4th Quarter 2013

The growth of the market for specialty crops may have been hindered in recent years by concerns about food safety. The U.S. Centers for Disease Control and Prevention (CDC) estimates that 48 million instances of foodborne illnesses occur each year resulting in 128,000 hospitalizations and 3,000 deaths (CDC, 2012). Of those with an identified cause, 46% of illnesses and 23% of deaths are attributable to illness acquired through produce consumption (Painter et al., 2013). Overall medical costs, productivity losses, and the costs of premature deaths due to identified and unspecified cases of foodborne illness have recently been estimated to be a staggering $51.0 billion annually (Scharff, 2012).

To mitigate these risks, public and private sectors have responded with new regulations, certifications, and standards. Key among such initiatives is the Food and Drug Administration (FDA) Food Safety Modernization Act (FSMA) signed into law in January 2011. While this Act is intended to improve food safety, some argue it lacks sufficient reach or addresses the wrong issues (Conroy, 2011). Further, the FSMA’s Tester-Hagan Amendment modified food safety requirements for small-and medium-scale (SMS) farms that locally sell more than 50% of their produce directly to consumers, food retailers, or restaurants. While this exemption is intended to reduce the regulatory burden on small- and medium-size producers, some food buyers feel that, with this exception, there is insufficient assurance of food safety practices from SMS producers.

Further, although firms may be duly diligent and meet or even exceed accepted food safety protocols, food could still become contaminated by an upstream supplier. In such cases, the final seller of the finished product and the organizations facilitating the sale of that product may be held (jointly) liable for damages resulting from that hazard. As a result, an increasing number of businesses now require food suppliers to carry food product liability insurance (FPLI) to provide protection in the event of injury to a user that may arise from the consumption, handling, use of, or condition of products manufactured, sold, handled, or distributed by producers. Larger foodservice establishments including schools and hospitals, food retailers, farmers’ markets, and kitchen incubators are increasingly requiring their suppliers, or those who supply through them, to carry this insurance product.

General barriers and food safety challenges in marketing specialty crops to institutional foodservice establishments have been recently explored through several research projects in the U.S. Southeast region. These projects examined marketing channel constraints and challenges from the perspectives of both SMS specialty crop farmers, and those buying and facilitating the sale of these crops. Study of this issue began with two series of focus groups held in North Carolina, South Carolina, and Georgia with groups of (1) farmers, and (2) food buyers and market facilitators. Uncertainty concerning food safety regulations and practices, and challenges with finding and financing FPLI are among the key concerns noted by farmers. Large group meetings were then held with stakeholders from throughout the SMS farm-to-institution specialty crops marketing channel to identify and evaluate possible solutions to the identified challenges.

Surveys of SMS producers, and school and hospital foodservice buyers were subsequently conducted to obtain quantitative insight into the qualitative findings. SMS specialty crop farmers from throughout the Southern-Sustainable Agriculture Research and Education (SARE) program region (the Southeastern United States includes states from Virginia to Texas) were surveyed electronically. Responses from school and hospital foodservice buyers from North Carolina, South Carolina, and Georgia were collected via a mailed paper survey. Additional details of the research methodology and results from the qualitative research phase, the producer survey, and the institutional foodservice buyer survey are documented in Westray (2012), DuBreuil (2013), and Nunnelley (2012), respectively. The following discussion draws upon results from these studies.

It is important to ensure that specialty crop producers are sufficiently motivated to provide safe food products. Literature shows that, in conjunction with liability rules designed to decrease incentives for insured firms to take on increased risk (moral hazard), or which reduce risk information asymmetry between producers and insurers (adverse selection), insurance can provide incentives to supply efficient levels of food safety (e.g., Turvey, Hoy and Islam, 2002; and Mojduszka, 2004). In practice, however, it is unlikely that this insurance product will motivate these outcomes. Qualitative results indicate that institutional food buyers and farmers’ market managers are generally unaware of the extent of their organization’s liability (Westray, 2012). For these buyers and market facilitators, in many instances it was reported that insurance coverage requirements were determined through hearsay of requirements by other groups rather than any assessment of a producer’s or a product’s risk. Industry groups and non-governmental organizations (NGOs) have not offered sufficient guidance concerning what coverage amounts should be required of suppliers. Importantly, however, a significant proportion of organizations who noted that FPLI is not currently a supplier prerequisite are considering instituting it as a requirement.

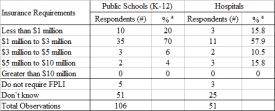

In cases where FPLI is already an established requirement, the amount of required coverage was found to vary considerably. Surveys of public school and hospital foodservice buyers reported that a majority of organizations had coverage requirements between $1 million and $3 million, but that this amount ranged from $100,000 to between $5 million and $10 million (Table 1). These results are generally consistent with findings of a U.S. Department of Agriculture (USDA) study which found that food product liability insurance coverage requirements for schools varied by school district and were between $100,000 to $3 million (USDA Agricultural Marketing Service, 2011).

In a substantial number of cases, buyers did not know their organization’s coverage requirements. Further and interestingly, all hospitals and 80% of schools who reported that they did not know what amount of insurance was required, indicated that proof of product liability insurance would be required from any farms selling directly to them.

Larger buyers, such as regional or national food retailers, were reported to have insurance coverage requirements ranging from $2 million to $5 million. Unsurprisingly, in this market there appears to be a positive correlation between the size of the buying firm and its FPLI coverage requirements.

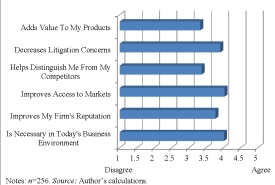

In a recent survey of small- and medium-scale specialty crop farmers in the U.S. Southeast region, 38% of respondents (n=258) indicated that they currently have FPLI. Their motivation for purchasing this insurance product varied, but generally was due to liability concerns (74% of policy holders), buyer requirements or requests (32%), or as an intentional part of their marketing strategy (14%). This latter result is particularly important. Firms reported that they viewed purchasing this insurance as helping to support their firm’s reputation (20.2%), adding value to their products (7.1%), and helping to distinguish their products from that of their competitors (5.1%). Thus until it is more widely adopted, this insurance product may effectively be included as a component in a firm’s marketing or differentiation strategy.

Farmer opinion regarding this insurance further reinforces the perceived multi-functionality of this product. When indicating the extent to which they agreed with statements about FPLI, responses concerning its role in decreasing litigation concerns and market access, elicited some of the strongest opinions (Figure 1). Importantly, however, here again marketing strategy impacts, and in particular the assurance that this insurance is thought to provide for a firm’s reputation, were strongly rated.

Procuring this insurance is often not without its own challenges. Of those who provided information regarding their insurance purchasing process (n=88), many (26.1%) noted challenges in identifying firms that would insure against this risk. On average farmers reported contacting 2.4 companies to get insurance premium quotes; about half of these companies were not able to provide FPLI policy quotes. Farmers who are currently insured by companies that offer this form of insurance though, reported it was relatively easy to add this coverage to their existing policy bundles (9.0%).

Availability of this insurance coverage, however, varies considerably across regions. Many buyers (9.6%) reported approaching five or more insurance companies before they were able to obtain a single quote. Further, several farmers indicated that they ultimately hired an insurance broker or approached state departments of agriculture for assistance in identifying companies which offered this insurance product. Other noted procurement challenges were the expense of this insurance (7.9%), low coverage limits, and exclusions (e.g. for “communicable diseases”) which were standard on many policies.

From these studies we also learned that food product liability insurance was noted among the most concerning and least understood business issues among specialty crop producers. In general, prior to providing respondents additional information, there was considerable confusion regarding the difference between FPLI and standard liability insurance. Farmers are relatively uninformed about the need for this insurance and to what extent, if any, they have coverage for this type of liability. Moreover, several respondents stated that they would have no need for this insurance due to their good on-farm handling practices. Clearly there is much need for additional Extension efforts on this topic.

The FPLI market for SMS diversified specialty crop producers is in its infancy. The insurance coverage being required by buyers of specialty crops varies considerably, and findings from our qualitative research (Westray, 2012) suggests coverage requirements are not correlated with the true risk of foodborne disease of the products being purchased. Further, those supplying this insurance product are not sufficiently familiar with foodborne disease risks associated with various specialty crops. As a result, insurance premiums have been reported to vary widely for similar coverage for farms that have very similar risk and output profiles. Here also there is a need for Extension efforts and insurance industry education.

It is important to note also that the provision and administration of product liability insurance is very different than that of crop insurance. Crop insurance is offered through a private-public partnership. Agents of private insurance companies sell and service crop insurance policies. The Federal Crop Insurance Corporation (FCIC) reinsures these policies and the USDA Risk Management Agency (RMA) administers and oversees all programs authorized under the FCIC. For this program, a limited amount of regulatory responsibility is delegated to each state (Klein and Krohm, 2008). In contrast, there is no uniform, comprehensive Federal law governing product liability, including that for farm and food products, in the United States (Buzby and Frenzen, 1999). Instead, individual states have jurisdiction over product liability law. As a consequence, the regulations governing FPLI and legal actions arising from foodborne illnesses that are governed by state laws often vary considerably.

The specific insurance lines of business under which FPLI is covered varies considerably as well. Farm owners multiple peril, homeowners multiple peril, commercial multiple peril, other liability - occurrence, and other liability - claims are some of the more common business lines under which product is insured. These lines of business differ, however, in the categories of items they cover. Coverage per occurrence or per year may be limited and is likely to vary across lines. Such details would clearly be important in the event of a food safety incident.

Accounting for coverage differences across and within various insurance lines makes it difficult to disentangle the premium amount specifically attached to FPLI. Indeed, when asked, at best most producers could cite only rates reflecting their whole bundle of liability insurance. Holland (2007) made some progress in exploring this issue. Based on an informal survey of insurance providers conducted in 1998, he reported that the annual premiums for FPLI ranged from $500 to $20,000 for a $1 million policy. The average food product liability premium was found to be $3,000 for a $1 million annual policy. The most significant factors contributing to the premium charged were: level of gross sales or annual payroll, prior claims (claims history), level of coverage, type of product, type of market, and recall plan. There were no “standard rates” for liability coverage for food products. The actual premium depended on the many “specific” characteristics of the product and the firm’s value added and marketing plans.

Despite the difficulty often reported in obtaining multiple quotes, our results suggest that it does pay to shop around. Many anecdotal examples were shared of the significant variance in quoted rates for farms with very similar risk profiles. Similarly, significant premium variance was noted by producers in obtaining multiple quotes for the same location. One respondent reported, for example, that quotes for the same $1million coverage on his/her farm varied from $250 to $1,500. Alternatively, producers could join a marketing or distribution network which offers this insurance as a service to its members. Markley (2010) documents several such case examples, and several respondents noted that they were required to participate in a group FPLI policy as a condition of selling at certain farmers’ markets. When insurance is provided through such groups, however, it provides coverage only for products marketed through those organizations.

The financial burden of foodborne illness outbreaks has historically been borne by firms in both suspected and the actual industries at fault for the incident. Increased use of traceability practices allows the cost of food safety incidents to be more targeted and increasingly borne by the implicated firms. In an effort to mitigate against potential liability in the face of such an incident, firms are increasingly requiring that their suppliers have food product liability insurance coverage. This requirement, however, has important implications for the success and profitability of specialty crop producers. Producers purchasing this insurance incur a new and oftentimes substantial fixed cost. Entire marketing channels may be closed to those who do not or cannot purchase such insurance. These concerns are particularly important for small- and medium-sized producers. These farmers frequently are financially constrained and, due to their relatively small volume of production and logistic constraints, already may have difficulty accessing many institutional or commercial foodservice markets. Therefore, inefficiencies associated with food product liability insurance could effectively increase the cost of specialty crop production, while at the same time limiting the ability of producers to sell products even through direct marketing channels. As a result, revenues and profitability could decline and, in some cases, viability of some producers could be affected.

There is, of course, the option for SMS farms to remain uninsured. Even if FPLI was not a requirement, however, a single incident of foodborne illness outbreak attributed to a SMS farm would likely have serious negative financial impacts on both the originating farm and those in the surrounding community. Buzby, Frenzen, and Rasco (2002) found that where awards were made in jury adjudicated cases of food poisoning, the median amount awarded was $25,560. Without insurance then, a single foodborne illness incident attributed to a SMS farm could foreseeably force a business shutdown. Further, such an event could also have significant and negative impacts on consumer confidence in that locality’s food system. Given the significant mobilization of investment and effort dedicated to increase the consumption and sourcing of fresh fruits and vegetables from SMS producers (e.g. USDA Women, Infants, and Children (WIC) Farmers Market Nutrition Program (FMNP), USDA Farm to School Grant Program), inflated costs and limiting market access for specialty crop producers due to liability insurance market inefficiencies is directly counter to the public interest and welfare. Efforts are needed to better inform all stakeholders in this emerging market about the real risks associated with food product liability.

Buzby, J.C., and Frenzen, P.D. (1999). Food safety and product liability. Food Policy, 24(6), 637-651.

Buzby, J.C., Frenzen, P.D., and Rasco, B. (2002). Jury decisions and awards in personal injury lawsuits involving foodborne pathogens. Journal of Consumer Affairs, 36(2), 220-238.

Centers for Disease Control and Prevention (CDC). (2012). Foodborne Diseases Centers for Outbreak Response Enhancement – About FoodCORE. Available online: http://www.cdc.gov/foodcore/about.html.

Connally, E.H. (2009). Good food safety practices: Managing risk to reduce or avoid legal liability, CTAHR FST-32. University of Hawaii at Mãnoa College of Tropical Agriculture and Human Resources. Available online: http://www.ctahr.hawaii.edu/oc/freepubs/pdf/FST-32.pdf.

Conroy, P. (2011). 2011 Consumer food and product insights survey. Deloitte. Available online: http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/Consumer%20Business/us_cp_2011foodsafetysurvey_041511.pdf.

DuBreuil, K.M. (2013). Exploring potential innovative marketing approaches for US agribusinesses (M.S. Thesis). Virginia Tech Department of Agricultural and Applied Economics, Blacksburg, Virginia.

Holland, R. (2007). Food product liability insurance (CPA Info #128). University of Tennessee Center for Profitable Agriculture.

Klein, R.W. and Krohm, G. (2008). Federal crop insurance: The need for reform. Journal of Insurance Regulation, 26(3), 23-63.

Markley, K. (2010). Food safety and liability insurance: Emerging issues for farmers and institutions. CFSC Report, funded by USDA Risk Management Agency. December 2010.

Mojduszka, E.M. (2004, August 1-4). Private and public food safety control mechanisms: Interdependence and effectiveness. Annual AAEA meeting, Denver, Colorado.

Nunnelley, A.R. (2012). Procuring and tracing produce from small- and medium-scale farmers for use in institutional foodservice operations in NC, SC and GA (M.S. Thesis). Clemson University Department of Food, Nutrition, and Packaging Sciences, Clemson, South Carolina.

Painter, J.A., Hoekstra, R.M., Ayers, T., Tauxe, R.V., Braden, C.R., Angulo, F.J., and Griffin, P.M. (2013). Attribution of foodborne illnesses, hospitalizations, and deaths to food commodities by using outbreak data, United States, 1998-2008. Emerging Infectious Diseases, 19(3), 407.

Scharff, R.L. (2012). Economic burden from health losses due to foodborne illness in the United States. Journal of Food Protection, 75(1), 123-131.

Skees, J.R., Botts, A., and Zeuli, K.A. (2001). The potential for recall insurance to improve food safety. International Food and Agribusiness Management Review, 4(1), 99-111.

Turvey, C.G., Hoy, M., and Islam, Z. (2002). The role of ex ante regulations in addressing problems of moral hazard in agricultural insurance. Agricultural Finance Review, 62(2), 103-116.

United States Department of Agriculture Agricultural Marketing Service. (2011). USDA Farm to School Team – 2010 Summary Report. Washington, DC. Available online: http://www.fns.usda.gov/cnd/f2s/pdf/2010_summary-report.pdf

Westray, L. (2012). Serving as suppliers to institutional foodservices: Supply chain consideration of small and medium scale specialty crop producers (M.S. Thesis). Clemson University Department of Applied Economics and Statistics, Clemson, South Carolina.