The Mercosur bloc—which includes Argentina, Brazil, Paraguay, Uruguay, and Venezuela (currently suspended) as permanent members—is a major player in agricultural markets. While Brazil represents the largest share of agricultural production in the region, Argentina, Uruguay, and Paraguay are well-established producers and exporters of agricultural products and increasing competitors in the global market for oilseeds, cereals, and meats. Their abundance of natural resources and relatively small and slow-growing population lead us to infer that these countries will have a growing role in the global market in the coming decades, conditional on addressing particular challenges that may dampen their production potentials. This article discusses the opportunities and challenges facing agriculture in the southern cone countries of Argentina, Paraguay, and Uruguay and provides market insights about the future role of this region in the global agricultural market. While we intentionally leave Brazil out for the sake of brevity, we recognize that much of the economic and agricultural development in the three countries of interest depends on the performance of the Brazilian economy.

Agriculture remains an important economic sector in the three countries: According to FAOSTAT, agriculture accounted for 5.7% of the gross domestic product in Argentina and Uruguay and 10.2% in Paraguay for 2015–2017, compared to 1.4% for the group of developed OECD countries and 1.0% for the United States during the same period. Argentina is the 20th largest agricultural producer in the world, while Paraguay and Uruguay rank 67th and 73th, respectively. These countries play a key role in specific agricultural markets: summing their production, they are the 3rd-largest producer of soybeans, 7th-largest producer of feed grains (corn and sorghum), and 7th-largest producer of beef in the world.

That these countries are more prominent agricultural exporters than would be suggested given their production capacity is largely due to their low population densities. According to FAOSTAT, Argentina is the 12th-largest exporter of agricultural products and ranks among the top five exporters of soybeans, soybean oil and meal, and corn. It was a top three exporter of beef before the imposition of export constraints in 2007 to keep beef domestic prices and inflation low and has regained part of its market share since 2015 after the removal of most of those export restrictions. Paraguay ranks as the 43th exporter of agricultural products and is among the top 5 exporters of soybeans and the top 10 exporters of beef. Likewise, Uruguay ranks 45th among all agricultural exporters and is among the top 10 exporters of soybeans, rice, and beef.

The expansion of socialism in Latin America in the past decade—most notoriously in Venezuela, but also in Argentina, Uruguay, and Paraguay—resulted in policies that favored urban constituents more and taxed agriculture. Aside from that regional pattern, the agricultural sector has faced distinct challenges across the three countries of interest. (Figure 1). Paraguay experienced the fastest growth in crop production, led by an impressive growth in soybeans and corn, the two largest field crops, and in livestock production. On the other hand, Argentina grew the least across all categories, largely due to the rise of export taxes that disproportionally affected agriculture.

The growth in Paraguay resulted from a combination of area expansion and productivity gains. For example, the production of soybeans, the main agricultural sector in Paraguay, almost doubled in the last decade thanks to a 48% increase in yields and 33% increase in area. The soybean boom of the 2000s explains the fast growth in crop production in Uruguay, which went from planting around 12,000 hectares in 2001 to 1,000,000 in 2010. Most of the growth in agricultural production in Argentina came from changes in land use: The area with annual crops increased by 26%, primarily at the expense of forestland as the agricultural frontier advanced north into more subtropical areas. Average yields increased during the same period, most notably those of soybeans (18%) and corn (10%).

Producers across the region have access to the latest technologies and management practices. According to International Service for the Acquisition of Agri-biotech Applications (ISAAA), Argentina and Paraguay rank 3rd and 7th in the adoption of biotech crops, with close to 24 and 3 million hectares planted in 2017, respectively, while Uruguay ranks 11th, with 1.3 million hectares of biotech crops. Moreover, sustainable management practices are widespread in the region, with over 90% of the cropping area in Argentina and Uruguay and 80% in Paraguay under direct (no-till) drilling.

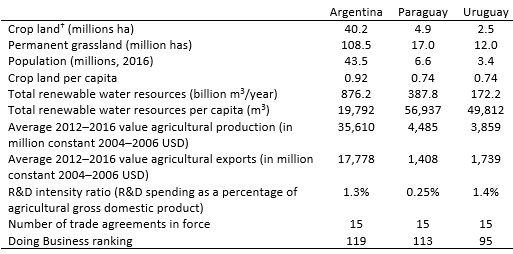

†Includes arable land and land under permanent crops.

Sources: FAO, 2016, 2019; World Bank, 2019; Organization of American States, 2019.

Agricultural research has been a key factor in increasing agricultural productivity in the region over the past decades. The latest data available show that agricultural research and development (R&D) spending in Argentina has grown significantly since the mid-2000s, representing around 1.3% of the agricultural gross domestic product in 2013, higher than the regional average and above the minimum R&D investment targets of at least 1% suggested by the United Nations. One major concern is the high dependence on the public budget (which accounts for 95% of the R&D investment) and the large share spent on salaries (80%). The nonprofit sector plays a crucial role in agricultural extension among leading crop and livestock producers, with programs such as the Regional Consortium of Agricultural Research (CREA) and the Direct Seeding Producer Association (AAPRESID), but extension services are otherwise in dire need of improvements.

Agricultural R&D in Paraguay is incipient and mainly conducted by the Paraguayan Institute for Agricultural Technology (IPTA), created in 2010. Total spending on agricultural R&D in Paraguay is very low by regional standards (around 0.25% of the agricultural gross domestic product in 2013), and the country relies strongly on technologies generated elsewhere, mainly in Brazil and Argentina, a strategy that has served it well in the last decade.

Uruguay spent 1.4% of its agricultural gross domestic product on agricultural R&D in 2013, half of which comes from the public budget. On the spending side, only around half of the budget covers wages, and the rest is available for capital investments and operating costs. As in Argentina, nonprofit organizations play a vital role, mainly in agricultural extension.

Agricultural production in the region is expected to continue growing in the next decade, fostered by the availability of untapped natural resources in western Paraguay, the availability of fallow arable land in Argentina, the conversion of grassland into more productive crop and livestock uses in Uruguay, and overall an increase in productivity, primarily in Paraguay. Production projections from the Organization for Economic Co-operation and Development and the UN Food and Agriculture Organization (OECD/FAO, 2018) and the U.S. Department of Agriculture (USDA) point to an increase in agricultural production and agricultural exports from the region, supported primarily by the further dismantling of agricultural taxes in Argentina and continuing agricultural investment in Paraguay. OECD/FAO estimates that soybean production in Argentina and Paraguay will reach 66 million metric tons and 12 million metric tons by 2027, or 33% and 21% more than the 2017–2018 average. Likewise, the USDA estimates that rice production and exports from the three countries will increase in the coming decade, which will consolidate the region as the 6th-largest global exporter of rice.

Agriculture faces quite different sets of opportunities and challenges across countries. Arguably, the main challenge for agriculture in Argentina is the overall economic and political instability prevalent during most of the last two decades. To illustrate, the economy shrank by 2.8% in 2018 despite a US$56 billion aid package granted by the International Monetary Fund to help cope with the economic crisis, and the inflation rate was 48% in 2018 (over 10 times the Latin American average) and estimated to reach 55%–60% in 2019. Argentina devaluated its currency over 100% (in nominal terms) in 2018, which resulted in a real devaluation of the currency. However, the lack of export financing and high indebtedness in the sector, along with the continuing high inflation, limit the export opportunities generated by the real devaluation of the currency. Export taxes continue to be prevalent (e.g., soybean exports are currently taxed 28%), although they have receded from the spike observed from the mid-2000s until 2015. Despite these challenges, the agricultural sector grew, albeit moderately, in the last decade (Figure 1). However, the sector will need more stable economic conditions and lower tax burdens to achieve higher growth and take advantage of the large endowment of natural resources readily available to increase production (for example, arable fallow land in the fertile Pampas region). Argentina experienced significantly higher growth in the 1990s, prior to the spike of taxes on agriculture.

Paraguay has abundant natural resources, including land and water, and has intensified the use of land for agriculture in the last decade. Arable land area increased 39% in the last decade, but around 17 million hectares or 78% of agricultural land still remains under permanent grassland. Moreover, there are vast areas of tropical and subtropical forest in the least developed Chaco region (west of the Paraguay River), which offers the most opportunities to expand the agricultural frontier, but development in that region is slow and faced with numerous challenges, including opposition from environmental organizations due to the potential impact on the rainforest. Deforestation has been particularly widespread in Paraguay since the 1970s, mainly because of the expansion of cattle farms in the western part of the country. Law 422/73, better known as the Forest Law, requires the approval of a soil management plan and the preservation of around half of the area within each farm as a condition for land clearing, but illegal land clearing is still widespread, despite government efforts. The development of the Chaco region also implies significant investments in infrastructure to supply the region with the services needed to compete in the international market. The major producing departments of the south and southeast (Itapúa, Alto Parana, Canindeyú, and Caaguazú) provide little room for area growth but some opportunities for yield improvements. For example, average soybean yields in the last five years are 10% below the yields obtained in Brazil and 15% the yields obtained in the United States.

A stable macroeconomic situation, austere government policies, market openness, and low tax burden have helped Paraguay achieve impressive economic growth in the last decade. Agriculture received a windfall of investment and was subject to very low tax rates, which helped improve profitability and encouraged investment in the sector, but there is mounting pressure to increase taxes on agriculture, primarily soybeans. The government approved an increase in the agricultural value-added tax in 2018, but the proposal to implement a 10%–15% export tax on soybeans and other raw crops such as corn and wheat is still under consideration in Congress. Stakeholders are familiar with the impact of export tax policies in neighboring Argentina and worry about their possible impact on the agricultural sector in Paraguay, which already faces shrinking profit margins due to high transportation costs and depressed commodity prices. The support to agriculture is marginal and related mainly to the provision of general services such as agricultural research and extension and pest and disease control.

For the most part, Uruguay already exhibits high productivity levels in many agricultural sectors, including cattle and rice, but still lags behind on soybeans, whose yields remain 30%–40% below those of Argentina, Brazil, and the United States. Aside from soybeans, it seems that Uruguay can support further production growth based on land use changes into more productive activities. To give some context, the area with annual crops in Uruguay doubled while the area with temporary pastures grew by 80% in the last decade, primarily at the expense of permanent grasslands and fallow arable land. Yet around 12 million hectares or 83% of agricultural land remains under permanent grassland, potentially available to be converted into more intensive uses. Irrigation remains limited mostly to rice; investment in irrigation infrastructure offers opportunities to increase productivity and resiliency to the challenges generated by climate change. Uruguay is a leader in agriculture sustainability, with a strict regulatory framework that governs the use of key natural resources such as soil and water, and a leader in the implementation of traceability policies in sectors such as cattle and forestry. Innovative measures such as these can help Uruguay continue being a reliable supplier of agricultural products with increasing value-added attributes.

Uruguay offers a stable political and economic environment that has favored the growth of agricultural production in the last decade. The economy has grown steadily since 2003 at 4% a year, and the inflation rate has been under control and mostly within the target range of 3%–7% in the last two years. The Uruguayan peso has depreciated significantly, by 21% since early 2018, far outpacing the inflation rate and thus benefiting agricultural exports. Although economic growth and the implementation of more inclusive social policies led to increases in food demand, they also increase pressure on the cost of production. Increasing costs of production are the main threat to the agricultural sector in Uruguay. For example, the mean wage index, a measure of labor costs, increased over 8% annually since 2017, and the price of gasoline averaged US$1.7/liter, more than twice the price in the United States. The high export dependency of the agricultural sector makes Uruguay very sensitive to shocks in the international markets, but the government has no countercyclical measures in place, which may undermine the future growth of the sector. While some agricultural sectors benefit from tax exemptions (for instance, a partial value-added tax rebate on diesel fuel for the rice and livestock sectors), farmer organizations are demanding a more widespread adoption of such mechanisms.

The situation of the rice sector in Uruguay is a good example of the challenges and opportunities facing the Uruguayan agricultural sector as a whole. Uruguay is the 9th-largest exporter of rice and has an established reputation as a supplier of high-quality long-grain rice that is reflected in the high prices received in the international market. Most of the acreage is planted following best management practices, resulting in average yields over 8 metric tons per hectare, one of the highest in the world. The efficiency in water use is high by international standards due to the low water use (less than 9,000 m3/hectare) and high yields. Surface water provides more than 90% of the irrigation needs, and the energy needed for pumping is low in part because around 50% of the area is irrigated by gravity. The efficiency downstream is also high, with four modern rice-milling companies processing and exporting over 80% of the rice. Land transportation is short (most rice produced within 400 km from the exporting port) and the port infrastructure is adequate. Despite the high efficiency throughout the rice supply chain and the premium received in the international market, the economic results over the last several years have been dire and led to a significant reduction in acreage, number of farmers, and overall level of activity.

As part of Mercosur, these three nations have embraced intra- and extra-regional integration as a cornerstone of economic development. To illustrate, these countries currently participate in 15 trade agreements, including the World Trade Organization (WTO), and are negotiating 10 other agreements with developed and developing countries such as the European Union, Singapore, South Korea, and Central America. As part of Mercosur, extra-regional imports are subject to a common external tariff scheme, while trade within the region is for the most part free. Unlike agricultural export subsidies, which are regulated/limited under the WTO, countries have much more freedom to implement export taxes, although these are rarely used. Paraguay and Uruguay maintain a free export policy with minimal interference, but pressure is mounting in Paraguay to implement export taxes on raw agricultural exports. In Uruguay, Law 17.780/2004 prohibits export taxes altogether. On the other hand, Argentina has frequently imposed export taxes as an intrinsic part of the national economic policy since the mid-1940s. The changes in economic strategies and agricultural trade policies of the last several decades greatly affected the performance of the Argentinean agricultural sector. After a period of economic and trade liberalization in the 1990s, which helped the agricultural sector achieve an average annual growth of 4%, the 2001 economic crisis led to a shift back to economic protectionism, high government intervention, the reintroduction of agricultural export controls in the form of export taxes on most agricultural products, and ad hoc export quotas and outright export bans, which particularly targeted selected sensitive products such as beef and wheat. By the mid- to late 2000s, agricultural growth was down to 1.5%, even when the international market for most agricultural commodities remained strong. The current administration has lowered the economic pressure on agriculture (for example, removed export permits and lowered most export taxes), but still taxes on agriculture remain high. As the history of the last 30 years shows, eliminating export barriers can have a great positive impact on Argentina’s agricultural production and exports.

The lack of investment in transportation infrastructure is a major bottleneck affecting the competitiveness of agriculture in Argentina, and the problem is worse for other products more geographically dispersed than soybeans, or regional productions outside the Pampas that have longer inland distances to the main exporting ports of Rosario and Buenos Aires. Due to lack of investment, the rail network in Argentina decreased from 47,000 km by the mid-1900s to 18,000 km currently. Further, inland truck transportation, which accounts for over half of the logistical cost of moving soybeans from the farm to the crushing and exporting hub of Rosario, is expensive and inefficient relative to competing industries such as the U.S. soybean and Australian wheat sectors. Improving the efficiency in the trucking and rail sectors has the potential to make agriculture profitable even in areas with great potential outside the Pampas. Most of the agricultural production in Argentina is moved inland via trucks, and only a marginal portion (less than 10%) uses less costly means such as rail or barges. For example, 87% of the soybeans are transported to Rosario, the main crushing and exporting hub, by truck, and the remaining by rail, compared to the United States where half of the soybean crop is moved by barges, 30% by rail, and only 20% by truck. The government is taking actions in this regard and currently implementing a plan to modernize and expand the capacity of the rail system by 2023 based on public and private investments. To that end, the government is investing in the main rail network that connects the production region in the northwest to the exporting ports, and the China Railway Construction Corporation is investing over $1 billion to reactivate the rail system connecting the western Cuyo region, known for its wine, olive, and nut industries, with the main export ports on the Atlantic coast. Investments in the barge industry are limited, although Argentina has a good network of rivers to transport most of the production in the eastern region. Finally, Argentina has a modern and efficient port infrastructure tailored to exporting its main agricultural commodities, but there are concerns about rising administrative costs and the lack of investment in new ports closer to production regions upriver.

Despite its landlocked position, Paraguay is an increasing player in the numerous international markets. Paraguay has developed a modern fluvial logistics sector that moves most of the domestic production via barges through the Paraná and Paraguay rivers. Around 80% of Paraguay’s exports are via barges down the Paraguay–Paraná waterway, which are then consolidated into ocean freights at ports downriver, primarily in Rosario, Argentina, and Palmira, Uruguay. The port export capacity increased 10 times since the mid-2000s with the construction of 22 new ports to attend the growing agricultural exports. However, transportation costs for exports in Paraguay remain high. To illustrate, the transportation cost of soybeans from Caazapá (Paraguay) to Shanghai (China) is 260% higher than from Davenport, Iowa, 90% higher than from Trinidad, Uruguay, and 53% higher than from Rafaela, Argentina. Such a high transportation cost limits the profitability of agriculture and threatens its growth and sustainability. It is worth noticing that Brazil is a major export market for many Paraguay products such as rice (60% of production goes to Brazil), which helps circumvent in part the high export logistics costs.

Argentina, Paraguay, and Uruguay have plenty of resources to expand agricultural production in the coming decade, but achieving growth depends on addressing some key challenges that lay ahead. Argentina presents the greatest potential for growth in nominal terms given its availability of natural resources, but this growth will depend on improving economic and political stability, reducing or dismantling export tax schemes, and investing in transportation infrastructure to lower logistics costs while sustaining investment in agricultural R&D. Paraguay must prioritize investment in infrastructure to lower its logistics costs, keep agricultural taxes low, increase investment in agricultural R&D, and strike a balance between agricultural development and the environment in the western region. Finally, Uruguay must find ways to reduce the high and rising production costs that result from increasing labor costs and the high tax burden on services and energy and sustain its investment in agricultural R&D.

Food and Agriculture Organization of the United Nations (FAO). 2016. AQUASTAT Main Database. Rome, Italy. Available online: http://www.fao.org/nr/water/aquastat/data/query/index.html?lang=en

Food and Agriculture Organization of the United Nations (FAO). 2019. FAOSTAT Statistical Database. Rome, Italy. Available online: http://www.fao.org/faostat/en/

Gauthier, G., R. Carruthers, and F. Millan Placci. 2016. Logística de la Soja: Argentina – Paraguay – Uruguay. Serie de Informes Técnicos del Banco Mundial en Argentina, Paraguay y Uruguay No 4. Washington, DC: World Bank Group. Available online: http://documentos.bancomundial.org/curated/es/923401468272770160/Logística-de-la-soja-Argentina-Paraguay-Uruguay

Lema, D. 2015. Crecimiento y Productividad Total de Factores en la Agricultura Argentina y Países del Cono Sur 1961–2013. Serie de Informes Técnicos del Banco Mundial en Argentina, Paraguay y Uruguay No 1. Washington, DC: World Bank Group. Available online: http://documentos.bancomundial.org/curated/es/970151468197997810/pdf/104000-WP-P155040-Crecimiento-y-Productividad-Total-de-Factores-en-la-Agricultura-Lema-PUBLIC-SPANISH.pdf

Organisation for Economic Co-operation and Development and Food and Agriculture Organization (OECD/FAO). 2018. OECD-FAO Agricultural Outlook 2018–2027. Available online: https://doi.org/10.1787/agr_outlook-2018-en

Organization of American States. 2019. Foreign Trade Information System. Washington, DC. Available online: http://www.sice.oas.org/

Paolino, C., L. Pittaluga, and M. Mondelli. 2014. Cambios en la Dinámica Agropecuaria y Agroindustrial del Uruguay y las Políticas Públicas. Serie Estudios y Perspectivas No. 15. Santiago, Chile: Comisión Económica para América Latina y el Caribe. Available online: https://www.cepal.org/es/publicaciones/36780-cambios-la-dinamica-agropecuaria-agroindustrial-uruguay-politicas-publicas.

Stads, G., N.M. Beintema, S. Pérez, K. Flaherty, and C.A. Falconi. 2016. Agricultural Research in Latin America and the Caribbean: A Cross-Country Analysis of Institutions, Investment, and Capacities. Washington, DC: International Food Policy Research Institute (IFPRI) and Inter-American Development Bank (IDB). Available online: http://ebrary.ifpri.org/cdm/ref/collection/p15738coll2/id/130310

U.S. Department of Agriculture. 2019. Paraguay Oilseeds and Products Annual. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service. Available online: https://gain.fas.usda.gov.

World Bank. 2019. World Development Indicators Washington, DC: World Bank. Available online: http://datatopics.worldbank.org/world-development-indicators/.