker was estimated at about 3.6%, or $4,889 per farmers’ market.

These reported averages, however, mask substantial variability across survey respondents. We found that the perceived impacts of MarketMaker on producers tend to be positively related to self-registration in MarketMaker, the amount of time since registering on the site, and the amount of time users spend on MarketMaker activities. In fact, producers who registered themselves on the MarketMaker website (83% of respondents) have received, on average, almost twice as many additional contacts and customers than those who were registered by someone else or do not know how they were enrolled in MarketMaker. Registration by others can occur if an existing list of producers—usually the one maintained by a state department of agriculture—is used to populate the MarketMaker database. Self-registered users are very likely to be more aware of their business presence on the site which facilitates the attribution of additional contacts and sales to it. It is also possible that the quality of the information provided by self-registered producers is more accurate and up to date.

Producers who spend between 30 and 60 minutes per month (12% of sample) on the MarketMaker website have an average annual sales increase of $242 compared to only $32 for those users who spend less than 30 minutes a month (83% of the sample) on MarketMaker-related activities. The most used site features include “logging on to check or update profile,” “searching for products,” and “searching for buyers and sales opportunities.” Less commonly used features include “searching for business partnerships,” “using of the buy/sell Forum,” and “finding target market for your products.” These findings about farmers’ registration and use intensity suggest that more education and promotion of MarketMaker is needed to encourage self-registration and more active use of MarketMaker to achieve the desired benefits from participation.

Our analysis of factors that affect the increase in farmers’ markets sales due to MarketMaker revealed the components needed for more successful use of MarketMaker by the farmers’ markets, namely, the established MarketMaker program, the established farmers’ market, and the active user-manager. Thus, the track record in the states with a longer presence on MarketMaker demonstrates the program’s potential for new users. The fact that more established farmers’ markets are able to achieve higher increases in sales than the new ones suggests that MarketMaker is possibly more effective in expanding existing markets rather than helping create new capacity. Finally, higher sales among more active users indicates that, in order to see the impact of MarketMaker on their operations, users have to invest time and effort in making the program work for them.

Since the long-term MarketMaker outcome for producers is an increase in profitability, we also asked producers the following hypothetical question regarding their willingness to pay for the services provided by MarketMaker: “If MarketMaker becomes privately funded, while retaining all the features and services it currently provides, would you be willing to pay an annual participation fee of $X for the services you receive from MarketMaker?” (Carpio et al., 2013). The willingness to pay (WTP) measure derived from the question is directly related to the increase in profits obtained from using the site (Zapata, 2012; and Hudson and Hite, 2003). The survey results indicate that, on average, producers are willing to pay $47.02 annually for the services they receive from MarketMaker. Willingness to pay analysis for the subsample of farmers’ markets revealed that managers are willing to pay an average of $41.19 annually for the services provided by MarketMaker. Theoretically, this value reflects the value users assign to the entire basket of MarketMaker services. The estimated mean WTP for farmers’ markets comprised about 1% of their perceived increase in sales estimated in this study.

Our findings indicate that registration type, time registered on MarketMaker, time devoted to the website, type of user, the number of marketing contacts received, and firm total annual sales have a significant effect on producers’ WTP for the services provided by MarketMaker. Thus, the effectiveness of MarketMaker is strongly linked with how it is used by producers after registration. For example, WTP is positively related to the time devoted to MarketMaker activities after registration. The positive relationship between the time producers have been registered on the site and the stated WTP implies that the benefits associated with MarketMaker tend to increase over time. Results of this research also indicate that additional marketing contacts increase producer WTP. Hence, with the aim to increase the number of marketing contacts received, MarketMaker website development should focus on encouraging producers to frequently update their site profiles, specifically their contact information—phone number, email, website URL—and products’ attributes and availability. Ultimately, these findings provide valuable information for current and potential users trying to better understand the expected costs and returns from a wide range of marketing, promotion, and other competing e-commerce activities.

The systemic approach to MarketMaker evaluation undertaken in this study offers several important lessons for future development and evaluation of e-commerce in agriculture.

MarketMaker and similar sites offer a way for businesses to gain inexpensive initial web presence, allowing them to be “known” to the rest of the world. MarketMaker differentiates itself form other websites because of its ability to map consumer and producer-related data. The platform has been supported by the land grant Cooperative Extension programs in participating states, as well as other state public and private agricultural organizations. The long-term potential benefits of MarketMaker to producers, farmers’ markets, and other user groups are now beginning to become evident. But, it is too soon to tell just how extensive these impacts will be. Much depends on the continued commitment of the program partners—and the users themselves—to turn this latent potential into realized net benefits. Perhaps the frameworks and initial analyses created under the scope of this study will help facilitate the execution of appropriate actions necessary by all parties, working in unison, to derive these benefits.

Since its creation in 2000, MarketMaker has offered its electronic infrastructure and resources to registered users at no cost. Federal and state governments have provided most of the funding for the initial platform development and maintenance. Public investment in this “cyber-infrastructure” project can be justified if some benefits also accrue to the public through increased access to a more efficient, transparent, and robust food supply chain. However, in this era of fiscal austerity, this financing model may not be sustainable. If this project were fully privately funded by an individual food supply business, it is possible that consumer acceptance and producer participation would be thwarted. Funding through a collection of associations, and public-private or non-profit public benefit-oriented groups that represent private interests is a possible alternative, so long as these groups represent a broad cross-section of food supply chain businesses and possibly even consumers. For certain, potential funders should fully recognize that substantial in-kind financial and other support has come from state-level institutions including (e.g., land grant universities, departments of agriculture). Involvement of these organizations has facilitated the connection of the platform with producers and consumers which might be harder to achieve for a private organization.

Batte, M.T., and Ernst, S. (2007). Net gains from net purchases? Farmers’ preferences for online and local input purchases. Agricultural and Resource Economics Review, 36(1), 84–94.

Carpio, C.E., Isengildina-Massa, O., Lamie, R.D., and Zapata, S.D. (2013). Implementation of an evaluation framework for the MarketMaker national network. Final report to U.S. Department of Agriculture FSMIP program. Available online: Available online: http://www.ams.usda.gov/AMSv1.0/getfile?dDocName=STELPRDC5104566&acct=gpfsmip

Cho, K.M., and Tobias, D.J. (2009). Impact assessment of direct marketing of small- and mid-sized producers through food industry electronic infrastructure MarketMaker. Paper presented at the National MarketMaker Annual Partnership Meeting, Broomfield, CO.

Elia, E., Lefebvre, L.A., and Lefebvre, E. (2007). Focus of B-to-B e-commerce initiatives and related benefits in manufacturing small- and medium-sized enterprises. Information Systems and E-Business Management, 5(1), 1-23.

Fox, J.L. (2009). Exploring and improving marketing practices and regional market access for Ohio’s food producing farmers. Paper presented at the National MarketMaker Annual Partnership Meeting. Broomfield, CO.

Fruhling, A.L., and Digman, L.A. (2000). The impact of electronic commerce on business-level strategies. Journal of Electronic Commerce Research, 1(1), 13-22.

Hudson, D., and Hite, H. (2003). Producer willingness to pay for precision application technology: implications for government and the technology industry. Canadian Journal of Agricultural Economics, 51: 39–53.

Lamie, R. D., Isengildina-Massa, O., Carpio, C.E., and Zapata, S.D. (2011). Evaluating MarketMaker: Analyzing the impact of an electronic food marketing network and its capacity to improve efficient market access for small to midsized farmers and food entrepreneurs. Final report to U.S. Department of Agriculture FSMIP program. Available online: http://www.ams.usda.gov/AMSv1.0/getfile?dDocName=STELPRDC5092120

Montealegre, F., Thompson, S., and Eales, J.S. (2007). An empirical analysis of the determinants of success of food and agribusiness e-commerce firms. International Food and Agribusiness Management Review, 10(1), 61-81.

W.K. Kellogg Foundation. (2004). Using logic models to bring together planning, evaluation, and action: Logic model development guide. Available online: http://www.wkkf.org/knowledge-center/resources/2006/02/WK-Kellogg-Foundation-Logic-Model-Development-Guide.aspx.

Zapata, S.D. (2012). The theoretical structure of producer willingness to pay estimates. In Three essays on contingent valuation. Ph.D. dissertation. Clemson University.

Zapata, S.D., Carpio, C.E., Isengildina-Massa, O., and Lamie, R.D. (2011). Do Internet-Based Promotion efforts Work? Evaluating MarketMaker. Journal of Agribusiness, 29(1): 159-180.