Notes: Nonrespondents are not accounted for in these data.

Notes: Nonrespondents are not accounted for in these data.

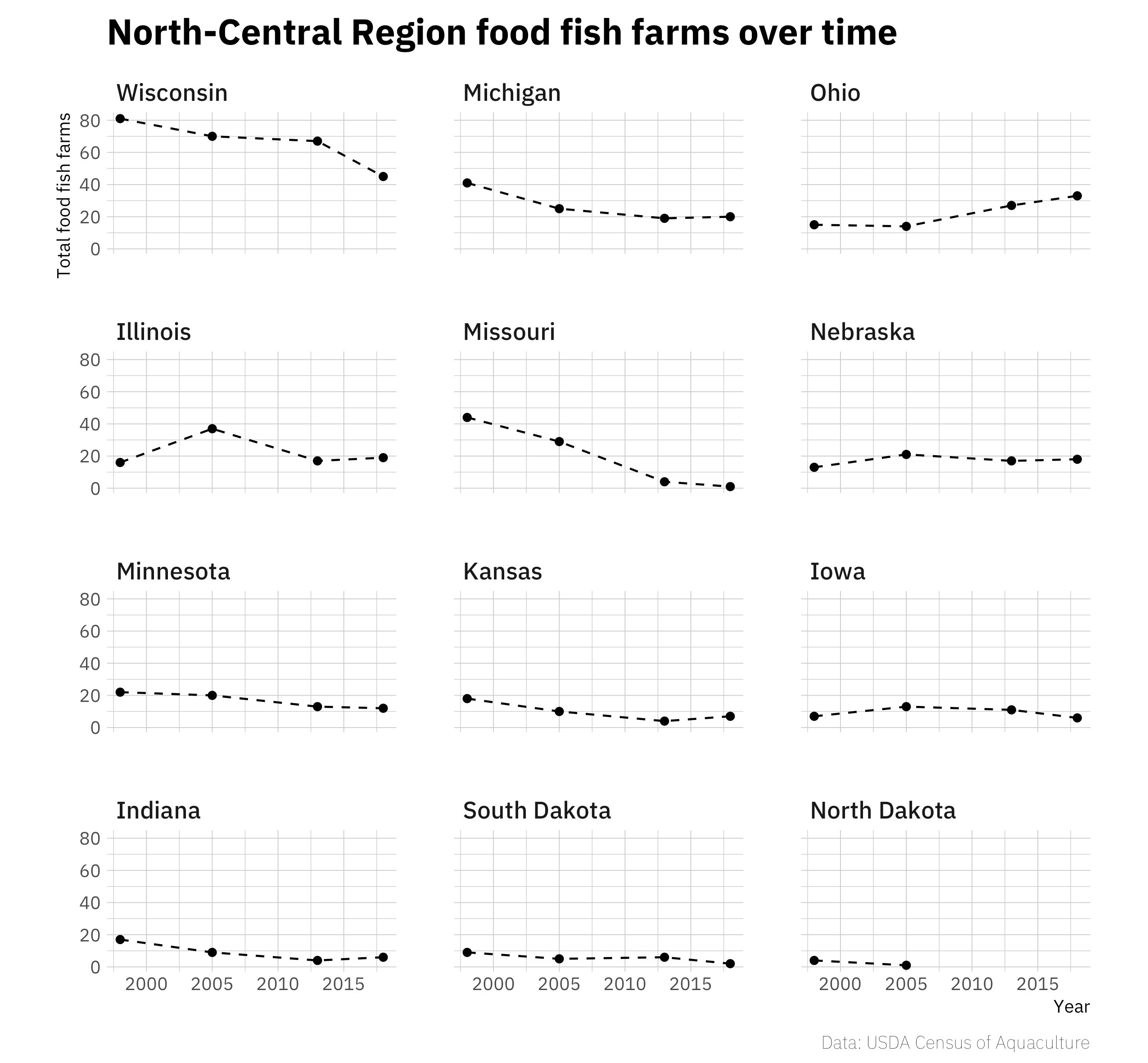

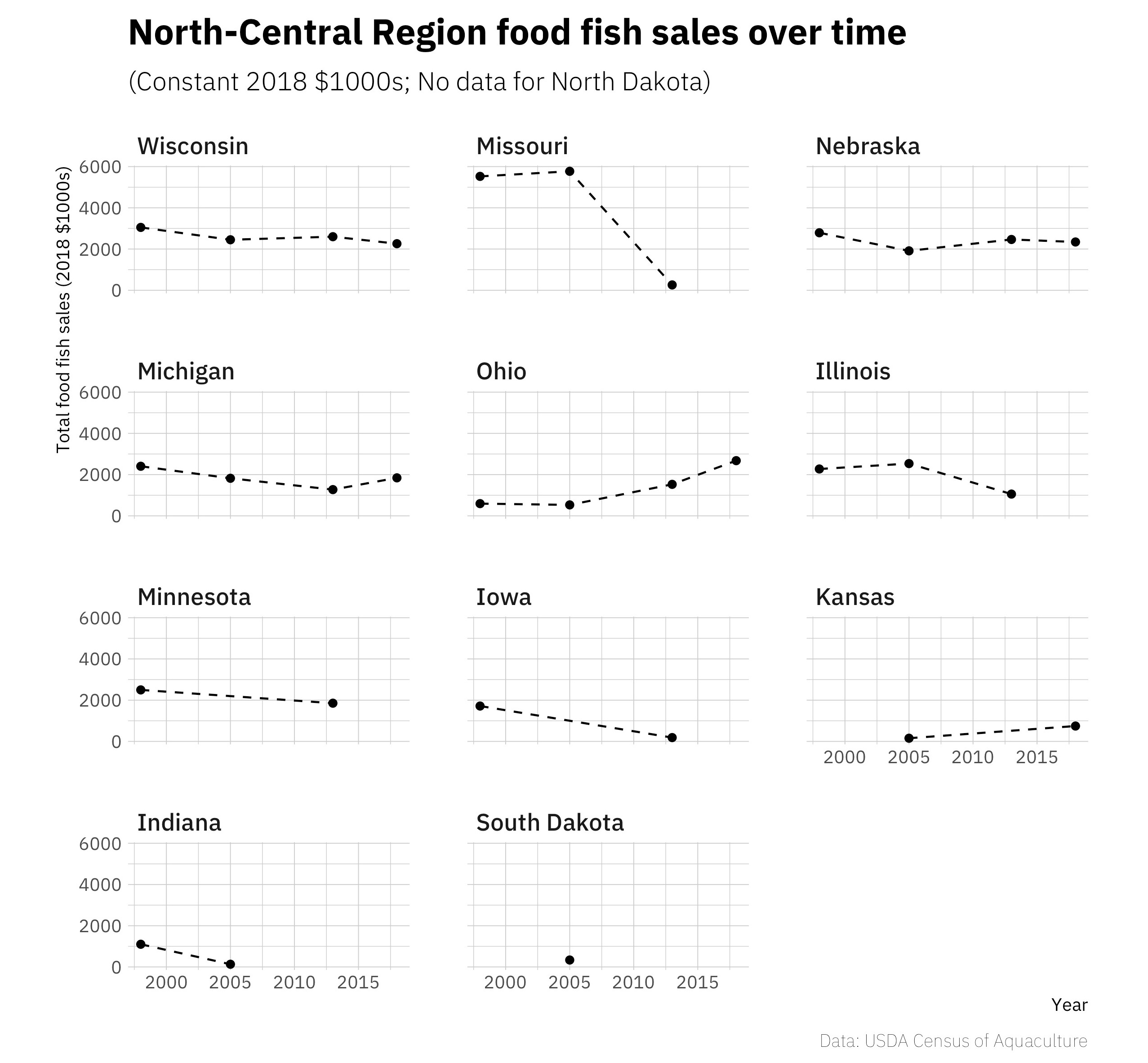

The promise of Midwest aquaculture lies in the region’s history and status as a major agricultural center within the United States. The twelve states in the USDA North-Central Region (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin) compose about 22% of the country’s land but contain about 33% of the country’s farms, 32.5% of the country’s farmland, and 39.1% of the market value of agricultural crops in the United States (U.S. Department of Agriculture, 2019a). Given this agricultural prowess, there is reason to believe that the region could be a strong aquaculture producer as well, leveraging the experience and efficiencies of the existing agriculture industry. However, despite the strong regional agriculture and despite the fact that the North-Central Region states are home to approximately 21% of the U.S. population (U.S. Census Bureau, 2019), the region has only about 16% of the foodfish aquaculture farms in the United States, which collectively represent about 1.4% of annual U.S. farmed foodfish sales, a number that has been flat or even decreasing over the last 20 years (U.S. Department of Agriculture, 2019b) (Figures 1–2).

Several factors likely contribute to the relatively soft Midwestern local-sourced foodfish market. First, Midwestern consumers eat less seafood than residents of coastal areas (U.S. Environmental Protection Agency, 2014) and therefore may be less likely to demand locally produced seafood. The reasons for this are not exactly clear and have not been studied extensively; anecdotal speculation includes sociocultural differences in the Midwest palate, a culinary culture that is more focused on farmed livestock such as beef, or the chicken-or-egg problem of a lack of sources of seafood leading to less seafood consumption and vice versa. Second, the Midwest has historically relied on wild-caught seafood, both locally caught and imported. Third, seafood produced in the Midwest often has to compete with cheaper, imported seafood, which may suppress demand. And finally, the Midwest may produce less foodfish than expected because other aquaculture markets (e.g., baitfish or pond-stocking) are relatively more lucrative.

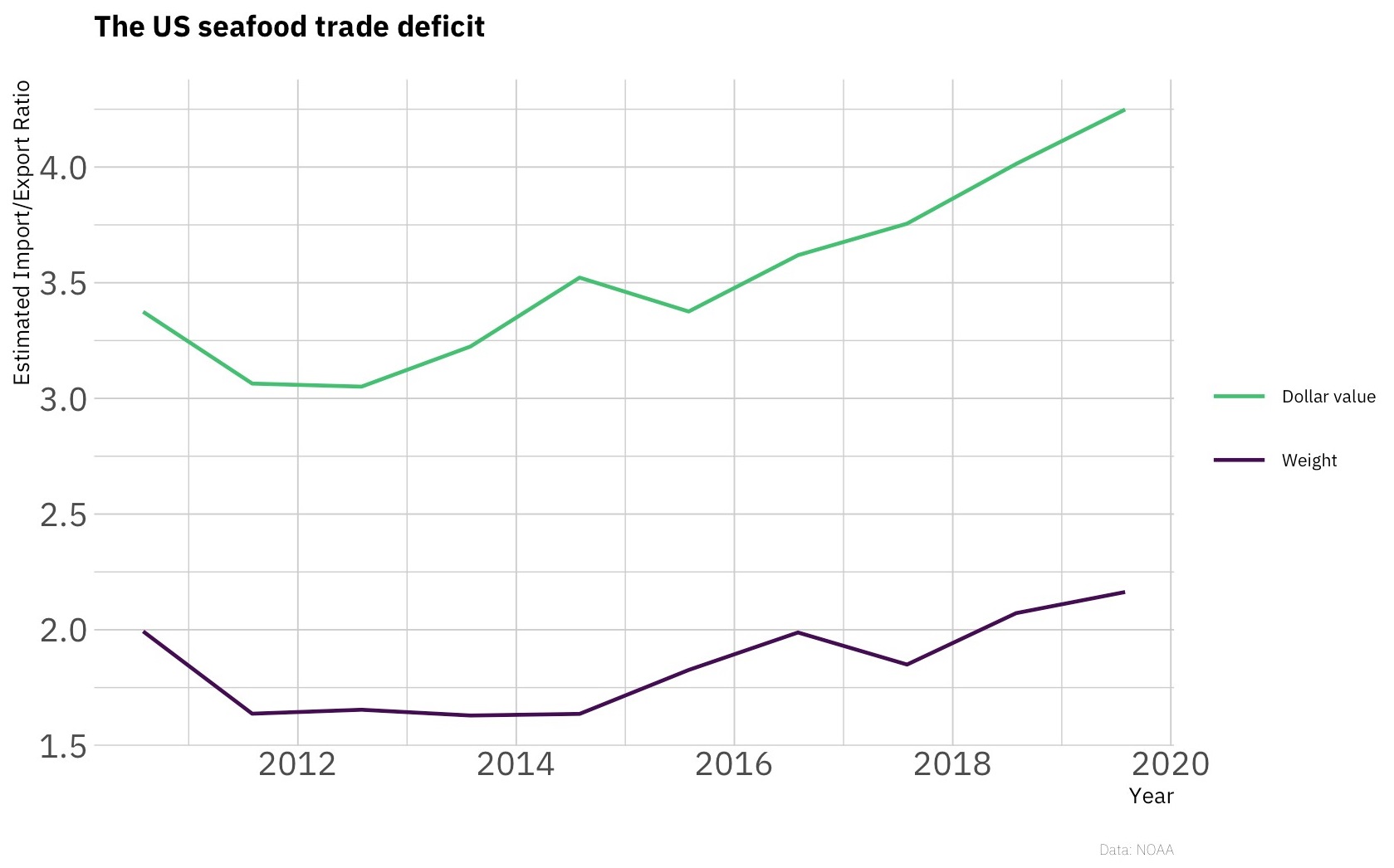

Regardless, a stagnant Midwestern foodfish aquaculture industry has national implications given the large and growing trade deficit in edible seafood (Figure 3), the second-largest natural resources trade deficit behind oil (National Marine Fisheries Service, 2021). A Midwestern population that ate more locally produced farmed and wild-caught seafood might reduce that deficit over time.

Against this backdrop—and against a backdrop of increasing feed, fuel, and other expenses—aquaculture producers are working to grow and market their products to maintain or increase their market share and profitability. How do producers do that in this region? How do they meet the challenge of setting prices and marketing their food? How do they view regulation? The answers to these questions can help policy makers, regulators, and land grant universities be more responsive to aquaculture producers’ needs.

To begin to explore these questions, we interviewed 30 aquaculture producers across the Midwest region as part of our work with the Great Lakes Aquaculture Collaborative and the Eat Midwest Fish projects. We used our professional networks to identify and select the 30 producers to represent a diverse range of production methods, species produced, and geographic locations. As part of these qualitative interviews, we asked producers about their pricing, business expansion plans, and their thoughts about regulators and regulations. These interviews took place in late 2019 and January 2020, before the COVID-19 pandemic affected the region.

After interviewing the producers, we transcribed the interviews and coded them using inductive coding, a process of examining the interview responses for emergent themes without a predefined notion of what those themes might be (Miles, Huberman, and Saldana 2014). Inductive coding allows researchers to remain open to and consider the potential nuances and multiple meanings of the responses before categorizing them.

Our findings are detailed below. It is important to remember that these are qualitative interviews within a specific region, so the goal of our study was not to draw general conclusions about all aquaculture producers. However, by forgoing the need to generalize we can focus on specific frames and themes that fill out the larger story, adding richness and nuance to our understanding of the producers’ experiences.

| Channel | Total mentions (of 30 producers) |

| In-person, on-farm | 17 |

| Restaurant | 12 |

| Ethnic markets/grocery stores | 4 |

| Grocery stores | 4 |

| Live markets | 3 |

| Farmers' markets | 2 |

| Fish haulers | 2 |

| Family and friends | 1 |

| Online | 1 |

| Distributors | 1 |

Most of the producers we interviewed sold their fish locally or within a narrow region. When asked to identify their most important sales channel (see Table 1), in-person, on-farm sales were listed by five producers, restaurants by four, grocery stores by three, and ethnic markets and fish haulers by two each, with other channels (live markets, farmers’ markets, processors, etc.) mentioned by zero or one producer. When asked why the channels they chose were most important, the answers were consistent: money. As one producer put it, their most important channel is the one that “pays the bills every week,” although another producer indicated that the potential brand-recognition benefits of selling at a farmers’ market were important, too.

Pricing is a consistent challenge for small businesses across industries, and Midwestern aquaculture is no different. One producer expressed their frustration with the challenges of setting a sustainable price succinctly: “Our pricing is awful.” We asked producers to describe how they priced their products in the marketplace, first as an open-ended question. After transcribing and reviewing their answers, we found the following common themes (note that since these were open-ended interviews, not every producer gave a “codeable” response, so the number of mentions will not add up to 30):

Price based on prevailing market (mentioned by five producers): This theme indicates a producer who prices their product primarily to be in line with existing market prices, based either on conversations with customers/distributors or by looking at the markets. This is often an imprecise process, as described by an Ohio producer, who said, “You hear what (fish) are going for up at Lake Erie, you kind of look on restaurant menus and just get a feel for what people are already paying and try to be somewhere in that area.”

Price as a premium product (four producers): Many producers perceive and price their product as premium compared to the market, either because of freshness, local origin, traceability, or perceived environmental quality of fish raised in the United States compared to other parts of the world. For example, a producer told us that, “I put a small premium (on the prevailing price) because what they were getting is not a similar product in terms of the quality of the water. And this is especially true for tilapia overseas: they often are not in high water quality situations, with very polluted waters…and essentially sewage coming out of some other farm.”

One producer explicitly mentioned using the premium price as a signal of quality: “There’s a tagline from Stella [Artois], which is a beer that I love… ‘Reassuringly Expensive.’ And that’s where I want to be.”

Price as low as possible (two producers): This describes a producer who prices their fish as low as they can while preserving profitability. As one producer phrased it, “[Our species of fish] is becoming commoditized a little bit and it’s becoming an item that is almost like ground beef… we want to be the cheapest on [our fish].”

Price compared to other proteins (two producers): Two producers explicitly mentioned their fish as competing with other, nonfish sources of protein, which they consider when pricing: “At the end of the day, you know, you’re not just competing against the tuna or the swordfish in the (seafood) case, you’re competing with the protein choices that are further down the aisle: chicken and beef and pork. And so you’re competing for people’s protein. You have to try to keep an eye on protein prices are in general.”

After the open-ended question about pricing, we asked a more standardized version, wanting to know how often the producers use each of the following pricing strategies:

The full results can be found in Figure 4. The highest-rated strategies were “We study the market to try to predict what price will produce optimal results” (average rating of 3.37/5) and “We set prices based on the cost of our ingredients and other inputs” (average rating of 3.33/5). The lowest-rated strategy was “We charge a low price designed to gain market share” (average rating 1.81/5), though several producers rated that strategy highly.

Despite aquaculture’s mixed history in the Midwest, most of the producers that we talked to were trying to expand their business in the near-term, with only seven of 30 indicating that they were not. Of those who indicated that they were looking to expand, the most common themes included:

Expanding to meet demand and increase profits (four producers): Many people who said they were expanding said they were doing so to meet demand and increase profitability. As one producer said, “We’re expanding so I can sell more [product]…we’re struggling now to where we can’t keep up [with demand].”

Expanding to diversify product line/revenue streams (three producers): This theme describes expanding to diversify their production either to protect their businesses from catastrophe: “I’d like to put in another pond; that way, I have two options, and if one pond failed, the other would provide some of the need.” Other producers indicated they were diversifying the types of products they sell or markets they’re selling into: “We are thinking of increasing the number of tanks of fish to be able to have a continuous supply of [processing-plate sized] food fish.”

Expanding with skill growth (three producers) A final business expansion theme that was raised multiple times is producers who were expanding as their skill and experience increased, as put succinctly by one smaller producer: “We finally started keeping more fish alive; the plan is to keep growing the farm until it can become a primary source of income.”

Producers who either were not expanding their business or who expressed concerns about their business expansion plans raised two consistent themes:

Regulatory concerns (four producers): Producers were concerned either with regulations making expansion too risky or that regulations limiting their ability to acquire new land to expand. Sometimes, this was a specific concern, such as expressed by one producer, who investigated expansion “after the Food Safety Modernization Act, and it was not economically feasible.” Other times, this was a more general concern about the “regulatory environment,” as one producer put it.

Capital concerns (two producers): Producers indicated that expansion was either economically infeasible (“It was it was basically we’re talking about an extra $50–60,000 of investment, just for the fish to be able to keep the 40–50,000 fish that they needed to keep to make it worth my time.”) or that they did not have access to sufficient cash or credit to expand.

We asked the producers for their thoughts on their primary regulator and why they trusted or distrusted them. The responses fit into one of five themes, two that were related to higher levels of trust and three that were related to lower levels of trust. Common themes related to higher levels of trust included:

Smooth processes and lack of conflict (four producers): Producers had not had any “run-ins” with the regulators, either on an interpersonal level or by bumping up against restrictive regulations. This theme is exemplified by a producer who said, “I have a lot of faith in [the regulator]: They’ve been very easy to work with and very accommodating.”

Perceived competence and legitimacy (two producers): Some producers indicated that the regulators were doing important, legitimate work in a competent manner: “When they inspect a facility, and they see what we’re doing, they’re putting their stamp of approval on the product… I have complete faith that when they do their inspection and pass me when they see our fish… They’re signing off on the whole deal that we’re doing what we should be doing and we’re doing it right.”

Common themes related to lower levels of trust included:

Regulators influenced by exogenous concerns (four producers): Some producers expressed concern that regulators do not have the best interests of the industry at heart and the producers perceive regulators as balancing other interests, too. It is unsurprising that producers feel this way, as regulators typically have responsibility for larger domains than just aquaculture (e.g., a water regulatory agency may primarily be concerned with water quality and quantity and only be concerned with aquaculture to the extent that it affects water quality). However, in this theme, producers indicated that the regulators balanced these interests in a way that the producers disagree with. This may be represented as “politics” or “money” or other potential users of the resource. This theme is exemplified by a quote from one producer, who said, “When you start making regulations because of politics [as opposed to] what’s good for the species or what’s good for aquaculture… that makes no sense to me.”

Increasing regulatory burden (three producers): Regulators increase the regulatory burden over time, potentially with regulations that do not make sense to the producers: “Their culture is to always seek higher levels of regulations. They’re ‘always, always, always’ institutions… every single renewal cycle, [we] end up arm wrestling over something new, that they want us to do, despite the fact that there are no identified issues, problems, violations, you name it, there [haven’t been] any problems to address on our farm.”

In addition, several producers specifically called out the Food Safety Modernization Act as an onerous regulation that challenged their business and damaged their relationship with regulators.

Lack of relevant knowledge (one producer): Regulators lack the detailed knowledge of aquaculture production that the producers consider essential to effectively regulate the industry: “Lack of industrial knowledge… I talked to my local health department and they didn’t know what aquaculture even was.”

Despite the historical challenges of the Midwestern aquaculture market, most of the producers we interviewed were generally optimistic about the future of their businesses, as reflected in the large number that are planning to expand in the next several years. This might reflect a change in business conditions compared to the past: The Midwestern aquaculture market has seen significant private and federal investment in recent years, which may lead to industry growth. The optimism could also be a sign of survivorship bias: The producers who are still in the market are those who run stronger businesses and, consequently, have more reason to be optimistic about future success. This could also reflect a biased sample or the natural optimism of business owners and farmers. Regardless, there is clearly more work to be done here to understand the nature and concerns of those who are or are not planning to expand their businesses: In future investigations we will attempt to tease out what factors cause producers to want to expand or not expand.

Despite their optimism on business expansion, many producers expressed concern about actual or potential regulatory burden. However, several producers expressed appreciation for straightforward regulators and regulatory processes that feel reasonable and considered as opposed to arbitrary and overly harsh. Many of the producers were concerned about regulators who were influenced by politics or exogenous concerns. Trust seems to coincide with a perception that regulators understand aquaculture and that the regulations are reasonable. However, trust in natural resources systems is complicated and multidimensional (Stern and Coleman, 2015) and there is a clear need to better understand the drivers of trust in aquaculture. In addition, there are likely state-by-state and regulator-by-regulator factors that influence producers’ perceptions of and trust in the regulatory process. Our data do n0t have that level of granularity, but this is worth investigating in the future.

These qualitative interviews and the quotes we included above tell an important story about the Midwest aquaculture market: There is no single Midwest aquaculture market and no one way of doing business. Each of the producers we interviewed had a unique set of challenges and market conditions and are doing their best to succeed under these conditions. These are largely small businesses without the same support, distribution, and consulting infrastructure that larger agricultural operations might have. As one producer put it, “Small farmer aquaculture in this country is in a state of its chaos… We’re doing business without written agreements… Things are done on a handshake. Our pricing is awful. We have regulators… telling us what we can’t do. You know, and in many cases, it’s preventing us from being profitable.” This attitude was not universally held, and many producers expressed optimism about their businesses and the industry, but this perspective is evidence that when it comes to the Midwest aquaculture market, many significant challenges remain.

Love, D.C., F. Asche, Z. Conrad, R. Young, J. Harding, E.M. Nussbaumer, A.L. Thorne-Lynam, and R. Neff. 2020. “Food Sources and Expenditures for Seafood in the United States.” Nutrients 12: 1810.

Miles, M.B., A.M. Huberman, and J. Saldana. 2014. Qualitative Data Analysis: A Methods Sourcebook. Thousand Oaks, CA: Sage.

National Marine Fisheries Service. 2021. Fisheries of the United States 2019. Washington, DC: U.S. Department of Commerce, NOAA Current Fishery Statistics No. 2019.

Stern, M.J., and K.J. Coleman. 2015. “The Multidimensionality of Trust: Applications in Collaborative Natural Resource Management.” Society & Natural Resources 28(2): 117–132.

U.S. Census Bureau. 2019. American Community Survey 1-Year Estimates Census Reporter Profile Page for Midwest Region. Washington, DC: U.S. Census Bureau.

U.S. Department of Agriculture. 2019a. 2017 Census of Agriculture, Volume 1 Geographic Area Series Part 51. Washington, DC: U.S. Department of Agriculture, National Agricultural Statistics Service.

U.s. Department of Agriculture. 2019b. 2018 Census of Aquaculture, Volume 3. Washington, DC: U.S. Department of Agriculture, National Agricultural Statistics Service.

U.S. Environmental Protection Agency. 2014. Estimated Fish Consumption Rates for the U.S. Population and Selected Subpopulations (NHANES 2003-2010. Washington, DC: U.S. Environmental Protection Agency EPA-820-R-14-002.